-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN OPEN: Fiscal Progress In DC? Antipodean Banks In Focus In Asia

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* PELOSI & MNUCHIN MAKE PROGRESS IN STIMULUS TALKS, TO SPEAK AGAIN TUESDAY (CNBC)

* UK SAYS STILL NO BASIS TO RESUME BREXIT TALKS WITH EU

* PBOC MAY STEP UP REVERSE REPO OPERATIONS (CSJ)

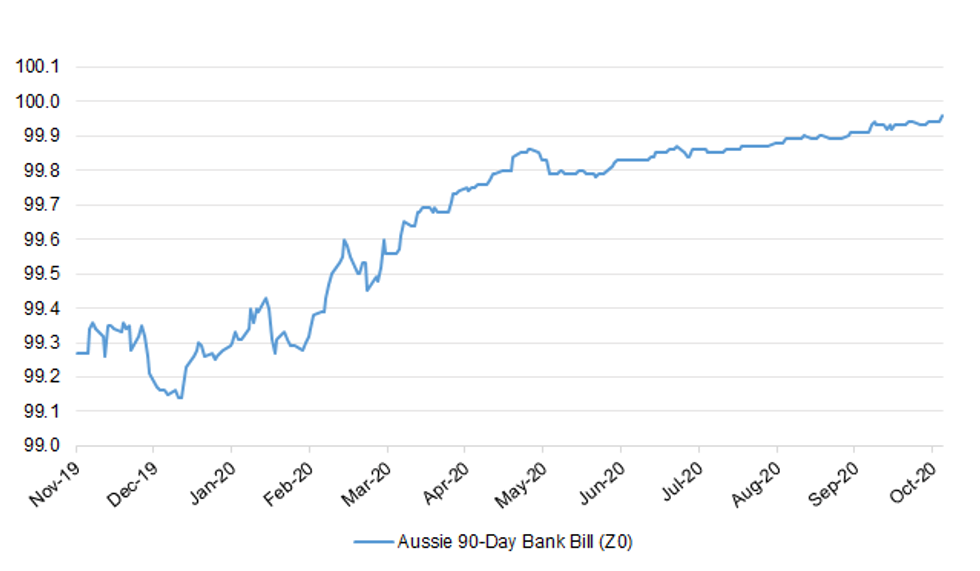

* RBA'S KENT: WOULD NOT BE UNEXPECTED FOR BBSW TO POP BELOW ZERO (BBG)

* RBNZ'S ORR: PREPARED TO USE ALL TOOLS TO COUNTER DEFLATION (BBG)

* MODERNA CEO EXPECTS COVID-19 VACCINE INTERIM RESULTS IN NOVEMBER (WSJ)

Fig. 1: Aussie 90-Day Bank Bill (Z0)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Manchester MPs and city leaders urged Boris Johnson to introduce shielding for the elderly and vulnerable in the region instead of bringing in new lockdown restrictions. The Prime Minister is expected to announce on Tuesday that Greater Manchester will be placed into the highest tier of Covid measures , with or without the consent of its leaders. On Monday night, Robert Jenrick, the Communities Secretary, said local leaders have until noon on Tuesday to reach an agreement on restrictions or be forced to comply with a Tier 3 lockdown. (Telegraph)

CORONAVIRUS/POLITICS: Just over half of the public think the government is making the wrong decisions in its handling of the coronavirus pandemic, according to a YouGov survey for Sky News. The poll also revealed that 67% of people would support a short "circuit breaker" lockdown in England The same percentage said they are scared about the impact of COVID-19 this winter. Asked about the UK government's response, 52% said they are making the wrong decisions - while 26% said they are making the right ones. And 61% said they don't trust Boris Johnson to make the right decisions over the virus. (Sky)

BREXIT: Britain said on Monday there was still no basis for trade talks with the European Union to resume, following a call between British and EU negotiators David Frost and Michel Barnier. "The UK continues to believe there is no basis to resume talks unless there is a fundamental change of approach from the EU," a statement from UK Prime Minister Boris Johnson's office said. "This means an EU approach consistent with trying to find an agreement between sovereign equals and with acceptance that movement needs to come from the EU side as well as the UK." The spokesman described the call as constructive and said that both sides had agreed to remain in close touch. "The UK has noted the EU's proposal to genuinely intensify talks, which is what would be expected at this stage in a negotiation," the statement said. (RTRS)

BOE: The Bank of England is likely to supplement its quantitative easing war chest next month to offer more support to an economy still struggling amid coronavirus restrictions on activity and fears of a no-deal Brexit, a Reuters poll found. (RTRS)

ECONOMY: Businesses are being set up in the UK at a record rate, according to the government's register of national corporate activity, as criminals attempting Covid-related fraud establish companies alongside entrepreneurs creating new ventures. (FT)

SCOTLAND: Britain's governing Conservatives are sketching out a strategy to counter rising support for Scottish independence, with a memo circulated to a select group of people including Cabinet minister Michael Gove, according to people familiar with the discussions taking place. The document from a political consultancy firm that works closely with the party looks at tactics to delay and then avoid a referendum in the event of a majority for the pro-independence Scottish National Party in next May's elections, an outcome that looks increasingly likely. (BBG)

EUROPE

ECB: Joint borrowing by European nations to overcome a pandemic shock should remain a one-off, Bundesbank President Jens Weidmann said on Monday, seemingly rebuffing European Central Bank President Christine Lagarde's call for a common budgetary tool. (RTRS)

GERMANY: Germany's CDU will suggest new laws to make investing into stocks more attractive, Welt says, citing a draft it obtained. The measures laid out in the draft include: Allowing each employee to receive at least EU3,500 in tax-free company shares per year, a threshold that would rise with family size. Measures are also meant to support startups that often pay parts of salaries in shares. Capital gains to turn tax-free after a certain holding period. (BBG)

IRELAND: Ireland's government imposed some of the most sweeping pandemic restrictions in Europe, as the virus threatened to spiral out of control again. Non-essential stores, bars and restaurants will close their doors for at least six weeks, Irish Prime Minister Micheal Martin said. Travel will be further restricted, with people told to stay within 5 kilometers (3.1 miles) from home. "These are the toughest of times," Martin said in a televised address in Dublin on Monday. (BBG)

ITALY: Lombardy, the Italian region around Milan, asked the government to approve a curfew from 11 p.m. to 5 a.m. starting on Thursday. The request was made after a meeting with the region's mayors and Lombardy Governor Attilio Fontana, according to a statement on Monday. It follows a forecast that Covid-19 patients in intensive care units will rise to as many as 600 by the end of the month. (BBG)

U.S.

FED: The U.S. economy is rebounding strongly after taking a big hit because of the coronavirus pandemic, but it may be another year before the economy returns to pre-crisis levels and take even longer for the labor market to recoup lost ground, Federal Reserve Vice Chair Richard Clarida said on Monday. The pandemic threw the U.S. economy into a "very deep hole," Clarida said. While economic activity likely bounced back strongly in the third quarter, the outlook is "unusually uncertain," he said. (RTRS)

FED: Slowing U.S. employment gains and an increased proportion of permanent layoffs could undermine the economic recovery with disproportionate harm to minorities, said Federal Reserve Bank of Atlanta President Raphael Bostic. "Widespread permanent job loss could become a material risk to the recovery," Bostic said Monday in prepared remarks to the Securities Industry and Financial Markets Association. "The data on this are clear: permanently laid off workers find it far more difficult to rejoin the labor force. This would make recovery more difficult to sustain." (BBG)

FED: MNI EXCLUSIVE: Fed May Shift QE Purchases Towards Long End

- The Federal Reserve may shift more of its bond-buying program towards the long end of the yield curve in order to keep up with Treasury issuance plans and as it awaits more clarity on the economic outlook before considering any increase in the amount of its purchases, former Fed officials told MNI - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin made progress in their latest coronavirus stimulus talks Monday as time runs short to reach a deal before the 2020 election. In a nearly one-hour phone call, the pair "continued to narrow their differences," the California Democrat's spokesman, Drew Hammill, said in a tweeted statement. Pelosi has directed House committee chairs to work to resolve areas of disagreement with the White House, and the speaker and Mnuchin plan to talk again Tuesday, Hammill added. "The Speaker continues to hope that, by the end of the day Tuesday, we will have clarity on whether we will be able to pass a bill before the election," he said. (CNBC)

FISCAL: A Fox reporter tweeted the following on Monday: "Meadows says he spoke w/Mnuchin on coronavirus bill. Says there's progress but no one is "popping the champagne corks yet."" (MNI)

FISCAL: A Fox reporter tweeted the following on Monday: "From sources familiar with today's House Democratic Caucus conference call:

- A) House committee chairs told rank and file members that "language" continues to be a problem in getting a universal coronavirus agreement.

- B) Testing and contact tracing for minority communities continues to be an issue. There is concern about getting enough assistance for Head Start, child care and food assistance for those in poverty.

- C) House Speaker Nancy Pelosi (D-CA) told Democrats they can't make matters worse. She also pushed for direct payments." (MNI)

CORONAVIRUS: President Donald Trump on Monday said the government's top pandemic fighter, Dr. Anthony Fauci, is a "disaster" — and possibly an "idiot" — as he claimed that Americans are "tired of" Covid-19, even as the number of coronavirus cases continued spiking in much of the United States. (CNBC)

CORONAVIRUS: A Wisconsin judge put back in place statewide restrictions on bars, restaurants and other indoor spaces that had been temporarily suspended last week as the state faced rising cases of Covid-19. (WSJ)

CORONAVIRUS/POLITICS: The Covid-19 pandemic is disproportionately affecting some crucial voters two weeks before Election Day, costing American lives and potentially hurting President Donald Trump, who has received overwhelmingly poor grades from Democrats and independent voters on his virus response. Wisconsin is the most extreme example, a swing state that Trump won in 2016 that now has America's fourth-worst outbreak by per-capita cases in the past week. Florida, Arizona, Pennsylvania, North Carolina and Michigan have all seen difficult stretches, and cases have been creeping back up in recent weeks. In North Carolina, counties with large Black communities -- which helped former President Barack Obama win the state in 2008 and 2012 -- are facing their hardest stretch of the pandemic. (BBG)

POLITICS: With only two weeks left until Election Day, Joe Biden's lead over President Trump has widened to 11 percentage points — Biden's biggest margin among likely voters in any Yahoo News/YouGov poll to date. The survey, which was conducted from Oct. 16 to 18, shows that a majority of likely voters (51 percent) now say they are voting for the Democratic nominee, while just 40 percent say they are voting for Trump. Biden's lead, which is identical among registered voters, has grown by 3 points since last week's Yahoo News/YouGov poll. (Yahoo News)

POLITICS: President Donald Trump appeared to cut into Democratic rival Joe Biden's lead in Pennsylvania, one of the election's most important battlegrounds, but Biden maintained a solid lead in Wisconsin, Reuters/Ipsos opinion polls showed on Monday. (RTRS)

POLITICS: An evenly divided Supreme Court said Monday it is declining to block a Pennsylvania state court ruling allowing mail-in ballots in the crucial battleground state to be counted as long as they're postmarked by Election Day, even if they arrive up to three days later. The order from the high court is a victory for Democrats, as the presidential campaigns prepare for an all-out battle for the state's 20 electoral votes. (POLITICO)

POLITICS: President Donald Trump and Democratic nominee Joe Biden will at times have their microphones temporarily cut during their next debate, the event's sponsors announced Monday. When one of the two candidates is given a chance to provide a two-minute answer to each of the six debate topics, his opponent's microphone will be muted, the Commission on Presidential Debates said in a statement. (CNBC)

FISCAL: High earners in New York and California could face combined federal and state tax rates of 62% under Democratic presidential nominee Joe Biden's tax plan, according to experts. While Americans earning less than $400,000 would, on average, receive tax cuts under Biden's plan, the highest earners would face double-digit increases in their official tax rates, according to nonpartisan analyses. In California, New Jersey and New York City, taxpayers earning more than $400,000 a year could face combined state and local statutory income tax rates of more than 60%. (CNBC)

EQUITIES: Democrats and Republicans have an issue they both agree on: tech companies have too much power and antitrust authorities should move to curb it. Where they disagree, however, is how to rein in the companies, especially when it comes to regulating perceptions of political bias on the platforms. (WSJ)

EQUITIES: Senate Judiciary Committee lists subpoena authorization for CEOs of Twitter and Facebook on its Oct. 22 agenda, but says staff are continuing negotiations with both cos. about voluntary testimony. (BBG)

EQUITIES: Goldman Sachs Group Inc. has reached a long-awaited pact with the U.S. Department of Justice to pay more than $2 billion for the bank's role in Malaysia's 1MDB scandal, and the deal may be announced within days, according to people familiar with the matter. The accord, part of an international action, will let the parent company avoid a U.S. criminal conviction, according to the people, who asked not to be named discussing the confidential talks. The payment to the Justice Department is broadly in line with the bank's prior reserves and analysts' estimates. (BBG)

OTHER

CANADA/CHINA: Deputy Prime Minister Chrystia Freeland is denouncing China's ambassador to Canada for threatening Canadians living in Hong Kong as Beijing staunchly defends its outspoken diplomat and accuses Ottawa of promoting "anti-China voices." Ms. Freeland told the House of Commons on Monday she was "well aware of the character of Communist authoritarian regimes" as she chided Chinese Ambassador Cong Peiwu for overstepping his diplomatic role. However, she sidestepped calls from the official opposition to expel the diplomat. "Let me say the recent comments by the Chinese ambassador are not in any way in keeping with the spirit of appropriate diplomatic relations between two countries," she said in response to questions from Conservative Leader Erin O'Toole. (Globe & Mail)

GEOPOLITICS: The U.S. is imposing sanctions on six Chinese firms for doing business with Islamic Republic of Iran Shipping Lines, an entity the State Department says is used by the Iranian government to transport material it uses in missiles and military programs. (BBG)

CORONAVIRUS: The World Health Organization said the public will have to deal with the coronavirus pandemic "for the long haul" as cases continue to rapidly grow across the globe. As the northern hemisphere enters the fall and winter seasons, the agency is seeing Covid-19 cases accelerate, particularly in Europe and North America, WHO Director-General Tedros Adhanom Ghebreyesus said during a press conference. (CNBC)

CORONAVIRUS: Moderna Inc. Chief Executive Stéphane Bancel said the federal government could authorize emergency use of the company's experimental Covid-19 vaccine in December, if the company gets positive interim results in November from a large clinical trial. Mr. Bancel, speaking during The Wall Street Journal's annual Tech Live conference Monday, said sufficient interim results from the study takes longer to get, government authorization of the vaccine may not occur until early next year. (WSJ)

CORONAVIRUS: An experimental coronavirus vaccine developed by China's Sinovac Biotech appeared to be safe in a late-stage clinical trial in Brazil, preliminary results showed on Monday. (RTRS)

HONG KONG: Chief Executive Carrie Lam said "conditions" weren't right for Hong Kong to further relax social distancing measures, and that authorities would brief regarding the latest on the restrictions later Tuesday. Lam was addressing a weekly briefing ahead of a meeting of her advisory Executive Council. The Hong Kong Economic Times reported earlier that authorities would discuss relaxing the current four-person limit on social gatherings at the meeting to allow local tour groups of as many as 30 people. (BBG)

BOJ: The Bank of Japan is expected to cut this fiscal year's economic and price forecasts when it issues fresh quarterly projections at next week's rate review, sources familiar with its thinking said. Any such downgrade is unlikely to trigger an immediate expansion of monetary stimulus, as the central bank is set to maintain its scenario that the world's third-largest economy is headed for a moderate recovery, the sources said. "It's somewhat weaker than three months ago," one of the sources said of this fiscal year's growth projections, a view echoed by two other sources. (RTRS)

RBA: Australia's central bank said further policy easing is likely to "gain more traction" as restrictions are lifted across the economy and agreed the governor would flag the shift to targeting actual over forecast inflation. "As the economy opens up, members considered it reasonable to expect that further monetary easing would gain more traction than had been the case earlier," the Reserve Bank of Australia said in minutes of its October meeting in Sydney Tuesday. "Some parts of the transmission of easier monetary policy had been impaired as a result of the restrictions on activity." (BBG)

RBA: The Reserve Bank of Australia says there is scope to lower the cash rate and use other policy instruments, as speculation mounts for a possible cut as early as November. RBA assistant governor for financial markets Christopher Kent, reiterating recent comments by governor Philip Lowe, said addition monetary policy easing could gain a bit more traction now the economy was opening up, including Victoria. "They could all go a little lower than they currently are," Dr Kent told a webinar on Tuesday, with reference to the cash rate and the three-year bond yield target. But he declined to speculate whether the RBA would start buying longer-dated bonds other than three-year issues. (The West Australian)

AUSTRALIA: The ABS notes that "between the week ending 19 September and the week ending 3 October 2020:

- Payroll jobs decreased by 0.9%, compared to an increase of 0.5% in the previous fortnight.

- Total wages paid decreased by 2.2%, compared to an increase of 1.3% in the previous fortnight." (MNI)

AUSTRALIA/RATINGS: S&P affirmed Australia at AAA; Outlook Negative

RBNZ: Reserve Bank of New Zealand Governor Adrian Orr has signalled he is prepared to use a suite of monetary policy tools to avoid seeing deflation take hold in the economy. "The failure of monetary policy is deflation," Orr said during a presentation to the INFINZ conference in Auckland. "I'd prefer to be battling with the quality problem of re-containing high inflation than the real challenge of battling deflation." The RBNZ has cut the official cash rate to a record-low 0.25% and begun quantitative easing to help meet its twin targets of 1-3% inflation and sustainable employment. Policy makers are assessing other tools including negative wholesale rates and term lending for banks if additional stimulus is needed. Orr reiterated the RBNZ will update on its plans for the Funding for Lending program at the Nov. 11 monetary policy statement. There is also "plenty of room" within the current QE strategy, he said. (BBG)

NEW ZEALAND: The latest NZIER Quarterly Survey of Business Opinion (QSBO) shows business confidence has improved, reflecting a pick-up in demand over the September quarter. A net 1 percent of businesses reported an increase in own trading activity – a turnaround from the net 37 percent reporting a decline in the previous quarter. This result supports our expectations of a V-shaped recovery in economic activity, as the New Zealand economy responds to the unprecedented amount of stimulus measures implemented by the Government and Reserve Bank. Nonetheless, businesses on the whole are still feeling downbeat, but this pessimism is reducing with a net 39 percent of businesses expecting a deterioration in general economic conditions over the coming months – lower than the 58 percent in the previous quarter. (NZIER)

CANADA: MNI POLICY: Canada Household Confidence Rebounds in Q3

- Canadian consumer confidence rebounded in the third quarter from a prior record low, reflecting improvement in the job market, incomes and expected home prices following the Covid-19 lockdown, an MNI review of central bank data shows. The MNI summary measure of the Bank of Canada's household survey data was +40 compared with -96 in the second quarter. Eight of 13 components in the summary measure showed improvement this time, while the previous results showed all but one figure had worsened - on MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com.

CANADA: The Canadian Alternative Reference Rate working group will conduct an analysis of the Canadian Dollar Offered Rate, the Bank of Canada said in a statement Monday. (BBG)

TURKEY: Senate Foreign Relations Chair Jim Risch says additional sanctions against Turkey for testing the Russian-made S400 missile system are at the top of his list after the presidential election. Risch and panel's top Democrat, Sen. Bob Menendez, have a bill that would require the president to impose sanctions on Turkey for using the system. (BBG)

MEXICO: Mexican Finance Minister Arturo Herrera said on Monday that he met with the International Monetary Fund director on Friday to discuss the renewal of a credit line. "In that meeting, the subject of the credit line that Mexico has was explicitly discussed," Herrera said in a virtual news conference, adding the mid-term review will be in a few days. Last year, Mexico renewed its credit line for an equivalent of $61 billion, a reduction from $74 billion. Herrera also said that the largest risks are not in the economy but in the resurgence of coronavirus cases, calling spikes in the number of cases in parts of Europe and the United States "worrying". (RTRS)

RUSSIA: Russian hackers targeted this year's Olympic Games in Tokyo with the aim of disrupting them, UK officials said. The Foreign Office said Russia's GRU military intelligence carried out "cyber reconnaissance" against officials and organisations involved. The alleged attacks took place before the Games were postponed until 2021 because of the coronavirus pandemic. Officials did not, however, specify the nature or extent of the cyber-attacks in detail. At the same time, the US Department of Justice announced charges against six Russian GRU officers for alleged cyber-attacks serving "the strategic benefit of Russia". (BBC)

ARGENTINA: IMF Managing Director Kristalina Georgieva said she spoke with Argentina Economy Minister Martin Guzman about the country's road ahead. "We'll continue to support the authorities as they work towards easing foreign exchange pressures, anchoring economic stability & laying the foundations for recovery". (BBG)

MARKETS: Nippon Life Insurance plans to apply an environmental, social and governance evaluation to all of its financing and investment deals from April, Kyodo reports, without attribution. Will be the first time a Japanese private-sector institutional investor has decided to use ESG for all of its assets. (BBG)

EQUITIES: SoftBank Group Corp. charged ahead with its new public stock trading arm, increasing equity positions to more than $20 billion despite an initially skeptical response from shareholders, according to a person familiar with the investments. Bloomberg reported in August that SoftBank had been targeting more than $10 billion and that the sum could reach into the tens of billions. The Japanese conglomerate considered tempering its trading plans in early September after reports that SoftBank's spending spree was stirring froth in tech stocks. The news erased about $9 billion in market value for SoftBank at the time. (BBG)

METALS: Vale SA produced more iron ore than expected last quarter in the latest sign of rising seaborne supplies that have stalled a rally in futures of the steelmaking ingredient. The Rio de Janeiro-based company reported third-quarter production of 88.7 million metric tons, its best result in almost two years. That compares with the 85.7 million-ton average estimate among six analysts surveyed by Bloomberg. (BBG)

OIL: OPEC and allied producers on Monday pledged action to support the oil market as concerns mounted that a second wave of the COVID-19 pandemic will hobble demand and an earlier plan to raise output from next year would further depress prices. (RTRS)

OIL: Russian Energy Minister Alexander Novak said the monitoring committee of the OPEC+ group of leading oil producing countries have recommended on Monday to stick in full to the global deal to reduce oil production. He said the next ministerial meeting of OPEC+ will gather in December. (RTRS)

OIL: Russian Energy Minister Alexander Novak said on Monday the oil market will likely see more uncertainty in winter when demand for fuel typically declines. He also told Rossiya-24 TV station current oil prices are in line with the "current situation", while there is a deficit of oil on the market at the moment to the tune of 1 million barrels of oil per day. (RTRS)

CHINA

PBOC: The PBOC may gradually increase reverse repo offerings from middle of this week, to offset quarterly tax payments and government bond issuance, China Securities Journal says in a front-page report, citing unidentified people. A cut in reserve requirement is unlikely in Oct., report says. (BBG)

YUAN: The yuan is likely to fluctuate around the current level after a period of strength, as the dollar index has reached a phasic low and a stronger yuan threatens to pressure exports, the Economic Information Daily reported citing Xu Gao, an economist at BOC International. The yuan has been propelled by China's better prevention and control of the pandemic and widening Sino-U.S. interest rate differentials, Xu said. The PBOC will continue to ensure the yuan's flexibility through macro-policies and the balance of payments, the newspaper said citing recent comments by Sun Guofeng, the head of the PBOC's Monetary Policy Division. (MNI)

PBOC: The PBOC may inject additional funds via reverse repo operations this month as tax payments and the large scale of government bond issuance drains liquidity, the China Securities Journal reported citing unidentified market sources. October is the traditional peak season for tax collections, while analysts expect the net supply of both China Government Bonds and local government bonds to exceed CNY700 billion this month, straining liquidity, the newspaper said. As the PBOC previously suspended reverse repo operations there are only CNY100 billion of reverse repos maturing, leaving room for new injections, the Journal said. (MNI)

INFRASTRUCTURE: China will speed up the construction of high-tech infrastructure including 5G, artificial intelligence and data centers, so to better support the development of the virtual reality industry, the Securities Times reported citing a speech by Vice Premier Liu He. Speaking at the 2020 World Conference on the VR Industry, Liu said the application of 5G+VR technologies should be accelerated in manufacturing, education, medical care, culture and entertainment as well as trade and logistics. (MNI)

OVERNIGHT DATA

CHINA SEP NEW HOME PRICES +0.34% M/M; MEDIAN +0.50%; AUG +0.56%

JAPAN SEP TOKYO CONDOMINIUMS FOR SALE +5.0% Y/Y; AUG -8.2%

JAPAN SEP CONVENIENCE STORE SALES -3.0% Y/Y; AUG -5.5%

AUSTRALIAN ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 98.1; PREV. 97.7

Alongside the release of the latest ANZ-Roy Morgan weekly consumer confidence reading ANZ noted that "building on the momentum from the Budget, confidence gained for the seventh week in a row. Barring Tasmania, New South Wales and Victoria all the states are above the neutral level of 100. Among the major cities, Melbourne weakened while confidence in Brisbane and Sydney surged. Further easing of COVID-19 induced restrictions should support the index over this week as it seeks to move back to its pre-pandemic level." (ANZ)

CHINA MARKETS

PBOC NET INJECTS CNY70BN VIA OMOS

The People's Bank of China (PBOC) injected CNY70 billion via 7-day reverse repos with the rate unchanged on Tuesday. This resulted in a net injection of CNY70 billion as no reverse repos matured, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2000% at 09:24 am local time from the close of 2.2494% on Monday: Wind Information.

- The CFETS-NEX money-market sentiment index closed at 49 on Monday vs 40 on Friday. A higher index indicates increased market expectations for tighter liquidity.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate below the 6.7000 level at 6.6930 on Tuesday, compared with the 6.7010 set on Monday, the strongest parity rate since Apr 18, 2019.

MARKETS

SNAPSHOT: Fiscal Progress In DC? Antipodean Banks In Focus In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 125.22 points at 23546.42

- ASX 200 down 43.883 points at 6185.5

- Shanghai Comp. down 4.353 points at 3308.314

- JGB 10-Yr future up 3 ticks at 152.13, yield down 0.1bp at 0.025%

- Aussie 10-Yr future down 0.5 ticks at 99.240, yield up 0.2bp at 0.754%

- U.S. 10-Yr future -0-02+ at 138-27, yield down 0.34bp at 0.766%

- WTI crude down $0.22 at $40.61, Gold down $3.33 at $1900.6

- USD/JPY up 11 pips at Y105.54

- PELOSI & MNUCHIN MAKE PROGRESS IN STIMULUS TALKS, TO SPEAK AGAIN TUESDAY (CNBC)

- UK SAYS STILL NO BASIS TO RESUME BREXIT TALKS WITH EU

- PBOC MAY STEP UP REVERSE REPO OPERATIONS (CSJ)

- RBA'S KENT: WOULD NOT BE UNEXPECTED FOR BBSW TO POP BELOW ZERO (BBG)

- RBNZ'S ORR: PREPARED TO USE ALL TOOLS TO COUNTER DEFLATION (BBG)

- MODERNA CEO EXPECTS COVID-19 VACCINE INTERIM RESULTS IN NOVEMBER (WSJ)

BOND SUMMARY: Core FI Sees Mixed Flows

A distinct lack of macro headline flow has allowed T-Notes to stick to a 0-03 range in Asia-Pac hours, last -0-03 at 138-26+, with cash Tsys showing marginal twist flattening, as yields sit within -/+ 0.5bp of their respective closing levels across the curve. E-minis have edged away from their late NY lows in post-settlement/Asia-Pac trade after a little more optimism re: fiscal talks in DC emerged on narrower differences between the Trump administration and the Democrats, although it is fair to say that many hurdles remain, which is reflected in the relative levels of e-minis vs. their Monday highs.

- JGB futures drew support from the curve flattening evident in cash JGB trade, with the contract last +2 vs. Tokyo settlement levels, a touch off highs. In terms of the bull flattening witnessed in cash trade, it looks like receiving in super-long swaps has been the driving factor, with 30- and 40-Year swaps tighter vs. their JGB equivalents. There has been a lack of macro headline flow, and the aforementioned round of swap receiving looks to have offset any U.S. Tsy/20-Year JGB supply related pressure. The latest 20-Year auction passed smoothly enough, with a focus on carry.

- In Australia YM +0.5, XM -0.5, with focus falling on comments from RBA Assistant Governor Kent. The most notable of which noted that a move into -ve territory for BBSW would not be unexpected. This supported the Bill space, which last sits +1-3 through the reds.

JGBS AUCTION: Japanese MOF sells Y972.8bn 20-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y972.8bn 20-Year JGBs:- Average Yield 0.394% (prev. 0.408%)

- Average Price 100.10 (prev. 99.85)

- High Yield: 0.397% (prev. 0.413%)

- Low Price: 100.05 (prev. 99.75)

- % Allotted At High Yield: 18.5341% (prev. 75.5975%)

- Bid/Cover: 3.860x (prev. 3.693x)

EQUITIES: E-Minis Off Monday Lows

E-minis have edged away from their late NY lows in post-settlement/Asia-Pac trade after a little more optimism re: fiscal talks in DC emerged on narrower differences between the Trump administration and the Democrats, although it is fair to say that many hurdles remain. This leaves the contracts well shy of their respective Monday highs after the dip seen in NY hours.

- The major Asia-Pac indices were unchanged to a touch lower, given the net impetus from Wall St. & e-mini trade.

- Nikkei 225 -0.3%, Hang Seng unch., CSI 300 -0.2%, ASX 200 -0.6%.

- S&P 500 futures +12, DJIA futures +87, NASDAQ 100 futures +50.

OIL: A Lack Of Upside Catalysts In Early Trade This Week

WTI & Brent sit ~$0.35 below their respective settlement levels as of typing, after finishing unchanged to a touch lower on Monday.

- Focus on Monday fell on the OPEC+ JMMC gathering, which made no recommendation re: the producer production pact, as expected, while Russia seemingly failed to submit a compensation plan re: its overproduction relative to its allocation under the deal. Elsewhere, the rhetoric coming out of the meeting surrounding the outlook for the oil market was generally guarded to negative and has likely contributed to post-settlement weakness for crude.

- Monday reports also pointed to yet another incremental uptick in Libyan production/supply, keeping the space in check.

- Weekly API crude inventory estimates are due after hours on Tuesday.

GOLD: Cross Currents

Gold hovers around $1,900/oz in Asia-Pac trade, after backing away from best levels on Monday as participants assessed the cross currents from the uptick in U.S. Tsy yields and downtick in the USD. Familiar fundamental factors alongside well-defined technical parameters remain in play.

FOREX: Antipodeans Undermined By Central Bank Speak, CNH Prints New Cycle High

Antipodean FX remained under pressure overnight as comments from local policymakers took focus. The Kiwi went offered as RBNZ Gov Orr talked up ample policy room, expressed preference for inflation overshoot rather than having to battle deflation and signalled potential for implementing macroprudential measures if banks "get carried away". Not too long thereafter, RBA Asst Gov Kent said that it wouldn't be unexpected for BBSW to plunge below 0% and his remarks overshadowed the fairly unimpressive minutes from the RBA's most recent monetary policy meeting. Central bank speak drove a round trip in AUD/NZD followed by some further wavering. AUD/USD sank through support from Oct 15 low, printing worst levels this month.

- USD/JPY ticked higher into the Tokyo fix. It is a Gotobi day today.

- USD/CNH peeked under another key support and briefly showed at levels not seen since Jul 2018, but promptly erased losses. The PBoC offered little to no impetus, as its daily fixing of USD/CNY mid-point and monthly LPR fixing fell in line with expectations.

- USD/KRW dipped through the KRW1,140.00 mark to the lowest levels since Apr 2019, despite the news that Intel agreed to sell its memory chip unit to South Korea's SK Hynix for about KRW10.3tn.

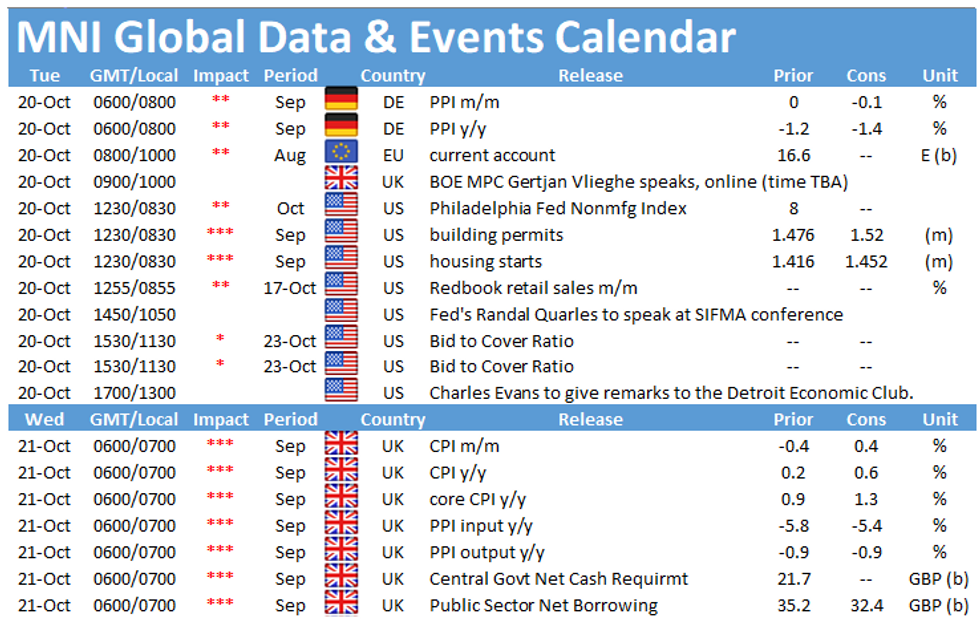

- Eyes move to U.S. housing starts & building permits, German PPI and comments from Fed's Quarles, Evans, Brainard & Bostic, ECB's de Cos, BoE's Vlieghe and Riksbank's Ingves & Ohlsson.

FOREX OPTIONS: Expiries for Oct20 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1650(E664mln), $1.1745(E1.4bln), $1.1790-00(E1.1bln), $1.1865-75(E688mln)

- USD/JPY: Y105.00($760mln), Y105.50-60($1.1bln), Y106.35-50($2.5bln-USD calls)

- AUD/USD: $0.7050(A$643mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.