-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Global Bond Yields Higher

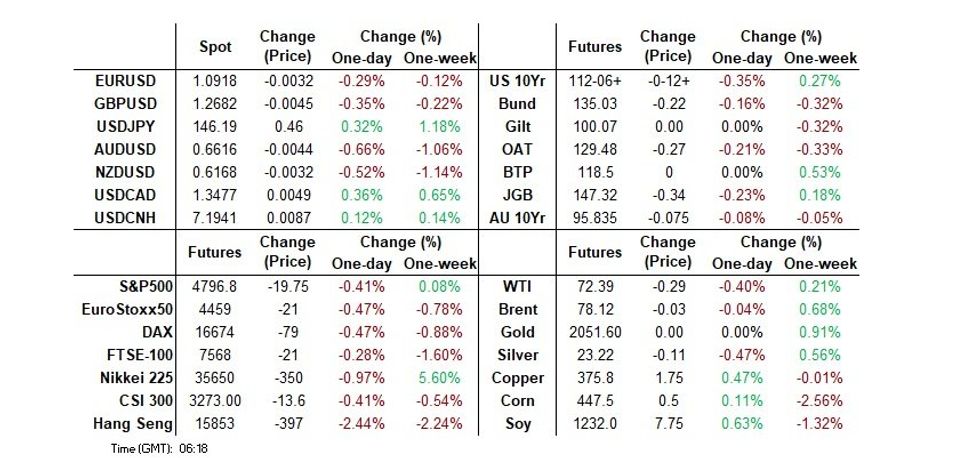

- The USD continued to strengthen on higher Treasury yields which saw G10 and Asian currencies weaken against the greenback across the board.

- Global bonds have traded heavily in today's Asia-Pac session after cash US tsys resumed dealings after yesterday's public holiday. US tsy yields are 5-7bps higher across benchmarks, with a slight flattening bias.

- Former US President Trump wins Iowa caucus with DeSantis a distant second and Haley in third.

US TSYS: Cash Bonds Dealing Weaker After Yesterday’s Holiday

TYH4 is trading at 112-07, -0-12 from NY closing levels on Friday.

- Cash bonds 5-7bps cheaper in today’s Asia-Pac session after yesterday’s public holiday.

- Comments from the ECB’s Holzmann on Monday that cuts this year were not assured given lingering inflation and geopolitical risks may have weighed in an otherwise newsflow light session.

- Later today the US calendar sees Empire Manufacturing for January. Fed's Waller also speaks on Economic Outlook and Monetary Policy.

JGBS: Cheaper After Poor 5Y Auction But Sell-Off Moderate

JGB futures are cheaper and just off the session’s worst level, -28 compared to settlement levels. JBH4 gapped lower in early afternoon dealings after the results of today’s JGB auction showed poor absorption again. The 5-year auction's low price failed to meet dealer expectations and the cover ratio of 3.788x was lower than the 3.851x recorded at December’s auction. Today's auction comes on the heels of suboptimal results at January’s 10- and 30-year JGB supply.

- There hasn’t been much in the way of domestic data drivers to flag, outside of the previously outlined December PPI print that surprised on the high side of expectations.

- JGBs have also likely been pressured by cash US tsys in today’s Asia-Pac session after the observance of the Martin Luther King public holiday yesterday. Benchmark yields are 5-6bps higher. Later today the US calendar sees Empire Manufacturing for January. Fed's Waller also speaks on Economic Outlook and Monetary Policy.

- Cash JGBs are cheaper across the curve, with the 20-year underperforming (+1.0bp). The benchmark 10-year yield is 0.8bp higher at 0.579% versus yesterday’s low of 0.556%.

- The 5-year yield is 0.4bp higher at 0.173% in post-auction trade versus yesterday’s low of 0.163%.

- Swaps curve has bear-steepened, with rates 1-2bps higher. Swap spreads are wider.

- Tomorrow, the local calendar is empty.

AUSSIE BONDS: Cheaper, US Tsys and JGBs Weigh, Dec-34 Supply Tomorrow

ACGBs (YM -7.0 & XM -7.5) are cheaper and near Sydney session lows. With today’s session data-light, the push lower can be largely attributed to weakness in US tsys. Cash tsys are dealing 5-6bps cheaper across benchmarks in today’s Asia-Pac session after the observance of the Martin Luther King public holiday yesterday.

- Higher JGB yields may also be weighing on the local market after this morning’s hotter-than-expected PPI and poor absorption of 5-year supply today.

- Cash ACGBs are 6-7bps cheaper, with the AU-US 10-year yield differential 2bps wider at +16bps.

- Swap rates are 6-7bps higher, with EFPs tighter.

- The bills strip has bear-steepened, with pricing -1 to -7.

- RBA-dated OIS pricing is flat to 4bps firmer across meetings, with December leading. A cumulative easing of 48bps is priced for year-end.

- TCV 5.25% A$2.5B Sep-38 bond was priced at EFP+116bps.

- TCorp has launched a new 4.75% 20 September 2035 Sustainability bond via syndication. Indicative price guidance for the transaction is 78-81bps over the 10Y bond futures contract, equivalent to 73.5-76.5bps over the ACGB 2.75% 21 June 2035. Pricing is expected on or before 17 January.

- Tomorrow, the local calendar is empty.

- Tomorrow, the AOFM plans to sell A$800mn of the 3.50% Dec-34.

NZGBS: Closed On A Weak Note, Card Spending Data Tomorrow

NZGBs closed near the local session’s worst levels, 3-4bps cheaper, with the 2/10 curve steeper. Weakness during the session likely reflected both homegrown and offshore factors.

- Locally, the NZIER Business Opinion Survey for Q4 showed a sharp pick-up in confidence. The outlook for the economy improved for the fourth straight quarter as demand lifted. On the positive side, labour was seen as easier to find and inflation pressures were seen easing with fewer firms reporting rising costs and fewer planning to raise prices in the current quarter.

- US tsys also likely weighed on NZGBs, with cash bonds 5-6bps cheaper in today’s Asia-Pac session after yesterday’s public holiday. Comments from the ECB’s Holzmann on Monday that cuts this year were not assured given lingering inflation and geopolitical risks may have weighed in an otherwise newsflow light session. Later today the US calendar sees Empire Manufacturing for January. Fed's Waller also speaks on Economic Outlook and Monetary Policy.

- Swap rates closed 3bps higher.

- RBNZ dated OIS pricing closed flat to 2bps firmer across meetings, with October leading. A cumulative easing of 99bps is priced by year-end.

- Tomorrow, the local calendar will see Card Spending data.

EQUITIES: APAC Markets Sink On Risk Pullback & Stronger USD

APAC equities are almost weaker across indices as markets followed Europe down (US was closed Monday), risk sentiment continued to deteriorate and the US dollar strengthened another 0.3%. The MSCI APEX 50 is down 1.5% today. While the S&P e-mini is only down slightly and the NASDAQ is 0.5% lower.

- China’s CSI 300 is down 0.4% driven by a 1.6% drop in the property index and -1.2% in tech. Major lender Ping An put 41 development firms on a list for funding support. HK’s Hang Seng is 1.9% lower with tech underperforming again falling 2.3%.

- Korea’s KOSPI has fallen 0.8% with the KOSDAQ -0.3%. Taiwan’s TAIEX is down 0.9%.

- Australia’s ASX 200 has closed down 1.1% to a 4-week low with all sectors weaker led by utilities, energy and mining. After underperforming on Monday, NZ has outperformed today finishing flat.

- ASEAN is generally down but Indonesia’s Jakarta Comp has outperformed APAC rising 0.4%. SE Thai is down slightly, Singapore’s Straits Times is 0.3% lower and Philippines PSEi is down 0.2%.

- India’s Nifty 50 is steady.

OIL: Crude Steady Despite Stronger US Dollar As Middle East Remains Volatile

Oil prices are little changed today with WTI down 0.2% to $72.54/bbl but Brent is 0.2% higher at $78.29/bbl, after falling briefly below $78 to a low of $77.87. Further problems in the Middle East have provided support while the greenback rose again (USD BBDXY up 0.3%) and risk continued its pullback.

- Tensions in the Middle East and risks that conflict spreads remain high. A US merchant vessel was hit by a Houthi missile on Monday and Iran attacked targets in northern Iraq in retaliation for the Soleimani Memorial attack, which killed almost 100 people.

- Central banks are monitoring the situation for the impact it may have on inflation, with shipping rates rising due to longer routes. Qatar is now shipping LNG to Europe via southern Africa, according to Bloomberg. The ECB has indicated that it may be too soon to ease policy given geopolitical uncertainties and sticky inflation.

- Given strong non-OPEC supply, so far oil markets are not too concerned about rising tensions in the region that produces a third of the world’s crude or delays to seaborne shipments.

- Later the Fed’s Waller speaks on the economic outlook and monetary policy (information here), ECB’s Villeroy participates in a Davos panel and BoE’s Bailey speaks. On the data front there is January US Empire manufacturing, UK employment/wages and Canada’s CPI.

GOLD: Middle East Tensions Support But Comments From ECB Holzmann & A Strong USD Weigh

Gold is 0.4% lower in the Asia-Pac session, after closing 0.4% higher at $2058.17 on Monday. Volumes were light with US markets closed for observance of the Martin Luther King Day public holiday.

- Monday’s move came despite a stronger USD and weaker US Treasury futures, with the yellow metal buoyed by increased geopolitical risks following Houthi strikes.

- However, comments from the ECB’s Holzmann on Monday that cuts this year were not assured given lingering inflation and geopolitical risks likely kept gains in bullion to a minimum.

- According to MNI’s technicals team, resistance for the precious metal is seen at $2064.0 (Jan 5 high).

FOREX: Dollar Strength Broadbased Across Currencies

The US dollar has continued its climb higher today with the USD BBDXY index rising another 0.3% to be up 0.5% this week. The strength is broadbased with the USD stronger against all of the G10 and Asia. The main underperformers have been AUD, pressured by a weak consumer confidence report, NZD and KRW.

- AUDUSD is down 0.7% to 0.6616, close to the intraday low of 0.6611. The pair is finding support around 0.6600. It has broken below initial support at 0.6641, Jan 5 low, and trendline support at 0.6628. The next level to watch is 0.6571. AUDNZD is down 0.1% to 1.0730, off the session low of 1.0726.

- USDJPY is up 0.3% to 146.12 after reaching a high of 146.23 earlier. AUDJPY is down 0.4% to 96.65 and EURJPY is down slightly to 159.51.

- NZDUSD is off its low of 0.6160 and is down 0.6% to 0.6165.

- EURUSD is 0.3% lower at 1.0917 and GBPUSD is -0.4% at 1.2682.

- The KRW has weakened 0.8% against the dollar to 1330.70, close to the intraday high of 1331.30.

- USDCNH is currently 0.2% higher at 7.1968, just off the session’s high.

- Later the Fed’s Waller speaks on the economic outlook and monetary policy (information here), ECB’s Villeroy participates in a Davos panel and BoE’s Bailey speaks. On the data front there is January US Empire manufacturing, UK employment/wages and Canada’s CPI.

AUSTRALIA DATA: Consumers Remain Depressed, Fewer Expect Further Tightening

Westpac’s measure of consumer confidence fell 1.3% in January to 81.0, but is still in the depressed range it has been in since May last year. Inflation and rate pressures continue to weigh on households’ finances but RBA tightening expectations have eased from last month. There are also increased concerns regarding the medium-term economic outlook. Markets don’t expect any further rate hikes and expect the first full cut by Q3 but Q4 CPI on January 31 remains key to the February RBA decision.

- Westpac notes that the January read of 81.0 was not only in the lowest 7% of responses since the survey began in the mid-1970s but was the lowest January since the early 1990s recession.

- 52% of respondents in January expect another rate hike in the next 12 months down from 60% in December. The move was probably driven by lower CPI inflation reads, which have received a lot of press coverage.

- Unemployment expectations rose 1.4% at 137, still below the series average.

- The “time to buy a major household item” was steady.

- “Time to buya dwelling” fell 3.1% and remains weak which is not surprising given the house price series rose 0.5% in January and is 51.5% higher on the year signalling a considerable deterioration in affordability.

- See Westpac’s report here.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/01/2024 | 0700/0800 | *** |  | DE | HICP (f) |

| 16/01/2024 | 0700/0800 | ** |  | NO | Norway GDP |

| 16/01/2024 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 16/01/2024 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 16/01/2024 | 0900/1000 | ** |  | EU | ECB Consumer Expectations Survey |

| 16/01/2024 | 0900/1000 |  | EU | ECB's De Guindos in ECOFIN meeting | |

| 16/01/2024 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 16/01/2024 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 16/01/2024 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 16/01/2024 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 16/01/2024 | 1330/0830 | *** |  | CA | CPI |

| 16/01/2024 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 16/01/2024 | 1500/1500 |  | UK | BOE's Bailey Lords Economic Affairs Committee | |

| 16/01/2024 | 1600/1100 |  | US | Fed Governor Christopher Waller | |

| 16/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 16/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 16/01/2024 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.