-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Morning FI Analysis: Issuance To The Fore

By Krzysztof Kruk & Anthony Barton

LONDON (MNI)

US TSYS: T-Notes edged lower overnight, with the contract last -0-06+ at 139-08+, as the curve steepens. The space took the lead from broader market

flows, as several strategists pointed to long 10-Year ACGB vs. short 10-Year U.S. Tsys expressions, which they believe will perform when the

pressure of today's ACGB issuance subsides.

- A reminder that T-Notes and 10-Year yields continue to respect their recent ranges, with the uptick in equity markets, COVID-19 vaccine optimism and soft 2- & 5-Year supply providing headwinds for the space as we moved through NY hours on Monday, leaving T-Notes at worst levels come the NY close, as the cash curve steepened. In terms of auction specifics, record low clearing yields and auction sizes saw tails of under 1.0bp vs. WI for both 2- & 5-Year supply, with cover ratios below recent avgs., while dealer takedown topped recent avgs.

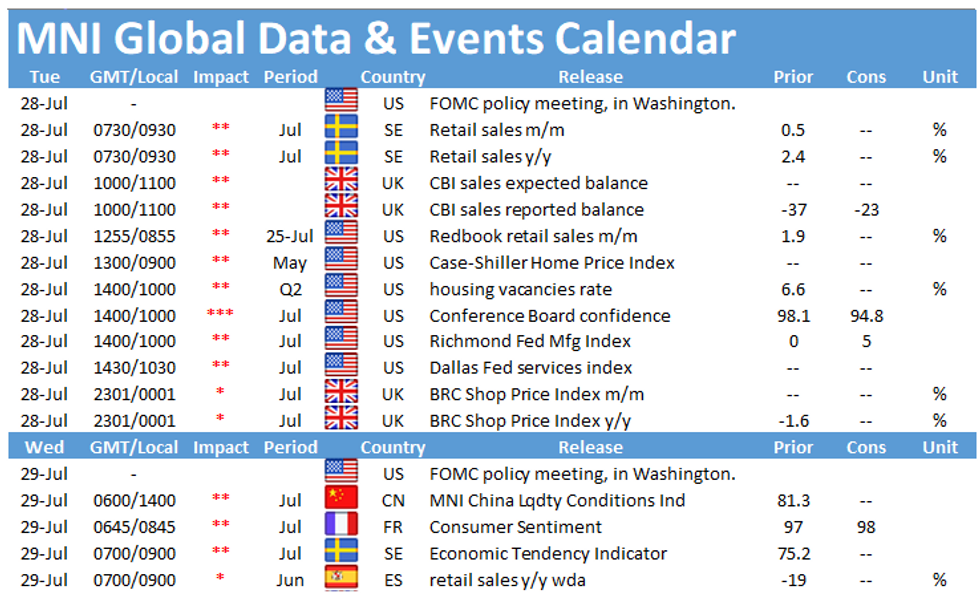

- 7-Year Note & 2-Year FRN issuance due today, as well as consumer confidence data.

JGBS: JGB futures -2 as we approach the bell, with the wings of the curve outperforming in cash throughout the day. Bonds drifted away from best

levels during the afternoon, with the latest round of 40-Year supply not particularly impressive, although the auction passed smoothly enough.

N.B. bonds richened ahead of supply, with specialness in repo suggesting a short base had formed.

- Elsewhere, reports have done the rounds pointing to the potential for increased Sino-Japan tensions surrounding Chinese developed phone apps, with a senior ranking ruling party member failing to play down the prospects of such a move in public remarks.

- 1-5 Year BoJ Rinban ops headline locally on Wednesday.

AUSSIE BONDS: ACGB steepening was evident surrounding the ACGB '51 syndication, as the bookbuild topped A$36.0bn and A$15.0bn priced at the tight end of

the guidance range. YM -1.5, XM -5.0, with little in the way of cushion evident as several strategists noted their interest/recommendations in

long 10-Year ACGB vs. short 10-Year U.S. Tsy expressions, which they believe will come to the fore as the impact of the auction wanes.

- Elsewhere, the latest round of ABS payrolls data showed another downtick for wages & the number of people employed, as the metrics

moved further away from their post-COVID peaks. This presents a particular source of worry with the knock-on effects of the Victoria

COVID-19 situation set to magnify in the coming weeks. - Q2 CPI headlines locally tomorrow, although statistical quirks and the impact of COVID-19 alongside the action already taken by the RBA

render it a little bit meaningless re: the policy discussion.

AUCTION/DEBT SUPPLY

BTPS: Italy plans to sell up to 2.75 billion euros of 1.85% bonds due Jul 1, 2025 in an auction on Jul 30.

- Italy plans to sell up to 3.25 billion euros of 1.65% bonds due Dec 1, 2030 in an auction on Jul 30.

- Italy plans to sell up to 1.25 billion euros of floating bonds due Apr 15, 2025 in an auction on Jul 30. (BBG)

JGBS AUCTION: The Japanese Ministry of Finance (MOF) sells Y499.7bn of 40-Year JGBs:

- High Yield: 0.575% (prev. 0.505%%)

- Low Price: 97.34 (prev. 99.82)

- % Allotted At High Yield: 3.4161% (prev. 93.4959%)

- Bid/Cover: 3.106x (prev. 3.058x)

TECHS

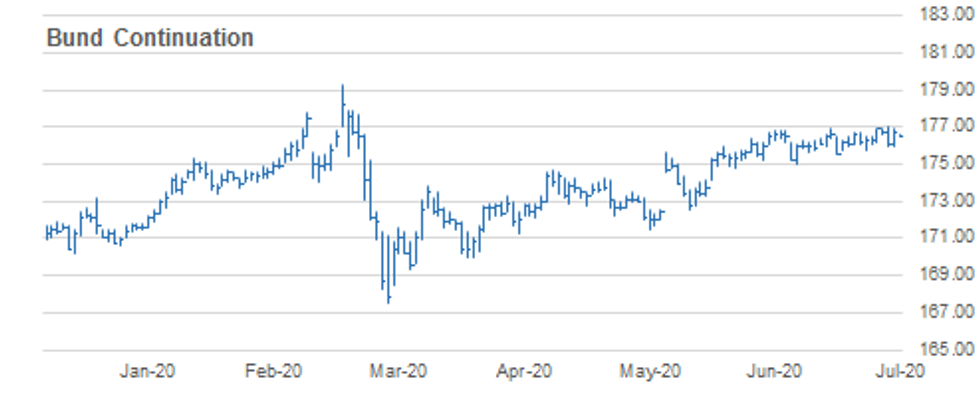

BUND TECHS: (U0) Holds Above Support

- RES 4: 177.52 High May 15

- RES 3: 177.35 High May 18

- RES 2: 177.00 Round number resistance

- RES 1: 176.98 High Jul 24

- PRICE: 176.50 @ 05:00 BST Jul 28

- SUP 1: 175.77/54 Low Jul 20 / Low Jul 9

- SUP 2: 175.04 Low Jul 2

- SUP 3: 174.80 Low Jun 17

- SUP 4: 174.74 50.0% retracement of the Jun 5 - Jul 10 rally

Bund futures yesterday retraced Friday's sell-off. The contract has remained above support at 176.54, Jul 20 low where a break would signal a reversal and expose 175.54, Jul 13 low and key support at 175.04. Jul 2 low. With support intact, a bullish theme dominates. A break of 176.98, Friday's high, would reinforce this theme and open 177.77, high Apr 30 and Jun 5.

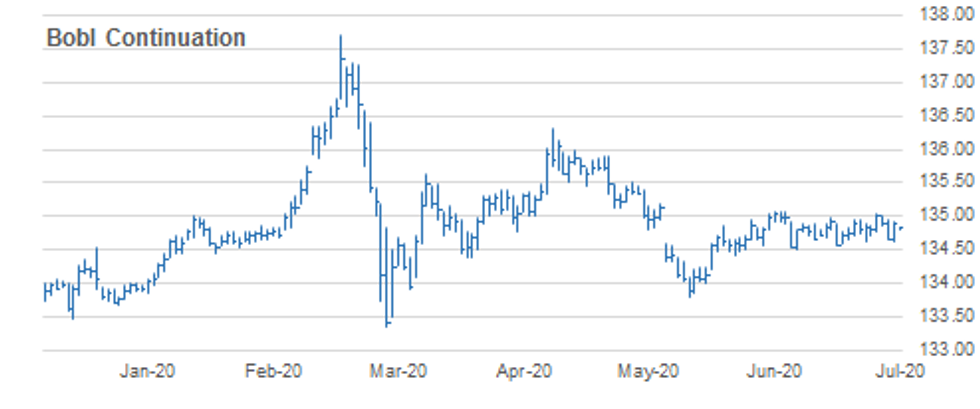

BOBL TECHS: (U0) Range Still Dominates

- RES 4: 135.150 50.0% retrace of the May 4 - Jun 10 decline (cont)

- RES 3: 135.080 High Jun 29 and the bull trigger

- RES 2: 135.040 High Jul 22

- RES 1: 134.950 High Jul 24

- PRICE: 134.820 @ 05:00 BST Jul 28

- SUP 1: 134.610/560 Low Jul 20 / Low Jul 13

- SUP 2: 134.510 Low Jul 2 and key support

- SUP 3: 134.435 50.0% retracement of the rally between Jun 5 - 29

- SUP 4: 134.410 Low Jun 17

Bobl futures stalled last week at 135.040, Jul 22 high. Although yesterday's rally retraced a large portion of the most recent move lower, the contract continues to trade sideways. This has created a range with the parameters defined by resistance at 135.080, Jun 29 high and support at 134.510, Jul 2 low. A break either side is required to highlight this market's near-term directional bias.

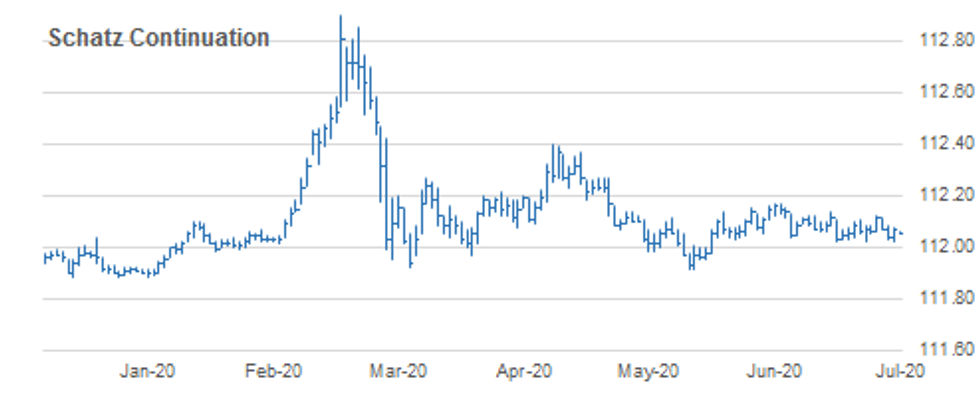

SCHATZ TECHS: (U0) Defines Support At 112.020

- RES 4: 112.180 High May 22

- RES 3: 112.170 High Jun 26 and key resistance

- RES 2: 112.135 High Jul 10 and near-term bull trigger

- RES 1: 112.120 High Jul 22

- PRICE: 112.050 @ 05:16 BST Jul 28

- SUP 1: 112.020 Low Jul 27

- SUP 2: 112.009 61.8% retracement of the rally between Jun 5 - 29

- SUP 3: 112.000 Round number support

- SUP 4: 111.975 Low Jun 11

Schatz futures edged lower yesterday. Support at 112.025, Jul 13 and 20 low was probed briefly before finding support. Yesterday's low of 112.020 for now, marks key near-term support. A clear downside break would risk a deeper sell-off and open 112.009, a Fibonacci retracement. On the upside, resistance is seen at 112.120, Jul 22 high where a break would open 112.135, Jul 10 high and key resistance at 112.170, Jun 26 high.

GILT TECHS: (U0) Monitoring Reversal Patterns

- RES 4: 139.70 Low Mar 3 (cont)

- RES 3: 139.05 High Mar 12 (cont)

- RES 2: 138.48 1.00 projection of Jun 19 - 25 rally from Jul 1 low

- RES 1: 138.46 High Jul 24 and the bull trigger

- PRICE: 138.34 @ Close Jul 27

- SUP 1: 137.82/79 Low Jul 24 / 20-day EMA

- SUP 2: 137.51 Low Jul 22

- SUP 3: 137.36 Low Jul 15

- SUP 4: 137.25 Low Jul 13 and key near-term support

Gilts futures traded higher last week however found resistance Friday at 138.46 resulting in a strong sell-off and a weak close. Japanese candle patterns allude to a potential top. A doji pattern Thursday and Friday's session, a bearish engulfing suggest bullish sentiment is waning. If correct, the risk is for weakness towards initial firm support at 137.51, Jul 20 low. A break of 138.46 negates the patterns and resumes the uptrend.

BTPS TECHS: (U0) Still Heading North

- RES 4: 148.97 High Feb 13 (cont)

- RES 3: 148.32 High Mar 4 (cont)

- RES 2: 147.43 High Mar 5 (cont)

- RES 1: 147.39 High Jul 27

- PRICE: 147.18 @ Close Jul 27

- SUP 1: 145.62 Low Jul 21 and key near-term support

- SUP 2: 145.06 20-day EMA

- SUP 3: 144.92 Low Jul 20

- SUP 4: 143.61 Low Jul 13 and key near-term support

BTPS futures edged higher again yesterday, maintaining the current uptrend that has been in place since late April. The bullish price sequence of higher highs and higher lows that defines an uptrend remains clearly intact. Furthermore, MA and momentum studies are in a bullish position although it is worth noting that the trend condition is overbought. Attention is on 148.32 next. Initial firm support is 145.62.

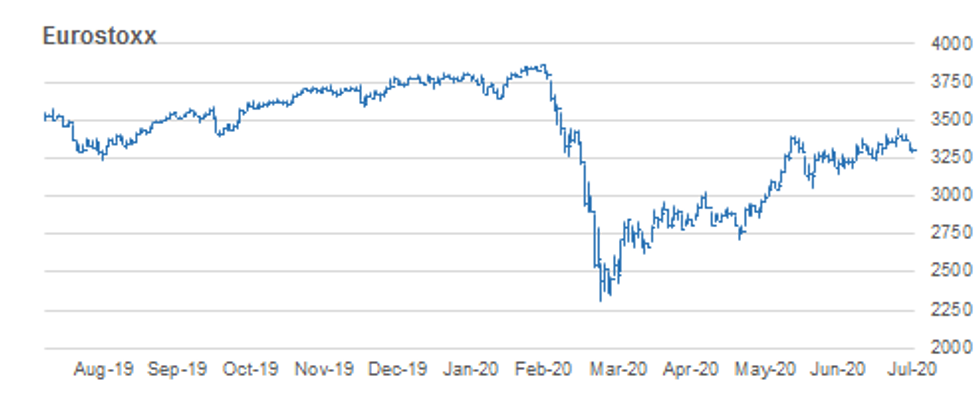

EUROSTOXX 50 TECHS: Trading At Recent Lows

- RES 4: 3553.05 High Feb 27

- RES 3: 3498.07 76.4% retracement of the Feb - Mar sell-off

- RES 2: 3451.16 High Jul 21 and the bull trigger

- RES 1: 3349.54 High Jul 24

- PRICE: 3302.84 @ Close Jul 27

- SUP 1: 3277.40 Low Jul 14

- SUP 2: 3241.29 Low Jul 10

- SUP 3: 3234.96 50-day EMA

- SUP 4: 3231.90 Bull channel base drawn off the Mar 16 low

EUROSTOXX 50 is trading at recent lows following last week's rejection off 3451.16 on Jul 21. The recent move lower has exposed 3241.29, Jul 10 low where a break would further undermine the recent bull run and expose the bull channel support drawn off the Mar 16 low. The line intersects at 3231.90. A break of the channel support would highlight a broader reversal. The key trigger for a resumption of gains is 3451.16.

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.