-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Equities Focus On The Positives In Asia

- Equities rally in Asia on expectations surrounding the Moderna COVID vaccine trial findings, PBoC liquidity injection & signing of the RCEP trade pact.

- Trump continues to try to muddy the waters re: the election result, doesn't concede.

- Central bank speak and Brexit matters provide the points of interest on Monday.

BOND SUMMARY: Off Lows, Bid In E-Minis Keeps Space In Check

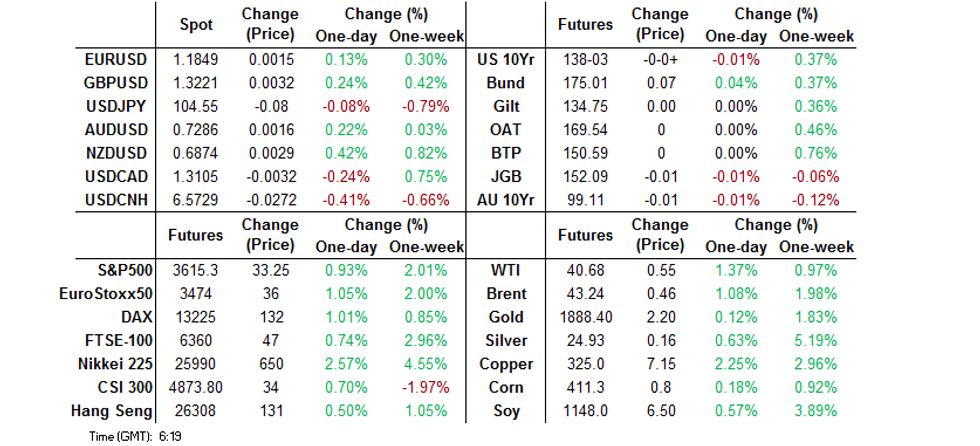

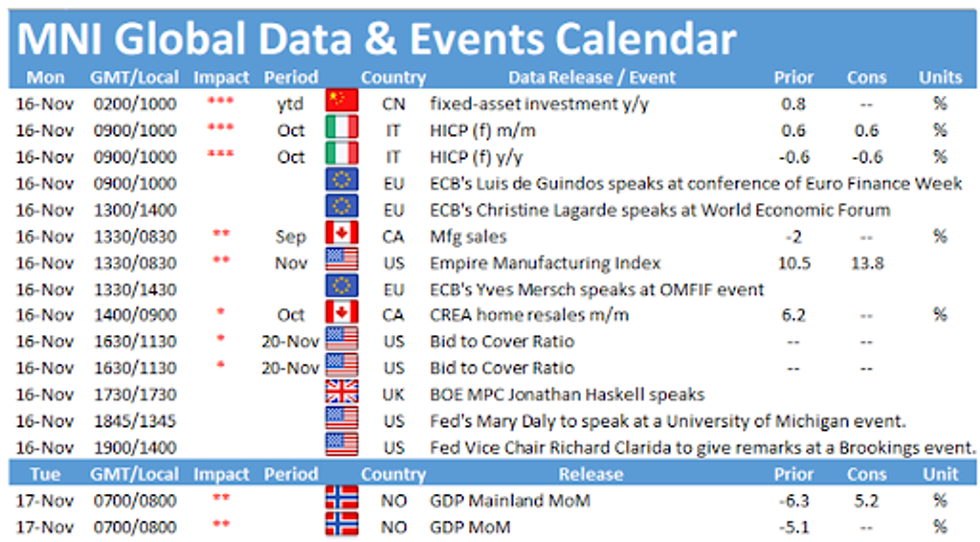

It has been a slow grind away from the early Asia-Pac lows for T-Notes, with little in the way of notable macro headline flow evident since the Asia-Pac re-open. The contract last prints -0-00+ at 138-03, operating in a 0-04+ range. Cash Tsy trade has seen very modest bull flattening, although yields are less than 1.0bp richer than settlement across the curve. Hope for further positive COVID-19 developments in the coming days has boosted most major equity indices, with core global FI a little more insulated, given the global COVID outlook and fresh restrictions that are evident/pending in the U.S. & Europe. On the data front, Chinese retail sales data for the month of October was a little soft, while the industrial production reading out of the same country was a touch firmer than expected. Eurodollar futures sit virtually unchanged across the reds. EDZ2/Z3 steepener screen flow provided the highlight overnight. Empire manufacturing & Fedspeak from Clarida & Daly headline on Monday.

- Early trade saw an unwind of the modest overnight losses for JGB futures, before the contract settled within a tight range, either side of unchanged, -1 vs. at the close. Cash JGBs saw modest richening, while swap rates nudged higher, leading to a modest widening of swap spreads. Local prelim Q3 GDP data was firmer than expected, but seen as very much in the rear-view mirror, given the evolving COVID situation, both at home and abroad. Local COVID-19 worry remains evident, with local press outlets suggesting that Hokkaido is set to raise its virus alert level in the coming days. Elsewhere, NHK suggested that Miyagi prefecture may call its own state of emergency.

- In Australia YM finished +0.5, while XM closed -1.0, with the grind away from lows in U.S. T-Notes that we have outlined elsewhere helping the space off worst levels, even with ACGB supply pressure (and indeed semi and corporate A$) evident. The RBA stepped in with an offer to purchase A$1.5bn of ACGB Apr '24, in order to enforce its 3-Year yield target, which seemingly provided some incremental support (the move came alongside the Bank's scheduled A$2.0bn round of purchases covering the lower end of maturities within the reach of its purer QE scheme). Bills finished unchanged through the reds. Later today RBA Governor Lowe will give a dinner address on "Covid, Our Changing Economy and Monetary Policy."

FOREX: Positives Dominate

Positive developments kept risk sentiment buoyant, as U.S. President-elect Biden's team ruled down a nationwide lockdown, 15 Asia-Pacific nations signed off on the world's largest regional free trade pact (RCEP), while the PBoC net injected CNY600bn of liquidity via its MLF facility. The upcoming announcement from Moderna on its Covid-19 vaccine research helped bolster sentiment and outweigh some familiar negatives. The greenback led losses in G10 FX space, with safe haven peers JPY & CHF sinking in tandem.

- Optimistic mood music lent support to commodity FX, which allowed NZD & NOK to top the G10 scoreboard. While the finalisation of the RCEP pact had the potential to soothe concerns over the close but tense Sino-Australian trade relationship (both are signatories to the deal), subsequent press reports noted that the bilateral spat over the recent trade disputes remain unresolved.

- Firmer risk appetite allowed GBP to shake off its earlier weakness, stemming from Friday's downgrade to the UK's credit rating by DBRS and uncertainty stoked by the news that PM Johnson was forced to go into quarantine as he was preparing to launch a "political reset".

- USD/CNH went offered owing to broader dollar weakness. There was little price reaction to China's monthly economic activity data, which included a beat in industrial output, a below-forecast acceleration in retail sales growth & a surprise downtick in unemployment.

- USD/KRW plunged through its 2019 lows and South Korea's MoF had to use some jawboning to kick the pair off worst levels. An MoF official said that the recent FX moves are excessive and authorities will take aggressive measures to stabilise markets.

- Focus moves to U.S. Empire M'fing, Canadian M'fing Sales, final Italian CPI & comments from RBA's Lowe, Fed's Clarida & Daly, ECB's Lagarde, de Guindos, de Cos, Mersch & Centeno, Riksbank's Skingsley & BoE's Haskel.

FOREX OPTIONS: Expiries for Nov16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1500(E1.1bln), $1.1830-50(E745mln)

- USD/JPY: Y103.40-50($740mln), Y104.45-55($541mln),

Y104.70-75($783mln), Y105.00($986mln), Y105.35($620mln), Y106.00-10($660mln) - EUR/JPY: Y123.00(E1.25bln)

- EUR/GBP: Gbp0.8825(E575mln-EUR puts), Gbp0.8925-35(E590mln-EUR puts)

- USD/CNY: Cny6.65($805mln-USD puts)

GOLD: Just Shy Of $1,900/oz

A softer USD has supported the yellow metal over the past couple of sessions, allowing bulls to force a challenge of $1,900/oz in spot during early Asia-Pac dealing this week. Spot deals at $1,892/oz, +$3/oz or so on the day, with price levels some way away from the key technical lines in the sand.

OIL: Supported By Equities

The broader uptick in equities (discussed elsewhere) has supported the major crude benchmarks in early trade this week, with WTI & Brent sitting ~$0.60 & ~$0.50 above their respective settlement levels, although the contracts still sit some way shy of last week's best levels. A reminder that crude struggled on Friday.

- In terms of crude-specific headline flow, a BBG source report lodged back on Friday noted that "the Trump administration is advancing plans to auction drilling rights in the U.S. Arctic National Wildlife Refuge before the inauguration of President-elect Joe Biden, who has vowed to block oil exploration in the rugged Alaska wilderness."

- Elsewhere, the broadening round of social mobility limitations in the U.S. and Europe will hurt the demand side of the coin, while incremental supply from Libya seemingly continues to nudge higher.

EQUITIES: Bid To Start The Week

Spill over from Wall St. trade and a focus on the potential for further positive COVID-19 vaccine announcements in the coming days seemingly supported the major regional equity indices during Asia-Pac hours, with a liquidity injection from the PBoC also adding a further leg of support for broader sentiment. Elsewhere, the formal signing of the RCEP trade pact provided another positive input for regional indices.

- These matters outweighed the negatives surrounding the political and fiscal landscape in DC, in addition the worry surrounding the U.S./global COVID outlook and realised/potential social mobility restriction in both the U.S. and Europe.

- Local economic data was mixed, with Japanese Q3 GDP topping exp. while Chinese retail sales data missed.

- E-minis pushed higher, with the NASDAQ 100 contract breaching 12,000, while the A&P 500 contract broke above 3,600.

- ASX 200 equity trade was suspended after a market data issue hampered trade, resulting in an early close on Monday.

- Nikkei 225 +2.1%, Hang Seng +0.6%, CSI 300 +0.7%, ASX 200 +1.2%.

- S&P 500 futures +34, DJIA futures +297, NASDAQ 100 futures +112.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.