-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK- Trump White House Offers More Press Access

MNI US MARKETS ANALYSIS - Euro Equities Hit New Highs

MNI EUROPEAN MARKETS ANALYSIS: RBNZ Dated OIS Sharply Higher

- The main macro focus today has a push higher in NZD/USD and sharp sell-off in NZ rates. This followed a local bank revising its RBNZ outlook to two hikes (Feb and Apr) taking the OCR to 6%. The AUD/NZD cross dipped briefly sub 1.0600 fresh lows back to May 2023.

- For NZ OIS, a cumulative 61bps of easing is priced by year-end versus 69bps yesterday. However, this is measured from a terminal OCR of 5.74% versus 5.58% yesterday. In Australia, here was limited market reaction to RBA Governor Bullock's appearance before the House of Reps Economics Committee.

- US yields have drifted lower a touch, while JGB futures are weaker and at Tokyo session lows, -29 compared to settlement levels, after a lacklustre 5-year JGB auction. Elsewhere it has been fairly quiet as parts of the Asia region commence LNY holidays.

- Looking ahead, US inflation revisions are in focus later. BLS will update seasonal factors affecting CPI inflation through 2019-23 on Friday, Feb 9 “from 0830ET”. Canada jobs data is also out.

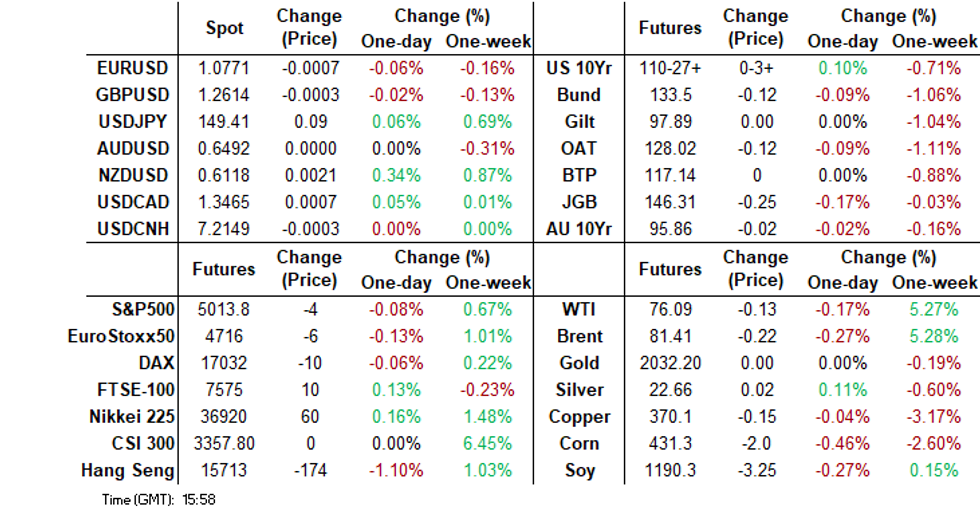

MARKETS

US TSYS: Yields Edge Lower As Market Awaits CPI Revisions

TYH4 is currently trading at 110-28, + 04 from New York closing levels.

Treasury futures were trading up a touch during the Asian morning however those gains have been pared. Cash yields are trading 0.5-1bp lower.

- Mar'24 10Y futures have been rangebound today, high of 110-30, low of 110-25+, on low volume as Lunar New Year kicks off. Currently we are trading at 110-28, Resistance at 111-18+ (20-day EMA), while support remains at 110-22+ (Feb 5th lows)

- Cash yields have done very little today, trading in a 1bp range, the 2Y yield is -0.6bp lower at 4.448%, 10Y yield is -0.6bps at 4.148%, while the 2y10y is +1.00 at -29.6.

- Looking ahead, US inflation revisions are in focus later. BLS will update seasonal factors affecting CPI inflation through 2019-23 on Friday, Feb 9 “from 0830ET”.

JGBS: IMF Advises BoJ To Consider Exit, Mixed Results For 5Y Supply, Holiday On Monday

JGB futures are weaker and at Tokyo session lows, -29 compared to settlement levels, after a lacklustre 5-year JGB auction.

- (BBG) This morning BoJ Governor Ueda said in Parliament that financial conditions in Japan will remain easy for the time being even after the BoJ puts an end to the world’s last negative rate regime. (See link ICYMI)

- (MNI) BoJ officials believe recent weak domestic demand data will not impede the Board’s desire to remove negative interest rates over the coming months as the economy will sustain the recovery, MNI understands.

- (BBG) The BoJ should plan an exit from its unprecedented monetary easing program now and raise interest rates gradually thereafter, with the return of sustained inflation, according to the IMF. (See link)

- Cash JGBs are cheaper out to the 30-year, with yields 1-3bps higher. The benchmark 10-year yield is 1.8bp higher at 0.723% versus the February low of 0.665% and the Nov-Dec rally low of 0.555%.

- The 5-year yield is 1.1bp higher on the day at 0.323% after today's supply. Overall, today’s auction is likely to be seen as disappointing after solid demand metrics seen at February’s 10- and 30-year JGB supply.

- The swaps curve has bear-steepened slightly, with rates 1-2bps higher. Swap spreads are tighter out to the 30-year.

- The local calendar is closed on Monday in observance of the National Foundation Day holiday.

AUSSIE BONDS: Cheaper, Limited Reaction To RBA Bullock, NZGB Sell-Off Largely Ignored

ACGBs (YM -3.0 & XM -1.5) are cheaper and in the middle of today’s Sydney session ranges. There was limited market reaction to RBA Governor Bullock's appearance before the House of Reps Economics Committee.

- (BBG) Australia’s central bank won’t wait for inflation to return to the midpoint of its 2-3% target before cutting interest rates, Governor Michele Bullock told a parliamentary panel on Friday, suggesting the board is open to beginning an easing cycle later this year. (See link)

- Apart from Governor Bullock’s comments, local participants have likely eyed US tsys in today’s Asia-Pac session for directional guidance. To that end, US tsys are currently dealing flat to 1bp richer across benchmarks. News flow has been light so far today.

- ACGBs looked past the sharp sell-off in NZGBs following ANZ's hawkish OCR call change.

- Cash ACGBs are 1-2bps cheaper, with the AU-US 10-year yield differential 4bps tighter at -3bps.

- Swap rates are 1-3bps higher, with the 3s10s curve flatter.

- Bills pricing is -1 to -4, with the strip steeper.

- RBA-dated OIS pricing is flat to 4bps firmer. A cumulative 43bps of easing is priced by year-end.

- The local calendar is empty on Monday.

- The AOFM plans to sell A$800mn of 1.00% Dec-30 bond on next Wednesday.

NZ STIR: RBNZ Dated OIS Shunts Higher After ANZ Forecasts 50bps Additional Tightening

RBNZ dated OIS has shunted higher after the ANZ bank announced that they expect the RBNZ to push the official cash rate higher this month and in April by 50bps in total, taking the official cash rate to 6.0%.

- (DJ) The RBNZ warned in November that "If inflation pressures were to be stronger than anticipated, the OCR would likely need to increase further." Data since then has been a series of small but pretty consistent surprises in that direction, Zollner said. (See link)

- A cumulative 61bps of easing is priced by year-end versus 69bps yesterday. However, this is measured from a terminal OCR of 5.74% versus 5.58% yesterday.

- NZGBs cheapened 9-14bps across benchmarks following the announcement.

Figure 1: RBNZ Dated OIS Pricing (%)

Source: MNI – Market News / Bloomberg

FOREX: AUD/NZD Close To 1.0600 Test

AUD/NZD got close to a test of the 1.0600 level in recent dealings (low of 1.0602). We are slightly higher now, last around 1.0615. NZD has continued to climb, last near 0.6115, up around 0.30% for the session (earlier highs were at 0.6122).

- The main NZD support has been the ANZ view change around the RBNZ outlook. To recap, the local bank sees hikes in Feb and Apr and the cash rate at 6% until Feb 2025.

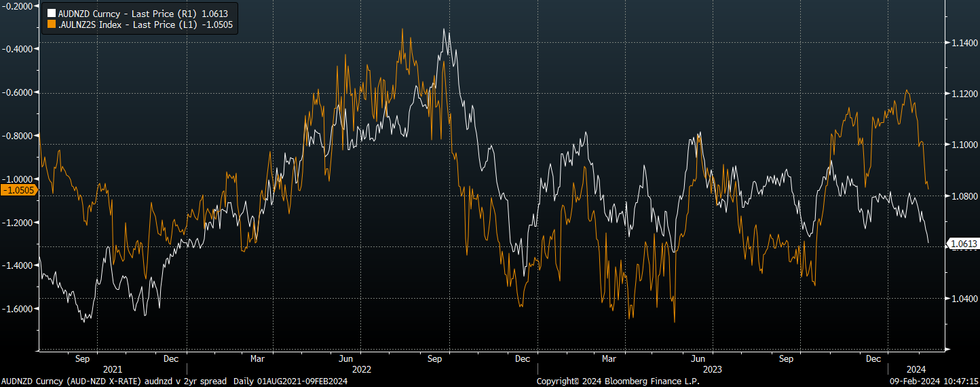

- Market re-assessment of the RBNZ outlook, relative to the RBA, has seen a sharp move lower in the AU-NZ rate differential. The chart below plots spot AUD/NZD versus the 2yr swap spread.

- We also noted the downside risks in the AUD/NZD cross in this piece, earlier in the week.

- For AUD, RBA Governor Bullock is testifying before parliament and is largely sticking to Tuesday's script and striking a balanced tone around the outlook, see this link for more details.

- If AUD/NZD can break 1.0600, May lows from last year of 1.0560 could be the next downside target.

Fig 1: AUD/NZD Versus AU-NZ 2yr Swap Spread

Source: MNI - Market News/Bloomberg

NZGBS: Yields Shunt Higher After ANZ Calls 50bps Of Additional Tightening

NZGBs closed 9-14bps cheaper across benchmarks after the ANZ Bank announced that they expected the RBNZ to push the official cash rate (OCR) higher this month and in April by 50bps in total, taking the OCR to 6.0%.

- (DJ) The RBNZ warned in November that "If inflation pressures were to be stronger than anticipated, the OCR would likely need to increase further." Data since then has been a series of small but pretty consistent surprises in that direction, Zollner said. (See link)

- Unsurprisingly, the NZGB 10-year has underperformed the $-bloc today, with the NZ-US and NZ-AU yield differentials closing 4bps and 7bps wider respectively.

- Swap rates closed 8-17bps higher, with the 2s10s curve sharply flatter.

- A cumulative 61bps of easing is priced by year-end versus 69bps yesterday. However, this is measured from a terminal OCR of 5.75% versus 5.58% yesterday. The expected year-end OCR has jumped 50bps over the past week.

- Next week, the local calendar is empty on Monday, ahead of Inflation Expectations on Tuesday, and REINZ House Sales, Card Spending and Food Prices on Wednesday. The RBNZ Policy Decision is on 28 February.

FOREX: AUD/NZD Hits Fresh Lows Back To May 2023, On Local Bank RBNZ View Change

Outside of NZD, USD dips have mostly been supported today, although overall moves have been fairly muted. The BBDXY sits a touch above end Thursday levels in NY, 1243.3.

- US yields are slightly lower, but we are away from session lows. US equity futures are down a touch, but neither space has impacted FX sentiment a great deal today.

- NZD has pushed higher, after ANZ's view change that it sees 25bps hikes in Feb and Apr of this year. The Bank then expects rates to hold at 6% until Feb 2025. NZD/USD got to a high of 0.6129, but we now sit back near 0.6120, still up neat 0.40% for the session.

- The AUD/NZD cross fell to a fresh low of 1.0596 (BBG), but we now sit slightly higher at 1.0605/10. Lows back to May last year sit at 1.0560.

- AUD/USD has been relatively steady, last near 0.6495. RBA Governor Bullock testified before local parliament this morning, but has struck a familiar tone to Tuesday's RBA statement and press conference. Risks around policy are finely balanced.

- USD/JPY got to 149.49, but we now sit slightly lower (last near 149.40). FinMin Suzuki just familiar rhetoric around FX markets (the first such since Jan 19), but this didn't impact market sentiment. BoJ Governor Ueda also stated before parliament that accommodative financial conditions will very likely continue even if the BOJ terminates its negative interest rate policy. This echoes similar comments from the Deputy Governor yesterday.

- Looking ahead, US inflation revisions are in focus later. BLS will update seasonal factors affecting CPI inflation through 2019-23 on Friday, Feb 9 “from 0830ET”. Canada jobs data is also out.

ASIA PAC EQUITIES: Equities Mixed On Low Volume, As Lunar New Years Gets Underway

Equities are mixed today, with Japan being the out performer. Much of the market is out today celebrating Lunar New Year, while volumes were unsurprisingly low.

- Hong Kong markets only traded the morning session today and will be closed until Wednesday, while mainland China equity markets will re-open on Feb 19th. In the shortened trading day, Hong Kong equities were lower, property stocks dropped after several major buildings announced poor contracted sales in January, while Chinese education stocks soared after the Ministry of education publish a draft clarity the country's after-school tutoring policy. Heading into the break, equity indices are lower, but well off their lows of the day HSI down 0.83%, HS tech is down 1.3% while Mainland property is 3.34% lower.

- Japan equities are extending their move higher, BOJ Governor Ueda has appeared in parliament earlier today, markets are reacting positive to his statements that financial conditions will remain accommodative even after NIRP is exited. The NIKKEI is up 0.62%, while the TOPIX trades 0.20% higher.

- Australia equities are only just holding onto gains as we go into the close. RBA Governor Bullock gave her first meeting under the new format, her comments didn't deviate too much from Tuesday, not ruling out another rate hike, and mentioned inflation is still too high. The ASX200 is currently 0.08% higher.

- New Zealand equities are lower today, in large due to ANZ's view that interest rates will continue to rise in NZ from 5.50 to 6.00% this year, equities now 1.05% lower.

- Elsewhere in SEA, most market will be observing Lunar New Years, however Pakistan equities are lower while formal results of the national elections were delayed.

OIL: Slightly Off Thursday Highs, Biden Urges Pause In Fighting In Gaza

Brent crude is a touch lower in the first part of Friday dealing's, but has largely tracked sideways. The front month contract was last near $81.55/bbl, sit close to Thursday highs near $82/bbl. We are tracking up strongly for the past week, +5.5%. Front month WTI is up by a similar amount for the week, last tracking near $76.20/bbl.

- US President Biden stated in a White House press conference that Gaza carnage has been 'over the top' and urged for a pause in fighting (see this BBG link).

- This follows earlier comments by Israeli PM Netanyahu, which appeared to pour cold water on a ceasefire, telling reporters that Israel, "will not suffice with less," than a decisive victory in their war against Hamas.

- This is keeping Middle East tensions elevated and was a key driver of oil's strong gain in Thursday trade.

- Focus for Brent is likely to rest on $84.17/bbl (Jan 29 high), also note current levels are just below the simple 200-day MA (near $81.75/bbl).

GOLD: Continues To Lack Direction

Gold is little changed in the Asia-Pac session, after closing unchanged at $2034.52 on Thursday.

- The precious metal’s stability came despite US Treasury yields pushing 3-5bps higher, with the 5-7-year bucket leading. Yields ticked higher after Initial Jobless Claims recorded a seasonally adjusted 218k (cons 220k) in the week to Feb 3 after last week’s surprise increase was revised a little higher to 227k (initial 224k).

- More generally, bullion continues to struggle for direction amid a lack of clarity regarding when the Fed is likely to start easing monetary policy.

- Fed speak on Thursday suggested the Federal Reserve has time to wait before cutting interest rates as the economy remains strong even as inflation falls. Richmond Fed President Thomas Barkin said on Thursday that “You don’t have to be in any particular hurry. We’ve got some time to be patient,” Barkin said in an interview with Bloomberg TV.

ASIA FX: Baht Weakens, Tight Ranges Elsewhere As LNY Gets Underway

Outside of THB, Asian FX has been relatively muted. USD/THB has rallied towards 36.00. China FX markets have been open, but trading interest has been limited. Elsewhere South Korea, Indonesia and Philippine markets have been closed. On Monday China, Hong Kong, South Korea, Singapore, Taiwan and Malaysia will be closed.

- USD/CNH has mostly followed broader USD sentiment. We saw a brief dip sub 7.2100, but we track back at 7.2125 this afternoon. Hong Kong equities were weaker in a shortened session ahead of the LNY break, this hasn't impacted CNH.

- 1 month USD/KRW has had little direction, the pair last near 1330.5. Onshore markets return on Tuesday.

- USD/THB has gravitated higher, but hasn't breach 36.00 yet. The pair was last near 35.95. A break above 36.00 could see 36.15 targeted, highs from mid Nov last year. Earlier Nov highs rested around 36.33. The 20-day EMA is trending higher and sits back at 35.52. Baht is the weakest performer in EM Asia FX over the past week, down nearly 2% (MYR is the next worst of close to 1.3%). Continued fall out from the dovish BoT hold on Wednesday has also been a theme in recent sessions. Comments from Assistant BoT Governor Pit have crossed from a BBG interview. He reiterated that the policy stance is neutral, but with most growth risks to the downside. If growth weakens they may recalibrate the policy bias. Note Q4 GDP is due out on Feb 19.

- USD/INR sits a touch higher, last near 83.00, but remains well within recent ranges. Onshore equities are a touch weaker, with carry over from yesterday's hawkish RBI hold a potential headwind. The spike in oil prices on Thursday is also likely weighing at the margins.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/02/2024 | 0700/0800 | *** |  | DE | HICP (f) |

| 09/02/2024 | 0700/0800 | ** |  | SE | Private Sector Production m/m |

| 09/02/2024 | 0700/0800 | *** |  | NO | CPI Norway |

| 09/02/2024 | 0900/1000 | * |  | IT | Industrial Production |

| 09/02/2024 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 09/02/2024 | 1415/1515 |  | EU | ECB's Cipollone speaks at Assiom Forex Annual Congress | |

| 09/02/2024 | 1530/1030 |  | CA | BOC Senior Loan Officer Survey | |

| 09/02/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 09/02/2024 | 1830/1330 |  | US | Dallas Fed's Lorie Logan |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.