-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Risk Gets Reprieve As Cooler Heads Prevail

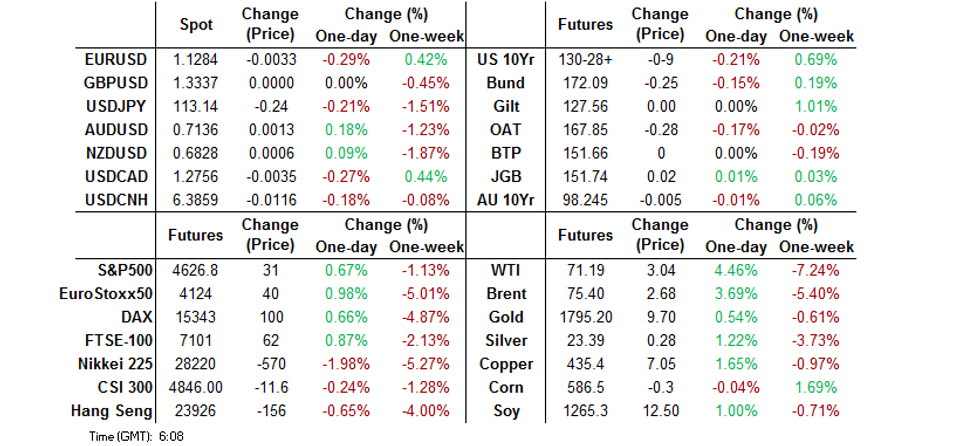

- U.S. e-mini futures edge higher as the reassessment of risks from the Omicron coronavirus variant brings stabilisation after Friday risk rout. Equity benchmarks in the Asia-Pacific are broadly lower in the wake of aggressive market moves seen ahead of the weekend.

- Core FI futures come under pressure but JGBs dodge the trend as PM Kishida announces a ban on entry of foreign travellers until further notice.

- Crude oil regains poise with OPEC+ due to discuss impact from Omicron and production policy this week.

BOND SUMMARY: Risk Stabilisation Saps Strength From Core FI But JGBs Hold Firm

Some positive musings on the Omicron coronavirus variant helped stabilise risk sentiment, applying pressure to core FI space. Suggestions that the new variant has been presenting with mild symptoms so far and upbeat comments from vaccine developers prompted participants to reassess the situation, even as the WHO urged caution and a number of countries tightened border controls to slow the spread of Omicron.

- Risk stabilisation sent T-Notes lower at the re-open, with the contract last seen -0-12 at 130-25+, moving further away from Friday's high of 131-10+. Cash U.S. Tsy yields climbed across the curve and last sit 4.3-6.8bp higher, with belly underperforming. Eurodollar futures run +0.5 to -6.0 ticks through the reds. The local data docket is fairly empty today, but speeches are due from Fed's Powell, Williams & Bowman.

- JGB futures defied broader market impetus and crept higher, as Japan PM unveiled the decision to ban entry of virtually all foreign visitors from Nov 30 until further notice. Cash JGB yields are little changed across the curve, albeit the belly outperforms at the margin. Japan's retail sales posted the second monthly increase in a row, while the BoJ offered to buy 3-10 Year JGBs as part of their Rinban ops.

- Cash ACGB curve steepened a tad and yields last trade -0.5bp to +2.3bp, with 10s lagging. Aussie bond futures went offered and YM now trades unch., with XM -2.5. Bills trade +1 to -2 ticks through the reds. Australia's company operating profit beat expectations, but inventories unexpectedly shrank in Q3. The RBA offered to buy A$1.6bn of ACGBs with maturities of Apr '24 to Nov '28, but excluding ACGB Apr '24.

FOREX: Dust Settles

Reassuring reports surrounding the Omicron variant of the Covid-19 virus brought relief to riskier currencies after sharp sell-offs seen Friday, despite an expected round of travel restrictions implemented over the weekend and considerable uncertainty surrounding the threat posed by Omicron. Two South African health experts suggested that the symptoms caused by the new variant have been mild so far. The WHO have urged caution on that front, but also confirmed that the current PCR tests can detect infection with Omicron. Meanwhile, vaccine developers are racing to produce an adjusted product, with Moderna noting that they could release an updated vaccine as soon as early next year.

- JPY and CHF unwound some of their Friday gains amid reduced demand for safe havens. USD/JPY bounced from its 50-DMA, which limited losses ahead of the weekend, while Japan banned entry of all new foreigners.

- Riskier currencies went bid, with a recovery in crude oil prices lending support to commodity-tied FX. The NZD ignored comments from RBNZ Chief Economist Ha, who told the WSJ that the MPC could press pause on tightening if Omicron proves to be a "massive game changer."

- The EUR went offered across the board in a reversal of Friday surge. In their weekend comments, ECB's Lagarde and Panetta argued that the spike in inflation is linked to temporary factors.

- The weakness in Eurozone's single currency lent support to the DXY. Nevertheless, spot USD/CNH sank amid improvement in market sentiment.

- German preliminary CPI data, Swedish GDP & final EZ consumer confidence headline today's data docket. There is plenty of central bank speak coming up from members of the Fed, ECB & Riksbank.

FOREX OPTIONS: Expiries for Nov29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1150-60(E529mln), $1.1250(E583mln), $1.1265-75(E582mln), $1.1300(E1.4bln)

- USD/JPY: Y113.20-25($561mln), Y115.20-25($1.1bln)

- AUD/USD: $0.7100(A$563mln)

- USD/CAD: C$1.2600($1.2bln)

ASIA FX: Yuan Leads Gains Amid Recovery In Sentiment, Baht Lags Behind

Market sentiment stabilised as the dust settled after the discovery of the Omicron coronavirus variant. The yuan led most Asia EM FX higher, albeit the baht lagged amid worrying prospects for the tourism sector.

- CNH: Spot USD/CNH went offered despite a marginally softer than expected yuan fixing. The recovery in broader risk appetite applied pressure to the pair.

- KRW: Spot USD/KRW printed a fresh seven-week high in early trade, but pared gains as mood music improved. South Korea's Vice FInMin said that officials will monitor markets on a 24h basis and stand ready to take pre-emptive and aggressive stabilisation measures if needed.

- IDR: Spot USD/IDR pared its initial gains amid stabilisation in risk sentiment. Local headline flow was rather limited.

- MYR: Spot USD/MYR operated in close proximity to neutral levels, as participants awaited the release of Malaysia's trade data.

- PHP: The Philippine peso gained alongside most of its regional peers. The Philippines expanded its "red list" by several European countries, after banning entry from a number of African nations.

- THB: The broader tightening of border restrictions in a bid to contain the spread of the Omicron variant undermined the baht, amid concerns that the tourism industry could take another hit. Spot USD/THB hit a fresh seven-week high.

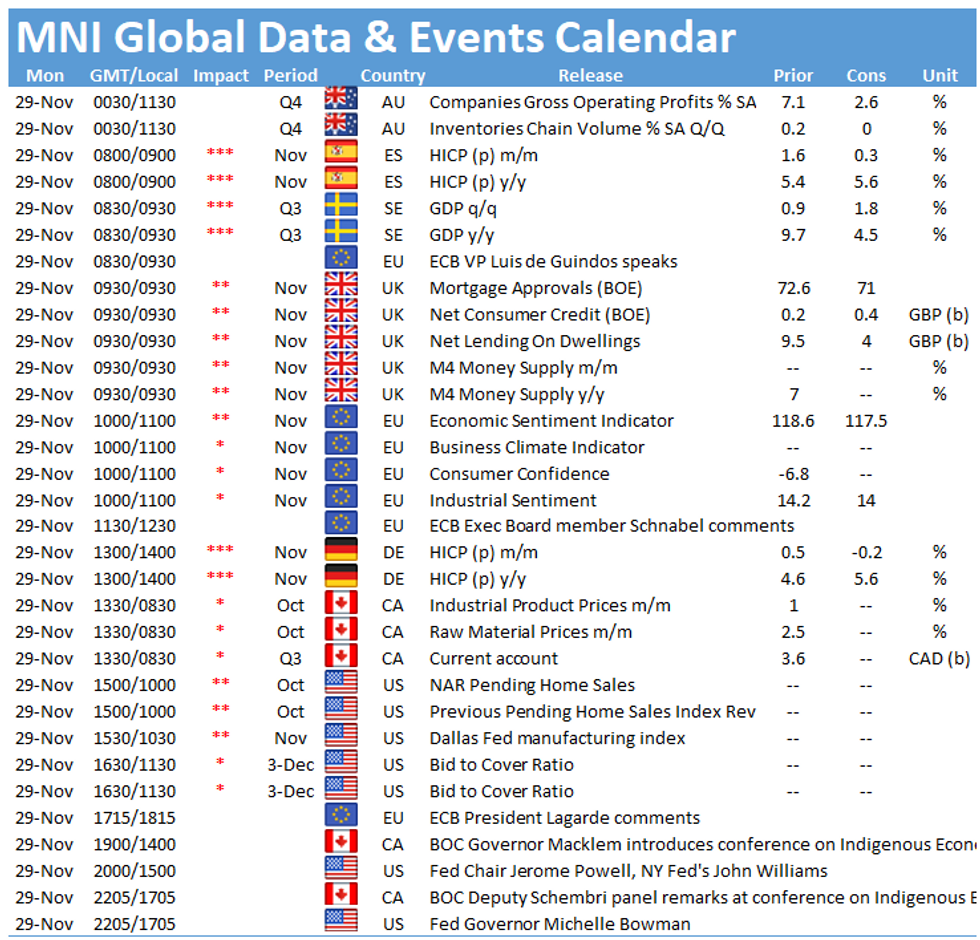

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.