-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS OUTLOOK: ACGBs Get Battered After RBA Decide Against Defending Yield Target

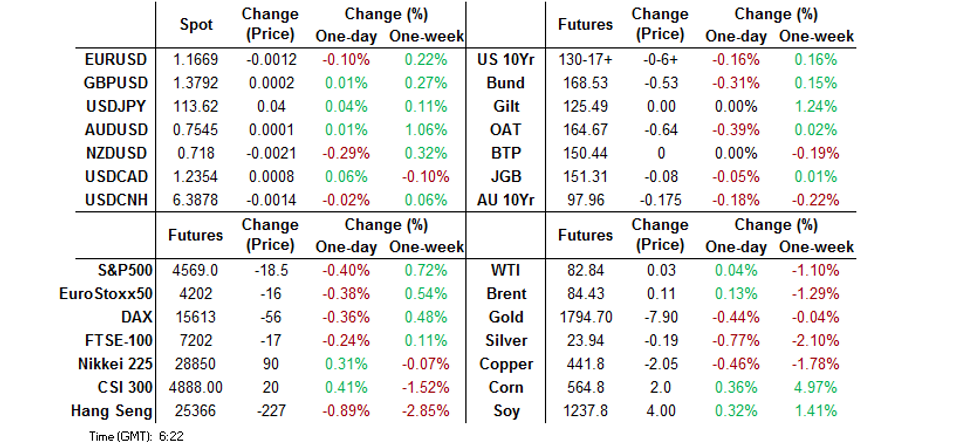

- ACGBs resume sharp losses as the RBA refrain from enforcing their yield target, triggering hawkish speculation surrounding next week's monetary policy meeting.

- AUD gains, leaving its commodity-tied peers behind. Its Antipodean cousin NZD lands at the bottom of G10 pile.

- U.S. e-mini futures operate in the red after underwhelming earnings reports from Amazon and Apple.

BOND SUMMARY: RBA Stay On Sidelines, Unleashing Surge In ACGB Yields

All eyes were on ACGB space as the RBA defied market expectations and stayed out of the market, instead of stepping in to enforce their ACGB Apr '24 yield target. The Reserve Bank looked through the surge in their target yield over the last two days, but bought A$1.0bn of ACGB Apr '24 last Friday, which fuelled expectations of another such intervention today. Their preference to remain on the sidelines inspired revisions to sell-side calls ahead of the upcoming monetary policy meeting, slated for this coming Tuesday. ANZ and NAB noted that they expect policymakers to scrap their yield target as soon as next week, while NAB added that they now expect the first cash rate hike in mid-2023 rather than in 2024.

- Expectations for an intervention in defence of the yield target were evident, as short-term yields retreated in early trade. Once got past the typical time of the RBA's bond purchase offer announcements, cash ACGBs got battered. Yields surged and last sit +9.7-19.5bp, the curve generally runs steeper, albeit 2s (ACGB Apr '24) underperform. Worth noting that 10-year yield posted its largest daily gain since Mar '20 as it hit session highs. Swings in Aussie bond futures were driven by the same factors and posted sharp pullbacks on the back of the RBA's silence. YM last -8.5 & XM -17.0, hovering close to session lows. Bills trade unch. to 7 ticks lower through the reds. Local data releases (incl. a beat in monthly retail sales) & ACGB Nov '32 supply were ignored, as was the release of the AOFM's weekly issuance plan.

- JGB futures slid to a session low of 151.27, likely on the back of spillover from ACGB space, but recouped those losses later on. The contract last sits at 151.33, 6 ticks shy of previous settlement. Cash JGB yield curve is marginally flatter, as the super-long end outperforms. Japan's preliminary industrial output & Tokyo CPI both missed forecasts, while unemployment remained steady, as anticipated. Uncertainty was elevated ahead of Japan's general election this Sunday.

- ACGB impetus drove T-Notes in early trade, but the latter contract failed to hold onto gains and faltered later in the session. As this is being typed, T-Notes trade -0-03 at 130-21. Cash Tsy yields recovered and sit marginally higher across the curve. Eurodollars last seen -1.0 to +1.0 tick through the reds. Today's U.S. docket features PCE index, MNI Chicago PMI & final Uni. of Mich. Sentiment, while the Fed are in their blackout period.

FOREX: RBA Silence Shields AUD From Negative Risk Tone, NZD Lags Behind

The NZD paced losses in G10 FX space as New Zealand reported 125 new community cases of Covid-19, while BBG trader sources pointed to NZD/USD sales by leveraged funds. New Zealand's ANZ Consumer Confidence Index deteriorated in October, with "both perceptions of current conditions and expectations down sharply," while ANZ commented that inflation expectations "went ballistic." NZD 2-year interest rate swap retreated, retracing some of its yesterday's advance.

- AUD knee-jerked higher as the RBA chose not to buy bonds in defence of its yield target. This resulted in revisions to RBA calls from some sell-side desks ahead of the Reserve Bank's imminent monetary policy meeting. ANZ expect the RBA to scrap their ACGB Apr '24 yield target next week, while NAB bought forward their projection of the first cash rate to mid-2023.

- Sales against its Antipodean cousin may have rubbed salt into the kiwi's wounds. AUD/NZD went bid, attacking the round figure of NZ$1.0500. The move coincided with a parallel move in AU/NZ 2-year swap spread.

- Broader risk tone was rather cautious, as underwhelming earnings reports from Amazon and Apple weighed on U.S. e-mini futures. JPY struggled to gain much strength nonetheless, with USD/JPY implied 1-week volatility hitting multi-month highs ahead of Japan's general election this Sunday.

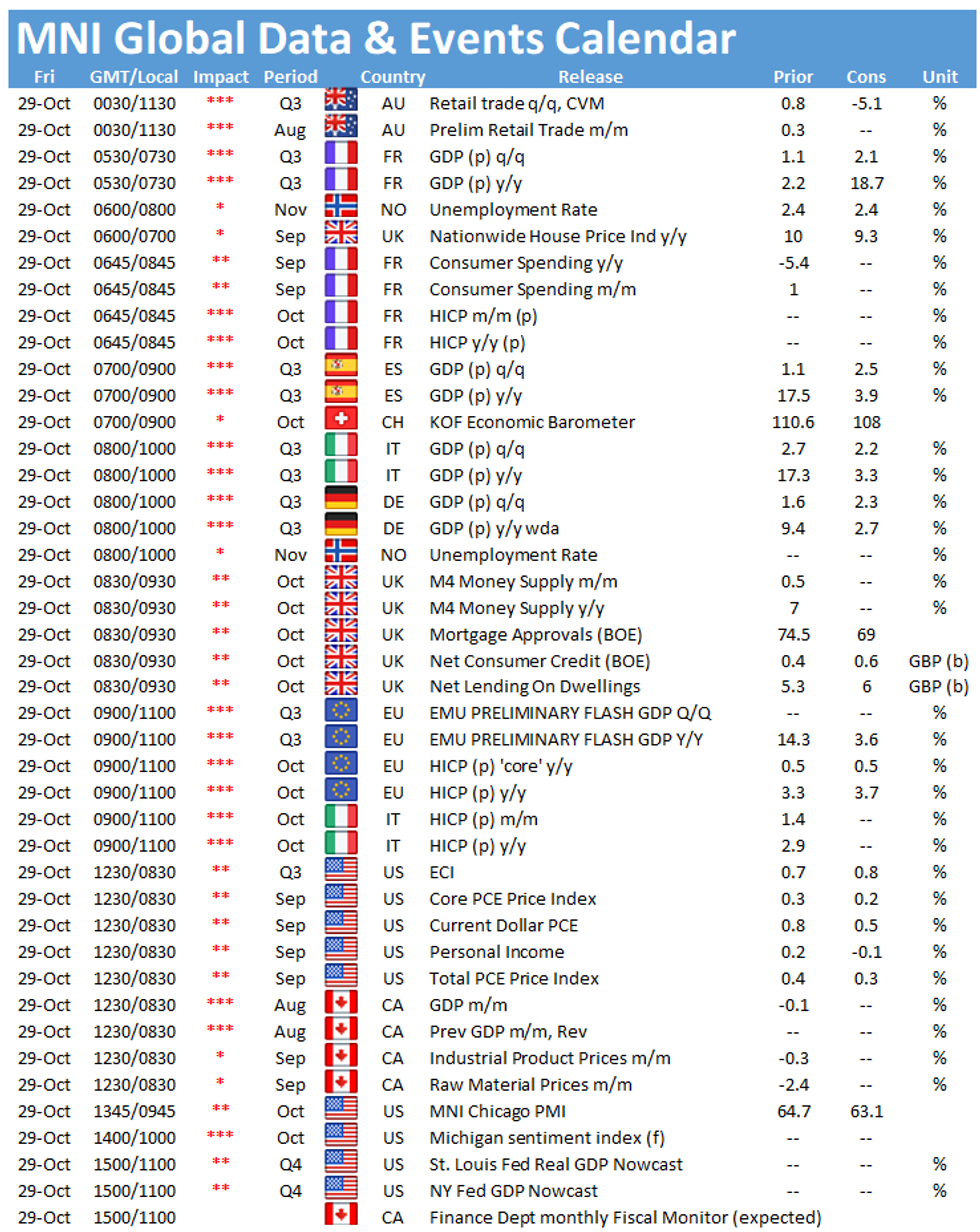

- The European data docket today includes flash GDP & HICP data from the EZ and several Eurozone economies. In NY hours, focus will turn to U.S. PCE, personal income/spending, MNI Chicago PMI as well as Canadian GDP.

FOREX OPTIONS: Expiries for Oct29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1480-00(E842mln), $1.1595-00(E1.3bln), $1.1645-55(E933mln)

- USD/JPY: Y113.00($674mln), Y113.75-90($1.3bln), Y114.60-75($1.4bln)

- NZD/USD: $0.7210(N$645mln)

- USD/CAD: C$1.2300($982mln), C$1.2345($610mln)

- USD/CNY: Cny6.4750($600mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.