-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI EUROPEAN OPEN: E-Minis Nudge Lower On Familiar Risks

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* TRUMP'S NATIONAL SECURITY ADVISER WARNS CHINA ON HONG KONG (BBG)

* ANOTHER RECORD DAY OF U.S. COVID CASES

* MODERNA COMPLETES CASE ACCRUAL FOR VACCINE INTERIM ANALYSIS (BBG)

* CHINA BANS LOG SHIPMENTS FROM AUSTRALIA'S VICTORIA STATE (BBG)

* HAWKESBY MARKET REACTION WAS TO ECONOMISTS CHANGING CALLS, NOT RBNZ COMMUNICATION (RTRS)

* OPEC+ FOCUSES ON DELAY TO OIL-OUTPUT HIKE OF THREE TO SIX MONTHS

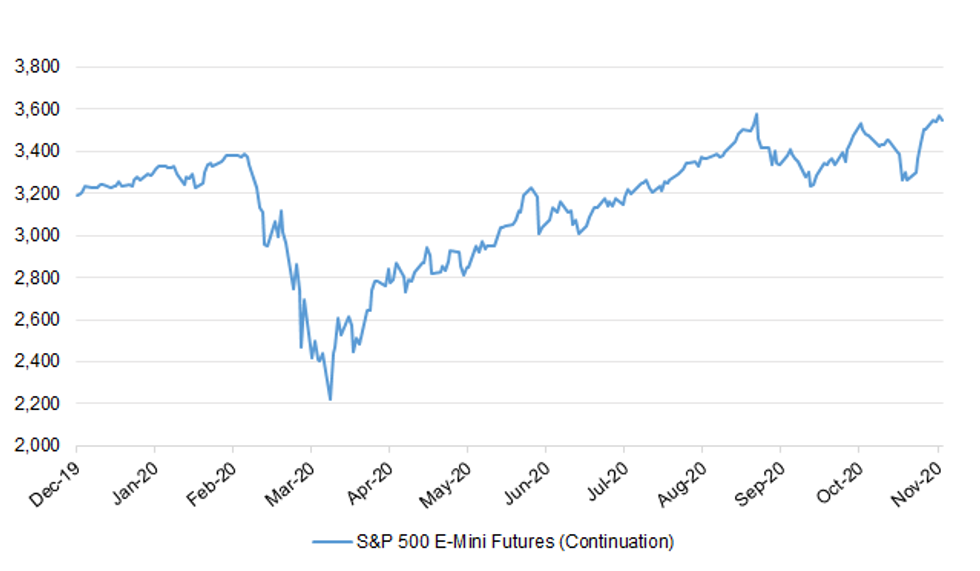

Fig. 1: S&P 500 E-Mini Futures (Continuation)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The UK has become the first country in Europe to pass 50,000 coronavirus deaths, according to the latest government figures. A total of 50,365 people have died within 28 days of a positive Covid test, up 595 in the past 24 hours. The UK is the fifth country to pass 50,000 deaths, coming after the US, Brazil, India and Mexico. Prime Minister Boris Johnson said the figures showed, despite hopes for a vaccine, "we are not out of the woods".

FISCAL: The amount of tax levied on capital gains could be raised by billions of pounds, according to a new report. About £14bn could be raised by cutting exemptions and doubling rates, according to the review, which was commissioned by Chancellor Rishi Sunak. The main losers would wealthy people who own second homes or assets not shielded from tax. It comes as Chancellor Rishi Sunak looks for ways to cover the enormous costs of the coronavirus pandemic. In September, he reassured recently-elected Tory MPs there would not be a "horror show of tax rises with no end in sight". The Office for Tax Simplification (OTS), however, found that many current features of capital gains tax "can distort behaviour" as people try to lower their bills. (BBC)

FISCAL: People earning more than £19,500 a year would pay more under a £40bn tax hike plan to boost the public finances in the wake of the COVID-19 crisis. The Resolution Foundation makes the case for a range of tax changes by the middle of the decade to avoid a return to austerity and tackle the record peacetime borrowing demanded by the government's response to coronavirus. The latest official figures showed £208bn was borrowed by the Treasury in the first six months of the current financial year alone - £175bn up on the same period in 2019. (Sky)

ECONOMY: The number of people falling into severe problem debt after being hit by the impact of coronavirus has doubled since March, a charity has said. StepChange said that 1.2 million people faced serious issues including falling behind on essential bills and using more credit to make debt repayments. It said the UK was "sleep-walking into a debt crisis" and long-term support was needed. Lenders and utility firms have offered bill holidays during the crisis. Some of those have been extended during current restrictions, but there are implications for some people taking these payment deferrals. (BBC)

BREXIT: Britain will attempt to reassure nervous business leaders that it appreciates the need for clarity on rules outside of the European Union by setting up a task force to discuss challenges 50 days before the transition period ends. (RTRS)

BREXIT: The UK's haulage and logistics groups have lambasted the government for failing to produce a handbook to help truck drivers prepare for new border controls that will come into force from January 1. With less than 35 working days until a new EU-UK trade regime comes into force, officials at the Department for Transport are rushing to rewrite early drafts of a handbook that were rejected as "unusable". (FT)

BREXIT: Justin Trudeau, Canada's prime minister, has claimed that Britain is struggling to conclude a trade deal with his country before the Brexit transition ends on January 1 because it does not have "the bandwidth". (FT)

POLITICS: British Prime Minister Boris Johnson's top adviser Dominic Cummings is not leaving for now, despite the departure of a close colleague, BBC reported on Thursday. "Dominic Cummings is NOT following Lee Cain out Number 10 door - PM's most senior advisor is staying on for now, despite departure of his close colleague, Mr Cain - understood to want to stay to work to combat coronavirus pandemic and in partic accelerate the mass testing programme", BBC political editor Laura Kuenssberg said in a tweet bit.ly/3ngdlmL. Johnson's director of communications Lee Cain had resigned on Wednesday.

EUROPE

GERMANY: German health minister Jens Spahn told CNBC it's "too early to say" whether the country will extend its partial lockdown beyond the month of November. "We still have an increase, yes, but a very much lower one than we have seen in the past days, last week, for example," Spahn said in an interview that aired on "Closing Bell." Germany has a seven-day average of new coronavirus cases of nearly 19,800, according to CNBC analysis of Johns Hopkins University data. That is up almost 22% from a week ago. (CNBC)

GREECE: Greece will apply a tighter curfew at night time, allowing movement only for work and health reasons as the second wave of the coronavirus pandemic increasingly pressures its public hospitals, authorities said on Wednesday. (RTRS)

BTPS: Futura Orders Total E1bn On Day 3

- Just under E1.000bn of retail orders for the Nov-28 BTP Futura, on the third day of sales -per Borsa Italiana data.

This brings the 3-day cumulative total to around E4.913bn.

SWEDEN: For the first time since the pandemic started, Sweden is imposing a partial lockdown on bars and restaurants by banning the sale of alcohol after 10 p.m. The restriction marks a departure from the country's previous guidelines that relied mainly on voluntary measures to stop transmission. The new measure applies across the country from Nov. 20 and means all businesses with a license to serve alcohol must close by 10:30 p.m. "We are facing a situation that could turn black as night," Prime Minister Stefan Lofven said at a press conference in Stockholm. "We risk ending up in the situation we had last spring." (BBG)

U.S.

CORONAVIRUS: The US tallied a record number of new coronavirus cases and active hospitalisations for the second day running. States reported a combined 144,270 infections on Wednesday, higher than the 130,989 cases added a day earlier and a one-week average of 125,057, according to a Financial Times analysis of Covid Tracking Project data. The data included more than 1.38m tests, compared with 1.24m in the previous day. There were 65,368 Covid-19 patients in hospital, up from 61,964. The number of deaths in the US attributed to Covid-19 rose by 1,421 to 233,080. (FT)

CORONAVIRUS: Shutting down businesses and paying people for lost wages for four to six weeks could help keep the coronavirus pandemic in check and get the economy on track until a vaccine is approved and distributed, said Dr. Michael Osterholm, a coronavirus advisor to President-elect Joe Biden. (CNBC)

CORONAVIRUS: President-elect Joe Biden has formed a special transition team dedicated to coordinating the coronavirus response across the government, according to documents obtained by POLITICO and people familiar with the decision. The group consists of dozens of transition officials and cuts across a slew of federal agencies, in a sign of the comprehensive approach that Biden is planning to take toward combating the worsening pandemic. (POLITICO)

CORONAVIRUS: New York Gov. Andrew Cuomo set new statewide restrictions on its businesses and residents as cases continue to rise and the state tries to avoid surging outbreaks. Bars and restaurants with a liquor license will have to shut down dining at 10 p.m., though they can continue operating for curbside pickup after that time, starting Friday evening. Gyms will also be forced to close at 10 p.m. Private gatherings will be capped at 10 people just ahead of the holiday season, Cuomo said. (CNBC)

CORONAVIRUS: Ohio governor Mike DeWine warned that the state may impose stricter measures aimed at slowing the spread of coronavirus, as new infections and hospital admission continued to trend higher in the Midwest. Mr DeWine, in an address on Wednesday evening, urged residents to stay home as much as possible and avoid hosting parties, saying current data trends could lead officials to close restaurants, bars and gyms. "We will look at this one week from tomorrow," Mr DeWine said.

CORONAVIRUS: The Mayo Clinic Health System is reporting that 100% of its hospital beds are full in northwestern Wisconsin, with 50% of intensive care units being occupied by patients who tested positive for COVID-19. Hundreds of its staff members are also on work restrictions due to COVID-19 exposure. (WCCO)

POLITICS: President Donald Trump met with his top election advisors on Wednesday as his chances for reversing an apparent win for President-elect Joe Biden in the race for the White House looked increasingly daunting. NBC News reported that Trump met with his son-in-law and senior White House advisor Jared Kushner, campaign manager Bill Stepien and senior campaign advisor Jason Miller to discuss a path forward for the Republican incumbent. Trump held a similar meeting on Tuesday that was more focused on the status of multiple legal challenges his campaign has launched to invalidate ballots cast for President-elect Biden in six battleground states. (CNBC)

POLITICS: A top legal advisor to President Donald Trump's campaign said Wednesday that she hopes a number of court challenges to ballots cast in the presidential election are resolved "within the next two weeks," even as Democrats dismissed claims of significant voter fraud. Jenna Ellis, Trump campaign legal advisor, during a Fox Business News interview, said it will "be up to the courts to make sure to hear these cases expeditiously." (CNBC)

POLITICS: Georgia officials said Wednesday they would hold a rare, by-hand recount of the state's 5 million votes for president, a move that comes when other states are winding down their official counts. President-elect Joe Biden was leading President Trump by more than 14,000 votes in Georgia in Georgia as of Wednesday. If Mr. Biden is declared the winner, it would be the first time a Democratic presidential candidate has carried the state since 1992. Mr. Biden has won enough states in the Electoral College to become the president-elect, even without Georgia, according to Associated Press projections and election results. Georgia Secretary of State Brad Raffensperger, a Republican, said that state law requires him to certify the election results by Nov. 20. Reached Wednesday evening, Mr. Raffensperger said he didn't believe the recount would change the vote tally in Georgia. "I have faith in the accuracy of the electronic voting machines," he said, adding, "I believe the results are accurate." (Dow Jones)

OTHER

CORONAVIRUS: Moderna Inc. said its vaccine trial has accumulated enough infections to allow for a preliminary analysis of the shot's effectiveness to begin. Moderna didn't predict how long it could take an independent monitoring committee to analyze the data, but said the company could get the data to the committee within days. The company said it is still blinded to the data. "Moderna has se en a significant increase in the rate of case identification across sites in the last week," the companysaid in a statement. "As a result, the company expects the first interim analysis will include substantially more than 53 cases, the targeted trigger point for the analysis." (BBG)

CORONAVIRUS: Moderna will begin looking at results from its phase 3 vaccine trials within a week, according to Anthony Fauci, the US's leading infectious disease expert. Dr Fauci told the FT's Global Pharmaceutical Summit that the US biotech company will assess data from its trial "within a week" and that he would "be surprised if we didn't see a similar degree of efficacy" to results released by Pfizer and BioNTech on Monday. (FT)

CORONAVIRUS: Chinese companies are the most upbeat about a recovery from the pandemic, followed closely by the US, according to a private survey, as the impact of the virus continues to weigh on output. The IHS Markit Covid-19 recovery survey, which included responses from 12 countries, found Chinese companies were the most positive about their recovery prospects, an improvement on the negative outlook recorded in June.

U.S./CHINA/HONG KONG: US national security adviser Robert O'Brien said China's latest clampdown in Hong Kong shows that the one country, two systems arrangement for the territory amounts to a "fig leaf" for dictatorship, and warned of new sanctions. The warning came after China's top legislative body on Wednesday (Nov 11) passed a resolution allowing for the disqualification of any Hong Kong lawmakers who were not deemed sufficiently loyal. (BBG)

GEOPOLITICS: U.S. President-elect Joe Biden assured Japanese Prime Minister Yoshihide Suga that the security treaty between the two countries covers East China Sea islands also claimed by China. Suga told reporters the commitment came in a phone call between the two leaders on Thursday morning in Japan, during which they agreed to meet as soon as possible and to work together on a range of issues, including the coronavirus. (BBG)

BOJ: MNI POLICY: BOJ Adachi: Policy 2% Target After COVID Wanes

- Bank of Japan board member Seiji Adachi said Thursday that monetary policy aimed at achieving the price stability target of 2% should be revisited after the COVID-19 disruptions subside and policy is seen in a post-COVID context. "I personally think that the policy objectives are generally being achieved, in the sense that they are helping the economy to withstand the spread of Covid-19," Adachi told business leaders in Matsumoto City via an online conference - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

JAPAN: Yasutoshi Nishimura, Japan's economy minister who's also tasked with handling its coronavirus response, said the rising trend in cases has become clearer and more stringent measures may be needed if the trend continues, Jiji reports in a flash headline. (BBG)

JAPAN: Japan's central government plans to work with local authorities to step up counter-cluster measures to prevent the spread of coronavirus infections, public broadcaster NHK reports, without attribution. The government is considering having people working at bars and clubs take PCR tests and asking eateries to shut early in a targeted manner. Also planning to analyze social media for early prevention of clusters. Government doesn't see the need to declare state of emergency for now. (BBG)

AUSTRALIA/CHINA: China has banned log shipments from Australia's Victoria state from Nov. 11, according to a notice on the Australian agriculture department's website. China Customs announced the ban in a statement Wednesday and said will further strengthen the quarantine on log shipments from Australia. The temporary halt to exports comes after China barred shipments of logs from Queensland state on Oct. 31 after finding pests in cargoes. (BBG)

AUSTRALIA/CHINA/HONG KONG: Australia says Beijing's disqualification of duly elected Legislative Council lawmakers seriously undermines Hong Kong's democratic processes and institutions, according to emailed statement from Marise Payne, Minister for Foreign Affairs. Australia says it calls on authorities to allow the Legislative Council to fulfill role as the primary forum for popular political expression in H.K. and to remain a key pillar of the rule of law and the "One Country, Two Systems" framework. Australia says it will continue to monitor developments closely. (BBG)

RBNZ: MNI INTERVIEW: Negative Rates An Option After FLP: RBNZ Yuong

- Retail Rates Lower Ahead Of FLP LaunchThe New Zealand economy still requires monetary stimulus and Wednesday's announcement of an NZD28-billion funding for lending program has given the central bank the option to introduce negative interest rates next year, said Yuong Ha, chief economist at the Reserve Bank of New Zealand - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

RBNZ: New Zealand's central bank said it's less likely to impose a negative official cash rate on banks if they use its new program of cheap loans to lower borrowing costs. "If the banks don't like having a negative OCR, then passing on as much of the Funding for Lending Program as possible through into lower lending rates is going to reduce the likelihood that a negative OCR is needed," Assistant Governor Christian Hawkesby told Bloomberg in an interview Thursday in Wellington. "So there is that incentive there for them, because it is about the overall amount of monetary stimulus that's required." (BBG)

RBNZ: Hawkesby said the market reaction was to economists changing their call, not an explicit change in RBNZ communication. "A number of economists had called the OCR to be negative next year. A number of them changed their call through the afternoon, and we feel the market reaction was driven from that as opposed to the message we were giving," he said. (RTRS)

NEW ZEALAND: Aucklanders who work in the CBD are being asked to work from home on Friday as the Ministry of Health investigates the possible source of a mystery community case. There have also been renewed calls for Aucklanders to make sure they are wearing masks on public transport and staying home and getting tested if unwell. (Stuff NZ)

NEW ZEALAND: ASB is moving immediately to increase the minimum deposit required from investors in the wake of the RBNZ considering the reintroduction of loan-to-value restrictions, CEO Vittoria Shortt says in emailed statement. (BBG)

SOUTH KOREA: South Korean President Moon Jae-in may reshuffle his cabinet after parliament passes 2021 budget on Dec. 2, DongA Ilbo newspaper reports, citing an unidentified official at ruling Democratic Party. Foreign, health, transportation, justice and SMEs ministers could be replaced. (BBG)

TAIWAN: The memorandum of understanding would institutionalize the Taiwan-U.S. Economic Prosperity Partnership Dialogue, Foreign Minister Joseph Wu tells lawmakers. Having such an agreement in place means the EPPD won't be affected by any transition of power. (BBG)

MEXICO: Fitch affirmed Mexico at BBB-; Outlook Stable

IRAN: Iran has finished moving a first cascade of advanced centrifuges from an above-ground plant at its main uranium enrichment site to an underground one in a fresh breach of its nuclear deal with big powers, a U.N. atomic watchdog report showed on Wednesday. (RTRS)

MIDDLE EAST: President Trump's newly installed acting Pentagon chief is bringing on a senior adviser in a sign the administration wants to accelerate the withdrawal of U.S. troops from the Middle East before the end of his presidency in January, three people familiar with the move told Axios. (Axios)

MIDDLE EAST: The Saudi-Led coalition said on Wednesday that it intercepted two explosive-laden boats in the southern Red Sea launched by Yemen's Houthis from the Yemeni governorate of Hudaidah, according to state TV. The Saudis have regularly accused the Houthis of using drones and missiles to attack Saudi Arabia. (RTRS)

OIL: Talks between OPEC and its allies are zeroing in on a delay to next year's planned oil-output increase of three to six months, according to several delegates. Saudi Arabia and Russia, leaders of the 23-nation coalition, have already indicated publicly that they are thinking twice about easing production cuts in January as the resurgent pandemic hits fuel demand. The presidents of both Russia and the Organization of Petroleum Exporting Countries have even mentioned the option of cutting production deeper. This idea hasn't garnered widespread support so far among other members, one delegate said. (BBG)

CHINA

LOANS: China should see a more controlled pace of lending growth in November and December, taking total aggregate new lending for the year to just under CNY20 trillion, the Financial News reported citing Wang Yifeng, an analyst from the Research Institute of Everbright Securities. China is also likely to avoid strong credit tightening in 2021, Wang said. Social financing in November is likely to be around 13.5% to 13.7%, compared with 13.7% in October, he said. (MNI)

BANKING: The use of perpetual loans is seen by the PBOC as optimal in alleviating capital shortages in the real economy and replenishing large banks' capital, the PBOC-run Financial News said. The central bank is likely to further boost market-based Central Bank Bill Swap (CBS) operations and extend their use to support small-to-medium banks, the newspaper said. (MNI)

EQUITIES: China is right to take active anti-trust measures to prevent E-commerce sites from monopoly behaviour as it represses innovation and drives the accumulation of disproportionate wealth, the 21st Business Herald reported on Thursday citing Zhou Xiaochuan, the former President of the PBOC. China should beware how these firms control user data and personal information as they are now serving many public service areas, said Zhou. Better governance of the Internet is urgently needed to improve the efficiency of the digital economy and the Chinese voice in the global cyberspace, Zhou told the Herald. (MNI)

EQUITIES: New listings by Chinese companies reached a record high at the US stock market this year despite some turbulence. Observers said that more listings might follow in the coming year as the market becomes increasingly optimistic that the incoming Joe Biden administration might work to improve economic relations with China. So far this year, 26 Chinese IPOs have been held in the US, with a total worth of $29 billion, the highest since 2014, according to statistics from Refinitiv, a market data provider. "Most investors in China see Biden as a fresh impetus, one that will be more predictable and less arbitrary," Dong Dengxin, director of the Finance and Securities Institute at the Wuhan University of Science and Technology, told the Global Times on Wednesday. "It means it is likely that more companies will go public in the US under his administration," Dong said. (Global Times)

OVERNIGHT DATA

JAPAN SEP CORE MACHINE ORDERS -11.5% Y/Y; MEDIAN -12.0%; AUG -15.2%

JAPAN SEP CORE MACHINE ORDERS -4.4% M/M; MEDIAN -1.0%; AUG +0.2%

JAPAN OCT PPI -2.1% Y/Y; MEDIAN -2.0%; SEP -0.8%

JAPAN OCT PPI -0.2% M/M; MEDIAN -0.1%; SEP -0.2%

JAPAN SEP TERTIARY INDUSTRY INDEX +1.8% M/M; MEDIAN +1.2%; AUG +0.8%

JAPAN SEP LOANS & DISCOUNTS CORP +7.53% Y/Y; AUG +8.50%

JAPAN OCT TOKYO AVG OFFICE VACANCIES 3.93; SEP 3.43

AUSTRALIA NOV CONSUMER INFLATION EXPECTATIONS +3.5%; OCT +3.4%

NEW ZEALAND OCT REINZ HOUSE SALES +25.0% Y/Y; SEP +37.1%

NEW ZEALAND SEP NET MIGRATION +808; AUG +1,144

SOUTH KOREA OCT EXPORT PRICE INDEX -6.4% Y/Y; SEP -5.9%

SOUTH KOREA OCT EXPORT PRICE INDEX -2.6% M/M; SEP 0.0%

SOUTH KOREA OCT IMPORT PRICE INDEX -11.6% Y/Y; SEP -11.3%

SOUTH KOREA OCT IMPORT PRICE INDEX -2.6% M/M; SEP -1.1%

UK OCT RICS HOUSE PRICE BALANCE 68%; MEDIAN 54%; SEP 62%

CHINA MARKETS

PBOC NET INJECTS CNY90BN VIA OMOS THURS

The People's Bank of China (PBOC) conducted CNY120 billion via 7-day reverse repos with rates unchanged at 2.2% on Thursday. This resulted in a net injection of CNY90 billion given the maturity of CNY30 billion of reverse repos today, according to Wind Information.

- The operations aim to maintain the liquidity in the banking system reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) declined to 2.2000% at 09:20 am local time from the close of 2.3857% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 59 on Wednesday vs 40 on Tuesday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.6236 THURS VS 6.6070

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a second day at 6.6236 on Thursday, compared with the 6.6070 set on Wednesday.

MARKETS

SNAPSHOT: E-Minis Nudge Lower On Familiar Risks

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 53.1 points at 25401.47

- ASX 200 down 31.481 points at 6418.2

- Shanghai Comp. down 6.785 points at 3335.417

- JGB 10-Yr future up 17 ticks at 152.01, yield down 1.0bp at 0.031%

- Aussie 10-Yr future up 8.5 ticks at 99.09, yield down 8.4bp at 0.910%

- U.S. 10-Yr future +0-07+ at 137-27, yield down 4.29bp at 0.932%

- WTI crude up $0.01 at $41.46, Gold up $5.52 at $1871.25

- USD/JPY down 22 pips at Y105.21

- TRUMP'S NATIONAL SECURITY ADVISER ROBERT O'BRIEN WARNS CHINA ON HONG KONG (BBG)

- ANOTHER RECORD DAY OF U.S. COVID CASES

- MODERNA COMPLETES CASE ACCRUAL FOR VACCINE INTERIM ANALYSIS (BBG)

- CHINA BANS LOG SHIPMENTS FROM AUSTRALIA'S VICTORIA STATE (BBG)

- HAWKESBY MARKET REACTION WAS TO ECONOMISTS CHANGING CALLS, NOT RBNZ COMMUNICATION (RTRS)

- OPEC+ FOCUSES ON DELAY TO OIL-OUTPUT HIKE OF THREE TO SIX MONTHS

BOND SUMMARY: Core FI Bid, As E-Minis Tick Lower, Familiar Risks Eyed

Several pockets of TY futures purchases & a downtick for e-minis have provided Tsys with some support overnight. There was some focus on the COVID situation in the U.S., as well as ongoing Sino-U.S. & Sino-Aussie relations. It could be also be a case of the Asia-Pac region being willing to buy the recent dip in the space again. 10s outperform on the curve, richening by 4.5bp, with T-Notes +0-07+ on the day at 137-27, a little shy of best levels. A note from Credit Suisse's Zoltan Pozsar, pushing back against the idea of year end funding pressure surrounding G-SIB dynamics, triggered a flurry of purchases in the front end of the Eurodollar strip, which runs unchanged to +1.0 through the reds.

- The broader defensive feel to early Asia-Pac trade, coupled with reports suggesting that the Japanese government could step up measures to fight COVID clusters, supported the JGB space, with futures adding 14 ticks to settlement levels as bulls force a test of 152.00. Cash trade has seen modest richening across the curve, although the super-long end underperformed, even with receiving in that zone of the swaps curve, resulting in longer dated swap spread tightening. There was a slide in the cover ratio at the latest 5-Year JGB auction as the recent cheapening of the line didn't do enough to entice solid demand, given little in the way of clear relative plays (as outlined earlier), with clearing yields a touch richer than the previous auction. Pricing was firm, with the low price coming in just above dealer expectations and no price tail.

- Aussie bonds wobbled early on, despite the RBA stepping in to reinforce its 3-Year ACGB yield target, with A$2.0bn worth of purchases, which came in addition to the already scheduled purchase of A$2.0bn of 4-12 Year ACGBs. Long positioning and jitters surrounding trans-Tasman developments at the RBNZ were seemingly the drivers here. The space then regained some poise with little else to really attribute the resumption of the bid to, outside of the broader bid in core global FI/downtick in the equity space, and the aforementioned headline flow. YM +1.0, XM +8.5, as the cash curve bull flattens and swap spreads widen from 5 years out.

JGBS AUCTION: Japanese MOF sells Y2.0368tn 5-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.0368tn 5-Year JGBs:- Average Yield -0.105% (prev. -0.091%)

- Average Price 101.00 (prev. 100.95)

- High Yield: -0.105% (prev. -0.089%)

- Low Price 101.00 (prev. 100.94)

- % Allotted At High Yield: 87.5921% (prev. 40.8768%)

- Bid/Cover: 3.525x (prev. 4.896x)

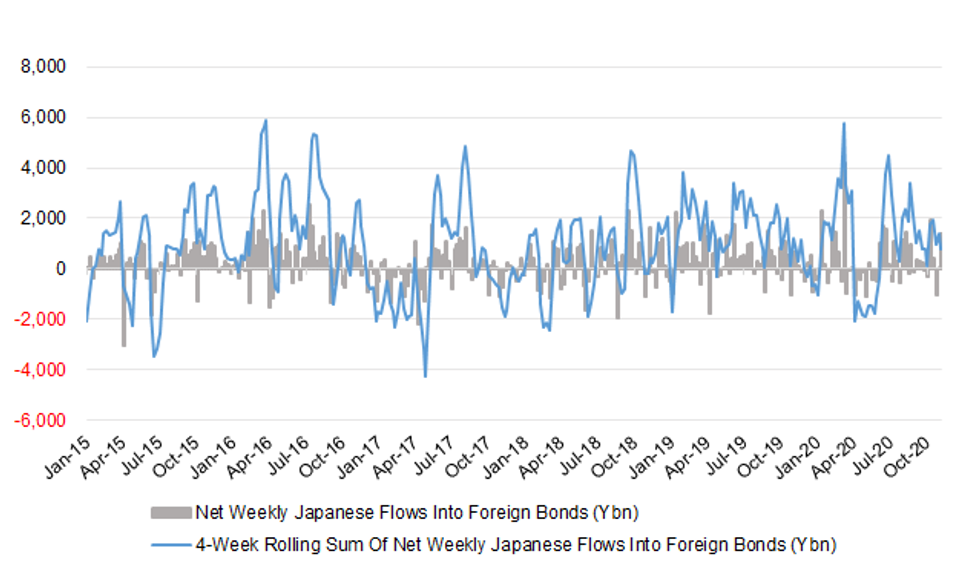

JAPAN: Decent Enough Buying Of Foreign Bonds Last Week

The most notable round of flows in the latest weekly Japanese international security flow data saw Japanese investors record a chunky round of net foreign bond purchases, which were likely FX-hedged (as per recent lifer comments). We flagged the potential for such a move earlier this week, given the dynamic surrounding U.S. 10—Year FX-hedged yield levels for Japanese investors.

- Elsewhere, the latest week saw foreign investors revert to net purchases of both Japanese bonds and equities.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 1365.8 | 72.1 | 797.0 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 140.5 | 346.3 | 303.8 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 424.2 | -272.0 | 711.9 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 485.5 | -212.7 | 407.6 |

EQUITIES: Caution Creeps In

There was little in the way of notable headline flow during Asia-Pac hours, although e-minis were biased lower as participants looked to the COVID-19 situation in the U.S., Sino-U.S. and Sino-Aussie tensions. The COVID-19 situation in Japan also got attention in some quarters, with talk surrounding the potential for broader containment measures evident there. As a reminder, Wednesday saw the NASDAQ 100 outperform on Wall St., while the Dow lagged, reversing the dynamic witnessed in recent sessions.

- The major Asia-Pac indices trade within close proximity of unchanged levels at typing, although the trajectory was generally lower as we moved through the session, given the aforementioned risk tone.

- Nikkei 225 +0.1%, Hang Seng -0.4%, CSI 300 -0.1%, ASX 200 -0.5%.

- S&P 500 futures -23, DJIA futures -173, NASDAQ 100 futures -75.

OIL: Back From Best Levels

WTI & Brent sit a handful of cents above settlement levels, after lodging the most modest of gains on Wednesday, edging back from best levels in Asia-Pac hours as a broader defensive feel crept into the timezone.

- Wednesday saw the release of the latest monthly OPEC report, which saw the cartel slash its expectations for global crude demand in both '20 and '21.

- Elsewhere, a BBG sources piece noted that "talks between OPEC and its allies are zeroing in on a delay to next year's planned oil-output increase of three to six months, according to several delegates... This idea hasn't garnered widespread support so far among members, one delegate said." Earlier in the day we saw the Algerian Energy Minister flag an extension/deepening of production cuts as possibilities.

- Also on the supply front, Wednesday saw source reports pointing to yet another uptick in Libyan crude production, although current levels still remain shy of target levels outlined by the country's oil officials in recent days.

GOLD: Nothing New

Bullion operates within the confines of the range established over the last couple of sessions, with spot +$5/oz at $1,870/oz at typing. Little to note on the fundamental/technical front, after Wednesday's Veterans Day holiday limited liquidity and the scope for broader developments over the last ~24 hours or so.

FOREX: Defensive Flows Negate Early Demand For NZD

Lack of any notable news flow kept focus on the global Covid-19 situation and China's tensions with Australia & the U.S., inspiring a degree of risk aversion. Safe havens gradually garnered strength and JPY climbed to the top the G10 scoreboard, building on an earlier round of purchases into the Tokyo fix.

- Risk-off flows undermined NZD, which had picked up a bid after BBG published an interview with RBNZ Asst Gov Hawkesby, who downplayed the need for deploying negative interest rates if banks make use of the new FLP facility, although stressed that it remains an option. He added that "less stimulus is required than we thought in August", but also pushed back against that the central bank's most recent decision was a surprise, attributing market reaction to sell-side analysts changing their calls. NZD/USD swung to a loss after printing a fresh 20-month high, while AUD/NZD backed off a 7-month low.

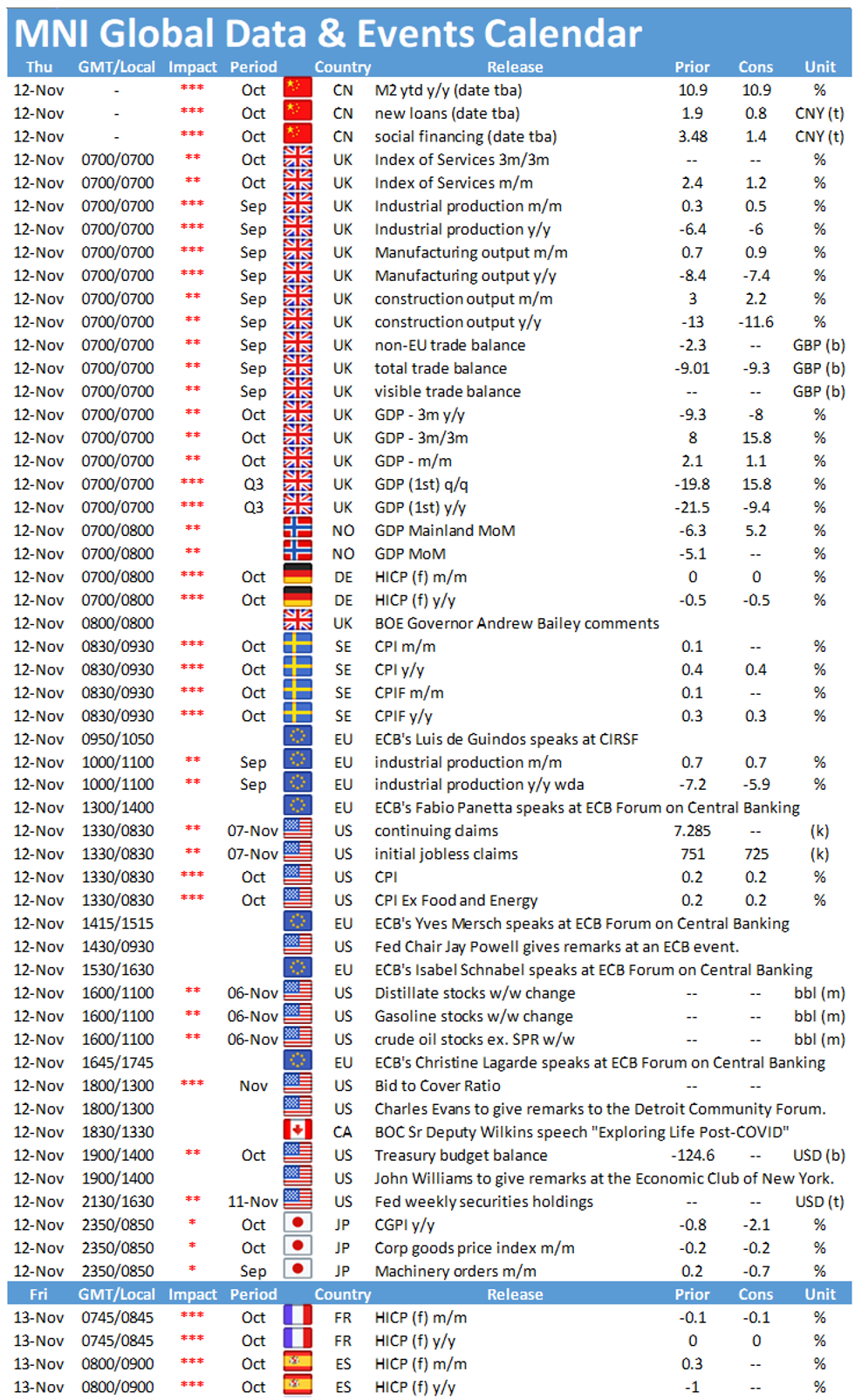

- Coming up today, we have UK quarterly GDP & monthly economic activity indicators, U.S. initial jobless claims, EZ industrial output as well as U.S., Swedish & German CPIs. Speeches are due from Fed's Powell & Evans, BoE's Bailey & Cunliffe, ECB's Lagarde & de Guindos, BoC's Wilkins & Riksbank's Breman.

FOREX OPTIONS: Expiries for Nov12 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1765(E688mln), $1.1795-05(E1.3bln), $1.1825-30(E744mln), $1.1925-30(E640mln)

- USD/JPY: Y103.00($1.9bln-USD puts), Y103.50-55($793mln), Y105.40-50($1.55bln), Y106.20($610mln), Y106.55-60($690mln)

- EUR/GBP: Gbp0.8900-10(E709mln)

- USD/CHF: Chf0.9225($450mln)

- EUR/AUD: A$1.6520(E973mln)

- AUD/JPY: Y74.00(A$603mln-AUD puts)

- USD/CNY: Cny6.64($900mln), Cny6.75($860mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.