-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY216 Bln via OMO Monday

MNI EUROPEAN OPEN: Soft China GDP Headlines Overnight, Limiting Early Risk +ve Flow

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* PELOSI SETS 48-HOUR DEADLINE FOR WHITE HOUSE ON STIMULUS TALKS (AXIOS)

* FEDERAL RESERVE DEBATES TOUGHER REGULATION TO PREVENT ASSET BUBBLES (FT)

* COVID MITIGATION MEASURES SEE WIDER DEPLOYMENT IN EUROPE

* U.K. PREPARED TO REWRITE LAWBREAKING BREXIT BILL TO GET EU DEAL (BBG SOURCES)

* MOODY'S DOWNGRADES THE UK BY ONE NOTCH

* CHINA Q3 GDP MISSES, SEP ECON ACTIVITY DATA BEATS

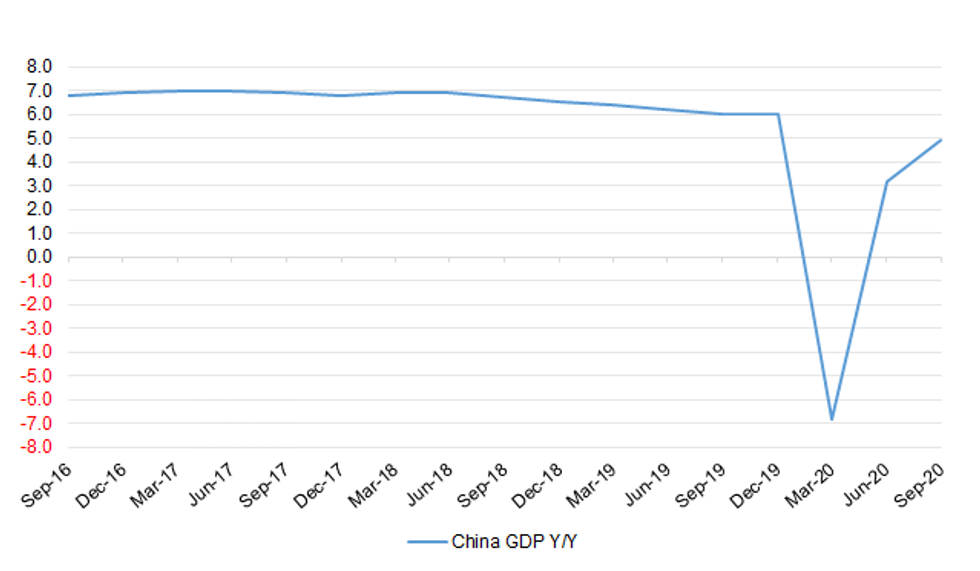

Fig. 1: China GDP Y/Y

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Britain needs an immediate three-week national lockdown as opposed to more limited regional restrictions, said Jeremy Farrar, a scientific adviser to the government. (BBG)

CORONAVIRUS: Boris Johnson says the spread of coronavirus in Greater Manchester is "grave" and he may "need to intervene" if new measures are not agreed. The prime minister urged mayor Andy Burnham to "engage constructively" with the government over the region entering "very high" tier three measures. He said the situation was worsening every day and "time is of the essence". (BBC)

CORONAVIRUS: Prime Minister Boris Johnson will attempt to call the bluff of Manchester's leaders on Monday by offering them up to £100 million to accept Tier-3 coronavirus restrictions or risk having them imposed against their will. (Telegraph)

CORONAVIRUS: The Liverpool city region has been given £30m by the UK government to help businesses in another concession to local politicians accepting tighter coronavirus restrictions. (FT)

CORONAVIRUS: Britain's biggest teachers' union has backed a "circuit-breaker" lockdown and called for secondary schools and colleges to be closed for an extended two-week half-term. (Telegraph)

CORONAVIRUS: Tory grandees are demanding that Boris Johnson urgently sets out an exit strategy from "a constant cycle of lockdowns", as an influential expert on public opinion warned the Prime Minister risked appearing "blasé" about the lives of ordinary people. (Telegraph)

BREXIT: The UK's chief Brexit negotiator has told his European counterpart not to come to London on Monday to resolve stalled talks, after the prime minister warned it was time to "get ready" to leave without a deal. David Frost spoke to Michel Barnier after Boris Johnson claimed Brussels had "abandoned" the ambition of a free trade deal but insisted "we always knew there would be changes" next year once the Brexit transition period ends. "There was accordingly no basis for negotiations in London as of Monday," a spokesperson for the prime minister said. However, they added that Lord Frost agreed to talk with Mr Barnier at some point early next week instead. (Sky)

BREXIT: Michael Gove today warns Brussels that Britain is "well prepared" for a no-deal Brexit and will brave the "turbulence" to go it alone, because the EU has refused to give any ground. In a stark intervention from the cabinet minister in charge of no-deal preparations, Gove makes clear that he has sidelined his well-publicised concerns and is now preparing to trade on World Trade Organisation terms. (Sunday Times)

BREXIT: British officials are ready to water down Boris Johnson's controversial lawbreaking Brexit legislation in a move that could revive failing talks with the European Union, according to people familiar with the matter. Negotiations over the two sides' future relationship have stalled, with the prime minister announcing on Friday that he will focus on preparations to leave the EU's single market and customs union at the year-end without a trade deal -- though he is still open to talks if the bloc changes its stance. (BBG)

BREXIT: Boris Johnson will this week warn business leaders that "time is running out" to prepare for the end of Britain's Brexit transition period on January 1, amid growing concern that chaos at the border with the EU is looming. The prime minister will launch a major advertising campaign to publicise customs rules, with one poll last week showing just over half of companies were not fully prepared with 75 days to go. (FT)

BREXIT: Ministers are racing to expand help for businesses to cope with a no-deal cliff-edge as the clock ticks down to the end of the Brexit transition period. (Telegraph)

BREXIT: More than 70 British business groups representing more than 7m workers have made a last-ditch attempt to persuade politicians to return to the table next week to strike a trade deal between the EU and UK. (FT)

BREXIT: The narrow EU deal sought by Boris Johnson will act as a "dead weight" on Britain's ability to trade, the former boss of the Brexit department has warned, amid rising concerns that the country remains dangerously ill prepared for such an outcome. (Guardian)

BREXIT: Emmanuel Macron is using the post-Brexit trade talks to shore up his domestic standing in France, UK sources have claimed, as they labelled talks with the EU "performance art". (Telegraph)

BOE: Bank of England Governor Andrew Bailey said risks to economic growth in Britain were skewed very heavily to the downside, and reiterated that he expected economic output at the end of September to have been 10% lower than a year earlier. "Ten percent is still a huge gap, let's be clear on that," Bailey told an online seminar for central bank governors hosted by the Group of 30. "We're operating at an unprecedented level of economic uncertainty. Of course, that is heightened now by the return of COVID.... The risks remain very heavily skewed towards the downside," he added. (RTRS)

BOE: The Bank of England's flirtation with negative interest rates risks a "massive dislocation" in financial markets, according to the former chairman of Barclays. (Telegraph)

ECONOMY: The finance chiefs of Britain's largest companies are pushing back the date for a return to business as usual. Over the last three months, chief financial officers of FTSE 100 and FTSE 250 companies have slashed their expectations for a full recovery in business demand before next summer, a closely watched survey by Deloitte published today shows. (The Times)

ECONOMY: Thousands of businesses warned Boris Johnson this weekend that Britain faces "mass redundancies" unless more financial support is provided in areas suffering under Covid-19 restrictions. (Sunday Times)

ECONOMY: Shop closures in the UK have hit record levels due to the coronavirus pandemic, according to a study released on Sunday. (FT)

FISCAL: The government is seeking to ride out calls by Andy Burnham, Labour mayor of Greater Manchester, for the state to pay 80 per cent of the wages of workers at hospitality businesses forced to close because of new coronavirus restrictions, according to Whitehall officials. (FT)

FISCAL: The head of the International Monetary Fund (IMF) has warned Rishi Sunak that "now is not yet the time to balance the books". In an interview with Sky News, Kristalina Georgieva said the UK must stand ready to spend more to support businesses and households through the second surge of the pandemic. Her comments come as the chancellor faces criticism for providing less generous fiscal support for the economy as Downing Street imposes further restrictions. (Sky)

FISCAL: New universal credit claimants should be offered a "starter payment" to ensure they have enough money to pay for food and heating during the five-week wait for a first benefit payment, a cross-party report by MPs has recommended. It proposed new claimants should receive a non-repayable grant when they sign on for the first time, typically ranging from £287 for a single person aged over 25 to £416 for a couple, at an initial cost of £1bn a year for the government. (Guardian)

POLITICS: British voters do not trust Boris Johnson and his health secretary Matt Hancock to beat coronavirus, according to a new survey – and less than a quarter (22 per cent) think it would be reasonable for ministers to expect them to keep obeying restrictions on their social and economic lives beyond the spring. The poll by BMG Research for The Independent laid bare the extent of financial hardship caused by the Covid-19 pandemic and the lockdown measures imposed by the government to fight it. (Independent)

RATINGS: Sovereign rating reviews of note from Friday included:

- Moody's downgraded the UK to Aa3, Outlook Stable

EUROPE

ECB: New restrictions being rolled out across the euro area to curb the surge of infections will increase uncertainty for companies and families, European Central Bank President Christine Lagarde said. The lop-sided impact that the pandemic has on services is particularly worrying as the sector accounts for 75% of employment in the 19-nation region, she said. That may slow the recovery and increase inequality. "The recovery remains uncertain, uneven and incomplete," Lagarde told a panel discussion with heads of central banks from the U.K., China and Japan. "It is clear that both fiscal support and monetary policy support have to remain in place for as long as necessary and 'cliff effects' must be avoided." (BBG)

ECB: The risk that the second wave of the coronavirus pandemic could derail the euro zone's recovery from deep recession makes ultra-easy monetary policy all the more necessary, European Central Bank board member Fabio Panetta has told a Greek newspaper. The ECB expects the bloc's economy to return to its pre-crisis level by the end of 2022 - but Panetta said this projection was now at risk, a comment likely to reinforce expectations that the ECB will expand its stimulus efforts in December. " (RTRS)

FISCAL: Eurozone governments plan to go deeper into the red than ever before this year, racking up budget deficits of close to €1tn as they splash out on emergency measures to counter the coronavirus crisis. Draft budget plans published by member states on the European Commission website indicate the 19-country bloc will slide to an aggregate fiscal deficit of €976bn, equal to 8.9 per cent of gross domestic product this year, according to Financial Times calculations. That means this year's budget deficits would be almost 10 times higher than both last year's levels and the commission's forecasts for this year. (FT)

CORONAVIRUS: The World Health Organization said Friday that Europe's coronavirus outbreak is "concerning" as the number of available intensive care beds continues to dwindle and near capacity in some regions. (CNBC)

ITALY: Italy has announced a new raft of measures to tighten restrictions amid a surge in coronavirus cases. A mask-wearing PM Giuseppe Conte said the measures were needed "to avoid a new lockdown". Mayors will get powers to close public areas after 21:00 and the opening times of restaurants and the size of groups allowed will tighten. (BBC)

ITALY: Italy's government approved next year's draft budget, which seeks to extend measures to support the economy amid a resurgence in coronavirus cases. The "strongly expansionary" budget will focus on the health sector, measures to support families and the extension of a moratorium on loan and mortgage payments, the government said in a statement Sunday. The draft budget sets aside 4 billion euros ($4.7 billion) to support the sectors hardest hit by the coronavirus crisis. (BBG)

BELGIUM: Belgium will close restaurants and cafes from Monday for four weeks and introduce a curfew from midnight to 5 a.m., Prime Minister Alexander de Croo said in a press conference Friday evening. The country's 14-day incidence rate rose to 550 cases per 100,000 from 494 Thursday, trailing only the Czech Republic as the hardest hit country in Europe. (BBG)

IRELAND: Ireland will bring in "decisive" nationwide COVID-19 restrictions on Monday but will stop short of reintroducing the kind of lockdown imposed earlier this year, Higher Education Minister Simon Harris said on Sunday. The government rejected a recommendation by health chiefs two weeks ago to jump Level 5, the highest level of COVID-19 curbs, and instead tightened restrictions in a varied regional approach that Harris said was no longer sufficient. (RTRS)

SWITZERLAND: Switzerland announced tighter restrictions on Sunday to tackle the second wave of the coronavirus hitting the country, including a nation-wide obligation to wear masks and a ban on large scale public gatherings. (RTRS)

SWEDEN: Swedish residential property prices rose 1.1% on the month in September, according to the Nasdaq OMX Valueguard-KTH Housing Index, HOX Sweden. HOX Sweden advanced 5.1% in the 3 months through September and rose 8.9% y/y. (BBG)

RATINGS: Sovereign rating reviews of note from Friday included:

- DBRS Morningstar downgraded France to AA (high), Stable Trend

- DBRS Morningstar confirmed Norway at AAA, Stable Trend

BONDS: Since July's agreement by EU leaders to establish a €750bn coronavirus recovery package funded by borrowing, investors have been preparing for the arrival of Brussels as a major force in bond markets. That shift begins in earnest as soon as this week with the bloc due to sell the first bond under its separate €100bn SURE programme before the end of October. The SURE borrowing will fund member states' efforts to help workers keep their jobs during the pandemic, particularly at a time when a second wave of virus infections is sweeping across the bloc. (FT)

U.S.

FED: Some parts of the U.S. economy are coming back strongly while others are still struggling because of the coronavirus pandemic, said Federal Reserve Bank of Atlanta President Raphael Bostic. "In some segments the economy is recovering and rebounding in a very robust way," Bostic said Sunday in an interview on CBS's "Face the Nation." "But in other segments, things like hotels and restaurants, small businesses, particularly in minority and lower-income communities, those places are seeing much more difficult situations." Bostic will be a voting member of the policy-setting Federal Open Market Committee in 2021. The FOMC will meet two more times in 2020. (BBG)

FED: Senior Federal Reserve officials are calling for tougher financial regulation to prevent the US central bank's low interest-rate policies from giving rise to excessive risk-taking and asset bubbles in the markets. (FT)

FISCAL: House Speaker Nancy Pelosi (D-Calif.) has given the White House a 48-hour deadline to reconcile differences in stimulus negotiations "to demonstrate that the administration is serious about reaching a bipartisan agreement," a top Pelosi aide tweeted. Pelosi said on ABC's "This Week" Sunday that the 48-hour deadline only applies to being able to get a deal done before the election. She said she is "optimistic" about the talks, but that a true breakthrough "depends on the administration." (Axios)

FISCAL: Senior White House economic adviser Larry Kudlow said Friday morning it would be "almost impossible" to execute a coronavirus relief package before the November election, even if Congress overcame a monthslong impasse and struck a deal. "Maybe some of it could be executed," he told FOX Business' Stuart Varney. "But you certainly couldn't get a grand, large deal." (Fox)

FISCAL: The Senate will vote on a $500 billion coronavirus stimulus bill on Wednesday, Senate Majority Leader Mitch McConnell said Saturday, as a larger bipartisan deal remains elusive despite continued talks between top Democrats and the Trump administration. McConnell blamed his opponents across the political aisle for the current stalemate, arguing that the Senate has enough time to pass the GOP stimulus package and confirm Supreme Court nominee Amy Coney Barret if "Democrats do not obstruct this legislation." (CNBC)

FISCAL: The Treasury Department privately encouraged banks to prioritize existing clients when implementing the federal government's Paycheck Protection Program that provided coronavirus relief to small businesses, according to a report Friday from a House oversight panel. (CNBC)

FISCAL: Efforts to combat the coronavirus pandemic left the U.S. government submerged in red ink as its fiscal year came to a close. The final tally for the budget deficit in fiscal 2020 came to $3.13 trillion, more than triple last year's shortfall of $984 billion and double the previous record of $1.4 trillion in 2009, courtesy of a stimulus package passed that year to battle the financial crisis. (CNBC)

CORONAVIRUS: Donald Trump has used rallies in Michigan and Wisconsin to urge their Democratic governors to relax coronavirus restrictions, even as both states experience record numbers of new cases. (FT)

CORONAVIRUS: The Trump administration on Friday announced a deal with CVS Health and Walgreens to administer coronavirus vaccines to the elderly and staff in long-term care facilities. The vaccine will be free and available for residents in all long-term care settings, including skilled nursing facilities, nursing homes, assisted living facilities, residential care homes and adult family homes, the Department of Health and Human Services said in a press release. (CNBC)

CORONAVIRUS: New York Gov. Andrew Cuomo on Saturday announced the state will deploy a "micro-cluster strategy" to target the coronavirus "block-by-block" instead of at the statewide or regional levels. (Axios)

MARKETS: Citadel Securities LLC sued the U.S. Securities and Exchange Commission over the regulator's approval of an order type introduced by stock-exchange operator IEX Group Inc. (BBG)

U.S. TSYS/TIPS: MNI POLICY: U.S. Treasury Seeks Dealer Input on TIPS Demand

- The U.S. Treasury has asked primary dealers for their input on debt projections and whether the department should increase TIPS auction sizes - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

EQUITIES: The chief executives of Facebook Inc., Twitter Inc. and Alphabet Inc. will appear before a Senate committee Oct. 28 to face questioning about their policies for moderating content on their internet platforms. (WSJ)

EQUITIES: The Senate Judiciary Committee plans to vote on whether to authorize a subpoena for Facebook CEO Mark Zuckerberg to testify on allegations of anti-conservative bias alongside Twitter CEO Jack Dorsey, Chair Lindsey Graham (R-S.C.) told POLITICO on Friday. (POLITICO)

OTHER

GLOBAL TRADE: The UK competition regulator has told the government to set up a digital regulator within a year or his agency will take action against Facebook and Google. (FT)

U.S./CHINA: Since March, Mr. Trump has approved a head-spinning series of actions to confront China. The U.S. has dispatched aircraft carriers to the South China Sea, blocked China's tech companies from getting advanced technology, increased arms sales to Taiwan, closed China's Houston consulate over alleged espionage and sought to ban popular Chinese apps from the U.S. market. Further moves are being considered, according to officials: monitoring Chinese state airlines' employees suspected of supporting espionage in the U.S., going after alleged Chinese government-backed efforts to influence U.S. politics and business, and blacklisting more Chinese technology firms. (WSJ)

U.S./CHINA: The Federal Communications Commission (FCC) asked the Justice Department and other U.S. agencies to detail if China Unicom's continued U.S operations pose national security risks, according to a letter released Friday. (RTRS)

U.S./CHINA: The U.S. Department of Commerce said in a statement on Friday that it has made a preliminary determination that exporters from China have dumped small vertical shaft engines in the United States. (RTRS)

U.S./CHINA: China passed a new law on Saturday to restrict sensitive exports to protect national security, helping Beijing gain reciprocity against U.S. as tech tensions mount. (BBG)

U.S./CHINA: Chinese government officials are warning their American counterparts they may detain U.S. nationals in China in response to the Justice Department's prosecution of Chinese military-affiliated scholars, according to people familiar with the matter. The Chinese officials have issued the warnings to U.S. government representatives repeatedly and through multiple channels, the people said, including through the U.S. Embassy in Beijing. (WSJ)

GEOPOLITICS: A cease-fire between Azerbaijan and Armenia was in tatters hours after coming into effect, with both sides trading accusations of violations early Sunday. It's the second truce brokered by Russia this month that has failed to stop the violence. Hundreds of people have been killed since the worst fighting in decades erupted between the countries over the breakaway region of Nagorno-Karabakh three weeks ago. (BBG)

CORONAVIRUS: China's Center for Disease Control and Prevention said it found active Covid-19 virus on the outer component of refrigerated food packaging, adding that it showed the possibility of infection via such contaminated surfaces, according to state broadcaster CCTV. (BBG)

CORONAVIRUS: Pfizer Inc. laid out a timetable for reaching key milestones in the development of its Covid-19 vaccine that could mean the shots start becoming available in the U.S. before year's end. Chief Executive Albert Bourla said Friday the company could start to see from a large study whether the vaccine works by the end of this month and would have data on its safety by the third week of November. If the preliminary results indicate the vaccine can work safely, Pfizer could ask U.S. health regulators to permit use by late November. (WSJ)

CORONAVIRUS: Dr. Reddy's Laboratories Ltd. and Russia's sovereign wealth fund got approval to conduct human clinical trials of their coronavirus vaccine in India, according to an emailed statement from one of the vaccine developers. The phase 2/3 trial will be a multi-center and randomized controlled study that will include safety and immunogenicity, according to the statement by the Russian Direct Investment Fund. (BBG)

CORONAVIRUS: A row broke out on Friday over a World Health Organization (WHO) clinical trial which concluded that the anti-viral drug remdesivir has little or no impact on a patient's chances of surviving COVID-19. Gilead Sciences Inc., the U.S. company that developed the drug, said the findings appeared inconsistent with evidence from other studies validating the clinical benefit of remdesivir, which was used to treat U.S. President Donald Trump's coronavirus infection. "We are concerned the data from this open-label global trial has not undergone the rigorous review required to allow for constructive scientific discussion," Gilead said. (RTRS)

CORONAVIRUS: The World Health Organization will revise its guidance on the use of remdesivir in coming weeks following the results of the Solidarity trial in which it was found not to reduce the risk of death, Chief Scientist Soumya Swaminathan said at a briefing in Geneva. The review will take into account all studies on the drug. The WHO will only give recommendations on vaccines once it has Phase 3 data about them, Swaminathan said when asked about Russian health authorities approving a second vaccine for public use. (BBG)

CORONAVIRUS: The NHS is preparing to introduce a coronavirus vaccine soon after Christmas. Trials have shown it will cut infections and save lives, Jonathan Van-Tam, the deputy chief medical officer, has privately revealed. He told MPs last week that stage three trials of the vaccine created at Oxford University and being manufactured by AstraZeneca mean a mass rollout is on the horizon as early as December. Thousands of NHS staff are to undergo training to administer a vaccine before the end of the year. (Sunday Times)

CORONAVIRUS: The World Health Organization said on Friday it had had very good dialogue with developers of a second Russian vaccine candidate against COVID-19. "We will only be able to have a position on a vaccine when we see results of the phase 3 clinical trials," WHO Chief Scientist Soumya Swaminathan told a news conference in Geneva. (RTRS)

CORONAVIRUS: The EU's medicines regulator has requested the complete results of the World Health Organization's remdesivir trial, the European Commission said, after the study found the Covid-19 treatment to have no substantial effect on rates of survival. (FT)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Sunday there was no need to change the central bank's inflation target or forward guidance, even though the United States and Europe are reviewing their policy frameworks to seek better ways to prop up growth. (RTRS)

AUSTRALIA: The government and business groups are calling on Australia's Victoria state to reopen the economy more quickly as Covid-19 cases decline, pointing to mounting job losses across retail and hospitality. State Premier Daniel Andrews on Sunday announced an easing of stay-at-home orders, but left many businesses shuttered until next month to ensure community transmission is further curbed. "Every day Victoria remains under restrictions to get the second wave in Victoria under control comes at a heavy cost," Prime Minister Scott Morrison said in a statement, adding that 1,000 jobs a day had been lost on average during the lockdown. (BBG)

AUSTRALIA: Not a single person in the NSW community has been diagnosed with COVID-19 since Saturday, as health authorities green-light larger gatherings at restaurants, cafes, weddings and corporate events. Premier Gladys Berejiklian is looking the Christmas, encouraging families and workplaces to celebrate by eating out, raising the cap on group bookings to 30 people. (Sydney Morning Herald)

AUSTRALIA/NEW ZEALAND: The fledgling travel bubble between Australia and New Zealand hit an early snag after 17 passengers who flew into Sydney on Friday caught a connecting flight to Melbourne in an apparent breach of the rules. (BBG)

NEW ZEALAND: New Zealand Prime Minister Jacinda Ardern swept to an historic election victory and said she will use her mandate to rebuild an economy battered by the coronavirus pandemic and tackle social inequality. Ardern's Labour Party secured the first outright majority in parliament since the introduction of proportional representation in 1996 and, if preliminary results stand, its biggest share of the vote in more than 70 years. Ardern said Sunday she wants to form a government within two to three weeks and plans to talk to the Green Party in coming days -- without indicating what role they could play in her new administration. (BBG)

NORTH KOREA: A North Korean propaganda outlet on Sunday slammed South Korea over a media report that Seoul approached Washington to purchase nuclear fuel for a nuclear-powered submarine. (Yonhap)

TAIWAN: Ministry of Economic Affairs plans to require Taiwanese companies to obtain prior permission before transferring technology to Chinese counterparts, Taipei-based Economic Daily News reports, citing officials. Measures aim to avoid Taiwanese companies operating in China from transferring core technologies when selling their Chinese units. (BBG)

BOC: MNI POLICY: BOC Federal Bond Holdings Top Quarter Trillion

Bank of Canada holdings of federal government bonds climbed CAD6.5 billion this week according to figures published on Friday, taking the total past the quarter trillion dollar mark for the first time - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

TURKEY: The Pentagon and State Department issued strong rebukes Friday following reports that Turkey's military tested a Russia-made missile system, a move that could further stoke tensions between Washington and the NATO member. (CNBC)

TURKEY: Turkish President Tayyip Erdogan has raised the estimated reserves in a gas field off its Black Sea coast to 405 billion cubic metres after finding an additional 85 billion cubic metres. Turkey's president boarded the drillship Fatih on Saturday, where he officially announced details of the new discovery of natural gas reserves. (TRT World)

RUSSIA: The FBI is investigating whether emails that were published by the New York Post related to Joe Biden's son, Hunter, are connected to a possible Russian influence operation to spread disinformation, according to a person familiar with the matter. (Associated Press)

RUSSIA: Russian President Vladimir Putin plans to have a video conference with the country's leading business lobby group as executives seek to discuss the government's response to the coronavirus pandemic and possible tax increases. (BBG)

MIDDLE EAST: An Islamic State spokesman called on the militant group's supporters to target westerners, oil pipelines and economic infrastructure in Saudi Arabia. (RTRS)

IRAN: A UN arms embargo on Iran expired on Sunday, in a blow to the Trump administration that failed in its attempts to extend it. (FT)

IRAN: Secretary of State Mike Pompeo warned Sunday that the United States will slap sanctions on any individual or entity that assists Iran's weapons program, a move that will likely further aggravate tensions between Washington and Tehran. (CNBC)

EQUITIES: Ant Group has won approval from the Chinese securities regulator for the Hong Kong leg of its initial public offering (IPO), moving it one step closer to listing, CNBC has confirmed. (CNBC)

METALS: The union of supervisors at BHP´s Escondida mine in Chile said it had reached an agreement on a labor deal, averting the threat of a strike at the world´s largest copper deposit. (RTRS)

OIL: Russian President Vladimir Putin and Saudi Crown Prince Mohammed bin Salman discussed energy markets and the implementation of agreements by the oil producers group known as OPEC+, the Kremlin said in a statement on Saturday. "Both sides have reiterated their willingness to continue close coordination in this area in order to maintain stability on the global energy market," it said. (RTRS)

CHINA

PBOC: China will see its economy expand by about 2% this year as it has put the coronavirus pandemic under control, the country's central bank governor Yi Gang said on Sunday. "The Chinese economy remains resilient with great potential. Continued recovery is anticipated, which will benefit the global recovery," he said in an online International Banking Seminar of the Group of Thirty. (RTRS)

PBOC: The PBOC is likely to keep the loan prime rate unchanged when it issues its monthly quotation guidance on Tuesday, the Securities Daily reported citing market analysts. The central bank has kept the rate of medium-term lending facilities unchanged this month, an indication that it intends to maintain the current interbank rates, the Daily said. Banks also lack the motivation to lower the October LPR quotes they submit to the PBOC as the average marginal cost of funds hasn't changed significantly, the newspaper said citing Wang Qing, chief analyst at Golden Credit Rating. The one-year LPR has dropped 30 bps so far this year to 3.85%, while the five-year LPR sits at 4.65% after decreasing 15 bps. (MNI)

BONDS: China has allowed Shenzhen to issue government bonds in the overseas offshore yuan market as a trial, The Paper reported citing the notice from the National Development and Reform Commission. The issuance of yuan bonds in foreign markets by local governments will effectively release local financial pressure, promote the internationalization of the Yuan, and increase the liquidity and risk resistance of local debts, the Paper reported citing Wang Yuanwei, an analyst from the National Development Bank. (MNI)

BONDS: China's increased financing support in areas such as manufacturing and infrastructure has led to an increase in medium-to-long term loans which totaled CNY 1.9 trillion in September, up CYN 20.47 billion y/y, the Financial News reported on Monday citing Yuan Xiaohui, a researcher from the BOC Research Institute. The increasing share of medium to long term loans in the credit structure will require banks to balance assets and liabilities to counter the effects of interest rate fluctuations and provide ample liquidity and capital when needed, Yuan said. Medium-to-long term loans to residents are likely to decrease in October due to new housing loan limitations, and loans to businesses are likely to maintain the increasing trend, the News cited Wang Qing, an analyst from Golden Credit Rating. (MNI)

OVERNIGHT DATA

CHINA Q3 GDP +4.9% Y/Y; MEDIAN +5.5%; Q2 +3.2%

CHINA Q3 GDP YTD +0.7% Y/Y; MEDIAN +0.7%; Q2 -1.6%

CHINA Q3 GDP +2.7% Q/Q; MEDIAN +3.3%; Q2 +11.5%

CHINA SEP INDUSTRIAL OUTPUT +6.9% Y/Y; MEDIAN +5.8%; AUG +5.6%

CHINA SEP INDUSTRIAL OUTPUT YTD +1.2% Y/Y; MEDIAN +1.0%; AUG +0.4%

CHINA SEP RETAIL SALES +3.3% Y/Y; MEDIAN +1.6%; AUG +0.5%

CHINA SEP RETAIL SALES YTD -7.2% Y/Y; MEDIAN -7.4%; AUG -8.6%

CHINA SEP UNEMPLOYMENT 5.4%; MEDIAN 5.5%; AUG 5.6%

CHINA SEP FIXED ASSETS EX RURAL YTD +0.8% Y/Y; MEDIAN +0.9%; AUG -0.3%

CHINA SEP PROPERTY INVESTMENT YTD +5.6% Y/Y; MEDIAN +5.2%; AUG +4.6%

MNI DATA IMPACT: China Q3 GDP Grows 4.9%; Spending Surges

- China's GDP surged 4.9% y/y in Q3, further expanding from the 3.2% in Q2 but shy of the 5.5% gain projected by economists, according to data released by the National Bureau of Statistics (NBS) on Monday on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

JAPAN SEP TRADE BALANCE +Y675.0BN; MEDIAN +Y980.7BN; AUG +Y248.6BN

JAPAN SEP TRADE BALANCE ADJ +Y475.8BN; MEDIAN +Y848.7BN; AUG +Y359.0BN

JAPAN SEP EXPORTS -4.9% Y/Y; MEDIAN -2.4%; AUG -14.8%

JAPAN SEP IMPORTS -17.2% Y/Y; MEDIAN -21.4%; AUG -20.8%

NEW ZEALAND SEP SERVICES PMI 50.3; AUG 47.2

BusinessNZ chief executive Kirk Hope said that like its sister survey for the manufacturing sector, the PSI returned to expansion (albeit close to no change) after lockdown restrictions were lifted in Auckland. "While the Northern region still displayed contraction in September, its improvement from August, along with increased activity in most other parts of the country, was enough to get the sector back in black". BNZ Senior Economist Doug Steel said that "recent PSI and PMI readings are consistent with a big bounce back in Q3 GDP from the massive decline in Q2. The exact degree of it is much more difficult to judge. What lies ahead is arguably more important – making the PSI and PMI indicators important to monitor over coming months". (BNZ)

UK OCT RIGHTMOVE HOUSE PRICES +5.5% Y/Y; SEP +5.0%

UK OCT RIGHTMOVE HOUSE PRICES +1.1% M/M; SEP +0.2%

CHINA MARKETS

PBOC NET DRAINS CNY30BN VIA OMOS

The People's Bank of China (PBOC) injected CNY50 billion via 7-day reverse repos with the rate unchanged on Monday. This resulted in a net drain of CNY30 billion given the maturity of CNY80 billion of Treasury's cash deposits at commercial banks, according to Wind Information.

- The operation aims to keep the liquidity in the banking system ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2379% at 09:20 am local time from the close of 2.1867% on Friday: Wind Information.

- The CFETS-NEX money-market sentiment index closed at 40 on Friday vs 36 on Thursday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.7010 MON VS 6.7332

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7010 on Monday, compared with 6.7332 set on Friday, the biggest daily rise in five trading days.MARKETS

SNAPSHOT: Soft China GDP Headlines Overnight, Limiting Early Risk +ve Flow

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 290.13 points at 23700.97

- ASX 200 up 67.606 points at 6244.1

- Shanghai Comp. down 11.064 points at 3325.294

- JGB 10-Yr future down 6 ticks at 152.09, yield up 0.3bp at 0.026%

- Aussie 10-Yr future down 3.0 ticks at 99.245, yield up 2.7bp at 0.749%

- U.S. 10-Yr future -0-05 at 138-29, yield up 1.33bp at 0.759%

- WTI crude down $0.18 at $40.69, Gold up $1.99 at $1901.27

- USD/JPY up 4 pips at Y105.44

- PELOSI SETS 48-HOUR DEADLINE FOR WHITE HOUSE ON STIMULUS TALKS (AXIOS)

- FEDERAL RESERVE DEBATES TOUGHER REGULATION TO PREVENT ASSET BUBBLES (FT)

- COVID MITIGATION MEASURES SEE WIDER DEPLOYMENT IN EUROPE

- U.K. PREPARED TO REWRITE LAWBREAKING BREXIT BILL TO GET EU DEAL (BBG SOURCES)

- MOODY'S DOWNGRADES THE UK BY ONE NOTCH

- CHINA Q3 GDP MISSES, SEP ECON ACTIVITY DATA BEATS

BOND SUMMARY: A Miss For Chinese GDP Halts Early Downside Momentum

A lack of fresh macro headline flow and the weaker than expected Chinese GDP reading has limited the downside impetus that was witnessed in early Asia-Pac trade (which was largely driven by the aforementioned uptick in e-minis, as they unwound some of Friday's late option expiry related losses). Contract last -0-04 at 138-30, while cash Tsys sit 0.6-1.5bp cheaper across the curve.

- The impetus from Tsys/e-minis/the Nikkei 225 weighed on JGB futures in early dealing this week, with the contract shedding its fairly modest overnight gains and more, last -7 ticks vs. Tokyo settlement levels. The swaps curve twist flattened, with receiving seen in 40s, which was an outlier, while cash JGB yields sit either side of unchanged.

- Aussie bonds have seen the impetus from the U.S. Tsy space spill over, resulting in some relatively light pressure, with one eye also on a flurry of A$ semi and corporate deals. YM -0.5, XM -3.0, with the latter struggling for meaningful momentum through its SYCOM lows, for now. The prospect of relatively imminent RBA easing continues to cushion AU 10s vs. their U.S. Tsy counterpart, allowing the AU/U.S. 10-Year yield spread to settle just below 0bp early this week.

JGBS AUCTION: Japanese MOF sells Y2.8907tn 1-Year Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8907tn 1-Year Bills:- Average Yield -0.1348% (prev. -0.1365%)

- Average Price 100.135 (prev. 100.136)

- High Yield: -0.1288% (prev. -0.1365%)

- Low Price: 100.129 (prev. 100.136)

- % Allotted At High Yield: 7.3593% (prev. 96.9742%)

- Bid/Cover: 3.616x (prev. 4.302x)

EQUITIES: E-minis Bid, But Upside Limited By Chinese GDP Miss

E-minis moved higher from the re-open after Friday's late dip (with some attributing the latter to option expiries), before running out of momentum ahead of the Q3 Chinese GDP reading, which missed expectations.

- The softer than expected Chinese GDP print allowed the space to edge away from best levels, with the major regional Asia-Pac indices following similar patterns to e-minis in the first session of the week. Chinese equities underperformed their major counterparts as a result of the release.

- A reminder that U.S. House Speaker Pelosi has issued a 48-hour deadline for a pre-election stimulus deal (which expires on Tuesday), while Senate Republicans are set to table a piecemeal round of fiscal support.

- Nikkei 225 +1.1%, Hang Seng +0.9%, CSI 300 +0.2%, ASX 200 +0.9%.

- S&P 500 futures +21, DJIA futures +149, NASDAQ 100 futures +99.

OIL: COVID & Supply Matters Outweigh Saudi-Russia Diplomacy

WTI & Brent sit ~$0.15 below their respective settlement levels at typing, with an uptick in the USD applying some pressure, outweighing the marginal uptick in e-minis. A reminder that the benchmarks registered similar losses on Friday.

- This downtick came despite the Saudi-Russia power axis continuing to provide diplomatic overtures ahead of Monday's OPEC+ gathering, even though the current production deal is not set to expire until the end of the year.

- It is fair to say the spectre of COVID-19 is swirling over Europe at present, with mitigation measures widening across the continent, while marginal production from Libya continues to be eyed, in addition to the resumption of production in the U.S. Gulf.

GOLD: Bullions Coils

A familiar cocktail of risk matters and fundamental drivers remain in play for the yellow metal, leaving spot bullion trading either side of $1,900/oz in early dealing this week, holding to a particularly narrow range in Asia-Pac hours. The well-defined technical parameters also remain in play.

FOREX: Chinese GDP Miss Moderates Risk-On Flows, NZD Bid After Labour Landslide

A miss in China's Q3 GDP arrested the upswing in commodity-tied FX, linked to an early uptick in e-minis, but failed to generate any sustained risk-off impulse as local economic activity indicators topped forecasts, sending an optimistic signal re: economic recovery dynamics. Onshore yuan printed its best levels vs. the greenback since Apr 2019 in the lead-up to the release, but both CNY & CNH wiped out initial gains. Yuan dynamics inspired the Antipodeans to trim gains, but they remained afloat nonetheless.

- NZD outperformed its G10 peers after New Zealand's ruling Labour Party secured a landslide victory in the country's general election. PM Ardern's party will be able to govern alone, but still intends to talk with the Greens over an unspecified form of potential collaboration. AUD drew some support from demand for its Antipodean cousin.

- GBP started on a softer footing, as regional players digested Friday's downgrade to the UK's sovereign rating by Moody's, but regained poise amid reports noting that the UK is willing to water down its controversial Internal Markets Bill in a bid to revive talks with the EU.

- USD/JPY erased its initial modest gains on the back of a round of sales into the Tokyo fix.

- KRW led gains in Asia. Broader risk-on impetus allowed USD/KRW to print a fresh 18-month low, despite the absence of any meaningful local catalysts.

- Focus turns to the BoC's Business Outlook Survey and comments from a whole host of central bankers from the Fed, ECB, BoE, Riksbank & Norges Bank.

FOREX OPTIONS: Expiries for Oct19 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1540-50(E1.1bln), $1.1600(E767mln), $1.1615-20(E720mln-EUR puts), $1.1650(E1.1bln), $1.1700-15(E1.0bln), $1.1730-35(E601mln), $1.1770-75(E1.1bln), $1.1800(E1.0bln), $1.1850(E659mln), $1.1900(E751mln), $1.1950(E981mln)

- USD/JPY: Y105.00($557mln), Y106.00($1.1bln), Y107.00-10($886mln)

- EUR/JPY: Y125.00(E514mln)

- AUD/USD: $0.7280-85(A$718mln)

- USD/CNY: Cny6.7735($1.0bln), Cny6.80($829mln), Cny7.00($750mln)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.