-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: E-Minis Rally As Markets Look To The Brighter Side

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* TRUMP PLANS LAST-MINUTE CHINA CRACKDOWN (AXIOS SOURCES)

* CHINA SAYS U.S. SHOULD STOP UNREASONABLY SUPPRESSING CHINESE FIRMS (RTRS)

* DOCUMENT: MERKEL, GERMAN STATES CONSIDER TOUGHER COVID-MEASURES (RTRS)

* CHINESE DATA MIXED, PBOC INJECTS NET CNY200BN VIA MLF

* COVID-19 VACCINE PIPELINE EYED, ALLOWS MARKETS TO SHRUG OFF NEGATIVES

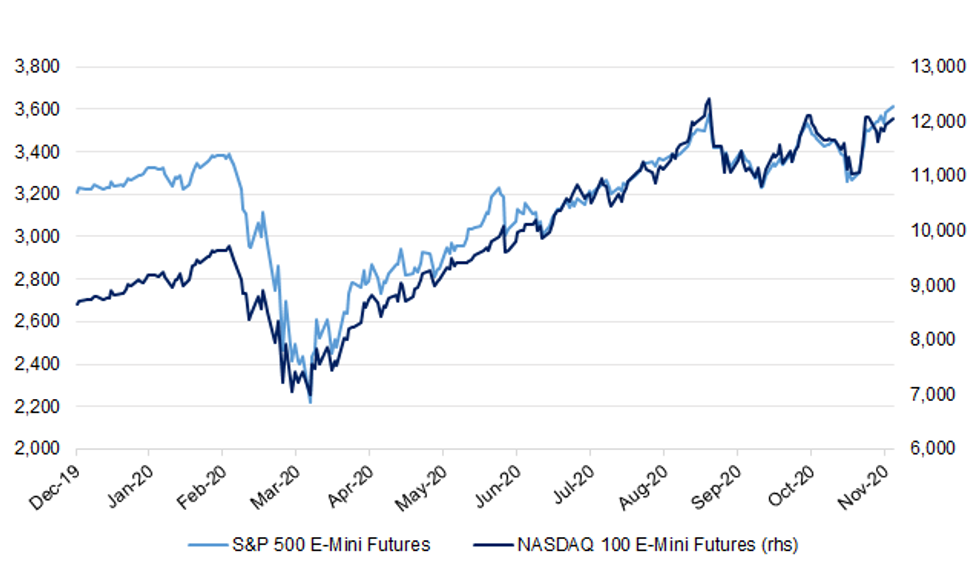

Fig. 1: S&P 500 E-Mini Futures vs. NASDAQ 100 E-Mini Futures

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The coronavirus lockdown tier system being used in England "was not very well thought out", a government scientific adviser has said. Under current plans, a regional tiered system is set to replace the national lockdown when it ends on 2 December. However, professor John Edmunds, a member of the Scientific Advisory Group for Emergencies (SAGE), has warned a return to the lowest alert level of the regional tier system, Tier 1, when the lockdown ends would be "very unwise". (Sky)

CORONAVIRUS/POLITICS: U.K. Prime Minister Boris Johnson will self-isolate after coming into contact with someone who tested positive for Covid-19, his spokesman said. Johnson, 56, is well, isn't showing symptoms and "will carry on working from Downing Street," the spokesman said in a statement Sunday. Johnson met with members of Parliament at 10 Downing Street on Thursday and one of them, Lee Anderson, later tested positive. The prime minister overcame a bout of Covid-19 in late March and April that had him in intensive care for three nights. (BBG)

FISCAL: Rishi Sunak is considering plans to charge motorists for using Britain's roads amid concerns over a £40 billion tax shortfall created by the switch to electric cars. A Treasury paper on a new national road pricing scheme has been presented to the chancellor. (The Times)

BREXIT: The departure of Dominic Cummings from Downing Street will not lead to fresh concessions to get a Brexit deal over the line, Boris Johnson's chief negotiator has warned. In a clear message to Brussels and London before resuming talks this week, Lord Frost said that Britain's red lines had not changed. Any settlement had to be "compatible with our sovereignty", he insisted. "That has been our consistent position from the start and I will not be changing it," he posted on Twitter. (The Times)

BREXIT: The U.K. hinted that Brexit talks could stretch out beyond this week as the two sides struggle to overcome the key barriers to reaching a trade deal. While officials from both sides of the Brexit divide agree the coming week is crucial, negotiations over a trade agreement have already passed a number of informal deadlines. Environment Secretary George Eustice said Sunday it would be possible to "squeeze out extra time" if the two sides were close to an agreement. (BBG)

BREXIT: Trade talks between the UK and EU are reaching the "make or break" point, the two sides have said, with key points of difference proving hard to resolve. EU sources said there had been less progress in recent days on outstanding sticking points than they had hoped for and the "moment of truth" was nearing. UK sources said there were still "quite big gaps" between the sides. Both sides doubted that a draft deal could now be reached in the coming days, as the EU had originally hoped. (BBC)

BREXIT: Boris Johnson was warned by Ireland's foreign minister that the main outstanding issues in Brexit trade talks must be "resolved in principle this week", with officials in London also confirming a crunch moment in the negotiations. Simon Coveney said on Sunday this was "move week", while British officials admitted that after months of phoney deadlines the talks on a future relationship agreement had reached a moment of truth. "We've got 10 more days, max," said one UK official. (FT)

BREXIT: A Brexit deal could be agreed in as little as ten days, a senior MEP said, after Michel Barnier briefed the European Parliament on the UK-EU trade negotiations on Friday. (Telegraph)

BREXIT: Officials are working on emergency tweaks to rules in the event the UK and the EU do not grant sufficient access rights to each other's financial services markets, in a set of so-called equivalence decisions, before Britain leaves the bloc on December 31. (FT)

POLITICS: Boris Johnson's right-hand man Dominic Cummings has left Downing Street after a power struggle that has rocked the prime minister's administration. Mr Johnson's senior advisor exited Number 10 carrying a large box on Friday evening following a bitter dispute which also led to the resignation of Mr Cummings' fellow Vote Leave veteran Lee Cain as communications chief. The dramatic events come ahead of crucial Brexit talks with Brussels with the transition period deadline of 31 December looming. (Sky)

POLITICS: Boris Johnson is facing a growing revolt against lockdown restrictions, as more than 30 MPs who voted for the current measures joined a parliamentary group opposed to any extension of restrictions. The Covid Recovery Group, which launched on Wednesday to fight the imposition of a third national lockdown at the beginning of next month, has grown substantially and now numbers around 70 MPs. The Telegraph can disclose that recruits include more than 30 lawmakers who supported the current lockdown, among them Damian Green, the former deputy prime minister, Tom Tugendhat, the senior backbencher, and many members of the Conservative Party's 2019 intake of MPs. (Telegraph)

POLITICS: Boris Johnson will attempt to reassure restless Conservative MPs that he remains committed to the party's new northern heartlands despite plans for a political "reset" after the departure of Dominic Cummings, his chief adviser, from Downing Street. (The Times)

AUTOS: The sale of new petrol and diesel cars will be banned within a decade, Boris Johnson is set to announce next week as part of a broader package of green initiatives. In February, Mr Johnson announced that the existing ban on selling new petrol or diesel cars would be brought forward from 2040 to 2035. Now the prime minister is expected to move the date forward to 2030 in an attempt to jump-start the market for electric cars in the UK and push Britain towards its climate goal, according to industry and Whitehall figures. (FT)

RATINGS: Sovereign rating reviews of note from Friday included:

- DBRS Morningstar downgraded the United Kingdom to AA (high), Stable Trend

EUROPE

GERMANY: Germany may see four to five more months of coronavirus restrictions, Economy Minister Peter Altmaier said Sunday, dashing hopes of a quick end to a partial lockdown introduced two weeks ago. "The infection numbers are still far too high -- much higher even than a fortnight ago," Altmaier told the Bild an Sonntag newspaper ahead of a government meeting on Monday to assess the progress of the restrictions. Germany went into partial lockdown in early November, closing bars, restaurants, gyms and other recreational facilities but keeping schools and shops open. (AFP)

GERMANY: Germany's federal government and states are considering new COVID-19 measures to halt the rise in infections, such as dramatically reducing the number of people at household gatherings and compulsory mask wearing for school students. A draft document of the measures, seen by Reuters, also said people would be urged to abstain from private parties completely until Christmas. Chancellor Angela Merkel and the heads of Germany's 16 states are expected meet on Monday. (RTRS)

GERMANY: Germany plans to set up hundreds of centers across the country in December to prepare for mass vaccination against the coronavirus, the Welt am Sonntag newspaper reported. (BBG)

GERMANY: Germany expects to pay out 22 billion euros ($26 billion) in COVID-19 relief aid from January through June 2021 to companies and self-employed people, people close to the matter said, as the impact of the pandemic extends into next year. Separately, Germany's November coronavirus aid package to compensate firms affected by lockdown measures will this month amount to 14 billion euros, they said. Initially, the government had expected to pay out 10 billion euros. (RTRS)

FRANCE: France reported 27,228 new coronavirus cases on Sunday. The seven-day average, which smooths out fluctuations in the data, shrank by 5.5% to 27,786, showing a continued decline over the past week. Deaths rose by 302 to 44,548 since the beginning of the pandemic. The pressure on France's intensive-care wards has been stabilizing in the last days, as seriously ill patients now occupy 96.5% of the country's initial I.C.U. capacity, French health authorities reported. That rate rose sharply in the last weeks to reach 96.6% on Thursday.

FRANCE: France is working on a strategy against Covid-19 to be used until next summer, as the nation needs to adopt long-term rules to live with the virus until a vaccine is found, French Prime Minister Jean Castex told daily Le Monde in an interview published on Saturday. (BBG)

ITALY: The country extended its soft lockdown to the regions of Florence and Naples as new cases continued soaring across the country. Health minister Roberto Speranza wrote in a Facebook post Friday evening that Campania and Tuscany will become "red zones," where bars and restaurants are closed, and leaving home is only allowed for essential reasons. (BBG)

SPAIN: Spain plans to extend grace periods for credits from state lender ICO at its cabinet meeting next week, Economy Minister Nadia Calvino said in an online forum. The positive news about Pfizer Inc.'s vaccine candidate will help remove uncertainty about the course of the pandemic that threatened to cloud the economic outlook, she said. Spain's economy may shrink more than 11% in 2020. (BBG)

GREECE: Greece decided to close all schools that remained open for two weeks beginning Monday, except for those educating special-needs children. Secondary and high schools were closed on Nov. 9. The government has already put in place a national lockdown and a night curfew through November. (BBG)

AUSTRIA: Austria will shut down schools, most stores and services such as hairdressers starting Tuesday, Chancellor Sebastian Kurz said, after attempts to rely on self-discipline and moderate restrictions failed to slow the coronavirus pandemic. The new measures come two weeks after a soft lockdown similar to Germany's was imposed that left large parts of the economy and society open. With Austria's infections spiking, Kurz said he hoped to end the latest measures on Dec. 6 to allow some sort of Christmas celebrations. (BBG)

SWITZERLAND: Switzerland's academic expert group recommended the federal government close bars and restaurants, among other measures. The body said steps taken so far hadn't caused a trend reversal in infections. (BBG)

RATINGS: Sovereign rating reviews of note from Friday included:

- Fitch affirmed Austria at AA+; Outlook Stable

- Fitch affirmed France at AA; Outlook Negative

- Moody's affirmed Austria at Aa1; Outlook Stable

- DBRS Morningstar confirmed Cyprus at BBB (low), Stable Trend

U.S.

FISCAL: U.S. President Donald Trump tweeted the following on Saturday: "Congress must now do a Covid Relief Bill. Needs Democrats support. Make it big and focused. Get it done!" (MNI)

FISCAL: Former Federal Reserve Chair Janet Yellen is under consideration to be President-elect Joe Biden's Treasury secretary, according to people familiar with the matter, joining other possible contenders. Yellen has withdrawn from at least one upcoming speaking engagement because she is now in contention for Treasury secretary, one of the people familiar with the matter said. The people spoke on condition of anonymity to discuss personnel deliberations. (BBG)

CORONAVIRUS: Roughly 20 million people could be vaccinated against the coronavirus in December, the head of the Trump administration's vaccine and drug accelerator said Friday. Americans can expect that about 25 to 30 million people could be vaccinated each month afterward, said Moncef Slaoui, co-lead of Operation Warp Speed, during a Rose Garden event with President Donald Trump and other top health officials. That timeline depends on the Food and Drug Administration authorizing the emergency use of one or more vaccines — which could happen in a matter of weeks, Slaoui noted. (POLITICO)

CORONAVIRUS: The success of Pfizer Inc.'s Covid-19 vaccine trial may help persuade more people to get inoculated amid a surge in new coronavirus cases, according to Anthony Fauci, the top U.S. infectious-disease doctor. (BBG)

CORONAVIRUS: A national lockdown of businesses and schools is a "measure of last resort," even as cases continue to surge to record-highs across the U.S., a top coronavirus advisor to President-elect Joe Biden said on Sunday. (CNBC)

CORONAVIRUS: President-elect Joe Biden's coronavirus advisors will meet with the leading drug companies developing coronavirus vaccines this week, Ron Klain, Biden's newly selected chief of staff, said on Sunday. (CNBC)

CORONAVIRUS: Washington Governor Jay Inslee reinstated a series of restrictions on social gatherings on Sunday as the state enters what he called a "third wave" that's more dangerous than ever before. Indoor dining is banned and outdoor dining will be limited to no more than five people, under the new measures, effective from Monday through Dec. 14. Indoor gatherings with people outside of the same household are also prohibited, unless visitors follow quarantine rules. (BBG)

CORONAVIRUS: Michigan Gov. Gretchen Whitmer (D) announced Sunday fresh restrictions designed to combat spiking COVID-19 cases — including suspending organized sports, halting in-person classes and closing restaurants and bars to indoor dining. (Axios)

CORONAVIRUS: The governor of Oregon issued sweeping new coronavirus restrictions, in one of the most aggressive steps in recent weeks to curb the rise in infections in the US. Kate Brown on Friday ordered a two-week "freeze" that will begin on Wednesday and will limit restaurants and bars to takeout only. Gyms, museums, pools, movie theaters and zoos in the state will be forced to close. All businesses will be required to close their offices to the public and mandate work-from-home "to the greatest extent possible". (Guardian)

CORONAVIRUS: Virginia Governor Ralph Northam announced new restrictions as infections surged to record levels. Starting Sunday, the state will expand its mask mandate, lower its cap on gatherings to 25 individuals from 250, strengthen enforcement for distancing and other rules at retail businesses, and set a 10 p.m. alcohol service curfew for restaurants and bars. (BBG)

CORONAVIRUS: Idaho Gov. Brad Little said he would sign an executive order mobilizing 100 members of the state's national guard to help with Idaho's Covid-19 response and issue a new public health order placing more restrictions on businesses and gatherings. (CNBC)

CORONAVIRUS: New Mexico's governor is ordering the shutdown of non-essential businesses. The action, announced by Michelle Lujan Grisham's office, is intended to relieve the "dramatically escalating strain on hospitals and health care providers across the state," the Santa Fe New Mexican reported. The two-week shutdown starts Monday. (BBG)

CORONAVIRUS: The Pittsburgh Public School District said Friday that it will close its schools and implement a remote instruction model for all students until at least January as COVID-19 cases continue to rise sharply in the region. (Pittsburgh Post Gazette)

CORONAVIRUS: North Dakota Gov. Doug Burgum ordered a statewide mask mandate and imposed several business restrictions late Friday in an effort to contain the spread of the coronavirus that has stressed the state's hospital capacity. (Associated Press)

CORONAVIRUS: California's top health official said new coronavirus cases are rising faster than at any point during the pandemic and warned more stringent measures may be needed to stop the spike. In the first seven days of November, the daily case count per 100,000 people jumped 47%, a faster increase than the state endured during a major surge this summer. (BBG)

CORONAVIRUS: The governors of California, Oregon and Washington issued a joint coronavirus travel advisory on Friday urging people arriving to their states to self-quarantine for 14 days and asking residents to avoid all non-essential out-of-state trips. The Pacific Northwest states said essential travel includes people who are traveling for "work and study, critical infrastructure support, economic services and supply chains, health, immediate medical care and safety and security," according to a statement. (CNBC)

CORONAVIRUS: As public-school parents around the city waited on tenterhooks, Mayor Bill de Blasio finally informed families in a tweet Sunday that in-person classes would go ahead Monday. In announcing his decision, Hizzoner noted the city's latest seven-day average positive-test rate, 2.57 percent, which was slightly lower than Saturday's reported 2.69 percent and Friday's 2.83 percent. The mayor has said that if the rolling rate hits 3 percent, city school buildings will close. (New York Post)

POLITICS: U.S. President-elect Joe Biden solidified his election victory on Friday by winning the state of Georgia, and President Donald Trump said "time will tell" if another administration takes over soon, the closest he has come to acknowledging Biden could succeed him. Edison Research, which made the Georgia call, also projected that North Carolina, the only other battleground state with an outstanding vote count, would go to Trump, finalizing the electoral vote tally at 306 for Biden to 232 for Trump. (RTRS)

POLITICS: President Donald Trump acknowledged publicly for the first time that President-elect Joe Biden won the election, more than seven days after media outlets including NBC News called the race for Biden. The president's comments, made in a seemingly offhand post on social media, come as his campaign continues to challenge the results of the election in court and as his administration holds up formal transition processes. In subsequent tweets, Trump wrote that he would not concede. The ostensible acknowledgement of defeat came on Twitter, in response to a post by the Fox News show "Watters' World" that suggested that Biden "didn't earn" the presidency. "He won because the Election was Rigged," Trump wrote, repeating an allegation that has been debunked by election officials around the country and his own Department of Homeland Security. Shortly after writing that Biden had won, though, Trump wrote in another post that he conceded "NOTHING" and claimed that "WE WILL WIN!" "He only won in the eyes of the FAKE NEWS MEDIA," Trump wrote. (CNBC)

POLITICS: U.S. President Trump tweeted the following on Sunday: "Many of the court cases being filed all over the Country are not ours, but rather those of people that have seen horrible abuses. Our big cases showing the unconstitutionality of the 2020 Election, & the outrage of things that were done to change the outcome, will soon be filed!" (MNI)

POLITICS: Lawyers for the Trump campaign dropped its lawsuit seeking a review of all ballots cast on Election Day after finding that the margin of victory for the presidential contest in Arizona could not be overcome. (CNN)

POLITICS: A federal appeals court in Philadelphia on Friday rejected an effort led by a Republican congressional candidate to block about 9,300 ballots that arrived after Election Day. The three-judge panel, led by Chief U.S. Circuit Judge Brooks Smith, noted the "unprecedented challenges" facing the nation this year, especially the "vast disruption" caused by the COVID-19 pandemic. (ABC)

POLITICS: Donald Trump has reportedly told long-time friend Geraldo Rivera he will "do the right thing" and accept his election defeat — but only after exhausting all legal options. The conservative Fox News host said he spoke with the president on Friday in a "heartfelt phone call". (Evening Standard)

POLITICS: Thousands of supporters of President Trump gathered in downtown Washington, D.C., on Saturday to protest the results of the election. Waving American flags and chanting "four more years," the protesters repeated allegations that the election had been marred by fraud, a claim advanced by Mr. Trump. (WSJ)

POLITICS: 16 assistant U.S. attorneys tasked with monitoring election misconduct urged Attorney General Bill Barr on Friday to retract a recent memo directing investigators to pursue allegations of "voting and vote tabulation irregularities" prior to the certification of election results, the Washington Post reported. (Axios)

POLITICS: House Speaker Nancy Pelosi will enter January with a narrower Democratic majority, but she contended Friday that fewer seats will not force her to change her strategy. "No, not at all," she told reporters when asked if her party's expected loss of at least six House districts in the 2020 election will force her to compromise more. "We have a president of the United States." (CNBC)

POLITICS: For nearly two years, allies of President Trump have been exploring ways to build up a formidable competitor to Fox News. One target they recently zeroed in on: the fledgling pro-Trump cable channel Newsmax TV. Hicks Equity Partners, a private-equity firm with ties to a co-chair of the Republican National Committee, has held talks in recent months about acquiring and investing in Newsmax, according to people familiar with the matter, part of a larger effort that could also include a streaming-video service. (WSJ)

OTHER

GLOBAL TRADE: French Finance Minister Bruno Le Maire said the European Union and the U.S. can reach a compromise soon in the long-running dispute on subsidies to aircraft makers Boeing Co. and Airbus SE. "I think there is a possibility to build an agreement between the U.S. and Europe on this Airbus-Boeing case," he said in an interview on CNN International Friday. "I do not underestimate the difficulties of bridging the gap between the positions of the U.S. and the EU, but I can tell you that we will not spare our efforts to build a compromise in this Boeing-Airbus case, in the interests of both the U.S. and Europe." (BBG)

U.S./CHINA: President Trump will enact a series of hardline policies during his final 10 weeks to cement his legacy on China, senior administration officials with direct knowledge of the plans tells Axios. He'll try to make it politically untenable for the Biden administration to change course as China acts aggressively from India to Hong Kong to Taiwan, and the pandemic triggers a second global wave of shutdowns. (Axios)

U.S./CHINA: China's commerce ministry said on Monday that the United States should stop its unreasonable suppression of Chinese firms, responding to Washington's decision to ban U.S. investments in firms tied to the Chinese military. The ministry said China firmly opposes the U.S. government's actions. China's foreign ministry made similar comments criticising the U.S. move last week. (RTRS)

U.S./CHINA: The Trump administration has extended a deadline for ByteDance to restructure ownership of its video app TikTok in the US, giving the Chinese company more time to resolve national security concerns raised by Washington. The Committee on Foreign Investment in the US granted a 15-day extension on Thursday, ByteDance said in a court filing on Friday morning, pushing the deadline to November 27. (FT)

U.S./CHINA: Qualcomm Inc on Friday received a license from the U.S. government to sell 4G mobile phone chips to China's Huawei Technologies Co Ltd, an exemption to U.S. trade restrictions imposed amid rising tensions with China. (RTRS)

U.S./CHINA: The Editor in Chief of the Global Times tweeted the following on Friday: "In my view, Beijing's precisely-worded congratulation is an expression of friendliness to Biden and Harris, it's also to express attitude to the Trump team's, especially Pompeo's, recent fierce attacks on Beijing." (MNI)

CORONAVIRUS: President Trump says an emergency use authorization for Pfizer's promising new COVID-19 vaccine will come "extremely soon," delivering his first public remarks since Joe Biden was declared the winner of the presidential election last Saturday. "Right away, millions of doses will soon be going out the door" after final approval arrives, Trump said, giving an update on his administration's efforts to accelerate coronavirus vaccine development and distribution. (NPR)

CORONAVIRUS: A coronavirus vaccine from a unit of Johnson & Johnson is set to move to the third phase of clinical trials in the U.K. on Monday that will test the safety and effectiveness of the shot. The testing round by Janssen Pharmaceutical Companies will include 6,000 volunteers and take place across 17 sites, according to a statement. The vaccine is the third candidate to be tested in the U.K., alongside one froman AstraZeneca in partnership with the University of Oxford and another from Novavax Inc., it said. Progress toward creating vaccines against Covid-19 has accelerated this month, with Pfizer Inc. and BioNTech SE saying their shot prevented more than 90% of symptomatic infections in a trial. Still, hurdles for production and development remain before vaccines could reach widespread use. (BBG)

CORONAVIRUS: China's fifth Covid-19 vaccine candidate has entered a phase-3 trial, state media Xinhua reported, citing the Uzbek government. The vaccine was developed by China's Anhui Zhifei Longcom Biopharmaceutical and was delivered to Uzbekistan, where 5,000 local volunteers will take part for a year, accor ding to local ministry. (BBG)

CORONAVIRUS: Johnson & Johnson announced the expansion to the partnership between its Janssen Pharmaceutical Companies (Janssen) and the Biomedical Advanced Research and Development Authority (BARDA), which is part of the Office of the Assistant Secretary for Preparedness and Response (ASPR) at the U.S. Department of Health and Human Services for the ongoing development of Janssen's investigational COVID-19 vaccine candidate. (PR Newswire)

HONG KONG: The Hong Kong government will tighten social-distancing restrictions and introduce mandatory testing for some groups after locally transmitted Covid-19 cases rose in the past week. The new measures, which mostly affect bars and restaurants, will be in place from Monday until Nov. 26, the city's Food and Health Secretary, Sophia Chan, said at a press conference. (BBG)

BOJ: MNI POLICY: BOJ Vigilant Against How Q4 GDP Cld Slow

- Japan's economic rebound in the third quarter had little impact on the Bank of Japan's economic view as bank officials are focused on how economic growth evolves in the fourth quarter, MNI understands - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

BOJ: The Bank of Japan must consider ways to make its monetary easing more sustainable as it will probably take a long while to hit the BOJ's price target, board member Takako Masai says Monday. (BBG)

JAPAN: MNI POLICY: Japan Economy Growth To Continue In Q4; Govt Aide

- Japan's economy is expected to grow again quarter-over-quarter in Q4, underpinned by exports and private consumption a senior official at the Cabinet Office said on Monday. The economy would normalize in the first quarter of 2022 on a quarterly basis, the official told reporters. "The economy rebounded sharply in the third quarter as economic activities reopened but the level remains at a low level," he said, although accepting the speed and depth of any recovery would be dictated by the spread of the virus and the government would need to keep on top of events - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

JAPAN: Japan's northeastern Miyagi prefecture may declare a state of emergency over the coronavirus as the number of hospital admission of Covid-19 patients rise, public broadcaster NHK reports, citing unidentified officials. The number of patients in medical facilities was at record 73 as of Nov. 15 with more than 80% of hospital beds occupied. (BBG)

AUSTRALIA: South Australia state is battling a growing number of Covid-19 infections, with 17 cases now linked to a family cluster in the capital, Adelaide. "It is a very, very dangerous situation we're in," state Premier Steven Marshall said Monday. He said his government would consider tougher social-distancing restrictions if necessary, adding "we will do whatever it takes to get on top of this cluster." (BBG)

AUSTRALIA/CHINA: There are signs that Australia's billion-dollar wine trade with China has effectively ground to a halt, as winemakers continue to grapple with disruptions. Federal Trade Minister Simon Birmingham has not yet heard from his Chinese counterpart, despite the Federal Government signing the largest ever free trade deal in history. (9 News)

AUSTRALIA/CHINA: Industry group Australian Grape and Wine says it has asked exporters if any shipments had cleared China's customs since an unofficial ban was touted two weeks ago, but so far none have reported success. (ABC)

SOUTH KOREA: Recent moves in the FX market are excessive and South Korea will take aggressive measures against any artificial moves that increase volatility, the finance ministry official says in a text message. (BBG)

NORTH KOREA: North Korean leader Kim Jong-un presided over a politburo meeting of the Workers' Party in his first public appearance in 25 days and discussed nationwide anti-coronavirus measures, state media said Monday. During the enlarged politburo meeting held Sunday, Kim discussed "COVID-19 and the state anti-epidemic situation and clarified the tasks for the Party, military and economic fields to further tighten the emergency anti-epidemic front," according to the Korean Central News Agency. (Yonhap)

ASIA: Fifteen Asia-Pacific economies formed the world's largest free trade bloc on Sunday, a China-backed deal that excludes the United States, which had left a rival Asia-Pacific grouping under President Donald Trump. The signing of the Regional Comprehensive Economic Partnership (RCEP) at a regional summit in Hanoi, is a further blow to the group pushed by former U.S. president Barack Obama, which his successor Trump exited in 2017. Amid questions over Washington's engagement in Asia, RCEP may cement China's position more firmly as an economic partner with Southeast Asia, Japan and Korea, putting the world's second-biggest economy in a better position to shape the region's trade rules. (RTRS)

BOC: MNI POLICY: BOC Bond Buys Lag CAD4bn Target For 2nd Week

- The Bank of Canada's purchases of bonds lagged its CAD4 billion target for a second week, figures released Friday showed. Federal government bond holdings rose about CAD2 billion for a second week in the period through Nov. 11, reaching CAD272 billion. Provincial bond holdings rose to CAD12.3 billion from CAD11.4 billion over that stretch. The entire balance sheet grew to CAD529 billion from CAD526 billion this week, following a decline from CAD531 billion. Assets had reached a record CAD547 billion at the end of July - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

CANADA: Residents of Canada's financial capital were asked to avoid leaving their homes except for essential reasons to slow a virus outbreak that has left hospitals at risk of being overwhelmed. Toronto, the country's largest city, and most of its suburbs are being placed in a "control-red" zone under Ontario's Covid-19 framework, Premier Doug Ford said Friday. The move means tighter restrictions on most indoor businesses and activities -- closing movie theaters and some personal care services and placing tight limits on restaurants and fitness centers. (BBG)

TURKEY: A shutdown of two to three weeks should be implemented in Istanbul as the city accounts for more than 50% of the coronavirus cases in Turkey, Mayor Ekrem Imamoglu said. (BBG)

MEXICO: Mexico City has reintroduced some restrictions for the next two weeks amid a resurgence of Covid-19 cases and a rise in hospital admissions in the capital. Mayor Claudia Sheinbaum told a news conferences that bars that had previously been authorised to open provided they offered food, would now not be allowed to open for the next two weeks even if they served meals. (FT)

BRAZIL: Candidates backed by President Jair Bolsonaro in Brazil's main capitals had a weak performance at Sunday's municipal elections, underscoring limits to the political influence of the Brazilian leader. The nation of 200 million chose mayors and city councilors in a vote seen as a referendum on the first half of Bolsonaro's four-year mandate. Stations closed at 5 p.m. local time, and exit polls show a challenging scenario for the far-right leader in the country's main capitals. About three-quarters of the population, excluding children and the elderly, were required to cast a ballot. (BBG)

EQUITIES: Trading on the Australian Securities Exchange was halted on Monday as the stock exchange operator cited "market data issues", shortly after shares touched their highest in more than eight months. (RTRS)

OIL: The Trump administration is advancing plans to auction drilling rights in the U.S. Arctic National Wildlife Refuge before the inauguration of President-elect Joe Biden, who has vowed to block oil exploration in the rugged Alaska wilderness. The Interior Department is set to issue a formal "call for nominations" as soon as Monday, kick-starting a final effort to get input on what tracts to auction inside the refuge's 1.56-million-acre coastal plain. The plans were described by two people familiar with the matter who asked not to be named detailing administration strategy. (BBG)

OIL: Enbridge Inc.'s battle with Michigan escalated on Friday as the governor took new legal action to shut down a key pipeline that supplies central Canadian refineries. (BBG)

CHINA

POLICY: The suspension of Ant Group's much-awaited stock market debut, reportedly at President Xi Jinping's behest, is only one sign of the Chinese government's increasing domination of private-sector companies. China's government, state-owned enterprises or state-backed funds have taken de facto control of 51 companies so far this year, up from around 20 to 30 in 2018 and 2019, disclosures by listed companies show. The increase comes as Xi advances a "dual circulation" strategy meant to cut the economy's dependence on foreign demand and prepare for a long struggle with Washington. (Nikkei)

YUAN: Chinese regulators should minimize the impact of exchange rate swings on sentiment and help stabilize expectations of future movements, the Securities Daily reported citing Dong Zhongyun, an economist from AVIC Securities. Regulators should use more precise macroeconomic tools to keep the economy stable, prevent large swings in inflation and interest rates and maintain the balance of payments, Dong said. Banks should provide more convenient exchange rate risk-prevention channels and increase the efficiencies of cross-border yuan flow and offshore clearance, the Daily reported citing Liu Chendong, the Deputy Director of Economic studies of CCIEE.

DEFAULT: Chinese regulators should calm the market and avoid systemic financial risk after the Yongcheng Coal Electricity Holding Group's default on its bonds caused the bond market to tumble, according to an opinion piece in China Securities Journal. Without intervention, the panic could reduce interest in credit bonds and hinder the bond market's normal functioning, the Journal report said. Regulators should also investigate whether Yongcheng neglected its liabilities and also step up market supervision, said the commentator.

DEBT: Vulture funds are racing to buy bonds of troubled Chinese state-owned enterprises, after a sharp sell-off sparked by a large coal mining group's default on a Rmb1bn ($156m) debt issue. Yongcheng Coal & Electricity, a coal miner in central Henan province, one of China's most populous provinces with more than 95m people, defaulted on Friday. This was just weeks after Brilliance Auto, a carmaker owned by the Liaoning provincial government, announced it would not be able to repay a three-year Rmb1bn bond. The default of the two groups has triggered a plunge in prices of state-backed corporate debt as international and onshore investors grappled with the prospect of China's central government stepping back from its traditional role as a safety net for local government businesses. (FT)

FINTECH: China's top banking regulator pledged to lower the risk of companies becoming "too big to fail" in financial innovation, suggesting the nation's biggest technology companies will face increasing scrutiny on their influence in its financial system. "Financial innovation shouldn't form oligopolies, reap excessive returns and harm public interests," Xiao Yuanqi, chief risk officer of the China Banking and Insurance Regulatory Commission, said at the Caixin Summit in Beijing on Saturday. Companies should not hide behind innovation to break rules of fair competition to benefit themselves, he said. (BBG)

OVERNIGHT DATA

CHINA OCT INDUSTRIAL OUTPUT +6.9% Y/Y; MEDIAN +6.7%; SEP +6.9%

CHINA OCT INDUSTRIAL OUTPUT YTD +1.8% Y/Y; MEDIAN +1.8%; SEP +1.2%

CHINA OCT RETAIL SALES +4.3% Y/Y; MEDIAN +5.0%; SEP +3.3%

CHINA OCT RETAIL SALES YTD -5.9% Y/Y; MEDIAN -5.9%; SEP -7.2%

CHINA OCT FIXED ASSETS EX RURAL YTD +1.8% Y/Y; MEDIAN +1.6%; SEP +0.8%

CHINA OCT PROPERTY INVESTMENT YTD +6.3% Y/Y; MEDIAN +6.0%; SEP +5.6%

CHINA OCT UNEMPLOYMENT RATE 5.3%; MEDIAN 5.3%; SEP 5.4%

MNI DATA IMPACT: China Oct Spending Up, Catering Rises Again

- China's industrial sector is recovering steadily at a relatively fast pace, while the services sector accelerated significantly in October with a holiday boost, said Fu Linghui, the spokesman of the National Bureau of Statistic at a data release briefing on Monday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

CHINA OCT FOREIGN DIRECT INVESTMENT CNY +18.3% Y/Y; SEP +25.1%

CHINA OCT NEW HOME PRICES +0.15% M/M; SEP +0.34%

JAPAN Q3, P GDP +5.0% Q/Q; MEDIAN +4.4%; Q2 -8.2%

JAPAN Q3, P GDP ANNUALISED +21.4% Q/Q; MEDIAN +18.9%; Q2 -28.8%

JAPAN Q3, P GDP NOMINAL +5.2% Q/Q; MEDIAN +4.6%; Q2 -7.8%

JAPAN Q3, P GDP DEFLATOR +1.1% Y/Y; MEDIAN +1.0%; Q2 +1.4%

JAPAN Q3, P PRIVATE CONSUMPTION +4.7% Q/Q; MEDIAN +5.2%; Q2 -8.1%

JAPAN Q3, P BUSINESS SPENDING -3.4% Q/Q; MEDIAN -2.9%; Q2 -4.5%

JAPAN Q3, P INVENTORY CONTRIBUTION % GDP -0.2%; MEDIAN -0.3%; Q2 +0.3%

MNI DATA IMPACT: Japan Q3 GDP Posts 1st Growth in 4 Quarters

- Japan's economy grew for the first time in four quarters in Q3, rising 5.0 q/q, or an annualized 21.4%, boosted by private consumption and net exports, according to preliminary GDP data released by the Cabinet Office on Monday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

JAPAN SEP, F INDUSTRIAL OUTPUT -9.0% Y/Y; FLASH -9.0%

JAPAN SEP, F INDUSTRIAL OUTPUT +3.9% M/M; FLASH +4.0%

JAPAN SEP CAPACITY UTILISATION +6.4% M/M; AUG +2.9%

NEW ZEALAND OCT SERVICES PMI 51.4; SEP 50.4

Activity in New Zealand's services sector lifted slightly in October, according to the BNZ - BusinessNZ Performance of Services Index (PSI). The PSI for October was 51.4, which was up 1 point from September (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). BusinessNZ chief executive Kirk Hope said that while the overall small lift in expansion was positive, the sub-indices that make up the main result were mixed. "New Orders/Business (58.4) lifted to its highest result since June, along with Stocks/Inventories (51.7) returning to expansion since July. However, Employment (49.5) remains in contraction for the 8th consecutive month, while Production (49.9) fell back down under the 50.0 mark." BNZ Senior Economist Craig Ebert said that "October's PSI was still shy of its historical average of 54.0. This was perhaps more disappointing than was the case for the PMI as the service sectors should arguably have been exhibiting a stronger rebound." (BNZ)

UK NOV RIGHTMOVE HOUSE PRICE INDEX +6.3% Y/Y; OCT +5.5%

UK NOV RIGHTMOVE HOUSE PRICE INDEX -0.5% M/M; OCT +1.1%

CHINA MARKETS

PBOC ISSUES CNY800BN 1-YR MLF; NET INJECTS CNY600BN

The People's Bank of China (PBOC) injected CNY800 billion via one-year medium-term lending facility (MLF) on Monday with the rate unchanged at 2.95%. The injection was CNY600 billion more than the amount of MLF maturing. Today's MLF operation also aimed to roll over CNY400 billion in MLF which matured on November 5th, according to a statement on the PBOC website. The central bank skipped conducting reverse repos today, the PBOC said.

- The operations aim to maintain the liquidity in the banking system at a reasonable and ample level, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) declined to 2.2654% at 09:30 am local time from the close of 2.6061% on last Friday.

- The CFETS-NEX money-market sentiment index closed at 36 on last Friday vs 63 on last Thursday. A lower index indicates decreased market expectations for tighter liquidity.

MARKETS

SNAPSHOT: E-Minis Rally As Markets Look To The Brighter Side

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 516.77 points at 25901.26

- ASX 200 up 79.079 points at 6484.3

- Shanghai Comp. up 30.483 points at 3341.465

- JGB 10-Yr future down 2 ticks at 152.09, yield down 0bp at 0.025%

- Aussie 10-Yr future down 1.0 tick at 99.110, yield up 1.2bp at 0.893%

- U.S. 10-Yr future -0-00+ at 138-03, yield down 0.49bp at 0.891%

- WTI crude up $0.6 at $40.74, Gold up $4.58 at $1893.99

- USD/JPY down 4 pips at Y104.59

- Trump alludes to defeat, but doesn't concede

- TRUMP PLANS LAST-MINUTE CHINA CRACKDOWN (AXIOS SOURCES)

- CHINA SAYS U.S. SHOULD STOP UNREASONABLY SUPPRESSING CHINESE FIRMS (RTRS)

- DOCUMENT: MERKEL, GERMAN STATES CONSIDER TOUGHER COVID-MEASURES (RTRS)

- CHINESE DATA MIXED, PBOC INJECTS NET CNY200BN VIA MLF

- COVID-19 VACCINE PIPELINE EYED, ALLOWS MARKETS TO SHRUG OFF NEGATIVES

BOND SUMMARY: Off Lows, Bid In E-Minis Keeps Space In Check

It has been a slow grind away from the early lows for T-Notes, with little in the way of notable macro headline flow evident since the Asia-Pac re-open. The contract last prints unch. at 138-03+, operating in a 0-04+ range. Cash Tsy trade has seen some light bull flattening, although yields are less than 1.0bp richer than settlement across the curve. Hope for further positive COVID-19 developments in the coming days has boosted most major equity indices, with core global FI a little more insulated, given the global COVID outlook and fresh restrictions that are evident/pending in the U.S. & Europe. On the data front, Chinese retail sales data for the month of October was a little soft, while the industrial production reading out of the same country was a touch firmer than expected.

- Early trade saw an unwind of the modest overnight losses for JGB futures, with the contract last -1 vs. Tokyo settlement levels, after holding to a tight range in morning dealing. Cash JGBs saw modest richening, while swap rates nudged higher, leading to a modest widening of swap spreads. Local prelim Q3 GDP data was firmer than expected, but seen as very much in the rear-view mirror, given the evolving COVID situation, both at home and abroad.

- In Australia YM is unchanged, while XM is -1.5, with the grind away from lows in U.S. T-Notes that we have outlined elsewhere helping the space off worst levels, even with ACGB supply pressure evident. Locally, the RBA stepped in with an offer to purchase A$1.5bn of ACGB Apr '24, in order to enforce its 3-Year yield target, which seemingly provided some incremental support (the move came alongside the Bank's scheduled A$2.0bn round of purchases covering the lower end of maturities within the reach of its purer QE scheme).

JGBS AUCTION: Japanese MOF sells Y498.5bn of 5-15.5 Year JGBs in liquidity enhancement auction:

- Average Spread: -0.007% (prev. -0.007%)

- High Spread: -0.005% (prev. -0.006%)

- % Allotted At High Spread: 14.3529% (prev. 4.5298%)

- Bid/Cover: 3.267x (prev. 4.425x)

EQUITIES: Bid To Start The Week

Spill over from Wall St. trade and a focus on the potential for further positive COVID-19 vaccine announcements in the coming days seemingly supported the major regional equity indices during Asia-Pac hours, with a liquidity injection from the PBoC also adding a further leg of support for broader sentiment. Elsewhere, the formal signing of the RCEP trade pact provided another positive input for regional indices.

- These matters outweighed the negatives surrounding the political and fiscal landscape in DC, in addition the worry surrounding the U.S./global COVID outlook and realised/potential social mobility restriction in both the U.S. and Europe.

- Local economic data was mixed, with Japanese Q3 GDP topping exp. while Chinese retail sales data missed.

- E-minis pushed higher, with the NASDAQ 100 contract breaching 12,000, while the A&P 500 contract broke above 3,600.

- ASX 200 equity trade was suspended after a market data issue hampered trade, resulting in an early close on Monday.

- Nikkei 225 +1.8%, Hang Seng +0.4%, CSI 300 +0.8%, ASX 200 +1.3%.

- S&P 500 futures +28, DJIA futures +232, NASDAQ 100 futures +111.

OIL: Supported By Equities

The broader uptick in equities (discussed elsewhere) has supported the major crude benchmarks in early trade this week, with WTI & Brent sitting ~$0.50 & $0.40 above their respective settlement levels, although the contracts still sit some way shy of last week's best levels. A reminder that crude struggled on Friday.

- In terms of crude-specific headline flow, a BBG source report lodged back on Friday noted that "the Trump administration is advancing plans to auction drilling rights in the U.S. Arctic National Wildlife Refuge before the inauguration of President-elect Joe Biden, who has vowed to block oil exploration in the rugged Alaska wilderness."

- Elsewhere, the broadening round of social mobility limitations in the U.S. and Europe will hurt the demand side of the coin, while incremental supply from Libya seemingly continues to nudge higher.

GOLD: Just Shy Of $1,900/oz

A softer USD has supported the yellow metal over the past couple of sessions, allowing bulls to force a challenge of $1,900/oz in spot during early Asia-Pac dealing this week. Spot deals at $1,895/oz, +$6/oz or so on the day, with price levels some way away from the key technical lines in the sand.

FOREX: Positives Dominate

Positive developments kept risk sentiment buoyant, as U.S. President-elect Biden's team ruled down a nationwide lockdown, 15 Asia-Pacific nations signed off on the world's largest regional free trade pact (RCEP), while the PBoC net injected liquidity via its MLF facility. The upcoming announcement from Moderna on its Covid-19 vaccine research helped bolster sentiment and outweigh some familiar negatives. The greenback led losses in G10 FX space, with safe haven peers JPY & CHF sinking in tandem.

- Optimistic mood music lent support to commodity FX, which allowed NZD & NOK to top the G10 scoreboard. While the finalisation of the RCEP pact had the potential to soothe concerns over the close but tense Sino-Australian trade relationship (both are signatories to the deal), subsequent press reports noted that the bilateral spat over the recent trade disputes remain unresolved.

- Firmer risk appetite allowed GBP to shake off its earlier weakness, stemming from Friday's downgrade to the UK's credit rating by DBRS and uncertainty stoked by the news that PM Johnson was forced to go into quarantine as he was preparing to launch a "political reset".

- USD/CNH went offered owing to broader dollar weakness. There was little price reaction to China's monthly economic activity data, which included a beat in industrial output, a below-forecast acceleration in retail sales growth & a surprise downtick in unemployment.

- USD/KRW plunged through its 2019 lows and South Korea's MoF had to use some jawboning to kick the pair off worst levels. An MoF official said that the recent FX moves are excessive and authorities will take aggressive measures to stabilise markets.

- Focus moves to U.S. Empire M'fing, Canadian M'fing Sales, final Italian CPI & comments from RBA's Lowe, Fed's Clarida & Daly, ECB's Lagarde, de Guindos, de Cos, Mersch & Centeno, Riksbank's Skingsley & BoE's Haskel.

FOREX OPTIONS: Expiries for Nov16 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1500(E1.1bln), $1.1830-50(E745mln)

- USD/JPY: Y103.40-50($740mln), Y104.45-55($541mln), Y104.70-75($783mln), Y105.00($986mln), Y105.35($620mln), Y106.00-10($660mln)

- EUR/JPY: Y123.00(E1.25bln)

- EUR/GBP: Gbp0.8825(E575mln-EUR puts), Gbp0.8925-35(E590mln-EUR puts)

- USD/CNY: Cny6.65($805mln-USD puts)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.