-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Core FI Creep Higher, PBOC Pumps Liquidity

- Headline flow fails to provide much in the way of notable market catalysts in muted Asia-Pac trade.

- T-Notes find some poise as participants assess the latest developments on the Omicron front.

- The PBOC injects more cash into the money market to alleviate seasonal liquidity shortage, China's overnight repo rate tumbles to 11-month low.

BOND SUMMARY: Core FI Garner Some Strength, Steepening Hits U.S. Tsy & JGB Yield Curves

Fresh headlines failed to offer much of real note, leaving participants to reflect on the most recent updates on the global Omicron situation. Resultant defensive feel provided some support to core bond markets in Asia.

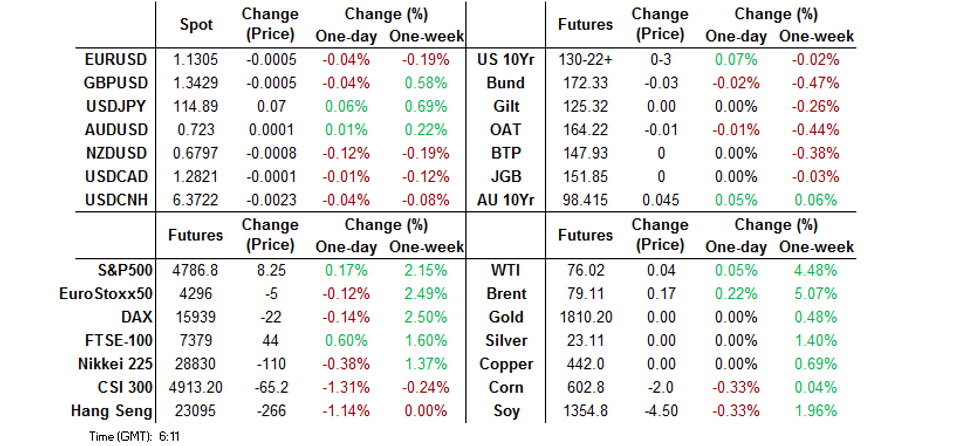

- T-Notes inched higher after the re-open but stabilised thereafter. The contract changes hands +0-03 at 130-22+ as we type, after topping out at 130-23+ earlier in the Tokyo session. U.S. Tsy curve bull steepened, with yields last seen 0.7-1.5bp lower. Eurodollar futures run 0.25-2.0 ticks higher through the reds. Wholesale inventories headline the thin domestic data docket today. On the issuance front, today's sale of 7-Year Tsys will mark the final U.S. bond offering this week.

- JGB futures wavered in a relatively tight range and last operate at 151.87, 2 ticks above previous settlement and slightly below their session high of 151.90. Cash JGB yield curve bull steepened, albeit 5s outperformed (note that this came after Wednesday's strong offering of U.S. 5-Year Tsys). The local headline flow was rather uninspiring.

- Aussie bonds climbed as Antipodean markets re-opened after a four-day Christmas break. Futures were bid, with YM last +3.5 & XM +3.5, both within touching distance from respective session highs. Cash ACGBs also firmed; yields last operate 2.5-3.8bp lower across a flatter curve. Bills trade unch. to +6 ticks through the reds. The space may have drawn some support from domestic Covid-19 developments, as NSW recorded a record daily case count and PM Morrison called a National Cabinet meeting for Thursday to discuss tweaking the country's re-opening strategy.

FOREX: Festive Season Lull

Volatility across G10 FX space was particularly limited as latest headline flow provided little of real note, leaving participants to assess most recent updates on the global Omicron situation.

- The DXY held yesterday's range. The dollar index holds below neutral levels as we are heading for the London session.

- Activity is set to remain subdued into the year-end. The global data docket is fairly empty today, with little beyond U.S. wholesale inventories due for release.

ASIA FX: Won Leads Gains Despite Covid Concerns, Peso Tumbles Ahead Of Holiday

Continued reassessment of Omicron risks provided the focal point overnight as broader headline flow carried little in the way of notable catalysts. The Korean won outperformed in Asia despite lingering domestic Covid worry.

- CNH: Spot USD/CNH held a tight range, price action was limited to a brief foray lower. The PBOC set the yuan reference rate in close proximity to sell-side estimate and provided another sizeable liquidity injection.

- KRW: The Korean won outperformed in Asia EM FX space, even as South Korea's daily Covid-19 cases bounced back above 5,000 and critical cases reached an all-time high. The latest BOK Business Survey showed that sentiment among South Korean manufacturers improved, which may have lent some support to the won.

- IDR: The rupiah went offered as Pres Widodo discussed implementing an overseas travel ban on all Indonesian citizens to prevent the spread of the Omicron variant across the country.

- MYR: Spot USD/MYR operated in a narrow range, ticked away from a fresh one-month low. Malaysia announced that it will halve the interval between the initial Covid-19 vaccination cycle and the booster dose for those receiving Pfizer and AstraZeneca jabs.

- PHP: The peso tumbled to its worst levels since mid-Oct ahead of Thursday's closure of onshore Philippine markets in observance of a public holiday. BSP Gov Diokno said that the central bank expect headline CPI inflation to settle within the +3.5%-4.3% Y/Y this month.

- THB: The baht softened a tad, ahead of End of Year/New Year holidays starting Friday. The currency was insensitive to a beat in Thailand's m'fing production, which received a boost from the relaxation of Covid-19 curbs.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.