-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI European Morning FI Analysis: Nobody Knows

US TSYS: Hours, Days Or Weeks?

U.S. Tsys recovered from early Asia lows, after early dealing focused on the perception surrounding the likelihood of a Biden victory in the White House, before a relatively strong showing from Trump across the early battleground states saw betting market pricing move in his favour. Still, a likely victory for Biden in Arizona, coupled with longer running counts across several key states has markets looking at the prospect of a drawn-out election process lasting days, if not weeks, while Biden re-narrowed vs. Trump in the betting markets. The chances of a blue wave have also diminished after the GOP held on to several key Senate seats. Focus moves to an incoming statement from Trump after he tweeted "We are up BIG, but they are trying to STEAL the Election. We will never let them do it. Votes cannot be cast after the polls are closed!" Generating further worry re: the prospects of a contested election. The NASDAQ outperformed among e-minis on the prospect of a lower regulatory burden if Trump prevails (when compared to Biden).

- T-Notes +0-19+ at 138-22+, with 20s leading on the cash curve, last sitting ~9.5bp richer on the day.

- Flow wise, we saw a FV/TH flattener blocked, in addition to a 12.0K block roll of a long position in the TYZ0 138.00 puts into the TYF1 137.00 puts.

- Eurodollar futures are +0.5 to +2.5 through the reds, with the strip bull flattening. Flow here was dominated by the selling of the 3EX0 99.50/99.375 put spread, with ~30K given through the session, across screen and block trade.

JGBS: Holiday Gap Closed, JGBs Firm

A strong 10-Year JGB auction added to the upward impetus drawn from U.S. Tsys, with the auction tail holding narrow, cover ratio above 4.0X and low price topping dealer estimates as proxied by the BBG poll.

- Futures +13 vs. Monday's settlement ahead of the Tokyo close, with the contract recouping the holiday catch up losses seen in early dealing, and more. The belly of the cash JGB curve has outperformed on the move in futures.

- Rhetoric from BoJ governor Kuroda failed to add anything fresh to the monetary policy discussion, as he focused on the need for the smooth functioning of FX markets and repeated well-trodden rhetoric surrounding the matter.

- Elsewhere, Finance Minister Aso seemed fairly non-committal re: the potential details of any fresh stimulus package, as he reiterated the government's desire to act in a "firm" manner.

- BoJ Rinban ops covering 1-5 & 25+ Year JGBs headline locally on Thursday.

AUSSIE BONDS: Off Lows

The ebbs and flows in the U.S. election saw futures correct a chunk of their SYCOM losses, with YM settling -1.0 and XM -2.0, with the cash curve steepening (but off extremes) as swaps tightened after yesterday's post-RBA swap spread widening.

- AU 10s widened vs. US 10s on the latest rally.

- Bills finished unchanged through the reds, with a fresh all-time low 3-Month BBSW fix.

- Markets looked through the marginally stronger than exp. retail sales data and ABS payroll data which revealed that "between the week ending 3 October 2020 and the week ending 17 October 2020: payroll jobs decreased by 0.8%, compared to a decrease of 0.9% in the previous fortnight" and "total wages paid decreased by 2.1%, compared to a decrease of 3.1% in the previous fortnight." Over a longer horizon, "between the week ending 14 March and the week ending 17 October 2020: payroll jobs decreased by 4.4%" and "total wages decreased by 5.1%."

- Local trade balance data is due tomorrow. Elsewhere, Thursday will also see the RBA's newly adopted form of QE deployed for the first time.

AUCTION/DEBT SUPPLY

JGBS AUCTION: Japanese MOF sells Y2.099tn 10-Year JGBs:

- Average Yield 0.046% (prev. 0.024%)

- Average Price 100.53 (prev.100.753)

- High Yield: 0.047% (prev.0.025%)

- Low Price 100.52 (prev.100.740)

- % Allotted At High Yield: 73.1880% (prev. 51.3823%)

- Bid/Cover: 4.125x (prev. 4.063x)

TECHS

BUND TECHS: (Z0) Rallies Off The Day Low

- RES 4: 177.00 Round number resistance

- RES 3: 176.89 1.764 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 2: 176.57 1.618 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 1: 176.53 Intraday high

- PRICE: 176.41 @ 04:52 GMT Nov 4

- SUP 1: 175.53 Intraday low

- SUP 2: 175.27 Low Oct 27

- SUP 3: 175.15 Trendline support drawn off the Sep 1 low

- SUP 4: 175.00 Low Oct 23 and a key support

Bunds are volatile but have rallied sharply higher off today's low printing a fresh high at 176.53. A bullish tone remains in place following last week's climb. Futures traded above the key resistance at 176.29, Oct 16 high confirming a resumption of the underlying uptrend that opens 176.57 next, a Fibonacci projection. Moving average studies are positive reinforcing current conditions. Initial support lies at 175.53, today's intraday low.

BOBL TECHS: (Z0) Bullish Focus

- RES 4: 136.14 High May 5 (cont)

- RES 3: 136.060 2.000 proj of Sep 1 - Sep 9 rally from Sep 10 low

- RES 2: 136.000 Round number resistance

- RES 1: 135.960 High Oct 29 and the bull trigger

- PRICE: 135.900 @ 05:01 GMT Nov 4

- SUP 1: 135.600 Intraday low

- SUP 2: 135.530 Low Oct 27

- SUP 3: 135.470 Low Oct 23 and 26

- SUP 4: 135.400 50-day EMA

SCHATZ TECHS: (Z0) Needle Still Points North

- RES 4: 112.543 2.382 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 3: 112.523 2.236 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 2: 112.505 61.8% retracement of the Mar - Jun sell-off (cont)

- RES 1: 112.495 High Oct 29

- PRICE: 112.475 @ 04:46 GMT Nov 4

- SUP 1: 112.440 Intraday low

- SUP 2: 112.425 Low Oct 27

- SUP 3: 112.407 20-day EMA

- SUP 4: 112.365 Low Oct 26 and key near-term support

Schatz futures remain bullish. The contract traded higher last week, resulting in a convincing break of key resistance at 112.460, Oct 19 /20 and 28 high. The break confirms a resumption of the underlying uptrend paving the way for strength towards 112.505, a Fibonacci retracement and 112.523, a Fibonacci projection. Key trend support has been defined at 112.365, Oct 26 low where a break would reverse the direction. Initial support lies at 112.440.

GILT TECHS: (Z0) Choppy But Holds Above Support

- RES 4: 136.97 High Oct 16 and the bull trigger

- RES 3: 136.38 Low Oct 20 and a gap high on the daily chart

- RES 2: 136.37 High Oct 29

- RES 1: 136.19 High Nov 2

- PRICE: 135.49 @ Close Nov 3

- SUP 1: 135.41 Low Nov 3

- SUP 2: 135.34 Low Oct 27

- SUP 3: 135.04 Low Oct 23 and the near-term bear trigger

- SUP 4: 134.99 1.00 proj of Sep 21 - Oct 7 downleg from Oct 16 high

Gilts have been choppy this week. Futures traded sharply lower yesterday however key near-term support at 135.34, Oct 27 low remains intact. A bullish focus dominates while price holds above support at 135.34. A rebound would refocus attention on 136.38, Oct 20 low where a print would fill a gap in the chart. This would also expose key resistance at 136.97, Oct 16 high. Sub 135.34 levels would expose the key support at 135.04, Oct 23 low.

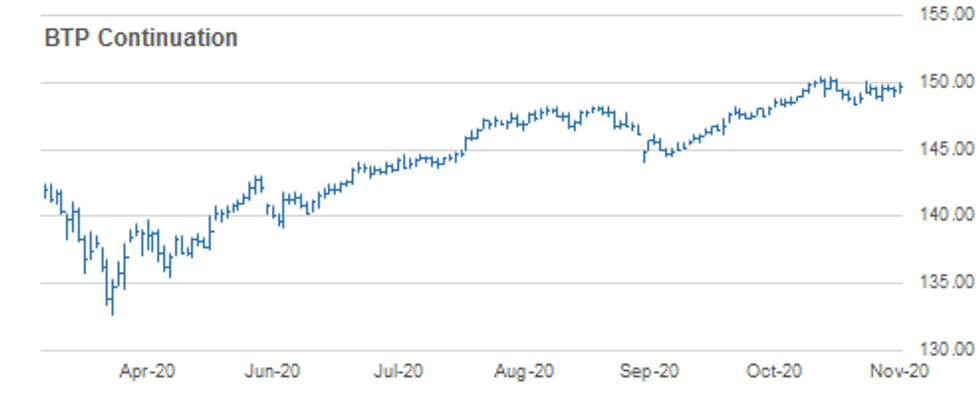

BTPS TECHS: (Z0) Corrective Phase

- RES 4: 152.00 Round number resistance

- RES 3: 151.17 0.764 of Jun 10 - Aug 20 swing from Sep 9 low (cont)

- RES 2: 150.46 High Oct 16 and the bull trigger

- RES 1: 150.12 Oct 26 high

- PRICE: 149.80 @ Close Nov 3

- SUP 1: 148.68 Low Oct 29

- SUP 2: 148.37 Low Oct 22 and key near-term support

- SUP 3: 148.03 38.2% retracement of the Sep 1 - Oct 16 rally

- SUP 4: 147.83 50-day EMA

BTPS outlook remains bullish however futures remain in a corrective cycle and below recent highs. This is allowing a recent overbought condition to unwind. Key short-term support has been defined at 148.37, Oct 22 low. A break of this level would signal scope for a deeper pullback, potentially towards 148.03, a Fibonacci retracement. Key resistance and the bull trigger is at 150.46, Oct 16 high. A break resumes the uptrend and opens 151.17.

EUROSTOXX50 TECHS: Extends This Week's Gains

- RES 4: 3282.55 High Oct 19

- RES 3: 3217.96 High Oct 23 and the near term key resistance

- RES 2: 3190.18 50-day EMA

- RES 1: 3124.90 20-day EMA

- PRICE: 3098.72 @ Close Nov 3

- SUP 1: 3030.89 Low Nov 3

- SUP 2: 2920.87 Low Oct 29

- SUP 3: 2912.96 Low May 25

- SUP 4: 2877.00 50.0% retracement of the Mar - Jul uptrend

The EUROSTOXX 50 near-term outlook has improved following this week's gains. A key resistance zone however is located between 3124.90 and 3190.18, the 20- and 50-day EMAs. A clear breach of this zone is required to strengthen bullish conditions and suggest scope for a stronger rally. A return lower however would refocus attention on the key support at 2920.87, Oct 29 low where a break would resume recent bearish pressure.

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.