-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS - Week Ahead 2-8 December

MNI POLITICAL RISK - Trump Targets BRICS w/New Tariff Threat

MNI Gilt Week Ahead: Triple issuance week?

MNI US MARKETS ANALYSIS - French Politics Undermines EUR

MNI EUROPEAN MARKETS ANALYSIS: Yen Sales Continue In Risk-On Trade

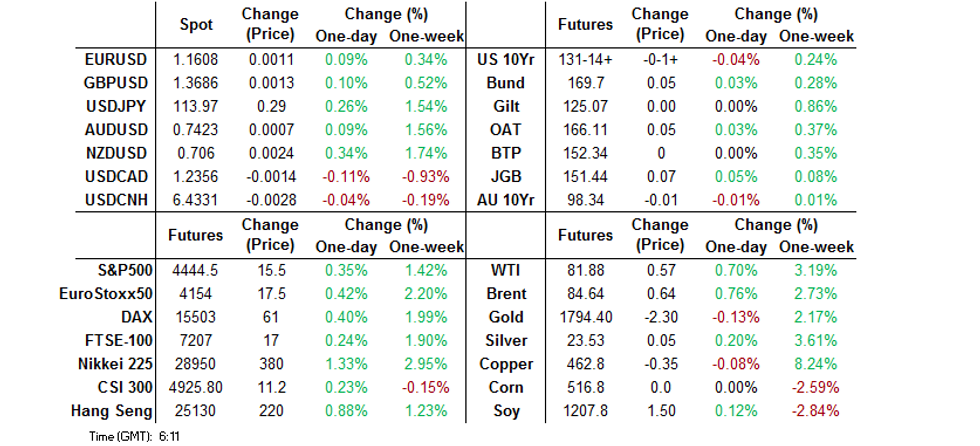

- Asia-Pac equity benchmarks rise in tandem with U.S. e-minis as the risk switch is flicked to on.

- Core FI face some pressure, albeit 5-Year ACGBs get some reprieve from strong demand at the sale of ACGB Apr '26.

- JPY extends losses to fresh multi-year lows, while NZD leads gains after the release of solid BusinessNZ M'fing PMI.

BOND SUMMARY: Positive Risk Sentiment Dents Core FI, Despite Strong ACGB Auction

Positive risk appetite carried over into the Asia-Pac session denting core FI, as solid earnings reports from Wall Street inspired optimism. Talk of China easing rules on home loans for the rest of the year provided further support to risk sentiment, leading to another round of weakness in core bond markets. Meanwhile, the PBOC fully rolled over CNY500bn of maturing MLF loans to keep liquidity ample.

- T-Notes edged lower and last change hands -0-02 at 141-14, off their session low of 131-12+. Cash U.S. Tsy curve bull steepened a tad, partly unwinding Thursday's move. Eurodollar futures last sit unch. to -2.0 ticks through the reds. The U.S. economic docket for today features retail sales, Empir M'fing, Uni. of Mich. Sentiment and Fedspeak from Williams & Bullard.

- Weakness was evident in in JGB futures, as the Nikkei 225 ground in the opposite direction. The contract printed a session low of 151.39 and last operates at 151.42, 5 ticks above previous settlement. Cash JGB yields are marginally mixed. The space shrugged off the government's monthly assessment of the economy, in which the Cabinet Office suggested that economic recovery has slowed.

- Cash ACGB curve runs generally steeper, with yields unch. to +3.7bp, albeit 5s drew some support from a firm ACGB Apr '26 sale. The auction attracted strong demand, with bid/cover ratio printing at 7.52x (prev. 6.15x). Aussie bond futures slid in tandem with their major overseas peers, YM last -2.0 & XM -1.5. Bills run 1-5 ticks lower through the reds. The AOFM unveiled a light issuance slate for next week, they are set to offer A$1.5bn of ACGB Apr '33 next Wednesday.

FOREX: Positive Risk Sentiment Rubs Salt Into Yen's Wounds, Kiwi Extends Gains

The yen extended losses and is on the course for finishing the week as the worst G10 performer. Positive risk appetite from Thursday's NY session spilled over into Asia, while a BBG report noting that China is easing mortgage rules kept sentiment buoyant. Continued equity gains and further increase in commodity prices conspired with Gotobi Day flows to sap some strength from the yen.

- USD/JPY was bought into the Tokyo fix, punching through multi-year highs printed earlier this week. The rate topped out at 113.45, its highest point since Nov 28, 2018.

- BBG trader sources cited USD/JPY purchases by short-term leveraged accounts amid lack of resistance from option desks and local exporters.

- Worth noting that Japanese FinMin Suzuki said that off'ls are assessing the impact of a lower yen on domestic economy and underscored the importance of stability in FX markets.

- NZD maintained Thursday's pole position in G10 FX space after BusinessNZ PMI report showed that New Zealand's manufacturing sector returned into expansion in September, following a sharp contraction recorded in the prior month.

- Mind that the details of New Zealand's PMI report were not all positive, as recovery remained uneven between regions, while the proportion of negative comments from respondents remained relatively high.

- AUD/NZD sales weighed on the broader AUD, despite positive risk backdrop. The Antipodean cross retreated, swinging into a weekly loss.

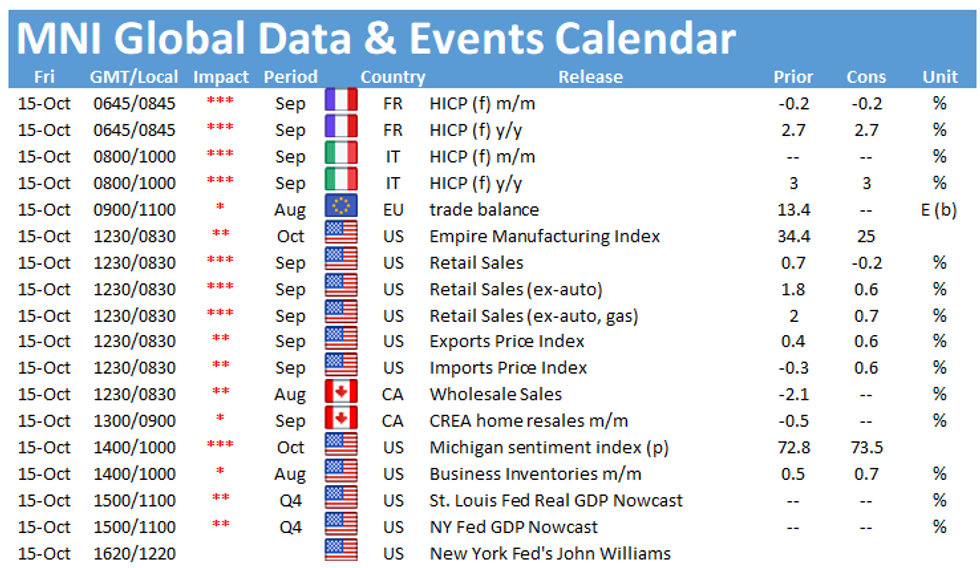

- U.S. retail sales, Empire M'fing & Univ. of Mich. Sentiment will hit the wires later today, alongside final French and Italian CPIs. Comments are due from Fed's Williams & Bullard.

FOREX OPTIONS: Expiries for Oct15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1550-65(E1.3bln), $1.1600(E670mln), $1.1650(E738mln)

- USD/JPY: Y111.90-00($788mln), Y112.50-65($1.0bln), Y113.00-15($1.4bln), Y113.90-00($585mln)

- USD/CAD: C$1.2360-75($630mln), C$1.2480-00($1.9bln)

- USD/CNY: Cny6.40($891mln), Cny6.45($770mln)

ASIA FX: Mixed; KRW Best Performer While THB Lags Peers

- CNH: Offshore yuan slightly stronger, but off best levels. The PBOC rolled over MLF funds, refraining from injections indicating it is comfortable with current policy against some speculation that easing is imminent.

- SGD: Singapore dollar is stronger, continuing post-MAS gains. There was a Fitch report which posited that the MAS are likely to tighten further in 2022.

- TWD: Taiwan dollar is stronger, USD/TWD moving back towards the 28.00 handle. Domestic equity markets saw gains of over 2% boosted by strong earnings from TSMC yesterday.

- KRW: Won is stronger. BoK Governor Lee hinted again that November was a live meeting for a hike.

- MYR: Ringgit is weaker, UMNO Supreme Council held a meeting on the upcoming Melaka state election yesterday, but failed to reach consensus on whether to team up with other parties.

- IDR: Rupiah is stronger, data showed exports rose 47.64% below estimates of 51.29%, the trade surplus widened to $4.37bn, above expectations.

- PHP: Peso dropped, BSP Gov Diokno said Thursday that "maybe there's no need" for the central bank to extend more loans to the gov't, after the renewal of a PHP540bn loan earlier this week.

- THB: Baht is weaker, BoT Gov yesterday noted its policy stance needs to remain accommodative for quite some time" and "it is probably too premature to talk about exiting given the depth of the crisis.

ASIA RATES: Indonesian Bonds Buck Regional Trend, China Futures Lower After MLF

- INDIA: Closed for market holiday.

- SOUTH KOREA: Futures lower in South Korea as risk on sentiment dominates and domestic equity markets record robust gains, futures choosing to ignore another move higher in UST's. 3-Year last down 1 tick while the 10-Year is down 9 ticks. US/SK spreads continue to narrow, the 2-Year spread last at 100.7bps from highs of 134bps in August. BoK Gov Lee hinted again that November was live for a hike. The BoK submitted a report to parliament that confirmed the Central Bank will gradually adjust the degree of accommodation, adding that they will mindful of growth in asset prices and household debt when enacting monpol. Meanwhile the finance ministry released its monthly economic report and highlighted continued uncertainty as slumps in person-to-person service sectors have extended amid the latest spike in COVID-19 cases, but noted labour market recovery and export recovery. 50-Year debt was sold to decent demand thanks to a 28bps yield concession from the previous auction.

- CHINA: Futures lower in China, dropping at the open. The PBOC rolled over CNY 500bn of MLF funds, refraining from extra injections, the Central Bank also matched maturing reverse repos. The roll over indicates the PBOC are comfortable with current policy settings, some have said easing is on the cards, and has seen CNH strengthen and futures drop, repo rates meanwhile creep slightly higher but are within recent ranges. As a reminder PBOC Governor Yang spoke at the G20 Central Bankers meeting earlier this week and said that policy will be "flexible, targeted, reasonable and appropriate".

- INDONESIA: Yields lower across the curve with buying concentrated in the belly, 5-Year yield drops to the lowest since as domestic bonds track UST's higher. Indonesia's trade surplus shrank in September but not as much as expected. Shipments rose slightly slower than forecast, imports growth also missed estimates. Looking ahead, Bank Indonesia will deliver their monetary policy decision next Tuesday.

EQUITIES: Make Hay While The Sun Is Shining

After a positive lead from Wall Street equity markets in the Asia-Pac region have pushed higher with prices in the green across the board. Markets in Taiwan lead the way higher, boosted by strong earnings from TSMC, markets in Japan up around 1.3% at time of writing helped higher by a drop in JPY which hit the lowest levels against the greenback since 2018. Markets in China higher; indices initially took a wobble after the PBOC rolled over MLF funds, refraining from injections, but recovered early losses after mortgage limits for banks were eased for the rest of the year amid worries of Evergrande contagion. In the US futures are higher, coasting on the positive sentiment yesterday engendered by strong earnings and robust employment market figures. In the US retail sales data for September crosses on Friday, with import/export price numbers also due.

GOLD: On Track For Best Weekly Gain Since May

The yellow metal has softened slightly, but still holds the bulk of the Wednesday rally, and has breached the 50-day EMA and resistance at $1787.4, the Sep 22 high. The resumption of strength reinforces short-term bullish conditions and the bullish engulfing candle pattern that signalled a potential reversal on Sep 3. The focus is on $1808.7 next, Sep 14 high. Initial firm support is at $1746.0, Oct 6 low. A break is required to undermine a bullish tone. Bullion prices are on track for the best weekly gain since May.

OIL: Best Weekly Run Since 2015

Crude futures built on recent gains in the Asia-Pac session and are on track for the eighth straight weekly gain, the longest run of gains since 2015. WTI crude futures initially ticked lower on the release of the weekly DoE crude oil inventories data (one day delayed due to the Columbus Day holidays) with markets focusing on the considerably larger-than-expected build in headline crude stockpiles (+6.1mln bbls vs. Exp. +521k). This pressured front-month WTI futures to lows of $80.38, although losses were limited by the countering draw in gasoline inventories, at -2mln bbls vs. Exp. build of +947k. The drop was soon reversed and both WTI and Brent finished with gains, the outlook remains bullish and the contract is holding onto recent gains. Monday's fresh high confirmed an extension of the current bullish price sequence of higher highs and higher lows, reinforcing the uptrend. Note that the $80.00 psychological hurdle has also been cleared. The focus is on $82.89, a Fibonacci projection.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.