-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

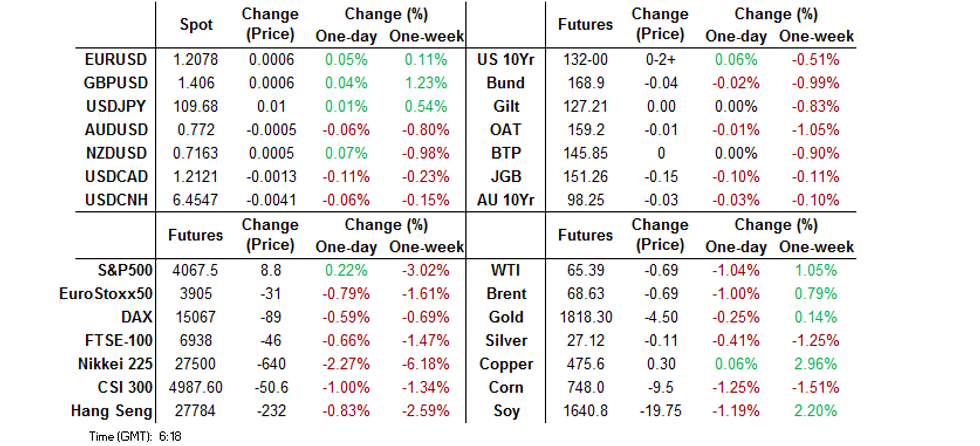

Free AccessMNI EUROPEAN MARKETS ANALYSIS: JGB Curve Steepens After Auction, E-Minis Tick Higher

- Regional equity benchmarks extend losses after another bleak NY session, but U.S. equity index futures edge higher

- JGB yield curve steepens after low price in 30-Year auction misses forecast, with other parameters close to YtD averages

BOND SUMMARY: T-Notes Edge Away From Wednesday's Low, JGB Curve Steepens After 30-Year Auction

T-Notes edged higher after unsuccessfully retesting Wednesday's low of 131-28. The contract last trades +0-01+ at 131-31, after holding a 0-05 range in Asia-Pac trade. Cash Tsy curve bull flattened, with yields last seen up to 2.0bp lower. Eurodollar futures are unch. to +1.0 tick through the reds. Activity and headline flow were limited by market closures in a number of Asia-Pac economies, including Singapore. The local docket is headlined by PPI, initial jobless claims, 30-Year debt supply & Fedspeak today.

- JGB futures staged a shallow round trip to session high of 151.31 before the lunch break and last trade at 151.27, 14 ticks shy of Wednesday's settlement as trading resumed in Tokyo. Cash JGB yield curve bear steepened a tad as the super-long end faltered. Low price in the latest 30-Year JGB auction missed estimate from BBG dealer poll (101.25 vs. est. of 101.30). Bid/cover ratio and tail were close to YtD averages. In local data, BoP current account surplus shrank slightly more than expected in March, with Eco Watchers Survey coming up later today.

- Cash ACGB space played catch up with yesterday's moves in U.S. Tsys in early trade, but Aussie bond yields are off steeps. They last sit 0.6-2.7bp higher. 10-year yield registered largest gains and trades at 1.793% at typing. YM trades -1.0, while XM ground higher through the session and last sits -2.5. Bills trade unch. to -2 ticks through the reds. The RBA offered to buy A$2.0 of ACGBs with maturities of Nov '28 to May '32, excluding ACGB Dec '30.

FOREX: Greenback Gives Away Some Of Its Wednesday's Gains

The greenback retreated from weekly highs registered yesterday, while the yen also struggled. Regional equity benchmarks faltered after another poor session on Wall Street, but U.S. equity index futures crept higher. Most G10 crosses held narrow ranges, as activity and headline flow was limited by market holidays in Singapore, India, Indonesia, Malaysia & the Philippines.

- USD/JPY blipped higher at Tokyo reopen, briefly showing above yesterday's high. The rate struggled to cling onto those modest gains and eased off, with a contact flagging hearsay re: profit taking by Japanese retail accounts. The rate bottomed out at Y109.48, but recovered thereafter and returned to neutral levels.

- BBG trader source pointed to exporters buying AUD/USD in the wake of yesterday's dip. The Aussie failed to hold these gains and sold off, as iron ore futures went offered. The kiwi diverged from its Antipodean cousin and firmed against most G10 peers.

- The PBOC set the central USD/CNY mid-point at CNY6.4612, just 3 pips above sell-side estimates. This comes after considerably larger deviations seen earlier this week, suggesting that China's central bank is happy with the impact of earlier fixings. USD/CNH slipped on the back of broader USD sales.

- Coming up today we have U.S. initial jobless claims & PPI data as well as comments from Fed's Bullard, Waller & Barkin, BoE's Bailey & Cunliffe, BoC's Macklem & ECB's Centeno.

FOREX OPTIONS: Expiries for May13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1865(E2.4bln), $1.1900-05(E1.4bln), $1.1950-55(E2.2bln-EUR puts), $1.1964-75(E2.0bln-EUR puts), $1.1995-00(E535mln), $1.2040-50(E538mln), $1.2100(E1.3bln-EUR puts), $1.2115-30(E850mln), $1.2150(E821mln), $1.2170-80(E2.5bln-EUR puts), $1.2235-50(E1.9bln)

- USD/JPY: Y107.00($1.1bln), Y107.20-30($910mln), Y108.30-40($678mln), Y108.90-109.00($1.6bln-USD puts), Y109.15-20($505mln), Y110.40-50($648mln)

- GBP/USD: $1.4200-04(GBP806mln-GBP puts)

- USD/CHF: Chf0.9085-95($1.3bln-USD puts)

- EUR/CHF: Chf1.1040(E1.1bln-EUR puts), Chf1.1150(E1.35bln-EUR puts)

- AUD/USD: $0.7690-00(A$656mln), $0.7760-65(A$1.0bln), $0.7780-95(A$1.7bln)

- USD/CAD: C$1.2090-10($503mln)

ASIA FX: Most Asia EM FX Weaker In Holiday Thinned Trade

Markets in Singapore, India, Indonesia, Malaysia, Philippines and Pakistan are closed for holiday's which kept liquidity thin

- CNH: Offshore yuan is stronger, but USD/CNH is still holding the majority of its move higher from yesterday after rising around 0.5% through the day. Data yesterday showed credit growth slowed as the PBOC steered loan growth lower.

- KRW: Won weakened, hitting the lowest level since late March before paring the move. South Korea reported 715 daily new coronavirus cases, back over 700 Thursday as the country's vaccination campaign nearly stalled over tight vaccine supply amid spreading variant cases. F

- TWD: Taiwan dollar is weaker for the third straight session. On the coronavirus front the government have confirmed they will tighten restrictions to contain the virus as well strengthening the screening process for shorter quarantines of business travelers. Apple Daily reported that New Taipei city will halt operations of venues including hostess bars, sports centre and libraries.

- THB: Baht has fallen, hitting a two-week low during the session. The gov't is focusing all efforts on fighting the resurgence of Covid-19. The Bangkok Post reported that state agencies "have been instructed to halt development proposals that were to be funded by the 1-trillion-baht emergency loan decree as the government is reserving the remainder to fight Covid-19 infections."

ASIA RATES: Jump On The Bandwagon

Several markets in the region closed, including India and Indonesia. The bond space was pressured by a sharp decline in US tsys after firmer than expected inflation.

- CHINA: The PBOC matched maturities with injections today, pausing a run of four days with CNY 10bn injection each. Repo rates are higher but in a similar pattern to yesterday have come off opening highs. Overnight repo rate is up 3.7bps at 1.9637% while the 7-day repo rate is up 3.4bps at 2.034%. Futures were unable to resist the move lower in UST's and have fallen in tandem with global bonds, 10-year down around 12 ticks at 98.13. Markets assess data from after-market yesterday that showed China's credit expansion slowed in April, a sign that the PBOC is steering credit growth lower. Aggregate financing fell to CNY 1.85tn from CNY 3.3tn in March and compared to estimates of CNY 2.29tn. In March the PBOC asked banks to reign in loan growth in a sign of tacit tightening.

- SOUTH KOREA: Bond futures are lower in South Korea, moving in tandem with global bonds. 10-Year future down 40 ticks at 125.29, the contract briefly touched 125.15 which denotes the lowest since March 19. A Moody's report earlier asserted that rapidly rising household debt in South Korea could leave banks vulnerable to economic shocks or interest rate rises. Data yesterday showed April household lending rose to KRW 1025.7tn.

EQUITIES: Lower For A Third Day; US Futures Higher

Equity markets in Asia were lower again, in negative territory for the third straight session with several indices erasing gains for the year. Markets in Singapore, India, Indonesia, Malaysia, Philippines and Pakistan are closed for holiday's which kept liquidity thin. Bourses in Japan lead the way lower, weighed down by SoftBank who sustained heavy losses following earnings. In Taiwan the Taiex managed to rebound from earlier losses of over 4% with the selling this week blamed on unwinding of leveraged positions. Futures in the US are higher, rebounding after yesterday's declines, the Nasdaq leads the way higher after declining almost 7% in May.

GOLD: Modestly Higher

After recording its biggest decline in six weeks yesterday as the greenback gained, the yellow metal is slightly higher in Asia-Pac trade, though a parabolic move has seen bullion give up the majority of its gains heading into European hours. Gold is last up $1.50 at $1817.50/oz compared to session highs of $1823.08/oz. A sell off in stocks also helped support gold, while the greenback held most of yesterday's gains.

OIL: Crude Futures Lower

Oil is lower in the Asia-Pac time zone on Thursday; WTI is down around $0.52 from settlement levels at $65.56/bbl while Brent is down $0.52 at $68.80/bbl. The Colonial Pipeline is returning to service, recovering from a cyberattack late last Friday. Fuel shipments resumed late Wednesday, though it could take days for supplies to return to normal after widespread shortages. Markets also assess US DOE inventory data that showed headline crude stocks fell by 426k bbls and hit the lowest levels since February. Elsewhere the IEA yesterday said a crude surplus built up during the pandemic has now been mostly worked off.

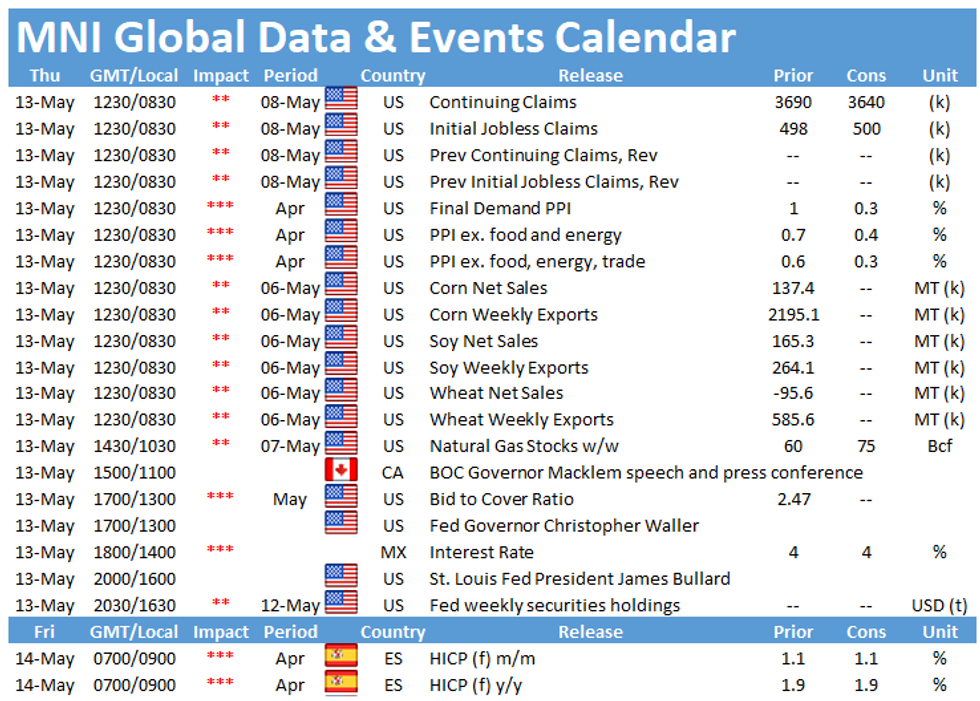

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.