-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: NFPs Are The Only Game In Town

- NFPs front and centre, with a catalyst lacking during holiday-thinned Asia-Pac trade. U.S. President Biden set to speak after release.

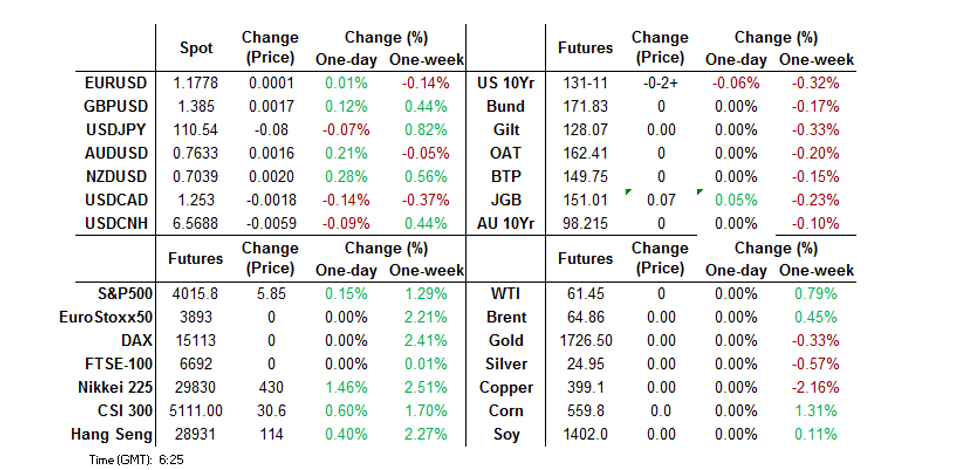

BOND SUMMARY: Core FI Off Best Levels In Asia

T-Notes have drifted marginally lower as we grind towards European hours, -0-02+ at 131-11, holding to a 0-05+ range during overnight trade, with under 40K lots trading thus far. The Easter period and associated holidays are clearly sapping liquidity, while there has been nothing in the way of notable headline flow apparent. Cash Tsys are closed until NY hours (which are themselves shortened). A reminder that the Tsy complex experienced a firm start to the month of April as the curve bull flattened on Thursday, with the longer end richening by ~8.0bp vs. Wednesday's closing levels. This came alongside/despite strong local data, which, when combined with the lower yield environment, allowed the equity space to firm. The S&P 500 index (and ES futures) traded and closed above 4,000 for the first time. The latest ISM m'fing survey revealed the fastest headline rate of expansion seen since the early 80s, but didn't create anything in the way of lasting selling pressure for Tsys as it came on the heels of a strong round of regional PMI prints. Elsewhere, block flow in FVM1 futures dominated with just under 32K lots trading via block throughout the NY session, a mixture of buying and selling observed (~13.4K bought vs. 18.5K sold). The NFP release headlines on Friday, with thinner liquidity having the potential to amplify any post-data swings in the space. The release will be followed an address from President Biden (which is seemingly linked to the jobs report), with the President set to speak from 11:00 Eastern time (16:00 London). Widespread market holidays and a lack of tier 1 data may limit activity ahead of NY hours.

- The cash JGB space firmed a little during the Tokyo morning, drawing support from Thursday's bid in U.S. Tsys and the overnight move in JGB futures. The space has retraced from best levels during the afternoon, alongside Tsys. Futures last printing 8 ticks above Tokyo settlement levels.

FOREX: Greenback Declines As Markets Hop Towards Easter Break

Thin volumes and news flow with several markets closed for holidays, while the usual pre-NFP lull is also expected to engender a subdued session.

- AUD and NZD both gained as the greenback gives some more ground, oil closed at its highs following the conclusion of the OPEC+ meeting, which is helped support high beta currencies.

- JPY slightly stronger, USD/JPY shedding around 2 pips. Data earlier showed March monetary base rose 22.8% Y/Y, the release did not have any effect on JPY.

- Offshore yuan is stronger, USD/CNH down 32 pips at 6.5736, still well within yesterday's range, sources note bids at 6.5716. Sino-US tensions continued to summer, in the latest development US Senate minority leader McConnell said the US must work with partners to impose consequences on China over Hong Kong. The PBOC fixed USD/CNY at 6.5649, 3 pips below sell-side estimates. The last time the PBOC fixed above sell-side estimates, indicating a preference for a weaker yuan, was 10 sessions ago.

- EUR struggled to gain despite losses in the greenback as markets focused on fresh lockdowns in several European nations starting this weekend.

FOREX: Pre-Payrolls, USD Positioning Close to Multi-Year Highs

- The US is expected to have added 650k jobs (range 232 - 1,000k) in March, pressing the unemployment rate to post-pandemic lows of 6.0%. The whisper number, however, is far more positive and looks for 790k job gains, suggesting markets may be looking for a strong read this month.

- Headed into the release, the USD index trades just below cycle highs of 93.437, the best level since early November. A break above here opens key resistance at 94.474, the 38.2% retracement of the 2020-21 downtrend.

- Options markets are pricing an overnight swing of just over 30 pips in EUR/USD. Given the very slight bias towards USD weakness, a stronger number may strengthen the significance of noted support for the pair at 1.1695, 38.2% retracement of the Mar 2020 - Jan rally.

- The MNI-weighted synthetic DXY 1m risk reversal has been trending higher over the past six months, hitting a post-pandemic high in early March and reflecting better underlying fundamentals (red line below). This is mirrored in CFTC positioning, with MNI's USD Positioning Indicator hitting the best levels in 18 months in late March.

FOREX OPTIONS: Expiries for Apr02 NY cut 1000ET (Source DTCC)

- USD/JPY: Y110.00($585mln)

- USD/CNY: Cny6.58($1.4bln)

ASIA FX: Many Markets Closed, Those Open Post Gains

Thin volumes and news flow with several markets closed for holidays, while the usual pre-NFP lull is also expected to engender a subdued session. The greenback lost some ground after falling in the session on Thursday, while risk assets were supported.

- CNH: Offshore yuan is stronger, USD/CNH down 32 pips at 6.5736, still well within yesterday's range, sources note bids at 6.5716. The PBOC fixed USD/CNY at 6.5649, 3 pips below sell-side estimates. The last time the PBOC fixed above sell-side estimates, indicating a preference for a weaker yuan, was 10 sessions ago.

- KRW: Won strengthened after positive CPI data, while sentiment was also supported in the region by reports that US officials was planning to meet with semiconductor firms to address the global shortage of microprocessors.

- MYR: Ringgit strengthened, spurred on by higher oil prices after the OPEC+ group agreed to only gradually repeal supply cuts. It was reported the government is considering allowing interstate travel for people who have been vaccinated.

- SGD: Singapore dollar is higher, USD/SGD is stuck above 1.3432 a 23.6% retracement level

- THB: Baht is stronger, though is still lower on the week. THB gained alongside regional equity markets. Data after market yesterday showed Thailand's fiscal deficit jumped 138% Y/Y.

ASIA RATES: Mixed In Thin Holiday Trade

China's bonds post gains in March, bucking the global trend. Quiet trade today with many markets on holiday.

- SOUTH KOREA: Bonds pressured lower on positive data and increased issuance. The MOF plans to sell KRW 14.5tn of bonds in April, compared to KRW 17.2tn in March against an original plan of KRW 14tn. It was flagged previously that South Korea would minimise issuance of longer-tenure bonds in order to address yield curve inversion in the long end. Data released earlier showed CPI rose 1.5% Y/Y, in line with estimates, while the core reading rose 1% against estimates of 0.9%. The 1.5% print is the fastest increase since January 2020.

- CHINA: The PBOC matched maturities with injections again today, the twentieth straight day of matching maturities, while the bank hasn't injected funds since February 25. Repo rates have declined from elevated levels yesterday, overnight repo rate last at 1.7215% after touching 2.20% yesterday, 7-day repo rate last at 1.99%, down from peaks of 2.60% earlier this week. Futures are higher, in the cash space some fattening seen. China sold CNY 55.7bn of local government bonds in February, with an average tenor of 8.9 years and average yield of 3.45%. Performance data for Q1 showed Chinese government bonds were resilient to the global bond sell off, and boasted lower volatility and correlation with global bonds.

- INDIA: Markets closed

- INDONESIA: Markets closed

EQUITIES: April Kicks Off With A Bang

Asia-Pac indices are in the green, making April a good month so far with two consecutive days of gains. Several markets were closed for holidays, which meant light news flow and thin volumes. Markets took a positive lead from the US, while higher oil prices post OPEC+ also helped support sentiment. Markets in South Korea were buoyed by reports that US officials was planning to meet with semiconductor firms to address the global shortage of microprocessors. Markets in China are on track for their best week since February. US equity futures are higher, buoyed by a record close on the S&P above the 4,000 level, tech shares were the outperformer.

GOLD: Drawing Support From The DXY & U.S. Yields

Spot bullion has added a couple of dollars to last trade at $1,731/oz in holiday-limited Asia-Pac dealing, just above yesterday's high. A softer DXY and downtick in U.S. real yields has supported bullion over the last 24 hours or so, allowing bulls to switch focus to key resistance in the form of the Mar 18 high ($1,755.5/oz). The NFP print is set to dominate during Friday's holiday-thinned session, with thinner markets having the potential to exacerbate volatility.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.