-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Crude Oil Imports Accelerate In November

MNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI EUROPEAN MARKETS ANALYSIS: Chinese Jitters Return

- China's crackdown on private-sector businesses dents risk sentiment, sending Asia-Pac equity benchmarks lower.

- Core FI draw support from broader risk aversion, with debt auctions eyed in the U.S., Japan and Australia.

- Coal futures print another record high in China, iron ore retreats moderating recent advance.

BOND SUMMARY: China Jitters Aid Core FI, Debt Auctions Take Focus

China's crackdown on the private sector inspired a dominant defensive feel in the Asia-Pac session, generating demand for core FI. Bond auctions were scrutinised in both Japan and Australia, with U.S. Tsy set to hold two offerings later today.

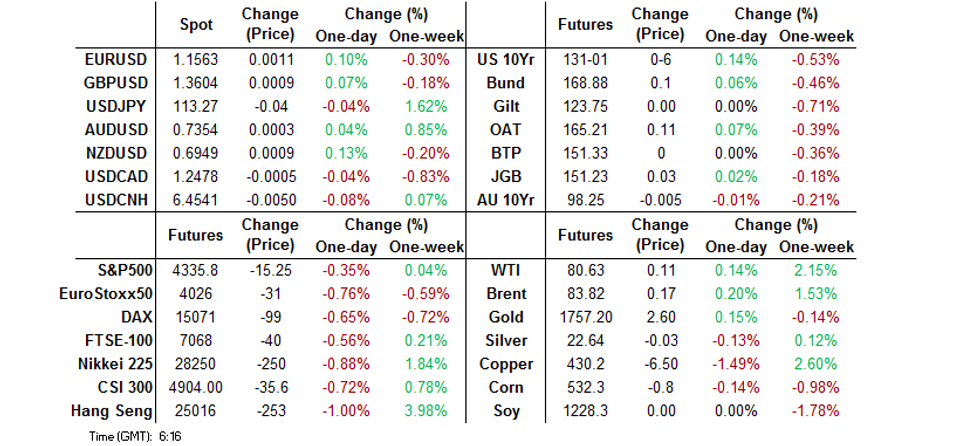

- T-Notes stabilised after the initial rally and last trade +0-05 at 131-00. The contract topped out at 131-01, just slightly below 131-01+ which capped gains on Monday. U.S. Tsy yield curve twist flattened as cash markets reopened after a closure in observance of a domestic holiday. Yields trade -0.6bp to +3.0bp at typing, off initial highs across the curve. Eurodollar futures trade -0.5 to +1.5 ticks through the reds. Focus in NY hours will move to 3-Year & 10-Year debt auctions as well as Fedspeak from Clarida, Bostic & Barkin.

- JGB futures advanced in morning trade before trimming gains and moving away from the session high of 151.27. The contract trade at 151.23, 3 ticks above previous settlement. Cash JGB yields trade marginally mixed. Japan's MOF auctioned 30-Year JGBs, with bid/cover ratio slipping to 2.90x from 3.00x seen at the previous auction and with low price matching BBG dealer poll forecast.

- Aussie bonds rode the wave of broader impetus. Futures promptly reversed losses and crept higher but lost steam later in the session. YM last sits -4.5, XM trades -0.5, the latter operates in close proximity to its session highs. Cash ACGB curve flattened a tad, yields last trade -2.5bp to +4.3bp. Bills run 1-4 ticks lower through the reds. Local headline flow and debt supply provoked little market reaction. The AOFM auctioned A$150mn of the 21 Nov '27 linker, drawing bid/cover ratio of 3.83x (prev. 4.68x). Elsewhere, ANZ Roy Morgan Weekly Consumer Confidence improved a tad, while monthly NAB Business Confidence deteriorated.

FOREX: Risk Sentiment Sours On China's Renewed Private Sector Crackdown

Risk sentiment soured in reaction to a WSJ report noting that China's Pres Xi has ordered a "sweeping round of inspections of financial institutions" to uncover their ties with big private-sector businesses. Separately, Bloomberg circulated a report pointing to a round of antigraft inspections of China's financial regulators.

- The Antipodeans went offered amid broader risk aversion, CAD followed suit. Crude oil prices stabilised, thus failing to provide any support to commodity-tied FX.

- The yen outperformed in G10 FX space, albeit only marginally. USD/JPY pulled back from its best levels since late 2018, but remained in relatively close proximity to those levels.

- CNH reversed its initial loss, the PBOC set their central USD/CNY mid-point at CNY6.4447, 6 pips above sell-side estimate.

- KRW hit a fresh 2021 low against the greenback after the BoK announced their decision to leave interest rates on hold.

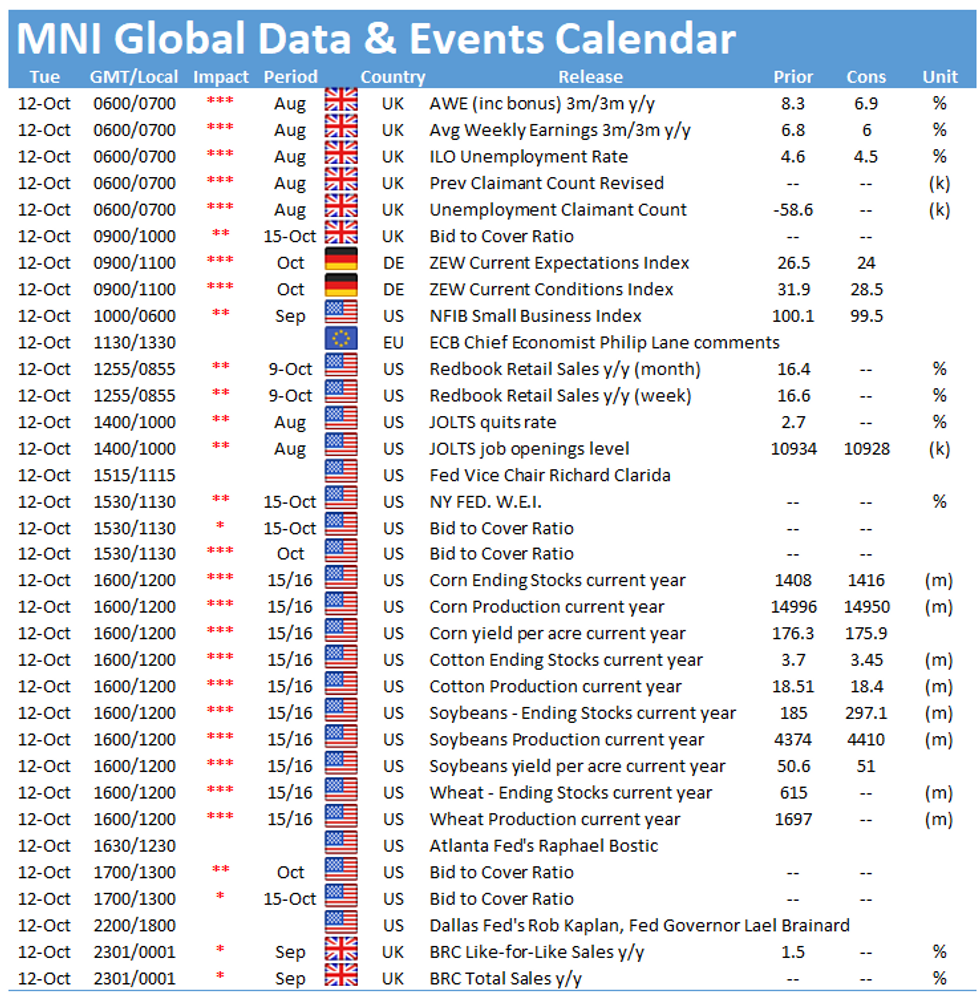

- Today's data highlights include German ZEW Survey & UK jobs data. Comments are due from a number of ECB speakers, including Pres Lagarde, as well as Fed's Clarida, Bostic & Barkin.

FOREX OPTIONS: Expiries for Oct12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1615(E1.4bln), $1.1835-40(E1.1bln)

- USD/JPY: Y111.40-50($1.1bln), Y112.00($712mln), Y112.50($878mln), Y113.00($575mln), Y113.20-25($835mln)

- AUD/USD: $0.7330-35(A$584mln)

- USD/CAD: C$1.2500-05($775mln)

ASIA FX: Baht Outperforms On Reopening Plans

- CNH: Offshore yuan is stronger, clawing back Monday's losses. The PBOC continued its liquidity drain and reports circulated that an RRR cut could come as soon as October. The NDRC said it was pushing for all industrial and commercial users to enter the power trading market, in an orderly way

- SGD: Singapore dollar is weaker, markets look ahead to the MAS policy announcement and GDP data later this week. Singapore government pushes ahead with travel lanes/reopening plans.

- KRW: Won is weaker, but off worst levels after the BoK rate announcement. The Bank kept rates on hold at 0.75% but announced two dissenters and indicated that the November meeting was live for another hike.

- TWD: Taiwan dollar is weaker, USD/TWD rising further above the 28.00 handle. The pair is the highest since May having risen above the 200-DMA late yesterday.

- MYR: Ringgit is weaker, today marks the last day of the Fourth Session of the 14th Parliament. Lawmakers will debate revoking the emergency ordinances enacted amid the Covid-19 pandemic.

- IDR: Rupiah is lower, Indonesia slashed its quarantine period for foreign visitors to 5 days for 18 countries amid a further reopening of borders

- PHP: Peso fell, data showed trade deficit at $3.577bn in August, narrowing a tad from July's $3.659bn, but not enough to match consensus forecast of $3.350bn. Exports grew 17.6% Y/Y, marginally slower than estimated, while imports rose 30.8% Y/Y, topping expectations.

- THB: Baht bucked the regional trend and strengthened seeing the biggest gain since August 24. The release of Thailand's reopening plan sent the baht flying as onshore markets reopened, with participants enthusiastic about recovery prospects for the local tourism sector.

ASIA RATES: BoK Keeps Rates On Hold, Bonds Drop As November Meeting Indicated Live

- INDIA: Yields lower in early trade. Market focus today will be on inflation data as well as the industrial production release, while the RBI will hold reverse repo operations and states will auction debt. Bonds dropped yesterday as oil continued to push higher which intensified worries around a large deficit, INR also came under pressure and dropped to the lowest level since August 2020. The announcement by the RBI that the GSAP programme would be discontinued continues to weigh, while bonds also suffered after reports that the government was considering additional bond sales to repay the debt of Air India. There were also reports yesterday that the government could consider increasing tax on some goods and services in order to simplify the tax structure, the two lowest rates could be raised by 1ppt each and eventually there would only be three applicable tax rates.

- SOUTH KOREA: 3-Year futures initially rose after the BoK kept rates on hold as expected, there was an outside chance of a 25bps hike after the Bank embarked on a hiking cycle in August, but fell into negative territory as the Governor revealed there were two dissenters and made other comments that put a November hike firmly on the table. The BoK said the economic recovery was on solid ground, and acknowledged that inflation would run above the 2% target for a while but leaving itself some flexibility for action at the November meeting and further down the line saying that saying that further adjustments depends on virus, growth and inflation. The Central Bank maintained an accommodative bias, stating it will conduct monpol to sustain the recovery.

- CHINA: The PBOC drained a net CNY 90bn via OMOs today as the drain of pre-Golden Week liquidity continues. Repo rates higher after dropping late on yesterday, but remain below the previous day's highs. Futures are higher as risk off sentiment takes hold in Asia, Chinese equity markets down around 0.7% at the time of writing, 10-Year future up 6.5 ticks, the first up day in October after being closed for Golden week – contract highs hit in September sit around 100.155. In Chinese press there was a piece in the 21st Century Business Herald which positing that the PBOC could cut banks RRR as soon as October. The latest development in the Evergrande saga sees some holders of dollar bonds with interest payments due Monday saying they had yet to receive them, while in a sign the situation is affecting others in the real estate sector Sinic has said it doesn't expect to pay the principal or interest payments due on October 18.

- INDONESIA: Curve twist flattens. Indonesia slashed its quarantine period for foreign visitors to 5 days for 18 countries amid a further reopening of borders. Elsewhere, Finance Ministry off'l Budiarso suggested that the gov't may seek to convince lawmakers to back a financial sector reform next year. Looking ahead, the government will sell bonds today and further down the line Indonesian trade data will hit the wires on Friday. Elsewhere, the Foreign Ministry holds a briefing on 2022 multilateral plans.

EQUITIES: Risk Off Resumes

Equity indices in Asia are lower, taking a negative lead from Wall Street which engendered a broad risk off tone. Markets in South Korea led the way lower after the BoK kept rates on hold but indicated a hike at the November meeting as two lodged dissent against the decision. Markets in China also lower, the China's NDRC said it was pushing for all industrial and commercial users to enter the power trading market, in an orderly way, while there was also some attention on an earlier report that regulators would scrutinise ties to state banks. Markets in Japan are lower, JPY pushed to fresh multi-year highs shaking off stronger than expected PPI data. US futures declined with e-minis seeing losses of around 0.5%, markets look ahead to CPI and retail sales data as well as the start of Q3 earnings season this week.

GOLD: Approaches Monday's High

The yellow metal has recovered early losses and approached Monday's high as risk off tone was the name of the game in Asia. Near-term attention is on the 50-day EMA at $1777.9 and $1787.4, Sep 22 high and a key resistance. A resumption of strength would reinforce the bullish engulfing candle that signalled a reversal on Sep 30. A break of $1787.4 would suggest scope for an extension. Initial support is at $1746.0, Oct 6 low. A break is required to undermine the current bullish tone.

OIL: Flat In Asia After Sharp Gains

Crude futures broadly flat heading into European trade. WTI and Brent crude futures traded higher still Monday, with WTI striking a new cycle high and showing above the $82/bbl mark for the first time since late 2014. Further strength came as markets continue to position for tight supplies across winter, with increasing evidence that oil is benefiting as a substitute for very expensive natural gas.

- The curve has steepened further, with the most notable price rises on Monday in the front- and second-month futures contracts. Upside targets are bumped higher to the 1.746 projection of the Aug 23 - Sep 2 - Sep 9 price swing at $82.89/bbl.

- There are increasing signs of official involvement in energy prices, with the UK's Business Minister Kwarteng submitting a formal bid for assistance for industries hit by high prices. Similarly, a White House official said they stand by calls to OPEC+ to do more in order to support the global economic recovery, adding that they have communicated this to several OPEC+ members at a senior level.

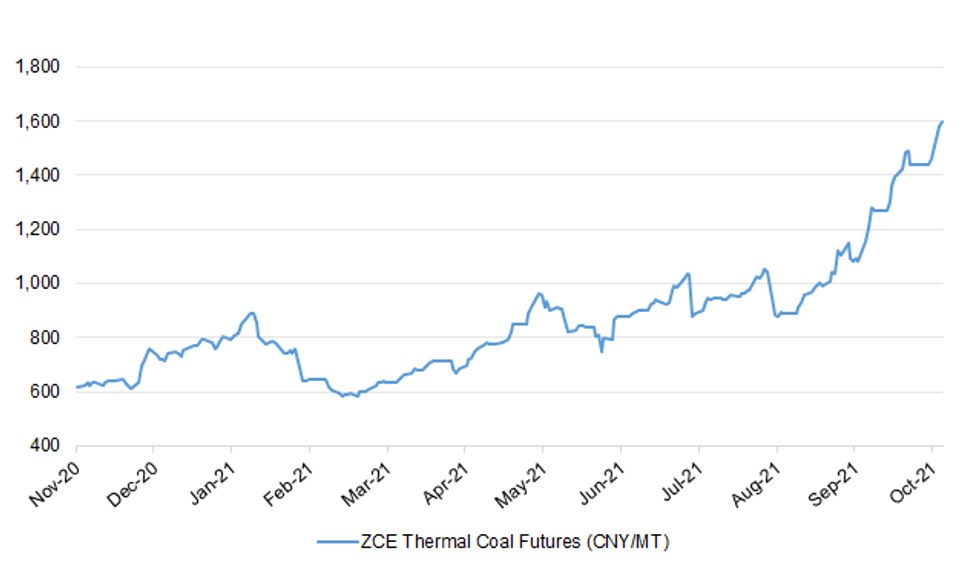

COAL: Coal Futures Hit Record Highs As Floods Force More Mine Outages

China's thermal coal futures on the Zhengzhou Commodity Exchange have surged to a fresh record high today after the Securities Times reported that two mines in Shaanxi have been affected by heavy rains. According to Caixin Global, the rainfall was so severe that it overtopped dams causing landslides and flooding.

- Shaanxi mine outages came after adverse weather conditions shackled the bulk of mining capacity of neighbouring Shanxi province, China's other major coal hub. As many as 60 of Shanxi's 682 mines have been shut owing to severe floods over the recent days. Xinhua reported that Shanxi had received over three times the average monthly rainfall for October just last week.

- Local authorities are scrambling to boost output. Shanxi, Shaanxi and Inner Mongolia pledged to supply 145mn tons of coal in Q4, in response to an instruction from the National Development and Reform Commission (NDRC).

Fig. 1: ZCE Thermal Coal Futures (CNY/MT)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.