-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Chinese Assets Trade Defensively As COVID Worry Reasserts Itself

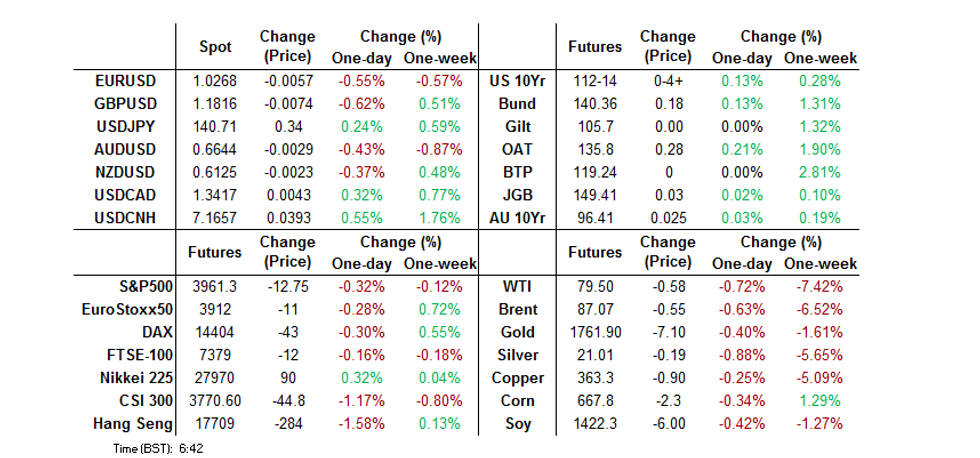

- COVID worry out of China (localised restrictions in some of the big cities, in addition to the deaths of 3 elderly Beijing citizens, although some of those individuals had complex health issues) garnered most of the attention in Asia. This weighed on equities and crude, providing a bid for the USD & Tsys in the process.

- Elsewhere, the weekend saw Atlanta Fed President Bostic (’24 voter) support the idea of a stepdown in the pace of hikes in December, while he conceded that the terminal rate may be a little higher than previously envisaged he pointed to a desire to deliver a cumulative 75-100bp of tightening during the remainder of the current cycle (which would leave the Fed Funds target at 4.75-5.00%)

- Looking ahead, German PPI data and an address from BoE’s Cunliffe present the European highlights. Meanwhile, in the US, the Chicago Fed’s National Activity Index is due, with Fedspeak from Daly also slated.

US TSYS: Chinese COVID Worry & Fedspeak From Bostic Provide Support In Asia

Tsys firmed in Asia, with COVID worry out of China (localised restrictions in some of the big cities, in addition to the deaths of 3 elderly Beijing citizens, although some of those individuals had complex health issues) garnering most of the attention. This weighed on equities and crude, providing a bid for the USD & Tsys in the process.

- Cash Tsys sit 3-4bp richer across the curve, with the 2-/10-Year yield spread registering the deepest level of inversion witnessed during the current cycle in Asia-Pac hours.

- Elsewhere, the weekend saw Atlanta Fed President Bostic (’24 voter) support the idea of a stepdown in the pace of hikes in December, while he conceded that the terminal rate may be a little higher than previously envisaged he pointed to a desire to deliver a cumulative 75-100bp of tightening during the remainder of the current cycle (which would leave the Fed Funds target at 4.75-5.00%).

- This came after Friday saw Boston Fed President Collins (’22 voter) suggest that a 75bp hike would be on the table at the December FOMC.

- Overnight flow was headlined by a block buyer of FV futures (+1,720).

- Looking ahead, NY hours will see the release of the Chicago Fed national activity index, 5-Year Tsy supply and Fedspeak from Daly (’24 voter).

JGBS: Futures Recover While Long End Struggles

JGB futures unwound their overnight losses as the Tokyo session wore on, with the impetus from the broader bid in core global FI markets surrounding the previously outlined COVID worries in China (more localised restrictions & guidance in some of the big cities, in addition to the deaths of 3 elderly Beijing citizens over the weekend, some of whom had complex health conditions) and an average to low round of offer/cover ratios in BoJ Rinban operations covering 1- to 25-Year JGBs lending support.

- That left JGB futures +2 ahead of the bell, although the long end struggled to catch a bid after the early weakness That was perhaps linked to catch-up to Friday’s weakness in U.S. Tsys, leaving the major cash JGB benchmarks flat to 4bp cheaper at the bell, as the curve steepened.

- Local headlined flow was dominated by continued headwinds for PM Kishida, who lost a cabinet member to a resignation surrounding campaign financing irregularities.

- Looking ahead, a liquidity enhancement auction for off-the-run 1- to 5-Year JGBs will headline on Tuesday, ahead of Wednesday’s national holiday & resultant JGB market closure.

AUSSIE BONDS: Firmer & Flatter On Chinese COVID Worry, Supportive Cash Flow Noted

Aussie bond futures finished a touch shy of their respective Sydney peaks, with the light widening bias in EFPs perhaps partially indicative of the deployment of the cash flows from the maturity of ACGB Nov-22 and notable coupon payments in the ACGB sphere, which we flagged earlier today.

- YM finished +1.0, while XM was +2.5. Wider cash ACGB trade saw 1-4bp of richening, with the super-long end outperforming as the curve bull flattened.

- Local headline flow was light, leaving the aforementioned cash flow and previously covered macro drivers (most notably the COVID situation in China) at the fore, resulting in a bid for the space and an unwind of the early losses, inspired by overnight price action in futures/U.S. Tsys.

- Bills finished +2 to -3 through the reds, with the strip twist steepening.

- Looking ahead, this week’s local docket is headlined by RBA Governor Lowe’s Tuesday dinner address on “Price Stability, the Supply Side and Prosperity.”

NZGBS: Swap Spreads Widen A Touch Ahead Of RBNZ

NZGBS nudged away from session cheaps on the latest round of COVID developments in China. However, the move in the space was very limited, leaving the major benchmarks 2.0-3.5bp cheaper at the bell, as the curve bear flattened after some initial catch up to Friday’s cheapening in U.S. Tsys.

- Swap rate moves were marginally more pronounced, resulting in some light swap spread widening across the curve. This may have been a result of some pre-RBNZ hedging via payside swap flow.

- A reminder that the wider consensus looks for a 75bp hike in the OCR at this week’s RBNZ meeting, before the Bank’s 3-month hiatus.

- Just over 65bp of tightening is priced into RBNZ dated OIS covering this week’s meeting, with a terminal rate of just over 5.10% priced. Both measures were incrementally higher vs. late Friday levels.

- Looking ahead, monthly trade balance data headlines the domestic docket on Tuesday.

FOREX: Flight To Safety To Start The Week

The USD is higher against all the majors at the start of the week, albeit to varying degrees. Traditional safe havens JPY and CHF have outperformed amid cross asset headwinds from the equity/commodity space. The main driver of sentiment has been negative China covid developments, as restrictions rise to curb the spread of the current outbreak.

- The BBDXY is +0.30%, last around 1286.60. EUR/USD is down sub 1.0300 (last 1.0285, -0.40%). Losses in the pair have accelerated somewhat this afternoon. Recent lows come in around 1.0270/80. GBP/USD has fallen to 1.1835/40.

- USD/JPY has crept higher, last just above 140.50. USD/CHF is just above 0.9550.

- AUD/USD was an underperformer, not helped by China developments, but found some support under 0.6640 (last 0.6645). NZD/USD is back to 0.6135, outperforming the weaker AUD trend though. AUD/NZD touched close to 1.0800 in the early trading today, lows last seen in April. Relative central bank divergences continue to weigh on the cross.

- Coming up later is Germany's PPI and BoE’s Cunliffe speech, while in the US the Chicago Fed’s November National Activity Index is out. The Fed's Daly ('24 voter) also speaks.

FX OPTIONS: Expiries for Nov21 NY cut 1000ET (Source DTCC)

EUR/USD: $1.0200-25(E1.1bln), $1.0280-00(E563mln)

USD/JPY: Y140.00($1.1bln)

USD/CAD: C$1.3300($554mln)

USD/CNY: Cny7.1000($590mln)

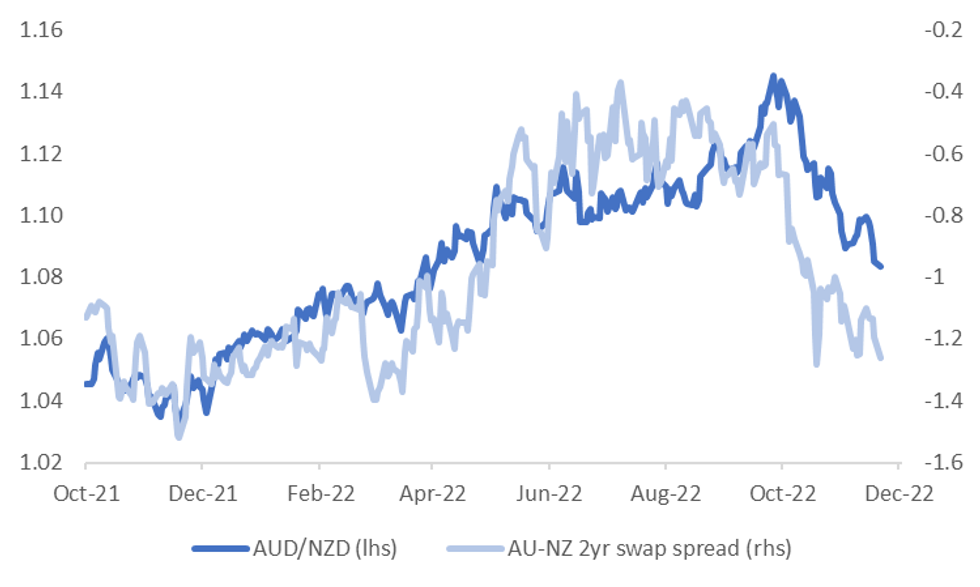

AUDNZD: Fresh Multi-Month Lows

The AUD/NZD cross hit fresh lows back to April of this year in the first part of trading today, falling close to 1.0800, before stabilizing. We were last at 1.0830/35, which is still more than 200pips down in a little over a week.

- The proximity of this week's RBNZ meeting is weighing. The chart below plots AUD/NZD against the AU-NZ 2yr swap spread. This spread is close to recent lows around -125/-130bps. A break lower in this spread would likely drive further AUD relative weakness.

- At this stage, market pricing for this week's RBNZ meeting is around +66bps, based off OIS, so not yet in line with economic consensus of +75bps.

- In contrast though, RBA market pricing for the December meeting is not yet at a full +25 bps (both futures and OIS a little over +20bps). Hence RBA market pricing is under a third of what is priced in for the RBNZ.

- The other headwind for AUD in the near term, is renewed China Covid headwinds, which risks unwinding some of the recent relative outperformance in AU's commodity basket (iron ore is down 3.7%, back sub $95/tonne).

Fig 1: AUD/NZD Versus AU-NZ 2yr Swap Spread

Source: MNI - Market News/Bloomberg

ASIA FX: USD Finds Fresh Support

USD/Asia pairs are higher across the board, as fresh China covid headwinds weigh.

- USD/CNH is around +0.50% above closing levels from last week, last close to 7.1650. China asset sentiment has faltered today amid rising Covid restrictions in major cities. Equities are lower, although losses haven't accelerated since the open. The USD/CNY fixing came out only modestly below expectations, which has also aided the USD/CNH bid. As expected, the LPR rates were left unchanged.

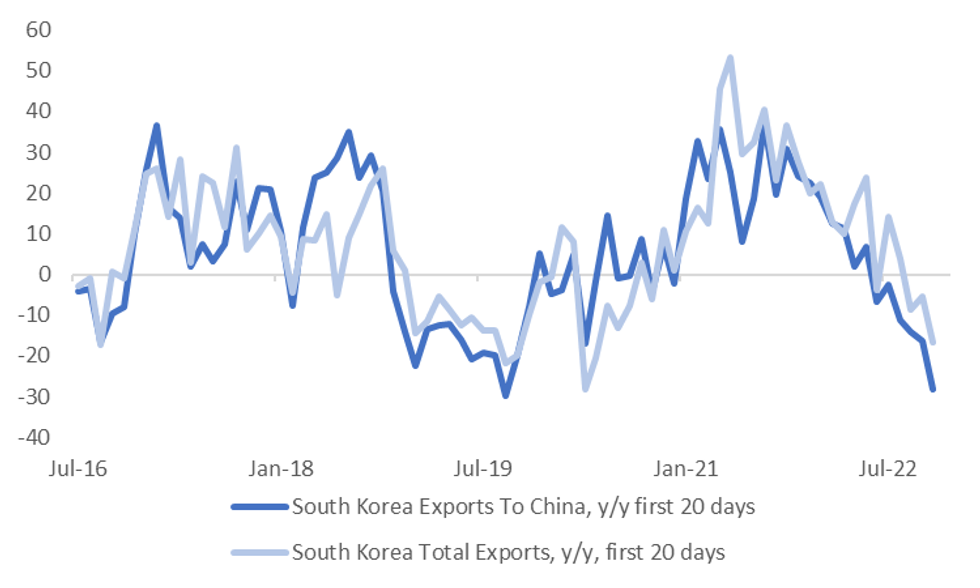

- USD/KRW 1 month NDF is up over 1%, but has found some selling resistance around the 1355 region, which is fresh multi-week highs for the pair. Onshore equities are down by over 1%, while November partial trade data showed export growth continuing to fall (in y/y terms). Spill over from higher USD/CNH levels was also evident.

- USD/THB is back above 36.00, last 36.07. We are still wedged between the 100 and 200-day MAs. Covid set backs in China risk delaying a further recovery for the local tourism sector. Q3 GDP did beat expectations, rising 1.2% q/q, versus 0.8% expected, amid a broad domestic demand recovery.

- USD/IDR is pressing higher, last at 15713, +25 figs for the session, amid broad USD gains in the region. Early November highs close to15750 could be eyed. The BI Governor stated the central bank expects 2023 GDP growth to be 4.37%, which is close to the consensus (4.9%). Inflation is forecast at 3.61%, below consensus at 4.4%.

- USD/MYR is higher, the pair last around 4.5640. We did spike as high as 4.5877 in the early part of the session before paring gains. Election uncertainty, following the weekend's hung parliament result, is weighing on sentiment. The Malaysian King has set a 2pm deadline (local time) for lawmakers to inform their choice of Prime Minister.

SOUTH KOREA: Export Growth Continues To Slow

The trend move lower in South Korean export growth continued for the first 20-days of November. In y/y terms exports were down -16.7%, while the daily average number was only slightly better at -11.3% y/y. Chips exports are nearly down 30% y/y, while exports to China continued to fall, see the chart below. Momentum is back towards 2019 lows for exports to China.

- Imports were also down in y/y (-5.5%), while the first 20-days trade deficit printed at -$4.42bn. This number should be slightly better for the full month, as we can see improvement in the final 10-days of the month.

Fig 1: South Korea Export Growth Continues To Lose Momentum

Source: MNI - Market News/Bloomberg

EQUITIES: Covid Headwinds Derail Recovery Trades

Regional equity markets have started the week on the back foot, with HK/China markets weighed by fresh covid headwinds. This has hurt most major regional bourses, while US futures are lower, -0.20-0.30 at this stage.

- The weekend news around China covid developments has seen a further unwinding of re-opening themed trades. The CSI 300 is off 1.3% at this stage, the Shanghai Composite off 0.80%.

- Fresh restrictions in Beijing and other major cities are weighing on the outlook, as cases continue to rise and the first reported deaths since May hurt sentiment. No formal lock downs have been announced, although indicators like trips on the metro rail in major cities point to reduced economic activity.

- H-shares are off 2.2%, while the HSI is lower by 2.10%, although opened down around 3%, so we are away from worst levels. Hong Kong is reportedly close to cutting non-emergency services at public hospitals amid rising Covid cases.

- Elsewhere, Japan stocks have traded resiliently, with the Nikkei 225 sitting close to flat at this stage. The Kospi is down around 1%, while the Taiex is off by around 0.40%.

- The ASX 200 has lost a modest 0.2%, with miners weighing, as commodity prices soften.

- Malaysian stocks are down around 0.50% at this stage, as election uncertainty drives a flight to safety.

GOLD: Stronger USD Weighs On Gold Prices

After falling throughout the Friday overnight session, gold prices have trended down again during APAC trading. They rose slightly to a high of $1753.05 and then fell to a low of $1743.97 and are now trading around $1747. The USD has been boosted (+0.2%) by a risk-off move in the wake of increased Covid restrictions in China and is weighing on bullion.

- Gold remains above the October 4 high of $1729.50 pointing to bullish short-term trend conditions. $1800 is the next level to watch and key resistance is at $1807.90. Initial support is at $1702.30, the November 9 low.

- There is little overnight to drive gold prices, as they have recently been dependent on the direction of the debate surrounding the next Fed move and economic data. The only events of note are BoE’s Cunliffe speech and the Chicago Fed’s November National Activity Index.

OIL: Oil Prices Weighed Down By Covid Restrictions In China

Oil prices are down again today, as news of new Covid restrictions in China boosted the USD and reinforced Friday’s crude demand concerns. WTI and Brent are currently down around 1% from the NY close after ending last week sharply lower.

- Oil prices remain in narrow ranges. WTI crude is off of its intraday low of $79.18 and trading under $80/bbl at $79.20 after reaching a high of $80.30 earlier. Brent is also off its low of $86.40 at around $86.75. It reached a high of almost $88 earlier in the session.

- Winter oil demand has so far been declining, despite the impending European sanctions against Russian oil. (ANZ)

- Goldman Sachs also reduced its oil price forecasts for Q4 by $10/bbl, now expecting Brent to rise to only $100. The revision was principally due to the prospect of further Covid restrictions in China.

- The only events of note tonight are BoE’s Cunliffe speech and the Chicago Fed’s November National Activity Index.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/11/2022 | 0700/0800 | ** |  | DE | PPI |

| 21/11/2022 | 0905/0905 |  | UK | BOE Cunliffe Speech at Warwick Conference | |

| 21/11/2022 | 1530/1530 |  | UK | DMO Announces Agenda for Consultation Meetings | |

| 21/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 21/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 21/11/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 21/11/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 21/11/2022 | 1800/1300 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.