-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Yen Rebounds, BoJ Stance To Be An Early 2023 Focus Point

- Broader macro focus remains on China's rapid re-opening, as countries put in place rules for incoming travellers from China to curb the spread of the virus. This has weighed on Asia Pac risk appetite, although more so in the equity space, with regional markets following Wall St lower.

- The USD is weaker in the FX space though, as the yen rebounds. Lower US yields at the back end has helped yen sentiment, while the BoJ outlook is likely to be a strong focus point in early 2023. Reuters reported today that former BoJ Deputy Governor Yamaguchi, who was a critic of Kuroda's stimulus program, may be the new Governor next year.

- Coming up there is the ECB monthly Economic Bulletin, while in the US jobless claims are due.

US TSYS: Richening Holds Through Asian Session

TYH3 deals at 112-12, +0-06, a touch off the top of its 0-06+ range on light volume of ~5k

- The early richening has extended a touch through the session with cash tsys running 0.5-3bps richer with the belly leading the strength.

- With limited macro newsflow and thin volume through Asia-Pac today, local participants faded the cheapening seen through the Europe and NY sessions yesterday.

- There is a thin data calendar in Europe today, further out US Initial Jobless Claims is the main point of interest ahead of a 7Y auction.

OIL: Crude Prices Lower As Market Growth Concerns Rise

MNI (Australia) - Oil has been trading in a tight range again today on thin year-end liquidity. WTI is down slightly again by 0.3% to about $78.70/bbl after falling 0.8% on Wednesday, as fears of a new global Covid wave grow. Brent is down 0.3% to $83.00. DXY is flat on the NY close.

- The Australian is reporting that the US, Italy, India, Japan and Taiwan have introduced procedures for incoming travellers from China after the end of its quarantine rules. The possible global spread of Covid has created some uncertainty in markets over the boost to growth from China’s reopening (bbg).

- Oil has traded in a wide range this year with WTI reaching a peak of $105.94/bbl at the beginning of June and a trough at the start of 2022 of $70.03, before the Russian invasion of the Ukraine. Brent had a high of $110.46 and a low at $73.68.

- API crude inventories fell 1.3mn in the latest data after a 3.07mn drawdown in the previous week. Distillate and gasoline stocks were higher.

- Another quiet day with only US jobless claims and EIA inventory data scheduled later.

GOLD: Bullion Up Slightly, Holding Above $1805/oz

Gold prices are up 0.2% during today’s session after falling 0.5% on Wednesday as trend conditions remain bullish. It is currently trading around $1807.50/oz after reaching a high of $1809.38 and a low of $1804.34. DXY is down 0.1%.

- Gold moves inversely with the USD. Many analysts are expecting bullion to rally later in 2023 as the USD eases with the slowdown and eventual pause of Fed tightening. Higher yields are likely to weigh on bullion but a lower USD should make it cheaper for non-US buyers.

- Gold hit a low of $1622.36 at the end of September this year and a high of $2050.76 at the start of March.

- Another quiet day with only US jobless claims scheduled later.

EQUITIES: Major Indices Tracking Lower As China Optimism Is Tempered

(MNI Australia) Regional equities have mostly followed the negative EU/US lead from Wednesday's session and are tracking lower today. Tech sensitive plays have again seen the largest falls. US futures are slightly higher, with the Nasdaq around +0.25/0.30% higher at this stage, while other major indices are closer to flat.

- Much of the focus remains on countries imposing restrictions on tourist/visitor arrivals from China, amid the current onshore outbreak and as China removes constraints on inbound/outbound travel.

- The HSI is down by 1.1%, the underlying tech index down 2.60%, more than unwinding yesterday's gain. More game approvals from China regulators failed to buoy sentiment, although it suggests potentially less regulatory burden on the sector as we move into 2023.

- Mainland shares are down, with the CSI 300 off by 0.41%.

- The Kospi is down a further 1.44%, led by the electronics sector. Offshore investors have sold a further -$232.8mn of local shares. The Taiex is down by 0.55%, the Nikkei 225 off by 1.15%.

- Only Malaysia, Thailand and Indonesian stock indices are in positive territory so far today.

FOREX: USD Slips, As Yields Soften, JPY & NZD Outperform

The USD has tracked lower through today's session, with the BBDXY back sub 1255, around 0.25% off NY closing levels. JPY and NZD have been the standouts, while lower US cash Tsy yields, led by the belly of the curve have been a broader USD headwind.

- USD/JPY hit lows of 133.50, but is now back near 133.65, still +0.60% for the session in yen terms. Post yesterday's Asia close we saw the dip sub 133.50 supported, so this may be a short-term support point. Next year the focus will be on the BoJ policy outlook, with Reuters reporting that ex BoJ Deputy Yamaguchi (who opposed Kuroda's stimulus program) is a potential contender to replace Kuroda.

- NZD/USD is up 0.50%, last near 0.6345. Yesterday's highs came in just above 0.6355. The NZD hasn't been affected by the negative tone to regional equities, while AUD/NZD downside has likely helped at the margin. The cross is back to 1.0640, after reaching 1.0766 yesterday.

- AUD/USD is up around 0.2%, tracking 0.6750 currently.

- Event risk is relatively limited for the offshore session, with the ECB publishing its monthly Economic Bulletin. In the US, jobless claims are on tap.

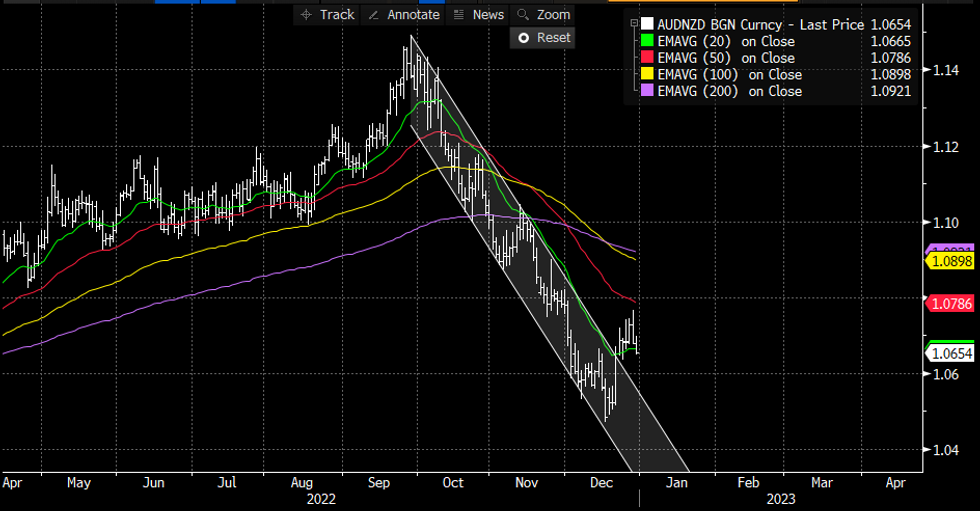

AUD/NZD: Broken Out Of Bear Channel, Bearish Bias Remains

AUD/NZD has broken out of the bear channel it had been in since late September, however there is still a way to go to turn the tide for bulls.

- Technicals remain bearish on the pair, with spot still trading comfortably below its 50,100 and 200-day EMA, and also the 20-day EMA at $1.0665 in today's session.

- Bears look to break 2022 lows at $1.0470, opening up 2021 lows at $1.0280.

- To reverse the trend, bulls will have to first break the 50-day EMA at $1.0786 after which they can then target 100-day EMA at $1.0898.

- Relative central bank pricing continues to point to further downside in the cross. Futures markets are pricing in ~13 bps of hikes into the February RBA meeting with a terminal rate of 4%, whilst across the Tasman OIS markets have ~70 bps priced into the RBNZ February meeting with the terminal rate at 5.57%. OIS markets do price in RBNZ rate cuts in 2023, however at the end of 2023 market expectations still price the RBNZ policy rate ~100bps higher than the RBA.

- The AU-NZ 2 swap spread is comfortably off mid-December lows (near -160), last around -138, but the rate of improvement (in AUD's favor) has slowed somewhat.

Fig 1: AUD/NZD Spot Broken Out Of Bear Channel

Source: MNI - Market News/Bloomberg

ASIA FX: Following The Majors Higher Against The USD

Most USD/Asia pairs are lower, shrugging off negative sentiment from regional equities. The USD is softer against the majors, amid lower US cash Tsy yields, which has helped Asian FX. Only IDR has been a laggard, along with TWD. Still to come is Thailand November trade figures, while tomorrow the South Korean CPI for December prints.

- USD/CNH has caught up with USD weakness to a degree. The pair is back to 6.9750, around -0.30% down for the session. The CNY fixing was close to neutral. Equity sentiment is weaker amid Covid concerns, but this isn't impacting FX sentiment a great deal into year-end. Selling interest is still evident on moves above 7.00.

- 1 month USD/KRW is testing through recent lows sub 1265. The pair last at 1262. IP figures were slightly better than expected, but chip production continues to fall. Onshore equities remain weak, the Kospi down 1.60%, while offshore investors remain net sellers of local equities. Tomorrow onshore markets are closed. They re-open on January 2.

- USD/IDR broke higher, the pair got above 15760, which is fresh highs back to early 2020, before selling interest emerged. We were last at 15710, with the authorities potentially on-guard against further weakness in thinner liquidity markets ahead of year end. Early April 2020 highs came in around the 15820 level and beyond that is the 16000 region.

- USD/PHP is back below 56.00, the pair last at 55.75. Earlier lows were at 55.685, while the simple 20-day MA comes in at 55.699, so this may have provided some support. Still, we are -0.70% lower for the pair compared to yesterday's closing levels. The BSP Governor stated GDP will likely grow much faster than the official 6.5-7.5% target, per Bloomberg reports. The BSP also expects December CPI to print between 7.8-8.6%, although the consensus already looks for an 8.3% outcome. This data is due early in January.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/12/2022 | 0800/0900 |  | ES | Retail Sales | |

| 29/12/2022 | 0900/1000 | ** |  | EU | M3 |

| 29/12/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 29/12/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 29/12/2022 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 29/12/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 29/12/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 29/12/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.