-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: GBP Surges, RBNZ Looks For Optionality

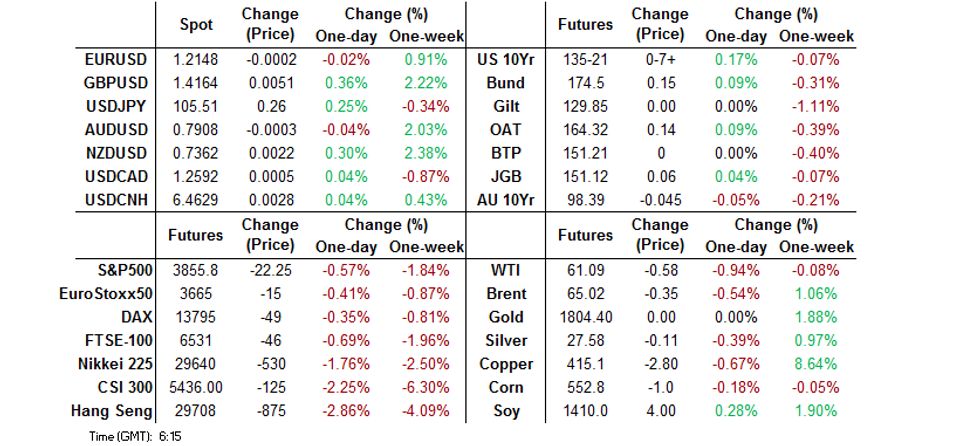

- GBP surges overnight. No overt catalyst, with talk of stops and barrier options extending the recent theme. Move now back from extremes.

- The rehashing of an old story re: the efficacy of Pfizer's COVID vaccine vs. some strains of the virus created some early chop.

- RBNZ wants to retain optionality moving forwards.

BOND SUMMARY: Some Chop Evident Overnight

T-Notes traded firmer at the re-open, printing through Tuesday's high. There was some early focus on the FT re-hashing a week-old study questioning the efficacy of the Pfizer vaccine vs. some COVID mutations, with the ensuing move retracing as it became more widely apparent that the story represented old news. T-Notes last +0-05+ at 135-19, after another round of choppy trade was briefly in play alongside some dollar weakness. Yields are little changed across the curve, with 30s richening by 0.7bp, representing the largest deviation from closing levels. Flow wise, 20.0K of the FVJ1 125.50/124.50 risk reversal was blocked, buying the puts to sell the calls, building on recently observed Asia-Pac exposure to downside FV structures. Day 2 of Fed Chair Powell's testimony on the Hill will be supplemented with Fedpseak from Vice Chair Clarida & Governor Brainard on Wednesday, with conventional 5-Year Tsy and 2-Year FRN supply also due.

- JGB futures lacked any real direction after Tuesday's Tokyo holiday, but were a little firmer in the afternoon, finishing +6 on the day. Cash trade saw mixed performance out to 10-Years, with some underperformance for the super-long end, resulting in bear steepening, while longer dated swap spreads were a touch wider on the day. Japanese Finance Minister Aso provided plenty of headline fodder, although none of it was new. Aso once again pointed to the COVID-driven deterioration in Japan's fiscal situation, while deploying some well-trodden rhetoric re: JGBs. A liquidity enhancement auction for off-the-run 5-15.5 Year JGBs saw the bid/cover ratio firm above 5.00x, likely providing light support to that area of the JGB curve in the afternoon.

- Aussie bonds looked through local matters, with the underperformance witnessed during overnight hours holding, while the space was subjected to the broader chop witnessed and outlined elsewhere. YM -1.0, XM -4.5 at the close, with growing sell-side interest in Aussie/U.S. 10-Year tighteners evident. There was no follow through as the RBA failed to step in to buy ACGB Apr '24 to enforce its 3-Year yield target, despite speculation that it may have done so today. Perhaps the RBA will choose to do so tomorrow alongside the Bank's scheduled longer dated ACGB purchases (assuming there isn't a sizeable rally in ACGBs over that timeframe). Local Q4 wage data was firmer than expected, although still limited in a historical sense, while soft completed construction work provided a negative start for Q4 GDP partials.

FOREX: Kiwi Bounces After RBNZ Decision, Sterling Gains On UK Reopening Plans

Kiwi dipped in the immediate wake of the RBNZ's monetary policy announcement but hit support at $0.7315 (a former breakout level/Jan 6 high) and swung back with renewed impetus just minutes thereafter, as participants digested the Reserve Bank's rhetoric. New Zealand's central bank left its main MonPol settings unchanged, while stressing that it remains ready to add stimulus if needed, amid uneven recovery and persistent uncertainties. It upgraded the economic projections but refrained from publishing the forecast for the OCR beyond the current quarter. The kiwi is the best G10 performer alongside GBP as we type. NZD/USD implied volatilities fell across the curve with the event risk behind.

- Sterling was on a tear amid continued enthusiasm about the UK's plans for gradually unwinding Covid-19 restrictions over the coming months. The bid in sterling was accompanied by the usual stops and thinner liquidity lines being thrown around by participants. EUR/GBP extended its losing streak to nine days hitting worst levels in a year, while cable had a look above $1.4200.

- Safe havens JPY & CHF comfortably underperformed their G10 peers despite a poor showing from most regional equity benchmarks. USD/JPY crept higher with $3.2bn worth of options with strikes at Y105.65-80 due to roll off at the NY cut.

- The PBOC fixed its USD/CNY mid-point at CNY6.4615, 10 pips above sell side estimates. The bank injected CNY 10bn via reverse repos, another small injection by historical standards. USD/CNH slipped initially, but recouped losses.

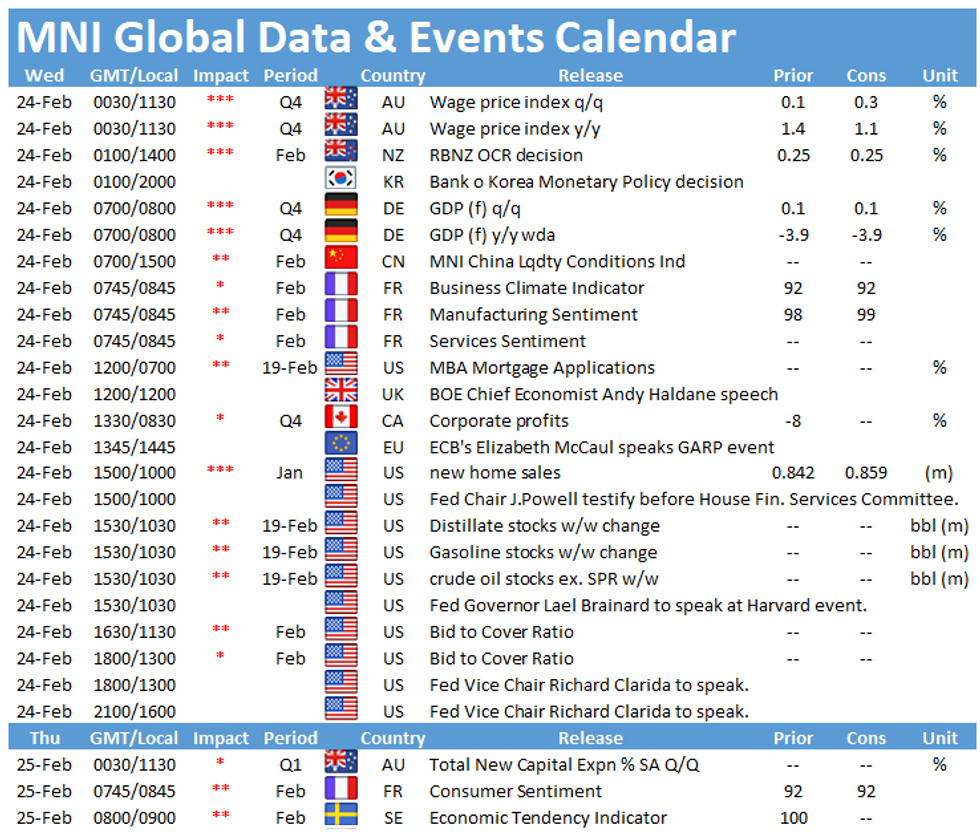

- The data docket is fairly light today, with final German GDP & U.S new home sales coming up. Central bank speaker slate includes Fed's Powell, Clarida & Brainard as well as BoE's Bailey, Broadbent, Vlieghe, Haskel & Haldane.

FOREX OPTIONS: Expiries for Feb24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000-05(E627mln), $1.2035-50(E768mln), $1.2090-1.2100(E1.2bln), $1.2130-35(E1.1bln-EUR puts), $1.2150-60(E1.6bln), $1.2170-90(E2.0bln-EUR puts), $1.2200-10(E728mln)

- USD/JPY: Y103.70-80($1.6bln), Y103.95-15($1.2bln), Y105.00(E1.7bln-USD puts), Y105.65-80($3.4bln), Y105.95-15($1.3bln), Y106.70-75($580mln), Y107.00-05($1.0bln)

- EUR/GBP: Gbp0.8650(E534mln), Gbp.0.8700-20(E614mln)

- AUD/USD: $0.7700-15(A$1.2bln), $0.7800(A$1.4bln), $0.7850(A$529mln), $0.7865-75(A$1.8bln), $0.7910(A$1.2bln), $0.7950(A$604mln)

- USD/CAD: C$1.2690-1.2700($1.3bln)

- USD/CNY: Cny6.50($784mln-USD puts)

- USD/MXN: Mxn20.50($714mln), Mxn20.64-65($556mln)

ASIA FX: Early Moves Reversed

The greenback initially slipped after US Fed Chair Powell indicated that the FOMC had no intention of tightening policy in the foreseeable future, but has retraced the move to sit at neutral levels, this has seen moves in USD/Asia crosses reverse course.

- CNH: Offshore yuan has completed a round trip, USD/CNH initially dropped to 6.4518 the pair has recovered to 6.4627. The PBOC injected CNY 10bn for the second day which saw repo rates drop.

- SGD: Singapore dollar is broadly flat, USD/SGD hovered around neutral levels amid a lack of local catalysts, an OCBC report doing the rounds posited that SGD is 0.46% above the NEER midpoint which could imply limited downside for USD/SGD.

- TWD: Taiwan dollar stronger on the day, markets look ahead to export orders due after market, they are expected to have risen 46% in January after a 38.3% rise in December.

- KRW: The won is marginally weaker, data earlier showed manufacturers confidence rose, while there was some caution after an uptick in COVID-19 cases. Markets await BoK decision tomorrow.

- INR: After spiking into the close yesterday and wiping out all of the day's gains, INR has spiked lower at the open today and is challenging yesterday's lows. Markets look ahead to an interview with RBI Gov Das today, and GDP data on Friday.

- IDR: Rupiah is broadly flat, the main focus was comments from FinMin Indrawati that the government considers paring back its financing plans amid rising borrowing costs.

- MYR: Ringgitt is stronger, earlier in the session data showed CPI at -0.2% compared to a -0.8% print expected. There was also some speculation that the recent expansion in Malaysia's foreign reserves could be a sign that BNM has been trying to reign in rupiah appreciation.

- PHP: Peso is slightly lower, Philippine Star cited Socioeconomic Planning Sec Chua as noting that the Philippines will have to review its 2021 growth targets, following Pres Duterte's decision not to loosen mobility restrictions for now.

- THB: Baht has weakened slightly, reversing its earlier move. PM Prayuth signalled that his gov't might consider waving the two-week quarantine requirement for foreign visitors who are vaccinated against Covid-19 to revive the embattled tourism industry.

ASIA RATES: Internal Operations Dictate Price Action

- CHINA: The PBOC injected CNY 10bn via reverse repos, another small injection by historical standards, the second CNY 10bn injection this week. Repo rates fell in the wake of the injection; overnight repo rate down 43ps to 1.51%, 7-day repo rate down 19bps to 2.08%. 1-year interest rate swap falls a total of 3bps in the past two days as markets reassess perceptions of the PBOC outlook. Cash bonds saw buying after well received 2-, 5- and 10-year auctions.

- INDIA: Yields are lower across the curve after rising yesterday, some bull steepening seen. The buying comes ahead of operation twist due from the RBI tomorrow where it will purchase INR 100bn of long end bonds and sell INR 100bn of short dated bonds.

- INDONESIA: Indonesian government bond yields trade lower across the curve after FinMin Indrawati said that the gov't considers paring back its financing plans amid rising borrowing costs.

- SOUTH KOREA: Bond futures in South Korea head into the close in positive territory as the KOSPI dropped, having initially hugged a narrow range slightly under neutral for the majority of the session. There is hope that the BoK will announce direct bond purchases at the rate announcement tomorrow, despite some opposition from government.

EQUITIES: Initial Positivity Wiped Out

A positive start quickly gave way to further declines in most Asia-Pac markets, the Nikkei and the ASX 200 were initially higher after US equity markets recovered into the close but the move higher was quickly erased.

- Shares in mainland China ground lower from the open and negative sentiment seeped into other markets. The Hang Seng is 3.5% lower on the day, with stamp duty on stock trading within the city set to be increased.

- US futures are lower, moving in a narrow range having recovered the bulk of their losses into the close yesterday after Fed Chair Powell indicated that the FOMC had no intention of tightening policy in the foreseeable future.

GOLD: We've Been Here Before

Spot gold has stuck to the confines of Monday's range during Asia-Pac hours, trading just shy of $1,808/oz at typing, with Fed Chair Powell striking a balance between reiterating the Fed's dovish leaning and not pushing back against recent market moves. The DXY Is a touch higher than it was 24 hours ago, but continues to operate within the recently observed range, while U.S. real yields are softer to flat vs. Friday's closing levels.

OIL: Inventory Rise Weighs On Crude

Crude futures have slipped in Asia-Pac trade on Wednesday, both benchmarks sustained some losses early on and have seen rangebound trade since. WTI is ~$0.60 worse off, while Brent sits around $0.40 lower.

- Oil has come under pressure after API inventories yesterday showed a gain in crude stockpiles, the first build in five weeks, while there is also some concern that oil is entering overbought territory. Headline crude inventories saw a 1m/bbl increase which surprised the market against an expected decline on account of severe weather in southern US states shuttering production. In downstream markets the data showed a 66,000 bbl increase in gasoline and a 4.5m bbl decrease in distillate. Market participants will now be looking toward more comprehensive inventory data from the US DOE.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.