-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Markets Indecisive In Asia, Lack Of Macro Movers Noted

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* FED'S POWELL: LONG WAY FROM FULL RECOVERY (MNI)

* TRUMP CONTINUES ELECTION-RELATED UNREST

* U.S. SOCIAL RESTRICTIONS WIDEN/DEEPEN

* BREXIT MOOD MUSIC SEEMS POSITIVE, BUT NOTHING FIRM EMERGES AS OF YET

* SOUTH AUSTRALIA GOES INTO "PAUSE" ON LOCAL COVID SITUATION

* RBNZ REVIEWING EARLY RELEASE OF NOV MPS

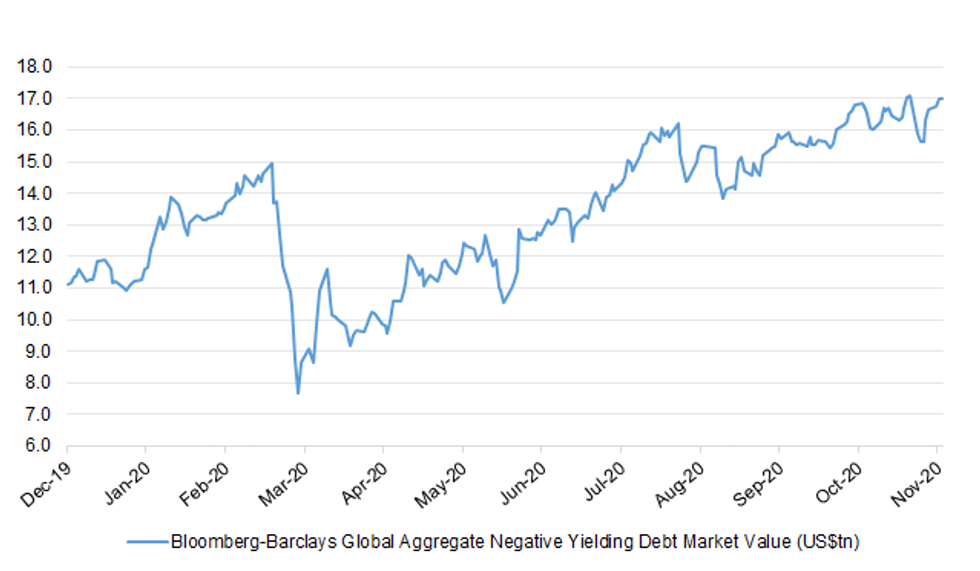

Fig. 1: Bloomberg-Barclays Global Aggregate Negative Yielding Debt Market Value (US$tn)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Households across the country are set to be banned from mixing when lockdown ends under Government plans to rescue Christmas, The Telegraph understands. (Telegraph)

CORONAVIRUS: The tiered system introduced in England in an effort to fight COVID-19 is "inadequate" and "did not contain the spread of the virus", according to the British Medical Association (BMA). The BMA has also said it was "inconsistent" in the way it was applied, and that it must be "urgently revised" before the country exits its second lockdown on 2 December. (Sky)

BREXIT: France is understood to have accepted that its fishing rights in UK waters will be reduced after the transition period ends on December 31, lowering one of the biggest hurdles in the path of a deal. The trade agreement could be announced as early as Monday, sources in Brussels suggested – but only if both sides made compromises on issues such as fishing and subsidy law. (Telegraph)

BREXIT: A Times reporter tweeted the following on Tuesday: "Is a Brexit trade deal imminent? Big push back from No10 today on suggestions. Senior folk in Brussels as well as SW1 also don't think so, because the politics aren't quite right yet. Why? Because Dom Cummings' departure has actually made it harder for the PM to compromise and compromise is what both sides still need to do. Figures close to the PM are nervous about Boris being painted as selling out, especially by Cummings, so want more time to pass. Week 1 or 2 in December now seen as most likely when there will still be JUST enough time to ratify it - 2 weeks needed by UK/Euro parliaments. But, it may fall even later than that, Jan or Feb. Emergency measures being quietly prepared now to keep trade flowing as long as a deal is in sight." (MNI)

BREXIT: British ministers confirmed a deal could take shape that allowed EU boats to continue to have "generous" access to UK waters for a transition period, reflecting the relatively small size of the British fleet. "We haven't got enough boats to catch all the fish," said one minister, adding that a deal must recognise British sovereignty, but could allow "generous" rights for EU boats while the UK fleet was built up. British officials talked of a "transition period, not the status quo", but that is not enough for the EU side which does not agree that access to UK waters should be conditional on the outcome of annual fishing negotiations. (FT)

BOE: MNI BRIEF: BOE Ramsden: Market Shock Risk From No Deal

- Bank of England Deputy Governor Dave Ramsden said Tuesday he "wanted to be very clear that negative rates remain in the toolbox" and that the Bank was continuing with its assessment of the practical issues. Ramsden, who has been portrayed as a negative rates sceptic, instead cited them as an example of the Bank continuing to innovate in policy - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

ECONOMY: Business leaders have warned the government that livelihoods are at risk because they are in the dark about what Covid-19 restrictions will be in place when England's lockdown ends on December 2. Bosses told MPs yesterday that they needed clarity over the rules they would have to adhere to in the crucial Christmas trading period so that they could make plans for their staff, sites and suppliers. (The Times)

POLICY: U.K. Prime Minister Boris Johnson announced a 12 billion-pound ($15.9 billion) plan to boost green industries and tackle climate change, in a blueprint he says will create or support as many as 250,000 jobs. (BBG)

FISCAL: Downing Street last night won its battle with the Treasury to agree a multi-year funding settlement for the armed forces. After intense discussions between the prime minister and chancellor yesterday, a four-year financial deal for the Ministry of Defence was agreed, it is understood. (The Times)

SCOTLAND: Boris Johnson is to launch a "union task force" to boost the social and cultural case for the UK following a series of missteps by the prime minister that are seen as weakening the bonds between England and Scotland. Scottish Conservatives on Tuesday scrambled to limit the damage from Mr Johnson's comments to northern English Tory MPs on Monday that devolution had been a "disaster north of the border" and the Scottish parliament was the "greatest mistake" of former prime minister Tony Blair. (FT)

SCOTLAND: The Scottish Tories may be forced to look again at splitting from the UK party if Boris Johnson continues to undermine them and the Union, party figures have warned him after he called devolution a "disaster". Conservative insiders said breaking away from the UK party was not supported by Douglas Ross, the new Scottish Tory leader, although he wanted more autonomy. (Telegraph)

EUROPE

EU: MNI EXCLUSIVE: EU Budget Standoff Set To Drag On Beyond Summit

- European Union leaders are likely to need more than this Thursday's video summit to break a deadlock over the bloc's EUR1.8 trillion 2021-27 budget, vetoed by Poland and Hungary over a requirement for member states in receipt of EU funds to meet standards for rule of law, officials told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

EU: EU ministers urged Poland and Hungary to drop their veto over the union's long-awaited budget deal as they warned of the continued economic damage being wrought by the Covid-19 crisis. Representatives from France, Germany, Denmark and other member states said citizens could ill-afford delays to the €1.8tn funding package first agreed at a July summit, as they grapple with continued opposition from Warsaw and Budapest over a so-called rule of law mechanism that would tie European spending to EU principles such as judicial independence. Germany's Europe minister Michael Roth, who chaired a video conference of EU affairs ministers on Tuesday, warned that Poland and Hungary should know their own citizens would also pay a price if the agreement continued to be delayed. (FT)

FRANCE: France's next phase in efforts to slow the spread of the coronavirus won't be a full end to lockdown measures, Prime Minister Jean Castex said in a hearing in the National Assembly on Tuesday. Some restrictions will be maintained "because the situation will have improved, but not sufficiently," he said. "The idea is to be able to manage a little more over time." (BBG)

FRANCE: French President Emmanuel Macron could speak next week to outline the major steps toward progressively ending the second nation-wide lockdown, French daily Les Echos reports on Tuesday, without saying how it got the information. (BBG)

FRANCE: France has cut its forecast for economic growth next year to 6 per cent from 8 per cent following the country's second nationwide lockdown, which includes the closure of non-essential shops and tight restrictions on travel. Bruno Le Maire, finance minister, said he would maintain his forecast for the current year of an 11 per cent decline in gross domestic product as a result of the coronavirus pandemic. Insee, the statistics agency, said on Tuesday the economy would probably shrink 9-10 per cent this year. (FT)

NETHERLANDS: The Dutch government extended partial lockdown measures while at the same time lifting some restrictions imposed two weeks ago. That means libraries, theaters, cinemas, museums and swimming pools can reopen in a rare move in Europe to ease curbs on movement. Bars and restaurants will remain closed. "The numbers we see every day are still too high, but the trend is one of decline and that is positive" Dutch Prime Minister Mark Rutte said in a press conference in the Hague. "No extra measures are necessary." (BBG)

SWEDEN: Swedish residential property prices rose 1.3% on the month in October, according to the Nasdaq OMX Valueguard-KTH Housing Index, HOX Sweden. HOX Sweden advanced 4.4% in the 3 months through October and rose 10.4% y/y. Adjusted for seasonal effects, the index rose 1.9% m/m in October. (BBG)

AIRLINES: Air France-KLM may raise 6 billion euros ($7.1 billion) in fresh funds to survive the Covid-19 pandemic, including contributions from the French and Dutch governments, according to a French report. The loss-making airline is talks to receive a capital injection of 3 billion euros from France and 1 billion euros from the Netherlands, Le Monde newspaper reported Tuesday, citing sources it didn't name. The plan would aim to keep the existing shareholder balance and avoid a nationalization of the carrier, it said. (BBG)

AUTOS: Germany will earmark 3 billion euros (£2.6 billion) to support the development and production of climate-friendly cars as the auto industry grapples with challenges posed by the COVID-19 pandemic and global climate crisis, the government said on Tuesday. (RTRS)

U.S.

FED: MNI POLICY: Fed's Powell: Long Way From Full Recovery

- The U.S. economy will need ongoing support from monetary and fiscal policy to navigate major risks including a surge in Covid cases that could slow the recovery, Federal Reserve Chairman Jerome Powell said Tuesday. The labor market, despite an impressive recovery from the initial second-quarter slump, was still a long way from the conditions seen before the crisis, he said. The unemployment rate was 6.9% in October - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: MNI POLICY: Fed's Barkin Sees Divergent Recovery Scenarios

- Federal Reserve Bank of Richmond President Tom Barkin said Tuesday his outlook for 2021 remains highly uncertain depending on the path of Covid-19 and the Fed should keep its stimulus program going. With a highly effective vaccine, "it's easy to imagine us getting back to where we were and beyond," he said, but a prolonged surge could slow the recovery, he told the Charleston Metro Chamber of Commerce on a Zoom call - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: MNI INTERVIEW: Biden Could Give Fed More Leeway - Spriggs

- A Biden administration will likely give the Fed more leeway to boost emergency lending and could pump money into struggling companies to boost federal support for the economy even in the absence of a large fiscal stimulus from Congress, William Spriggs, an adviser to the president-elect's campaign who is reportedly in the running for a senior government post, told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: MNI INTERVIEW: Job Benefits End At Worst Possible Time - SF Fed

- The U.S. may see a wave of bankruptcies if two jobless benefits are allowed to lapse next month, a move that will also bring few discouraged workers back into the labor market, San Francisco Federal Reserve researcher Nicolas Petrosky-Nadeau told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: Judy Shelton's controversial nomination to the Federal Reserve suffered a possibly fatal blow Tuesday in a key procedural vote in the Senate. The upper chamber voted against a move to limit debate on the nomination, typically a death knell because the opposition simply could block the vote from ever coming to the full floor. The only avenue for Shelton to get through would be if Senate Minority Leader Mitch McConnell can get at least 50 votes together. Following the vote, McConnell moved to preserve his right to bring Shelton's name up again for consideration. In case of a 50-50 split, Vice President Mike Pence would be called on to break the tie. (CNBC)

FISCAL: Congress appeared nowhere close to passing another coronavirus relief bill Tuesday as infections surge across the country and new public health restrictions threaten businesses and jobs. Lawmakers have not passed new aid in months during the health and economic crisis. As the virus again overwhelms hospitals and forces state and local officials to restrict economic activity, Republicans and Democrats have not budged from their positions on stimulus. Senate Minority Leader Chuck Schumer and House Speaker Nancy Pelosi have not spoken with Senate Majority Leader Mitch McConnell about another relief bill since the Nov. 3 election, congressional leaders said this week. They appear stuck in their pre-election stances, when Democrats pushed for a package that costs at least $2.2 trillion and Republicans sought a roughly $500 billion bill. (CNBC)

FISCAL: The Business Roundtable, a large and influential group consisting of prominent corporate leaders, has decided on its key policy priorities under President-elect Joe Biden's administration and a new Congress. Joshua Bolten, the CEO of the advocacy and lobbying group, told reporters Tuesday that it will start pushing policymakers on a slew of initiatives, including another coronavirus relief bill to help small businesses, the removal of tariffs, and police reforms. (CNBC)

CORONAVIRUS: President Donald Trump's health secretary expects Pfizer Inc. and Moderna Inc. to apply "any day now" for government approval of their coronavirus vaccine candidates, and he downplayed the likelihood that wrangling over the election outcome will delay distribution. (BBG)

CORONAVIRUS: Coronavirus hospitalizations in New York have topped 2,000, the highest since early June, Governor Andrew Cuomo announced Tuesday. (BBG)

CORONAVIRUS: Illinois Governor J.B. Pritzker announced a series of new statewide restrictions that go into effect Nov. 20. Casinos and museums will close, gyms will cease indoor group classes, and bars and restaurants won't offer indoor service. Retailers will reduce capacity to 25%. Pritzker also called for home gatherings to be limited to household members and for employees to work remotely when possible. (BBG)

CORONAVIRUS: Ohio Gov. Mike DeWine issued a statewide curfew in response to the state's worsening coronavirus outbreak. The 21-day curfew, which goes into effect Thursday, begins at 10 p.m. and lasts until 5 a.m. (CNBC)

POLITICS: In an effort to battle a dangerous surge in COVID-19 cases, Los Angeles County officials will soon announce new limits on hours of operation for some businesses while also limiting the size of outdoor gatherings. Officials also warned that if cases and hospitalizations continue to surge, more extreme measures would be taken in the coming weeks, including limiting restaurants to pick-up orders and some type of return to the "safer at home" order that would "only allow essential workers and those securing essential services to leave their homes." Starting Friday, restaurants, breweries, wineries and nonessential retail establishments will be barred from providing outdoor service between 10 p.m. and 6 a.m., said L.A. County Supervisor Sheila Kuehl. (Los Angeles Times)

CORONAVIRUS: Maryland has ordered bars and restaurants to cease late-night in-person dining and tightened capacity limits on indoor gatherings as the state grapples with record daily coronavirus cases and strained hospital resources. (FT)

CORONAVIRUS: Montana's governor on Tuesday expanded a mask mandate statewide and announced other restrictions as COVID-19 infections continue to surge and strain hospital resources. (Associated Press)

CORONAVIRUS: Pennsylvania will require travellers to the state to have a negative coronavirus test within 72 hours of arrival and expand its mask mandate in an effort to clamp down on record levels of Covid-19 cases and a surge in hospital admissions. (FT)

POLITICS: President Trump is "seriously" considering a 2024 bid for president and has "100%" mentioned it in conversations with his top advisers in recent days, a Trump campaign senior adviser and a Trump ally told CBS News. (CBS)

POLITICS: Trump has until 5 p.m. on Wednesday to submit the $7.9 million estimated cost for a Wisconsin statewide recount and other required paperwork. Trump could also file for a recount only in select counties, which would reduce his cost and allow him to target areas where votes were predominantly for Biden. Counties would have to start the recount no later than Saturday and complete it by Dec. 1. (Associated Press)

POLITICS: The state of Georgia announced Tuesday that an official audit of its voting machines found no evidence of fraud or foul play during the 2020 elections. Secretary of State Brad Raffensperger, who had ordered a certified testing laboratory to conduct an audit of a random sample of Georgia's machines, said that the probe was both complete and successful in ensuring that the machines hadn't been manipulated. (CNBC)

POLITICS: The Pennsylvania Supreme Court on Tuesday ruled 5-2 that a Trump campaign ballot processing observer in Philadelphia had no right to stand any particular distance away from election workers, and it's up to counties to decide where poll watchers can stand. It's a significant loss for President Donald Trump's campaign at a moment in which the legal strategy to block President-elect Joe Biden's win and undermine the election results is crumbling and entering its final throes. (CNN)

POLITICS: Republican appointees on a key board in Michigan's most populous county Tuesday night reversed their initial refusal to certify the vote tallies in the Detroit area, striking a last-minute compromise with Democrats that defused a political fight over the process to formalize President-elect Joe Biden's victory in the state. (Washington Post)

POLITICS: A group of Nevada Republicans asked a state court judge to declare President Donald Trump the winner of the election, claiming rampant fraud from mail-in ballots made the results of the Nov. 3 vote illegitimate. (BBG)

POLITICS: U.S. President Trump tweeted the following on Tuesday: "The recent statement by Chris Krebs on the security of the 2020 Election was highly inaccurate, in that there were massive improprieties and fraud - including dead people voting, Poll Watchers not allowed into polling locations, "glitches" in the voting machines which changed votes from Trump to Biden, late voting, and many more. Therefore, effective immediately, Chris Krebs has been terminated as Director of the Cybersecurity and Infrastructure Security Agency."

EQUITIES: Securities and Exchange Commission Chairman Jay Clayton on Tuesday called for company insiders to avoid immediately trading after they set up plans to sell shares they have accumulated, following a spate of big-ticket stock sales by pharmaceutical executives. Mr. Clayton called for a "cooling-off period" for so-called 10b5-1 plans, which allow company executives to sell stock at a predetermined time—even if they are in possession of important nonpublic information—without exposing themselves to insider-trading charges. (WSJ)

OTHER

GEOPOLITICS: President-elect Joe Biden said Tuesday he would work to rebuild international institutions he said were damaged during Donald Trump's presidency and that his message to world leaders is that "America is back." Biden met Tuesday with defense and intelligence experts, many of whom worked for President Barack Obama when Biden was vice president. He had gathered them together because the Trump administration has blocked him from getting the intelligence briefings traditionally granted the president-elect. (BBG)

CORONAVIRUS: Pfizer has reached the safety milestone for its Covid-19 vaccine, paving the way for the company to file with the US regulator for an emergency use authorisation as early as this week. (FT)

CORONAVIRUS: Pfizer may be within days of filing for an emergency use authorization for its Covid-19 vaccine, having collected the safety data necessary to submit an application to the Food and Drug Administration, CEO Albert Bourla said Tuesday. "We are very close to submitting for an emergency use authorization," Bourla said during the STAT Summit, which this year is a virtual event. Bourla sidestepped the question of whether Pfizer's filing would be made this week. "Let us not create expectations," he said in conversation with STAT's Matthew Herper. "We will announce it as soon as we are doing it." (STAT News)

CORONAVIRUS: Johnson & Johnson's JNJ.N chief scientist said the drugmaker is recruiting over 1,000 people per day for the late-stage trial of its experimental COVID-19 vaccine and expects to have all the data needed to seek U.S. authorization by February or earlier. (RTRS)

CORONAVIRUS: Sinovac Biotech's experimental COVID-19 vaccine CoronaVac triggered a quick immune response but the level of antibodies produced was lower than in people who had recovered from the disease, preliminary trial results showed on Wednesday. While the early to mid-stage trials were not designed to assess the efficacy of CoronaVac, researchers said it could provide sufficient protection, based on their experience with other vaccines and data from preclinical studies with macaques. (RTRS)

HONG KONG: Hong Kong police arrest former opposition lawmakers Eddie Chu, Ray Chan and Ted Hui in relation to a June Legislative Council meeting where the national anthem law was passed, Cable TV reports, citing unidentified people. (BBG)

JAPAN: The Tokyo Metropolitan Government is making final arrangements to raise its alert to the highest of four levels to warn the coronavirus is spreading, Nikkei reported, citing several unidentified people. Tokyo also is considering asking stores to close earlier, Nikkei said. (BBG)

JAPAN: Japan's government and ruling coalition are considering a plan to spend a combined 12 trillion yen ($115 billion) in five years from fiscal 2021 for disaster-proof infrastructure, the Nikkei newspaper reported on Wednesday. The size would mean Japan will spend roughly the same amount on disaster-proof measures annually as under the current three-year plan, which sets aside a combined 7 trillion yen (£51 billion) and expires in March. The plan, expected to be decided by the cabinet in December, will be funded by a third extra budget for the current fiscal year ending in March, as well as annual budgets in the next five years, the paper said. (RTRS)

JAPAN: Japan's Aso: Continue To Target Balanced Budget By FY 2025. (BBG)

BOJ: MNI POLICY: New BOJ Facility Won't Affect Policy: Kuroda

- Bank of Japan Governor Haruhiko Kuroda said on Wednesday that the recently introduced Special Deposit Facility will not affect yield curve control and change monetary policy. "The new facility is prudence policy, not monetary policy, and it will not affect the yield curve control policy and will not cause a change in monetary policy," Kuroda told lawmakers - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

RBA: Reserve Bank chief Philip Lowe said Australia's governments were right to load up on debt to support their economies and warned that a "very uneven" recovery was likely to persist "for quite a while" yet. "In the current environment, where we're suffering a once-in-a-century pandemic, it's entirely the right thing to do for the governments to borrow against future income to support current income," Lowe said in Sydney Wednesday. "The cost of doing that at the moment is very low, global interest rates are extraordinarily low and they're going to stay low for some time." The governor told the Australian's Strategic Forum 2020 that the economy is now "on the road back," but highlighted the unbalanced nature of the recovery. (BBG)

AUSTRALIA: South Australia Premier Steven Marshall has announced a six-day ''pause'' for the community in South Australia. "We need a circuit-breaker,'' he said. The state will be shutting down all schools from midnight tonight, along with universities. Open inspections for real estate are being closed, along with pubs and cafes. Aged care and disability care will be in lockdown and elective surgery is banned. The construction industry will be closed for six days. Weddings and funerals will be banned for six days. Regional travel is banned. Masks will be compulsory for outdoors. After that six day period there will be further eight days of other lesser restrictions. (AFR)

AUSTRALIA/CHINA: Australian wine exporters should be preparing for their peak selling season, the months preceding Christmas and New Year celebrations in China. They are instead watching stockpiles of product mount in warehouses as its biggest market clamps down on shipments from the country. Already on edge after China announced two trade probes into the country's wine industry earlier this year, people familiar with the situation said this month Beijing had also ordered traders to stop purchasing at least seven categories of Australian commodities -- including wine, rock lobsters, barley, and copper ore -- in its most sweeping trade move against Canberra yet. The prospect of indefinite bans would be a worst case scenario for Australian exporters, who have already been hit this year by Covid-19 lockdowns. (BBG)

AUSTRALIA/CHINA: The trade tensions between China and Australia seems to have fallen for a propaganda stunt by some Australian media outlets that are obsessed with fueling market panic over every trade frustration with China. Media on Monday reported fears that Australia's wine exports to China may have been cut off entirely after an industry group claimed that none of its member exporters have reported shipment clearance at Chinese customs in two weeks. In the absence of any official confirmation of the facts, such market rumors will clearly just make the stalemate between China and Australia even worse. In fact, in recent months, it has not been uncommon to see Australian media outlets play up so-called China's "economic retaliation" against Australia, unanimously ignoring China's official response or explanations on several trade issues. (Global Times)

RBNZ: The Reserve Bank has engaged Deloitte to independently review internal processes, after information was accidentally disclosed to a small group of financial services firms a short time before it was made public in the November Monetary Policy Statement (MPS). The accidental disclosure was included in a letter sent to non-bank financial institutions to finalise a consultation process. The letter confirmed the Reserve Bank's decision to introduce a Funding for Lending Programme (FLP), but did not contain specifics of the FLP. The information should not have been communicated until after the 2pm release, but was sent 45 minutes early. The limited information contained in the letter is unlikely to have provided anyone with a market advantage, but the Reserve Bank is taking the matter seriously. The Reserve Bank is working closely with the reviewers, and will comment further on any outcomes when the review is complete. (RBNZ)

BOC: MNI POLICY: BOC Says Climate Change Work Must Get Faster

- Bank of Canada Governor Tiff Macklem said Tuesday policy makers must move faster to understand the financial and economic risks posed by climate change, which threaten to upend markets as investors reprice assets through the transition to lower-carbon production - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

CANADA: Canadian prime minister Justin Trudeau on Tuesday called on the country's Senate to fast-track a coronavirus aid bill, as provinces buckled under a surge of new cases. "We don't have to choose" between the economy and public health, Mr Trudeau said at a press conference, noting that Quebec, Ontario, Alberta and Saskatchewan notched record numbers of new cases last weekend. (FT)

CANADA: MNI REALITY CHECK: Canada Consumers In Second Wave Slowdown

- Canadian consumer spending is heading into a slowdown as a second wave of Covid-19 discourages non-essential purchases, industry sources told MNI. October's 12-month inflation rate due Wednesday is expected by economists to slow to a 0.4% pace from September's 0.5%, led by energy and travel services. On a monthly basis, prices are seen gaining 0.2% after September's 0.1% decline according to an MNI survey, led by homes and automobiles - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

MEXICO: U.S. Attorney General William Barr said he'll seek the dismissal of drug-trafficking charges against Mexico's former defense minister so that the nation's prosecutors can investigate him in his home country. U.S. prosecutors will share evidence with Mexico to support their investigation against the former minister, General Salvador Cienfuegos, according to a joint statement from both countries. (BBG)

TURKEY: Turkey's president Recep Tayyip Erdogan has bowed to months of pressure to take new steps to curb the spread of coronavirus, imposing new restrictions on provinces across the country. Speaking after a cabinet meeting on Tuesday, Mr Erdogan announced that the working-age population across the country would be forbidden from going out at weekends between the hours of 8pm and 10am. People under the age of 20 and over 65 would face stricter curfews. (FT)

SOUTH AFRICA: The chief investment officer of South Africa's second-biggest pension fund said it's time to buy shares in companies that rely on the country's economy for their earnings. (BBG)

MIDDLE EAST: Acting Pentagon chief Christopher Miller said Tuesday that the United States will reduce its military presence in Afghanistan to 2,500 troops and 2,500 troops in Iraq by Jan. 15. The United States has approximately 4,500 troops currently in Afghanistan and more than 3,000 in Iraq. (CNBC)

MIDDLE EAST: About the same time, the top Senate Republican, Majority Leader Mitch McConnell, cautioned against any major changes in U.S. defense or foreign policy in the next couple of months, including any precipitous troop drawdowns in Afghanistan and Iraq. (RTRS)

IRAQ: Four rockets have struck inside a heavily fortified area in Baghdad housing foreign embassies including that of the United States, according to the Iraqi military, signalling an apparent end to a temporary halt in attacks by Iran-backed militias targeting Washington's presence in the country. The assault on Tuesday came less than an hour after the US announced plans to reduce its troop levels in Iraq from 3,000 to 2,500. (Al Jazeera)

SYRIA: Israeli fighter jets struck military targets on Syrian territory overnight, belonging to the Iranian Quds force and the Syrian Armed Forces, in response to explosive devices found, the Israel Defence Forces (IDF) said in a statement early Wednesday. (DPA)

BONDS: China's Ministry of Finance announced on Wednesday initial price guidance for a three-tranche euro bond offering. China is selling notes with tenors of five years, 10 years and 15 years, according to a person familiar with the matter. (BBG)

OIL: Pipeline operator TC Energy said on Tuesday that Canadian indigenous group Natural Law Energy will invest up to C$1 billion ($763.77 million) in its Keystone XL oil pipeline, despite U.S. President-elect Joe Biden's promise to stop the project. (RTRS)

CHINA

YUAN: The signing of the Regional Comprehensive Economic Partnership between China and 14 other Asia-Pacific countries has fuelled the appreciation of the yuan against the U.S. dollar as many foreign investors believe the deal will boost the yuan's acceptance in the Asia Pacific region, the 21st Century Business Herald reported. With the amount of trade between China and Southeast Asian countries set to further increase, foreign trading companies need to have more yuan for commodity purchases and settlements, while dollar settlements are seen as risker due to the depreciation pressure, the newspaper said, citing an unnamed head of a Southeast Asian foreign trade company. Some investors projected the yuan to trade at 6.45-6.55 to the dollar, the newspaper added. (MNI)

ECONOMY: China sees challenges in optimising economic structure and switching growth drivers, including the threat of a prolonged global recession from the pandemic and the backlash against globalisation, which could have an uncertain impact on global industrial and supply chains, Premier Li Keqiang wrote in the People's Daily commenting on the 2021-2025 plan. China must tackle lopsided development, boost innovation, address employment and income and increase environmental protection, Li said. The country must stick to its dual-circulation strategy boosting domestic demand as well as deepening its opening up and global cooperation, Li wrote. (MNI)

INFRASTRUCTURE: China's infrastructure investments may grow 7% y/y each month in November and December due to surging fiscal expenditure, the China Securities Journal reported, citing Zhu Jianfang, an economist from CITIC Securities. In the first 10 months, newly issued special-purpose local government bonds totalled 3.5 trillion yuan, a sharp rise from 2.1 trillion yuan a year ago, the newspaper said, citing Ministry of Finance data. In September, the government relaxed its policy and allowed some of the proceeds to be used as working capital for existing infrastructure projects, leading to a jump in such spending, the journal cited Li Qilin, a member of the China Chief Economist Forum, as saying. Such momentum will likely be carried into November and December, the journal said, citing Jin Yi, an analyst from Sealand Securities. (MNI)

NPLS: Chinese banks will boost the disposal of non-performing assets in Q4 by CNY1.67 trillion, the Economic Information Daily reported. Regulators will supervise banks to categorize assets, expose non-performing assets and reserve full provision for loan losses. Banks have disposed a total of CNY1.73 trillion of non-performing loans in the first three quarters, and the NPL rate was 1.96% by end-September, a rise of 0.02 percentage point from the previous quarter, the newspaper said. (MNI)

BONDS: New debt issued by Chinese companies affected by fresh U.S. sanctions will not be eligible for inclusion in JPMorgan's suite of indexes going forward, according to a Tuesday note from the firm.No existing instruments will be removed from JPMorgan indexes due to the sanctions, JPMorgan analysts including Nikhil Bhat wrote in the note. (BBG)

OVERNIGHT DATA

JAPAN OCT TRADE BALANCE +Y872.9BN; MEDIAN +Y300.0BN; SEP +Y687.8BN

JAPAN OCT TRADE BALANCE ADJ +Y314.3BN; MEDIAN +Y117.4BN; SEP +Y440.0BN

JAPAN OCT EXPORTS -0.2% Y/Y; MEDIAN -4.5%; SEP -4.9%

JAPAN OCT IMPORTS -13.3% Y/Y; MEDIAN -8.8%; SEP -17.4%

AUSTRALIA Q3 WAGE PRICE INDEX +1.4% Y/Y; MEDIAN +1.5%; Q2 +1.8%

AUSTRALIA Q3 WAGE PRICE INDEX +0.1% Q/Q; MEDIAN +0.2%; Q2 +0.2%

AUSTRALIA OCT WESTPAC LEADING INDEX +0.11% M/M; SEP +0.23%

This is the first positive, above trend, growth rate since November 2018. It is also the strongest seen since the early 1980s. That said, it mainly reflects the severity of the preceding contraction which saw the index growth rate drop to an extreme low of –5.5% in April. Indeed, the level of the Index has still not fully recouped the sharp decline seen during COVID lockdowns earlier in the year. This and previous developments in the Index are consistent with Westpac's view that growth in the Australian economy will be significantly above trend in both the September and December quarters (around an 8% annualised pace). We note that recently other forecasters, including the Reserve Bank, have moved to adopt a similar view. (Westpac)

NEW ZEALAND Q3 PPI INPUT +0.6% Q/Q; Q2 -0.9%

NEW ZEALAND Q3 PPI OUTPUT -0.3% Q/Q; Q2 -0.2%

CHINA MARKETS

PBOC NET DRAINS CNY50BN VIA OMOS WED

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with rates unchanged at 2.2% on Wednesday. This resulted in a net drain of CNY50 billion given the maturity of CNY150 billion of reverse repos today, according to Wind Information.

- The operations aim to maintain the liquidity in the banking system reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2000% at 09:17 am local time from the close of 2.1826% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Tuesday vs 35 on Monday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5593 WED VS 6.5762

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.5593 on Wednesday, compared with the 6.5762 set on Tuesday.

MARKETS

SNAPSHOT: Markets Indecisive In Asia, Lack Of Macro Movers Noted

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 194.79 points at 25819.83

- ASX 200 up 26.091 points at 6524.3

- Shanghai Comp. up 15.797 points at 3355.692

- JGB 10-Yr future up 8 ticks at 152.15, yield down 0.5bp at 0.020%

- Aussie 10-Yr future up 6.0 ticks at 99.105, yield down 6.3bp at 0.893%

- U.S. 10-Yr future +0-04+ at 138-14, yield down 0.82bp at 0.849%

- WTI crude down $0.05 at $41.38, Gold down $0.91 at $1879.46

- USD/JPY down 10 pips at Y104.09

- FED'S POWELL: LONG WAY FROM FULL RECOVERY (MNI)

- TRUMP CONTINUES ELECTION-RELATED UNREST

- U.S. SOCIAL RESTRICTIONS WIDEN/DEEPEN

- BREXIT MOOD MUSIC SEEMS POSITIVE, BUT NOTHING FIRM EMERGES AS OF YET

- SOUTH AUSTRALIA GOES INTO "PAUSE" ON LOCAL COVID SITUATION

- RBNZ REVIEWING EARLY RELEASE OF NOV MPS

BOND SUMMARY: Tsy Block Flow & Aussie Restrictions Lend Support In Asia

T-Notes nudged higher during Asia-Pac hours, last +0-04 at 138-13+, although struggled for anything that could be classed as meaningful follow through above Tuesday's best levels. Cash Tsys saw some light bull flattening, with yields sitting unchanged to 1.0bp richer across the curve, building on the momentum seen on Tuesday. President Trump continued to provide election-related unrest, and fired the Director of the Cybersecurity and Infrastructure Security Agency from his post on election related matters. Flow-wise 40K of FVF1 126.00 call sales were quasi-hedged via 10.0K of TYZ0 lifts, split across 2 block trade. Eurodollar futures sit unchanged to +0.5 through the reds, with a flurry (~19.0K) of EDZ0 salles noted at 99.750.

- JGB futures held a tight range during Tokyo dealing, last +9 vs. settlement levels. The long end has outperformed in cash JGB trade, even with a slightly weaker than prior 20-Year JGB offering, which saw the cover ratio nudge lower and price tail edge wider. The cover ratio represented the lowest such reading seen at a 20-Year auction since April's 20-Year offering. Still, the low price topped dealer expectations (proxied by the BBG dealer poll).

- The dynamic in U.S. Tsys and earlier flagged "pause" (social restrictions) implemented in South Australia on the back of the local COVID situation has provided some support for the Aussie bond space in what has been a fairly lacklustre Sydney session, allowing the overnight flattening impetus to extend at the margin. YM +1.0, with XM +6.5. Governor Lowe offered nothing of any real note in his latest appearance.

JGBS AUCTION: Japanese MOF sells Y967.8bn 20-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y967.8bn 20-Year JGBs:- Average Yield 0.388% (prev. 0.394%)

- Average Price 100.22 (prev. 100.10)

- High Yield: 0.391% (prev. 0.397%)

- Low Price 100.15 (prev. 100.05)

- % Allotted At High Yield: 17.0997% (prev. 18.5341%)

- Bid/Cover: 3.611x (prev. 3.860x)

EQUITIES: No Clear Direction In Asia

It was a mixed Asia-Pac session for the major regional equity markets, with a lack of macro headline flow apparent.

- A reminder that Tuesday's Wall St. session saw market sentiment turn a little more defensive, with focus on the soft retail sales data and swelling COVID-19 count/social mobility restrictions in the U.S. Still, the major indices managed to recover from worst levels come the closing bell on Wall St.

- E-minis were generally biased lower during Asia-Pac hours, and weren't helped by news that U.S. President Trump has fired as Director of the Cybersecurity and Infrastructure Security Agency on the back of matters surrounding the election. However, the contracts did manage to recover from worst levels during the overnight session.

- Nikkei 225 -0.7%, Hang Seng +0.6%, CSI 300 +0.2%, ASX 200 +0.5%.

- S&P 500 futures -5, DJIA futures -28, NASDAQ 100 futures -3.

OIL: Little Changed In Wake Of Mixed API Inventory Estimates

WTI & Brent sit a handful of cents below their respective settlement levels at typing. This comes after the benchmarks finished little changed on Tuesday.

- Late Tuesday saw the latest API crude inventory estimates reveal a surprise headline build in crude stocks, alongside a slightly wider than expected build in gasoline stocks. Still, this was tempered by a deeper than expected drawdown in distillate stocks. Elsewhere, there was a modest build in stocks at the Cushing hub.

- A reminder that the latest OPEC+ JMMC gathering heralded nothing in the way of formal recommendations, with participants pointing to the need for adherence to the current production quotas. That came after source reports pointed to much wider than previous excess supply calculations for '21. Uncertainty surrounding COVID, despite the recent developments on the vaccine front, were front and centre in public communique.

GOLD: Familiar Range, ETF Holdings Nudge Lower

Bullion continues to operate in familiar territory, dealing little changed at ~$1,880/oz at typing, with the well-defined technical lines in the sand remaining untouched. We should also flag that total known ETF holdings of gold have fallen for 4 consecutive days, with recent weeks seeing that particular metric edge back from the latest all-time high, which was logged in mid-October.

FOREX: Calm & Cautious

The Asia-Pac session was calm, dominated by a moderate sense of caution. AUD was the worst G10 performer, albeit trailing its peers from the basket by relatively narrow margins. RBA Gov Lowe offered little in the way of fresh insight in his latest address, as he warned against uneven economic recovery. AUD/JPY ground lower printing a one-week trough and threatening to attack its100-DMA, but backed off before testing that moving average. Sales in AUD/NZD helped the pair move closer to its recent cycle low, but stabilised seeing the key level ~25 pips away. JPY firmed up a tad, with USD/JPY shedding a handful of pips into the Tokyo fix.

- The redback touched best levels against the greenback in more than two years. USD/CNH edged higher after a slightly weaker than expected PBoC fix, but then turned its tail and dipped to fresh session lows.

- USD/KRW inched lower later in the session, despite a worrying acceleration in the spread of new Covid-19 infections in South Korea. The rate tested the round figure of KRW1,105.00, virtually coinciding with the low print of Dec 4, 2018.

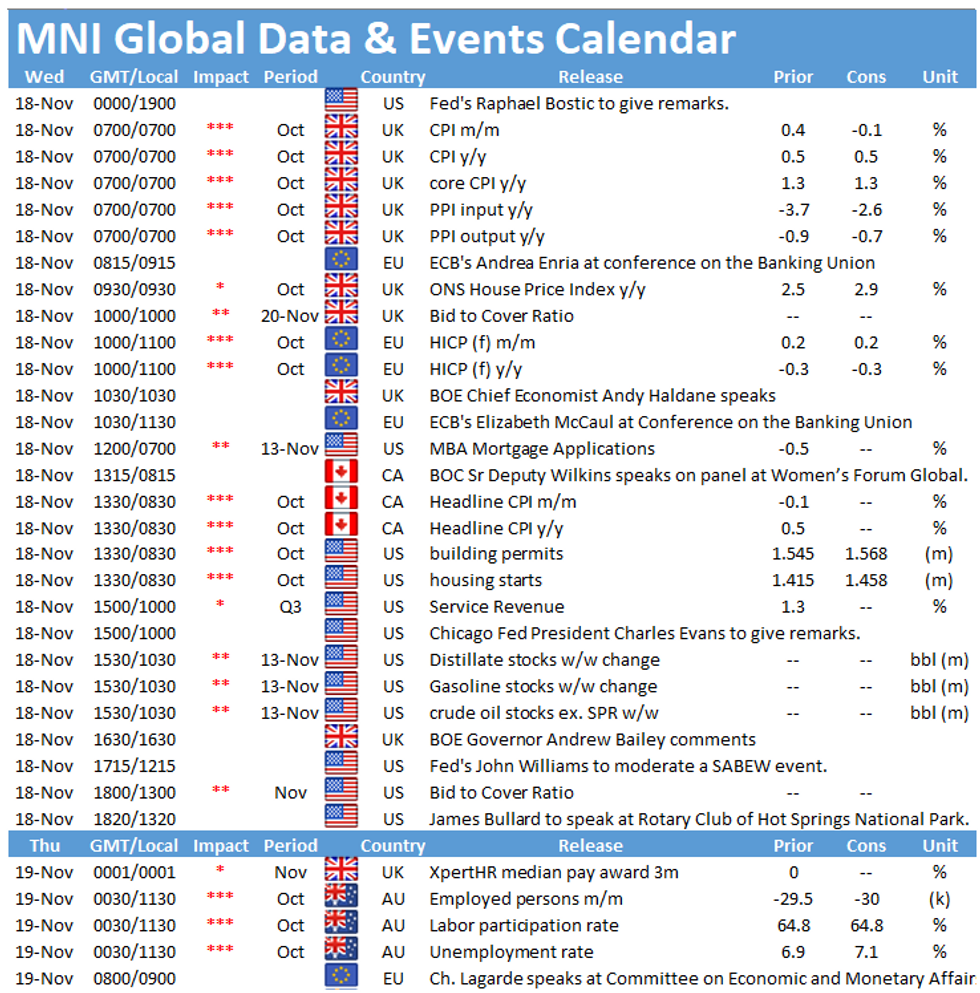

- Focus turns to inflation data from the UK, EZ and Canada, U.S. housing starts & building permits, as well as comments from Fed's Williams, Bullard and Kaplan, BoE's Bailey & Haldane, ECB's Enria & BoC's Wilkins.

FOREX OPTIONS: Expiries for Nov18 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1770-90(E1.3bln), $1.1995-1.2000(E996mln-EUR calls)

- USD/JPY: Y104.95-00($580mln)

- USD/CAD: C$1.3000($1.1bln), C$1.3195-00($645mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.