-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: LNY Saps Liquidity, Markets Look Through Biden-Xi Call

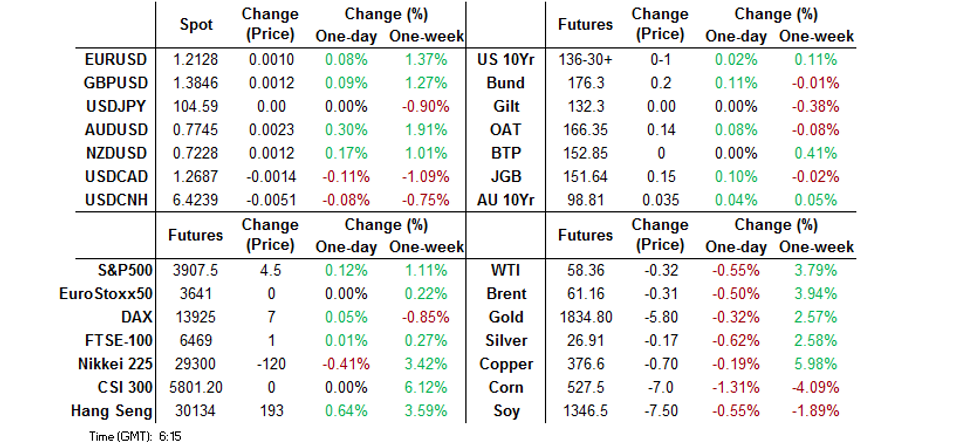

- USD ever so slightly lower among G10 FX in Asia, but the moves are limited with Japanese & Lunar New Year holidays sapping liquidity.

- Markets look through Biden-Xi phone call, with the leaders re-affirming their known stances.

BOND SUMMARY: Core FI Looks Through Biden-Xi Call, While Holidays Sap Liquidity

T-Notes remain stuck in the 0-02 range established early in Asia-Pac hours, last +0-01 at 136-30+, looking through the communique surrounding the Biden-Xi phone call, with no smoking guns revealed. Ahead of the call a senior U.S. official told RTRS that "President Joe Biden's administration will look at adding "new targeted restrictions" on certain sensitive technology exports to China in cooperation with allies." Flow remained sub-par owing to the earlier flagged holidays evident across the Asia-Pac region, with cash Tsys closed until London hours on the back of a Japanese holiday. T-Notes have seen ~55K lots trade on the day. 10-Year Tsy supply stopped through WI by 0.2bp, with dealer takedown pretty much unchanged at sub-average levels. Elsewhere, the auction saw a slight moderation in the cover ratio vs. prev. falling back in line with the 6-auction average. 30-Year supply and weekly jobless claims data headlines the local docket on Thursday.

- Aussie bond futures ticked along in a narrow range during Sydney hours, with no reaction to the communique surrounding the phone call between the U.S. & Chinese Presidents. YM unch., XM +3.5 at the close, as the curve flattened, with swaps wider vs. ACGBs across most of the curve. On the central bank front a BBG interview with RBA board member Harper saw focus fall on the remaining excess capacity in the Australian economy, while he played down the risk of asset bubbles. On QE, Harper noted that the pace of the economic recovery, in both local and global terms, in addition to actions by other central banks are the main factors that will determine whether the Bank's bond buying scheme is extended again. Elsewhere, the space looked through comments made by Australian Treasury Secretary Kennedy (who also sits on the RBA board), as he noted that the country's economic recovery is probably "locked in" and the nation should shift to a "growth mindset." A$1.0bn of ACGB 3.25% 21 April 2029 supply headlines the local docket on Friday, with next week's AOFM issuance slate also set to hit.

FOREX: Market Closures Limit Activity In Asia

Light pressure emerged on safe haven currencies as e-minis erased early losses in what was a very quiet Asia-Pac session, as a number of market closures across the region put markets in a lull. The DXY softened, consolidating below its 50-DMA.

- NZD cemented its position as the worst G10 performer this week (on a par with USD). The kiwi's wings were clipped by weak NZ card spending data, albeit the currency clawed back initial losses towards the London morning tracking gains in AUD.

- USD/JPY held a tight range with Japan off for the National Foundation Day, establishing itself above the 100-DMA, which limited losses yesterday. Worth noting that $1.1bn of options with strikes at Y105.00-05 expire at today's NY cut, with spot currently trading at Y104.59.

- Lunar New Year holidays kicked off in China and USD/CNH tread water, ignoring headlines re: U.S. Pres Biden's phone call with Chinese Pres Xi.

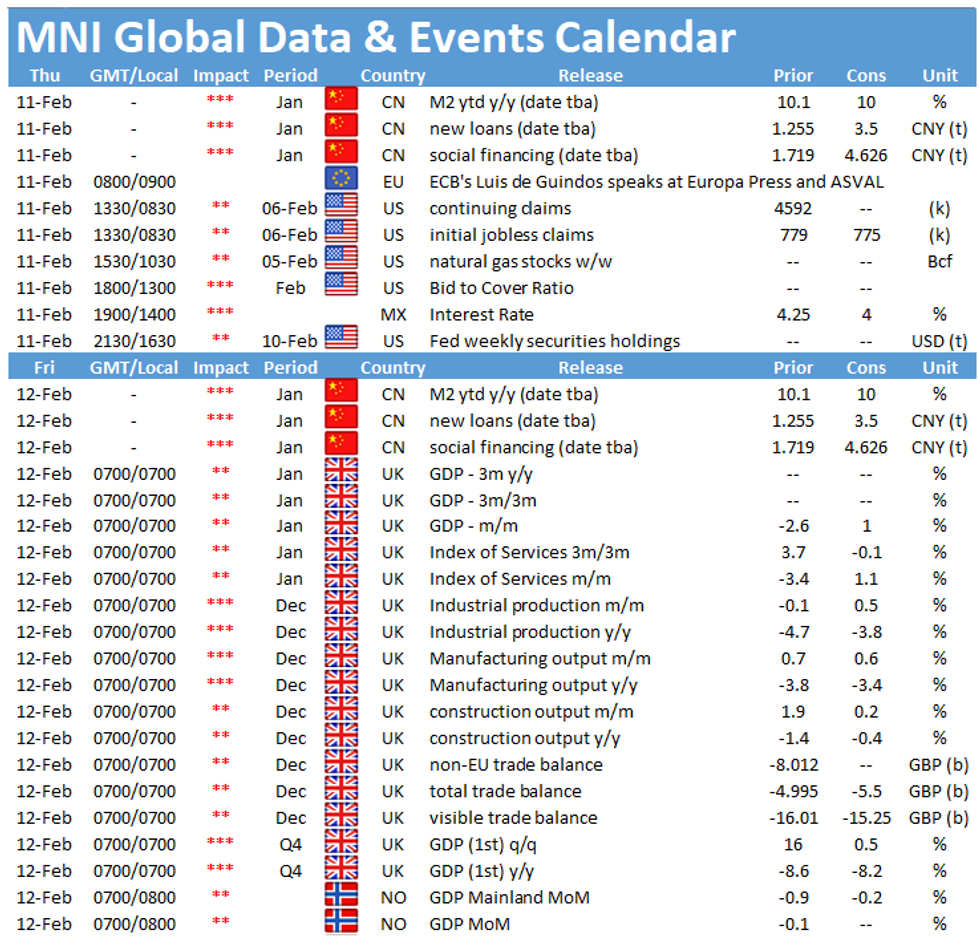

- U.S. initial jobless claims headline the data docket today. Speeches are due from ECB's de Guindos, Villeroy & Knot, while the European Commission will release its economic forecasts.

FOREX OPTIONS: Expiries for Feb11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1955-65(E517mln), $1.1985-95(E800mln), $1.2100(E459mln)$1.2280(E607mln)

- USD/JPY: Y105.00-05($1.1bln), Y105.75($2.1bln), Y106.05-10($600mln)

- EUR/GBP: Gbp0.8765-80(E886mln)

- AUD/JPY: Y79.00(A$659mln), Y80.73-75(A$1.0bln)

- AUD/USD: $0.7650-60(A$591mln), $0.7675(A$558mln)

- USD/MXN: Mxn20.88($700mln)

ASIA FX: Muted Moves

An extremely quiet session for Asia FX with many markets closed for the LNY holiday period.

- CNH: Offshore yuan hovered between minor gains and minor losses, USD/CNH heads into the European session slightly higher at 6.4313. During the session there were reports that US President Biden had spoken with his Chinese counterpart Xi about trade and other issues.

- SGD: Spot USD/SGD has lost a handful of pips through the session as USD is offered in the later part of the session. The UK-Singapore FTA comes into effect today.

- INR: The rupee has strengthened, the rate playing catchup with USD weakness seen on Wednesday. Market looks ahead to special bond auction after the OMO yesterday.

- IDR: Rupiah is higher, though implied USD/IDR 1-month volatility dipped today, printing lowest levels in a year. The Indonesian Chamber of Commerce and Industry has been lobbying Pres Jokowi to allow private Covid-19 vaccinations.

- MYR: Ringgitt is hovering around neutral levels, dropping after data showed GDP fell 5.6% in 2020, Q4 GDP contracted 3.4% against expectations of a 3.1% decline.

- PHP: Peso unchanged and moving within a tight range ahead of BSP monetary policy announcement later today. The bank are not expected to change rates.

- THB: Baht has weakened slightly, losing a handful of pips gradually throughout the session. Focus turns to Thailand's GDP data, due next Monday.

ASIA: Lunar New Year Holiday Regional Exchange Schedules

Selected Asia-Pac exchange Lunar New Year holiday schedules can be viewed below:

EQUITIES: Quiet Amid Lack Of Catalysts, Market Closures

Most Asia equity markets are closed for the Lunar New Year holiday, news flow has been extremely thin in the time zone. In Australia the ASX 200 is flat, hovering around neutral levels throughout the session.

- US futures are subdued, in minor positive territory after equity markets dropped for a second day yesterday.

- During the session there were reports that US President Biden had spoken with his Chinese counterpart Xi about trade and other issues. A senior administration official said in the wake of the call that the US would not remove all tariffs on China prematurely, but there would be changes in trade policy.

GOLD: Tight After 50-EMA Capped On Wednesday

The yellow metal has seen little net movement over the last 24 hours or so, with spot ~$5/oz softer on the day at typing, a touch above the $1,835/oz mark after a brief foray above $1,850/oz on Wednesday. From a technical perspective bulls now look for a break above the 50-day EMA after failing to print above that metric yesterday. U.S. real yields are flat to a little lower across the curve over the last 24 hours, with the DXY showing little net change over that horizon.

OIL: Rally Pauses

Crude futures are in negative territory in Asia, with WTI & Brent ~$0.30 worse off at typing. Oil managed to squeeze out gains yesterday after seeing losses early on. Yesterday US DOE stockpile data showed headline inventories declined by 6.65m/bbls against estimates for an 800k/bbl draw. The data showed that in downstream products gasoline stocks rose for the third consecutive week to the tune of 4.3m/bbls. News flow in Asia has been light with many markets away for LNY.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.