-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Sobering CPI, But Wait for Thursday's PPI

MNI BRIEF: US Budget Deficit Widens To Record $840B Thru Jan

MNI European Open: Precious Metals In The Driving Seat

By Krzysztof Kruk & Anthony Barton

LONDON (MNI)

EXECUTIVE SUMMARY

- LEADING DEMOCRATS DEMAND MORE FROM GOP FISCAL PLAN

- NEW ZEALAND SUSPENDS HONG KONG EXTRADITION TREATY, CITING CHINA LAW (BBG)

- PRECIOUS METALS COMPLEX DRIVES BROADER MARKET GYRATIONS OVERNIGHT

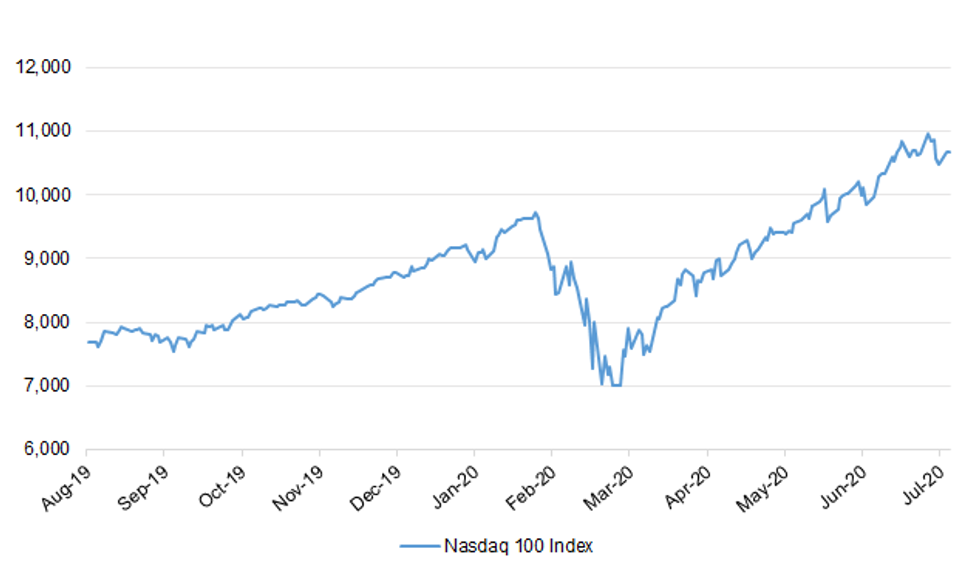

Fig. 1: Nasdaq 100 Index

MNI - Market News/Bloomberg

MNI - Market News/Bloomberg

UK

CORONAVIRUS: Quarantine for people arriving from Spain and other countries with high levels of Covid-19 will be cut to 10 days under plans being finalised by ministers, The Telegraph has learnt. (Telegraph)

CORONAVIRUS: Travel bosses are pleading for ministers to exempt top destinations such as Majorca and Ibiza from a new Spanish quarantine as it wreaked havoc across the industry on the first day of the summer holidays. Some £1.4bn was wiped off the value of listed airlines and holiday firms after passengers landing in the UK from Spain were told they must self-isolate for two weeks due to a surge of infections. (Telegraph)

FISCAL: The days of "seven-year delays" for government projects are over, Steve Barclay will pledge on Tuesday as he unveils a "radical" new Treasury approach. (Telegraph)

ECONOMY: Sales at pubs, restaurants and hotels across the UK plunged by £30bn during lockdown, according to the hospitality sector. UK Hospitality said that revenues plummeted by 87% between April and June, compared to the same period last year. Boss Kate Nicholls said it shows many firms still need government support. The trade body says sales for the three-month period came to £4.6bn, £29.6bn lower than in 2019. Last year the hospitality industry contributed £38bn in tax receipts, a figure that will be substantially lower for 2020. (BBC)

BREXIT: Leading members of the UK government are pushing for a minimal, light-touch regime for state aid for British business after Brexit — a stumbling block for talks between London and Brussels over an EU-UK trade deal. Influential Brexiters led by Dominic Cummings, the prime minister's most senior adviser, are arguing against any legislation that would see the UK's internal market subsidy regime between England, Scotland and Wales governed by an independent regulator. The light-touch regulatory approach would be opposed strongly by Brussels, with the EU's chief Brexit negotiator Michel Barnier saying last week there could be no future economic partnership without "robust guarantees" on a level playing field for future trade — including on state aid. (FT)

THE CITY: Four out of five global investors are continuing to put money into or are planning new moves in London after the pandemic has subsided. A poll of 506 investors with combined assets under management of $1 trillion found they remained confident about investing in London, despite the severity of the economic and public health crisis caused by Covid-19. (The Times)

HOUSING: House prices in the U.K. are set to grow by as much as 3% for the rest of this year, driven by a sales-tax break and resurgent demand following the coronavirus lockdown. Prices grew by 2.7% in June from a year earlier, the fastest pace in nearly two years, according to a report from property portal Zoopla Ltd. The staggered opening of housing markets across the U.K. and the boost from the temporary tax relief will help buoy prices in the coming months, and any declines are more likely in the first half of 2021. Zoopla previously forecast price growth to cool toward the end of this year. (BBG)

HOUSING: UK ministers are drawing up plans to extend the Help to Buy property support scheme beyond its December deadline to prevent buyers losing out due to Covid-19 delays. The government is set to prolong the Help to Buy Equity Loan programme, which allows people in England to buy a new-build property with a tiny deposit, to protect several thousand people whose purchases have been delayed by the coronavirus pandemic. Introduced in 2013, the initiative helps people buy a home with a deposit of as little as 5 per cent of the property's total value, with the government providing a further 20 per cent equity loan, or up to 40 per cent in London. The scheme accounts for a large proportion of sales by housebuilders, and has helped more than 272,000 households buy a home since it was set up seven years ago. (FT)

EUROPE

CORONAVIRUS: External borders shut to travelers from most countries including the U.S. for at least two more weeks amid spikes in coronavirus cases, according to two officials familiar with the matter. The EU is leaning toward shortening a list of 13 states -- Canada, China, Japan and South Korea among them -- whose residents have the green light to visit the bloc, the officials said. They spoke on the condition of anonymity because deliberations on Monday among experts were confidential. The EU's travel "white" list also includes Algeria, Australia, Georgia, Morocco, New Zealand, Rwanda, Thailand, Tunisia and Uruguay. (BBG)

GERMANY: German officials are stepping up calls for people to stick to containment efforts after an outbreak among migrant workers at a farm in Bavaria provided the latest warning that the coronavirus pandemic is far from over. Germany plans to make testing, rather than self-isolation, mandatory for travelers returning from high-risk areas as Europe's biggest economy seeks to limit the number of infections being brought back from vacation. "Rising infection numbers are reason for concern," Helge Braun, Chancellor Angela Merkel's chief of staff, told reporters in Berlin. (BBG)

ITALY/BTPS: Italy plans to sell up to 2.75 billion euros of 1.85% bonds due Jul 1, 2025 in an auction on Jul 30.

- Italy plans to sell up to 3.25 billion euros of 1.65% bonds due Dec 1, 2030 in an auction on Jul 30.

- Italy plans to sell up to 1.25 billion euros of floating bonds due Apr 15, 2025 in an auction on Jul 30. (BBG)

SPAIN: Britain's decision to slap a quarantine on people travelling from Spain was unfair, Spanish Prime Minister Pedro Sanchez said on Monday, adding that the Spanish government was in touch with the British government to try and make it change its mind. Sanchez said the "error" was for London to have considered the rate of coronavirus infection in Spain as a whole, when most regions had a lower rate than Britain's. (RTRS)

GREECE: Greece is poised to ban scores of traditional August festivals around the country because of fears that overcrowding in village streets and squares could cause a rapid upsurge in coronavirus cases. The festivals, featuring local folk music and all-night dancing, are popular with tourists but could become hotspots for the virus to spread, Nikos Hardalias, the deputy minister for citizens' protection, warned at the weekend. (FT)

PORTUGAL: Portugal says Jan.-June budget deficit was EU6.78b, widening by EU6.12b from the same period of 2019, Finance Ministry says in an emailed statement. Budget figures reflect effects of the pandemic and of measures implemented to face the outbreak. (BBG)

BELGIUM: Belgium's prime minister put the brakes on the country's coronavirus exit plan Monday with a set of drastic social distancing measures aimed at avoiding a new general lockdown as local authorities in the province of Antwerp imposed a curfew amid a surge of COVID-19 infections. Speaking after an urgent meeting of the national security council, Prime Minister Sophie Wilmes said that from next Wednesday contacts outside every household will be limited to the same five people over the next four weeks, as the so-called "social bubble" now applies to a house and its occupants and not to individuals. Belgian residents are currently allowed to meet with 15 different people per week. (Associated Press)

US

FED: Sen. Susan Collins (Maine) said Monday that she will vote against Judy Shelton's Federal Reserve Board nomination, becoming the second Republican senator to oppose President Trump's controversial nominee. "I have serious concerns about this nomination. In her past statements, Ms. Shelton has openly called for the Federal Reserve to be less independent of the political branches, and has even questioned the need for a central bank," Collins said in a statement. "This is not the right signal to send, particularly in the midst of the pandemic, and for that reason, I intend to vote against her nomination if it reaches the floor," she added. (The Hill)

FISCAL: Millions more U.S. jobs will be lost in coming months if a federal relief package fails to support struggling households and businesses, labor market experts told MNI. For full story please click here - for more details please contact sale@marketnews.com (MNI)

FISCAL: Senate Majority Leader Mitch McConnell unveiled the Republican coronavirus relief plan on Monday as Congress scrambles to respond to a pandemic still wreaking havoc across the country. The GOP outlined its plan after states stopped paying out the $600 per week enhanced federal unemployment benefit and a federal eviction moratorium expired. Senate GOP leaders want their proposal to serve as a starting point in talks with Democrats on a bill that could pass both chambers of Congress. McConnell, a Kentucky Republican, said the legislation would include relief for jobless Americans, another direct payment to individuals of up $1,200, more Paycheck Protection Program small business loan funds and liability protections for doctors and businesses, among other provisions. While the Senate GOP leader did not specify how the party would construct the unemployment benefit, reports Monday indicated the party aims to set the enhanced insurance at 70% of a worker's previous wages, and set the sum at an additional $200 per week while states figure out how to implement the new policy — a third of what individuals received previously. States have worried about their ability to quickly figure out a policy change as Americans wait on unemployment insurance. (CNBC)

FISCAL: U.S. Senate Democratic Leader Chuck Schumer said Monday a Senate Republican coronavirus relief plan as described by Majority Leader Mitch McConnell is "totally inadequate." Speaking on the Senate floor, Schumer said the Republicans' aid plan would cut federal unemployed relief by 30 percent and is "unworkable." (RTRS)

FISCAL/BANKING: The chairman of the Senate Banking Committee is preparing to relax capital requirements imposed in the wake of the 2008 financial crisis. Big banks may get a big gift in the stimulus bill being drafted by Senate Republicans. Lawmakers are expected to include language that would give the Federal Reserve authority to relax a requirement surrounding capital levels at the biggest banks, essentially allowing firms to load up on riskier assets, according to three people familiar with the effort. The push is the culmination of a monthslong effort by industry lobbyists and a top Federal Reserve official to change a restriction put in place in the wake of the 2008 financial crisis to prevent banks from engaging in risky behavior. (New York Times)

FISCAL: U.S. Senate Republicans on Monday backed an additional $10 billion in assistance for airports that face a dramatic shortfall in revenue because of a coronavirus travel falloff. The Republican proposal also calls for $75 million to maintain essential air service to rural communities and $50 million for the Federal Aviation Administration's administrative costs related to air traffic control tower cleanings, janitorial services and supplies. (RTRS)

CORONAVIRUS: The US reported its smallest daily increase in daily coronavirus deaths in three weeks, helped by an apparent slowdown in new infections in hard-hit states such as Florida, California and Texas. A further 55,134 people tested positive for the disease in the past 24 hours, according to Covid Tracking Project, from 61,713 on Sunday. That is the smallest increase since July 7. (FT)

CORONAVIRUS: The recent surge in coronavirus across the US sunbelt has shown tentative signs of slowing, even as the number of new cases remains substantially higher than a few months ago. Florida on Monday reported fewer than 9,000 news cases, its smallest increase in almost three weeks. California and Arizona both reported the fewest number of new infections in about a week. The slower pace could signal a more encouraging turn for the pandemic in the US, the country with by far the largest number of coronavirus cases. Last week coronavirus cases in the US topped 4m, while California and Florida overtook New York — the epicentre of the early wave — as the states with the highest number of infections. The seven-day average of cases in the US is now 66,158 a day, having stood at just over 21,000 in mid-June. However, for the first time since June 13, the average new cases over seven days is now below the average over a fortnight. (FT)

CORONAVIRUS: President Donald Trump announced on Monday announced that the U.S. government has awarded Fujifilm a $265 million contract to expand the country's coronavirus vaccine manufacturing capacity. The Department of Health and Human Services awarded the contract to the Fujifilm Texas A&M Innovation Center in College Station, Texas, Trump said. He made the announcement at the Bioprocess Innovation Center at Fujifilm Diosynth Biotechnologies in Morrisville, North Carolina, where the company is manufacturing "bulk drug substance" for a coronavirus vaccine by Novavax, which was awarded $1.6 billion by the federal government to help develop the vaccine. (CNBC)

CORONAVIRUS: President Donald Trump said a number of governors are moving too slowly to open their states' economies amid the coronavirus pandemic -- a shift from last week when he praised social distancing measures and state executives. "I really do believe a lot of the governors should be opening up states that they are not opening," Trump told reporters Monday at an event in North Carolina. "And we'll see what happens with them." The comments are similar to those the president made earlier in the pandemic when he frequently lashed out at governors. Trump didn't single out any states or governors for criticism Monday. (BBG)

CORONAVIRUS: The owners of a New Jersey gym were arrested Monday after they repeatedly defied Gov. Phil Murphy's coronavirus restrictions on businesses, becoming a rallying point for advocates of small businesses devastated by the pandemic. (CNBC)

CORONAVIRUS/POLITICS: President Donald Trump wore a mask and talked up the possibility of a coronavirus vaccine by the end of the year on Monday as he looked to show voters in the battleground state of North Carolina that he is responding to the pandemic. (RTRS)

POLITICS: Texas Gov. Greg Abbott (R) issued a proclamation on Monday extending the early voting period for Texans casting ballots in the 2020 election and allowing more time for mail-in ballots to be delivered prior to Election Day. (Axios)

SOCIETY: The Trump administration is sending more federal agents to Portland, Ore., as officials consider pushing back harder and farther against the growing crowds and nightly clashes with protesters, vandals and rioters, The Washington Post has learned. To strengthen federal forces arrayed around the city's downtown courthouse, the U.S. Marshals Service decided last week to send 100 deputy marshals to Portland, according to an internal Marshals Service email reviewed by The Post. The personnel began arriving Thursday night. (Washington Post)

EQUITIES: Amazon.com Inc.'s policies on safeguarding workers during the pandemic are being examined by California Attorney General Xavier Becerra, according to a court filing. The investigation was revealed Monday in the case of an employee who is a picker in an Amazon grocery warehouse. The worker accused the company of taking inadequate measures to protect staff, including sanitizing equipment and maintaining social distancing. (BBG)

EQUITIES: The Trump administration pressed its offensive against online companies it accuses of censoring conservatives, asking regulators to dilute a decades-old law that social media giants such as Facebook Inc., Twitter Inc. and Google say is crucial to them. The Commerce Department on Monday asked the Federal Communications Commission to write a regulation weakening protections laid out in Section 230, language in a 1996 law that protects online companies from legal liability for users' posts, and for decisions to remove material. The request was called for in an executive order that President Donald Trump signed in May. Tech trade groups, civil liberties organizations and legal scholars have slammed the executive order, saying that it was unlikely to survive a court challenge. (BBG)

EQUITIES: Facebook has taken the EU to court for invading the privacy of its employees, according to two people with direct knowledge of the matter. The social media company claims EU regulators have asked broad questions beyond the scope of two ongoing antitrust probes, and it has requested that the General Court in Luxembourg intervene. The EU is investigating both how Facebook collects and makes money from data and whether its Marketplace business has an unfair advantage over rivals in classified advertising. (FT)

EQUITIES: Texas is investigating Facebook for possibly running afoul of state laws on the collection of biometric data, according to June documents uncovered by a tech watchdog group. Texas Attorney General Ken Paxton has emerged as a key tech investigator, and going after Facebook for illegally harvesting biometric data may be a fruitful line of inquiry. Facebook users in Illinois secured a major settlement over the issue. (Axios)

EQUITIES: Representative Matt Gaetz on Monday filed a criminal referral against Facebook CEO Mark Zuckerberg for allegedly making false statements to Congress during two joint hearings in April 2018. (Newsweek)

OTHER

GLOBAL TRADE: China continues to lag behind the pace of imports from the U.S. needed to meet the terms of the two nations' trade deal, amid a rapidly worsening diplomatic standoff that's sparking global fears of a new Cold War. By the end of the first half of this year, China had bought about 23% of the total purchase target of more than $170 billion for goods in 2020, according to Bloomberg calculations based on Chinese Customs Administration data. That has quickened on a month-over-month basis from May's 19% marker, but it means China needs to buy about $130 billion in the remainder of the year to comply with the agreement signed in January. (BBG)

GLOBAL TRADE: China is a step closer to reducing its dependency on the imported helium it uses to make hi-tech products, according to scientists working at a new facility in the northwest of the country. They say they are extracting helium from the waste product of natural gas at the plant, and it could be the key to mass production in China. (SCMP)

U.S./CHINA: The US is increasing aerial surveillance over the South China Sea to a record level as relations between Washington and Beijing deteriorate and fears grow for the safety of Taiwan. Spy planes from the US navy, air force and army are involved in an apparent three-pronged drive to track Chinese submarines and monitor activity by the People's Liberation Army (PLA), which has redoubled training for operations aimed at Taiwan. In Beijing, procurement documents from the China State Shipbuilding Corporation have revealed plans to build an amphibious assault ship ideal for island invasion. (The Times)

U.S./CHINA: The Biden campaign is forbidding staff from trading individual stocks without approval from the campaign's general counsel, according to an email sent by the Democratic nominee's top lawyer to staff on Monday afternoon. Joe Biden's general counsel, Dana Remus, wrote in an email to staff obtained by Bloomberg News that the campaign is updating its employee handbook to "ensure that staff do not even inadvertently trade on nonpublic information." The rule says staff cannot trade stocks "without advance written approval of the General Counsel," and it will remain in effect until Dec. 14, 2020, the date the Electoral College votes. (BBG)

GLOBAL TRADE: A Japanese ruling Liberal Democratic Party group is set to propose restrictions on the use of Chinese-developed apps over concerns about data security, national broadcaster NHK said. The group led by tax panel chief Akira Amari is set to meet Tuesday to discuss limits on the use of Chinese apps, which it would then urge the government to adopt, the broadcaster said. The move comes as the U.S. threatens a crackdown on apps from China, amid a broader standoff between the world's two largest economies. (BBG)

CORONAVIRUS: Anthony Fauci, the U.S.'s top infectious disease expert, says no corners are being cut in the development of a coronavirus vaccine and there is no political pressure to get a vaccine out before the presidential election in November. "Safety is very important," Fauci tells Fox News. "We are following the standards". Fauci also says he is "cautiously optimistic" on the prospects for Moderna's Covid-19 vaccine trial. (BBG)

CORONAVIRUS: Dr. Anthony Fauci, the nation's leading infectious disease expert, said he is "not particularly concerned" about the safety risk of a potential coronavirus vaccine by Moderna, despite the fact that it uses new technology to fight the virus. The vaccine, which entered a large phase three human trial Monday, uses Messenger ribonucleuc acid, or mRNA molecules to provoke an immune response to fight the virus. Scientists hope mRNA, which relays genetic instructions from DNA, can be used to train the immune system to recognize and destroy Covid-19. While early studies show promise, mRNA technology has never been used to make a successful vaccine before. (CNBC)

CORONAVIRUS: Pfizer Inc. and BioNTech SE said they would begin a later- stage trial for their top coronavirus vaccine candidate, with a goal of submitting it for regulatory review as soon as October. The drugmakers said Monday that they had selected a lead vaccine candidate from within a broader development program and will proceed with a late-stage safety and efficacy trial of the experimental shot in a two-dose regimen. (BBG)

CORONAVIRUS: Johnson and Johnson is launching clinical trials in the U.S. this week and could start a larger, late-stage trial as early as September. (RTRS)

HONG KONG: The Hong Kong government is considering postponing upcoming legislative elections, the Hong Kong Economic Times reported, after a sudden surge in coronavirus cases raised new questions about the September vote. Hong Kong Chief Executive Carrie Lam's advisory Executive Council was expected to meet Tuesday to discuss postponing the Sept. 6 legislative elections, the Hong Kong Economic Times said, citing people it didn't identify. An announcement could come later in the day, the paper added. (BBG)

HONG KONG: A leading Hong Kong official has said senior members of the city's government are finding it increasingly difficult to bank with foreign institutions as tensions mount between China and the US over the territory's future. Bernard Chan, convener of the Executive Council, the de facto cabinet that advises Carrie Lam, Hong Kong's chief executive, said a US bank recently informed him it was closing his account and refunding his money. He declined to name the bank but said other senior officials were facing a similar issue. "I have a better chance today to go to a local bank to open an account. If I go to a US bank, they don't want anything to do with a politically exposed person . . . even HSBC won't want anything to do with me," he told the Financial Times. Mr Chan's comments follow growing acrimony between the US and China after Beijing imposed a national security law on Hong Kong that punishes crimes such as subversion with up to life imprisonment. (FT)

JAPAN: Tokyo confirmed about 270 new cases of coronavirus Tuesday, Nikkei reported, citing an unidentified person. That's more than twice the 131 cases the Japanese capital found Monday. The city has reported more than 100 new daily cases for weeks as it faces a renewed resurgence. In April and May, Japan was under a state of emergency imposed by the government. (BBG)

AUSTRALIA: Australia's state of Victoria reported 384 new coronavirus cases on Tuesday as its government pledged support to residential care homes experiencing a large number of infections. Daniel Andrews, Victoria's premier, said six more people had died from the virus, taking the state's tally to 83. Four of the new fatalities were people linked to private-sector aged care, which has been badly hit by the outbreak. (FT)

AUSTRALIA: The ABS notes that "total payroll jobs decreased by 1.1% in Australia between mid-June and mid-July. In Victoria, payroll jobs decreased by 2.2% between mid-June and mid-July as additional COVID-19 restrictions were progressively introduced, with jobs 7.3% below mid-March in this state. Nationally, payroll jobs are 5.6% below mid-March, when Australia recorded its 100th confirmed COVID-19 case. Payroll job losses in other states and territories since mid-March ranged from a 6.8% decrease in Tasmania to a 3.1% decrease in Western Australia. The latest data shows that around 35% of lost payroll jobs had been regained by mid-July… Between the week ending 14 March 2020 (the week Australia recorded its 100th confirmed COVID-19 case) and the week ending 11 July 2020 total wages decreased by 4.8%." (MNI)

AUSTRALIA/CHINA: With the China-Australia political standoff progressing, this is certainly not the right time to expect businesses on the two sides to continue their cooperation as nothing has happened. (Global Times)

NEW ZEALAND/CHINA/HONG KONG: New Zealand suspended its extradition agreement with Hong Kong, falling into step with its western allies after China passed a national security law for the financial hub. "China's passage of its new national security legislation has eroded rule-of-law principles, undermined the 'one country, two systems' framework that underpins Hong Kong's unique status, and gone against commitments China made to the international community," Foreign Affairs Minister Winston Peters said in a statement Tuesday in Wellington. "New Zealand can no longer trust that Hong Kong's criminal justice system is sufficiently independent from China." The move is likely to strain relations with China, New Zealand's largest trading partner. (BBG)

NEW ZEALAND/CHINA/HONG KONG: China's Embassy in Wellington is accusing New Zealand of interfering in international relations with its decision to suspend extradition with Hong Kong. (Radio New Zealand)

RBNZ: The Reserve Bank of New Zealand Bill was introduced to Parliament today, a further step in the Review of the Reserve Bank Act 1989 announced by the Minister of Finance in November 2017. Key changes in the new Bill will strengthen governance and accountability and provide the new Board with a financial policy remit. The Treasury will take on the monitoring role for the Reserve Bank, strengthening oversight of the Bank's performance. The Bill also carries over the changes made to the monetary policy framework in 2018 as part of Phase 1 of the Review of the Reserve Bank, including providing the Bank with a new employment objective and the creation of the Monetary Policy Committee. Other parts of the Review's phase 2 reforms including the Government's in-principle decisions in relation to the regulation of banks and other deposit takers, and the introduction of a deposit insurance scheme, will be progressed through a separate Deposit Takers Act scheduled for introduction in 2021. (New Zealand Treasury)

NEW ZEALAND: Statistics New Zealand publishes monthly employment indicators for June, on website. Seasonally adjusted filled jobs rise 0.8% m/m or ~17,000 to 2.20m. Second month of recovery after slump to 2.17m in April. Actual filled jobs rise 1.8% y/y. Stats NZ says filled jobs are usually quite similar in March and June, but this year actual June filled jobs are ~20,000 less than March. (BBG)

NORTH KOREA: North Korea leader Kim Jong Un said his country's hard-won nuclear weapons were a solid security guarantee and a "reliable, effective" deterrent that could prevent a second Korean War, state media reported Tuesday. Kim's comments before war veterans marking the 67th anniversary of the end of the 1950-53 Korean War again show he has no intention of abandoning his weapons as prospects dim for resuming diplomacy with the United States. North Korea has previously ratcheted up fiery rhetoric or conducted weapons tests to wrest outside concessions. But some experts say Pyongyang will likely avoid serious talks with Washington before the U.S. presidential elections in November as there is a chance for a U.S. leadership change. Kim said in his speech Monday his country has tried to become "a nuclear state" with "an absolute might" to prevent another war and that it has now built such a deterrent, according to the Korean Central News Agency. "Now, we've changed to a country which can defend itself reliably and unwaveringly against high-intensity pressures and military threats and blackmailing by imperialistic reactionaries and hostile forces," Kim said. (Associated Press)

AIIB: Chinese President Xi Jinping is likely to use an upcoming speech to unveil more policies to support the Asia Infrastructure Investment Bank (AIIB) and help fund the regional and global economic recovery from the Covid-19 pandemic, the official English-language China Daily reported citing government analysts. Xi is also likely to use the speech to promote China's epidemic containment and growth opportunities, the Daily said.The AIIB has doubled its COVID-19 crisis recovery facility to provide up to $10 billion to member economies, and has approved coronavirus response loans to about a dozen Asian countries, including India, Pakistan, Vietnam, the Philippines, Mongolia and Indonesia, the Daily said. (MNI)

MEXICO: Mexico's central bank is prepared to take needed action, corresponding to its authority, to manage shocks to financial and economic activity, according to a presentation by Alejandro Diaz de Leon posted to Banxico's website. Pandemic, in addition to a deep economic contraction, has affected production and supply chains, leading to reassigned spending, which has pressured inflation in different ways and led to uncertainty in its outlook. (BBG)

RUSSIA: The Russian defence ministry said it had sent a Su-27 fighter plane on Monday to intercept a U.S. surveillance plane over the Black Sea that it said was approaching the Russian border. The U.S. plane, identified as a P-8 Poseidon, has changed course to move away from the Russian border, the ministry added. (RTRS)

SOUTH AFRICA: The International Monetary Fund said on Monday its executive board approved $4.3 billion in emergency financing for South Africa to help the country address the "severe economic impact" and health challenges of the coronavirus pandemic. The IMF said the Rapid Financing Instrument loan, equal to 100% of South Africa's IMF quota, or shareholding, will help fill urgent balance of payments needs from pandemic-caused fiscal pressures. (RTRS)

ARGENTINA: Argentina's main bondholder groups say they now represent more than 50% of the country's overseas debt, potentially strengthening their bargaining power at a crucial time in the country's bond restructuring. A group of creditors seeking to extract better terms from the government in its $65 billion debt restructuring says they have added large funds to their bloc, according to people with direct knowledge of the matter. Thirty investment funds, some of them part of the Ad Hoc Bondholder group, the Exchange Bondholder group and the Argentina Creditor Committee, sent a letter to Economy Minister Martin Guzman on Monday saying they hope to reach a consensual agreement, according to a copy obtained by Bloomberg News. (BBG)

EQUITIES: HSBC may not receive any further benefits in China after it served as an accomplice to the U.S. government's political "murdering" of Huawei, government portal China.com.cn said in a strongly worded commentary written by Tan Hua. Referring to the bank's cooperation with U.S. investigations into Huawei's conduct with Skycom that faulted CFO Meng Wanzhou, the commentary accused HSBC of "shamelessly" bowing to U.S. pressure and agreeing to produce documents to the U.S. Justice Department which betrayed customers for its own illegal interests. (MNI)

GOLD: China's 1H20 gold consumption decreased 38% from a year earlier to 323 tons, according to China Gold Association. The association attributed the drop to coronavirus control measures, the economic slowdown and the surging price of gold. China 1H gold output fell 5.9% on year to 170 tons. Gold production has fully resumed since 2Q as domestic virus outbreak eased, and 2Q output rose 5.8% from 1Q. (BBG)

METALS: The U.S. Mint has reduced the volume of gold and silver coins it's distributing to authorized purchasers as the coronavirus pandemic slows production, a document seen by Bloomberg shows. The Mint's West Point complex in New York is taking measures to prevent the virus from spreading among its employees, and that will probably slow coin production there for the next 12 to 18 months, the document shows. The facility is no longer able to produce gold and silver coins at the same time, forcing it to choose one metal over the other, according to the document, which was presented to companies authorized to buy coins from the Mint last week. A spokesman for the Mint didn't immediately have comment. (BBG)

TURKISH LIRA: The Turkish lira slumped as much as 2% against the dollar Monday in the space of minutes before rallying to recover most of its losses amid local limits on credit lines and liquidity. (BBG)

OVERNIGHT DATA

JAPAN JUN PPI SERVICES +0.8% Y/Y; MEDIAN +0.8%; MAY +0.5%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 89.0; PREV. 90.7

Confidence continues to deteriorate, with the fifth straight decline. Sentiment has dropped almost 10% from its high at the end of May. The rise in pandemic related deaths in Victoria and new case numbers rising in Sydney seem to be sapping confidence. The reductions in the Jobkeeper and Jobseeker payments from the end of September may have also weighed, with 'Current economic conditions' falling sharply and the improvement in 'Current finances' stalling at a low level. Inflation expectations rose again, with the four week moving average at its highest level since mid-May. This lift comes just ahead of the Q2 CPI data, which is likely to show the biggest ever fall in headline inflation. (ANZ)

UK JUL LLOYDS BUSINESS BAROMETER -22; JUN -30

CHINA

CORONAVIRUS: Beijing reported one new coronavirus case on Tuesday, its first in 21 days, reflecting the fragility of the Chinese capital's success at stamping out infections earlier this month. The new case is linked to the outbreak in the northeastern port city of Dalian, where more than 40 people have become infected. The cluster, which first started from a man working at a seafood processing plant, has also spread to other northeastern provinces as well as China's southern Fujian province. The infection threatens to undercut Beijing's efforts that brought new cases to zero after a local outbreak that started last month infected over 300 people. Authorities had started to relax restrictions in the capital after aggressive testing and targeted lockdown measures, but resurgences elsewhere in China may now pose a threat to normalization. (BBG)

PBOC: The PBOC may lower banks' RRRs twice in H2 by a total of 50 bps and cut the MLF rate by 20 bps to meet the targets of CNY20 trillion in new loans and CNY30 trillion in social financing to consolidate the economic recovery, the 21st Century Business Herald reported. Citing Liu Ligang, Chief China Economist at Citibank, the report said that China's monetary policy should continue to be loose in H2 as the current recovery is still fragile with concerns about PPI deflation, high corporate financing costs and the wide spread in interest rates between China and other major economies. (MNI)

HOUSING: Chinese authorities may tighten housing policies to keep prices at "healthier levels" in H2 if some cities continue to experience price surges, the Economic Information Daily reported. Citing Yan Yaojin, research director at CRIC, the Daily's report says that the average home price in 100 cities rose 10.9% year on year in H1, with some markets showing larger gains. Hangzhou, Nanjing and Chengdu, three second-tiered cities, led the gains with Chengdu's average jumping as much as 21% y/y, the newspaper said. Housing investments were favored due to lower returns on wealth products and stock volatility. (MNI)

RATINGS: Fitch Affirmed China at 'A+'; Outlook Stable

BANKING/RATINGS: China's efforts to improve the financial system's credit efficiency are set to experience a temporary setback in 2020 as a result of the shock from the coronavirus pandemic, but banks' potential capital shortfall associated with credit at higher risk of impairment ("inefficient credit") has stabilised in recent years, says Fitch Ratings. (Fitch)

CHINA MARKETS

PBOC NET INJECTS CNY70BN VIA OMOS

The People's Bank of China (PBOC) injected CNY80 billion via 7-day reverse repos with the rate unchanged on Tuesday. This resulted in a net injection of CNY70 billion due to the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1974% at 09:25 local time from the close of 2.1958% on Monday: Wind Information.

- The CFETS-NEX money-market sentiment index closed at 39 on Monday vs 33 on Friday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.9895 TUES VS 7.0029

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for the first time in four trading days at 6.9895 on Tuesday, compared with Monday's 7.0029.

MARKETS

SNAPSHOT: Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 0.47 points at 22714.94

- ASX 200 up 0.725 points at 6044.9

- Shanghai Comp. up 19.241 points at 3224.468

- JGB 10-Yr future down 1 tick at 152.29, yield up 0.4bp at 0.026%

- Aussie 10-Yr future down 5.0 ticks at 99.045, yield up 4.4bp at 0.930%

- U.S. 10-Yr future -0-04+ at 139-10+, yield up 1.32bp at 0.628%

- WTI crude down $0.05 at $41.55, Gold up $2.53 at $1944.58

- USD/JPY up 27 pips at Y105.64

- LEADING DEMOCRATS DEMAND MORE FROM GOP FISCAL PLAN

- NEW ZEALAND SUSPENDS HONG KONG EXTRADITION TREATY, CITING CHINA LAW (BBG)

- PRECIOUS METALS COMPLEX DRIVES BROADER MARKET GYRATIONS OVERNIGHT

BOND SUMMARY: T-Notes edged lower overnight, with the contract last -0-04+ at 139-10+, as the curve marginally steepens. The space took the lead of broader market flows, as several strategists pointed to long 10-Year ACGB vs. short 10-Year U.S. Tsys expressions, which they believe will perform when the pressure of today's ACGB issuance subsides.

- JGB futures softened in early afternoon trade, last -1, with the wings of the curve outperforming in cash throughout the day. The latest round of 40-Year supply wasn't particularly impressive, although the auction passed smoothly enough.

- ACGB steepening was evident surrounding the ACGB '51 syndication, with the bookbuild reportedly topping A$36.0bn and A$15.0bn set to price at the tight end of guidance. Elsewhere, the latest round of ABS payrolls data showed another downtick for wages & the number of people employed, as the metrics moved further away from their post-COVID peaks. YM -1.0, XM -5.0.

JGBS AUCTION: The Japanese Ministry of Finance (MOF) sells Y499.7bn of 40-Year JGBs:

- High Yield: 0.575% (prev. 0.505%%)

- Low Price: 97.34 (prev. 99.82)

- % Allotted At High Yield: 3.4161% (prev. 93.4959%)

- Bid/Cover: 3.106x (prev. 3.058x)

EQUITIES: The positive lead from Wall St. spilled over into Asia-Pac trade, generally supporting the major regional equity markets, with Monday's outperformance in tech names (at least on Wall St.) proving to be a consistent theme, as the likes of TSMC traded well.

- Still, the broader risk tone was driven by the precious metals space and USD dynamics, with the DXY's uptick from lows capping the major regional indices/e-minis.

- Nikkei 225 +0.3%, Hang Seng +0.3%, CSI 300 +0.8%, ASX 200 +0.2%.

- S&P 500 futures +4, DJIA futures +22, NASDAQ 100 futures +29.

FOREX: DXY bounced into positive territory and the greenback jumped onto the top of the G10 pile as gold and silver retreated. Precious metals were offered amid apparent profit taking after gold futures topped out at 2,000. A sudden recovery in USD set the tone of G10 FX price action in the Asia afternoon.

- AUD crosses pulled back from highs alongside gold & silver. NZD followed suit, but its decline was deeper, perhaps as China protested New Zealand's decision to suspend its extradition treaty with Hong Kong.- The loonie was bid, USD/CAD printed a 7-week low before USD recovery.

- Despite trimming losses, USD/IDR continued to operate below neutral levels, following the formation of a "death cross" (50-DMA < 200-DMA).-

- Renewed demand for USD inspired a strong rebound in USD/KRW, capped only by yesterday's highs. The won led losses in Asia EM FX space.

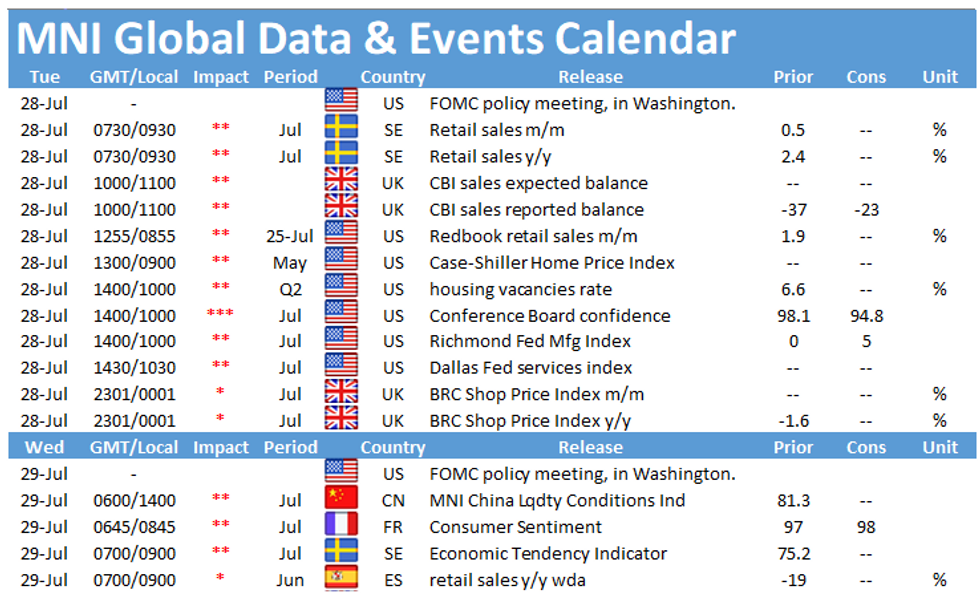

- Focus moves to U.S. Conf. Board Consumer Confidence, as well as Swedish retail sales and trade balance.

FOREX OPTIONS:

- EUR/USD: $1.1495-1.1500(E735mln), $1.1570-75(E572mln)

- USD/JPY: Y106.00($600mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.