-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Biden Admin Eyes Productive Lame Duck

MNI US MARKETS ANALYSIS - Tsys Firmer Ahead of Early Close

MNI EUROPEAN MARKETS ANALYSIS: Risk-Off Flows Dominate

- Asia-Pac equity benchmarks and U.S. e-mini futures retreat on a negative lead from Wall Street. Topix stages a foray into correction territory.

- Core bond markets bid on the back of risk aversion as deepening geopolitical angst undermines market sentiment.

- Oil futures extend losses after EIA reports a surprise increase in U.S. crude stockpiles.

BOND SUMMARY: Geopolitical Anxiety Adds Fuel To Bond Rally

Core bond markets received a fillip from continued risk-off flows, as lacklustre Asia-Pac headline flow failed to add much to the existing narrative. Geopolitical frictions frayed nerves amid the lingering risk of a potential Russian military strike on Ukraine, which provoked Western retaliation threats over the recent days. The spectre of aggressive Fed tightening kept appetite for riskier assets in check, while Thursday's weakness in key U.S. stock indices infected their Asia-Pacific peers.

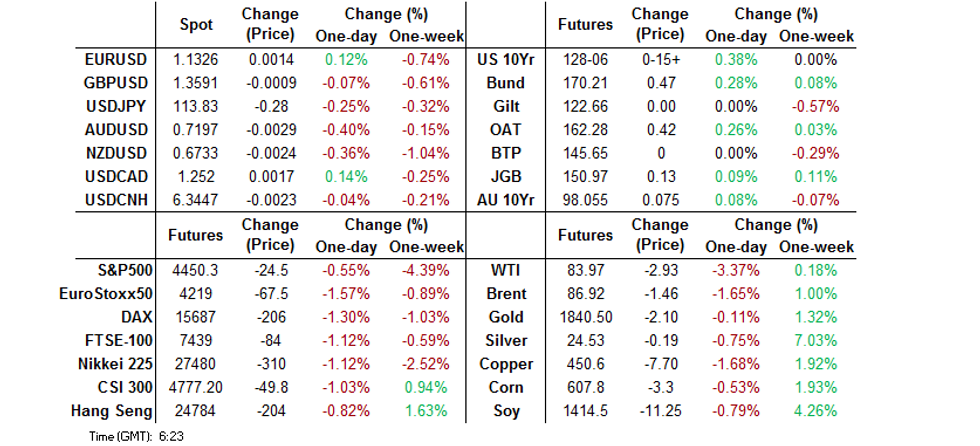

- T-Notes surged to a session high of 128-10, their best level in a week, before stabilising below there. TYH2 changes hands +0-15 at 128-05+ as we type. Eurodollar futures run 1.5-6.5 ticks higher through the reds. Tsys faltered in cash trade, with the belly leading declines. Yields last sit 1.4-3.9bp lower across the curve, with 10-year yield now back below 1.80%. The U.S. economic docket is fairly empty ahead of the weekend, which leaves the main focus on geopolitical matters.

- JGB futures extended gains after a firmer re-open, but trimmed gains after the Tokyo lunch break. JBH2 trades at 150.99, 15 ticks above last settlement and 10 ticks shy of session highs. Cash JGBs tracked moves in U.S. Tsys as the yield curve shifted lower, with belly outperforming. Japanese CPI data failed to elicit any volatility, even as a marginal miss in core inflation underscored the BoJ's message that policy normalisation will not be happening anytime soon. Likewise, there was no reaction to domestic debt supply, with global market impetus in the driving seat.

- Australia's yield curve bull flattened as ACGBs turned their tails in cash Sydney trade. Yields last sit 5.0-9.0bp lower across the curve. Aussie bond futures were in demand, with YM last +8.0 & XM +9.0, both stabilising near session highs. Bills trade unch. to +9 ticks through the reds. The space showed no reaction to a fairly standard issuance slate for next week, the supply of ACGB Apr '25 also came and went.

FOREX: Flight To Safety

Risk-off flows intensified in Asia, with regional equity benchmarks retreating after a sharp reversal in key U.S. stock indices during Thursday's NY session. Looming Fed's policy tightening and underwhelming earnings reports wreaked havoc on Wall Street, while Asia-Pac headline flow offered no consolation. The escalating geopolitical risk surrounding Russia's military activity near the Ukrainian border helped undermine market sentiment.

- Participants rushed into safe havens, generating heavy demand for the yen. USD/JPY retreated past the Y114.00 mark to a fresh one-week low, with talk of JPY purchases against AUD and EUR doing the rounds. The main well-known risk barometer AUD/JPY tumbled below Y82.00 for the first time in a month.

- The yen was unfazed by domestic CPI report, which failed to provide evidence of rising inflation pressures. The key gauge of underlying inflation targeted by the BoJ stayed unchanged, marginally missing expectations.

- The Aussie was the worst performer in G10 FX space, as AUD/USD sank through the $0.7200 figure to erase all of its gains registered in the wake of Thursday's release of strong jobs data out of Australia.

- Weakness in crude oil futures applied additional pressure to commodity-tied FX, after the EIA reported a surprise build-up in U.S. stockpiles.

- UK retail sales & advance EZ consumer confidence headlines today's data docket, with comments coming up from ECB's Lagarde & BoE's Mann.

ASIA FX: Risk Aversion Saps Strength From Asia EM FX

Persistent defensive feel sapped strength from most Asia EM currencies, as global geopolitical frictions and the spectre of Fed tightening loomed large.

- CNH: Spot USD/CNH held a very tight range, despite expectations that the PBOC would continue easing policy. Reuters sources suggested that China's central bank could cut SLF rates as soon as next Monday. Elsewhere, SAFE's spokeswoman said that the knock-on effects from Fed tightening are expected to be smaller than before.

- KRW: Spot USD/KRW crept higher on the back of broader risk aversion. South Korea's Vice FinMin Anh said that officials stand ready to take all available steps to stabilise bond markets in case of excessive volatility.

- IDR: Offshore pressure hit the rupiah, which sold off even as Bank Indonesia shed some light on its policy normalisation plans on Thursday. Policymakers look to raise the RRR to 5% in March, with further hikes pencilled in for later this year.

- MYR: Spot USD/MYR swung into a loss, with the ringgit outperforming all of its Asia EM peers. Participants assessed Thursday's stand-pat decision from Bank Negara Malaysia and a marginal beat in December CPI.

- PHP: Spot USD/PHP held in positive territory, operating in close proximity to recent cycle highs at PHP51.500.

- THB: The baht retreated as daily Covid-19 cases rose to a two-month high ahead of the imminent relaxation of border rules. Thailand's Commerce Ministry said they expect the baht to remain at favourable level for exports, as customs trade balance unexpectedly flipped into a deficit.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/01/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 21/01/2022 | 1230/1330 |  | EU | ECB Lagarde on Global Economic Outlook at WEF | |

| 21/01/2022 | 1300/1300 |  | UK | BOE Mann speaks at OMFIF | |

| 21/01/2022 | 1330/0830 | ** |  | CA | Retail Trade |

| 21/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 21/01/2022 | 1500/1600 | ** |  | EU | consumer confidence indicator (p) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.