-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Fed-Treasury Spat Dominates, Pressuring E-Minis

- Fed-U.S. Treasury tensions surrounding the wind down of Fed support schemes weighs on e-minis overnight.

- Asian markets generally trade with a non-committal tone ahead of the long weekend in Tokyo.

- Fed & ECB speak provides the highlights ahead of the long weekend.

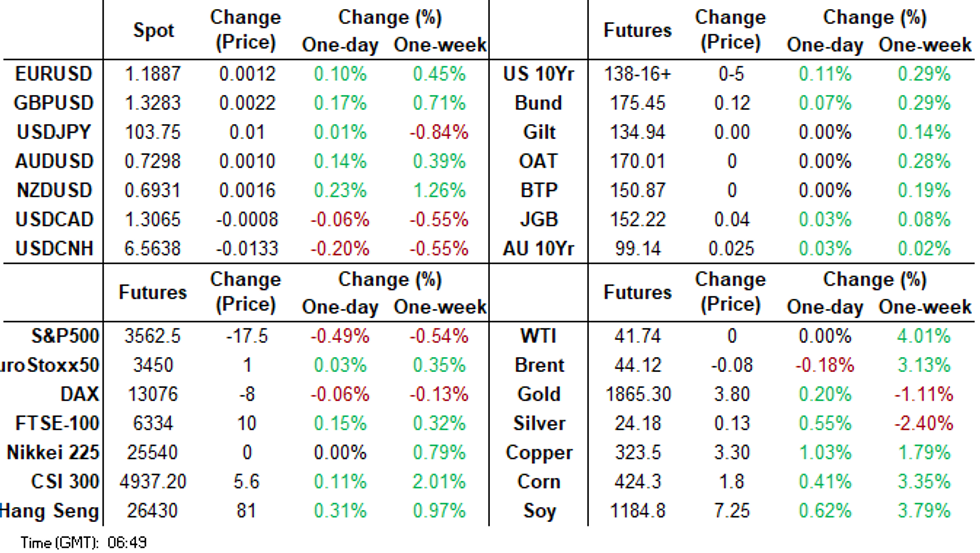

BOND SUMMARY: Underpinned By Fed-U.S. Tsy Tensions

T-Notes last deal at 138-15+, +0-04 on the day, a little off of best levels as S&P 500 e-minis failed to pierce Thursday's low, while the cash curve has witnessed modest twist flattening. The impact from the U.S. Tsy's request for the Fed to return unused funds that were provided for support schemes/a push to unwind some of the facilities at least partially moderated, although the contract never got back to unchanged levels vs. settlement, while the Fed has shown disagreement re: the request. There has been little of any real note on the headline front during Asia-Pac hours, with market flow centring on the downside TY option plays that were similar to flows seen during the timezone during the earlier part of the week. There was a 10K block buy of the TYG1 136.50/135.50 put spread vs. selling of the TYF1 139.50 calls. There was also ~4.5K of the TYG1 137.50/136.50 bought on screen, this time against the TYG1 139.50 calls.

- Friday provided another narrow session for JGB futures, ahead of a long weekend for Tokyo, with the contract +4 ticks at the close. The cash space saw some modest richening across the curve. There was little of note on the news flow front, with Japanese Chief Cabinet Secretary Kato playing down the need for a COVID-induced state of emergency, at least at present. Elsewhere, we have heard from Finance Minister Aso, who noted that policymakers must stimulate sentiment with fiscal policy. Local data releases saw all 3 CPI metrics print in negative territory, in line with expectations, while the flash PMI readings revealed a slightly sharper rate of contraction across the 3 major metrics.

- Aussie bonds were flatter on the Tsy dynamic, with the futures curve a little off of flattest levels come the close. YM unch., XM +2.5. Local preliminary retail sales data was solid, while the release of the AOFM's weekly issuance slate was vanilla after this week's long end syndicated tap. On the COVID front, South Australia tempered its strict lockdown measures after authorities ascertained that some misleading information was given by one of the close contacts to the local COVID cluster.

FOREX: JPY Grinds Lower On Gotobi Day, U.S. Tsy & Fed Clash Over Stimulus Funds

Conflicting opinions of U.S. Tsy & Fed on whether to unwind the central bank's emergency lending facilities inspired light risk aversion early on, which gradually faded away through the session. Outgoing Tsy Sec Mnuchin requested the return of unused cash from some lending programmes run by the Fed, which replied that it prefers to keep "the full suite of emergency facilities". Subsequent headline and data flow was lacklustre and provided little to move the needle, with the PBoC leaving its LPRs unchanged. JPY faltered, possibly on the back of Gotobi Day sales against USD, ahead of a long weekend in Japan.

- USD/CNH swung to a loss as the greenback shook off its initial strength, even as the PBoC set its central USD/CNY mid-point higher than expected.

- The Bank of Thailand unveiled measures to stem THB appreciation and reiterated its concern with the current level of the exchange rate.

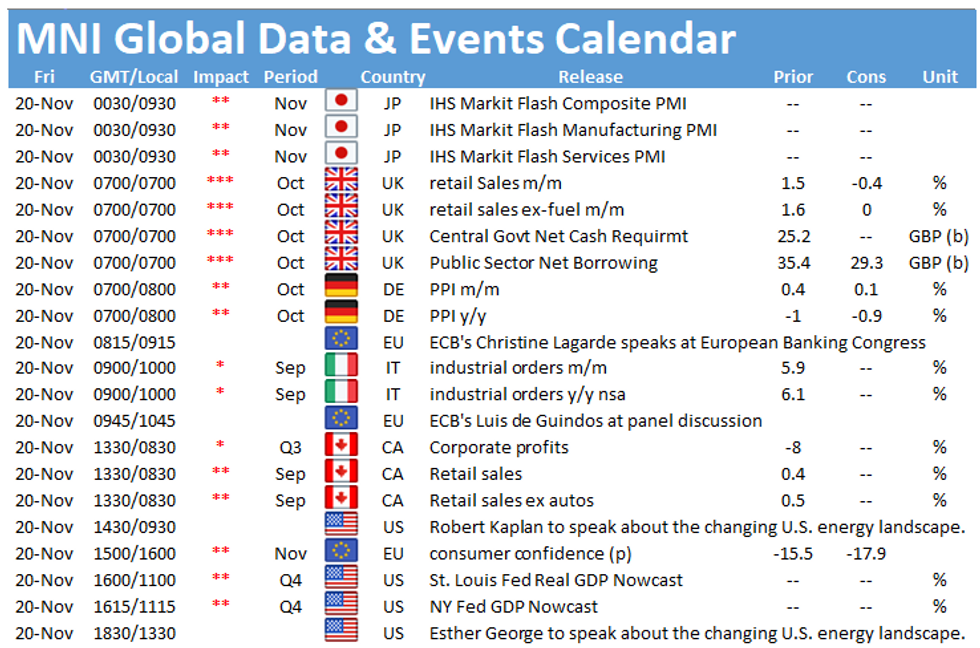

- Today's highlights include UK & Canadian retail sales, EZ consumer confidence, as well as comments from Fed's Kaplan, Barkin & George and ECB's Lagarde, de Guindos & Weidmann.

FOREX OPTIONS: Expiries for Nov20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1850(E652mln), $1.1900(E966mln)

- USD/JPY: Y103.20-25($630mln-USD puts), Y103.75($642mln), Y104.00($965mln), Y105.46-50($1.3bln), Y106.50($1.1bln)

- GBP/USD: $1.3100(Gbp531mln)

- EUR/GBP: Gbp0.8840(E570mln-EUR puts)

- AUD/NZD: N$1.1000(A$1.6bln-AUD calls)

- USD/CAD: C$1.2900($760mln-USD puts), C$1.3000($838mln-USD puts), C$1.3100-20($1.6bln)

- USD/CNY: Cny6.60($1.37bln-$1.32bln of USD puts), Cny6.90($2.0bln)

EQUITIES: U.S. Tsy-Fed Tension Weighs On E-Minis

Risk was dented late in the NY day as U.S. Treasury Secretary Mnuchin requested that the Fed return the unused cash that was made available for its numerous support schemes, while Mnuchin pushed for an end to some of the facilities. The Fed noted that it "would prefer that the full suite of emergency facilities established during the coronavirus pandemic continue to serve their important role as a backstop for our still-strained and vulnerable economy." This clearly represents a potential source of tension between the two institutions, which weighed on e-minis after hours.

- The major Wall St. benchmarks recovered from worst levels on Thursday, closing in positive territory, aided by comments from DC which pointed to an impending resumption of talks surrounding fiscal support.

- Regional equities were mixed during Asia-Pac hours, with a strong showing for Chinese auto names given the well-documented positive focus surrounding the development of the sector on the part of policymakers.

- Nikkei 225 -0.6%, Hang Seng +0.4%, CSI 300 unch., ASX 200 unch.

- S&P 500 futures -22, DJIA futures -231, NASDAQ 100 futures unch.

GOLD: Range Remains Intact

Spot is little changed, hovering around the $1,867/oz mark. The strength of the broader USD and direction of travel for U.S. real yields continue to come under scrutiny, with gold having a look lower on Thursday, before recovering from worst levels in NY hours. Bears have still not been able to force a challenge of support at $1,848.8/oz, which represents the Sep 28 low and bear trigger.

OIL: Muted

WTI & Brent sit little changed at typing, holding narrow ranges in Asia-Pac hours after a limited Thursday session which saw the benchmarks finish little changed come settlement time.

- Oil-specific news flow has been limited at best over the last 24 hours, headlined by reports that Libyan crude production has recovered to 1.25mn bpd, although this remains a few hundred thousand barrels shy of levels that would trigger broader OPEC+ calls for the enforcement of limitations on Libyan crude production.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.