-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Equities Recover, AUD Outperforms

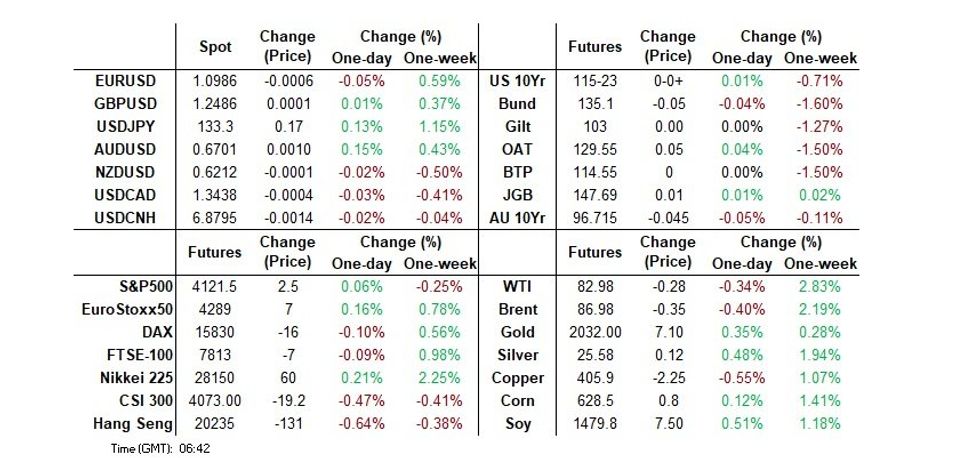

- Core FI markets lack meaningful direction as Asia-Pac participants digest Wednesday's U.S. CPI data & FOMC minutes from the March meeting.

- Equities recovered from worst levels of the session, although the Hang Seng Tech Index lagged. AUD outperforms in the G10 FX sphere on the back of the latest Australian labour market report.

- UK GDP and final German CPI provide the data highlights in Europe. Further out we have U.S. PPI and initial jobless claims. On the speaker slate we will hear from ECB's Nagel, BoC's Macklem & BoE's Pill, with the latter speaking at an MNI event.

US TSYS: Marginally Cheaper In Asia As Regional Matters Dominate

TYM3 deals at 115-23, +0-00+, a 0-08+ range has been observed on volume of ~65k.

- Cash tsys sit 1-2bps cheaper across the major benchmarks, light bear flattening has been observed.

- Tsys were marginally richer to start as the latest North Korean missile test provided a level of support in early trade. The move however had little follow through and tsys pared gains to sit marginally cheaper.

- Pressure extended a touch as spillover from ACGBs in lieu of the Australian Unemployment rate holding steady weighed on tsys.

- Losses were marginally pared and tsys dealt in narrow ranges with little follow through on moves for the remainder of the Asian session.

- UK GDP and final German CPI provide the highlights in Europe. Further out we have PPI and Initial Jobless claims. We also have the latest 30-Year Supply.

JGBS: Curve Twist Flattens

Core global FI markets have generally ticked away from session lows, with a similar dynamic observed in JGB futures as we approach the bell. The contract is -3, after more than reversing the modest overnight session uptick. Cash JGBs are 1bp cheaper to 3bp richer as the curve twist flattens.

- Mixed internals at the latest liquidity enhancement auction for off-the-run 15.5- to 39-Year JGBs applied pressure in the early part of the Tokyo afternoon (spread dynamics were firm, but the cover ratio was soft, probably owing to the flatness of the JGB curve). A recovery from session lows in Asia-Pac equities pressured JGBs earlier in the day.

- Elsewhere, support from the previously outlined North Korean missile launch and dovish rhetoric from BoJ Governor Ueda gave way as the tension surrounding the missile launch peeled off from extremes, with the projectiles avoiding Hokkaido. An uptick from session lows in equities also applied some light pressure to the space.

- In terms of specifics, Ueda pointed to a need to exercise more caution re: inflation undershooting the Bank’s goal than overshooting it on a sustainable basis, flagging differences between inflation in Japan vs. its major global peers. As mentioned above, this once again places Ueda on the dovish side of the broader spectrum, at least for now.

- Looking ahead, the latest BoJ Rinban operations headline the domestic docket on Friday.

JAPAN: International Investors Bought Record Amount Of Japanese Equities Last Week

Weekly international security flow data from the Japanese MoF reveals that Japanese investors shed international bonds for a second consecutive week during the week ending 7 April, the first instance of back-to-back weeks of net sales observed since January. Still, the 4-week rolling sum of the measures remains comfortably in positive territory given the sizable rounds of net purchases deployed in the weeks prior to the current run.

- Japanese investors were also net buyers of international equities for a second consecutive week, although the net purchases were paltry.

- International investors were net buyers of Japanese bonds for the third week in four but got nowhere near challenging the record weekly net purchase levels observed in March.

- Finally, international investors deployed the largest round of net weekly purchases of Japanese equities on record last week.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -788.8 | -483.4 | 3248.8 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 28.2 | 390.3 | 494.5 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 1311.1 | 944.1 | 4674.6 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 2368.9 | 62.2 | 54.1 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

AUSSIE BONDS: Yields Higher After Jobs Data

ACGBs sit just off session cheaps (YM -4.0 & XM -4.5) after stronger-than-expected employment data sparks a 9bp and 6bp sell-off in respectively 3-year and 10-year bond futures. The Employment Report for March printed a 53k increase and an unemployment rate of 3.5% versus expectations of +20k and 3.6%. Overall, today’s data presented a robust labour market with demand in line with trend supply (higher participation rate and more hours worked) growth.

- Cash ACGBs are 4bp weaker with the AU-US 10-year yield differential +5bp at -12bp.

- Swap rates are 5bp higher with EFPs slightly wider.

- Bills strip shunts 4-8bp cheaper after the data to be -4 to -7 on the day.

- RBA dated OIS firms 4-7bp for meetings beyond August after the data with year-end easing expectations reduced to 14bp. A 23% chance of a 25bp hike in May remains priced.

- Also on the data front, Melbourne Institute Inflation Expectations eased from 5.0% to 4.6%, their lowest in 14 months.

- With the local calendar light until next week, the local market will focus on US Tsys as it navigates US PPI and Initial Jobless Claims today ahead of US Retail Sales and Industrial Production for March on Friday.

AUSTRALIA: Inflation Expectations Ease To Lowest In 14 Months

Melbourne Institute consumer inflation expectations for April eased to 4.6% from 5%, their lowest since February 2022. This was the third consecutive monthly decline and is consistent with the RBA’s view that inflation has peaked and that inflation expectations remain anchored. They peaked at 6.7% in June 2022. Expectations also points to a further moderation in monthly CPI inflation in the months ahead. The important Q1 and March CPI data print on April 26.

Fig. 1: Australia MI inflation expectations vs monthly CPI y/y%

Source: MNI - Market News/ABS/Refinitiv

AUSTRALIA: Job Ads Stabilise At Still High Levels

SEEK/NAB job ads fell 0.6% m/m in March after a 1.3% drop the previous month. But ads in Q1 were still 1.9% above December and remain over 25% above the 2019 peak. The message is that while vacancies are off their mid-2022 peak, they have stabilised at the start of 2023 at an elevated level. On the labour supply side, the number of applicants per job rose by 4% m/m in February. Labour demand remains strong and an increase in labour supply should help as long as there isn’t a skills mismatch.

- Despite the overall fall, 12 of 28 industries recorded an increase in job ads in March. There was further normalisation in hospitality and tourism as they continued to underperform other areas. 6 of 28 sectors have advertising below pre-Covid levels.

- Applicants per ad, while well off the 2022 lows, are still 35% below December 2019.

Source: MNI - Market News/SEEK/

NZGBS: At Cheaps, Higher ACGB and US Tsy Yields

NZGBs closed 1-4bp cheaper at session cheaps in sympathy with the post-employment data weakening in ACGBs. US Tsys are also 1-2bp cheaper in Asia-Pac trade. Like ACGBs, NZGBs have underperformed US Tsys with the 10-year yield differential +6bp at +64bp. The weekly NZGB auction held today displayed robust demand (cover ratio 3.0-4.0x range). However, with the shortest offering approximating a 5-year bond versus a 3-year bond last week, today’s auction failed to receive bids linked to RBNZ over-tightening risks and recessionary concerns.

- Swap rates are 3-4bp higher with the implied swap spread box flatter.

- RBNZ dated OIS closed little changed with 20bp of tightening priced for the May meeting and 42bp of easing priced for Feb-24 off a terminal OCR expectation of 5.48% (July).

- The local calendar is scheduled to release Manufacturing PMI (Mar) and Net Migration (Feb) tomorrow. The PMI has moved well off its recent low (47.4), but headwinds are mounting after the RBNZ’s aggressive tightening cycle. Net migration has recently returned to strong inflows with the border now open.

- Further afield, US PPI and Initial Jobless Claims will be the focus today ahead of US Retail Sales and Industrial Production for March on Friday.

FOREX: AUD Firms As Labor Market Remains Tight

The AUD is the strongest performer in the G-10 space at the margins. The March employment report did not show any signs of the labour market easing, the unemployment rate held steady at 3.5% and the participation rate rose a touch to 66.7%. Elsewhere in G-10 ranges have been narrow with little follow through in a relatively muted Asian session.

- AUD/USD firmed in the aftermath of the print, post US-CPI highs remain intact for now as resistance was seen at $0.6720 and the pair marginally pared gains to sit ~0.3% higher.

- AUD/NZD briefly dealt above $1.08, the handle has emerged as a key level for bulls as they have been unable to sustain a break of this level in recent dealing.

- NZD/USD is a touch firmer, the pair last prints at $0.6215/20 ~0.1% higher today. A narrow $0.6200/20 range has been observed through the session as the NZD hasn't followed through on moves.

- Yen was firmer in early trade, USD/JPY dropped below the ¥133 handle as North Korea conducted their latest missile test. Support was seen below this level and the pair pared losses to sit a touch firmer.

- Cross asset wise; e-minis pared early losses to sit a touch firmer. BBDXY is little changed and US Treasury Yields are marginally higher across the curve.

- UK GDP and final German CPI provide the highlights in Europe. Further out we have US PPI and Initial Jobless claims.

FX OPTIONS: Expiries for Apr13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E3.4bln), $1.0850(E1.7bln), $1.0885-90(E1.1bln), $1.0900(E6.3bln), $1.0950(E1.5bln), $1.1000(E3.1bln)

- USD/JPY: Y131.25-30($800mln), Y132.00-05($1.3bln), Y132.20-25($663mln), Y133.00($1.2bln), Y134.00-05($1bln)

- GBP/USD: $1.2360-80(Gbp1.1bln)

- EUR/GBP: Gbp0.8795-10(E595mln)

- AUD/USD: $0.6625-30(A$1.7bln), $0.6645-50(A$1.7bln)

- USD/CAD: C$1.3525($1bln)

- USD/CNY: Cny6.8785-00($500mln), Cny6.9000($852mln)

EQUITIES: Firm Chinese Exports Help Turn Risk Mood, Hang Seng Tech Struggles

The early negative momentum in e-mini futures, as Asia-Pac participants reacted to Wednesday’s Wall St. downtick, as well as the negative feedthrough from the latest North Korean missile launch (which triggered a cautionary seek shelter warning in Japan’s Hokkaido region, although the warning was subsequently removed), has reversed, with the 3 major contracts running little changed to 0.2% firmer.

- The Hang Seng has bounced from early session lows after shedding ~2%, with the uptick in e-minis and much firmer than expected monthly export data out of China aiding that dynamic, although the index still runs 0.5% worse off on the day.

- To recap, the early weakness in the Hang Seng stemmed from pressure on tech giant Alibaba, which tumbled after the FT pointed to SoftBank offloading a significant chunk of its holdings in the company. Meanwhile, embattled Chinese property developer Sunac came under notable pressure as dealing in the company’s equity resumed after a year-long halt. Tech names kept the index heavy (HS Tech last -1.1%).

- The Nikkei 225 benefitted from the aforementioned turnaround in risk appetite, more than paring early losses, last printing 0.2% higher. The related move away from session lows in USD/JPY further aided the bid in the Nikkei 225. This comes after data from the Japanese MoF revealed the largest ever round of weekly net purchases of Japanese equities on the part of international investors (for the week ending 7 April).

GOLD: Bullion Supported By Lower US Inflation, Watch PPI Later

Gold prices are up another 0.2% to $2019.25/oz during the APAC session after finishing 0.6% higher on Wednesday at $2014.93. Gold spiked following the lower-than-expected US headline inflation data to a high of $2028.28, which pushed the greenback lower, but soon afterwards bullion tested the $2000 level. The USD is close to flat today.

- With core inflation in the US rising 0.1pp to 5.6%, as expected, analysts still expect the Fed to hike rates 25bp on May 3. The greater decline in the headline though has supported bullion as the market now expects monetary easing by year end.

- Later there is US PPI data for March, which is expected to post lower annual growth rates, and also jobless claims. There are no Fed speakers scheduled. There is also euro area and UK February output data.

OIL: Crude Lower Today But Market Generally More Positive

Oil prices are down during APAC trading today after rising around 2% on Wednesday on the back of a weaker dollar driven by the larger than expected drop in headline US inflation. WTI is currently 0.3% lower at $82.98/bbl and Brent is -0.4% to $87.00, both are around their intraday lows. The USD is close to flat so far today.

- Supply factors have also been supporting crude with OPEC announcing it will reduce output from May, flows from Iraqi Kurdistan still halted, signs that Russia is reducing production and lower US stocks at Cushing. Timespreads from futures contracts are also pointing to a tightening of the market. Moderating US inflation is boosting optimism that the Fed is close to a peak but core remains sticky. Analysts still expect another 25bp hike in May.

- China saw a sharp increase in energy imports in March to their highest since mid-2020. Also exports of refined products fell 12%, as fuel was kept for domestic use.

- The monthly OPEC report on market conditions is published today. On Wednesday, the IEA said that it expects demand to be stronger than supply in H2 2023.

- Later there is US PPI data for March, which is expected to post lower annual growth rates, and also jobless claims. There are no Fed speakers scheduled. There is euro area and UK February output data.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/04/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 13/04/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 13/04/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 13/04/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 13/04/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 13/04/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 13/04/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 13/04/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 13/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/04/2023 | - |  | EU | ECB Lagarde and Panetta in IMF/World Bank, G20 Finance Ministers' Meetings | |

| 13/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 13/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 13/04/2023 | 1230/0830 | *** |  | US | PPI |

| 13/04/2023 | 1300/0900 |  | CA | Governor Macklem speaks at IMF | |

| 13/04/2023 | 1300/1400 |  | UK | BOE Pill Speaker at MNI Connect | |

| 13/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 13/04/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 13/04/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 13/04/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.