-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Lira Trims Losses, Risk Aversion Lingers

- USD/TRY trims gains after rising 15% in reaction to Turkish President Erdogan's surprise move to fire the central bank chief

- Net negative news flow from over the weekend weighs on broader risk appetite

- PBOC leaves 1-Year & 5-Year Loan Prime Rates unchanged

- RBNZ LSAP operations see very light offers for for NZGB Apr '27 & NZGB May '41

BOND SUMMARY: Core FI Power Ahead Amid Risk-Off News Flow, Antipodean QE Ops In Focus

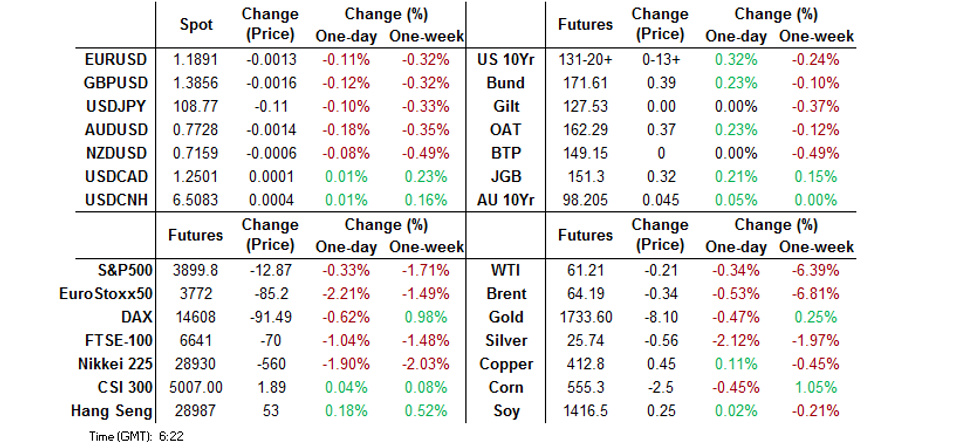

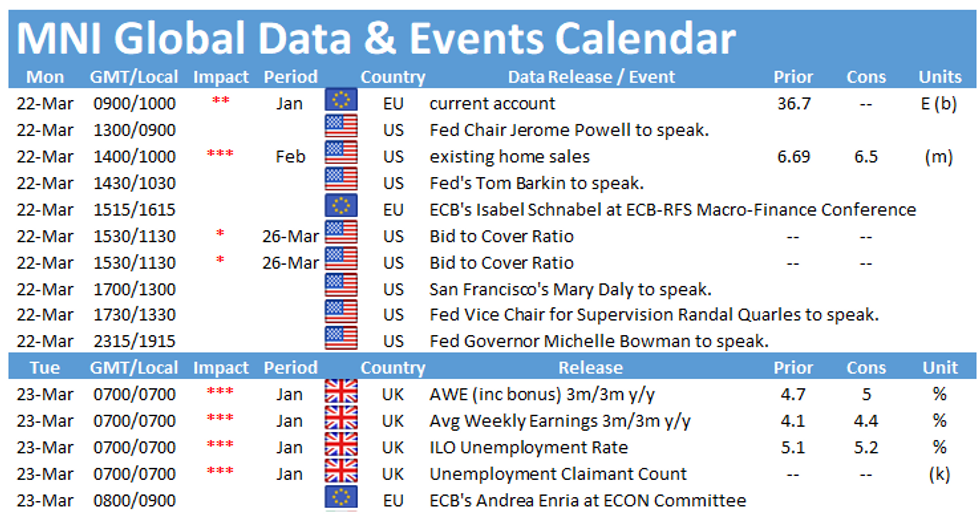

Weekend headline mix provided a risk-impetus, putting a bid into core FI across the Asia-Pac region. T-Notes remained in demand and last trade +0-11+ at 131-18+ as we are heading for the London session, in close proximity to the Asia-Pac high of 131-20+ and the prior trading day's high of 131-21+. Cash Tsy curve bull flattened, yields last trade 0.6-5.5bp lower. Eurodollar futures run -0.5 to +1.5 tick through the reds. Turkish Pres Erdogan's decision to replace the CBRT chief grabbed most attention in early trade, with simmering geopolitical tensions (incl. a Telegraph report re: planned U.S. cyber attacks against Russia) providing further reasons to remain cautious. The latest portion of Fedspeak saw Mr Powell reiterate the commitment to providing stimulus "for as long as it takes," while Mr Barkin saw no signs of unwanted inflation pressures. There is more Fedspeak coming up today, with existing home sales also due out of the U.S. Local issuance slate is particularly heavy this week, with focus on Thursday's seven-year note supply, after the previous auction saw the lowest bid/cover ratio on record.

- JGB futures ebbed off highs after the Tokyo lunch break but remained afloat and last sit at 151.26, 28 ticks above settlement. Cash JGB yield curve bull flattened, with 20s outperforming. In local news, Japan confirmed that the Tokyo Olympics will take place without foreign spectators, while a 6.9 mag. quake hit off the coast of Japan. The BoJ left the sizes of its 1-10 Year JGB purchases unch. There was little in the way of market-moving insights in the latest addresses from BoJ Gov Kuroda & Japanese officials.

- ACGBs powered ahead, YM last sits +2.0 & XM +5.0, both just shy of best levels of the Asia-Pac session. Cash ACGB yields sit +0.6bp to -6.1bp across a flattened curve, while bills run unch. to +2 ticks through the reds. New South Wales saw adverse weather conditions result in floods, which forced the authorities to evacuate thousands of people and disrupted Covid-19 vaccinations. QE operations on both sides of the Tasman grabbed attention. Firstly, the RBA offered to buy A$2.0bn of ACGBs with maturities of Nov '24 to May '28, but excluding Nov '24 ahead of this Friday's sale of ACGB 0.25% 21 Nov '24. Secondly, ACGBs may have been aided by spill-over from the RBNZ's LSAP operations, which saw very light offers for for NZGB Apr '27 & NZGB May '41, with bid/cover ratios slipping below 2.0x.

FOREX: Abrupt Ouster Of CBRT Chief Finds Fertile Ground For Denting Risk Appetite

Turkish Pres Erdogan's surprise decision to oust CBRT Gov Agbal sent the lira tumbling in early Asia-Pac trade. USD/TRY wiped out four months worth of losses amid thin liquidity, despite touted action by Turkish state banks, before gradually trimming gains through the rest of the session. Erdogan's move coupled with a number of press reports flagging renewed (geo)political tensions on several familiar fronts kept risk appetite at bay.

- Demand for safe haven currencies pushed JPY to the top of the G10 pile. USD/JPY dipped after the re-open with some linking the move to the suspected unwinding of TRY/JPY positions by "Mrs Watanabe" (Japanese retail accounts." Subsequent recovery attempt allowed the rate to briefly return to neutral levels, but proved short-lived. Worth noting that $1.1bn of USD/JPY options with strikes at Y108.75 expire today.

- AUD went offered and continued to lag all of its G10 peers as broader risk-off flows overlapped with large floods in NSW as well as softer oil & iron ore prices. A BBG trader source pointed to demand from local exporters who bought AUD for repatriation, helping the currency move off worst levels.

- CAD held up well despite a weaker commodity complex, even as was the second worst performer in the G10 basket. The loonie ignored headlines noting that Canadian CP Rail agreed to buy Kansas City Southern for $25bn, in the largest acquisition of a U.S. asset by a Canadian company since 2016.

- GBP weakened as the UK's spat with the EU over Covid-19 vaccine supply escalated and the two sides publicly traded barbs over the issue.

- PBOC fixed its central USD/CNY mid-point at CNY6.5191, in-line with sell side estimates, and left its 1-Year & 5-Year LPRs unchanged. USD/CNH re-opened a touch higher, after the weekend saw PBOC Governor Yi note that the central bank still has space to expand liquidity.

- The global data docket is rather light today, includes U.S. existing home sales. Central bank speaker slate features Fed's Powell, Barkin, Daly, Quarles & Bowman as well as ECB's Knot, Weidmann, Schnabel & de Cos.

FOREX OPTIONS: Expiries for Mar22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1840-50(E1.0bln), $1.1875-85(E660mln-EUR puts), $1.1990-1.2010(E1.1bln-EUR puts)

- USD/JPY: Y107.36-40($667mln), Y107.95-108.02($1.1bln), Y108.56-65($567mln), Y108.75($1.1bln-USD puts), Y109.05($605mln), Y109.15-20($716mln)

- EUR/GBP: Gbp0.8500(E420mln), Gbp0.8525(E650mln)

- USD/CHF: Chf0.9250($535mln)

- EUR/CHF: Chf1.1000-05(E430mln)

- NZD/USD: $0.7080(N$1.2bln-NZD puts), $0.7400(N$1.0bln-NZD puts)

- USD/CAD: C$1.2600($989mln-USD put)

- USD/CNY: Cny6.50($774mln-USD puts), Cny6.5650($800mln-USD puts)

- USD/MXN: Mxn21.00($547mln)

ASIA FX: Ripples Of Risk Off From Turkey

A bout of risk aversion after Turkish President Erdogan removed the central bank governor saw the greenback strengthen and put Asia FX under pressure.

CNH: Offshore yuan is weaker, but has come off worst levels as the session has worn on. Comments over the weekend from PBOC Governor Yi that the bank still has space to expand liquidity also helped weaken the yuan. LPR rates were kept on hold.

SGD: Singapore dollar is weaker, but did briefly foray into positive territory, SGD is supported by virtue of having the highest real yields of any AAA rated country.

TWD: Taiwan dollar is weaker, USD/TWD continues its move higher and brushes up against resistance at 28.50. Markets look ahead to export orders at 0800GMT/1600HKT.

KRW: The won is flat, recouping losses through the session after opening lower. Data earlier showed exports were strong in the first 10-days of the month, on track for another bumper month.

INR: Rupee is stronger, the rise comes even as the RBI survey cautions over the rising number of coronavirus infections.

MYR: Ringgit is weaker, palm oil futures continued to falter on Friday and erased gains registered over the last two weeks. Brent & WTI both have resumed losses today which has weighed on the ringitt.

IDR: Rupiah is weaker, Fitch said Bank Indonesia could deliver a further 50bp worth of rate cuts this year. As a reminder, many sell-side desks have already called an end to the easing cycle.

PHP: Peso has bucked the trend in the region and is stronger, the gov't imposed restrictions on travel into/out of the Manila region for the two weeks between Mar 22 - Apr 4.

THB: Baht is weaker, Thai Dept of Disease Control said that it detected a fresh cluster of Covid-19 infections among migrant workers in Samut Prakan, with the province re-emerging as a Covid hotspot. BSP said last Friday that the current account surplus is expected to narrow this year after hitting $13bn in 2020

ASIA RATES: Safe Havens Supported

Yields generally lower as safe havens see a bid on the fallout from Turkish President Erdogan removing the central bank governor.

- INDIA: Yields lower across the curve, after spiking higher on Friday. The auctions on Friday saw a negative yield quoted for the first time ever after a bank placed an incorrect price due to human error. Overall though, the auctions were decent and the RBI increased sales amounts. Bonds further supported today after the regulator said it would ease proposed rules on perpetual notes of domestic banks.

- SOUTH KOREA: Futures gained in South Korea as the treasury curve bull flattened, broad risk aversion helping to benefit the space. 10-year futures up some 47 ticks. Markets await the 20-year bond auction tomorrow. There are also plans to issue KRW 600bn 2-,3-,30-year bonds through non-comp auctions in order to combat yield curve inversion.

- CHINA: Futures are higher in China, while repo rates have risen but are within recent ranges. The PBOC kept LPR rates unchanged as expected, the bank matched liquidity maturities with injections, meaning this is the tenth straight day without injections.

- INDONESIA: Yields mixed across the curve, with steepening the general theme. The government will increase the current containment measures to five provinces to slow number of positive cases and deaths

EQUITIES: Mixed

Markets are mixed in Asia, the start of trading saw a wave of risk aversion after Turkish President Erdogan removed the central bank governor. Markets in China, Taiwan and South Korea managed to squeeze out gains, while Japan and Hong Kong continued to languish in negative territory.

- In the US futures fluctuated between gains and losses, at pixel time Dow Jones futures are negative, while S&P and Nasdaq are higher, the latter leading gains.

GOLD: Lower At The Start To The Week

The yellow metal is lower to start the week, last trading down $3.3544 at $1741.81/oz but having come off earlier lows around $1732.The falls come amid a spate of risk aversion sparked by Turkish President Erdogan removing the central bank governor; the greenback remains resilient, holding on to its recent gains, while 10-year yields in the US hover around their highest in a year.

OIL: Retreats On Demand Concerns

Crude futures are lower on Monday, giving back some of the gains seen on Friday. WTI is down $0.21 from settlement levels at $61.21/bb;, while Brent is $0.25 lower at $64.28/bbl.

- There is some uncertainty in the market as lockdown measures extend in Europe which has cast doubts over a recovery in demand. France and Germany have extended lockdown measures, while Germany is reportedly considering the same. The demand equation is further clouded by an increase in the number of unsold cargoes from West Africa in April.

TURKEY: MNI MARKET ANALYSIS: TRY Blindsided as Erdogan Drops CBRT Governor

Early Saturday, Erdogan fired CBRT Governor Agbal in a move highlighted as a core tail risk to the CBRT's tightening drive for some time.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.