-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: DXY A Touch Lower Ahead Of Biden Inauguration

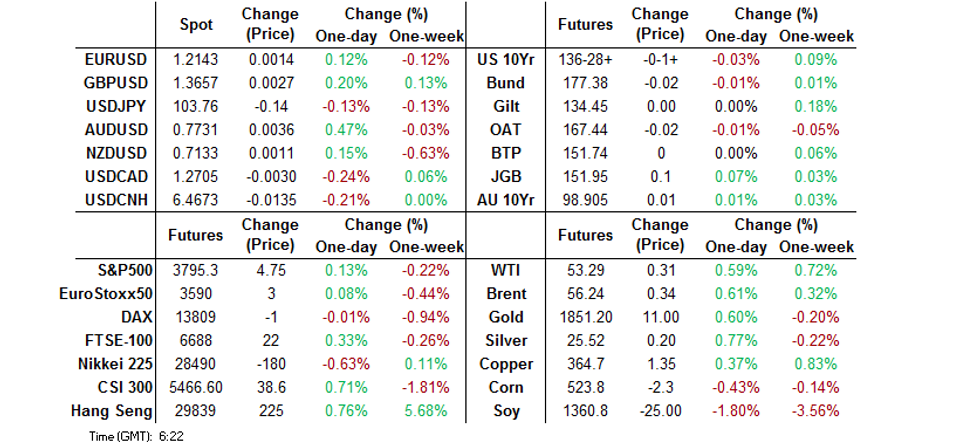

- DXY a little lower with U.S. yields flat in Asia, market moves a little more reactionary to themes and headline flow witnessed during the NY session.

- The PBoC's liquidity injections have picked up over the last couple of days, after shorter-term money market rates edged higher.

- President-elect Biden's inauguration and a heavy central bank schedule headline over the next 24 hours or so.

BOND SUMMARY: Sedate Asia-Pac Trade

U.S. Tsys experienced relatively sedate Asia-Pac trade, with macro headline flow on the lighter side, leaving T-Notes to operate in a narrow 0-03+ range, last -0-01 at 136-29, while cash Tsys sit within 1.0bp of closing levels, biased ever so slightly cheaper on the day. Pockets of TY selling were seen, although it was a 10K block of the TYJ1 138.00/133.50 risk reversal, selling the calls to buy the puts that caught the eye (with that particular round of flow going against the broader mantra of recent regional block trades i.e. selling TYH1 puts to buy TYH1 calls, albeit at a slightly longer maturity). Eurodollar futures trade +0.5 to -0.5 through the reds. Once again, pockets of selling caught the eye here, with EDH1, EDM1 & EDZ2 given at different times. 20-Year Tsy supply and President-elect Biden's inauguration headline locally on Wednesday.

- JGB futures ticked higher as the BoJ's 2-day meeting got underway, with little in the way of notable headline flow seen, while the offer/cover ratios witnessed at the latest round of BoJ 1-10 Year Rinban ops weren't particularly supportive. Futures +10 last, a touch shy of best levels of the day, while the 5- to 20-Year zone of the curve outperformed in cash JGB trade.

- Aussie bonds generally benefitted from a solid showing at the first ACGB auction of calendar '21, although the pricing of A$2.5bn of TCV's new Nov '25 benchmark line triggered hedging related flows in YMH1 and pressure in that zone of the curve during the Sydney morning. YM unch., XM +1.0 at the close, while cash trade saw some light outperformance for the 10- to 12-Year sector of the curve.

FOREX: USD Extends Losses After Yellen's Remarks

The greenback extended losses amid risk-on impetus generated by yesterday's testimony from U.S. Tsy Sec nominee Yellen, who backed U.S. Pres-elect Biden's stimulus plan and pushed back against any imminent tax hikes. A strong earnings report from Netflix released after U.S. hours lent further support to risk appetite. The DXY faltered through yesterday's worst levels, while G10 crosses were happy to hold tight ranges ahead of Joe Biden's inauguration as the new POTUS.

- Firmer oil prices filtered through into commodity-tied FX space, supporting AUD, NOK & CAD against the U.S. dollar. The Aussie topped the G10 pile amid little in the way of local catalysts. AUD/JPY pushed higher for the second day in the row, but failed to test yesterday's high.

- The PBOC fixed USD/CNY at CNY6.4836, around 47 pips lower than yesterday on greenback weakness, but 12 pips above sell side estimates. The central bank injected CNY278bn of liquidity, the second injection after a prolonged drain after year end. The LPR rates were left unchanged, in line with expectations.

- South Korea said it will tighten FX monitoring of non-bank financial companies.

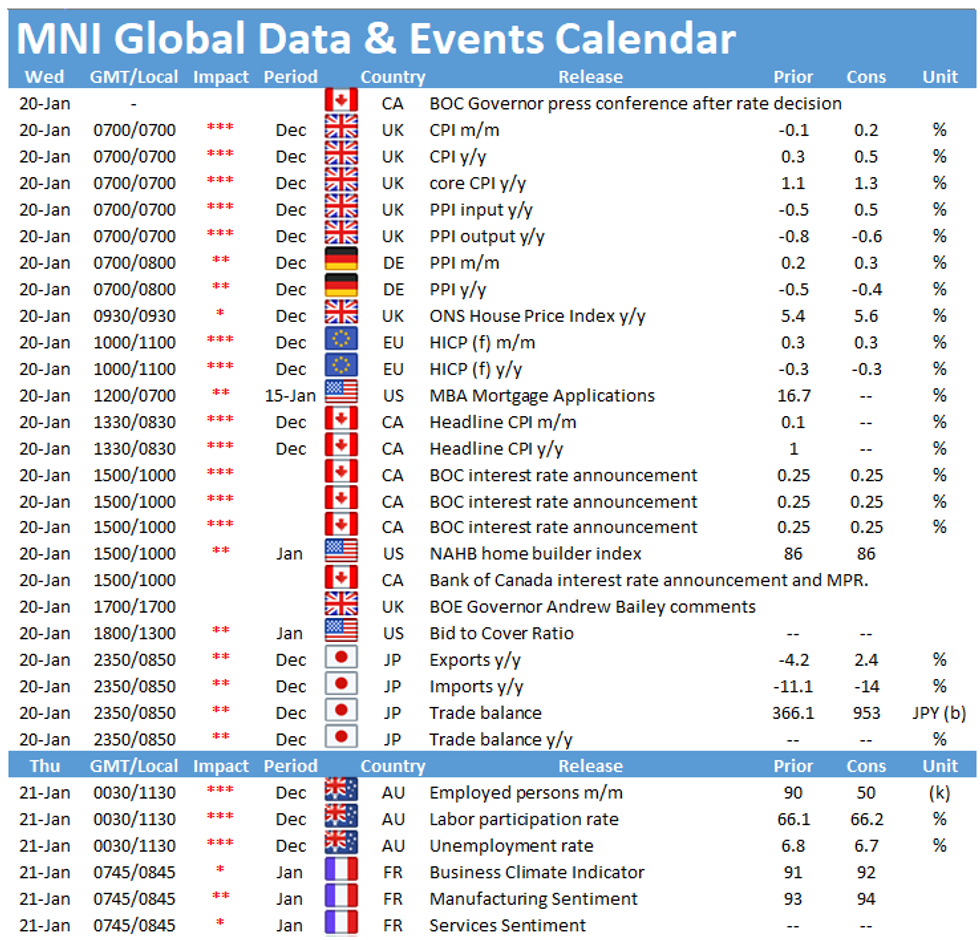

- Coming up today we have inflation data from the UK, Canada & EZ, a monetary policy decision from the BoC and comments from Riksbank's Skingsley & BoE's Bailey.

FOREX OPTIONS: Expiries for Jan20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2185-90(E512mln), $1.2300(E966mln)

- GBP/USD: $1.3700(Gbp387mln-GBP puts)

- EUR/NOK: Nok10.35(E713mln)

- AUD/USD: $0.7690-0.7700(A$1.0bln)

- NZD/USD: $0.6900(N$913mln)

- USD/CAD: C$1.2500($900mln), C$1.2700-15($1.1bln-USD puts), C$1.3000($540mln)

- USD/CNY: Cny6.50($1.6bln)

- USD/MXN: Mxn19.70($500mln-USD puts), Mxn19.90($500mln-USD puts)

ASIA FX: Gains For Second Session

Positive risk sentiment and a weaker greenback has put Asia FX on the front foot today. US Tsy Sec nominee Yellen managed to boost risk appetite with her testimony that hinted at even more stimulus spending.

- USD/CNH 131 pips lower at 6.4675. The PBOC kept LPR rates unchanged, while adding liquidity to the system again.

- USD/SGD down 36 pips at 1.3257, the pair has trended lower through the session and sits just above support at 1.3250.

- USD/TWD hovering below the 28.00 handle again, the pair has eked out some small gains after accounting for opening/closing swings.

- USD/HKD down 5 pips at 7.7518 and coasting along the bottom of the band. The Hang Seng has soared again amid continued inflows.

- USD/KRW dropped with the won higher for the second consecutive day. USD/KRW last down 3.70 at 1099.10

- USD/IDR last 14027, down slightly, extending yesterday's losses but capped by the descending 50-DMA

- USD/MYR down 18 pips at 4.048, markets await the upcoming BNM decision.

- USD/THB down 57 pips at 29.97. The pair re-opened on a softer footing after Thai ministers OK'd a cash handout scheme, while Bangkok authorities said they will apply for easing local Covid-19 curbs.

EQUITIES: Tech Leads The Way Higher

Positive risk sentiment has boosted Asia-Pac equity markets, further support provided by strong earnings from the US after market. US Tsy Sec nominee Yellen managed to engender some benign risk sentiment with her testimony that hinted at even more stimulus spending. However gains in China were capped as markets evaluated President-elect Biden's cabinet picks' stance on China, which appears more hard line than most expected.

- In Asia the Nikkei 225 is the laggard, down around 0.4%, dragged lower by financials and real estate. The index has rallied almost 75% since March. Hong Kong led gains in the region for a second day amid a continued inflow of mainland Chinese funds and relief re: the wellbeing of Alibaba chief Jack Ma.

- US futures are mixed, Nasdaq futures outperforming after a strong set of earnings from Netflix that saw shares spike 11% in after-market trade, tech sectors have led gains in Asia-Pac indices.

GOLD: Back Above $1,850/oz

A downtick in the USD has supported bullion in Asia-Pac trade, with lower U.S. real yields also providing support since the start of Tuesday's NY session. Still spot hasn't moved outside of the recently established range, last dealing a little above the $1,850/oz mark, against a well-defined technical backdrop.

OIL: Builds On Yesterday's Gains

Positive risk sentiment has seen oil rise in Asia-Pac trade; WTI & Brent up last up $0.30 apiece. Oil has built on gains made during the session on Tuesday as USD ticks lower, with further supported offered by testimony from US Tsy Sec nominee Yellen that sparked hopes of sizable fiscal stimulus.

- Upside was limited by forecasts from the IEA that predicted global oil demand will be negatively impacted as the pandemic forces national governments to impose lockdowns. The IEA trimmed forecasts by 300k bpd.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.