-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI European Morning FI Analysis: Core FI Softens In Asia

US TSYS: T-Notes Look Through Recent Lows, Cash Closed for Vets Day

Antipodean matters dominated headline flow during the Asia-Pac session, weakness in that region's FI space perhaps pressured T-Notes during a thinner liquidity session, with cash Tsys closed (on the back of the Veterans Day holiday), as the contract traded below the lows seen in recent sessions, last -0-03+ at 137-10+, just off worst levels, on volume of ~125K (which jumped on the break through the recent lows).

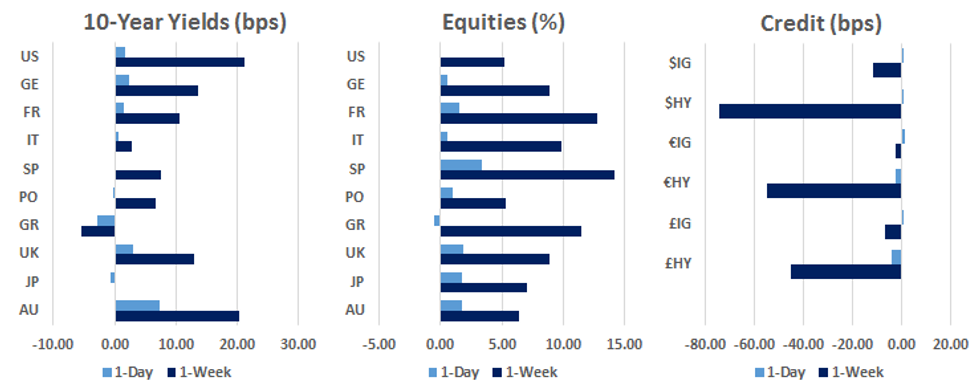

- The curve saw some light bear steepening on Tuesday, with 10s underperforming as issuance dynamics and continued optimism surrounding the COVID-19 vaccine developments were at the fore. Pricing of the latest round of 10-Year Tsy note issuance was firm enough, as the auction stopped through WI by 0.2bp, although the cover ratio was sub-par and the dealer takedown jumped. Tuesday's slew of Fedspeak generally added little new to the broader dynamic/discussion. On that front, Boston Federal Reserve President Eric Rosengren told MNI on Tuesday that he would prefer to see the Fed lengthen the average duration of its Treasuries purchases rather than increase buying, adding that more QE overall may be "advantageous" if longer rates rise amid a challenging next six months.

- Eurodollar futures run unchanged to 0.5 tick lower through the reds. J.P.Morgan issued a recommendation to sell 2.0K lots of EDZ0 at 99.760, given likely GSIB score dynamics in the wake of the recent equity market moves and current year-end turn pricing.

JGBS: Tight After Overnight Dip

JGB futures have held shy of Tuesday's settlement levels, trading either side of the overnight close thus far, -8 as we work towards the end of the Tokyo session, with the space a little more insulated than broader core FI markets.

- The cash space has seen some light richening, with marginal outperformance for 20s.

- The BoJ left the size of its 1-10 Year Rinban purchases unchanged, with little in the way of meaningful movement in offer to cover ratios:

- 1-3 Year: 2.62x (prev. 1.80x)

- 3-5 Year: 2.47x (prev. 2.42x)

- 5-10 Year: 2.34x (prev. 2.42x)

- Elsewhere, there was little news of note, outside of press reports pointing to an extension of the limit on gathering sizes in Japan.

AUSSIE BONDS: Longs Squeezed, RBNZ Adds To Pressure

Trans-Tasman matters, namely the RBNZ decision and communique (which saw an unwinding of OIS pricing re: negative rates in 2021), added fresh weight to a space that had been biased lower ahead of the RBNZ decision, squeezing already long positioning. YM -1.5, XM -7.5 come the close, with the latter threatening to break through the 1.00% implied yield level after a brief look through. A reminder that XM traders have used this price zone to build longs in recent times, but the already long positioning may limit such a dynamic this time around.

- Pre-RBNZ trade saw participants push the space lower after the RBA failed to step in with off schedule ACGB purchases to reinforce its 3-Year ACGB yield target on the latest uptick in yields, after it chose to do so earlier this week. The RBA did buy A$1.0bn of semis as scheduled.

- Elsewhere, the cover ratio seen at the latest ACGB Nov '31 auction was firm enough, nudging above 4.00x, although pricing wasn't as firm as some of the recent ACGB offerings, with the average yield stopping ~0.4bp through prevailing mids at the time of supply, per BBG pricing (the recent sell off in the space may have weighed on general bidding). Still, all in all, the auction was digested smoothly enough.

AUCTION/DEBT SUPPLY

BOJ: 1-10 Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y1.34tn of JGB's from the market, sizes unchanged from previous operations.

- Y500bn worth of JGBs with 1-3 Years until maturity

- Y420bn worth of JGBs with 3-5 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

AUSSIE BONDS: The AOFM sells A$2.5bn of the 1.00% 21 Nov '31 Bond, issue #TB163:

The Australian Office of Financial Management (AOFM) sells A$2.5bn of the 1.00% 21 November 2031 Bond, issue #TB163:- Average Yield: 1.0211% (prev. 0.8975%)

- High Yield: 1.0225% (prev. 0.9000%)

- Bid/Cover: 4.2628x (prev. 3.8560x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 74.5% (prev. 31.2%)

- bidders 54 (prev. 56), successful 21 (prev. 27), allocated in full 11 (prev. 18)

TECHS

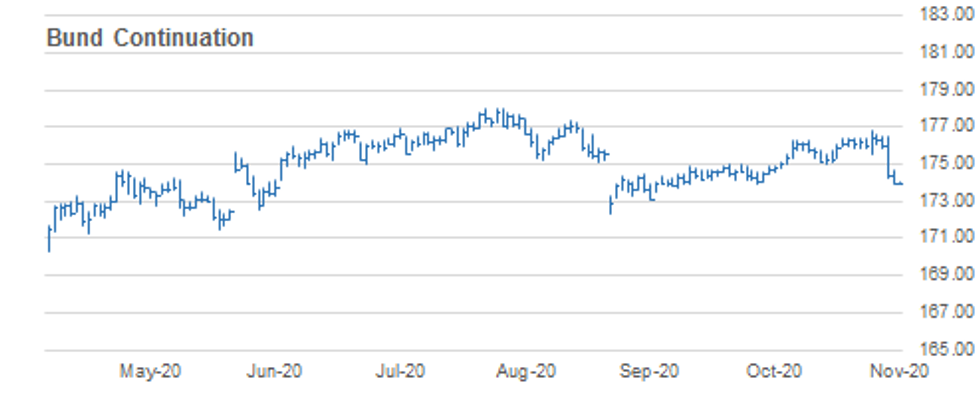

BUND TECHS: (Z0) Sharp Sell-Off Extends

- RES 4: 175.53 Low Nov 4

- RES 3: 175.45 Former trendline support drawn off the Sep 1 low

- RES 2: 175.00 Low Oct 23

- RES 1: 174.63 High Nov 10

- PRICE: 173.92 @ 04:58 GMT Nov 11

- SUP 1: 173.92 Intraday low

- SUP 2: 173.74 Low Sep 17

- SUP 3: 173.32 76.4% retracement of the Aug 28 - Nov 4 rally

- SUP 4: 173.06 Low Oct 9

Sharp losses dominated price action in Bunds Monday and futures extended the move lower yesterday. Weakness this week resulted in a break of trendline support drawn off the Sep 1 low signalling a reversal of the recent 2-month uptrend. The break of support at 175.00, Oct 23 low also reinforces the importance of yesterday's bearish pressure and has opened 173.74 next, Sep 7 low. Firm resistance is at 175.00.

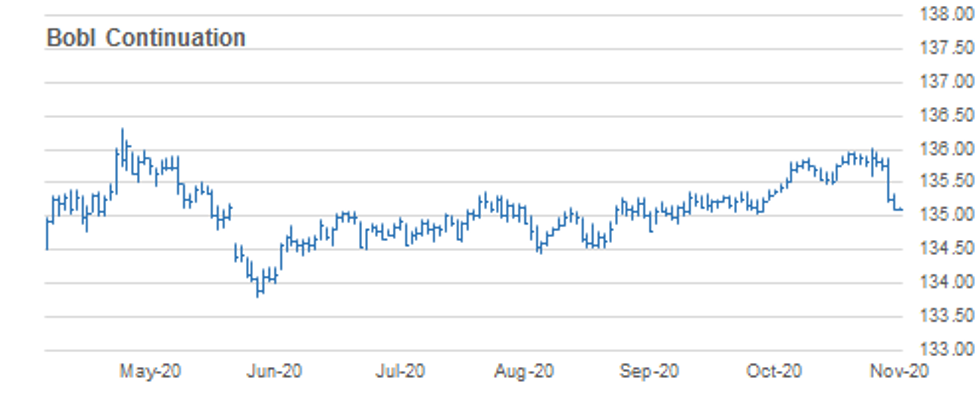

BOBL TECHS: (Z0) Sharp Reversal Weighs

- RES 4: 135.600 Low Nov 4

- RES 3: 134.470 Low Oct 23 and 26 and a recent breakout level

- RES 2: 135.434 Former trendline support drawn off the Sep 1 high

- RES 1: 135.320 High Nov 10

- PRICE: 135.090 @ 05:06 GMT Nov 11

- SUP 1: 135.080 Intraday low

- SUP 2: 135.030 Low Oct 7

- SUP 3: 134.945 76.4% retracement of the Sep 1 - Nov 4 rally

- SUP 4: 134.900 Low Sep 17

BOBL futures sold off sharply Monday and bearish price action extended yesterday. This week's move lower has resulted in a break of trendline support drawn off the Sep 1 low. Furthermore, futures also cleared 135.470, Oct 23 and 26 low, reinforcing the significance of Monday's move. The likely 2-month trend reversal that has occurred sets the scene for weakness towards 135.030 next, Oct 7 low. Initial resistance is at 135.320.

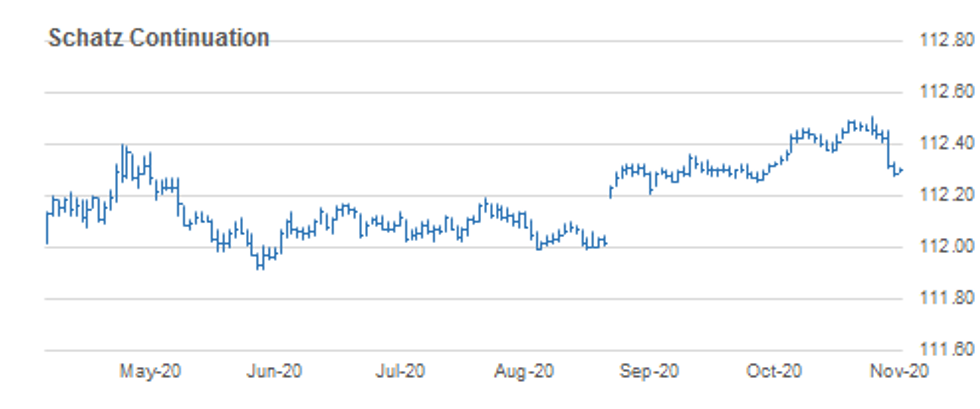

SCHATZ TECHS: (Z0) Bears In Control

- RES 4: 112.475 High Nov 5

- RES 3: 112.450 High Nov 9

- RES 2: 112.407 20-day EMA

- RES 1: 112.365 Low Oct 26 and a recent breakout level

- PRICE: 112.295 @ 05:02 GMT Nov 11

- SUP 1: 112.280 Low Nov 10

- SUP 2: 112.261 76.4% retracement of the Aug 26 - Nov 4 rally

- SUP 3: 112.250 Low Sep 17

- SUP 4: 112.210 Low Sep 10

Schatz futures sold off sharply Monday in a move that signals a potential trend reversal. The outlook remains bearish. The move lower this week resulted in a break of former support at 112.365, Oct 26 low reinforcing the significance of Monday's change in direction. This highlights potential for weakness towards 112.261 next, a Fibonacci retracement. On the upside, initial firm resistance is seen at 112.365.

GILT TECHS: (Z0) Bearish Theme Having Cleared Key Support

- RES 4: 135.97 High Nov 9

- RES 3: 135.34 Low Oct 27

- RES 2: 135.04 Low Oct 23 and a recent breakout level

- RES 1: 134.48 High Nov 10

- PRICE: 134.05 @ Close Nov 10

- SUP 1: 133.93 Low Nov 10

- SUP 2: 133.79 1.50 proj of Oct 16 - 23 sell-off from Nov 5 high

- SUP 3: 135.55 61.8% retracement of the Mar - May rally (cont)

- SUP 4: 133.29 1.76 proj of Oct 16 - 23 sell-off from Nov 5 high

Gilts sold off sharply Monday clearing a number of key support levels in the process. Most importantly, price traded through support at 135.04, low Oct 23 and through 134.32, Aug 28 low. The move lower confirms a resumption of the broader downleg that has been in place since early August. With futures lower again yesterday, the focus is on 133.79 next, A Fibonacci extension. On the upside, firm resistance is at 135.04.

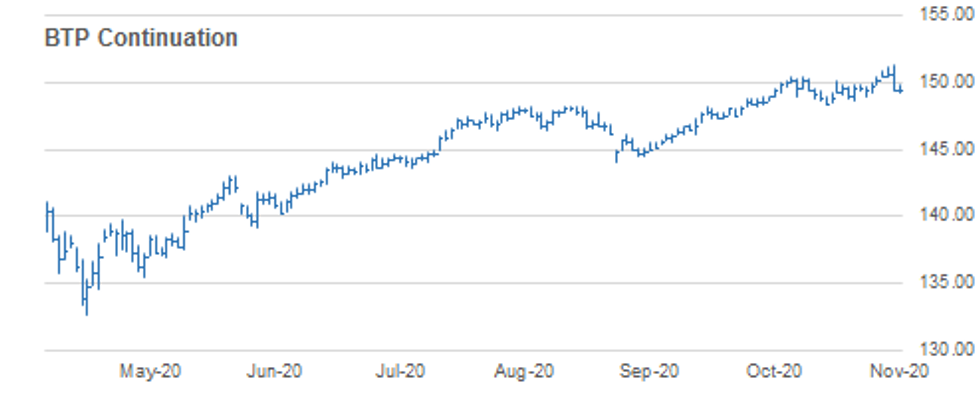

BTPS TECHS: (Z0) Corrective Cycle

- RES 4: 153.09 1.000 of Jun 10 - Aug 20 swing from Sep 9 low (cont)

- RES 3: 152.00 Round number resistance

- RES 2: 151.30 All Time High Nov 9

- RES 1: 150.36 Low Nov 5

- PRICE: 149.42 @ Close Nov 10

- SUP 1: 149.18 Low Nov 10

- SUP 2: 148.97 Low Nov 2

- SUP 3: 148.68 Low Oct 29

- SUP 4: 148.37 Low Oct 22 and key support

BTPS stalled at Monday's all-time high of 151.30 and has reversed sharply lower this week. The sell-off is a possible early signal that a long overdue correction may have started. If correct, this has opened the key near-term support handle at 148.37, Oct 22 low. A break of this level would signal scope for a deeper pullback. On the upside, gains above Monday's high of 151.30 is required to confirm a resumption of strength.

EUROSTOXX50 TECHS: Probes Key Resistance

- RES 4: 3630.53 0.618 proj of Mar 16 - Jul 21 rally from Oct 29 low

- RES 3: 3553.05 High Feb 27

- RES 2: 3498.07 76.4% retracement of the Feb - Mar sell-off

- RES 1: 3460.08 High Nov 9

- PRICE: 3442.62 @ Close Nov 10

- SUP 1: 3396.02 High Sep 3

- SUP 2: 3311.59 Former channel top drawn off the Jul 21 high

- SUP 3: 3305.77 High Oct 12

- SUP 4: 3217.40 Intraday low

EUROSTOXX 50 gains Monday and yesterday's follow through has resulted in a probe of the Jul 21 high of 3451.16 key resistance. Clearance of this resistance would confirm a resumption of the broader recovery since March The first objective would be 3498.07, the 76.4% retracement of the Feb - Mar sell-off. A move through this retracement would expose 3600.00 further out. 3396.02 is first support

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.