-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Mixed Asia Session As U.S. Observes Thanksgiving

- Asia-Pac session quiet with U.S. out for Thanksgiving holiday

- T-Notes & ACGBs firm up, JGBs edge lower amid little in the way of news or data signals

- G10 FX space sees a degree of risk aversion

BOND SUMMARY: Core FI Steady Amid Thanksgiving Lull

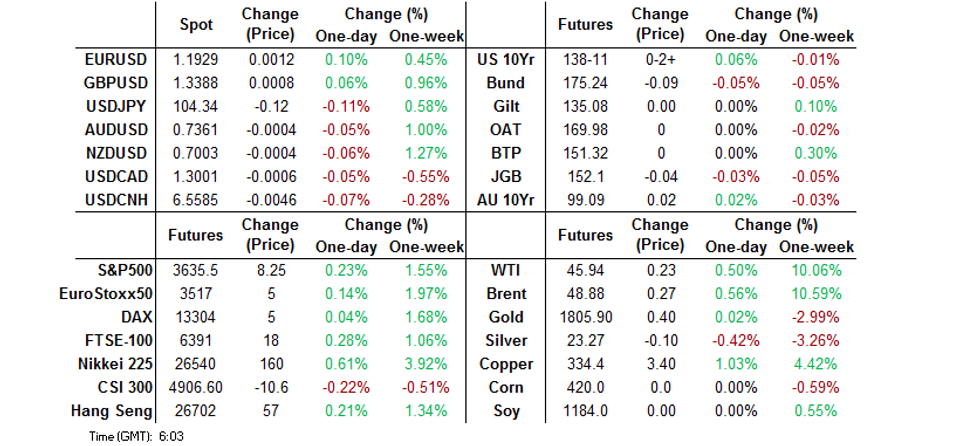

Trading activity waned in the Asia-Pac session owing to the Thanksgiving holiday in the U.S., with cash Tsy markets shut. Little to report on regional developments, as news and data flow lacked any notable market-movers. T-Notes edged higher and last trade +0-03 at 138-11+, after holding a 0-03 range in Tokyo trade, with Eurodollars running unch. through the reds.

- JGB futures slipped through overnight lows into the lunch break, before stabilising in the afternoon session. The contract last deals at 152.10, 4 ticks shy of last settlement, as the Nikkei 225 managed to eke out some gains. Cash JGB curve underwent some very light steepening, with the super-long end underperforming. The space looked through the BoJ's decision to leave the sizes of its 1-3 & 5-25 Year JGB purchases unch. Local debt issuance outlook provided some interest. Japanese MoF officials held a meeting with bond investors and are set to meet with primary bond dealers later today, as the gov't is putting together the third extra budget. Elsewhere, Tokyo metropolitan government said it will sell Y60bn of coronavirus bonds, expected to be priced today.

- Aussie bonds also held relatively narrow ranges, with YM trading unch. XM slowly ground higher and wrapped up +2.0. Cash ACGB curve bull flattened at the margin, with yields last seen unch. to -2.3bp. Bills showed little deviation from neutral levels. The space was unfazed by the RBA's offering to buy A$2.0bn worth of ACGBs with maturities of Nov '28 - Nov '31 or Australia's below-forecast Q3 private capex data.

BOJ: 1-3 & 5-25 Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y1.040tn of JGB's from the market, sizes unchanged from previous operations:

- Y500bn worth of JGBs with 1-3 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

- Y120bn worth of JGBs with 10-25 Years until maturity

JGBS: Tokyo Joins Global Boom In Bond Sales To Fund Virus Relief

Japan's capital is joining a global surge in coronavirus bond sales, with the city marketing debt to help firms during pandemic. The move comes as the nation battles an upsurge in the virus. Cases are hitting a record this month, putting strains on hospitals in the capital and the local economy. It would be the first note by a Japanese municipal government that specified the proceeds would be used exclusively to help with the pandemic. The Tokyo Metropolitan Government plans to price the 60 billion yen ($575 million) bond on Friday. Tokyo plans to use the funds from its bond to offer small-to-mid sized companies long-term financing at low interest rates. The city's decision to specify the use of proceeds for pandemic-related relief "resonated with a lot of investors," according to Kosuke Suzuki, deputy director of the bond section at Tokyo Metropolitan Government's finance bureau. The local government initially planned to sell 30 billion yen of the note, but doubled the amount due to strong demand, he said. (BBG)

JGBS: Tokyo Plans Yen Bond For Lending To Companies Hurt By Pandemic

The Tokyo Metropolitan Government plans to sell a five-year, 60 billion yen ($575 million) bond to raise funds for loans to small-to-mid sized companies hurt by the pandemic, the first such bond issued by a municipal government in Japan

- Underwriters are still marketing the deal to investors, and planning to price it on Friday, according to underwriter Mitsubishi UFJ Morgan Stanley Securities

- Tentative coupon: 0.01%

- Amount: 60 billion yen

- Underwriters: Mitsubishi, SMBC Nikko and Goldman Sachs (BBG)

FOREX: Activity Subdued With U.S. Off For Thanksgiving

The yen narrowly outperformed its G10 peers, with activity thinned by the Thanksgiving holiday in the U.S. Lack of any notable regional headline and data flow kept major crosses rangebound. A light sense of caution helped JPY & CHF remain afloat through the Asia-Pac session, with the Antipodeans facing a modicum of selling pressure. The greenback traded mixed, with the DXY wavering around Wednesday lows.

- The BoK left its main policy rate unchanged, as expected by all analysts surveyed by BBG. KRW shrugged off the decision, but pulled back from session highs as BoK Gov Lee expressed a sense of worry with rapid currency appreciation, driven by herd-like behaviour. Lee noted that the BoK will step in to stabilise FX markets if needed, citing negative impact of FX volatility for domestic exporters and general uncertainty.

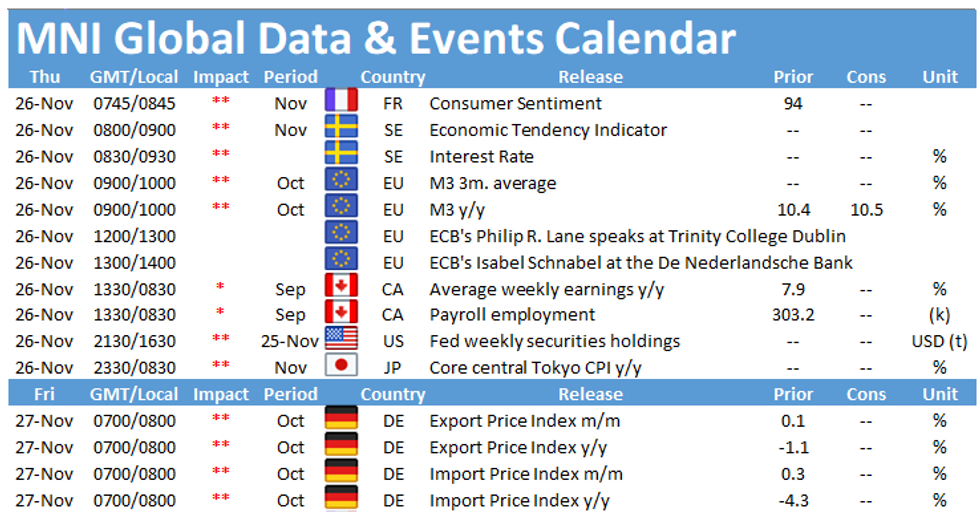

- Focus turns to minutes from the ECB's Oct MonPol meeting, Riksbank's MonPol decision, Swedish Econ Tendency Survey, French consumer confidence and comments from ECB's Lane & Schnabel, Riksbank's Breman and BoC's Macklem & Wilkins.

FOREX OPTIONS: Expiries for Nov26 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1740-50(E1.7bln), $1.1765-70(E643mln), $1.1800(E662mln), $1.1815-30(E1.0bln), $1.1850-60(E1.35bln), $1.1950-60(E654mln)

- USD/JPY: Y102.50($1.3bln-USD puts), Y104.00($1.7bln), Y104.90-00($1.1bln), Y106.45-50($907mln)

- EUR/JPY: Y124.00-15(E609mln)

- AUD/USD: $0.7300-10(A$1.2bln), $0.7400(A$733mln)

- USD/CNY: Cny6.6250($780mln)

FOREX OPTIONS: Option Expiry Highlights For Nov26:

- Nothing particularly stands out for today's cut. US enjoying its Thanksgiving holiday and expected to make trade through the day fairly subdued especially into the European afternoon.

- USD/JPY has Y104.00 strike option interest rolling off at 1500GMT, total of $1.71bln with $1.07bln of this interest being USD calls.

- Into next week and interest swings to USD puts with $3.35bln of USD puts rolling off at Y104.00 on Dec3. Y103.00 also holds strikes of some fairly decent sized expiries through next week. (current level Y104.33)

EQUITIES: Still Grinding Higher On Vaccine News With Lack Of Bad New News

Asia-Pac equities generally moved higher (with the exception of Australia) and equity futures across Europe and the US are also in positive territory.

- There seemed to be no new clear drivers of the moves, with most pointing to continued follow through from the positive vaccine developments over recent days and a lack of bad news.

- However, after a decent rally so far in November, the S&P/ASX200 rally seems to have run out of steam somewhat. This was largely due to financials getting hit as Australian capex data for Q3 came in worse than expected at -3.0% (-1.5% exp) with downward revisions to the Q2 data.

- US markets will remain closed today due to the Thanksgiving holiday, and liquidity could be impacted elsewhere.

- Japan's NIKKEI up 240.45 pts or +0.91% at 26537.31 and the TOPIX up 10.58 pts or +0.6% at 1778.25

- China's SHANGHAI down 2.823 pts or -0.08% at 3359.504 and the HANG SENG ended 45.74 pts higher or +0.17% at 26720.81

- German DAX futures up 3 pts or +0.02% at 13302, FTSE 100 futures up 14 pts or +0.22% at 6387 and EURO STOXX 50 futures up 6 pts or +0.17% at 3518.

- Dow Jones mini up 57 pts or +0.19% at 29886, S&P 500 mini up 9 pts or +0.25% at 3636, NASDAQ mini up 40.75 pts or +0.34% at 12193.

GOLD: Stabilizing But Technicals Still Pointing Lower

After some big moves over the past few days, yesterday's price action was more subdued as the yellow metal stabilised above Tuesday's lows.

- There was little reaction in gold from either the US data or the FOMC Minutes yesterday with the metal instead sticking to a $1,801.8/oz to $1,817.8/oz range.

- Overnight price action has been even more subdued, sticking to a $1,806.9/oz to $1,812.8/oz range.

- The initial resistance for the yellow metal will come at $1,848/oz, the Sep28 low and the former bear trigger. Our technical analyst notes, however, that price action still looks negative and that the break below $1,848/oz set the scene for weakness towards the $1800.00 level and a Fibonacci retracement at $1763.5.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.