-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Gold & Yen Benefit From Weaker Equity Sentiment

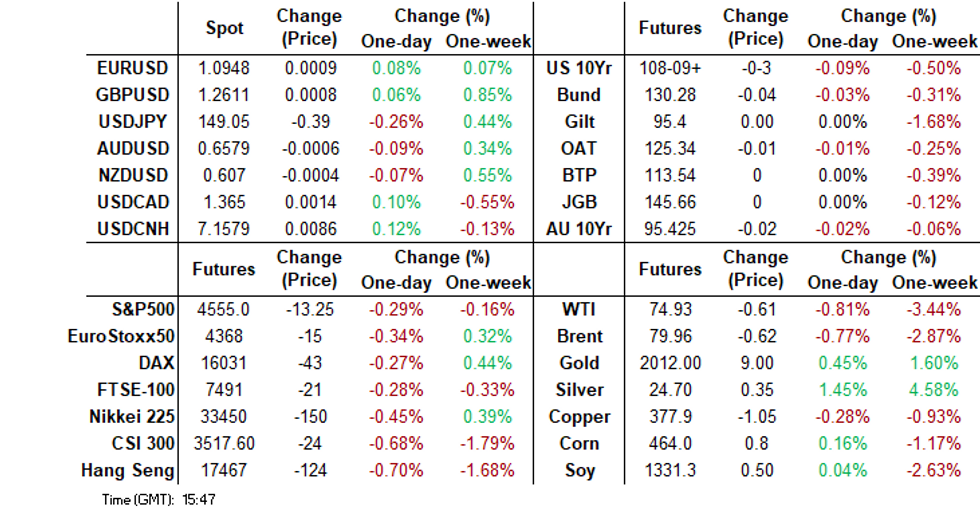

- The risk tone has been a cautious one in Asia markets to start the week. Equity sentiment is softer, with US futures down, higher US yields likely weighing at the margin. China and Hong Kong indices are down, but away from session lows.

- Commodities have been mixed, with Gold breaking higher, which aided G10 moves against the USD, but AUD and NZD couldn't sustain gains as equities faltered. Oil remains under pressure.

- Looking ahead, later US new home sales and Dallas Fed index are released. ECB President Lagarde makes introductory comments at the European Parliament.

MARKETS

US TSYS: Marginally Cheaper, Ranges Narrow In Asia

TYZ3 deals at 108-08+, -0-03, a 0-07+ range has been observed on volume of ~195k.

- Cash tsys sit 2-3bps cheaper across the major benchmarks, the belly is marginally leading the cheaps.

- Tsys ticked lower in early trade, there was no overt macro driver as perhaps the possibility of an extended truce between Hamas and Israel weighed.

- Support was seen as WTI ticked away from session highs and tsys recovered to hold cheaper dealing in a narrow range for the most part. WTI sits ~1% lower.

- There is a thin docket in Europe today, further out we have New Home Sales, Dallas Fed Mfg Activity and latest 2- and 5-Year supply.

JGBS: Futures Remain Off Highs, But Little Follow Through To The Downside, 40yr Supply Tomorrow

JGB futures have largely been range bound in post lunch time trade. We were last 145.64, -.02. We sit close to the mid point recent ranges, lows for the session at 145.53, while end last week levels were at 145.73.

- Spill over from US Tsy futures has been evident, which after breaking lower in earlier trade we sit a touch higher in recent dealings (last 108-10+).

- The slightly stronger than expected services PPI from earlier didn't shift sentiment, while we await to see if Ueda's scheduled appearance before parliament delivers any fresh insights.

- In the cash JGB space, we are higher in yield terms, although more so at the back end of the curve. The 10yr is above 0.78%, down from session highs (0.785%). The 20-40yr tenors are holding yield gains better (1.5-3bps higher). The 20yr was last above 1.51%.

- It is a similar story in the swap space, with the 10yr back above 0.99%.

- Note tomorrow we have 40yr supply on tap.

JAPAN DATA: Services PPI Continues To Trend Higher

The services PPI rose 2.3% y/y for October, above the market consensus (2.1%) and also above the prior 2.0% outcome (revised from an initial 2.1% read). This puts the y/y gain at the highest since early 2020. In m/m terms we rose 0.5%, after a flat outcome in September.

- This index tracks the price of services provided by businesses to other businesses and the government sector. Its relationship with national headline CPI is evident, with a correlation of 69% (for y/y moves) for the past 2yrs.

AUSSIE BONDS: Slightly Softer, Ranges Narrow, Bullock Due Tomorrow

ACGBs sit ~1bp cheaper across the major benchmarks, holding cheaper after early spillover from Friday's cheapening in Tsys. Narrow ranges were observed for the most part as the move lower didn't follow through.

- XM (-0.015) and YM (-0.02) are both marginally lower however both remain well within recent ranges.

- The Australian government will introduce legislation to facilitate the revamp of the RBA this week (BBG). Included in the bill is mandating that the RBA’s overarching objective is to “promote the economic prosperity and welfare of the people of Australia, both now and into the future”. The Federal Treasurers power to overrule monetary policy decisions will be repealed.

- RBA dated futures are steady pricing a terminal rate of ~4.50% in Jun 24 with ~20bps of cuts by Dec 24.

- Looking ahead, RBA Governor Bullock is participating in a panel in Hong Kong tomorrow. We also have October Retail Sales on the docket.

AUSTRALIAN DATA: SEEK Advertised Pay Robust But Easing

The SEEK advertised salary index for October rose 0.3% m/m to be up 4.6% y/y. This was the lowest monthly increase since May, as the impact of government-mandated rises wanes, and the annual rate eased from 4.8% in the previous two months but it remains elevated and in the range seen all year. Last week RBA Governor Bullock noted that 4% wages growth was on the “high side” when there is no productivity growth. This data shows that pay offers remain high but below inflation.

- Advertised salary growth has eased towards 4% in NSW and Victoria due to softer demand for labour, according to SEEK. The strength is being seen in the other states.

- The government’s increase in pay for aged care workers has impacted the SEEK data since mid-year and the community services & development sector saw advertised pay up 8% y/y, the strongest area.

Source: MNI - Market News/SEEK

NZGBS: Tick Lower Through Monday's Session

NZGBs have ticked lower through Monday's session however ranges remained narrow in the space, and sit 1-3 bps cheaper across the major benchmarks. Light bear steepening has been observed.

- Pressure was seen on the space as regional equities ticked lower alongside US equity futures and the USD firmed as the PBoC vowed to boost bond issuance by private firms, and also support M&A's, IPOs of private sector firms.

- 10 Year NZ US swaps spreads remain stable and sit at +52bps.

- With Wednesday's RBNZ meeting in view OIS price no change in the OCR with ~40bps of cuts by October 2024.

- PM Luxon noted that he is concerned at the risk of recent fiscal deterioration.

- Looking ahead, the data docket is empty tomorrow. The aforementioned RBNZ meeting is the next event of note in NZ.

FOREX: Yen Firms In Asia

The Yen is the strongest performer in the G-10 space at the margins in Asia today. Mont-end Exporter demand for the Yen has added support in Asia today (BBG). Elsewhere risk off flows have escalated through the session, AUD and NZD are lower, as are US Equity Futures and Regional equities. BBDXY is flat and WTI is down ~1%.

- USD/JPY is down ~0.3% and is testing the ¥149 handle as we approach the European open, support is at ¥147.15 low from Nov 21. Resistance comes in at ¥149.96, the 20-Day EMA.

- AUD/USD is down ~0.2%, the pair briefly dealt above Friday's high before waning risk sentiment saw a fall of ~0.4% from peak to trough. Technically the trend needle points north, resistance comes in at Friday's high ($0.6591) then $0.6656, 61.8% retracement of Jul-Oct bear leg. Support is at $0.6475 the 20-Day EMA.

- Kiwi is also softer however ranges have been narrow for the most part. NZD/USD is consolidating above the 200-Day EMA ($0.6062).

- Elsewhere in G-10 NOK is ~0.2% firmer however liquidity is generally poor in Asia.

- There is a thin docket in Europe today.

EQUITIES: Sentiment Softens, China Property Losses Weigh

Regional equity sentiment has generally deteriorated as Monday's Asia session has progressed. Hong Kong and China related bourses have been the weakest performers, further unwinding some of the recent gains seen. US equity futures are mostly lower. Eminis sit near session lows, off around 0.30%, last at 4555. Nasdaq futures are down more, off 0.45%. US yields are higher across the curve, ahead of key US data this week, including PCE figures. This may be tempering US futures sentiment at the margin.

- For China/HK stocks renewed weakness in property stocks is evident. The CSI 300 real estate index is off 3.0% at the break, the headline CSI 300 is down 1.2%, and back sub 3500 in index terms. For HK, the HSI is down nearly 1% at the break.

- Earlier we had headlines from the PBoC pledging financial support for the private sector. The central bank stated it will encourage banks not to cut loans for private companies that are facing temporary difficulties. This may be weighing on broader sentiment, with the financials index down 1.63%.

- China industrial profits were +2.7% y/y in Oct, positive but well off recent highs (17.2% in August). China President XI is scheduled to visit Shanghai tomorrow, including the futures exchange.

- Elsewhere, Japan markets are off 0.35% for the Topix, -0.50% for the Nikkei. The yen is firmer, +0.35% and back sub 149.00, which may be weighing.

- The Kospi is -0.15%, unwinding earlier gains. The Taiex is down nearly 0.50%.

- In SEA, most markets are weaker, but the JCI in Indonesia and the Philippines bourse are higher.

OIL: Crude Falls As Risk Sentiment Declines

Oil prices continued to trade lower during the APAC session as risk appetite deteriorated and the market focuses on Thursday’s delayed OPEC+ meeting. After falling around 2% on Friday, crude is down around a percent today with Brent falling below $80 and is currently around $79.82/bbl and WTI below $75 to $74.73. The USD index is flat.

- Softer-than-expected industrial profits in China pointed to demand continuing to struggle there and as a result the data weighed on equities and commodities.

- The OPEC+ meeting was delayed from Sunday to Thursday due to a dispute over output quotas. A Bloomberg survey showed that about half of analysts believe that measures to reduce supply further will be announced following the meeting.

- The IEA expects that there will be a crude surplus in 2024. The increase in non-OPEC production and some countries being flexible around their quotas make the task of tightening the market more difficult. Futures contracts are in a bearish pattern.

- Shipping risks in the Middle East remain high with reports of a chemical tanker being boarded by Houthi rebels yesterday.

- Later US new home sales and Dallas Fed index are released. ECB President Lagarde makes introductory comments at the European Parliament.

GOLD: Consolidates After Earlier Break Higher

After spiking to fresh highs above $2018, gold has largely consolidated as the Monday Asia Pac session has progressed. We were last near $2011.5, up over 0.50% on closing levels from Friday (near $2001).

- The earlier break puts gold back to fresh highs last seen in May. Highs back in early May were near $2063, although be mindful of round figure resistance at $2050. On the downside, note the 20-EMA sits back near $1977.40.

- The catalyst for today's move may have been partly technical, particularly as we broke above recent highs near $2010, which held in late October.

- Broader USD sentiment has clearly softened, although if anything, gold's move today appeared to weigh on the USD rather than the other way around.

- Elsewhere, equity sentiment has been softer, offsetting the tick higher in US yields.

ASIA FX: CNH & KRW Lose Ground Amid Equity Weakness, THB Outperforms

Some USD/Asia pairs have gravitated higher amid weaker equity leads, most notably USD/CNH and USD/KRW. There have been pockets of strength elsewhere though. The THB has been a strong outperformer, with the gold price bounce a likely positive for the baht. Tomorrow, we get South Korean consumer confidence early. Later on, Taiwan Q3 GDP prints.

- Spot USD/CNH sits near 7.1600 in recent dealings. We got to 7.1645 earlier, comfortably above Friday session highs. The USD/CNY fix was set slightly higher, ending the recent run of down moves in the fixing. Local equity sentiment has also been quite negative, with property stocks and financials underperforming. Headlines have crossed from Rtrs that the Beijing Stock Exchange has suspended major shareholders from reducing shares in listed companies, which has helped take markets away from their repsective lows post the break. Industrial profits were positive for October in y/y terms, but sit comfortably off August highs.

- 1 month USD/KRW has gravitated higher today. The pair last above 1304, around 0.20% weaker in KRW terms. Earlier highs were close to Friday highs, above 1306. Equity sentiment has deteriorated as the session progressed, which has weighed on the won.

- Spot USD/HKD continues to trend lower. The pair was last near 7.7875, against earlier lows of 7.7861. We opened at 7.7928. Even as CNH has stabilized somewhat, HKD continues to enjoy yield support as Hibor rates climb further. The 1 month his a fresh 16yr year high today at 5.534%, (+15.5bps). The 3 month fixed at 5.71%, +6.6bps. The US-HK 3 month yield continues to track lower, last at -32bps, fresh lows back to Jan of this year. Seasonality in terms of cash demand and a low start starting point for the aggregate balance, are being cited as factors driving firmer yields.

- Local markets are closed in India today for the observance of a national holiday and will reopen tomorrow. On Friday USD/INR was marginally firmer closing at 83.3775, the pair has ticked away from the 20-Day EMA (83.2872) in recent trading . Broader USD trends dominated flows and the Rupee has not yet seen support from falling Oil prices. Q3 GDP on Thursday provides the highlight this week a print of 6.9% Y/Y is expected, the prior read was 8.0%. Also due on Thursday is the October Fiscal Deficit. On Friday we have November S&P Global Mfg PMI.

- The SGD NEER (per Goldman Sachs estimates) is little changed this morning, we remain a touch off recent cycle highs. The measure sits ~0.3% below the top of the band. USD/SGD sits in a narrow range as the pair continues to see-saw around the $1.34 handle, the pair sits a touch off the base of the recent $1.3390/1.3420 range as broader USD trends continue to dominate. The docket is light this week with just October Money Supply due on Thursday..

- The Ringgit has been marginally pressured in early dealing, however USD/MYR remains well within recent ranges as broader USD trends dominate flows. The pair prints at 4.6795/4.6845, ~0.1% above Friday's closing levels. November S&P Global Mfg PMI on Friday is the only data of note this week, there is no estimate and the prior read was 46.8.

- USD/THB is a touch above session lows. Last near 35.25, against an earlier lows just under 35.24. We are still near 0.70% stronger in baht terms for the session, as we see somewhat of a catch up to recent USD weakness, plus the break higher in gold prices today. This has offset customs data, which showed a slip back into trade deficit (a surplus had been projected).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/11/2023 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 27/11/2023 | 1400/1500 |  | EU | ECB's Lagarde statement at ECON hearing | |

| 27/11/2023 | 1500/1000 | *** |  | US | New Home Sales |

| 27/11/2023 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 27/11/2023 | 1530/1530 |  | UK | DMO Quarterly Investor/GEMM Consultation Meetings | |

| 27/11/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 27/11/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 27/11/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 27/11/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.