-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - EUR Vols Surge Ahead of US CPI

MNI China Daily Summary: Wednesday, December 11

MNI EUROPEAN MARKETS ANALYSIS: Caution Prevails Overnight

- Broader/deeper mobility restrictions in the U.S. result in a cautious tone overnight, although Chinese equities outperform as Xi re-affirms focus on dual circulation policy.

- GBP underperforms among G10 as source reports point to EU officials calling for contingency planning re: a no deal Brexit scenario.

- A raft of EM central bank decisions are due on Thursday.

BOND SUMMARY: Tsys Firm In Asia, Underpins Broader Core FI

Regional demand for Tsys was firm in Asia-Pac hours, with T-Notes last +0-04+ at 138-10+, a little off of highs, while cash Tsys bull flatten as 30s richen by ~1.6bp. Upbeat rhetoric from Chinese President Xi re: relationship building among APEC nations has done little to bolster broader risk appetite (Xi also continued to point to a focus on the dual circulation strategy), with Brexit worry and Five Eyes communique re: recent developments in Hong Kong dominating headline flow overnight. On the flow side there was a screen seller of TYF1 137.00 puts in Asia-Pac hours. Wednesday saw markets continue to assess the balance of the near term economic hit from broader/deeper mobility restrictions in the U.S. vs. the hope surrounding positive vaccine developments, which are more of a medium term consideration for now (while questions remaining broader distribution remain evident). The latest 20-Year Tsy auction was soft, with a 0.9bp tail seen, marginal uptick in dealer takedown and dip in the cover ratio. The auction saw T-Notes move to intraday cheaps, before the closure of NYC schools saw a correction from lows into the close as equities sold off. The belly of the curve underperformed in cash trade. Roll activity supported broader volume.

- JGB futures pared their modest overnight losses during the Tokyo morning, with U.S. Tsys trading on the front foot and domestic equities struggling for most of the session, although the contract held to a narrow range, finishing +1 on the day. The long end of the cash curve saw some underperformance today, after yesterday's outperformance, even with receiving seen in the super-long end of the swap space. Locally, the COVID situation in Tokyo continues to dominate, with a local government briefing on the matter set to be held later today. The capital has already moved to enact its highest virus alert level.

- The Aussie bond space was happy to look through the latest local labour market report, with a modest blip lower unwound. YM & XM both finished unchanged, unwinding their overnight losses on the broader cautious tone.

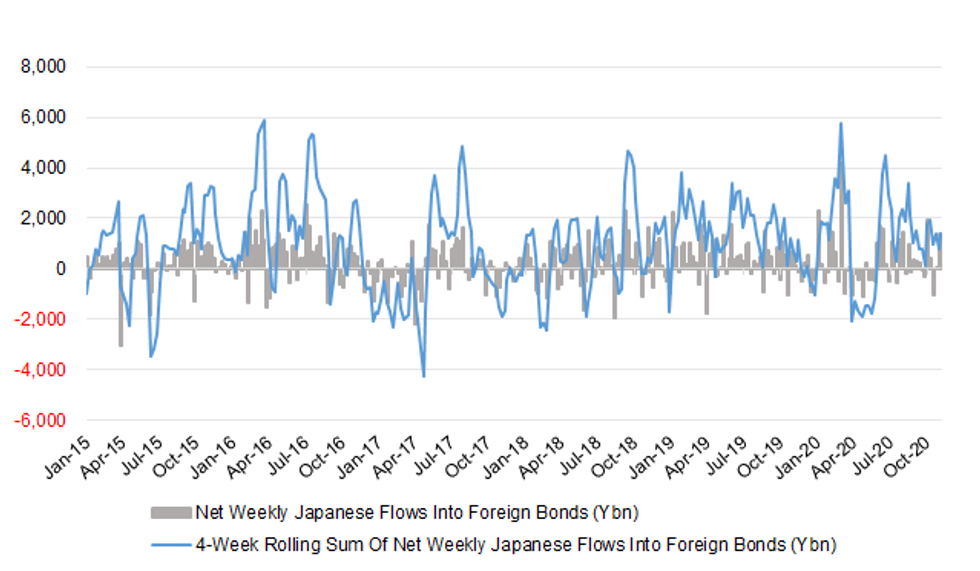

JAPAN: Japanese Purchases Of Foreign Bonds Headline Weekly Intern'l Flow Data

Little to note in the latest round of Japanese weekly international security flow data, outside of a second consecutive week of net purchases of foreign bonds >Y1.0tn for Japanese investors. A reminder that any such flows were likely FX hedged, per the latest lifer investment plans.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 1009.1 | 1372.8 | 1390.8 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -270.8 | 151.1 | 206.9 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 736.4 | 424.2 | 1046.3 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 422.5 | 484.5 | 923.0 |

Source: MNI - Market News/Japanese Ministry Of Finance

FOREX: Asia Plays It Safe

Caution prevailed as combative Five Eyes communique re: China's recent measures vs. Hong Kong and press reports suggesting that EU leaders may want to draw up contingency plans for a no-deal Brexit took focus, against the backdrop of the lingering Covid-19 angst. In the latest developments, Tokyo raised its virus alert to the highest level, South Australia started its "circuit-breaker" lockdown and South Korea's case count eclipsed yesterday's multi-month high. Risk aversion prompted participants to seek safe havens, bolstering USD, JPY and CHF.

- The Antipodeans went offered despite the release of a strong Labour Force Survey out of Australia. An unexpected addition of 178.8k jobs (vs. forecasts of a 27.5k dip) was coupled with a surprise upswing in the participation rate, which yielded a milder than projected uptick in the unemployment rate, with both underemployment and underutilisation easing off. AUD crosses blipped higher only briefly in reaction to the report, though AUD/NZD swung to a gain and held above neutral levels.

- GBP was the worst G10 performer after the Telegraph & the Times reported that EU leaders were set to demand from the European Commission to come up with plans for a no-deal Brexit, should there be no trade agreement between London and Brussels in the coming days.

- USD/Asia crept higher on the back of preference for safer assets. KRW was easily the worst performer in the region, after South Korea took its jawboning to the ministerial level, with FinMin Hong pledging active measures "at any time" if needed to stabilise FX markets. Reports were doing rounds of suspected BoK purchases of USD to stymie KRW appreciation.

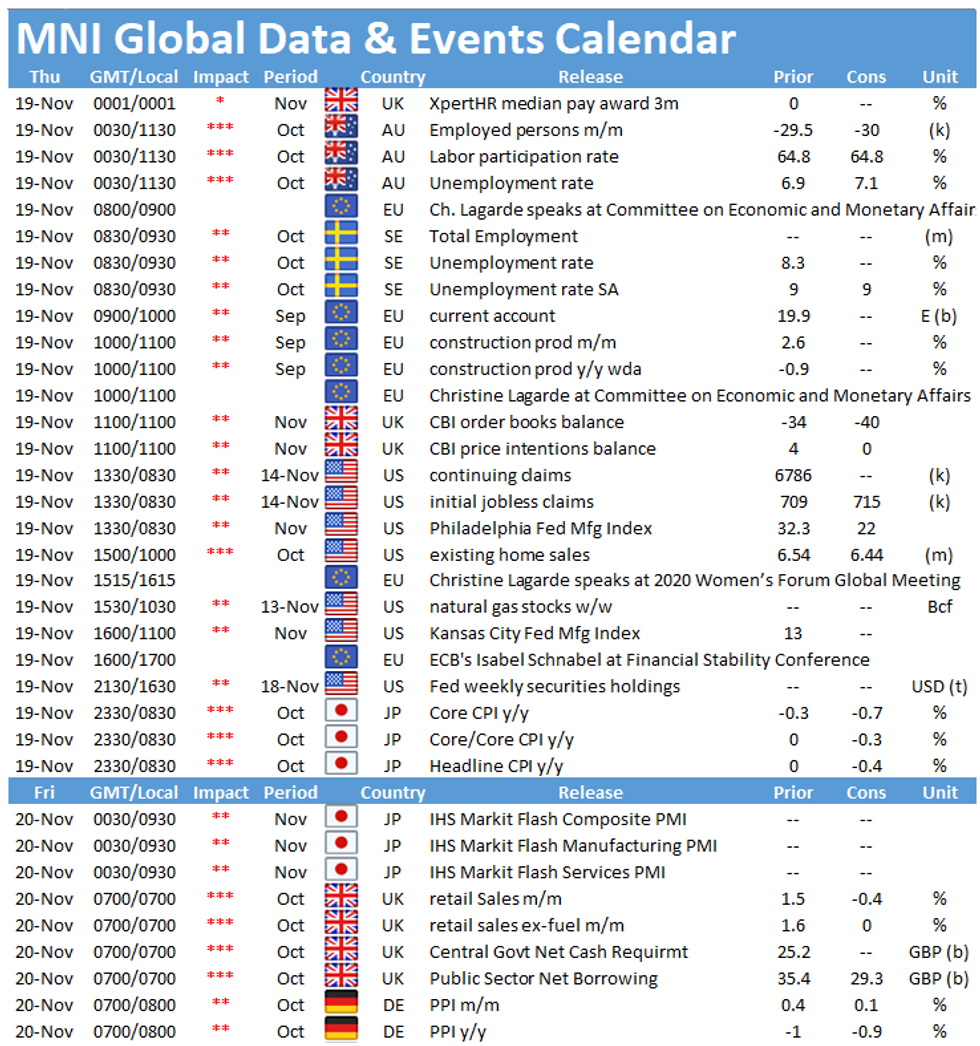

- U.S. initial jobless claims, existing home sales & Philly Fed Biz. Survey, Swedish unemployment and speeches from Fed's Bostic, Mester & Rosengren, ECB's Lagarde, Villeroy, de Cos & Schnabel take focus today. EM central bank activity picks up, with MonPol decisions from BI, BSP, SARB & CBRT coming up.

FOREX OPTIONS: Expiries for Nov19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1685-00(E687mln), $1.1750(E653mln),

$1.1790-00(E649mln), $1.1850-60(E848mln),

$1.1870-75(E713mln), $1.1900(E874mln-EUR calls), $1.1965-70(E692mln), $1.2100(E860mln) - USD/JPY: Y102.00($604mln), Y104.25-35($1.15bln), Y104.50-60($1.6bln), Y104.75-80($519mln), Y105.00($1.1bln)

- GBP/USD: $1.3400(Gbp571mln-GBP calls)

- EUR/GBP: Gbp0.8775(E978mln-EUR puts), Gbp0.8900(E645mln-EUR puts), Gbp0.8925(E733mln-EUR puts),

- AUD/NZD: N$1.0650(A$1.6bln)

- AUD/USD: $0.7235-50(A$523mln)

- USD/CNY: Cny6.59($580mln)

EQUITIES: Mostly Lower In Asia Against Broader Defensive Feel

The major regional equity indices stuck to relatively narrow ranges during Asia-Pac hours, although some idiosyncracies were apparent. More broadly, caution on the Brexit front, some geopolitical tension surrounding recent goings on in Hong Kong & wider COVID-related worry provided a defensive feel to the session.

- The Nikkei 225 underperformed on the back of COVID worry in Tokyo and fear surrounding subsequent implementation of fresh social restrictions in the capital.

- China's mainland shares found themselves on the other side of the ledger, aided by rhetoric from President Xi, who reiterated the focus on the dual circulation strategy and boosting domestic demand.

- E-minis were lower for most of the session but operated within tight ranges. This comes after wider/deeper social restrictions across the U.S. outweighed the positives surrounding Pfizer's COVID vaccine on Wednesday, leaving the major Wall St. indices comfortably lower come the close of cash trade.

- Nikkei 225 -0.4%, Hang Seng -0.5%, CSI 300 +0.4%, ASX 200 +0.3%.

- S&P 500 futures unch., DJIA futures +11, NASDAQ 100 futures -15.

GOLD: Still Rangebound

An uptick in the DXY has pressured spot back towards Wednesday's lows during Asia-Pac trade, last dealing -$10oz at $1,862/oz, with the first line of meaningful support coming in at $1,848.8/oz, which represents the Sep 28 and bear trigger. U.S. real yields and the DXY will continue to dominate, while total known ETF holdings of gold should also be watched in the wake of the recent downtick in that particular metric, which we flagged earlier this week.

OIL: Risk Appetite & UAE Threats Apply Light Pressure

WTI & Brent sit $0.35 and $0.25 below their respective settlement levels at typing, with the broader defensive feel evident during Asia-Pac hours (drivers outlined elsewhere) applying some light pressure to crude, although both benchmarks have recovered from worst levels. This comes after the metrics lodged gains of ~$0.35 & ~$0.60 respectively on Wednesday.

- A quick reminder that late Wednesday saw a BBG source report suggest that "the United Arab Emirates ratcheted up tension with oil allies Saudi Arabia and Russia, with officials privately floating a surprising idea: the Gulf producer is even considering leaving the OPEC+ alliance…It's unclear whether the warning is a manoeuvre to force a negotiation over production levels, or represents a genuine policy debate." Perhaps the UAE is growing tired of the serial undercompliers re: the OPEC+ production pact, given the UAE's own voluntary overcompliance.

- Elsewhere, the Saudi Energy Minister pointed to the stability in markets fostered by the OPEC+ agreement, while noting that the group has the will and ability to provide further stability.

- Wednesday's weekly DoE inventory report saw a shallower than expected build in headline crude stocks (which was also notably shallower than the build seen in the API estimates), while the release affirmed the relatively deep drawdown in distillate stocks and build in gasoline inventories. Elsewhere, refinery runs saw a larger than expected uptick, with U.S. crude production also edging higher as Gulf of Mexico facilities came back online after the recent tropical storm-related outage.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.