-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Morning FI Analysis: Tsys Insulated, ACGB & JGB Supply Eyed

LONDON (MNI)

US TSYS: The space was a little more insulated than most of the major global markets during overnight trade, as has been the case in recent times,

with participants seemingly needing a "game changer" to force a move out of the established range.

- T-Notes hovered around unchanged levels for the duration of the

Asia-Pac session and last sit +0-01 at 139-19+, sticking to a 0-03 tick

range. Yields sit unchanged to 0.6bp richer across the curve. - The closure of the Chengdu and Houston consulates and

surrounding war of words keep Sino-U.S. tensions at the fore, while

fresh pockets of COVID-19 worry have emerged across the globe. A

little closer to home, a wide chasm in GOP/Democratic fiscal plans

remains evident. - Asia-Pac flow saw 3.0K of the SOFR Q0 futures sold vs. Fed Funds.

- Durable goods data and fiscal dynamics headline locally on Monday.

2-Year supply is also due.

JGBS: JGB futures have traded lower than settlement during Tokyo hours, last -5, with some underperformance evident in the 7-20 Year sector of the cash curve for most of the day, as the zone cheapened, vs. slight richening elsewhere. 10-25 Year Rinban ops saw a widening of spreads, cover ratio virtually unch.

- Chief Cabinet Secretary Suga retained a similar tone re: the local

COVID-19 backdrop, although Economy Minister Nishimura sounded

a little more worried than he had been in recent times, even as the

Tokyo case count moderated (a reminder that Sunday's often see a

dip in testing). - There wasn't much else to note, with participants looking through the

summary of opinions from the BoJ's most recent meeting. Final Q1

CapEx data was a fair chunk softer than flash. - 40-Year supply headlines locally tomorrow.

AUSSIE BONDS: The long end of the Aussie curve blipped lower as the AOFM announced the formal launch of its new ACGB June '51, via syndication. Some suggested that the fact that the AOFM will hold off on further issuance of the line until at least Nov may drive lumpy issuance size when the bond prices tomorrow. Curve a little steeper on the day, but has recovered from intra-day steeps. YM -1.0, XM -3.0.

- Elsewhere, Victoria's COVID-19 case count was eyed, with fresh

records lodged on several occasions in recent days, although follow

through into markets was again limited. - RBA Asst. Governor Kent offered little new on the monetary policy

front, echoing recent central bank rhetoric re: the efficacy of

monetary policy, the prospect of -ve rates and the level of the AUD. - Looking to tomorrow, the pricing of the new ACGB Jun '51 will draw

the most attention.

AUCTION/DEBT SUPPLY

EUROZONE ISSUANCE: Germany, Italy and Belgium will issue bonds this week. We estimate supply of E21.3bn compared to E9.5bn last week.

- ISSUANCE: Belgium will be the first to come to market with a sale of the 0.80% Jun-25 OLO and 0.90% Jun-29 OLO for E1.5-2.0bn on Monday. On Tuesday Italy will auction the 0.40% May-30 BTPEi for E0.75-1.0bn and the May-22 CTZ for E2.75-3.25bn. Germany will follow with a tap of the 0% Nov-27 bund for E4bn. On Wednesday Germany will return to auction the 0% May-35 Bund for E3.5bn. Italy will similarly return to the market for a second time on Thursday to auction M/L-Term BTPs with details TBA.

- CASH FLOWS: E45.0bn in redemptions and E9.8bn of coupon payments will leave net cash flows at E-33.6bn of the week.

** For further details please MNI Eurozone Issuance Profile & Cash Flow Matrix: https://emedia.marketnews.com/CFM270720x10it.pdf

BTPS: Italy plans to sell 7 billion euros ($8.1 billion) of bills due Jan 29, 2021 in an auction on Jul 29. (BBG)

BOJ: The BoJ offers to buy a total of Y120bn of JGB's from the market, sizes unchanged from previous operations:

- Y120bn worth of JGB's with 10-25 Years until maturity

AUSSIE BONDS: The AOFM announces the issue by syndication of a new 1.75% 21 June 2051 Treasury Bond. The issue will be the new 30 year bond and will be of a benchmark size. Initial price guidance for the issue is a spread of 98 to 105 basis points over the implied bid yield for the primary ten-year Treasury Bond futures contract. The issue is expected to be priced on Tuesday, 28 July 2020 and settle on Wednesday, 5 August 2020. ANZ, Commonwealth Bank of Australia, Deutsche Bank, J.P. Morgan Securities Australia Limited and UBS AG, Australia Branch will act as Joint-Lead Managers for the issue. There will be no further issuance of this Treasury Bond prior to November 2020. The AOFM will be mindful of the performance of the bond when considering the timing of future issuance. (AOFM)

TECHS

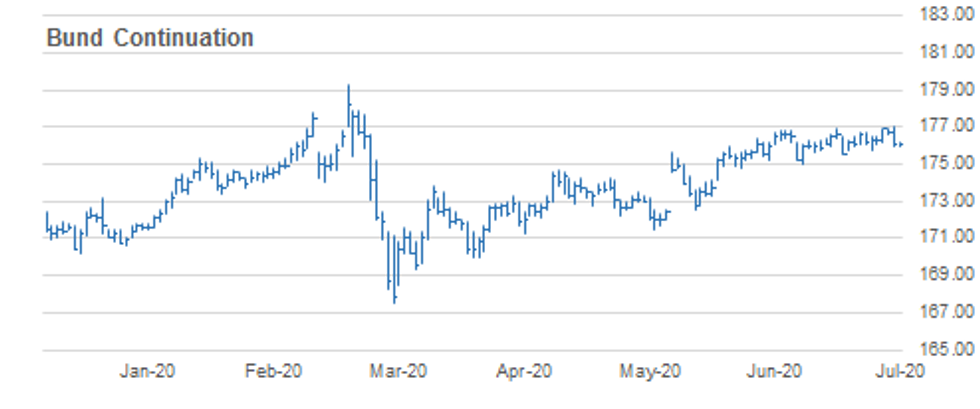

- RES 4: 177.52 High May 15

- RES 3: 177.35 High May 18

- RES 2: 177.00 Round number resistance

- RES 1: 176.98 High Jul 24

- PRICE: 176.11 @ 04:51 BST Jul 27

- SUP 1: 175.77/54 Low Jul 20 / Low Jul 9

- SUP 2: 175.04 Low Jul 2

- SUP 3: 174.80 Low Jun 17

- SUP 4: 174.74 50.0% retracement of the Jun 5 - Jul 10 rally

Bund futures retreated Friday failing to convincingly clear resistance at

196.95, Jul 22 high. Attention turns to support at 176.54, Jul 20 low where

a break would instead signal a near-term reversal and expose 175.54, Jul

13 low and the key support at 175.04. Jul 2 low. For bulls, a break of

176.98, Friday's high is required to reinstate a bullish theme. This would

open 177.77, high Apr 30 and Jun 5.

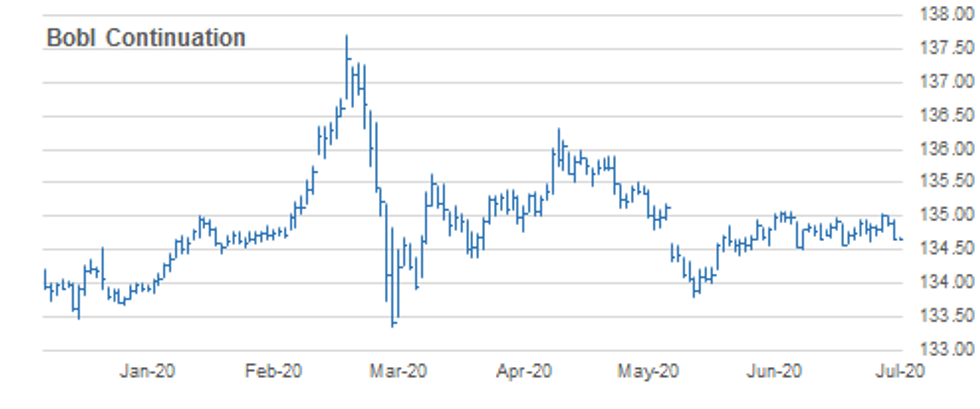

- RES 4: 135.150 50.0% retrace of the May 4 - Jun 10 decline (cont)

- RES 3: 135.080 High Jun 29 and the bull trigger

- RES 2: 135.040 High Jul 22

- RES 1: 134.950 High Jul 24

- PRICE: 134.670 @ 04:47 BST Jul 27

- SUP 1: 134.610/560 Low Jul 20 / Low Jul 13

- SUP 2: 134.510 Low Jul 2 and key support

- SUP 3: 134.435 50.0% retracement of the rally between Jun 5 - 29

- SUP 4: 134.410 Low Jun 17

Bobl futures stalled last week at 135.040, Jul 22 high. The sell-off late last

week keeps in place a sideways move that has dominated since late

June. This has created a range with the parameters defined by resistance

at 135.080, Jun 29 high and support at 134.510, Jul 2 low. A break of

either side is required to highlight this market's near-term directional bias.

The immediate risk is for a move lower towards the range base.

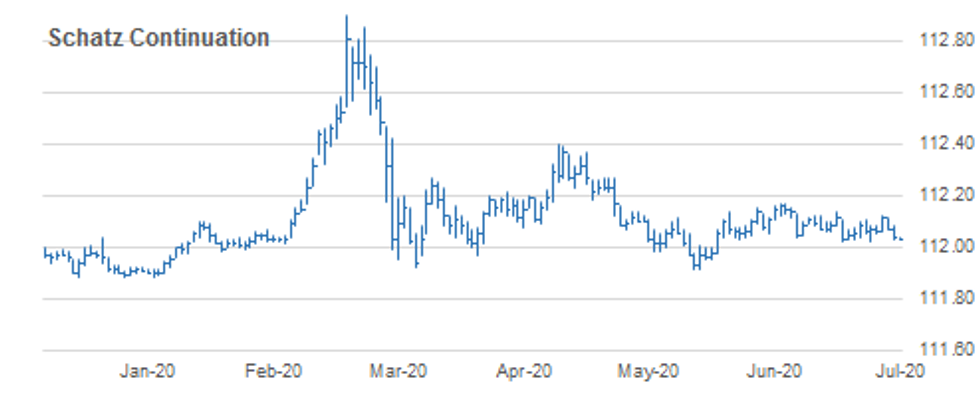

SCHATZ TECHS: (U0) Looking For A Break Higher

- RES 4: 112.180 High May 22

- RES 3: 112.170 High Jun 26 and key resistance

- RES 2: 112.135 High Jul 10 and near-term bull trigger

- RES 1: 112.120 High Jul 22

- PRICE: 112.075 @ 04:42 BST Jul 24

- SUP 1: 112.025 Low Jul 13 and Jul 20 and the key support

- SUP 2: 112.009 61.8% retracement of the rally between Jun 5 - 29

- SUP 3: 112.000 Round number support

- SUP 4: 111.975 Low Jun 11

Schatz futures are moving sideways. Price stalled at 112.135 on Jul 10. The subsequent sell-off highlighted a bearish risk breaching of 112.040, Jul 1 low. Futures however bounced late last week to keep the contract above support at 112.025, Jul 13 low. This support held again Monday and the contract recovered. Attention is on resistance at 112.135, Jul 10 high where a break would open 112.170, Jun 26 high. Key support is at 112.025.

- RES 4: 139.70 Low Mar 3 (cont)

- RES 3: 139.05 High Mar 12 (cont)

- RES 2: 138.48 1.00 projection of Jun 19 - 25 rally from Jul 1 low

- RES 1: 138.46 High Jul 24 and the bull trigger

- PRICE: 137.90 @ Close Jul 24

- SUP 1: 137.51 Low Jul 22

- SUP 2: 137.36 Low Jul 15

- SUP 3: 137.25 Low Jul 13 and key near-term support

- SUP 4: 137.21/136.95 50-day EMA / Low Jul 1

Gilts futures traded higher last week however found resistance Friday at 138.46 resulting in a strong sell-off and a weak close. Japanese candle patterns alluding to a potential top. A doji pattern Thursday, and Friday's session a bearish engulfing suggest bullish sentiment is waning. If correct, the risk is for weakness towards the initial firm support handle at

137.51, Jul 20 low. A break of 138.46 resumes the uptrend.

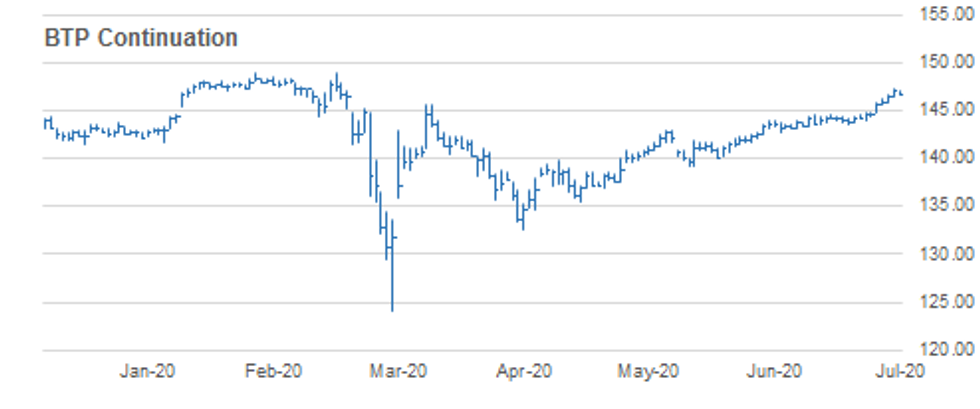

BTPS TECHS: (U0) Still Heading North

- RES 4: 148.97 High Feb 13 (cont)

- RES 3: 148.32 High Mar 4 (cont)

- RES 2: 147.43 High Mar 5 (cont)

- RES 1: 147.30 High Jul 23

- PRICE: 147.16 @ Close Jul 23

- SUP 1: 145.62 Low Jul 21 and key near-term support

- SUP 2: 144.92 Low Jul 20

- SUP 3: 144.62 20-day EMA

- SUP 4: 143.61 Low Jul 13 and key near-term support

BTPS futures traded higher again yesterday, confirming a resumption once again of the current uptrend that has been in place since late April. This maintains the bullish price sequence of higher highs and higher lows that defines an uptrend. Furthermore, MA and momentum studies are in a bullish position although it is worth noting the trend condition is overbought. Attention is on 148.32 next. Initial firm support is 145.62, the Jul 21 low.

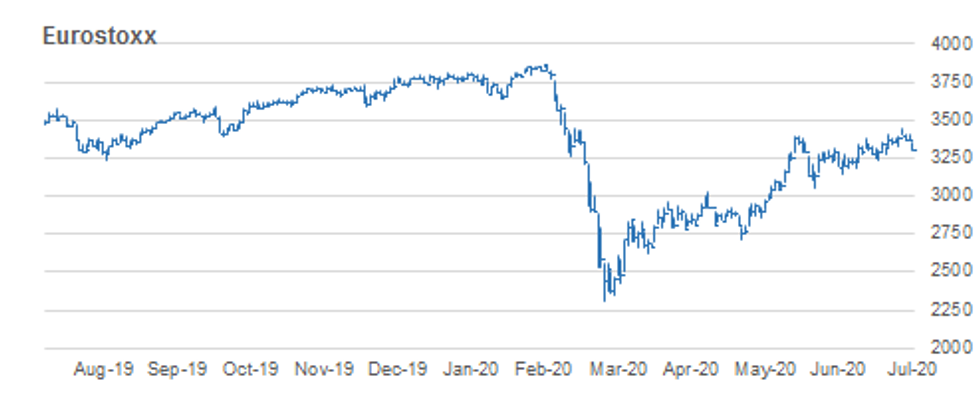

- RES 4: 3553.05 High Feb 27

- RES 3: 3498.07 76.4% retracement of the Feb - Mar sell-off

- RES 2: 3451.16 High Jul 21 and the bull trigger

- RES 1: 3349.54 High Jul 24

- PRICE: 3310.89 @ Close Jul 24

- SUP 1: 3277.40 Low Jul 14

- SUP 2: 3241.29 Low Jul 10

- SUP 3: 3232.18 50-day EMA

- SUP 4: 3222.02 Bull channel base drawn off the Mar 16 low

EUROSTOXX 50 ended last week on a softer note having found

resistance at 3451.16 on Jul 21. The move lower has exposed 3241.29,

Jul 10 low where a break would further undermine the recent bull run and

expose the bull channel support drawn off the Mar 16 low. The line

intersects at 3222.02. A break of the channel support would highlight a

broader reversal. The key trigger for a resumption of gains is 3451.16.

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.