-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Gold & Silver Lose Shine

- Gold and silver slump to fresh multi-month lows in early Asia-Pacific trade but trim losses, crude oil retreats.

- Core FI stabilise after a heavier start, China's gov't bond yields advance as domestic inflation data beat expectations.

- Holidays in Japan and Singapore limit activity in the region.

BOND SUMMARY: Post-NFP Musings Handicap Core FI, Holidays Limit Activity

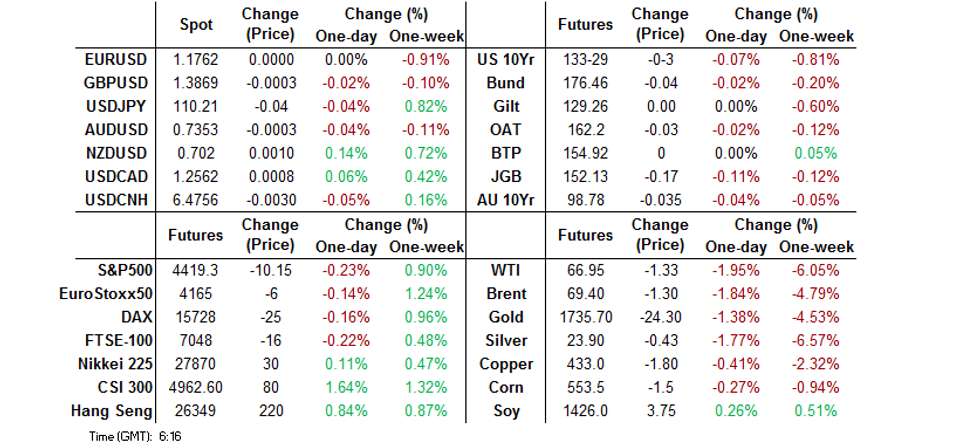

The impression left by the upbeat U.S. NFP report released Friday continued to reverberate around the markets, with activity limited by market holidays in Japan and Singapore. Resultant speculation surrounding prospects for sooner Fed taper applied some modest pressure to T-Notes in early trade, with the contract staging a round trip from its lowest point since Jul 19. Its oscillations occurred within a fairly narrow 0-04 range and T-Notes stabilised later in the session, as the post-NFP impetus petered out. TYU1 last seen -0-03 at 133-29, which represents the midpoint of the intraday range. Eurodollars last trade unch. to -1.0 tick through the reds. Cash Tsys are closed until the London open, owing to the market closure in Tokyo.

- ACGBs faltered at the reopen, as the space played catch up with post-NFP moves in U.S. Tsys. They held narrow ranges following that softer reopen, with bear steepening still evident in cash ACGB curve. Aussie participants weighed strong U.S. jobs data against a softer commodity complex, with gold, oil and iron ore all posting dips in early trade. The space looked through above-forecast Chinese inflation figures, which pushed CGB yields higher. The latest round of ACGB purchases from the RBA also went unnoticed, with the Reserve Bank offering to buy A$2.0bn of ACGBs with maturities of Nov '24 to May '28, but excluding ACGB Apr '27. Aussie bond futures remained rangebound, YM -3.0 & XM -4.0 at typing. Bills trade 1-4 ticks lower through the reds.

FOREX: Early Moves Reversed

The start of the session in Asia saw an extension of Friday's move as the greenback pushed higher while AUD and NZD came under selling pressure, each dropping around 35 pips at their bottom. The move was exacerbated by another sharp decline in gold down to $1,690 putting the cumulative move including Friday at $113/oz.

- As the session matured the move almost fully reversed, despite no real headline flow. Gold recovered to $1,740, while AUD/USD retraced all of its losses and last trades flat on the session, NZD/USD peeking into positive territory trades with gains of 9 pips as DXY dropped back to neutral levels.

- USD/JPY proved more resilient than its peers, the pair moved in a narrow range of around 15 pips. The rate briefly challenged Friday's highs at 110.35 but dropped away from the level, last trades down 4 pips on the session. Japanese markets were closed for a market holiday.

- Offshore yuan also held a narrow range, a muted reaction seen to inflation data. USD/CNH rose in the early the session to challenge 6.4850. Inflation data showed CPI and PPI both slightly above estimates which helped USD/CNH come of its highs, last trades down 33 pips at 6.4753.

- Oil came under further selling pressure, USD/CAD briefly rose to the highest since July 28 before the retreating greenback dragged the rate lower, last trades up 5 pips at 1.2559.

ASIA FX: PHP Leads The Way Higher As RRR Cut Off Table

Early moves saw Friday's price action extend before the greenback peaked and retreated which helped some Asia EM currencies into positive territory, while others only managed to pare losses.

- CNH: Offshore yuan is slightly stronger, recovering early losses. CPI rose 1.0%, faster than the 0.8% expected but slower than the 1.1% in June, PPI rose 9.0% against estimates of 8.8% and 8.8% last time out.

- SGD: Singapore dollar is weaker, Singapore markets are closed for a holiday and will return tomorrow. Focus this week will be on GDP data.

- TWD: Taiwan dollar is weaker but off worst levels of the session. The Taiex was under pressure today, selling off for a second day after a four day rally.

- KRW: Won is weaker, On the coronavirus front South Korea reported 1,492 daily new coronavirus cases, back to below 1,500 on fewer tests over the weekend as the country has extended its highest virus rules for another two weeks due to relentless spread of the virus.

- MYR: Ringgit is weaker for a second day, Deputy PM Yaakob said 31 MPs from the ruling coalition continue to back PM Muhyiddin administration

- IDR: Rupiah declined, the government is expected to update the current restrictions amid a decline in Java's caseload and the coronavirus' spread into outer regions

- PHP: Peso is stronger, BSP Gov Diokno said the Bank would keep policy accommodative but that an RRR cut was off the table.

- THB: Baht is weaker, Phuket authorities "Phuket Sandbox" pledged to make all-out efforts to restore confidence in the reopening project, following the murder of a Swiss tourist last week.

ASIA RATES: China Repo Rates Invert

- INDIA: Yields higher after a brief initial move lower. Friday's auctions were poorly received, the RBI didn't accept any bids for the 6.10% 2031 and sold only INR 150bn against an original target of INR 260bn. Yields were higher on the day after the RBI rate announcement where the MPC kept rates on hold, but the vote saw unexpected hawkish dissent. 10-Year yield rose to 6.24% on Friday, the highest since March. Short-dated bonds could come under pressure today as markets digest the RBI's announcement of an expanded VRRR plan to drain liquidity. There are no releases on the economic docket today markets await industrial production and CPI data later in the week.

- SOUTH KOREA: Futures sold off at the open in South Korea, playing catch up with moves in US tsys after a strong US NFP print. On the coronavirus front South Korea reported 1,492 daily new coronavirus cases, back to below 1,500 on fewer tests over the weekend as the country has extended its highest virus rules for another two weeks due to relentless spread of the virus. Elsewhere KDI, a state run think tank, said that the South Korean economy is facing heightened uncertainty as the recovery of domestic demand is likely to slow amid a recent spike in COVID-19 cases.

- CHINA: The PBOC matched liquidity maturities with injections today; repo rates are higher with the overnight and the 7-day rate inverting. The overnight rate is up 33bps at 2.2389%, the 7-day repo rate is up 2.3bps at 2.1733%. Futures lower from the open and hanging around session lows, the worst levels since July 30, in the cash space 10-year yields are up 4.5bps while equity markets have pushed higher. Data earlier showed CPI rose 1.0%, faster than the 0.8% expected but slower than the 1.1% in June, PPI rose 9.0% against estimates of 8.8% and 8.8% last time out.

- INDONESIA: Yields higher amid uncertainty over government's handling of the pandemic. Authorities are expected to update the current restrictions amid a decline in Java's caseload and the coronavirus' spread into outer regions. On Saturday, the Cabinet released a video from their latest meeting, where it emerged that areas outside Java and Bali now account for more than half of new infections. President Widodo called for fresh mobility curbs for at least two weeks.

EQUITIES: Asia Markets Mostly Positive, US Futures Slip

A mostly positive day for equity markets in Asia, liquidity is thinned with participants in Japan and Singapore absent for market holiday's. In China markets are higher by around 0.7%, though chip stocks came under pressure after a state broadcaster said it would crack down on speculators in the chip market. Other indices in the region have hovered around neutral levels. In the US future are lower, markets continuing to assess the latest labour market report, focus this week will switch to inflation data.

GOLD: Yellow Metal Retraces Early Decline

Spot gold went offered as trading resumed after the weekend, extending its post-NFP losses seen Friday hitting lows of $1,690. There was no obvious headline action on which to pin the move, stop-loss selling may have been in play, with broader activity limited by public holidays in Japan and Singapore. From a technical perspective, a breach of support from Jun 29 low of $1,750.8/oz may have inspired further selling pressure. The rate bottomed out and bounced though, trending higher throughout the session which bought the rate back to $1,739.74/oz, down around $23/oz on the session.

OIL: Crude Futures Extend Decline

Crude futures are lower in Asia-Pac trade on Monday, extending Friday's decline. WTI is down $1.39 from settlement levels at $66.89/bbl, Brent is down $1.40 at $69.30/bbl. Concerns around the delta variant of coronavirus have dampened the outlook, while a stronger greenback post-NFP on Friday has also weighed. For Brent, this keeps the outlook negative for now, with the move below the 50-day EMA earlier this week looking convincing. This exposes initial support at $66.91 ahead of $65.75. Focus for WTI is $65.01, Jul 20 low and the key support.

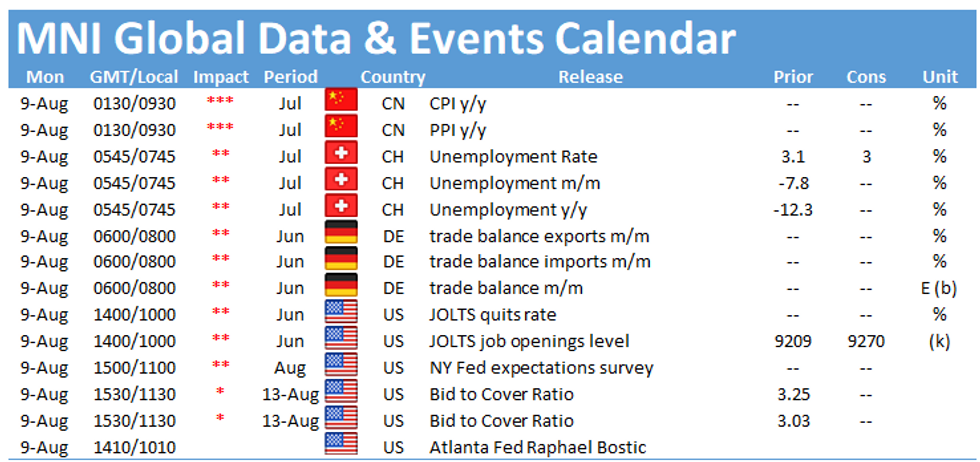

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.