-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS. Buy The Rumour, Sell The....

- After U.S. President-elect Biden outlined his stimulus package focus quickly turned to what would pass through the Senate, with some focusing on the potnetial need for a watering down of the proposals.

- PBoC drains liquidity from system via latest round of 1-Year MLF ops.

- Equities generally offered in Asia as a result, with U.S Tsys bid as the curve flattened.

BOND SUMMARY: Better Bid On Questions Re: The Passage Of Biden's Support Plan

U.S. Tsys have rallied during Asia-Pac hours with the move extending further in the wake of U.S. President elect Biden's address re: his COVID support plan (which was initially outlined in the NY-Asia crossover). There was nothing in the way of surprises in the plan, allowing the extension of the early sell the rumour buy the fact theme. Now questions surrounding the prospect of the support package's passage through the Senate are at the fore i.e. will members of the more moderate Democratic wing support the scheme, if not it may be watered down. T-Notes last +0-06+ at 136-24+, a touch shy of best levels of the day and still within the confines of yesterday's range, while cash trade sees bull flattening, with 30s sitting a little over 3.0bp richer vs. the close. Flow was also supportive, with a 10.0k block buyer of the TYH1 137.50 and 138.00 calls, which appeared to be new bullish positions for the timezone, and smaller block buying of FVH1 futures (3x 2.0K or smaller clips). A raft of local data and Fedspeak from Kashkari headlines locally on Friday.

- JGB futures stuck to a narrow range, with early afternoon trade seeing the strong cover at the 5-15.5 Year JGB liquidity enhancement auction provide support. The move only resulted in a brief breach of the overnight/Tokyo morning highs, with futures falling back to finish near unchanged levels, +1 on the day. Yields were mixed across the curve, but nothing more than 1.0bp away from settlement levels, while the swap curve saw modest steepening. In local news Japanese Finance Minister Aso noted that it has become harder to restore the health of the Japanese fiscal situation while commending the BoJ for its efforts re: keeping yields low.

- Aussie bonds initially drew support from the impetus in U.S. Tsys, with the AOFM's issuance update also providing a bid. The typical weekly bond issuance notional guidance was lowered owing to the well ahead of task run rate (which was expected), while no imminent ACGB Nov '32 syndication and confirmation that particular line will represent the only new launch during the remainder of the current FY also provided support. YM +1.0, XM +1.5 at the bell, with the curve bull flattening and swaps mostly tighter across the curve. Pricing of A$200mn worth of ADB 10s and A$150mn worth of Mercedes Benz 3s provided nothing in the way on tangible pressure for the space.

JAPAN: Domestic Money Markets Dominate Weekly International Security Flow Data

There was little in the way of sizeable headline net flows witnessed in the latest round of Japanese weekly international security flow data, although Japanese investors flipped to net buying of foreign bonds after logging 2 consecutive weeks of net sales.

- Looking under the hood of the data revealed that Japanese short-term debt instruments saw the largest round of weekly foreign inflows on record (Y8.0677tn) although this came after the largest ever round of weekly sales 2 weeks prior (Y4.9210tn). The inflows seen in the most recent week were likely aided by foreign participants (namely in the U.S.) exploiting FX-hedged yield pickups available in that particular space (which are attractive when compared to comparable assets' yield levels on offer domestically in the U.S.).

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 730.7 | -291.6 | 679.8 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 282.9 | 159.9 | -413.1 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -245.0 | 61.6 | -3069.3 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 580.8 | -85.5 | 28.0 |

Source: MNI - Market News/Japanese Ministry Of Finance

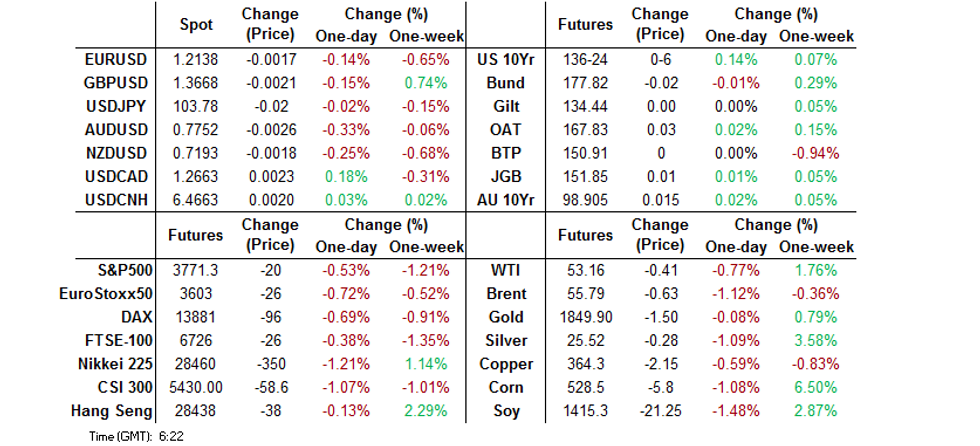

FOREX: Risk Appetite Wanes After Biden's Fiscal Address

Light risk-off feel crept in as U.S. President-elect Biden unveiled his $1.9tn economic relief plan, with concerns surfacing over potential resistance from GOP lawmakers against generous spending. Simmering Sino-U.S. tensions surrounding the White House's actions vs. Chinese tech companies helped undermine sentiment. Safe haven demand lent support to USD & JPY, while USD/JPY held a tight range wavering around neutral levels, despite today being a Gotobi day.

- Antipodean currencies helped bring up the rear in G10 FX space, alongside the NOK. AUD/USD and NZD/USD still sit a handful of pips lower apiece, albeit the prior day's lows remain intact.

- The PBOC fixed USD/CNY at CNY6.4633, around 113pips lower than yesterday as greenback weakness translates into redback strength – the fix was broadly in-line with sell side estimates. USD/CNH was rangebound through the session.

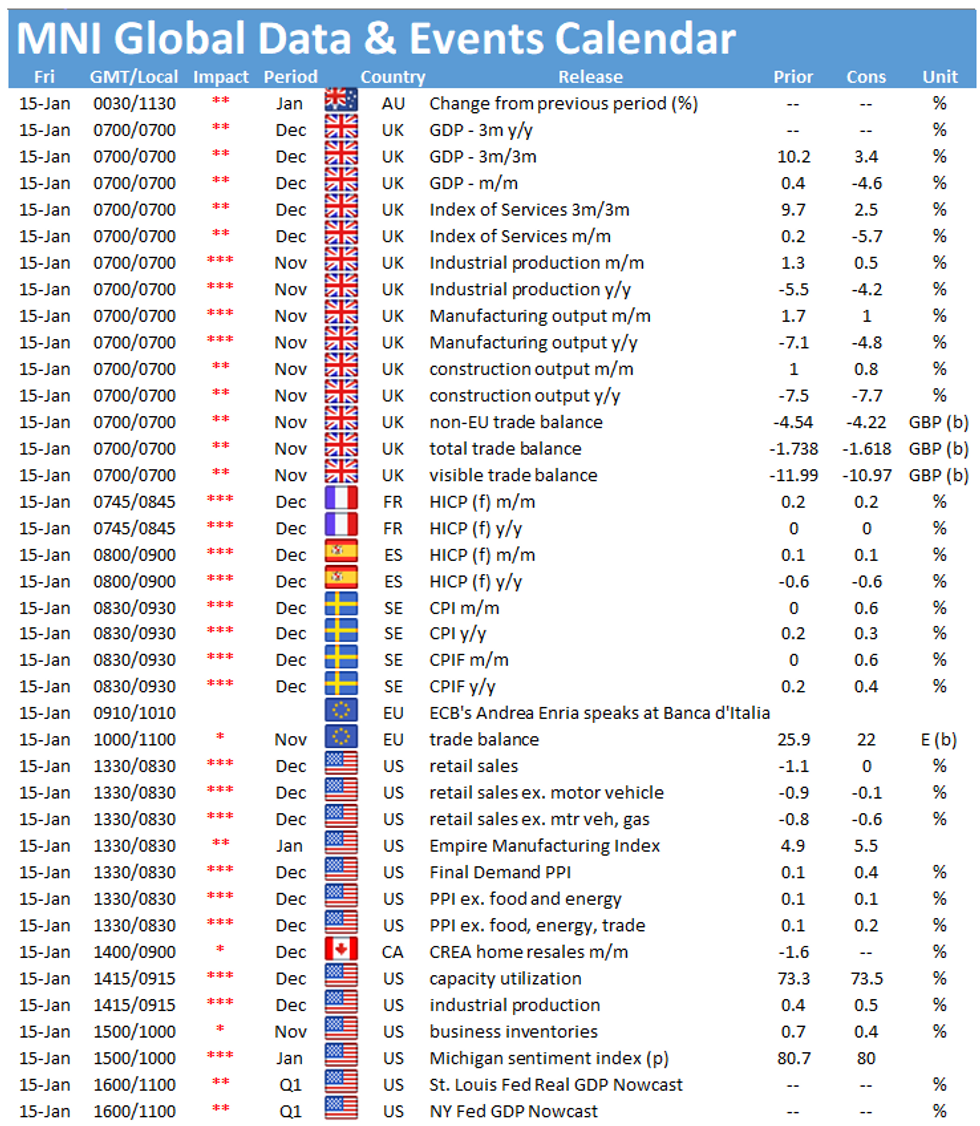

- As we are nearing the end of the week, focus turns to U.S. advance retail sales, Empire M'fing & flash U. of Mich. Setiment, UK economic activity indicators, French & Swedish CPI reports, comments from Fed's Kashkari & ECB's Visco and a panel discussion with ECB's Stournaras, Herodotou, Makhlouf & Vasiliauskas.

FOREX OPTIONS: Expiries for Jan15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E750mln), $1.2100(E777mln), $1.2135-50(E1.4bln), $1.2175-90(E1.1bln), $1.2195-1.2200(E670mln)

- USD/JPY: Y101.00($610mln), Y103.00-10($694mln), Y103.50-60($1.2bln), Y104.00($1.0bln), Y104.80-00($1.5bln)

- GBP/USD: $1.3400(Gbp677mln), $1.3585-1.3600(Gbp572mln), $1.3700(Gbp453mln)

- EUR/GBP: Gbp0.8650(E1.5bln), Gbp0.8845-60(E2.7bln), Gbp0.8900(E750mln)

- AUD/USD: $0.7695-00(A$705mln)

- USD/MXN: Mxn19.50($1.2bln)

ASIA FX: Inside Day For Most USD/Asia Crosses

The greenback started the Asia session on the back foot but recovered heading into the press conference from US President Elect Biden as he outlined the latest stimulus package and said he would plan another once in office.

- Spot USD/KRW is flat, last changing hands at 1098.20. The BoK kept rates on hold at 0.50% as expected. BoK Gov. Lee said the decision was unanimous and the bank would keep easing stance until stable recovery expected, and noted the bank was cognizant of risks to financial stability.

- USD/IDR re-opened lower today, before trimming losses slightly, and last sits -27 pips at IDR14,030. There was limited reaction to relatively strong exports data so far, with the figure rising 14.63% Y/Y vs. exp. of a deceleration in growth to +6.20% from +9.54%.

- Spot USD/THB trade at THB29.98, just 1 pip shy of neutral levels, as it continues to waver within a narrowing range around the THB30.00 figure. Little in the way of local catalysts to inspire larger price swings.

- Spot USD/PHP remains trapped within a tight range just above PHP48.00, last sitting -2 pips at PHP48.04. Health officials said that the Philippines will tighten Covid restrictions including stricter border controls after a new, more infections variant of coronavirus was detected in the country.

- USD/MYR resumed losses as onshore ringgit trade re-opened today. The pair has shed 13 pips last sits at MYR4.0340. Continued sell-off has allowed the rate to swing into a loss on a weekly basis. Political tensions flare in the country as the decision to declare an emergency over the pandemic draws criticism.

- USD/TWD has ground higher through the session on Friday, the move supported by some resilience in the US dollar. The move higher has spiked volatility in TWD which had fallen amid conjecture that the central bank was attempting to guide the currency. USD/TWD last at 27.981.

- USD/SGD has gradually ground higher through the session. Not much to report domestically, price action dictated by the greenback. The pair last up 2 pips at 1.3257

- The PBOC fixed USD/CNY at 6.4633, around 113pips lower than yesterday as greenback weakness translated into redback strength – the fix was broadly in-line with sell side estimates. USD/CNH saw rangebound trade, last up 25 pips at 6.4668, dragged higher by USD.

EQUITIES: Most Of The Major Metrics Edge Lower In Asia

E-minis and the major Asia-Pac equity indices trade little changed to a touch lower in the main overnight, with little in the way of notable headline flow to ponder, leaving most to digest U.S.-President elect Biden's COVID support plan (which provided no surprises) and continued Sino-U.S. sabre rattling in the final days of Donald Trump's Presidential term.

- Participants now question how palatable the support plan will be within U.S. Congress and the potential for watering down of the plan.

- Elsewhere, the latest 1-Year liquidity injection from the PBoC came in at the lower end of expectations, resulting in a net drain of liquidity, which may have added some light pressure.

- Nikkei 225 -0.6%, Hang Seng -0.1%, CSI 300 -0.2%, ASX 200 unch.

- S&P 500 futures -19, DJIA futures -156, NASDAQ 100 futures -42.

GOLD: Steady Overnight

Gold has steadied since yesterday's Asia-Pac blip lower and subsequent recovery, with U.S. real yields softer over that horizon, while the DXY is holding at fairly stable levels, a little off of cycle lows. That leaves bullion's technical picture unchanged vs. yesterday, with spot gold last dealing around the $1850/oz mark, $5/oz or so higher on the day.

OIL: Lower In Asia

WTI & Brent sit $0.50-0.70 below their respective settlement levels at typing, giving back yesterday's modest gains as e-minis tick lower in the wake of the release of U.S. President-elect Biden's COVID support plan (perhaps a bit of buy the rumour sell the fact crept in).

- There has been little in the way of meaningful crude-specific headline flow over the last day or so, with the latest OPEC monthly oil report (which covered the month of December) a little outdated given the moves made by OPEC+ in early January.

- Elsewhere, the Iraqi oil minister noted that the country is in "heavy talks" with OPEC+ re: postponing adherence to the compensation scheme for overproduction vs. the quota prescribed in the group's pact. He noted that "OPEC members and allies were understanding to Iraq's situation and its financial crisis," and that the compliance issues stemmed from the non-commitment of the country's Kurdish region.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.