-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI EUROPEAN OPEN: A Defensive Feel In Asia

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* FED'S BARKIN: 'LET'S SEE HOW IT GOES' ON WHETHER MORE QE NEEDED (RTRS)

* DEBATE ON FED STANDING REPO FACILITY TO RETURN (MNI)

* CHINA'S XI VOWS NO DECOUPLING IN CALL TO HALT PROTECTIONISM (BBG)

* BREXIT TALKS IN 'FINAL PUSH' AS EU CAPITALS CALL FOR LAUNCH OF NO DEAL PLANS (TELEGRAPH)

* EU LEADERS PRESS FOR OWN NO-DEAL PLANS (THE TIMES)

* POLAND, HUNGARY HARDEN RHETORIC IN EU BUDGET ROW (AFP)

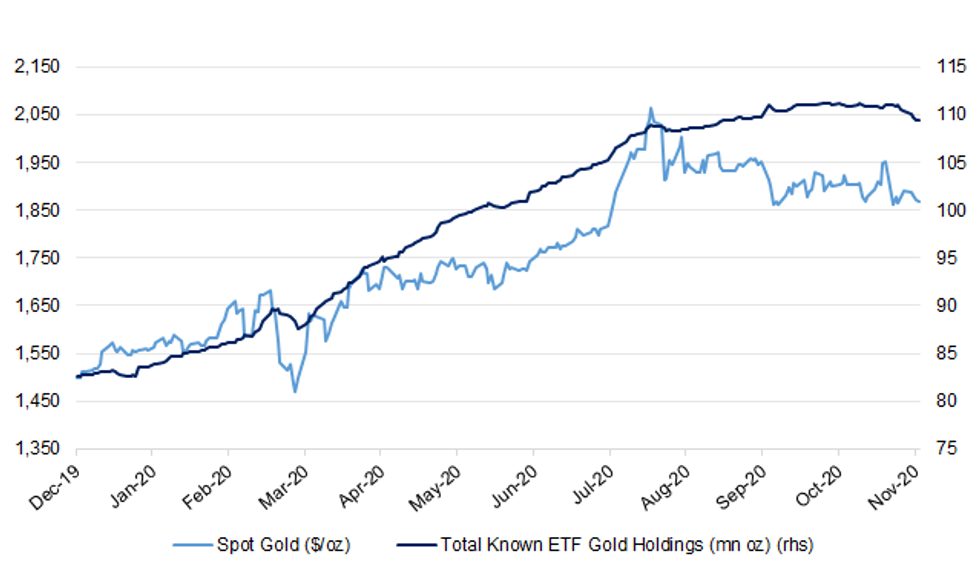

Fig. 1: Spot Gold ($/oz) vs. Total Known ETF Gold Holdings (mn oz)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Families could be allowed to meet at least two other households to celebrate Christmas under plans being considered by the Government. Ministers across the UK are in talks about easing restrictions over the festive period and giving families up to five days of "freedom". The move would allow relatives to spend several days together for the festivities and mean families would not have to "choose between grandparents", sources said – but health officials warned that every day of freedom would cost five in tighter restrictions, raising the possibility of 25 further days of strict measures in December and possibly into January. Under the measures being discussed, a limited number of households would be allowed to join together to form one "bubble" for a number of days. (Telegraph)

BREXIT: Brexit negotiating teams are in the "final push" for a trade agreement with Britain, Michel Barnier told a meeting of EU Commissioners in Brussels on Wednesday. Senior diplomats warned that EU governments would demand the European Commission launch emergency no deal plans if a trade accord was not struck by Friday. There was a risk that could poison the ongoing negotiations in Brussels, one senior diplomat said, but, with six weeks to go before the end of the year the EU had no choice but to start work on its no deal safety net. The plans aim to mitigate the worst disruption to EU interests in sectors such as aviation and freight but fall far short of a "managed no deal", which would involve consultation and consideration of British interests. (Telegraph)

BREXIT: Europe's leaders will demand today that the European Commission publish no-deal plans amid fears that Brexit negotiations are dragging on without businesses knowing what they need to prepare for in the worst scenario. Several European Union governments are growing frustrated that deadlines for trade, security and fishing talks are slipping, leaving little time to get ready if the negotiations fail to reach agreement. The Netherlands, France, Belgium and other frontline countries are concerned that businesses and fishing communities will be hit by economic disruption without EU contingency measures to cushion the blow of no-deal. (The Times)

BREXIT: An agreement, which would avert tariffs on U.K.-Canada trade from Jan 1. when the Brexit transition period ends, could be announced within days, according to people familiar with the talks, speaking on condition of anonymity. (BBG)

BREXIT: The government has lost two more votes in the Lords over its Brexit bill. Peers voted by 367 to 209 to amend the Internal Market Bill, after claims that it would allow the UK government to "shackle" devolved administrations as powers are returned from Brussels. And they voted by 327 to 223 to curb ministers' powers to rewrite parts of the bill at a later stage. The proposed law aims to create a UK-wide internal market after the Brexit transition period ends on 31 December. It was approved by the Commons in September but is encountering strong resistance in the Lords, where Boris Johnson's government does not have a majority. (BBC)

BREXIT: Northern Ireland businesses have called for an extension of the Brexit transition period in the region, warning they "simply will not be ready" for the mandatory border checks on 1 January. They say they are the "rope in a tug of war" between the UK and the EU and warned of a "huge black hole" in information and a "disconnect" with Westminster and Brussels over the reality of Brexit checks kicking in 43 days' time. (Guardian)

FISCAL: Boris Johnson will announce an extra 16.5 billion pounds ($22 billion) in defense spending over the next four years, as he tries to boost U.K. influence and counter growing threats from cyber and space warfare. In a speech Thursday to mark the initial findings of a military and foreign policy review, the prime minister will lay out plans for an agency dedicated to artificial intelligence, the creation of a National Cyber Force and a new Space Command capable of launching its first rocket in 2022, his office said. (BBG)

ECONOMY: MNI BRIEF: UK Pay Awards Edge Higher In October

- UK headline pay awards increased to 2.0% in the three months to Oct, data published by XpertHR on Thursday showed, building on an upwardly revised 1.0% gain in Sep. A fall in the proportion of pay freezes shifted the headline rate into positive territory, however private-sector pay awards continue to record levels below the ones seen last year - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FDI: Britain is braced for foreign inward investment projects to fall by a third this year as Covid-19 dampens the appetite of overseas multinationals. Only 43 per cent of companies are pursuing UK investments planned before the pandemic, down from 72 per cent in the spring, according to EY. (The Times)

EUROPE

FISCAL: Poland and Hungary toughened their rhetoric on Wednesday in a row that is blocking the European Union's long-term budget and coronavirus rescue on the eve of a summit in Brussels. The two countries, which are both accused by Brussels of rolling back democratic freedoms, are opposed to the EU's plans to tie funding to criteria on rule of law. Polish Prime Minister Mateusz Morawiecki said a "European oligarchy" was trying to bully weaker EU members, while his Hungarian counterpart Viktor Orban called the conditionality plan a form of "blackmail" against member states opposed to immigration. But the European Parliament said that "no further concession will be made on our side" and France warned there might be a way of proceeding without the two countries vetoing the 1.8-trillion-euro package. (AFP)

FISCAL: European Union leaders could push ahead with a post-Covid recovery fund without Poland and Hungary as a last resort if they refuse to drop their veto, a French official said. France's priority remains finding an agreement that includes the two eastern European members while protecting the rule of law, said the official, who works in President Emmanuel Macron's office, asking not to be identified in line with French government practice. (BBG)

GERMANY: The prospect of bailing out more companies battered by the coronavirus pandemic is opening up a split in the German government, with free marketeers resisting a push for increased state intervention, according to people familiar with the matter. (BBG)

FRANCE: France reported 28,383 new confirmed coronavirus cases on Wednesday, with the weekly pace of infections again heading lower after an increase the previous day. Positive tests accounted for 16.2% of all testing, down more than 3 points from a week ago. Hospitalizations and the number of severely ill patients in intensive-care units both fell for a second day, with ICU occupation falling the most since May 20. Deaths linked to the virus, which trail other indicators, increased by 425 to 46,698. (BBG)

U.S.

FED: MNI BRIEF: Fed's Williams Says Economy 'More Challenged'

- New York Fed President John Williams said on Wednesday he is worried the economy will be "more challenged" because of waning fiscal support for growth. The Fed stands ready to support the recovery, he said, but was not specific about how it might do so - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed's Kaplan Dismisses Need For QE Tweak

- Dallas Fed President Rob Kaplan on Wednesday dismissed the need to change the central bank's quantitative easing program. "As we are in the teeth of the crisis I wouldn't change it [QE] but as we get beyond the crisis and weathered it I would like to see us taper these purchases and start to wind them down," Kaplan said in a webinar with Dallas PBS affiliate KERA - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: Federal Reserve Bank of St. Louis President James Bullard said the $3 trillion in federal relief passed by Congress earlier this year is more than the contraction the U.S. economy will suffer, and additional fiscal assistance should be targeted to areas of the economy most in need. (BBG)

FED: Richmond Federal Reserve Bank President Thomas Barkin on Wednesday said the central bank continues to add policy accommodation with its monthly bond purchases, but held out the possibility of the central bank doing more. "Every month we engage in those asset purchases is more stimulus," Barkin said in an interview with Yahoo Finance. "That's a lot of support to the economy. In terms of whether we do something different or more, let's just see how it goes. We are projecting a lot - let's see how it goes." (RTRS)

FED: MNI EXCLUSIVE: Debate On Fed Standing Repo Facility To Return

- The Federal Reserve will need to revive its debate over the creation of a standing repo facility as a permanent source of alternative funding for dealers under stress to avert any repetition of the market strain seen in March, former Fed officials, researchers and market sources told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: Judy Shelton's nomination to the Federal Reserve board was left in limbo with little chance of revival Wednesday as the Senate prepared to leave Washington for the Thanksgiving holiday recess. Senate Majority Leader Mitch McConnell, confronted by the absence of two key Republican members, has scheduled no more votes for the week. (BBG)

FISCAL: White House Chief of Staff Mark Meadows said Wednesday that he "can't guarantee" lawmakers will be able to reach a deal to avert a mid-December shutdown of the federal government. Congress and the White House have until Dec. 11 to approve new spending legislation to prevent the federal government from shutting down in the middle of a pandemic and amid a surge in coronavirus cases. Meadows said he was hopeful an agreement would be reached but did not rule out that an impasse. There has already been two government shutdowns during President Trump's four years in office, one lasting more than a month. (Washington Post)

FISCAL: The Internal Revenue Service is doubling down on its stance that businesses that manage to get their Paycheck Protection Program loans forgiven don't qualify for some valuable tax write-offs, according to agency guidance. (BBG)

CORONAVIRUS: US coronavirus deaths rose by the most in more than six months on Wednesday, propelling the country's average fatality rate above that seen during the summer and to its highest since May. States attributed a further 1,869 deaths to coronavirus, according to Covid Tracking Project data, up from 1,555 on Monday and compared with 1,543 on Wednesday last week. There have been 241,704 deaths attributed to coronavirus since the start of the pandemic, according to Covid Tracking Project data, which the Financial Times uses for analysis. Johns Hopkins University, which uses an alternative methodology, today put the tally at 250,000. (FT)

CORONAVIRUS: The United States is in the midst of an "absolutely dangerous situation" as the coronavirus outbreak continues to worsen, Adm. Brett Giroir, assistant secretary of health, said Wednesday. Covid-19 hospitalizations and deaths are both up 25% week over week, "and that is not going in the right direction," said Giroir, who leads the government's Covid testing effort. "Right now, we are in an absolutely dangerous situation that we have to take with the utmost seriousness," he said Wednesday on MSNBC. "This is not crying wolf. This is the worst rate of rise in cases that we've seen in the pandemic in the United States and right now there's no sign of flattening." (CNBC)

CORONAVIRUS: German company BioNTech and its partner, drug giant Pfizer, will ask the US on Friday to allow emergency use of their Covid-19 vaccine candidate, CEO Ugur Sahin told CNN during an exclusive interview on Wednesday. (CNN)

CORONAVIRUS: COVID-19 vaccines from Pfizer Inc and Moderna Inc could be ready for U.S. authorization and distribution within weeks, setting the stage for inoculation to begin as soon as this year, U.S. Health and Human Services Secretary Alex Azar said on Wednesday. (RTRS)

CORONAVIRUS: Every American state will receive a shipment of Covid-19 vaccines within 24 hours of the US drug regulator issuing an emergency use authorisation, according to plans drawn up by Operation Warp Speed. General Gustave Perna said vaccines will be sent to 64 jurisdictions, including all 50 states, six metropolitan areas, and territories, as soon as the Food and Drug Administration has given the go ahead. (FT)

CORONAVIRUS: The Trump administration is seeing high uptake of a program that will allow CVS Health and Walgreens to administer Covid vaccines to seniors in long-term care facilities, according to Health and Human Services Secretary Alex Azar said. (CNBC)

CORONAVIRUS: New York City's schools will move to remote learning only as the city tries to tamp down a growing number of coronavirus cases, Mayor Bill de Blasio announced Wednesday. The shuttering of the nation's largest school system had been anticipated for days after de Blasio told parents on Friday to have a plan in place in case the city decided to close schools for in-person learning, NBC News New York reported. Remote learning will begin Thursday, the mayor said in breaking the news over Twitter. (CNBC)

CORONAVIRUS: Virus caseloads are soaring across Texas as new hot spots emerge and hospitals strain to handle the inflow. (BBG)

CORONAVIRUS: Wisconsin Governor Tony Evers said he will extend into January a peacetime emergency and reissue an order requiring face masks because of an alarming increase in Covid-19 cases statewide. "It's clear, based on where we're headed, we can't afford to stop or have a gap in some of the only mitigation efforts we still have in place," Evers said. He said he'll sign the orders no later than Saturday, when the current mask mandate expires. (BBG)

CORONAVIRUS: Minnesota Gov. Tim Walz has announced new COVID restrictions that will impact social gatherings, restaurants, gyms and sports. The restrictions are in effect between Friday at 11:59 p.m. and Friday, Dec. 18. In-person social gatherings with people outside of your household are prohibited. Bars and restaurants will have to go take-out only. Gyms and entertainment spaces will need to close, and wedding receptions, private parties and celebrations will also be restricted. Adult and youth sports will be put on pause, but college and pro sports are exempt. (Associated Press)

CORONAVIRUS: Arizona will launch coronavirus testing sites at the airports and direct $25 million to help hospitals with staffing as the state faces rising cases and anticipates holiday travel, Governors Doug Ducey said Wednesday. Hospitals can use the funding, from the federal CARES Act, to give frontline workers bonuses or to pay for higher costs. Getting back to normal "isn't in the cards right now," Ducey said. He emphasized the importance of wearing masks, even as he has yet to mandate them statewide despite the pleas of local officials such as Phoenix Mayor Kate Gallego. (BBG)

CORONAVIRUS: Freezers required to store Covid-19 vaccines are in place at health systems that are preparing to administer the initial doses once the shots receive a green light from regulators, U.S. health officials said Wednesday. (BBG)

POLITICS: President Donald Trump's election campaign on Wednesday asked a judge to declare him the winner in Pennsylvania, saying the state's Republican-controlled legislature should select the electors that will cast votes in the U.S. Electoral College system. (RTRS)

POLITICS: President Donald Trump is to seek a partial recount of votes in the state of Wisconsin, which his rival Joe Biden is projected to win by 20,000 votes. Hours before a Wednesday deadline, the Trump campaign said it wanted a recount in the counties of Milwaukee and Dane, alleging irregularities. (BBC)

HOUSING: Fannie Mae and Freddie Mac will be required by their regulator to hold hundreds of billions of dollars in capital to protect against losses, a step considered crucial to freeing the mortgage giants from U.S. control. The Federal Housing Finance Agency rule finalized Wednesday stipulates how much of a capital cushion the companies would have to maintain against their assets as fully private entities in order to weather a financial crisis. The combined total could exceed $280 billion, and Fannie and Freddie would likely need to sell shares and retain earnings for years to raise the funds. (BBG)

EQUITIES: Apple will pay states $113 million in a settlement over allegations that the phone maker secretly throttled speeds on older iPhones to extend battery life, Arizona Attorney General Mark Brnovich announced Wednesday. (Axios)

OTHER

U.S./CHINA: The Federal Communications Commission is planning a Dec. 10 vote to implement a federal law that would require telecom providers to replace network equipment made by Huawei Technologies Co. and other foreign suppliers that pose a national security threat, Chairman Ajit Pai announced. The rules would require companies to remove equipment deemed unsecure and establish a program to compensate smaller carriers for the costs of replacing the gear, Pai said. (BBG)

GEOPOLITICS: The United States, Britain, Australia, Canada and New Zealand on Wednesday jointly accused China of violating its commitments by ousting pro-democracy lawmakers from Hong Kong's legislature. The foreign ministers of the five allies said that China was going against its 1984 promise to Britain that it would preserve autonomy in the financial hub after the then colony's handover in 1997. (AFP)

CORONAVIRUS: A fifth Chinese-made Covid-19 vaccine has been approved to start final stage efficacy trials, as the country's leading developers rush to close on global leaders in the race to find a coronavirus cure. Anhui ZhifeiLongcom, a subsidiary of Shenzhen-listed Chongqing Zhifei Biological, has launched phase 3 trials in Xiangtan city, Hunan province after receiving regulatory approval and intends to begin similar tests overseas this month, Chinese state media reported. (FT)

CORONAVIRUS: A coronavirus vaccine this winter won't help countries beat back the current wave of Covid-19 infections sweeping across Europe and North America and overwhelming hospitals, the World Health Organization warned on Wednesday. "We're not there with vaccines yet. We will get there, but we're not there," said Dr. Mike Ryan, executive director of the WHO's health emergencies program, during a live Q&A event. "And many countries are going through this wave, and they're going to go through this wave and continue through this wave without vaccines." (CNBC)

JAPAN: The Tokyo Metropolitan Government isn't considering asking stores to close early even as it prepares to raise the coronavirus alert to the highest level today, national broadcaster NHK reports, without attribution. (BBG)

JAPAN: Japan needs to set up a fund of up to 10 trillion yen ($96 billion) to invest in a green and digital transformation of society that is a key goal for Prime Minister Yoshihide Suga, according to one of the premier's advisers. (BBG)

AUSTRALIA: The latest SEEK Employment Report data shows continued strong m/m performance with an increase of 8.5% in national jobs advertised. This compares to last month's growth of 9.2%. Comparing October 2020 with October 2019, job ads are 11.7% lower, which notably is the smallest y/y decline since the pandemic began. We have seen positive national month-on-month job ad growth since the end of April. Significantly, job ad volume is 11.7% lower than 12 months ago, which represents the smallest gap in this metric since the pandemic began. This difference has been reducing each month as Australia continues its recovery, previously measuring at 20.9% and 29.1% in September and August respectively. Looking at the national picture, we have continued to see strong growth across all states and territories except the Northern Territory, which had a very small decline in October but is still up on this time last year. We would traditionally see a quieter job market for both candidates and hirers as we head into the summer months, particularly in December and January, before picking up again after Australia Day. Given recent trends, we will watch with interest to see if more job opportunities than usual arise ahead of the holiday period. (SEEK)

NEW ZEALAND: Statistics New Zealand reports experimental weekly series based on payday filing to the Inland Revenue, on website. Paid job numbers rise 330 in week ended Oct 11 to 2,221,490. Numbers rise 24,480 in four weeks ended Oct 11 after falling 2,770 in four weeks ended Sept 13. (BBG)

SOUTH KOREA: South Korea may review raising the social distancing steps further to level 2 if the average daily number of newly confirmed coronavirus cases exceeds 200 for a week in the greater Seoul area, Edaily says, citing Sohn Young-rae, a health ministry spokesman. (BBG)

SOUTH KOREA: South Korea's finance minister said Thursday that financial authorities are closely monitoring the foreign exchange market, warning that it is ready to take actions at any time to smooth out the local currency's sharp gains. Finance Minister Hong Nam-ki voiced concerns about the Korean currency's rapid strength against the U.S. dollar, saying that excessive currency volatility is not desirable. (Yonhap)

SOUTH KOREA: Dealers told Reuters the central bank was suspected of buying dollars on Thursday to stem gains for a currency that has gained nearly 3% this month to Wednesday. (RTRS)

SINGAPORE: Singapore could be in a so-called Phase 3 of virus curbs for more than a year, until an effective vaccine or treatment is widely available and distributed, Education Minister Lawrence Wong, who also co-chairs the virus taskforce, said in a Bloomberg TV interview. (BBG)

CANADA: Ontario may impose severe lockdown measures in Toronto and some surrounding areas in coming days, as the coronavirus "is spreading at an alarming rate," Premier Doug Ford said during a news conference. (BBG)

CANADA: Restrictions at the U.S.-Canada land border are expected to be extended until Dec. 21, CTV's Michel Boyer reported, citing unidentified sources. (BBG)

MEXICO: Central bank rules wouldn't allow reserves to be invested in Pemex bonds, Banxico Deputy Governor Gerardo Esquivel said on Twitter. Esquivel replied to a question about investing reserves in Pemex bonds in response to a report in El Universal that said the state oil company's board will explore the possibility. (BBG)

BRAZIL/RATINGS: Fitch affirmed Brazil at BB-; Outlook Negative

RUSSIA: Retaliation bill, allowing sanctions against Internet platforms for censorship against Russian media will be submitted to the lower house of the Russian parliament, on Thursday, RIA Novosti reports, citing an unidentified person familiar with details. Decisions sanctions will be taken in agreement with the Foreign Ministry. Measures may include blocking, slowing down traffic and administrative fines. (BBG)

SOUTH AFRICA: Eskom Holdings Mulls Potential Debt To Equity Deal. (BBG)

MIDDLE EAST: A bipartisan group of senators announced four bills to block President Donald Trump's massive weapons sale to the United Arab Emirates on Wednesday, two hours after HuffPost first revealed their plans to challenge the deal. (Huffington Post)

IRAN: Foreign Minister Mohammad Javad Zarif has introduced a give-and-take approach to help ease tensions over a 2015 nuclear deal between Iran and world powers, conditioning Iran's return to the deal on the U.S. compliance with it. "The U.S. is definitely in no position to set out conditions for us. As a UN member and a permanent member of the UN Security Council, the U.S. is duty-bound to implement Resolution 2231. If the resolution is implemented, the sanctions will be removed. Iran has announced that in that case, it will resume honoring its commitments under the JCPOA," the chief Iranian diplomat said. "Thus, first, if the U.S. meets its commitments under Resolution 2231, we will fulfill ours under the JCPOA. Second, if the U.S. seeks to join the JCPOA again, we are ready to negotiate the terms and conditions of Washington's membership in the deal." Zarif made the remarks in an interview with the official Iran newspaper that was published on Wednesday. (Tehran Times)

IRAN: The United States on Wednesday imposed broad sanctions targeting Iran, blacklisting a foundation controlled by Supreme Leader Ayatollah Ali Khamenei and taking aim at what Washington called Iran's human rights abuses a year after a deadly crackdown on anti-government demonstrators. (RTRS)

OIL: The United Arab Emirates ratcheted up tension with oil allies Saudi Arabia and Russia, with officials privately floating a surprising idea: the Gulf producer is even considering leaving the OPEC+ alliance. The move is unusual because the UAE has for a long time avoided public clashes, preferring to solve disputes quietly behind closed doors. It's unclear whether the warning is a maneuver to force a negotiation over production levels, or represents a genuine policy debate. (BBG)

CHINA

POLICY: President Xi Jinping pledged that China wouldn't engage in decoupling, in an address to Asia-Pacific leaders in Kuala Lumpur just days after the region inaugurated the world's largest free-trade agreement. Xi's speech during Asia-Pacific Economic Cooperation summits Thursday came as he -- and the world -- await clues on how U.S. President-elect Joe Biden will approach the region. The White House declined to say Wednesday whether President Donald Trump plans to address the gathering in Malaysia, held virtually this year because of the pandemic. (BBG)

MARKETS: China needs to raise the proportion of direct financing from capital markets, particularly equity financing, to avoid an excessive reliance on bank borrowing, the Securities Daily reported citing an article by PBOC Governor Yi Gang. Bank loans currently play the major role in financing China's real economy, placing large risks on banks, and this is not an efficient use of financial resources, Yi said. China will implement the stock issuance registration system and establish a normalized delisting mechanism, the Daily reported citing the government's 2021-2025 Plan. (MNI)

SOES/DEFAULTS: The province of Shanxi has vowed to restructure the debts and liabilities of its local state-owned companies and avoid adding risk to financial institutions, said Vice Governor Wang, according to an official WeChat blog. Wang was commenting after a bond default by Yongcheng Coal Group, an SOE in the neighboring Henan province, roiled the market this month and drew scrutiny over China's ageing domestic coal miners. Wang stressed that Shanxi, a province with a high concentration of coal mines. will increase securitization by SOEs and implement digitized management systems to aid with clearance, reduce costs and increase efficiency, and balance the ratio of assets to liabilities. The aim was to limit an escalation of debt among SOEs. (MNI)

NPLS: MNI POLICY: China Should Ramp Up Bad Loan Disposal: Official

- China's financial industry should hasten the disposal of non-performing assets, prevent a resurgence of high-risk shadow banks and steadily expand the sector's opening to outside investment, Guo Shuqing, Chairman of the China Banking and Insurance Regulatory Commission, wrote in an article on the central bank's website. Banks should also formulate realistic income and profit plans, as well as increasing provisions and capital replenishment, Guo said - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

AUTOS: China's central government is seeking to raise domestic consumption by asking local authorities to reduce limits on car purchases, increase the release of license plates and subsidize the replacement of old cars, according to a readout from the State Council executive meeting on Wednesday. The State Council is also seeking to incentivize the replacement of home appliances and furniture with environmentally friendly new ones, The statement also said the government is calling for the development of "Internet + Tourism" to expand the tourism market, including building smart tourist attractions and encouraging scenic spots to increase their online marketing efforts. The government is also urging officials to deepen reform and speed up the implementation of the Regional Comprehensive Economic Partnership. (MNI)

BONDS: A total of 3.5b yuan additional 2022 bonds and 1.5b yuan additional 2025 bonds will be made available for tender on a price-bid basis, Hong Kong Monetary Authority says in a statement. 2022 bonds bear interest at 2.10% p.a.; 2025 bonds carry interest at 2.20% p.a. Tender will be held on Nov. 25 for settlement on Nov. 27. (BBG)

OVERNIGHT DATA

CHINA OCT SWIFT GLOBAL PAYMENTS CNY 1.66%; SEP 1.97%

JAPAN OCT TOKYO CONDOMINIUMS FOR SALE +67.3% Y/Y; SEP +5.0%

AUSTRALIA OCT UNEMPLOYMENT RATE 7.0%; MEDIAN 7.1%; SEP 6.9%

AUSTRALIA OCT EMPLOYMENT CHANGE +178.8K; MEDIAN -27.5K; SEP -42.5K

AUSTRALIA OCT FULL-TIME EMPLOYMENT CHANGE +97.0K; SEP -40.3K

AUSTRALIA OCT PART-TIME EMPLOYMENT CHANGE +81.8K; SEP -2.2K

AUSTRALIA OCT PARTICIPATION RATE 65.8%; MEDIAN 64.8%; SEP 64.9%

AUSTRALIA OCT RBA FX TRANSACTIONS MARKET +A$935MN; SEP +A$1.017BN

AUSTRALIA OCT RBA FX TRANSACTIONS GOV'T -A$981MN; SEP -A$1.040BN

AUSTRALIA OCT RBA FX TRANSACTIONS OTHER -A$782MN; SEP +A$187MN

SOUTH KOREA Q3 SHORT-TERM EXTERNAL DEBT $144.1; Q2 $154.3BN

CHINA MARKETS

PBOC NET DRAINS CNY50BN VIA OMOS THU

The People's Bank of China (PBOC) injected CNY70 billion via 7-day reverse repos with rates unchanged at 2.2% on Thursday. This resulted in a net drain of CNY50 billion given the maturity of CNY120 billion of reverse repos today, according to Wind Information.

- The operations aim to maintain the liquidity in the banking system reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1996% at 09:34 am local time from the close of 2.1880% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 42 on Wednesday vs 44 on Tuesday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5484 THU VS 6.5593

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.5484 on Thursday, compared with the 6.5593 set on Wednesday.

MARKETS

SNAPSHOT: A Defensive Feel In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 186.75 points at 25537.77

- ASX 200 up 16.101 points at 6547.2

- Shanghai Comp. up 5.437 points at 3352.938

- JGB 10-Yr future down unch. at 152.17, yield down 0.2bp at 0.016%

- Aussie 10-Yr future down unch. at 99.115, yield up 0.1bp at 0.887%

- U.S. 10-Yr future +0-06 at 138-12, yield down 1.96bp at 0.851%

- WTI crude down $0.21 at $41.61, Gold down $4.62 at $1867.65

- USD/JPY unch. at Y103.82

- FED'S BARKIN: 'LET'S SEE HOW IT GOES' ON WHETHER MORE QE NEEDED (RTRS)

- DEBATE ON FED STANDING REPO FACILITY TO RETURN (MNI)

- CHINA'S XI VOWS NO DECOUPLING IN CALL TO HALT PROTECTIONISM (BBG)

- BREXIT TALKS IN 'FINAL PUSH' AS EU CAPITALS CALL FOR LAUNCH OF NO DEAL PLANS (TELEGRAPH)

- EU LEADERS PRESS FOR OWN NO-DEAL PLANS (THE TIMES)

- POLAND, HUNGARY HARDEN RHETORIC IN EU BUDGET ROW (AFP)

BOND SUMMARY: Tsys Firm In Asia, Underpins Broader Core FI

Regional demand for Tsys remained firm in Asia-Pac hours, with T-Notes last +0-06+ at 138-12+, representing best levels of the session, while cash Tsys bull flatten as 30s richen by ~2.5bp. Upbeat rhetoric from Chinese President Xi re: relationship building among APEC nations has done little to bolster broader risk appetite (Xi also continued to point to a focus on the dual circulation strategy), with Brexit worry and Five Eyes communique re: recent developments in Hong Kong dominating headline flow overnight.

- JGB futures pared their modest overnight losses during the Tokyo morning, with U.S. Tsys trading on the front foot and domestic equities edging lower, although the contract held to a narrow range, and last deals at unchanged levels. The long end of the cash curve has seen some underperformance today, after yesterday's outperformance, cheapening during the Tokyo morning, even with receiving seen in the super-long end of the swap space. Locally, the COVID situation in Tokyo continues to dominate, with a local government briefing on the matter set to be held later today. The has already moved to enact its highest virus alert level.

- The Aussie bond space was seemingly happy to look through the latest local labour market report, with a modest blip lower unwound. YM & XM both sit unchanged, unwinding their overnight losses on the broader cautious tone. The dataset saw a large upswing in the number employed vs. expectations for a dip (+178.8K vs. -27.5K). The upswing in the participation rate (to 65.8% from 64.9%, now only 0.4ppt shy of the 2019 highs) outweighed the move higher in the number employed, with the unemployment rate edging up to 7.0% vs. exp. of 7.1%. Employment gains were pretty well split between full-time (97.0K) and part-time (81.8K). Underemployment and underutilisation both moderated, while the ABS noted that "in seasonally adjusted terms monthly hours worked in all jobs: increased by 20.6 million hours (1.2%) to 1,711 million hours and decreased by 3.4% over the year, which is larger than the 1.0% decrease in employed people."

JGBS AUCTION: Japanese MOF sells Y2.8707tn 1-Year Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8707tn 1-Year Bills:- Average Yield -0.1340% (prev. -0.1348%)

- Average Price 100.135 (prev. 100.135)

- High Yield: -0.1291% (prev. -0.1288%)

- Low Price 100.130 (prev. 100.129)

- % Allotted At High Yield: 47.2222% (prev. 7.3593%)

- Bid/Cover: 3.507x (prev. 3.616x)

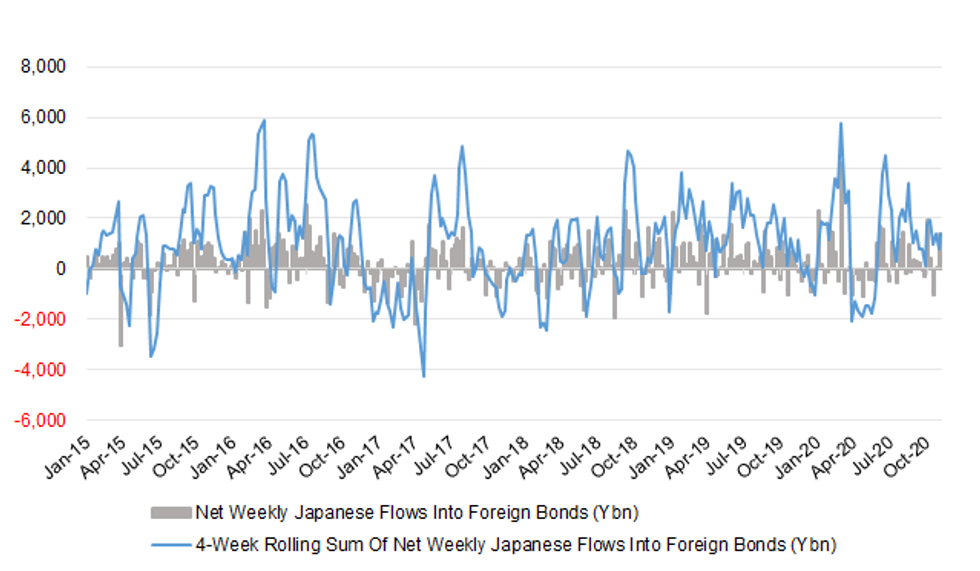

JAPAN: Japanese Purchases Of Foreign Bonds Headline Weekly Intern'l Flow Data

Little to note in the latest round of Japanese weekly international security flow data, outside of a second consecutive week of net purchases of foreign bonds >Y1.0tn for Japanese investors. A reminder that any such flows were likely FX hedged, per the latest lifer investment plans.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 1009.1 | 1372.8 | 1390.8 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -270.8 | 151.1 | 206.9 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 736.4 | 424.2 | 1046.3 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 422.5 | 484.5 | 923.0 |

Source: MNI - Market News/Japanese Ministry Of Finance

EQUITIES: Mostly Lower In Asia Against Broader Defensive Feel

The major regional equity indices stuck to relatively narrow ranges during Asia-Pac hours, although some idiosyncracies were apparent. More broadly, caution on the Brexit front, some geopolitical tension surrounding recent goings on in Hong Kong & wider COVID-related worry provided a defensive feel to the session.

- The Nikkei 225 underperformed on the back of COVID worry in Tokyo and fear surrounding subsequent implementation of fresh social restrictions in the capital.

- China's mainland shares found themselves on the other side of the ledger, aided by rhetoric from President Xi, who reiterated the focus on the dual circulation strategy and boosting domestic demand.

- E-minis were lower for most of the session but operated within tight ranges. This comes after wider/deeper social restrictions across the U.S. outweighed the positives surrounding Pfizer's COVID vaccine on Wednesday, leaving the major Wall St. indices comfortably lower come the close of cash trade.

- Nikkei 225 -0.9%, Hang Seng -0.6%, CSI 300 +0.4%, ASX 200 -0.1%.

- S&P 500 futures -5, DJIA futures -45, NASDAQ 100 futures -45.

OIL: Risk Appetite & UAE Threats Apply Light Pressure

WTI & Brent sit $0.35 and $0.25 below their respective settlement levels at typing, with the broader defensive feel evident during Asia-Pac hours (drivers outlined elsewhere) applying some light pressure to crude, although both benchmarks have recovered from worst levels. This comes after the metrics lodged gains of ~$0.35 & ~$0.60 respectively on Wednesday.

- A quick reminder that late Wednesday saw a BBG source report suggest that "the United Arab Emirates ratcheted up tension with oil allies Saudi Arabia and Russia, with officials privately floating a surprising idea: the Gulf producer is even considering leaving the OPEC+ alliance…It's unclear whether the warning is a manoeuvre to force a negotiation over production levels, or represents a genuine policy debate." Perhaps the UAE is growing tired of the serial undercompliers re: the OPEC+ production pact, given the UAE's own voluntary overcompliance.

- Elsewhere, the Saudi Energy Minister pointed to the stability in markets fostered by the OPEC+ agreement, while noting that the group has the will and ability to provide further stability.

- Wednesday's weekly DoE inventory report saw a shallower than expected build in headline crude stocks (which was also notably shallower than the build seen in the API estimates), while the release affirmed the relatively deep drawdown in distillate stocks and build in gasoline inventories. Elsewhere, refinery runs saw a larger than expected uptick, with U.S. crude production also edging higher as Gulf of Mexico facilities came back online after the recent tropical storm-related outage.

GOLD: Still Rangebound

An uptick in the DXY has pressured spot back towards Wednesday's lows during Asia-Pac trade, last dealing -$5oz at $1,867/oz, with the first line of meaningful support coming in at $1,848.8/oz, which represents the Sep 28 and bear trigger. U.S. real yields and the DXY will continue to dominate, while total known ETF holdings of gold should also be watched in the wake of the recent downtick in that particular metric, which we flagged earlier this week.

FOREX: Asia Plays It Safe

Caution prevailed as combative Five Eyes communique re: China's recent measures vs. Hong Kong and press reports suggesting that EU leaders may want to draw up contingency plans for a no-deal Brexit took focus, against the backdrop of the lingering Covid-19 angst. In the latest developments, Tokyo raised its virus alert to the highest level, South Australia started its "circuit-breaker" lockdown and South Korea's case count eclipsed yesterday's multi-month high. Risk aversion prompted participants to seek safe havens, bolstering USD, JPY and CHF.

- The Antipodeans went offered despite the release of a strong Labour Force Survey out of Australia. An unexpected addition of 178.8k jobs (vs. forecasts of a 27.5k dip) was coupled with a surprise upswing in the participation rate, which yielded a milder than projected uptick in the unemployment rate, with both underemployment and underutilisation easing off. AUD crosses blipped higher only briefly in reaction to the report, though AUD/NZD swung to a gain and held above neutral levels.

- GBP was the worst G10 performer after the Telegraph & the Times reported that EU leaders were set to demand from the European Commission to come up with plans for a no-deal Brexit, should there be no trade agreement between London and Brussels in the coming days.

- USD/Asia crept higher on the back of preference for safer assets. KRW was easily the worst performer in the region, after South Korea took its jawboning to the ministerial level, with FinMin Hong pledging active measures "at any time" if needed to stabilise FX markets. Reports were doing rounds of suspected BoK purchases of USD to stymie KRW appreciation.

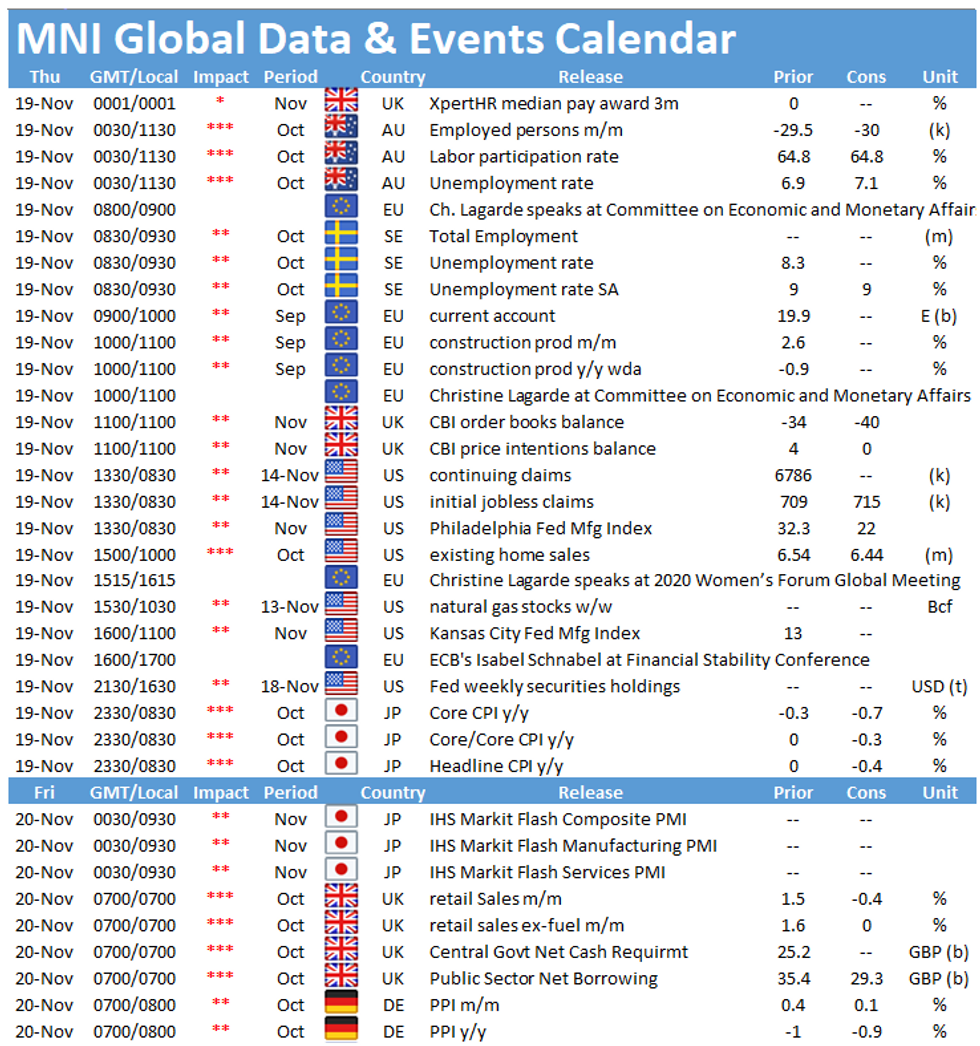

- U.S. initial jobless claims, existing home sales & Philly Fed Biz. Survey, Swedish unemployment and speeches from Fed's Bostic, Mester & Rosengren, ECB's Lagarde, Villeroy, de Cos & Schnabel take focus today. EM central bank activity picks up, with MonPol decisions from BI, BSP, SARB & CBRT coming up.

FOREX OPTIONS: Expiries for Nov19 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1685-00(E687mln), $1.1750(E653mln), $1.1790-00(E649mln), $1.1850-60(E848mln), $1.1870-75(E713mln), $1.1900(E874mln-EUR calls), $1.1965-70(E692mln), $1.2100(E860mln)

- USD/JPY: Y102.00($604mln), Y104.25-35($1.15bln), Y104.50-60($1.6bln), Y104.75-80($519mln), Y105.00($1.1bln)

- GBP/USD: $1.3400(Gbp571mln-GBP calls)

- EUR/GBP: Gbp0.8775(E978mln-EUR puts), Gbp0.8900(E645mln-EUR puts), Gbp0.8925(E733mln-EUR puts),

- AUD/NZD: N$1.0650(A$1.6bln)

- AUD/USD: $0.7235-50(A$523mln)

- USD/CNY: Cny6.59($580mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.