-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Credit Weekly: Le Vendredi Noir

MNI: Canada Apr-Sept Budget Deficit Widens On Spending

MNI EUROPEAN MARKETS ANALYSIS: Trump Administration Greenlights Transition

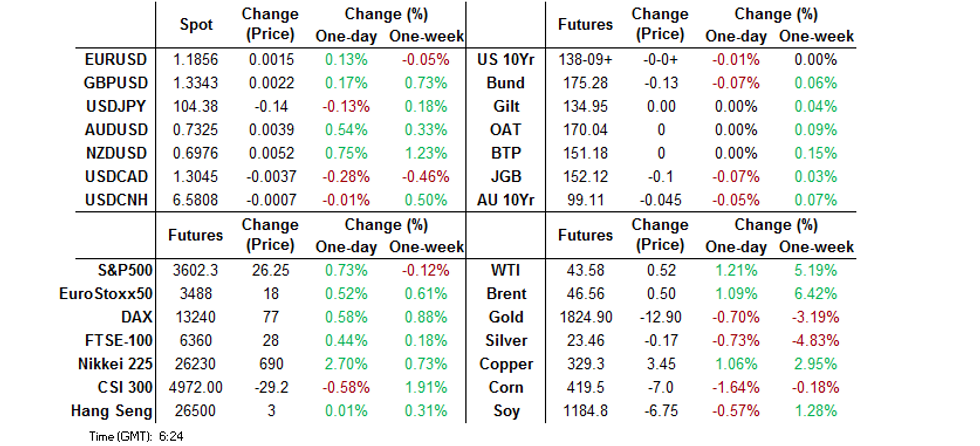

- Risk appetite remained positive in Asia as U.S. General Services Administration ascertained that Joe Biden was the "apparent winner" of the presidential election, triggering formal transition procedure

- The news came after U.S. President-elect's decision to pick former Fed Chair Yellen to become the Treasury Secretary in his administration and positive headlines surrounding coronavirus vaccines

- NZD picked up a bid after New Zealand's Finance Minister proposed to add house prices to the RBNZ's remit

Source: MNI - Market News

Source: MNI - Market News

BOND SUMMARY: Core FI Come Under Pressure As Trump Administration Agrees To Begin Transition

T-Notes extended Monday losses after U.S. General Services Administration recognised Joe Biden as the "apparent winner" of the presidential election and gave a green light for starting the formal transition process. The news provided further support to broader risk appetite, on top of yesterday's positive Covid-19 vaccine headlines & Biden's decision to pick ex-Fed Chair Yellen to become Tsy Sec in his administration. When this is being typed, T-Notes trade -0-01+ at 138-08+. The contract slipped as news wires circulated the GSA's decision and established itself sougth of yesterday's worst levels. Cash Tsy curve has bear steepened a tad. Eurodollar futures trade unch. to +0.5. Focus in the U.S. turns to local Conf. Board Cons. Conf. & 7-Year debt supply.

- Japanese markets re-opened after a holiday, digesting the net positive news flow from over the long weekend. JGB futures re-opened lower and slid further, pressured by the aforementioned news on White House transition. The contract last changes hands at 152.10, 12 ticks shy of last settlement. Cash JGB yield curve underwent a degree of steepening. There was little of note in the latest address from BoJ Gov Kuroda, while local news flow revolved around Japan's coronavirus situation and its fiscal ramifications, with a Sankei report suggesting that the gov't might adopt a third extra budget exceeding Y20tn. Elsewhere, the BoJ left the sizes of its 1-10 Year JGB purchases unchanged.

- Aussie bonds shrugged off a speech from RBA Dep Gov Debelle on "Monetary Policy in 2020", which added little fresh to the recent RBA speak. YM -0.5 & XM -4.5, the latter steadied after slipping in reaction to the aforementioned transition headlines. Cash ACGB curve has bear steepened, with yields sitting 0.1-5.1bp cheaper. Bills trade unch. to -2 ticks through the reds. The AOFM auctioned A$150mn worth of 20 Sep '25 I/L Bonds, while Australia's preliminary trade data for the month of Oct revealed an increase in exports, driven by record shipments of iron ore.

JGBS AUCTION: Japanese MOF sells Y3.1688tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y3.1688tn 6-Month Bills:- Average Yield -0.1027% (prev. -0.1128%)

- Average Price 100.051 (prev. 100.056)

- High Yield: -0.0987% (prev. -0.1068%)

- Low Price 100.049 (prev. 100.053)

- % Allotted At High Yield: 83.6926% (prev. 44.6363%)

- Bid/Cover: 3.297x (prev. 3.517x)

BOJ: 1-10 Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y1.34tn of JGB's from the market, sizes unchanged from previous operations.- Y500bn worth of JGBs with 1-3 Years until maturity

- Y420bn worth of JGBs with 3-5 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

AUSSIE BONDS: The AOFM sells A$150mn of the 3.00% 20 September 2025 I/L Bond, issue #CAIN407:

The Australian Office of Financial Management (AOFM) sells A$150mn of the 3.00% 20 September 2025 I/L Bond, issue #CAIN407:- Average Yield: -0.9733% (prev. -0.2597%)

- High Yield: -0.9700% (prev. -0.2500%)

- Bid/Cover: 5.7533x (prev. 2.8933x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 96.2% (prev. 45.5%)

- bidders 51 (prev. 28), successful 11 (prev. 13), allocated in full 8 (prev. 10)

FOREX: Risk Buoyant As White House Transition Gets Underway, NZD Aided By Proposal To Amend RBNZ Remit

U.S. politics took centre stage, after the General Services Administration recognised Joe Biden as the "apparent winner" of the presidential election, triggering a formal transition process. Outgoing Pres Trump suggested that he will continue his legal fight, but said he instructed his team to cooperate, with subsequent reports pointing to various gov't agencies preparing for the transfer of power. The news bolstered risk appetite, building on yesterday's positive Covid-19 vaccine news & U.S. Pres-elect Biden's decision to nominate ex-Fed Chair Yellen to become the next U.S. Tsy Sec. Risk-on flows swept across G10 FX space, putting a bid into high-beta currencies.

- NZD comfortably outperformed its G10 peers, as existing risk-on pressure was amplified by the unwinding of RBNZ easing bets in reaction to NZ FinMin Robertson's proposal to add house prices to the RBNZ's remit. In a letter to RBNZ Gov Orr, Robertson asked the central bank to urgently consider the idea amid "the recent escalation in housing prices, and forecasts for this to continue". RBNZ Gov Orr replied that the MPC already takes asset prices into consideration, but monetary and financial policy alone cannot fix structural problems with the housing market, adding that he will respond with a broader feedback in due course.

- Greenback weakness helped NZD/USD punch through key resistance from Dec 4, 2018 high of $0.6970 and briefly approach the $0.7000 mark. AUD/NZD tested the water under key near-term support from Apr 21 low of NZ$1.0484.

- AUD looked through a speech from RBA Dep Gov Debelle, who said that the central bank's expected policy easing delivered this month helped lower the exchange rate.

- BoJ Gov Kuroda offered little in the way of fresh insights in his latest parliamentary testimony. JPY sat at the bottom of the G10 pile as Japan returned from holidays.

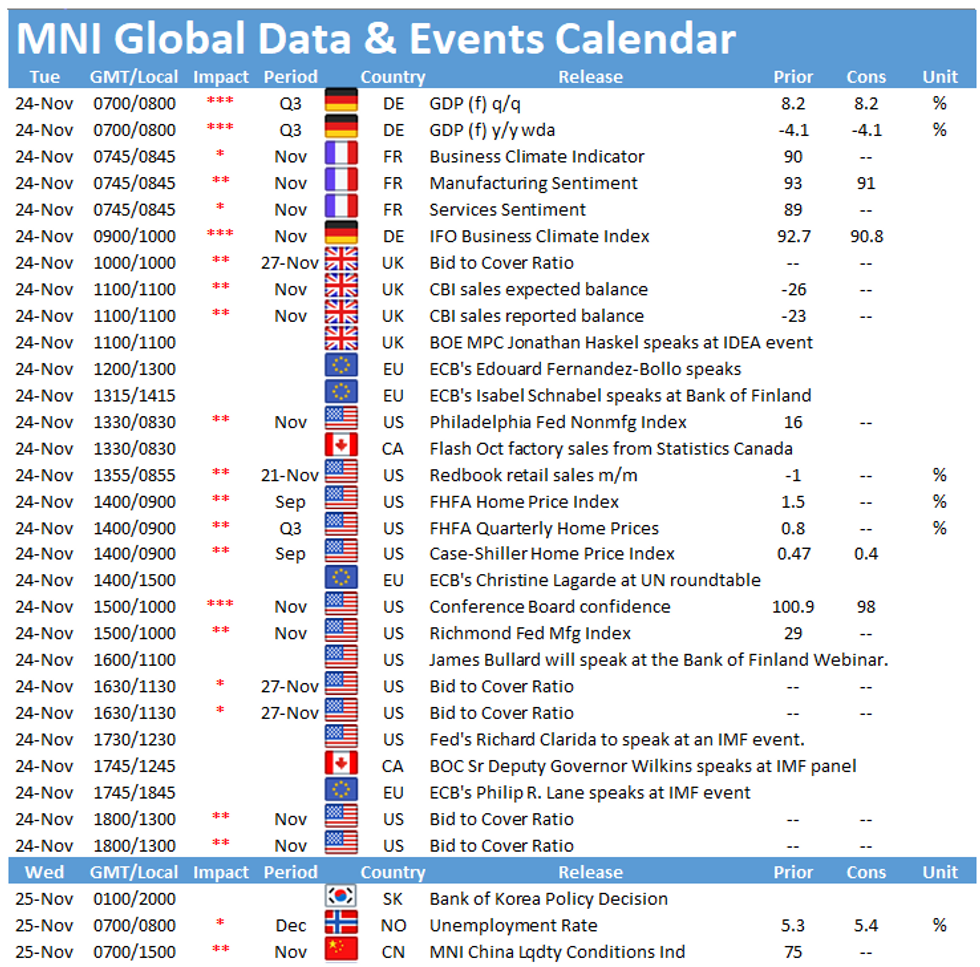

- German Ifo Survey & final GDP, U.S. Conf. Board Consumer Confidence take focus today, with speeches due from Fed's Bullard, Williams & Clarida, ECB's Lagarde, Lane & de Cos, BoE's Haskel & BoC's Wilkins.

FOREX OPTIONS: Expiries for Nov24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700(E419mln-EUR puts)

- USD/JPY: Y102.00($996mln-USD puts), Y105.00($1.5bln)

- EUR/GBP: Gbp0.8800(E510mln-EUR puts)

- USD/CAD: C$1.3170-80($523mln)

EQUITIES: Moving Higher While The DAX's Increase In Constituents Is Confirmed

Equity indices across Asia are generally higher as President Trump finally allowed transition proceedings to President-elect Biden to begin, although he still vowed to continue to fight.

- The big news of the morning comes with the confirmation that the DAX index would be increased from 30 to 40 stocks. Note that these proposals had been made some time ago in response to the Wirecard scandal and this comes after a four-week consultation. So this is official confirmation the changes will be made.

- The biggest movers in terms of Asian stocks have been Japanese indices which moved higher, partly playing catch up with yesterday's moves after they had been closed. Chinese stocks moved lower in contrast.

- European and US equity futures are also tracking higher.

- Japan's NIKKEI up 638.22 pts or +2.5% at 26165.59 and the TOPIX up 35.01 pts or +2.03% at 1762.4

- China's SHANGHAI closed down 16.504 pts or -0.48% at 3398.657 and the HANG SENG ended 15.73 pts higher or +0.06% at 26502.81

- German Dax futures up 81.5 pts or +0.62% at 13238, FTSE100 futures up 29 pts or +0.46% at 6359 and Eurostoxx50 futures ' up 19 pts or +0.55% at 3488.

- Dow Jones mini up 243 pts or +0.82% at 29795, S&P 500 mini up 26.25 pts or +0.73% at 3602.25, NASDAQ mini up 61.25 pts or +0.51% at 11966.

GOLD: Moved To Four Month Lows

Gold fell to its lowest level in four months yesterday as positive news surrounding the AstraZeneca / Oxford vaccine helped buoy risk sentiment. The yellow metal has shed another $10/oz overnight on continued follow through, also helped by President Trump agreeing that transition proceedings to President-elect Biden could now begin.

- Our technical analyst notes that we traded below the bear trigger of $1848.0/oz, the Sep 28 low, and this has reinforced the downside movement. This level now marks resistance, but the overall technical picture points to further downside. The overnight low of $1821.4/oz and $1815.8/oz (low Jul 21) mark the next support levels ahead of the psychological $1,800/oz level.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.