-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Credit Weekly: Le Vendredi Noir

MNI: Canada Apr-Sept Budget Deficit Widens On Spending

MNI EUROPEAN MARKETS ANALYSIS: Oil Remains Under Pressure, Yen Outperforms

- US Cash tsys are trading 1-2bps richer across benchmarks in today's Asia-Pac session. There hasn’t been anything meaningful on the newsflow front other than Fed Bowman’s aftermarket comments, which flagged the potential to begin cutting interest rates at some point to prevent overly tight policy. She did however caution against expectations for cuts in the near term.

- Lower US yield hurt USD sentiment, but losses have been pared. Yen has outperformed. AUD/USD is lower despite a retail sales beat. Regional equity markets are mostly higher, but China markets continue to struggle for positive traction.

- In the commodity space, oil benchmarks are tracking lower, albeit remaining above Monday session lows.

- Looking ahead, Swiss currency reserves will be published in European hours on Tuesday, alongside German industrial production and European unemployment figures. US and Canadian trade balance data is also scheduled.

MARKETS

US TSYS: Cash Bonds Dealing Slightly Stronger

TYH4 is trading at 111-30, -0-03+ from NY closing levels.

- Cash tsys are trading 1-2bps richer across benchmarks in today's Asia-Pac session.

- There hasn’t been anything meaningful on the newsflow front other than Fed Bowman’s aftermarket comments, which flagged the potential to begin cutting interest rates at some point to prevent overly tight policy. She did however caution against expectations for cuts in the near term.

- NFIB Small Business Optimism and Trade Balance data is due later today.

- The market however remains focused on US CPI/PPI inflation measures on Thursday/Friday respectively.

JGBS: Bull-Flattening, Rinban Operations Supportive, 10Y Supply Tomorrow

JGB futures are in positive territory, +12 compared to settlement levels, and at the session's best level.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Tokyo CPI data that printed close to expectations.

- (Reuters) Japan is preparing the expansion of budget reserves in the fiscal 2024/25 budget from its planned 500 billion yen ($3.48 billion) to support the recovery from the Noto peninsula earthquake, Finance Minister Shunichi Suzuki said on Tuesday.

- Elsewhere, after finishing yesterday’s NY session with moderate gains across benchmarks, cash tsys have extended those gains by 1-3bps in today’s Asia-Pac session. NFIB Small Business Optimism and Trade Balance is due later today. The market however remains focused on US CPI/PPI inflation measures on Thursday/Friday respectively.

- Today’s BoJ Rinban operations covering 1-5-year and 10-25-year JGBs saw generally lower cover ratios and negative spreads. This likely helped support the market in afternoon trade.

- The cash JGB curve has bull-flattened, with yields 0.3bp to 2.7bps lower. The benchmark 10-year yield is 2.0bps lower at 0.590% versus the Nov-Dec rally low of 0.555%. 10-year supply is due tomorrow.

- Swap rates are slightly lower across all maturities. Swap spreads are wider.

- Tomorrow, the local calendar sees Labor & Real Cash Earnings.

JAPAN DATA: Tokyo CPI Close To Expectations, Core-Core Moving Lower Gradually

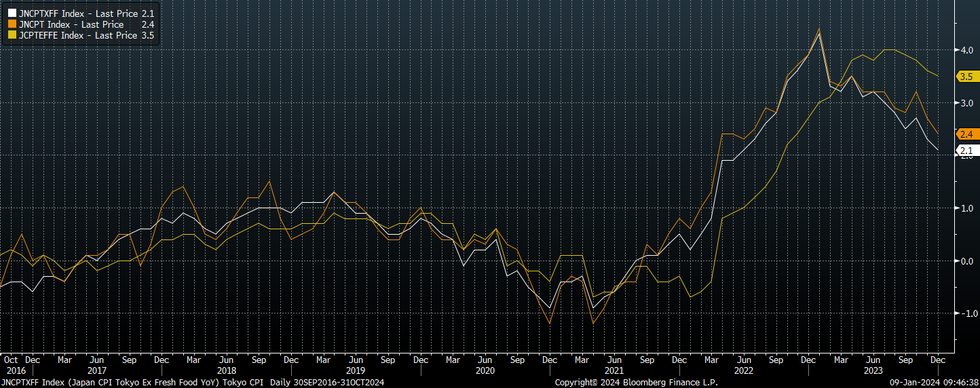

Japan Dec Tokyo CPI figures were close to expectations. Headline CPI printed at 2.4%y/y (against a 2.5% forecast, and 2.7% prior). The ex fresh food category was 2.1% y/y in line with forecasts (2.3% prior). The ex fresh food, energy index rose 3.5% y/y, also in line with expectations (prior was 3.6%).

- In m/m terms, headline inflation was flat (versus -0.2% in Nov). The core measures were both +0.2% m/m, with goods +0.3% and services inflation flat. The measure which excludes all food and energy (non seasonally adjusted) rose 0.1% m/m.

- In terms of the sub categories we had drags from food (-0.4%m/m) and utilities (-0.3%m/m), but entertainment +0.7% m/m and clothing +0.2% m/m were positive offsets.

- In y/y terms, the biggest drag remained from utilities, -17.2% y/y. Food y/y inflation also eased back to 6.6%. Most other categories saw either upticks in y/y momentum or steady outcomes.

- Overall, the data continues to show moderation in inflation pressures, albeit with core's much more gradual than the headline, see the chart below. Base effects will be less supportive for further headline falls as we progress through 2024.

- Other data showed household spending fell -2.9% y/y in Nov, versus -2.3% expected.

- Note we get Nov labor nominal and real earnings data tomorrow.

Fig 1: Tokyo CPI Measures Y/Y

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: Remain Richer Despite Stronger Than Expected Domestic Data Drop

ACGBs (YM +6.0 & XM +5.5) are richer and at or near Sydney session highs despite today’s domestic data drop surprising on the strong side. November Retail Sales beat market expectations printing +2.0% m/m versus +1.2% est, while November’s Building Approvals also exceeded expectations printing +1.6% m/m versus -2.0% est.

- Elsewhere, after finishing yesterday’s NY session with moderate gains across benchmarks, cash tsys have extended those gains by 1-2bps in today’s Asia-Pac session. NFIB Small Business Optimism and Trade Balance is due later today. The market however remains focused on US CPI/PPI inflation measures on Thursday/Friday respectively.

- Iron ore fell for a fourth day, with fresh data from China showing the nation’s struggling steel-intensive property sector remains in the doldrums. (See Bloomberg link)

- Cash ACGBs are 5-7bps richer on the day, with the AU-US 10-year yield differential 2bps tighter at +10bps.

- Swap rates are 5-6bps lower on the day, with EFPs slightly mixed.

- The bills strip has bull-flattened, with pricing flat to +8.

- RBA-dated OIS pricing is 1-6bps softer for meetings beyond March. A cumulative easing of 48bps is priced for year-end.

AUSTRALIAN DATA: Nov Retail Sales Surge On Black Friday Sales

Nov retail sales comfortably beat expectations. The 2.0% m/m rise compared with a +1.2% forecast and a revised -0.4% fall in October. In y/y terms spending is up 2.2%, so only slightly up from recent lows.

- Discretionary spending was the clear standout, with household good retailing up 7.5% m/m, department store sales were +4.2%. Apparel was +2.7%. Food and cafe and restaurant spending recorded a more modest +0.4%m/m rise.

- The bounce in Nov was heavily influenced by sales in the month. The ABS noted: "Black Friday sales were again a big hit this year, with retailers starting promotional periods earlier and running them for longer, compared to previous years.

- “The strong rise suggests that consumers held back on discretionary spending in October to take advantage of discounts in November. Shoppers may have also brought forward some Christmas spending that would usually happen in December."

- Hence, we may see some payback in Dec on the back of today's result.

- Other data showed building approvals rose 1.6% m/m, versus a -2.0% projected drop. The Oct rise was 7.2%.

NZGBS: Richer, Light Local Calendar, ANZ Commodity Prices Tomorrow

NZGBs closed with the benchmarks richer and at or near the local session’s best levels. With the local calendar once again light, the direction of the market is likely entirely due to movements in US tsys.

- After finishing yesterday’s NY session with moderate gains across benchmarks, cash tsys have extended those gains by 1-2bps in today’s Asia-Pac session. The market remains focused on US CPI/PPI inflation measures on Thursday/Friday respectively.

- Nevertheless, the NZGB 10-year has underperformed its $-bloc counterpart, with the NZ-US and NZ-AU yield differentials 1bp and 3bps wider respectively.

- Swap rates closed 3-4bps lower, with the 2s10s curve slightly steeper.

- RBNZ dated OIS pricing closed 2-5bps softer across meetings beyond February. Cumulative easing by year-end sits at 94bps.

- Tomorrow, the local calendar sees ANZ Commodity Prices. REINZ House Sales and CoreLogic House Prices are due over the coming days also.

FOREX: Yen Strength Continues, AUD Can't Sustain Data Induced Bounce

Yen strength has been the main feature in the G10 space today. USD/JPY dipped as far as 143.42, but we now sit back around the 143.60/65 level, around 0.45% stronger in yen terms. A continued mover lower in US yields has aided yen sentiment. The BBDXY is back near 1221.5, slightly down for the session. Moves elsewhere have been muted, with AUD unable to capitalize on a retail sales data beat.

- Yen gains have come despite a benign Tokyo CPI print, with headline inflation continuing to track lower in y/y terms. Core-core inflation is proving stickier though. There is a chunky option expiry at 143.60, which may also be influencing spot.

- US yields opened lower and have stayed that way, the back end of the curve -2-3bps lower. There hasn’t been anything meaningful on the newsflow front other than Fed Bowman’s aftermarket comments, which flagged the potential to begin cutting interest rates at some point to prevent overly tight policy. She did however caution against expectations for cuts in the near term.

- The AUD got to highs of 0.6735 post the +2%m/m Nov retail sales gain, which was above expectations. The data suggest some pay back in Dec though, as the Nov data was aided by Black Friday sales. AUD/USD last back at 0.6715/20. NZD/USD sits back at session lows as well, last near 0.6250.

- Looking ahead, Swiss currency reserves will be published in European hours on Tuesday, alongside German industrial production and European unemployment figures. US and Canadian trade balance data is also scheduled.

EQUITIES: Asia Pac Markets Higher, Taking Cue From US & EU Gains

Regional equities are tracking higher in Tuesday Asia Pac trade, in line with cash gains in US & EU markets from Monday's session. Japan and Australian markets are the standouts at this stage, both with gains over 1%. US equity futures sit slightly down in, Eminis under 4800, while Nasdaq futures sit near 16788.

- Japan's Nikkei 225 is up 1.1%, the Topix trailing at +0.7%. The strong tech bounce in US markets on Monday has aiding this space on Japan's bourse today. A firmer yen backdrop hasn't hurt sentiment meaningfully, while Tokyo inflation data didn't point to a dramatic BoJ shift at the upcoming policy meeting.

- Other tech sensitive plays, like the Taiex and Kospi haven't outperformed though. The Taiex is around flat, although the local election is not too far away.

- The Kospi up a modest 0.15%. Weaker than expected Samsung Electronics profit results is a potential headwind. The Kosdaq hit +20% gains from the Oct 31 low in earlier trade, but sits off best levels.

- Chian and Hong Kong markets are modestly higher at the break.

- The ASX 200 is up around 1%, led by the financials.

- In SEA, the Indonesian stock market is off by a little over 1%, bucking the positive trends elsewhere. The index had a strong run higher from Nov lows, so we may be seeing some consolidation post that move.

OIL: Largely Holding Monday Losses

Brent crude has tracked tight ranges in the first part of Tuesday trade. We were last near $76.35/bbl in terms of the benchmark front month contract, slightly above end Monday levels (+0.30%). This follows Monday's sharp 3.35% pull back amid fresh demand concerns, with Saudi Arabia cutting prices by more than expected to its Asian customers over the weekend. The WTI benchmark has tracked a similar trajectory and sits near $70.90/bbl in recent dealings.

- The benchmarks are largely holding Monday losses at this stage, although we are above intra-day lows from Monday (near $75.25/bbl for Brent).

- The Saudi price cut, robust non-OPEC supplies, and a fall in fund net-long positions indicate bearish sentiment in the space.

- Broader USD sentiment has softened today, which has likely helped oil stabilize further at the margins.

- Looking we get the EIA releases its Short Term Energy Outlook in US trade on Tuesday. The US API report on inventories will publish later in the session as well.

GOLD: Slight Recovery From Monday’s Softness

Gold is 0.3% higher in the Asia-Pac session, after closing 0.8% lower at $2028.07 on Monday.

- The weakness in bullion aligned with commodities in general that started the trading week softer, including Brent, which tumbled 4%, and iron ore.

- At the heart of the weakness in gold this year has been the continued pushback against bets of early rate cuts by the Federal Reserve.

- Overnight, Fedspeak from Bostic and Bowman highlighted the potential for cutting interest rates this year, but there was pushback against the early timing and the magnitude of easing.

- Nevertheless, US Treasuries finished 1-3bps richer after starting the day with moderate losses in spillover from Europe. A decline in the NY Fed's inflation expectation index saw the Treasury market recover.

- The market remains focused on US CPI/PPI inflation measures on Thursday/Friday respectively.

- According to MNI’s technicals team, Monday’s low of $2020 was still well above support at $2011.3, the 50-day EMA.

ASIA FX: USD/Asia Dips Supported, China Equities Struggle

USD/Asia pairs are mixed, with most up from earlier lows. USD/CNH has pushed towards 7.1700, while dips in USD/KRW have also been supported. The baht has recovered some ground after yesterday's sharp fall. Still to come today is Taiwan Dec trade data. Tomorrow, the South Korean unemployment rate is due, along with bank lending to households. Philippines trade figures are also out. Thailand PM Srettha will also meet with the BoT Governor tomorrow.

- USD/CNH has remained within recent ranges, albeit an upside bias for the Tuesday session so far. The pair last near 7.1700. The yuan enjoyed little positive spill over from stronger yen levels, although other G10 currencies have also lost ground against the USD. Local and HK equities are also struggling to maintain positive ground (the CSI 300 is back in the red after the lunch time break). Potential for further PBoC policy support may also be weighing on the FX at the margins.

- 1 month USD/KRW got to lows under 1307 but we have since rebounded back to 1312/13, to be weaker in won terms versus Monday closing levels. Onshore equities have struggled for positive ground, although offshore inflows have remained positive. A weaker CNH trend hasn't helped.

- USD/THB pulled back to lows of 34.82, but sits slightly higher now, last near 34.88. We closed yesterday above 35.00. Today's gain would be the first since the end of 2023. PM Srettha will meet with the BoT Governor tomorrow at 1pm local time to discuss the digital wallet plan and recent issues in the corporate bond market.

- USD/PHP has pushed higher this afternoon, the pair back above 55.90, a PHP loss of over 0.40%. There doesn't appear to be a clear catalyst for this round of USD strength. This puts the pair back near the 56.00 level, which generally drew selling interest in the latter stages of 2023.

- Trends elsewhere are mixed, with most pairs up from session lows this afternoon.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/01/2024 | 0645/0745 | ** |  | CH | Unemployment |

| 09/01/2024 | 0700/0800 | ** |  | DE | Industrial Production |

| 09/01/2024 | 0745/0845 | * |  | FR | Foreign Trade |

| 09/01/2024 | 1000/1100 | ** |  | EU | Unemployment |

| 09/01/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 09/01/2024 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/01/2024 | 1330/0830 | * |  | CA | Building Permits |

| 09/01/2024 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 09/01/2024 | 1330/0830 | ** |  | US | Trade Balance |

| 09/01/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 09/01/2024 | 1700/1200 |  | US | Fed Vice Chair Michael Barr | |

| 09/01/2024 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.