-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Morning FI Analysis: ACGBs Underperform In Asia

US TSYS: Debate Fails To Move The Needle

T-Notes struggled for a clear sense of direction in Asia-Pac trade, with no real game changing moments identified in the final Trump-Biden debate. Still, volume in the contract was above average overnight, with the contract last unchanged at 138-10+ after managing to recover from worst levels. Cash Tsy trade has seen light bull flattening creep in, but yields are within 1.0bp of closing levels. Block flow was noted, as the TYF1 138.00/137.00 put spread saw 20.0K blocked at 0-23, which looked like a sell, some suggested that this looked like the rolling down and out of an existing position. There was also some small screen interest in the FVZ0 124.00/124.50/125.00 call fly, with 2.0K lifted there.

- Thursday saw participants continue to focus on the prospect of a fiscal pact being agreed in DC, as opposed to the timing. Still, participants were willing to look through the more cautious leanings from the Republican side of the discussions, with longer dated yields leading the cheapening as the space bear steepened and the 5s30s spread hit the steepest level seen since the aftermath of the 2016 election.

- Eurodollar futures sit unchanged to +0.5 through the reds.

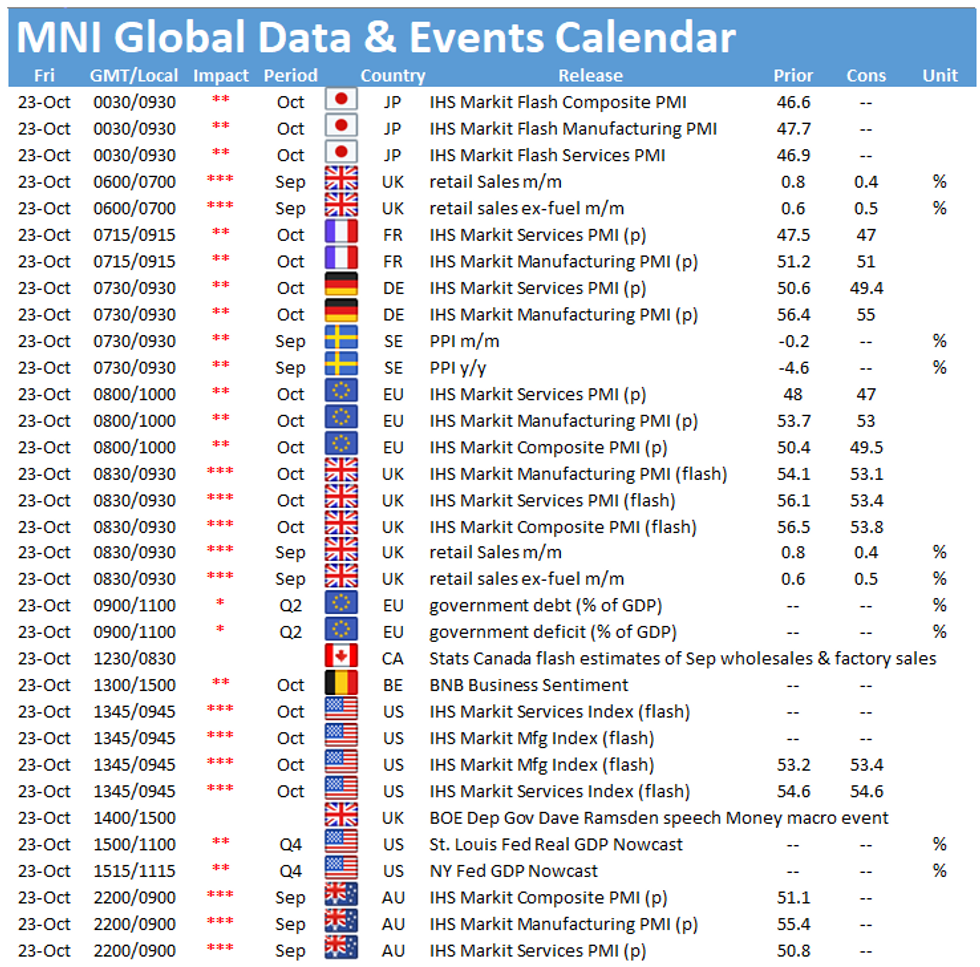

- Flash PMI data is due today. Elsewhere, NY Fed's Logan is set to speak on market liquidity.

RATINGS: Rating reviews of note scheduled for after hours on Friday include:

- S&P on the UK (current rating: AA; Outlook Stable), the EFSF (current rating: AA; Outlook Stable), Greece (current rating: BB-; Outlook Stable) & Italy (current rating: BBB; Outlook Negative).

- Fitch on the Netherlands (current rating: AAA; Outlook Stable).

- DBRS Morningstar on Greece (current rating: BB (Low); Stable Trend).

JGBS: Softer On Offshore Matters

JGB futures sit 17 ticks below settlement, just off worst levels, after bears failed to force a challenge of trend support at 151.75. 7s and 40s were the weak points on the cash curve, with the former likely linked to weakness in futures, while the longer end weakness would fall in line with the steepening pressure witnessed in U.S. Tsys on Thursday. The Japanese swaps curve also steepened. There was nothing of local note to drive the space, with no real impetus coming from the flash PMI and national CPI readings.

AUSSIE BONDS: Steeper On U.S. Tsy Direction

Aussie bonds steepened with XM trading as much as 6.0 ticks lower vs. settlement before edging away from worst levels, having unwound all of the gains it saw in the wake of RBA Governor Lowe's October 15 address as weak longs get flushed out on the impetus from the U.S. Tsy space. YM -1.0, XM -4.5 at typing.

- The latest ACGB '26 auction was solid, although the cover ratio wasn't particularly standout by recent standards (~4.50x), but the pricing was strong, with average yields stopping ~0.9bp through prevailing mids at the time of supply (per BBG prices).

- October's flash CBA PMIs saw the rate of expansion in the composite reading accelerate, driven by an uptick in the services metric, while the rate of expansion witnessed in the manufacturing sector slowed at the margin.

- Bills sit 1-2 ticks softer through the reds.

AUCTION/DEBT SUPPLY

BTPS: Italy to sell up to EUR2.5bn of zero bonds due Sep 28, 2022 on Oct 27

Italy plans to sell up to 2.5 billion euros ($3 billion) of zero bonds due Sep 28, 2022 in an auction on Oct 27. The sale is a reopening of previously issued securities with 3.827 billion euros outstanding. Currently the securities are being quoted at a price to yield of -0.216 percent. (BBG)

BTPS: Treasury announces the results of syndicated exchange transaction

Treasury announces the results of syndicated exchange transaction, according to statement. Bought back EU2b of BTP 01/08/2021, EU2b BTP 01/05/2023, EU2b of BTP 01/08/2023, EU1.97b of BTP 01/10/2023, EU2b of CCTeu 15/01/2025. The settlement date of the transaction is set on Oct. 29. (BBG)

JGBS AUCTION: Japanese MOF sells Y6.1574tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y6.1574tn 3-Month Bills:- Average Yield -0.0793% (prev. -0.0834%)

- Average Price 100.0213 (prev. 100.0224)

- High Yield: -0.0744% (prev. -0.0781%)

- Low Price 100.0200 (prev. 100.0210)

- % Allotted At High Yield: 54.9827% (prev. 26.7333%)

- Bid/Cover: 3.228x (prev. 3.229x)

AUSSIE BONDS: The AOFM sells A$1.5bn of the 0.50% 21 Sep '26 Bond, issue #TB164:

The Australian Office of Financial Management (AOFM) sells A$1.5bn of the 0.50% 21 September 2026 Bond, issue #TB164:- Average Yield: 0.3937%

- High Yield: 0.3950%

- Bid/Cover: 4.5220x

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 64.0%

- bidders 49, successful 16, allocated in full 7

AUSSIE BONDS: Nothing Of Note On Next Week's AOFM Issuance Schedule

The AOFM has released its weekly issuance schedule:

- On Monday 26 October it plans to sell A$1.5bn of the 2.75% 21 November 2028 Bond.

- On Thursday 29 October it plans to sell A$1.0bn of the 26 February 2021 Note & A$1.0bn of the 23 April 2021 Note.

- On Friday 30 October it plans to sell A$2.0bn of the 1.50% 21 June 2031 Bond.

TECHS

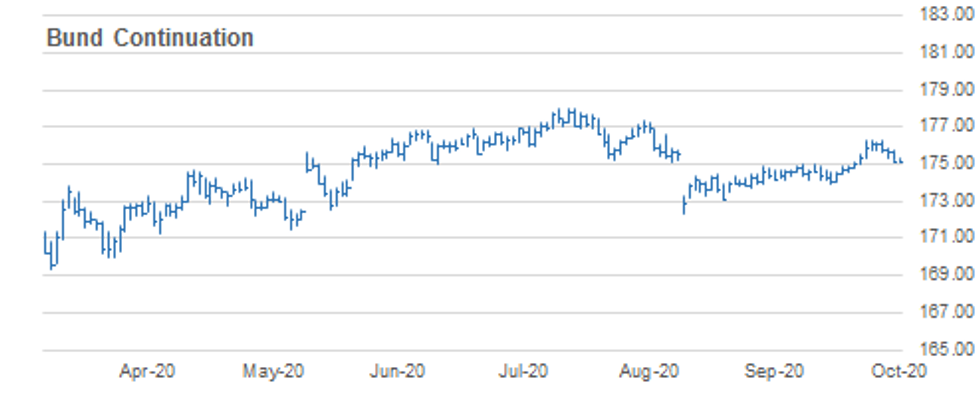

BUND TECHS: (Z0) Corrective Cycle

- RES 4: 176.57 1.618 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 3: 176.32 1.500 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 2: 176.29 High Oct 16 and the bull trigger

- RES 1: 175.86 High Oct 21

- PRICE: 175.27 @ 04:55 BST Oct 23

- SUP 1: 175.09/08 20-day EMA / High Aug 4 and recent breakout level

- SUP 2: 174.76 Low Oct 13

- SUP 3: 174.66 Trendline support drawn off the Sep 1 low

- SUP 4: 174.52 50-day EMA

Bund gains stalled this week with key resistance defined at 176.29, Oct 16 high and futures remain soft. The pullback is likely a correction though following recent gains. Attention is on support at 175.08, Aug 4 high and a former breakout level. The 20-day EMA intersects at 175.09. On the upside, clearance of 176.29, the bull trigger, would confirm a resumption of the uptrend and open 176.32/57, Fibonacci projections. Resistance is at 175.86.

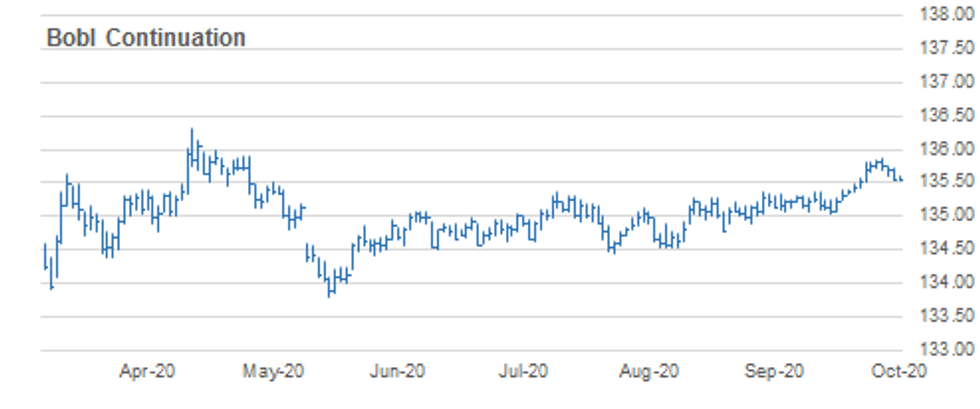

BOBL TECHS: (Z0) Off Recent Highs

- RES 4: 136.000 Round number resistance

- RES 3: 135.907 1.764 proj of Sep 1 - Sep 9 rally from Sep 10 low

- RES 2: 135.860 High Oct 20 and the bull trigger

- RES 1: 135.760 High Oct 21

- PRICE: 135.590 @ 04:50 BST Oct 23

- SUP 1: 135.540 Low Oct 22

- SUP 2: 135.510 Low Oct 15

- SUP 3: 135.452 20-day EMA

- SUP 4: 135.370 High Sep 21 and Oct 5 and former breakout level

BOBL gains have stalled this week and remain in a corrective cycle. Key resistance has been defined at 135.860, Tuesday's intraday high. Attention is on the next support at 135.510, Oct 15 low ahead of the 20-day EMA at 135.452. A break of the average would signal scope for a deeper pullback. On the upside, clearance of 135.860, the bull trigger, would confirm a resumption of the uptrend and open 135.907, a Fibonacci projection.

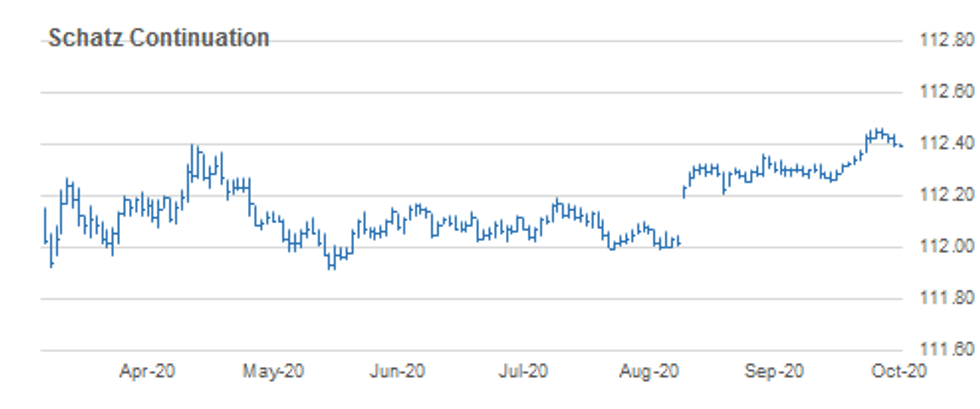

SCHATZ TECHS: (Z0) Corrective Week

- RES 4: 112.490 2.000 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 3: 112.457 1.764 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 2: 112.460 High Oct 19 / 20 and the bull trigger

- RES 1: 112.440 High Oct 21 /22

- PRICE: 112.400 @ 05:09 BST Oct 23

- SUP 1: 112.390 Intraday low

- SUP 2: 112.361 20-day EMA

- SUP 3: 112.360 High Sep 21 and the recent breakout level

- SUP 4: 112.340 Low Oct 14

GILT TECHS: (Z0) Sharp Sell-Off Extends

- RES 4: 136.38 Low Oct 20 and a gap high on the daily chart

- RES 3: 136.27 High Oct 21 and a gap low on the daily chart

- RES 2: 136.08 50-day EMA

- RES 1: 135.87 High Oct 22

- PRICE: 135.37 @ Close Oct 22

- SUP 1: 135.32 Low Oct 22

- SUP 2: 135.06 Low Oct 7 and the bear trigger

- SUP 3: 134.59 Low Sep 1

- SUP 4: 134.32 Low Aug 28 and a key support

Gilt futures remain heavy. Yesterday's sell-off extends this week's sharp move lower reversing the strong rally between Oct 7 - 16. Futures have traded through 135.79, 61.8% of the Oct 7 - 16 upleg and 135.51, the 76.4% retracement. The impulsive break lower exposes primary support at 135.06, Oct 7 low. Clearance of this level would reinforce this week's bearish developments. Initial resistance is at 135.87, yesterday's high.

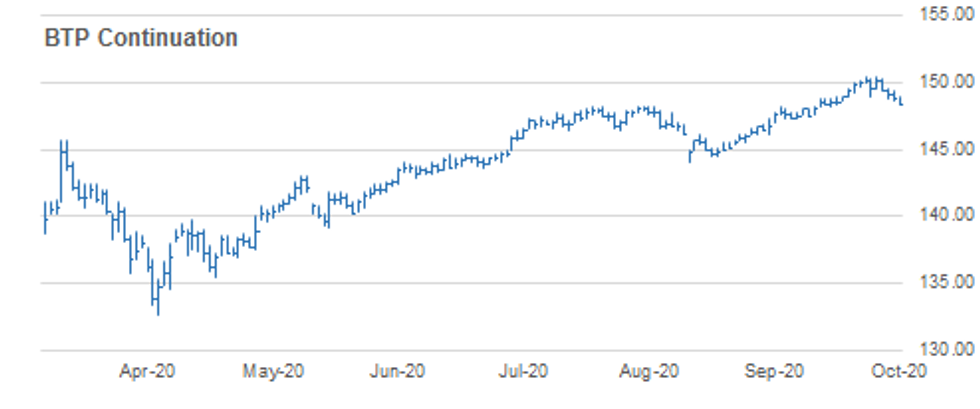

BTPS TECHS: (Z0) Through The 20-Day EMA

- RES 4: 152.00 Round number resistance

- RES 3: 151.17 0.764 of Jun 10 - Aug 20 swing from Sep 9 low (cont)

- RES 2: 150.46 High Oct 16 and the bull trigger

- RES 1: 149.58 Oct 20 high

- PRICE: 148.45 @ Close Oct 22

- SUP 1: 148.37 Low Oct 22

- SUP 2: 148.03 38.2% retracement of the Sep 1 - Oct 16 rally

- SUP 3: 147.46 Low Sep 30

- SUP 4: 147.27 50.0% retracement of the Sep 1 - Oct 16 rally

BTPS outlook remains bullish however futures are currently in a corrective cycle with price still softer and trading below recent highs. The contract has breached the 20-day EMA at 148.73 signalling scope for a deeper pullback, potentially towards 148.03, a Fibonacci retracement level. Initial resistance is at 149.58, Oct 20 high. A break of 150.46, Oct 16 high and the bull trigger would resume the uptrend.

EUROSTOXX50 TECHS: Bearish Focus

- RES 4: 3326.79 High Sep 18

- RES 3: 3305.77 High Oct 12 and the bull trigger

- RES 2: 3282.55 High Oct 19

- RES 1: 3236.09 20-day EMA

- PRICE: 3171.41 @ Close Oct 22

- SUP 1: 3135.48 Low Oct 22

- SUP 2: 3097.67 Low Sep 25 and the bear trigger

- SUP 3: 3054.11 Low June 15

- SUP 4: 3012.50 38.2% retracement of the Mar - Jul uptrend

A bearish EUROSTOXX 50 focus remains intact. The index traded lower yesterday before finding support. Recent weakness off 3305.77, Oct 12 high has reversed the recent Sep 25 - Oct 12 recovery. Support at 3147.28, Oct 2 low has been breached and attention turns to the primary support handle at 3097.67, Sep 25 low. A break would represent an important bearish development. Key near-term resistance is at 3282.55, Oct 19 high.

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.