-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Defensive Feel Lingers, Core FI Hold Gains

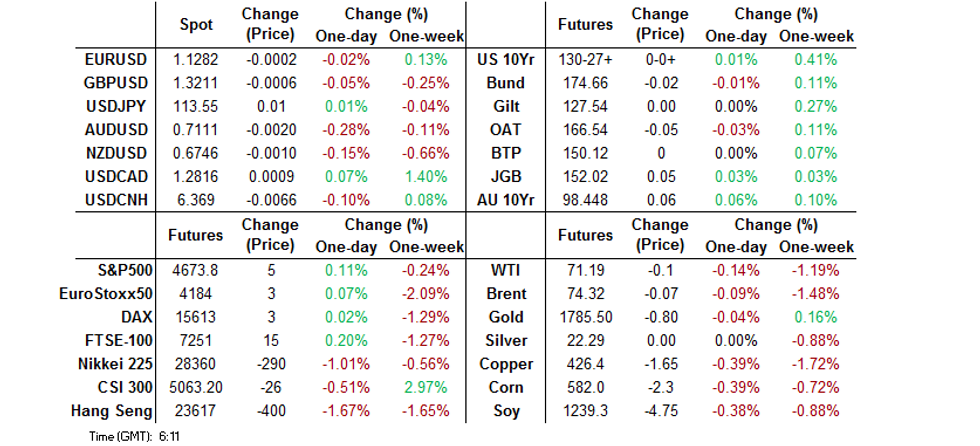

- Equity benchmarks across the Asia-Pacific are in the red as risk aversion lingers after a poor Wall Street session, albeit U.S. e-mini futures edge higher.

- Core FI hold tight ranges ahead of plenty of central bank monetary policy decisions this week, including from the Fed, ECB, BoE and BoJ.

- Commodity currencies trade on a softer footing amid losses in crude oil futures and Omicron angst.

BOND SUMMARY: Consolidation

It was a rather uneventful session for core FI, which held tight ranges close to their best levels from the previous trading day. Lingering Omicron jitters and the proximity of some major central bank decisions allowed major bond markets to hold gains registered at the start to the week.

- T-Notes wavered within a 0-03 range, last trade flat at 130-27, after topping out at a fresh one-week high of 130-30+ on Monday. Cash U.S. Tsy yields sit 0.4-1.2bp higher across a marginally flatter curve. Eurodollars last seen 0.5-2.0 ticks lower through the reds. Domestic PPI report takes focus in the U.S. today, as we await Wednesday's FOMC announcement.

- JGB futures slipped, albeit only marginally, even as the Nikkei 225 extended losses after the Tokyo lunch break. The contract sits at 152.06, 9 ticks above Monday's settlement. Cash JGB yields trade lower across the curve, with the liquidity enhancement auction covering off-the-run 5- to 15.5-Year JGBs provoking no market reaction.

- Overnight impetus drove early price action in cash ACGBs, with bull flattening evident. Yields last trade 1.8-6.5bp lower across the curve. Aussie bond futures operated in narrow ranges, YM & XM last +6.0 apiece. Bills run unch. to +7 ticks through the reds. The latest round of monthly NAB Business Confidence data was shrugged off.

FOREX: Commodity Currencies Underperform As Omicron Spoils Mood

Caution lingered in Asia after a negative Wall Street session, in the early part of a MonPol-heavy week. Omicron remained the big theme, with the latest round of mobility curbs undermining hope for a swift economic recovery.

- Commodity currencies turned their tails in tandem with crude oil futures, as Omicron jitters outweighed an optimistic OPEC demand forecast.

- AUD was the worst performer in G10 FX space, with BBG trader sources noting that "short-term leveraged funds sold out of recently entered longs." AUD/USD probed the water under the $0.7100 mark.

- GBP traded on a softer footing after UK Health Sec Javid said that the estimated real number of daily Covid-19 infections is about 200,000, while PM Johnson refused to rule out more virus countermeasures before Christmas.

- The greenback remained the best performer among major currencies, as the conclusion of FOMC gathering drew nearer. The DXY pierced yesterday's peak and printed a fresh one-week high.

- USD/CNH traded with a bearish bias as the PBOC set the yuan reference rate in close proximity to market estimate. The fixing was interpreted as a sign of waning appetite on the PBOC's part to continue reigning in yuan strength.

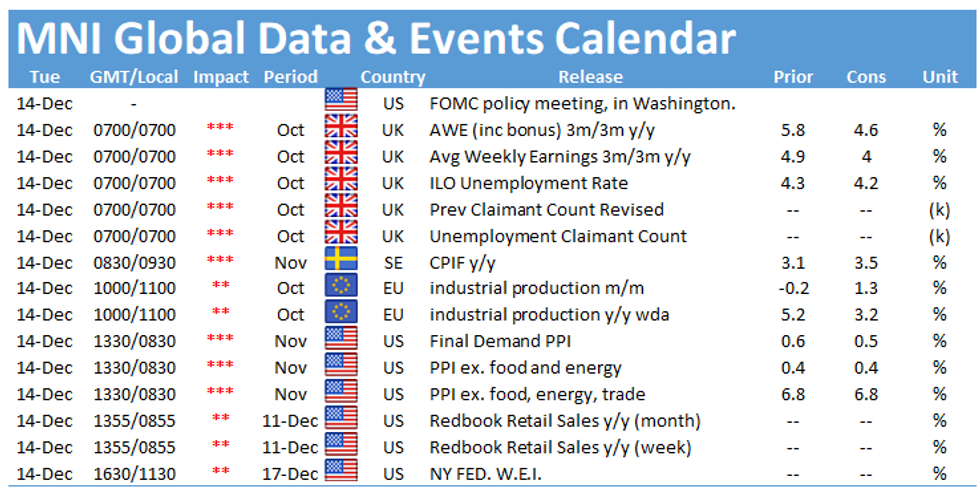

- UK labour market report, Swedish CPI & U.S. PPI take focus on the data front today, with little in the way of notable central bank speak coming up.

FOREX OPTIONS: Expiries for Dec14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1295-00(E642mln)

- USD/JPY: Y113.00($825mln), Y113.80-95($1.4bln)

- EUR/GBP: Gbp0.8450(E710mln), Gbp0.8530-50(E879mln)

- AUD/USD: $0.7130(A$596mln)

- USD/CAD: C$1.2670-75($529mln), C$1.2750($515mln)

ASIA FX: Won Leads Losses Amid Risk Aversion, Yuan Gains After PBOC Fix

Unease with the global spread of the Omicron coronavirus variant dented risk appetite, with participants awaiting this week's monetary policy decisions, including from the Fed, BI and BSP.

- CNH: The deviation between the daily fixing of yuan reference rate and Bloomberg average estimate shrank further to a very narrow margin, convincing watchers that the PBOC have pressed pause on attempts at curbing yuan strength. Spot USD/CNH slipped in the immediate wake of today's PBOC fix and the pair remained heavy thereafter.

- KRW: Spot USD/KRW gapped higher at the reopen and held gains, as the won was the worst performer in Asia. Broader risk aversion coupled with worrying domestic Covid-19 developments (fresh record highs in deaths & critical cases) undermined the won.

- IDR: Spot USD/IDR traded above neutral levels, with participants awaiting Thursday's monetary policy decision from Bank Indonesia.

- MYR: The ringgit extended its recent losses, despite the absence of notable local headline flow. The Dewan Rakyat passed budget 2022 yesterday, sending it to the upper house for final approval.

- PHP: The Philippine peso held a narrow range ahead of this week's BSP Monetary Board meeting. Gov Diokno suggested Monday that the central bank will take a cautious approach to policy normalisation.

- THB: The baht showed some resilience in early trade but gave up eventually. The World Bank said that they see the BoT holding their key interest rate through next year to support the economic recovery.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.