-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Familiar Themes Dent Risk Appetite

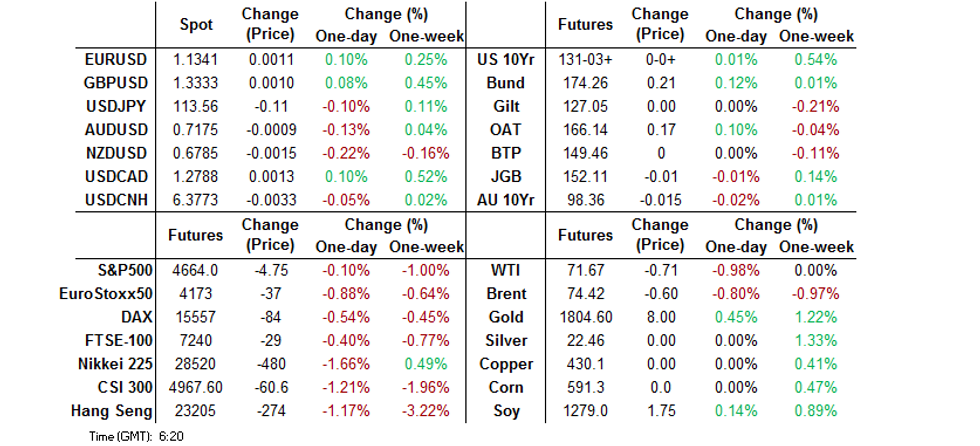

- Asia ends the week on a cautious note, with most regional equity benchmarks posting losses. Chinese tech shares struggle, with Hang Seng Tech printing worst levels since mid-2020.

- Light selling pressure hits core FI in early Asia-Pac trade but largely dissipates thereafter. T-Notes claw back their initial losses amid subdued appetite for riskier assets.

- Risk aversion evident in G10 FX space, as the yen leads gains at the expense of commodity-tied currencies.

BOND SUMMARY: Initial Selling Pressure Peters Out, Risk Aversion Takes Hold

Initial headwinds for core FI dissipated later in the session, giving the space some reprieve. The return of a defensive mood music likely played a role here, as concerns over Omicron, geopolitics and the implications of global monetary policy tightening resurfaced.

- Following an early sell-off to a session low of 130-30+, T-Notes clawed back losses and last trade +0-00+ at 130-03+. Their recovery coincided with a pullback in U.S. e-mini futures, which entered negative territory. Cash Tsy curve flattened at the margin, with yields sitting up to 1.0bp higher. Eurodollars last seen up to half a tick either side of neutral levels. A speech on the economic outlook from Fed's Waller will take focus in the U.S. amid an empty data docket.

- JGB futures sold off as trading re-opened in Tokyo before stabilising into the lunch break. The contract meandered after the BoJ announced their monetary policy decision and last deals at 152.14, 2 ticks above previous settlement. Cash JGB yields are mostly lower, by narrow margins. The BoJ kept their core policy settings unchanged but implemented tweaks to emergency Covid-19 support programmes. The central bank extended the duration of a special aid scheme targeting smaller companies, while pledging to slow down purchases of corporate bonds and commercial paper from Apr '22. Elsewhere, there was little market follow-through from press reports noting that the gov't is preparing to compile a budget in the high Y107tn range (NHK) and is set to keep JGB issuance in the Y30tn range (Sankei).

- Cash ACGB curve reversed some of yesterday's steepening, with yields last seen -0.2bp to +6.2bp across the flattened curve. The initial rise in yields lost steam later in the session, albeit they refused to give away earlier gains. Likewise, light selling pressure hit Aussie bond futures in early Sydney trade, but they stabilised later on. YM last operates -0.5 & XM -3.5, with YMXM +3.5 as we type. Bills trade 1-5 ticks lower through the reds. The AOFM slashed its planned bond issuance for FY2021-22 to A$105bn from their July forecast of A$130bn.

FOREX: Defensive Feel Drives Price Action

Market sentiment soured towards the end of a week which saw a marathon of monetary policy decisions, prompting participants to reflect on the outlook for global policy tightening. Meanwhile, the risks from the rapidly spreading Omicron coronavirus variant and simmering Sino-U.S. tensions sapped appetite for riskier assets.

- The Antipodeans led commodity-tied FX lower amid weakness in crude oil prices. Australia's Covid-19 situation provided a source of concern as NSW daily case count hit an all-time high for the second day in a row. New Zealand's ANZ Business Confidence deteriorated in December, with firms reporting troubles with freight disruptions and finding labour.

- The yen topped the G10 scoreboard as participants flocked into the traditional safe haven currency. USD/JPY extended losses after yesterday's rout, showing little in the way of immediate reaction to the BoJ monetary policy decision. Japanese policymakers kept key parameters unchanged, extended emergency aid for small firms and scaled back support for larger companies.

- Final EZ CPI, German Ifo Survey, UK retail sales & Norwegian unemployment are on today's data docket. Comments are due from Fed's Waller & ECB's Rehn.

FOREX OPTIONS: Expiries for Dec17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1200(E2.4bln), $1.1300(E2.5bln), $1.1340-50(E1.4bln), $1.1380-00(E4.4bln), $1.1415-25(E1.37bln), $1.1450(E2.1bln), $1.1500(E1.2bln)

- USD/JPY: Y113.00($1.8bln), Y113.50-75($3.0bln), Y113.90-05($1.9bln), Y114.50($1.3bln)

- GBP/USD: $1.3200-10(Gbp1.1bln), $1.3250(Gbp1.5bln), $1.3300-20(Gbp1.1bln), $1.3350(Gbp1.1bln)

- EUR/GBP: Gbp0.8400(E2.0bln), Gbp0.8540-50(E1.1bln)

- USD/CAD: C$1.2730-50($1.0bln), C$1.2850($826mln), C$1.2900($785mln)

- USD/CNY: Cny6.3700($675mln), Cny6.4000($1.4bln)

ASIA FX: Won Leads Losses Amid Risk Aversion, MonPol Matters Under Scrutiny

Familiar themes kept broader risk appetite in check, while participants assessed the outlook for regional central bank policy trajectories.

- CNH: Offshore yuan narrowly outperformed the greenback, with the upcoming LPR fixing already drawing attention. BBG consensus forecast looks for no change to the benchmark interest rate on Monday, albeit some analysts have speculated that the PBOC could deliver a marginal cut.

- KRW: Spot USD/KRW advanced as risk aversion did no good to the Korean won. South Korean finance ministry warned that the flare-up in Covid-19 infections will hurt domestic demand, with tightened restrictions set to take effect this weekend.

- IDR: Spot USD/IDR extended yesterday's rally amid expectation that Bank Indonesia will keep interest rates lower for longer. The central bank kept the 7-Day Reverse Repo Rate unchanged on Thursday, pledging to pursue a "pro-stability" stance going forward.

- MYR: Spot USD/MYR meandered in positive territory, with domestic political affairs providing some interest. The delayed Sarawak state election takes place this weekend, while Malaysiakini reported that some factions within UMNO are pushing for a snap general election.

- PHP: The Philippine peso was a tad firmer following yesterday's monetary policy decision from Bangko Sentral ng Pilipinas. The Monetary Board stood pat on interest rates and raised their inflation outlook for this year and next, while noting that the economic growth "appears to be on firmer ground."

- THB: USD/THB held below neutral levels, with participants preparing for next week's meeting of the Bank of Thailand's Monetary Policy Committee.

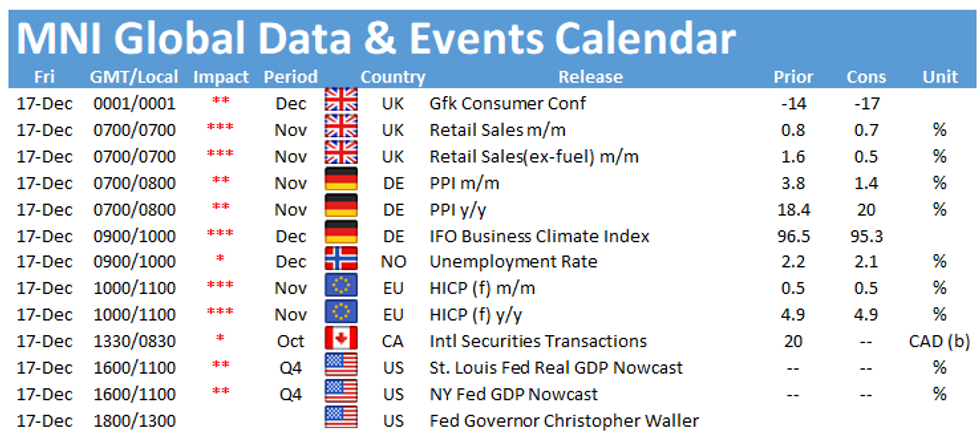

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.