-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Oil Advances, E-Minis Rebound

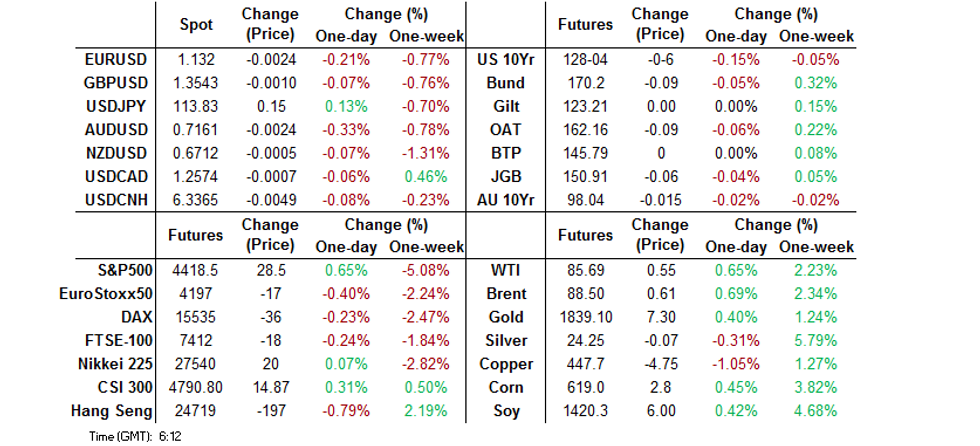

- Core bond markets soften as U.S. equity index futures regain poise and Asian equity benchmarks move away from initial lows.

- Firmer crude prices lend support to oil-tied currencies, safe havens lose ground.

- The PBOC cut the interest rate applied to their 14-Day Reverse Repo operations by 10bp to 2.25%.

BOND SUMMARY: Core FI Lose Ground Amid Bounce In U.S. E-Minis, U.S. Tsy Curve Flattens

Light selling pressure hit core FI at the start to the week, in spite of bubbling geopolitical tensions over Russia's military build-up near the Ukrainian border. Participants eyed Wednesday's monetary policy decision from the Fed, which should shed some more light on the policy outlook. U.S. e-mini futures caught a bid, which coincided with weakness in core bond markets.

- T-Notes meandered within a fairly tight range overnight, they last change hands -0-07 at 128-03. Eurodollar futures trade 1.5-4.5 ticks lower through the reds. The Tsy curve bear flattened as cash trading got under way, with yields last seen 1.8-3.1bp higher. Flash Markit PMIs & 2-Year Tsy auction headline the local docket today.

- JGB futures sold off in the morning session to stabilise after the Tokyo lunch break. JBH2 operates at 150.95 at typing, 2 ticks shy of last settlement. Cash JGB yields are little changed across the curve. The space shrugged off domestic PMI data & Covid-19 headline flow, with JGBs happy to move in tandem with peers.

- Cash ACGB yields crept higher and last trade 0.7-2.7bp across the curve. Aussie bond futures slipped in sync with cash ACGBs, with YM last -2.0 & XM -2.0. Bills last sit 1-3 ticks lower through the reds. There was no material follow-through from the release of local PMI figures or today's round of ACGB Sep '26 supply, which drew bid/cover ratio of 4.09x (prev. 6.08x).

FOREX: Safe Havens Ignore Geopol Risks; Crude Rises & Oil-Tied FX Hitch Ride

The Japanese yen and Swiss franc brought up the rear in G10 FX space. A recovery in U.S. e-mini futures sapped strength from safe haven currencies, with participants eyeing Wednesday's monetary policy decision from the Fed. Further escalation in geopolitical tensions over Ukraine failed to generate any significant safe haven bid.

- USD/JPY climbed over the Tokyo fix and held the bulk of its initial gains, as U.S. Tsy yields rose across the curve in cash trade.

- Firmer oil prices supported CAD and NOK. The combination of enthusiasm about a potential recovery in demand as Omicron countermeasures are lifted and a failed missile strike on the UAE helped keep crude buoyant.

- Spot USD/CNH hovered just above support from Dec 8 cycle low of CNH6.3305, the rate's lowest point since 2018. However, the yuan reference rate virtually matched average estimate, suggesting that the PBOC are comfortable with redback appreciation. The central bank also lowered the interest rate applied to 14-Day Reverse Repo operations by 10bp, adding to a suite of rate cuts delivered last week.

- A suite of PMI figures from across the globe will keep hitting the wires today, while the central bank speaker slate is virtually empty.

FOREX OPTIONS: Expiries for Jan24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1230-35(E875mln)

- USDJPY: Y113.95-05($795mln), Y114.85-00($634mln)

- AUDUSD: $0.7200(A$761mln), $0.7235(A$1.6bln)

ASIA FX: Rupiah Leads Gains, Yuan Nears Cycle Highs

Most USD/Asia crosses crept lower, with the rupiah leading gains in Asia EM space. The baht bucked the regional trend and slipped across the board.

- CNH: Spot USD/CNH threatened to print a fresh cycle low, as the pair hovered just above Dec 8 low of CNH6.3305, its worst level since 2018. The PBOC showed no signs of concern with redback appreciation, fixing the yuan reference rate virtually in line with expectations.

- KRW: Spot USD/KRW oscillated within a fairly tight range, printing a two-week high in the process. The government submitted a draft KRW14tn extra budget to parliament but lawmakers have called for more spending.

- IDR: The absence of notable domestic headlines allowed spot USD/IDR to move on the back of broader market impetus. The rate gapped lower at the re-open and remained in negative territory.

- MYR: Spot USD/MYR edged lower but its 100-DMA proved resilient. Political goings-on drew attention in Malaysia, after the state government of Johor called a snap election to be held within 60 days.

- PHP: Spot USD/PHP moved further away from key resistance located at PHP51.500. The improvement in Metro Manila's Covid-19 situation may have lent some support to the peso.

- THB: There was less optimism about Covid-19 dynamics in Thailand's, as daily infections remain elevated. The baht showed some modest weakness at the start to the week.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/01/2022 | 0815/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/01/2022 | 0815/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 24/01/2022 | 0830/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 24/01/2022 | 0830/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 24/01/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 24/01/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 24/01/2022 | 0900/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 24/01/2022 | 0930/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 24/01/2022 | 0930/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 24/01/2022 | 0930/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 24/01/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/01/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 24/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/01/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.