-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Equities Turn Their Tails In Asia

- Asia-Pac equity benchmarks take their cue from Monday's tech-led rout on Wall Street, which spills over into broader risk environment

- 10-Year JGB auction draws the lowest bid/cover ratio since 2015, while lowest price is marginally higher than forecast in BBG dealer poll

- Crude oil weakens as Continental Pipeline promises to substantially restore all service by the weekend

BOND SUMMARY: Risk Aversion Lingers, 10-Year JGB Auction Draws Lowest Bid/Cover Ratio Since 2015

JGB futures crept higher as the Nikkei 225 tumbled alongside other major Asia-Pac equity indices, but pulled back off session highs at 151.48 after the lunch break. The latest 10-year JGB auction drew the lowest bid/cover ratio (3.038x) since 2015, while low price was marginally higher than forecast in the BBG poll. As we type, JGB futures trade at 151.45, 5 ticks north of last settlement. Cash JGB yields are broadly lower across a slightly flattened curve, with 10s outperforming. The space was unfazed by a strong beat in Japanese household spending print for the month of March.

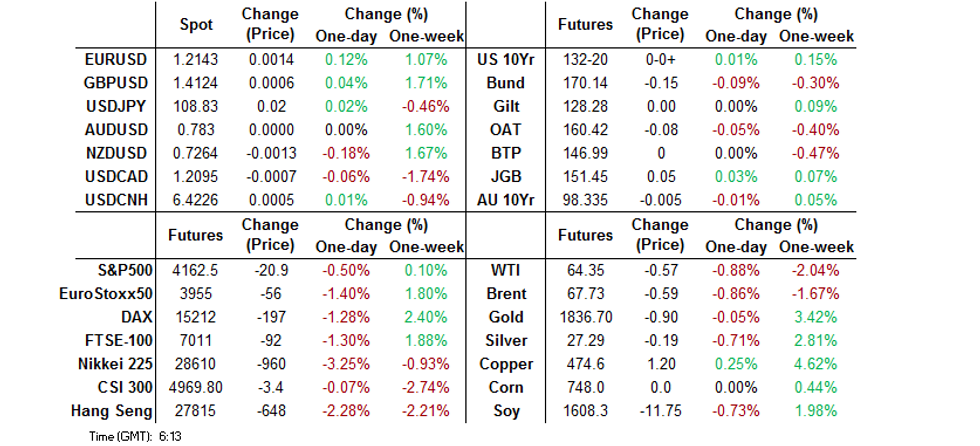

- T-Notes last trade +0-01+ at 132-21 after topping out at 132-23+. Cash Tsy curve bull flattened on the back of broader risk-off impetus, which sent e-minis & major regional equity indices lower; Tsy yields last trade 0.2-1.6bp lower. Eurodollar futures trade -0.5 to +0.5 tick through the reds. There is plenty of Fedspeak coming up today.

- XM unwound their initial uptick and last trade -1.5, with YM unch. Cash ACGB curve has bear steepened a tad, yields last sit -0.5bp to +1.6bp. Bills trade unch. to -1 tick through the reds. The AOFM sold A$100mn of Feb '50 linker, drawing a bid/cover ratio of 3.600x. The bond was last auctioned in 2019. The syndication of AUSCAP May '30 is expected today. Elsewhere, main focus is on Australia's 2021/22 Federal Budget, with recent commodity & jobs mkt developments expected to allow the gov't to boost spending & keep a lid on fiscal deficit.

FOREX: Looking For Clear Direction

It was a mixed Asia-Pac session for G10 FX, with AUD catching a light bid early on amid chatter that local exporters bought the Aussie after its pullback from a multi-week high. Australian Treasurer Frydenberg is set to unveil the 2021/22 Federal Budget today. NZD diverged from its Antipodean cousin and lagged the rest of the G10 pack.

- JPY and USD struggled even as U.S. e-minis slipped in Asia, while regional equity benchmarks registered losses in the wake of yesterday's disappointing session on Wall Street. Safe haven peer CHF remained fairly resilient.

- The PBOC set its central USD/CNY mid-point at 6.4254, 32 pips above sell-side estimates, signalling that it wants to reign in the redback's rally. USD/CNH continued to hover close to its three-year lows, largely looking through China's inflation data.

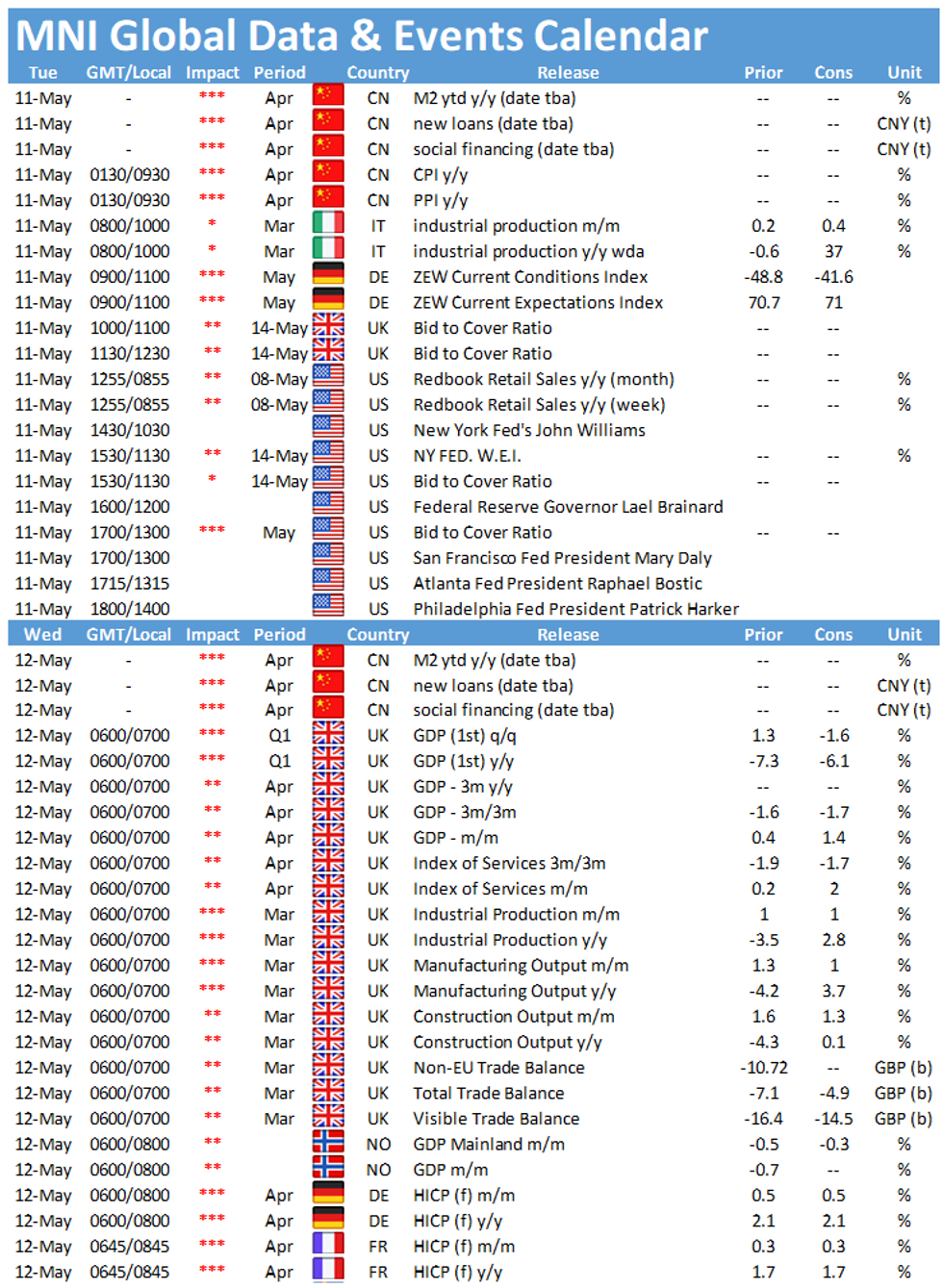

- German ZEW Survey & Italian industrial output take focus on the data front. Fed speaker slate is tightly packed, with ECB's Knot & de Cos, BoE's Bailey & Norges Bank's Bache also due to speak. The Queen's Speech will outline UK gov't's legislative priorities.

FOREX OPTIONS: Expiries for May11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2095-00(E1.3bln), $1.2125(E1.3bln), $1.2185-90(E1.5bln)

- USD/JPY: Y108.00($1.4bln), Y109.40-50($1.2bln)

- AUD/USD: $0.7620-30(A$2.7bln)

- NZD/USD: $0.7200(N$661mln)

ASIA FX: Risk Sentiment Sours

Risk sentiment soured in Asia on Tuesday while the greenback gained, which saw Asia EM FX drop.

- CNH: Offshore yuan heads into Europe slightly weaker, but holding near 3-year highs. The PBOC set its central USD/CNY mid-point at 6.4254, 32 pips above sell-side estimates, signalling that it wants to reign in the redback's rally, the pair mostly looked through China's inflation data.

- SGD: Singapore dollar is slightly weaker as coronavirus concerns persist after the latest reports indicate that Malaysia has decided to suspend the Green Lane scheme with Singapore from May 13 and normal travel arrangements will resume.

- TWD: After touching a 24-year high yesterday Taiwan dollar has retreated, the pair is holding below 28.00 and has still not filled yesterday's opening gap. Limited news flow, Taiwan's President said Taiwan and European Union should begin bilateral investment talks to further deepen ties.

- KRW: Won weakened from the open and wiped out yesterday's gains. The losses came even as data earlier showed South Korea's exports soared 81.2% Y/Y in the first 10 days of May as shipments of chips, autos and petroleum goods remained robust amid a global economic recovery.

- MYR: Ringgit is weaker, the gov't imposed a nationwide Movement Control Order (MCO) across the whole country days after announcing similar curbs in Selangor and Kuala Lumpur. The MCO takes effect on Wednesday and will last through Jun 7. PM Muhyiddin warned that "Malaysia is facing a third wave that could break into a national crisis."

- IDR: Rupiah is flat, data showed Indonesia's retail sales rose 9.8% Y/Y in March, while Intertek data showed that Indonesia's palm oil exports rose by a quarter in April vs. a year before.

- PHP: Peso fell, Q1 GDP fell more than expected at -4.2% compared to -3.2% expected. Following the data the government said it would continue reopening gradually and would be guided by data.

- THB: Baht bucks the trend and is stronger after posting a 2.5 month low yesterday, PM Prayuth chairs the weekly cabinet meeting today. Ministers will discuss and may give a nod to a new round of stimulus measures.

ASIA RATES: China Repo Rates Rise

Local dynamics in play despite heavy losses in equity markets. Positive data in Indonesia sees yields rise while conflicting signals in South Korea results in futures treading water.

- INDIA: Participants will scrutinize an INR 125bn sale of state debt today for indications as to appetite for Indian debt. Pressure grows in Indian PM Modi to declare a nationwide lockdown, even as individual states begin to impose stricter curbs. There are now over 4,000 daily deaths attributed to COVID-19. The sell side has started trimming estimates for growth, a trend that is likely to accelerate should a national lockdown be imposed. Markets await a data dump tomorrow including inflation and industrial production.

- SOUTH KOREA: Futures failed to make any decisive gains and head into the close broadly flat. Data earlier showed South Korea's exports soared 81.2% Y/Y in the first 10 days of May as shipments of chips, autos and petroleum goods remained robust amid a global economic recovery. South Korea reported 511 new cases of coronavirus in the past 24 hours, back above 500 after a brief dip below. South Korea is also in talks with the US to quickly secure COVID-19 vaccines. In the cash space yields are slightly lower, but moves are muted despite heavy selling in equity markets. Second Vice Finance Minister Ahn Do-geol hosts meeting to review govt bond market at 0900BST/1600KST.

- CHINA: China matched liquidity maturities with injections again after a CNY 10bn injection yesterday, repo rates rose but have come off highest levels. CPI was slightly softer than expected while PPI rose above estimates again. Futures rose from the off, 10-year meeting resistance around 98.18. Latest data from ChinaBond showed foreigners were net buyers to the tune of CNY 52bn in April after being net sellers in March for the first time in two years.

- INDONESIA: Yields higher across the curve with some bear flattening seen, data showed Indonesia's retail sales rose 9.8% Y/Y in March, while Intertek data showed that Indonesia's palm oil exports rose by a quarter in April vs. a year before. Elsewhere markets digest comments from the finance ministry over proposals to increase tax revenue including higher VAT.

EQUITIES: Tech Leads The Way Lower

Equity markets in the Asia-Pac region are in the red after taking a negative lead from the US. Losses are broad, but Japanese markets hold the dubious honour of being the biggest decliners with losses of almost 3%., there were also reports in Asahi that a Japan wide emergency shouldn't be ruled out. Tech heavy indices such as the Taiex and the KOSPI have also sustained heavy losses, following in the footsteps of the Nasdaq, inflation concerns amid surging commodity prices was adduced as the reason behind the Nasdaq's decline. In Australia the ASX 200 lost over 1% as iron ore declined over 4% from its highs after surging yesterday. In the US futures are lower, the Nasdaq once again leading the way lower.

GOLD: Yellow Metal Holds Recent Gains

Gold has squeezed out some gains in the Asia-Pac session, though is still some way below yesterday's peak. The yellow metal last trades at $1836.89 having briefly dropped as low as $1831.47. The market remains focused on inflation pressures being stoked by surging commodity prices; markets will digest a raft of Fed speakers today ahead of CPI data tomorrow.

OIL: Crude Futures Fall

Oil fell in Asia on Tuesday, WTI down $0.48 from settlement levels at $64.44/bbl while Brent is down $0.51 at $67.81/bbl. Earlier, Colonial Pipeline Co. hit the wires and said service will be mostly restored by the end of this week following a cyberattack. In the meantime fallout from the attack is evident with some gas stations running out of fuel and North Caroline declaring a state of emergency. Markets look ahead to the OPEC report due later today, the cartel is bringing back around 2m bpd of supply by July, starting with 600k bpd this month.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.