-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Moderna CEO Weighs On Risk Appetite Into Europe

- Risk-off flows into European trade on the back of pessimistic comments from Moderna's CEO re: the efficacy of the current crop of vaccines when it comes to fighting the Omicron COVID strain and caution re: the timeline when it comes developing a new vaccine.

- Fed Chair Powell's pre-released comments sounded a little more cautious on the back of the recent COVID developments.

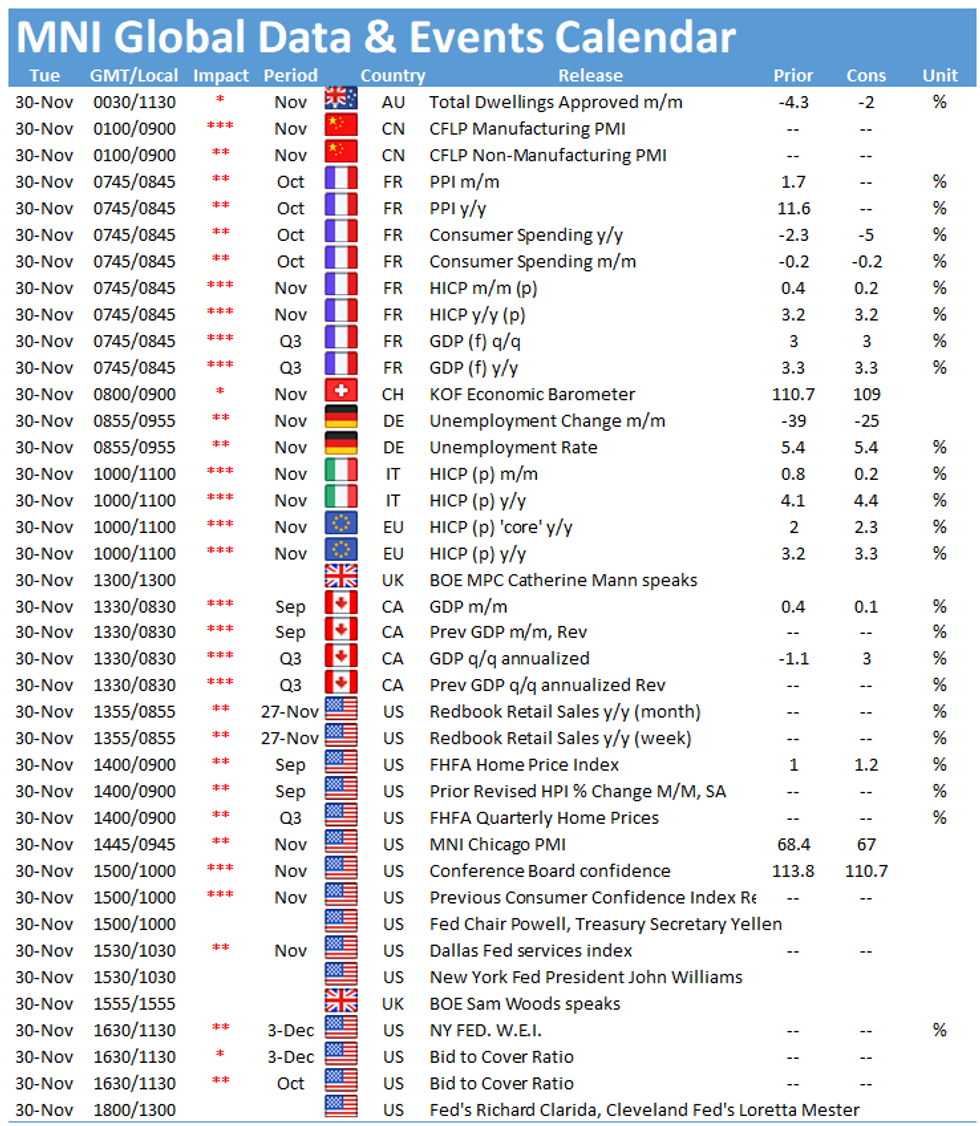

- Flash Eurozone CPI data, the latest MNI Chicago PMI reading from the U.S. & Canadian GDP headline the remainder of Tuesday’s economic docket. Elsewhere, comments from Fed Chair Powell & U.S. Tsy Sec. Yellen on the Hill, as well as ECB speak from Villeroy & de Cos, will garner attention.

BONDS: Moderna CEO Cautious Re: Omicron Vaccines, Weighing On Risk

The previously flagged sense of caution from the Moderna CEO re: the efficacy of the current crop of vaccines and imminent development of a suitable vaccine when it comes to fighting the Omicron COVID strain provided a bid for the core FI space ahead of European hours, after a generally lethargic round of early Asia trade.

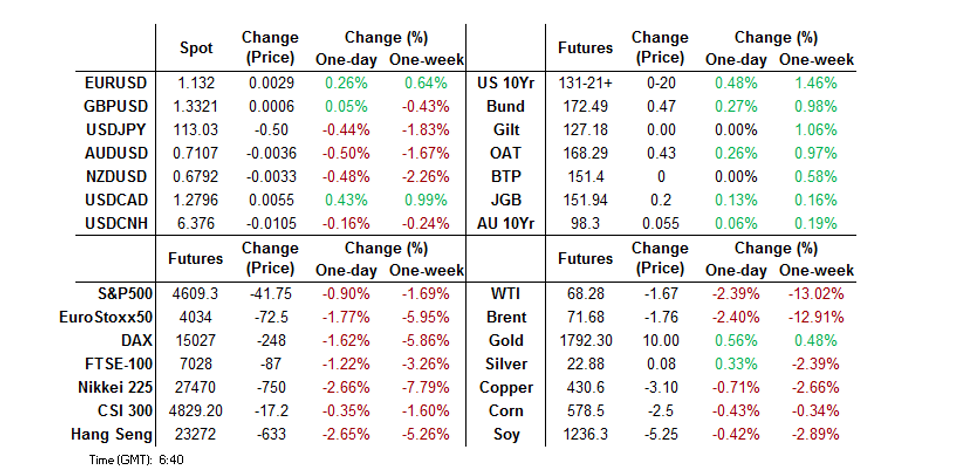

- U.S. Tsys were already in the process of unwinding their early cheapening (which came as e-minis nudged higher and Chinese official PMI data beat expectations). The aforementioned headline allowed TYH2 to push trough Monday’s high, last dealing +0-18+ at 130-27+, 0-03 off best levels. Cash trade sees the major Tsy benchmarks richen by 2.0-4.5 bp, with 7s leading the rally. House price data, consumer confidence and the latest MNI Chicago PMI reading headline the NY economic docket on Tuesday. Elsewhere, focus will fall on the Powell-Yellen testimony on the Hill (a reminder that Powell’s pre-released comments sounded a little more cautious vs. recent Fed rhetoric, owing to Omicron, meaning that focus will shift to the answers in the Q&A session).

- JGB futures followed the broader ebb & flow and deal +19 ahead of the Tokyo close, with 7s leading the bid in the cash JGB space, pointing to a futures-driven move. 2-Year supply was easily absorbed. We saw comments from Japanese Finance Minister Suzuki, who flagged the government’s strong concerns re: the Omicron strain of COVID, pointing to the need for swift passage of the supplementary budget measures and stability in the FX market.

- Aussie bond futures looked through local data, surging to best levels of the day on the broader risk-off move, before finishing off of highs (perhaps a case of fast money accounts/longs booking some quick profit ahead of the close). YM was +4.0, while XM was +5.5 at the bell.

FOREX: Moderna CEO Weighs On Risk

An FT interview with the CEO of Moderna generated a defensive round of flows as we moved towards European trade, as he “predicted that existing vaccines will be much less effective at tackling Omicron than earlier strains of Covid-19 and warned it would take months before pharmaceutical companies can manufacture new variant-specific jabs at scale.”

- This allowed the JPY to move to the top of the G10 FX table after some early underperformance (which was being pared ahead of the release of the interview), while the commodity-linked currencies gave way, falling to the bottom of the G10 board.

- USD/JPY hovers just above Y113.00 and Monday’s low (Y112.99) as a result.

- EUR/USD traded above $1.1300 on the news, after an earlier failed test of the figure.

- JPY, AUD & NZD ignored local data releases.

- Stronger than expected official Chinese PMI data and a cautious round of rhetoric from Fed Chair Powell during the NY/Asia crossover (owing to Omicron) provided a couple of boosts to the broader risk asset sphere throughout the session, but the moves were timid and have been dominated by the aforementioned caution from the Moderna CEO.

- Flash Eurozone CPI data, the latest MNI Chicago PMI reading from the U.S. & Canadian GDP headline the remainder of Tuesday’s economic docket. Elsewhere, comments from Fed Chair Powell & U.S. Tsy Sec. Yellen on the Hill, as well as ECB speak from Villeroy & de Cos, will garner attention.

FOREX OPTIONS: Expiries for Nov30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1250-55(E905mln),$1.1350(E550mln), $1.1445-50(E1.5bln)

- USD/JPY: Y113.80($1.2bln), Y115.00($2.8bln)

- USD/CNY: Cny6.3800($525mln), Cny6.3900($552mln), Cny6.4300($891mln)

EQUITIES: Mixed In Asia

The major equity indices traded lower overnight, with pessimism from Moderna's CEO re: the efficacy of current vaccines when it comes to fighting the Omicron COVID variant, in addition to a bit of a reality check when it comes to new vaccination timelines, weighing on risk. Chinese & Hong Kong equities had already lost ground on Tuesday, which dragged the likes of the Nikkei 225 and the ASX 200 back from best levels of the day, before broader E-minis also moved away from best levels (the DJIA now leads declines in the latter, shedding ~1.3%).

- Note that Chinese media flagged the details of guidance when it came to greater oversight re: the ride hailing space, which may have weighed on the Chinese tech space and related names. There was also an argument for good news being bad news re: the Chinese markets, with firmer than expected official PMI data perhaps lessening the need for imminent policy easing. Note that the PBoC continued its recent run of net liquidity injections via OMOs on Tuesday.

- This came after Fed Chair Powell sounded a little more cautious in his pre-released, initial comments ahead of his Tuesday testimony. A reminder that Monday saw the NASDAQ 100 reverse all of Friday’s Omicron-inspired losses, while the S&P 500 & DJIA ate away at their own respective Friday losses, aided by the retracement from cheaps in the U.S. Tsy space, alongside less worry re: the mortality rate of the new COVID strain.

- All in all, participants continue to weigh up the balance of the economic impact of the Omicron COVID strain vs. the potential elongation of ultra-loose policy settings owing to the same economic impact.

GOLD: In The Recent Range

Gold hasn’t got anywhere near testing Friday’s highs since Sunday’s re-open, with spot last a handful of dollars higher on the session, printing just shy of $1,790/oz. The underlying level of fear surrounding the Omicron COVID variant has eased, although a wider, longer length sample will need to be observed before making any firm judgement on its mortality rate. The new variant resulted in a little more caution when it came to pre-released testimony comments from Fed Chair Powell. Note that the testimony will take place on the hill later Tuesday, with the Q&A session set to provide the focal point of that event. A reminder that initial technical support is now located at the Nov 24 low ($1,778.7/oz), with key support coming in below there, at the Nov 3 low ($1,759.0/oz). To the topside, initial resistance is seen at the Nov 16 high ($1,877.2/oz).

OIL: Marginally Lower In Asia

WTI and Brent trade ~$2.00 below their respective settlement levels at typing, with the previously flagged caution from the Moderna CEO re: the prospects of current vaccines being successful in the fight against the Omicron COVID variant triggering broader risk-off flows.

- This comes after a relatively sharp pullback from best levels on Monday, with initial gains coming on the back of less worry re: the mortality threat posed by the Omicron COVID variant, before optimistic tones from some of the parties at the latest round of Iran-related talks (which do not include the U.S.) mixed with questions re: short-term demand implications surrounding Omicron weighed on the space.

- We also saw the White House stress that it is not reconsidering the plan to release inventory from its SPR, even though oil prices have shifted lower since the announcement. An administration official went as far as telling CNBC that the Biden admin stands ready to release even more barrels of oil from its strategic reserves should the need arise again, when questioned on the matter.

- Continued focus falls on this week’s OPEC+ gathering (particularly in light of the recent co-ordinated release of crude stockpiles on the part of some of the major oil consuming nations), while the latest API inventory estimates will also provide interest later on Tuesday.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.