-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Morning FI Analysis: Tsys Tight With Japan Out, ACGBs Steal Limelight As RBA Eases

US TSYS: Red Or Blue?

T-Notes -0-01+ at 138-08, with the contract happy to stick to a 0-03 range in Asia-Pac hours, ahead of the well-documented round of local event risk, with the lower liquidity backdrop owing to the Japanese holiday and ensuing cash Tsy market closure (until London hours) also limiting activity. The contract drifted to lows into European hours, with e-minis higher vs. settlement, but someway shy of best levels.

- A reminder that pre-election caution allowed Tsys to trade on the front foot on Monday, although stronger than expected ISM m'fing data helped cap the rally, before the move higher in equities and crude oil saw the space back from best levels of the day. Still the curve flattened as 30s richened by over 4.0bp come the closing bell.

- Eurodollar futures sit unchanged to +0.5 through the reds, with a 4.0K screen buyer of the 3EH1 99.375/99.250 put spread seen overnight.

- The U.S. election headlines the local risk docket today. Focus remains centred on the battleground states. There has been little in the way of meaningful movement re: 'Blue Sweep' pricing in the betting markets (please see our election preview pieces for further colour on the matter), which hovers around a coin toss probability, while Biden remains the clear front runner to take the White House (per betting market and opinion polls)

AUSSIE BONDS: RBA Places Chips On Cup Day

Aussie swaps have widened vs. the ACGB space on the back of the RBA decision, with the more aggressive than consensus 5-10 Year bond purchase horizon (6 months vs. 12-month consensus) frontloading the RBA's purer take on QE, alongside an in line with consensus purchase war chest of A$100bn, forward guidance tweak pointing to lower for longer settings at the RBA (after the expected 15bp cuts to the cash rate target, 3-Year ACGB yield target and rate applied to the TFF facility) and openness to doing more, if required, at the fore (Governor Lowe's press conference highlighted that any further easing would likely focus on the bond side of the equation, as opposed to interest rates, with the Bank still against the idea of -ve rates).

- YM +2.0 and XM +5.0 at the Sydney close, as the latter finished shy of reaction highs, and the curve settled curve flatter vs. pre-decision levels.

- Bills also firmed & closed 2-3 ticks higher through the reds. The IRH1 contract printed as high as 100.01, i.e. in negative BBSW territory. This was aided by the interest rate being paid on E/S surplus balances lodged at the RBA being set at 0.00% (given the recent relationship between this rate and BBSW fixings), which only a few pointed to as their base case ahead of the decision (most looked for 0.01% or 0.05%). A reminder that RBA Assistant Governor Kent recently noted that it wouldn't be surprising to see the BBSW fixing slip into negative territory.

TECHS

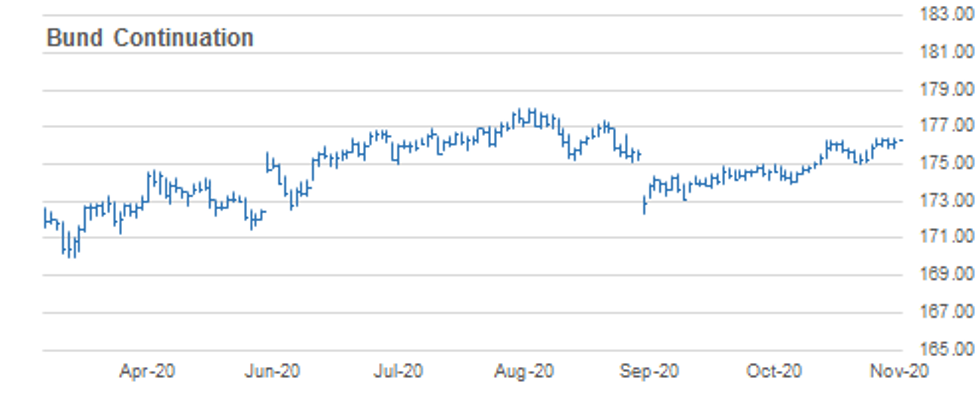

BUND TECHS: (Z0) Bullish Conditions Remain Intact

- RES 4: 177.00 Round number resistance

- RES 3: 176.89 1.764 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 2: 176.57 1.618 proj of Aug 28 - Sep 9 rally from the Sep 10 low

- RES 1: 176.44 High Oct 29 and the bull trigger

- PRICE: 176.34 @ 04:54 GMT Nov 3

- SUP 1: 175.90 Low Oct 30 and Nov 2

- SUP 2: 175.53 20-day EMA

- SUP 3: 175.27 Low Oct 27

- SUP 4: 175.08 Trendline support drawn off the Sep 1 low

Bunds rebounded off yesterday's intraday low and are holding onto recent gains with a positive tone maintained following last week's climb. Futures last week traded above the key resistance at 176.29, Oct 16 high confirming a resumption of the underlying uptrend that opens 176.57 next, a Fibonacci projection. Moving average studies maintain a positive structure reinforcing current conditions. Initial support lies at 175.90, Oct 30 and Nov 2 low.

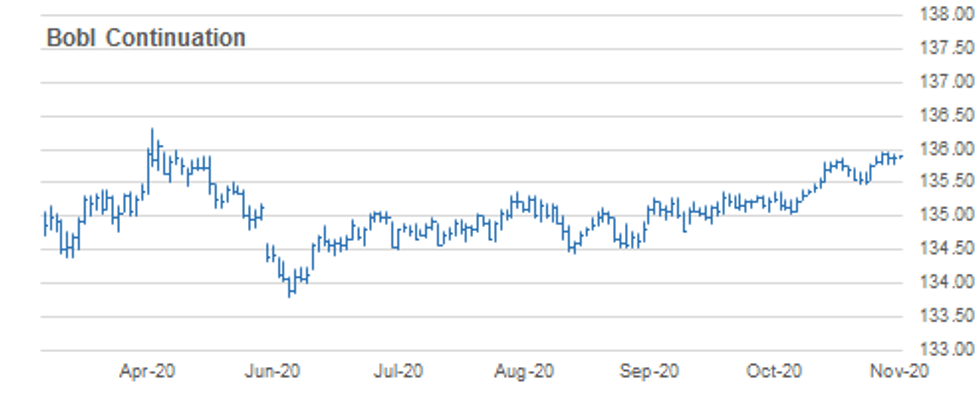

BOBL TECHS: (Z0) Holding Onto Recent Gains

- RES 4: 136.14 High May 5 (cont)

- RES 3: 136.060 2.000 proj of Sep 1 - Sep 9 rally from Sep 10 low

- RES 2: 136.000 Round number resistance

- RES 1: 135.960 High Oct 29 and the bull trigger

- PRICE: 135.910 @ 04:36 GMT Nov 3

- SUP 1: 135.770 Low Oct 28

- SUP 2: 135.623 20-day EMA

- SUP 3: 135.530 Low Oct 27

- SUP 4: 135.470 Low Oct 23 and 26

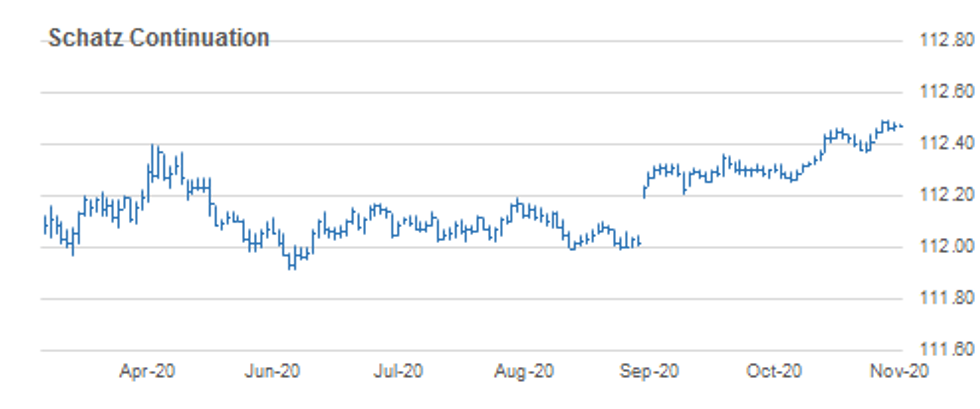

SCHATZ TECHS: (Z0) Heading North

- RES 4: 112.543 2.382 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 3: 112.523 2.236 proj of Aug 26 - Sep 9 rally from the Sep 10 low

- RES 2: 112.505 61.8% retracement of the Mar - Jun sell-off (cont)

- RES 1: 112.495 High Oct 29

- PRICE: 112.480 @ 05:09 GMT Nov 3

- SUP 1: 112.445 Low Oct 29

- SUP 2: 112.425 Low Oct 27

- SUP 3: 112.402 20-day EMA

- SUP 4: 112.365 Low Oct 26 and key near-term support

Schatz futures remain bullish. The contract traded higher last week, resulting in a convincing break of key resistance at 112.460, Oct 19 /20 and 28 high. The break confirms a resumption of the underlying uptrend paving the way for strength towards 112.505, a Fibonacci retracement and 112.523, a Fibonacci projection. Key trend support has been defined at 112.365, Oct 26 low where a break would reverse the direction. Initial support lies at 112.445.

GILT TECHS: (Z0) Rebound Reinstates Bullish Focus

- RES 4: 136.97 High Oct 16 and the bull trigger

- RES 3: 136.38 Low Oct 20 and a gap high on the daily chart

- RES 2: 136.37 High Oct 29

- RES 1: 136.19 High Nov 2

- PRICE: 136.07 @ Close Nov 2

- SUP 1: 135.50 Low Nov 2

- SUP 2: 135.34 Low Oct 27

- SUP 3: 135.04 Low Oct 23 and the near-term bear trigger

- SUP 4: 134.99 1.00 proj of Sep 21 - Oct 7 downleg from Oct 16 high

Strong gains last week were somewhat neutralised Friday following a sharp pullback. However yesterday's gains have reinstated a bullish focus and futures have held above support at 135.34, Oct 27 low. Attention is on 136.38, Oct 20 low where a print would fill a gap in the chart. This would also expose key resistance at 136.97, Oct 16 high. On the downside, sub 135.50/34 levels would instead expose the key support at 135.04, Oct 23 low.

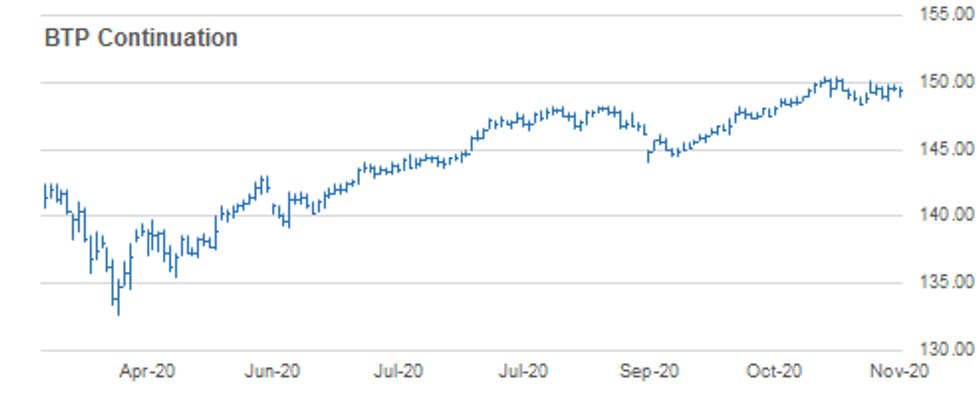

BTPS TECHS: (Z0) Corrective Phase

- RES 4: 152.00 Round number resistance

- RES 3: 151.17 0.764 of Jun 10 - Aug 20 swing from Sep 9 low (cont)

- RES 2: 150.46 High Oct 16 and the bull trigger

- RES 1: 150.12 Oct 26 high

- PRICE: 149.50 @ Close Nov 2

- SUP 1: 148.68 Low Oct 29

- SUP 2: 148.37 Low Oct 22 and key near-term support

- SUP 3: 148.03 38.2% retracement of the Sep 1 - Oct 16 rally

- SUP 4: 147.75 50-day EMA

BTPS outlook is bullish however futures remain in a corrective cycle and below recent highs. This is allowing a recent overbought condition to unwind. Key short-term support has been defined at 148.37, Oct 22 low. A break of this level would signal scope for a deeper pullback, potentially towards 148.03, a Fibonacci retracement. Key resistance and the bull trigger is at 150.46, Oct 16 high.

EUROSTOXX50 TECHS: Corrective Bounce

- RES 4: 3217.96 High Oct 23 and the near term key resistance

- RES 3: 3193.91 50-day EMA

- RES 2: 3135.48 Low Oct 22

- RES 1: 3058.86 High Oct 28

- PRICE: 3091.54 @ Close Nov 2

- SUP 1: 2920.87 Low Oct 29

- SUP 2: 2912.96 Low May 25

- SUP 3: 2877.00 50.0% retracement of the Mar - Jul uptrend

- SUP 4: 2854.07 Low May 22

Despite yesterday's gains, the EUROSTOXX 50 outlook remains bearish following last week's sell-off. The index cleared a key support on Oct 28 at 3064.10, the base of a bear channel drawn off the Jul 21 low. This followed a breach on Oct 27 of key support at 3097.67, Sep 25 low. The focus is on 2877.00 next, 50% retracement of the Mar - Jul rally. Initial resistance is at 3058.86, Oct 28 high and just above the former channel base.

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.