-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Crude Oil Imports Accelerate In November

MNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI EUROPEAN MARKETS ANALYSIS: Equities Struggle In Asia, PBoC Underwhelms

- Headlines surrounding Sino-U.S. trade weigh on broader risk appetite, but present nothing new.

- The PBoC's first round of liquidity provisions covering the LNY holiday underwhelmed, representing a roll of existing liquidity.

- DXY back near yesterday's high, with U.S. 5-/30-Year yield spread tagging fresh multi-year highs.

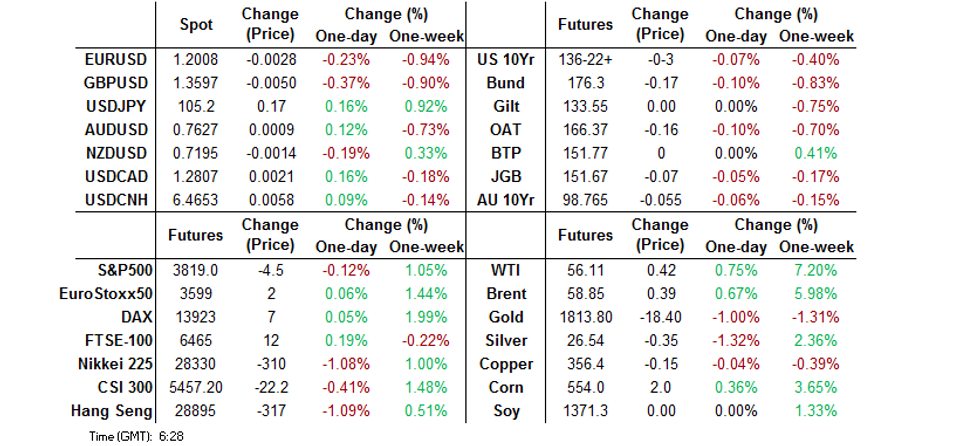

BOND SUMMARY: Core FI Mostly Lower

Asia-Pac trade saw fresh ~12-month highs for 30-Year Tsy yields and Alibaba launch a $5bn round of multi-tranche $ supply, covering 10-, 20-, 30- & 40-Year paper, although the Tsy space moved off worst levels, with equities trading on the defensive as U.S. President Biden's nominee for Commerce Secretary noted that the likes of Huawei & ZTE should remain on the restricted trade list (we would argue that this doesn't provide a shock, but dented broader risk sentiment in a limited overnight session). T-Notes still print lower on the day, -0-03 at 136-22+, while the cash curve has seen some modest twist steepening. Swap spreads are a little wider on the day, which would have helped the early upward momentum in yields (10s and 30s have cheapened for 5 consecutive days on a closing basis). On the flow side, an 800 lot block buyer of WNH1 was seen. Weekly jobless claims, nonfarm productivity and factory orders headline the local data docket on Thursday, with Fedspeak from Kaplan and Daly also due.

- The wings of the cash JGB curve were firmer throughout Thursday trade, looking through the offshore impetus. However, the belly lagged all day, and actually cheapened during afternoon trade, underperforming for a second straight day as futures added to their overnight losses, before edging away from worst levels, closing -7. The latest 30-Year JGB auction wasn't the firmest, but wasn't as weak as last month's offering, with the tail pretty steady, although the low price did match broader dealer exp. (as proxied by the BBG poll), while the cover ratio recovered from last month's dip to print at "normal" levels. 5-25 Year BoJ Rinban ops headline locally on Friday.

- YM -0.5 and XM -5.5 come the Syndey close, with the latter operating through its recent lows. The curve was steeper on the day, with no respite for those of a bullish disposition, even with any hedging flow surrounding the pricing of the A$1.6bn tap of NSWTC's Mar '33 line subsiding. As we have flagged previously, there is speculation that the syndication of a new ACGB Nov '32 could be announced via the weekly AOFM issuance slate, due to be released on Friday, while fresh multi-month highs for U.S. 30-Year yields and the trans-Tasman impetus from NZ bonds stemming from RBNZ re-pricing will have added pressure from abroad. Retail sales, A$1.0bn of ACGB 0.50% 21 September 2026 supply and the aforementioned AOFM weekly issuance slate headline locally on Friday.

JAPAN: Bland Weekly International Security Flows

Once again, little stands out in terms of headline net flow in the latest round of weekly Japanese international security flow data, which is outlined below.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 729.6 | 756.2 | 2498.3 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -569.2 | -264.5 | -588.5 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 62.1 | 143.3 | 486.7 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -187.5 | 209.8 | 712.3 |

FOREX: Commodity Market Dynamics Underpin AUD

AUD topped the G10 pile on the back of firmer commodity prices, as crude oil extended its rally after OPEC+ pledged to continue reducing the supply surplus, while iron ore gained after Vale's quarterly output undershot forecasts. In addition, the Australian Bureau of Statistics highlighted a surge in iron ore exports to a fresh record of A$12.6bn in December. The data was part of the monthly trade report, which saw trade surplus widen less than expected, owing to a miss in exports. However, also on the data front, a recovery in Australia's NAB Business Confidence helped keep the Australian dollar buoyant. BBG trader source flagged demand for the Aussie from local exporters, with option-related offers reportedly placed ahead of sizeable $0.7650 strikes. AUD/NZD snapped its four-day losing streak and showed above the prior day's range.

- USD/JPY edged higher, extending its winning streak to seven days in a row. There are some chunky option expiries coming up at today's NY cut, including $1.6bn of options with strikes at at Y104.30-40, $1.4bn at Y105.00 & 41.0bn at Y105.55-65.

- The greenback fared relatively well, but the DXY struggled to break out of yesterday's range despite adding a handful of pips through the session.

- The PBOC fixed USD/CNY at CNY6.4605 today, 14 pips above sell side estimates and the twelfth straight fix above the estimate. The PBOC matched liquidity withdrawals with injections today, but used the 14-day repo tool as we get closer to LNY.

- GBP went offered ahead of today's announcement of the BoE's latest monetary policy decision. Cable printed worst levels in two weeks and narrowed in on the $1.3600 mark.

- Other than the BoE decision, focus turns to U.S. initial jobless claims, factory orders & final durable goods orders, EZ retail sales, ECB economic bulletin and comments from ECB's de Cos and Fed's Kaplan & Daly.

FOREX OPTIONS: Expiries for Feb04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1890(E585mln), $1.2000-10(E1.15bln), $1.2025-35(E1.4bln), $1.2045-50(E1.7bln), $1.2125-35(E575mln), $1.2150-60(E886mln)

- USD/JPY: Y102.00($780mln), Y104.30-40($1.6bln), Y105.00($1.4bln), Y105.55-65($1.0bln)

- AUD/USD: $0.7550(A$828mln), $0.7595-00(A$697mln)

- AUD/NZD: N$1.0690-1.0700(A$615mln-AUD puts)

- NZD/USD: $0.7100(N$853mln), $0.7375(N$502mln)

- USD/CAD: C$1.2590-1.2600($760mln)

- USD/CNY: Cny6.39($625mln), Cny6.43($580mln), Cny6.45($876mln)

- USD/MXN: Mxn19.50($609mln), Mxn19.75($605mln), Mxn20.00($817mln), Mxn20.50($1.8bln)

ASIA FX: A Session Of Two Halves Amid Risk Off

A session of two halves in the Asia session, most USD/Asia EM crosses lower in early trade as the greenback ran into some offers, but equity bourses in the region opened in the red after US stocks wiped out most of the day's gains into the close which negatively impacted sentiment, sending USD higher and sapping the bid in most Asia FX.

- CNH: The PBOC fixed USD/CNY at 6.4605 today, 14 pips above sell side estimates and the twelfth straight fix above the estimate, bringing the total misses in February to +56 pips. Yuan weakened amid comments regarding a trade blacklist from US President Biden's nominee for commerce secretary.

- SGD: Singapore dollar turns lower, USD/SGD runs into resistance at 1.3350. Singapore has given provisional clearance for Moderna's Covid-19 vaccine, the first shipment is expected around March.

- TWD: Taiwan dollar has come off best levels, but is still one of the better performers after earlier touching fresh 23 year lows. After market yesterday Taiwan announced intentions to tighten regulations around the declaration of FX transactions.

- KRW: The won is the worst performer in Asia, the government are said to be holding talks on additional bond sales to finance the extra budget today which has caused some concern.

- IDR: The rupiah weakened, Indonesian FinMin Indrawati pledged to boost stimulus budget this year to IDR619tn from the previously estimated IDR533tn to better support domestic businesses.

- MYR: Ringgitt is lower but has held its ground better than some other currencies, supported by higher oil and jopes the MCO order will be less strict than last time.

- PHP: The peso weaker, Philippine bank lending shrunk 0.7% Y/Y in Dec after expanding 0.4% in Nov. It was the first decline in lending since 2008.

- THB: The baht holding around neutral levels, managing to resist USD strength. The BoT took a unanimous decision to leave its benchmark policy rate unchanged, with little to rock the boat in the accompanying statement.

ASIA RATES: Fixed Income Under Pressure Despite Risk Off Tone

Asia-Pac trade saw fresh circa 12-month highs for 30-Year US treasury yields which saw bonds in the region sell off in sympathy. While a $5bn multi-tranche deal announced by Alibaba also likely stole some attention EM sovereigns.

- CHINA: The PBOC matched liquidity withdrawals with injections today, but used the 14-day repo tool as we get closer to LNY. The move indicated PBOC is still cautious over the levels of excess liquidity in the system. The overnight repo rate has risen following the OMOs, the rate is 21bps higher at 2.0761% but still way below the panic driven highs of 3.5698%. Bond futures sold off amid comments regarding a trade blacklist from US President Biden's nominee for commerce secretary.

- INDIA: Wait and see mode for India sovereign debt. Market participants await the RBI meeting on Friday for any measures to support a debt market facing heavy supply after a borrowing binge in 2020 and elevated issuance figures in 2021/22.

- INDONESIA: Indonesian bonds came under pressure from the open after FinMin Indrawati pledged to boost stimulus budget this year to IDR619tn from the previously estimated IDR533tn to better support domestic businesses and health sector amid the worst Covid-19 outbreak in Southeast Asia.

- SOUTH KOREA: The fixed income space in South Korea has come under pressure on concerns that additional bond sales will be required to finance the touted additional budget that will feature handouts to citizens and businesses.

GOLD: Still Biased Lower

Bullion has softened over the last 24 hours, with spot sitting a little over $10/oz softer during Asia-Pac trade, last printing a touch above $1,822/oz, with the technical upside break in the DXY and uptick in longer dated U.S. real yields allowing bears to switch their focus to the Jan 18 low at $1,804.7/oz.

OIL: Rally Extends

Crude futures gained for fourth session, extending their rally after comments from OPEC+ ministers indicated the group would continue to work on reducing the supply surplus. WTI & Brent print ~$0.45 higher on the day into Europe.

- In a post JMMC meeting communique, OPEC+ "stressed the importance of accelerating market re-balancing without delay" and also noted uncertain demand prospects headings forward. The group kept output levels for February and March unchanged as expected. On the supply front the EIA projected that American oil production wouldn't surpass 2019 levels until 2023.

- US DOE supply data was also supportive, the figures showed a drawdown in headline inventories of 994k which takes stocks down to a 10-month low. Also supportive on the supply front were projections from the EIA that US oil production won't surpass 2019 levels until 2023. Upside was tempered by a large build in gasoline inventories of 4.47m/bbls.

EQUITIES: Rally Loses Steam

Asia-Pac equities couldn't manage to extend their rally into a fourth day, most indices in the region are lower. The move lower started near the end of the US session as the S&P wiped out the majority of the day's gains, while the Nasdaq dropped into negative territory.

- The move lower started with US futures as after-market earnings disappointed. Qualcomm dropped as the chipmaker missed on sales estimates. US futures have extended declines, e-mini S&P down around 0.5% at the time of writing.

- Markets in South Korea and Hong Kong lead the way lower with losses over 1%, bourses in mainland China are lower on comments regarding a trade blacklist from US President Biden's nominee for commerce secretary.

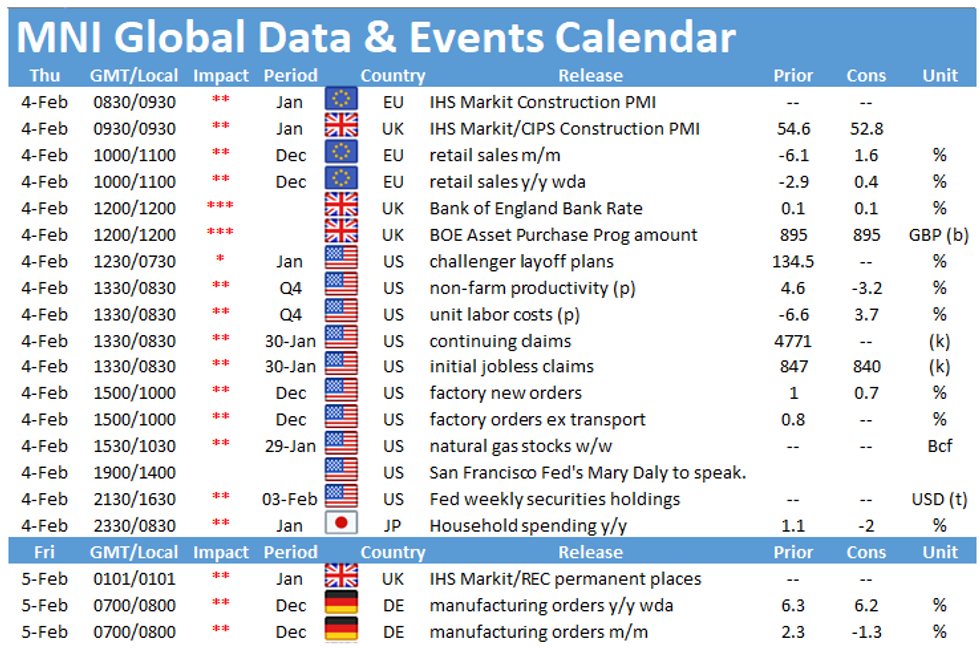

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.