-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: New Lows For DXY, Fiscal Matters Eyed

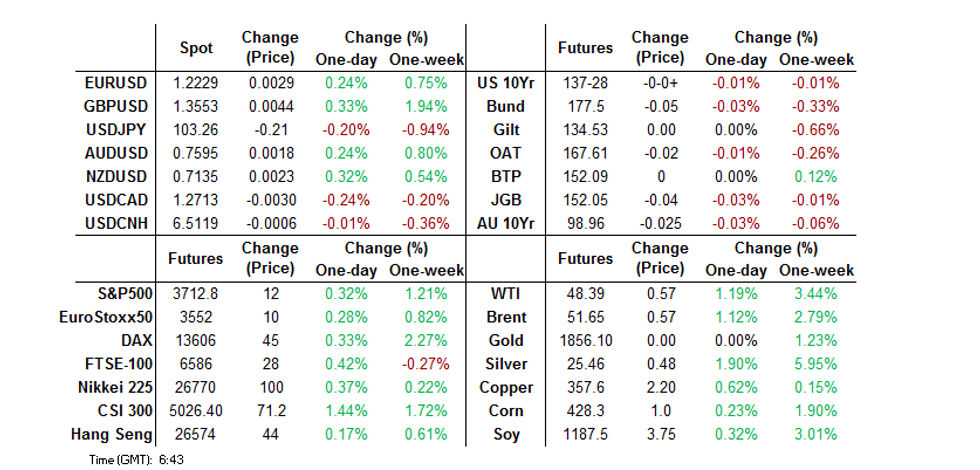

- The DXY edged lower in Asia hours with Tsys operating in a tight range in the wake of the final FOMC decision of '20.

- U.S. fiscal matters are set to dominate play into year end.

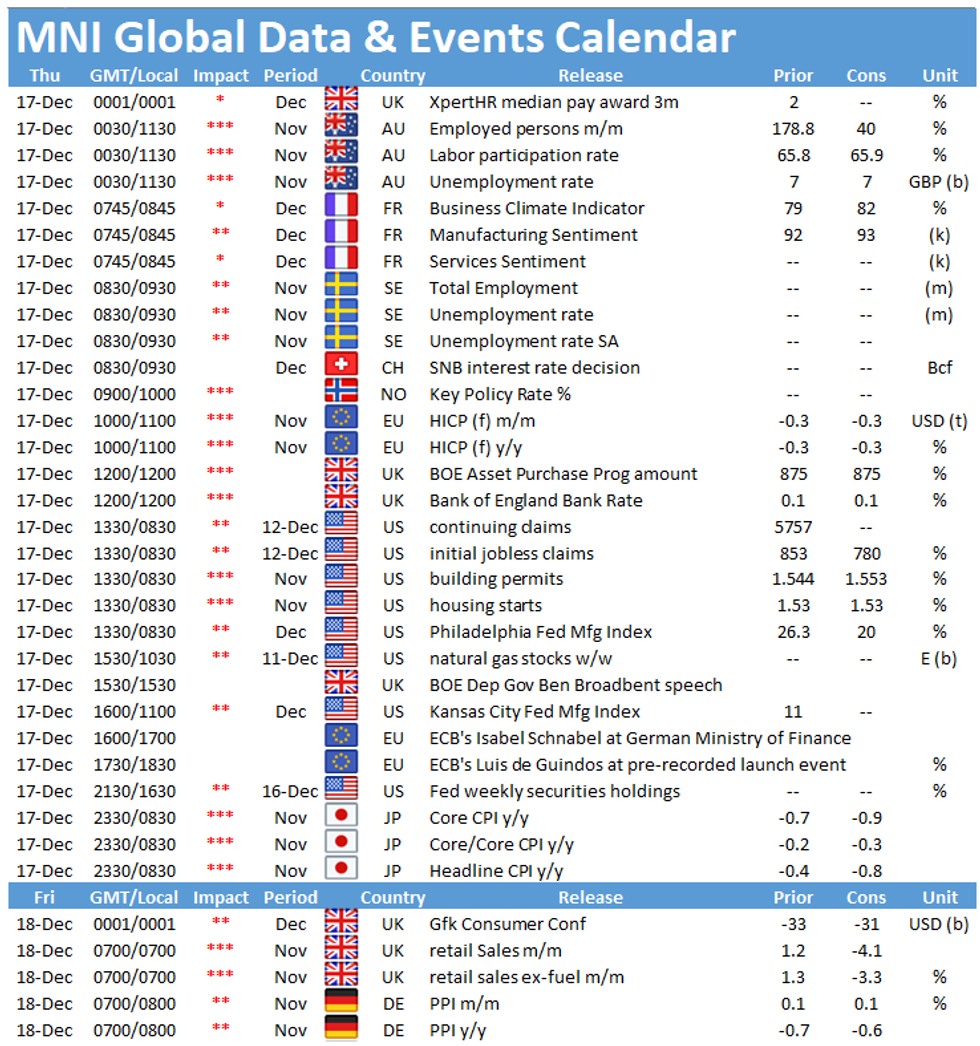

- BoE, Norges Bank & SNB monetary policy decisions are due on Thursday.

BOND SUMMARY: Core FI Biased A Touch Lower

U.S. Tsys came under modest pressure in post-FOMC Asia-Pac trade, with focus on the continued positive musings around the fiscal situation in DC evident, although there was little in the way of solid progress on that front. T-Notes stuck to a 0-05 range, with the contract last -0-01 at 137-27+, while the cash curve is back from session steeps, as Tsys sit unchanged to 0.8bp cheaper across the curve. 2x 10K downside TY block structures drove matters on the flow side in Asia.

- JGB futures finished 4 ticks lower on the day after failing to challenge the overnight low. Long end outperformance came to the fore as we moved through Tokyo trade, with marginal richening for super long paper come the bell. Participants had an eye on the local COVID-19 situation and continued focus on the JGB issuance burden for the upcoming fiscal year. The final BoJ decision of 2020 and national CPI data will hit on Friday.

- The Aussie bond space softened in the wake of the release of a firmer than expected domestic labour market report, although corrected from worst levels ahead of the close. YM finished -2.0, with XM -2.5, while swaps tightened marginally vs. ACGBs across most of the curve. To sum things up, November's labour market report was much stronger than expected, with jobs growth in Victoria accounting for 74K of the 90K jobs added nationally, while underemployment and underutilisation continue to move away from their respective '20 peaks. The much stronger than expected headline jobs growth was largely driven by full time employment gains (84.2K) and more than offset the uptick in the participation rate (which has recovered to all-time highs of 66.1%), providing an unexpected dip in the headline unemployment figure. The MYEFO provided a narrower deficit path vs. the budget that was only issued 2 months ago, although deficit projections remain at historically extreme levels, at least by Australian standards.

FOREX: US Dollar Downtrend Resumes As AUD & NZD Bid In Asia

Central banks and data dominated headline flows. The final FOMC decision of 2020 was ultimately in line with expectations, with new asset purchase guidance but no change to the asset purchase program itself. The decision and optimistic-looking summary of economic projections initially saw the US dollar strengthen before moving back to pre-announcement levels.

- US dollar is seeing some softness in Asia after US Representative Hoyer, a member of the House Democratic leadership, said a fiscal aid deal could be imminent. Though other Congressional leaders have tempered this optimism suggesting negotiations could run into the weekend. All indications remain that both sides are keen to do a deal. President-elect Joe Biden said there would be need for additional measures by February.

- Employment data from Australia was stronger than expected, 90k jobs were added in November against expectations of a gain of 50k, the unemployment rate dropped to 6.8%, while the participation rate also rose to 66.1% from 65.8%.

- AUD/USD has been bid after the release, hitting fresh cycle highs of 0.7592 and rising above 0.7583, the Jun 14, 2018 high. Officials continue to highlight risks over tensions with China, while the budget update forecasted a deficit of AUD 197.7bn in 2020/21

- NZD/USD also moved higher, catching a fresh bid after FinMin Robertson said New Zealand were not concerned with NZD at these levels. Elsewhere Q3 GDP came in above expectations

- USD/JPY has trended lower through the session, mostly on the back of US dollar weakness. Markets await the BoJ rate decision tomorrow, no change is expected.

- GBP/USD has moved higher, gaining around 30 pips on the session, focus continues to fall on Brexit negotiation back and forth. European Commission President Ursula von der Leyen said yesterday that "there is a path to an agreement now", increasing the probability of a deal being reached before the hard deadline of December 31.

- The PBOC fixed USD/CNY at 6.5362, 7 pips higher than the previous fix. USD/CNH continued its move lower, touching 6.50 before rebounding to 6.5112, down 13 pips on the session. The 6.50 barrier was last breached on December 9.

FOREX: Expiries for Dec17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1875-80(E1.1bln), $1.2000(E1.2bln), $1.2050(E543mln), $1.2100-15(E841mln), $1.2200-05(E508mln)

- USD/JPY: Y102.95-103.00($500mln-USD puts), Y103.75-90($1.0bln), Y104.15-20($633mln), Y104.30($610mln)

- AUD/USD: $0.7300(A$541mln), $0.7350(A$531mln), $0.7550(A$609mln-AUD puts)

- USD/CNY: Cny6.50($1.2bln-USD puts), Cny6.55($755mln-USD puts)

EQUITIES: A Little Firmer In Asia

The major regional Asia-Pac equity indices were little changed to higher during Thursday trade, with positive mood music surrounding the fiscal situation in DC in focus, while there was little in the way of lasting fallout from the final FOMC decision of '20.

- Meanwhile, e-minis edged higher as we worked out way through the overnight session.

- Nikkei 225 +0.2%, Hang Seng +0.3%, CSI 300 +1.2%, ASX 200 +1.1%

- S&P 500 futures +12, DJIA futures +90, NASDAQ 100 futures +41.

GOLD: Well Defined Lines

Little has changed for gold in the wake of the final FOMC decision of '20. Spot continues to sit within well defined technical lines in the sand, last dealing around the $1,870/oz mark. U.S. fiscal matters are now set to dominate into Christmas, with the DXY operating at cycle lows.

OIL: New Highs

WTI & Brent sit ~$0.60 above settlement levels, building on yesterday's modest gains, extending to fresh multi-month highs during Asia-Pac trade as the USD traded to fresh cycle lows.

- Wednesday saw the weekly DoE inventory report reveal a deeper than expected headline drawdown in crude stocks vs. a surprise build in the API readings, with marginal builds seen in distillate, gasoline and Cushing inventories.

- There was little else of note for the space, with broader focus falling on the final FOMC decision of the calendar year and the fiscal situation in DC.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.