-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: Tsy-Fed Tension Makes For Cautious End To Week In Asia

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* U.S. TREASURY OPPOSES EXTENDING SOME FED FACILITIES (MNI)

* SCHUMER: MCCONNELL TO DISCUSS COVID RELIEF, AIDES NEGOTIATE GOV'T FUNDING (CNBC)

* UK, EU TRADE AGREEMENT COULD BE ANNOUNCED MONDAY (TELEGRAPH)

* EU LEADERS URGED TO STEP UP PREPARATIONS FOR NO-DEAL BREXIT (BBG)

* PBOC LOAN PRIME RATES UNCHANGED

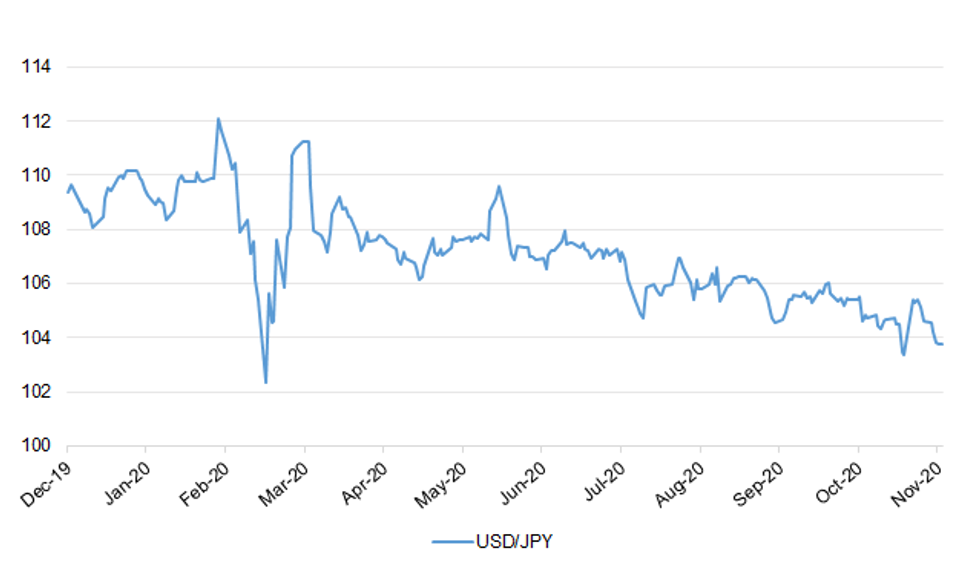

Fig. 1: USD/JPY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: The EU and UK chief negotiators have stepped back from post-Brexit trade talks after a member of the EU team tested positive for Covid-19. The EU's Michel Barnier said his UK counterpart Lord David Frost had agreed to suspend negotiations between them for a "short period". Mr Barnier added their teams would continue discussions in "full respect" of safety guidelines. (BBC)

BREXIT: EU diplomatic sources claim the trade deal is 90 per cent done but warn that crucial breakthroughs on fishing, "level playing field" guarantees and protocols around the deal's enforcement remain elusive. An UK-EU free trade agreement could be announced as early as Monday, a source predicted, if compromises are made. News of the Covid case plunged the tight timetable for the agreement and ratification of the trade deal into disarray, but Brexit deadlines have a habit of being stretched. A senior EU official warned that if the deal was not agreed by Monday there would not be enough time to translate the agreement into the EU's other 23 official languages for ratification by the European Parliament. MEPs must ratify the finalised agreement before the end of the year, otherwise the UK will trade with the EU on WTO no-deal terms from January 1. A few more weeks could be bought if the decision was made to forego translation and simply ratify the deal in English, the official said. Diplomatic sources said that was likely to be resisted by France. (Telegraph)

BREXIT: The leaders of France and Belgium urged the European Union to step up preparations for a no-deal Brexit at the end of the year in case negotiations with the U.K. fail to yield a last-minute breakthrough. At a virtual summit of EU leaders Thursday, French President Emmanuel Macron and Belgian Prime Minister Alexander De Croo both called on their colleagues to make contingency plans in case talks to sign a trade and security agreement fail, according to two people with knowledge of the discussion. De Croo pointed out that the negotiations have already run long past their initial deadline and said the bloc can't go on hoping that the disagreements with Britain will resolve themselves, the people said. (BBG)

FISCAL: The chancellor, Rishi Sunak, is preparing to announce a renewed squeeze on public sector pay in next week's government spending review in response to the economic shock of the coronavirus pandemic. Government sources said an announcement on pay restraint would be part of the mini-budget on Wednesday, as part of plans to launch a Whitehall savings drive to tackle record levels of government borrowing incurred during the crisis. (Guardian)

EUROPE

FISCAL: European Union leaders will continue to discuss the bloc's 1.8 trillion euro ($2.14 trillion) plan to recover from the recession caused by the COVID-19 pandemic, which has been vetoed by Poland and Hungary, German Chancellor Angela Merkel said. Hungary and Poland blocked the EU's 2021-2027 budget and recovery plan on Monday because access to the funds would be conditional upon respecting the rule of law. "There is consensus on the EU budget, but not on the rule of law mechanism," Merkel told journalists after a meeting with EU leaders late on Thursday. "This (veto) means ...we have to continue talking with Hungary and Poland," she added. (RTRS)

FISCAL: MNI SOURCES: VTC Not Right Format For EU Budget Deal Talks

- European Union leaders meeting Thursday decided that a video conference is not an appropriate format in which to broker a politically difficult compromise with Poland and Hungary over their objections to attaching Rule of Law conditions to the next EU budget, a senior Brussels official said. "A VTC is not the appropriate format to discuss such a complicated issue," the EU source said - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

CORONAVIRUS: The coronavirus vaccines devised by Pfizer-BioNTech and Moderna could receive EU conditional marketing authorisation within weeks, the European Commission chief has said. Ursula von der Leyen said the European Medicines Agency had told her it might give the go-ahead for this "very, very first step" to bringing the jabs to market next month. The year-long conditional approval would allow the companies to start selling their vaccines while collecting further evidence of their safety and efficacy. (FT)

FRANCE: France reported fewer Covid-19 patients in hospitals and in intensive care for a third consecutive day as an Oct. 30 lockdown starts to stem infections. The weekly pace of new cases fell to the lowest in almost a month, Director General for Health Jerome Salomon said at a briefing. (BBG)

RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include

- Fitch on Portugal (current rating: BBB, Outlook Stable)

- Moody's on Latvia (current rating: A3; Outlook Stable)

- DBRS Morningstar on Latvia (current rating: A (low), Stable Trend) & Lithuania (current rating: A, Stable Trend)

AUTOS: The European Commission plans to step into the patent dispute between tech companies and carmakers and may set up a system to check whether some patents are essential to a technology standard as claimed, according to a Commission document. (RTRS)

U.S.

FED: MNI POLICY: MNI POLICY: US Treasury Opposes Extending Some Fed Facilities

- Treasury Secretary Steven Mnuchin on Thursday in a letter to Federal Reserve Chair Jay Powell declined to extend some CARES Act lending facilities beyond Dec. 31, requesting the associated unused funds be returned to the government. The Primary Market Corporate Credit Facility, Secondary Market Corporate Credit Facility, Municipal Liquidity Facility, Main Street Lending Program, and the Term Asset-Backed Securities Loan Facility have "achieved their objective," the Treasury Secretary wrote: "As such, I am requesting that the Federal Reserve return the unused funds to the Treasury" that "will allow Congress to re-appropriate $455 billion, consisting of $429 billion in excess Treasury funds." Mnuchin said it would be "unlikely" such facilities would need to be re-established, but recommended the Fed reach out to the Biden administration if necessary. Mnuchin did request a 90-day extension on other facilities, including the Commercial Paper Funding Facility, the Primary Dealer Credit Facility, the Money Market Liquidity Facility and the Paycheck Protection Program Liquidity Facility that are currently set to be terminated Dec. 31. The Fed in a statement said it "would prefer that the full suite of emergency facilities established during the coronavirus pandemic continue to serve their important role as a backstop for our still-strained and vulnerable economy" - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: But people familiar with the decision say that either Mnuchin or a new Treasury secretary from the Biden administration could decide to revive the emergency lending programs under a new agreement with the Fed. About $25 billion of existing equity from the Treasury will be left at the Fed from the CARES Act funds. In addition, the Treasury has about $50 billion in the Exchange Stabilization Fund. Using 10-to-1 leverage — which is what it used for the emergency programs — the Fed will have about $750 billion of lending authority to backstop markets in the event of a disruption. Congressional approval will not be required. There will, however, have to be a new agreement between the Treasury secretary and the Federal Reserve Board of Governors. The Fed, so far, has only loaned about $25 billion from the programs that are being shuttered, making the $750 billion fairly sizable in context. It's not an optimal arrangement from the Fed's standpoint, since it would likely require some new shock to the financial system to precipitate restarting the programs. The Fed had hoped to avoid that shock by keeping the programs in place. But the money would be there if it was needed. (CNBC)

FED: Federal Reserve Bank of Atlanta President Raphael Bostic says he was "a bit surprised" by Treasury Secretary Steven Mnuchin's move to seek to let some Federal Reserve emergency lending programs expire Dec. 31. Bostic says, in a Bloomberg TV interview with Kathleen Hays, the programs have become an important backstop that has provided markets with confidence. (BBG)

FED: Dallas Federal Reserve Bank President Robert Kaplan on Thursday said the economy could shrink this quarter as consumers in more states and cities pull back from economic activity amid the record coronavirus case surge. "It is possible we could have negative growth if this resurgence gets bad enough and mobility falls off enough," he said, pointing to a drop in activity already visible in places like El Paso, Chicago, Utah, Wisconsin, and Colorado. "The next couple of quarters is going to be very challenging." (RTRS)

FED: Michelle Bowman, a member of the Federal Reserve's board of governors, warned Thursday that the U.S. mortgage industry is vulnerable to a crisis that could send shockwaves through the broader financial system. (The Hill)

FED: MNI POLICY: Fed Balance Sheet Grows to Record USD7.24 Trillion

- The Federal Reserve's balance sheet grew to a record USD7.24 trillion this week on increased holdings of mortgage-backed securities and Treasuries, data released Thursday showed. Over the last week the Fed's assets increased USD68 billion, primarily from a USD51 billion increase in MBS and a USD32 billion increase in Treasuries. The Fed purchased about USD29 billion in nominal notes and bonds and USD2.4 billion in TIPS, to beat the previous record of USD7.18 trillion set on Oct. 21 - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed Studying Climate Change Impact On Dual Mandate

- The Fed will continue to explore how climate change poses risks to markets and the central bank's dual mandate, Andreas Lehnert, director of the division of financial stability at the Fed board of governors, said Thursday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED/FISCAL: MNI BRIEF: Biden Praises Fed Dollar Policy, Says Aids Fiscal

- President-elect Joe Biden praised the Federal Reserve Thursday including how it has handled the dollar, noting that low interest rates will allow for further fiscal stimulus. "Quite frankly the way the Federal Reserve has been approaching, dealing with the dollar has been in a positive direction," Biden said. "Our interest rates are as low as they have been in modern history and I think that is a positive thing. It lends credence to the possibility of us being able to expend the money and deficit spend in order to generate economic growth right off the bat and so I think it has been positive so far" - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: Senate Majority Leader Mitch McConnell, R-Ky., has agreed to resume negotiations with Democrats over a potential new Covid-19 relief bill as cases continue to surge around the country, Sen. Chuck Schumer, D-N.Y., said on Thursday. "Last night, they've agreed to sit down and the staffs are going to sit down today or tomorrow to try to begin to see if we can get a real good Covid relief bill," the minority leader said during a press conference in New York. "So there's been a little bit of a breakthrough in that McConnell's folks are finally sitting down and talking to us." (CNBC)

FISCAL: President-elect Joe Biden said Thursday that he has decided whom he will nominate for Treasury secretary, and that he will make the announcement in the coming weeks. "You'll soon hear my choice for Treasury, either just before or just after Thanksgiving," Biden told reporters in Wilmington, Delaware. "It's someone who will be accepted by all elements of the Democratic Party, from the progressive to the moderate coalitions," he added. (CNBC)

ECONOMY: About 12 million Americans will lose unemployment benefits in December when CARES Act provisions lapse, absent an extension, according to a new analysis. Unemployment benefits will terminate for more than half of current recipients at the end of the year, coinciding with a lapse in federal protections for renters and a resumption in student loan payments. (CNBC)

CORONAVIRUS: Coronavirus cases in the US jumped by a record on Thursday, while hospitalisations topped 80,000 for the first time and deaths rose by the most in more than six months. States reported 182,832 coronavirus cases, according to Covid Tracking Project, up from 163,975 on Wednesday and topping the previous record on November 13 by more than 10,000 infections. The country's seven-day average of cases has doubled since the end of October to hit 161,782 on Thursday, a record rate. (FT)

CORONAVIRUS: Vice President Mike Pence sought to reassure Americans on Thursday evening that the country is "prepared" to handle the coronavirus outbreak even as the nation's top health agency warns that new deaths caused by Covid-19 are accelerating into the winter. (CNBC)

CORONAVIRUS: The Centers for Disease Control and Prevention on Thursday advised Americans not to travel for the Thanksgiving holiday to help prevent the spread of the coronavirus. Dr. Henry Walke, the CDC's Covid-19 incident manager, said there is "no more important time than now for each and every American to redouble our efforts to watch our distance, wash our hands and, most importantly, wear a mask." (CNBC)

CORONAVIRUS: Anthony Fauci, America's top infectious diseases expert, has promised that "the cavalry is on the way" in the form of a coronavirus vaccine but urged one last great national effort to stop the spread. (Guardian)

CORONAVIRUS: Dr. Celine Gounder, who sits on President-elect Joe Biden's coronavirus task force, told CNBC that more people will be infected with Covid-19 and die the longer the Trump administration delays the transition process and avoids coordinating the vaccine's distribution. (CNBC)

CORONAVIRUS: US President-elect Joe Biden has vowed not to shut down the country despite soaring coronavirus cases, pushing instead for a national order on wearing masks. He also took a shot at Trump's "incredible irresponsibility." (Deutsche Welle)

CORONAVIRUS: Health and Human Services Secretary Alex Azar said Thursday that Pfizer is expected to file an application to the FDA for emergency use of its coronavirus vaccine on Friday, with Moderna soon to follow. "Pfizer's partner, BioNTech, has announced that tomorrow they intend to file for emergency use authorization at the FDA," Azar said during the White House coronavirus task force's first public meeting in months. "We would expect Moderna filing soon also." (CNBC)

CORONAVIRUS: Eli Lilly's rheumatoid arthritis drug baricitinib has received US emergency approval as a treatment for patients seriously ill with Covid-19. The US Food and Drug Administration issued a second emergency use authorisation for an Eli Lilly drug after a trial showed that when taken with Gilead's remdesivir, it helped patients recover faster. Anti-inflammatories may help later in the disease when a patient's immune system goes into overdrive. (FT)

CORONAVIRUS: Governor Andrew M. Cuomo today announced updated COVID-19 micro-cluster focus zones in New York State. Rockland County's Yellow Precautionary Zone will be expanded, and parts of Orange and Westchester counties will become Yellow Precautionary Zones due to increased cases, positivity, and hospital admissions from these areas. (NY.gov)

CORONAVIRUS: More than 90 per cent of California's residents will have their late-night movements restricted for the next month after Governor Gavin Newsom on Thursday issued a curfew covering most of the state. The "limited Stay at Home Order" takes effect on Saturday and will apply to counties in the so-called purple tier that are currently subject to the state's most stringent economic restrictions. (FT)

CORONAVIRUS: A similar 10 p.m.-to-5 a.m. curfew order was issued on Thursday in Ohio and will remain in effect for the next 21 days, Governor Mike DeWine, a Republican, announced separately. (RTRS)

CORONAVIRUS: Governor Gina Raimondo said Rhode Island will be put on a two-week "pause" starting Nov. 30 to tamp surging infections and near-capacity hospitalizations. The pause would limit in-person high school, close higher education, limit social gatherings to one household, halt group sports and shutter gyms and bars. "It's gonna suck," she said, but she said the restrictions were the only way to avoid a full shutdown. "I'll be out of options." (BBG)

CORONAVIRUS: The Buckeye state had its first purple alert, the highest on a four-tier warning system. Ohio Governor Mike DeWine said the alert for Franklin County -- the state's most populous that encompasses the Greater Columbus area -- was raised after six or more indicators have been flagged for two weeks. (BBG)

CORONAVIRUS: New Hampshire has issued a statewide mask mandate to try and control a surge in coronavirus cases and prevent the state's healthcare system from being overwhelmed. (FT)

CORONAVIRUS: Utah Governor Gary Herbert said the state would permit more than one household to gather over Thanksgiving and other holidays, even while advising against it. He also said he'll extend the state's mask-wearing mandate. "What you do in the confines of your own home is going to be up to you," Herbert told reporters on Thursday as the state broke daily records for infections and deaths. (BBG)

CORONAVIRUS: Texas Governor Greg Abbott ruled out a return to lockdown status to combat surging virus hospitalizations across the second most-populous U.S. state, saying proponents overestimate what would be achieved. "Statewide, we're not going to have another shutdown," Abbott said during a media briefing in Lubbock, one of the state's worst hot spots. (BBG)

CORONAVIRUS: South Carolina Won't Impose COVID Restrictions. (Fox)

POLITICS: Georgia has finished its statewide audit of the razor-thin presidential race, confirming that President-elect Joe Biden defeated President Donald Trump, according to a news release from the Secretary of State's office. (CNN)

POLITICS: President Donald Trump's attorney, Rudy Giuliani, took the president's voter fraud claims even further on Thursday, baselessly alleging during a frenzied news conference that the fraud was nationally coordinated. (NBC)

POLITICS: President-elect Joe Biden is growing impatient with President Donald Trump's refusal to allow his administration to cooperate in the transition, but his advisers are concerned that any legal action to try to force such cooperation could backfire, according to four people familiar with the internal discussions. The worry is that Biden could be left with little recourse if the courts were to rule against his case, these people said, putting a transition on indefinite hold. (NBC)

POLITICS: Four senior House Democrats are demanding that GSA Administrator Emily Murphy brief them Monday on the reason she has yet to ascertain Joe Biden's win in the presidential election, warning that her answers will determine whether they intend to haul her to Capitol Hill for a public hearing, along with other senior General Services Administration officials. (POLITICO)

OTHER

U.S./CHINA: Sources tell FOX Business' Charlie Gasparino that the Biden administration will give the TikTok-Oracle deal a thorough review given Oracle's ties to Trump. (FOX Business)

U.S./CHINA: The outlook for U.S. businesses in China is improving, whether politically or revenue-wise, the American Chamber of Commerce in Shanghai said in a survey released Friday. Out of 124 company leaders surveyed from Nov. 11 to 15, only two said they are more pessimistic about doing business in China following President-elect Joe Biden's win this month. Just over half, or 54.8%, said they are "more optimistic" and 8.1% are "much more optimistic" given the expected change from President Donald Trump's administration, the survey found. (CNBC)

GEOPOLITICS: The Global Times, one of China's state-owned newspapers, said the country has no reason to compromise with the Five Eyes alliance, a group that it claims projects racial superiority. The tabloid newspaper, part of the People's Daily group, made the comments following a joint statement by the alliance criticizing China for disqualifying four legislators in Hong Kong. China will be able to defend its independent governance in the face of such actions, the Times said. The Five Eyes, originally meant to share intelligence, has evolved into "a loudspeaker" for the U.S. lead anti-China campaign and a fan club for Western countries to show loyalty to Washington, according to the newspaper. It singled out Australia for having gone too far in repeatedly attacking China over human rights and openly interfering in China's internal affairs in Xinjiang and Hong Kong. (MNI)

CORONAVIRUS: A World Health Organization panel advised doctors Thursday against using Gilead Sciences' antiviral drug remdesivir as a treatment for patients hospitalized with Covid-19, saying there is currently "no evidence" that it improves survival or shortens recovery time — standing in stark contrast to U.S. regulatory guidance on the drug. The WHO Guideline Development Group, a panel of international experts who provide advice to the agency, said its recommendation is based on new data comparing the effects of several drug treatments, including data from four international randomized trials involving more than 7,000 patients hospitalized with the disease. (CNBC)

CORONAVIRUS: Johnson & Johnson expects to know the efficacy of its Covid-19 vaccine candidate come January or February, Chief Scientific Officer Paul Stoffels said at a Reuters health conference. Johnson & Johnson anticipates it will have all 60,000 participants enrolled in the final-stage study by the year's end. On Wednesday, a J&J spokesperson told Bloomberg it had already enrolled more than 10,000 participants. (BBG)

HONG KONG: Hong Kong is going to conduct mandatory virus testing for specific groups as the epidemic situation rapidly worsens, Secretary for Food and Health Sophia Chan says at a briefing. Specific groups include symptomatic people, workers in elderly homes and taxi drivers. Hong Kong government will announce further tightening of social distancing measures though Chan doesn't give any details. (BBG)

HONG KONG: "We've probably entered into a new wave of cases", Secretary for Food and Health Sophia Chan says at a briefing in response to a question whether the city is in the forth wave of coronavirus outbreak. (BBG)

JAPAN: Japanese Prime Minister Yoshihide Suga, speaking in Tokyo, said the country should be on highest alert over the virus, and that authorities would press ahead with health care preparations. (BBG)

JAPAN: Japan's government must use fiscal policy to lift sentiment, finance minister Taro Aso tells reports Friday in Tokyo. Japan needs to increase productivity given population decline and aging demographics. Govt should think about ways to stimulate business investment that leads to productivity gains via loan programs, fiscal spending or other means. Separately, he says some firms and industries have grown because of the pandemic

AUSTRALIA: South Australia will come out of hard lockdown on Saturday night - three days early - and outdoor exercise will be allowed "effective immediately". Premier Steven Marshall thanked South Australians for "their spirit" during this lockdown, which only allowed people to leave their homes once a day to obtain essential goods. "One of the close contact linked to the Woodville Pizza Bar deliberately misled the contact tracing team," he said. "We know now that they lied." (ABC)

AUSTRALIA: An increase in superannuation would cut lifetime wage earnings for the average Aussie by 2 per cent and lower-income earners would be hit the hardest, a long-awaited review has found. The government is paving the way to scrap a legislated super rise after the retirement income review found current policy settings were "effective, sound and … broadly sustainable". The review warns the "weight of evidence suggests the majority of increases in the super guarantee come at the expense of growth in take-home wages". It instead emphasises "voluntary saving" and home ownership as key to long-term financial security. Treasurer Josh Frydenberg said most Australians would be better off if super wasn't increased. "Working life income, for most people, would be around 2 per cent higher in the long run," he said. (News Au)

RBA: Following a review, the Reserve Bank has assessed that Authorised Deposit-taking Institutions (ADIs) using the Committed Liquidity Facility (CLF) can increase their reasonable holdings of high-quality liquid assets (HQLA) from 26 to 27 per cent of the stock of HQLA securities by the end of 2020, and to 30 per cent of the stock of HQLA securities by the end of 2021. This assessment reflects the increase in issuance of HQLA securities in 2020 and in prospect for 2021. (RBA)

TAIWAN: The Cabinet-level head of the U.S. Environmental Protection Agency, Andrew Wheeler, will visit Taiwan, the island's premier said on Friday, in what will be the third visit by a senior U.S. official since August. (Nikkei)

SOUTH KOREA: South Korea's prime minister has urged the public to avoid social gatherings and stay at home as much as possible as the country's coronavirus tally hovered above 300 for a third consecutive day. (Associated Press)

CANADA/RATINGS: Moody's affirmed Canada at Aaa; Outlook Stable

BRAZIL: A federal judge has ordered to temporarily remove the directors of Brazil's national energy regulator and grid operator after more than two weeks of blackout in the Amazonian state of Amapa. Thursday's ruling determined that regulator Aneel and operator ONS have failed either by omission or negligence in their duties to assure the resumption of services, resulting in what the judge called "a blackout of public management." The decision is the most aggressive judicial move yet to pressure the country's energy players to resolve the compounding crisis. (BBG)

SOUTH AFRICA/RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include

- Moody's on South Africa (current rating: Ba1; Outlook Negative)

- S&P on South Africa (current rating: BB-; Outlook Stable)

OIL: Loadings of Libya's largest crude stream are set to rise sharply, after the OPEC member managed to raise output to pre-blockade levels of 1.25 million barrels per day (bpd). Loadings of Es Sider crude in December were pegged at around 258,000 bpd, a preliminary programme seen by Reuters showed on Thursday. This compares with 187,000 bpd in the final November programme. (RTRS)

OIL: The Trump administration on Thursday proposed to loosen Obama-era safety regulations for the oil industry in the Arctic Ocean off Alaska to ease the way for petroleum extraction in the region, an effort that President-elect Joe Biden will likely throw out once in office. (RTRS)

CHINA

PBOC: MNI POLICY: PBOC Keeps Nov Loan Prime Rate Unchanged

- China's central bank maintained its key loan rate unchanged Friday for the seventh month in a row as it aims to normalize monetary policy with the economy recovering and debt pressures increasing. The November Loan Prime Rate, the benchmark to set companies' cost of borrowing, remains at 3.85% for the one-year maturity and at 4.65% for the five-year maturity - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

BONDS: A total of 52 bonds worth CNY398.8 billion were canceled or postponed in the period from November 10th to 19th, YiCai reported citing data from Wind. The bond default by the SOE Yongcheng Coal Group caused rising difficulties in financing primary market bonds and debt issuance, particularly of industrial and urban investment bonds with weak qualifications, YiCai said citing industry sources. Corporate bond issuance rates rose from 3.6843% to 5.4129% from November 2 to 20 due to rising benchmark interest rates and credit spreads, the newspaper reported citing data from Wind and industry sources. Future credit markets will need to recalibrate valuations for bonds, while liquidity and credit risk premiums might continue to expand for SOEs and companies with weak qualifications, YiCai said citing Guotai Junan Securities. (MNI)

DEFAULTS: China's market regulator expanded its investigation into bond sales for a state-backed coal miner that unexpectedly defaulted on payments last week, dragging in a number of banks, rating and accounting firms. (BBG)

AUTOS: China's passenger car sales are projected to jump over 15% y/y in 2021, contributing 1 percentage point to retail sales growth, the Economic Information Daily reported citing projections from industry analysts. Local governments are expected to increase plate quotas, promote car sales in rural areas, and encourage trade-ins of older models, the Daily reported citing the State Council executive meeting held on Nov 18th. China currently has 66 cities each with more than 1 million vehicles, and future growth comes largely from rural areas with low rates of car ownership, industry sources said. (MNI)

OVERNIGHT DATA

JAPAN OCT CPI -0.4% Y/Y; MEDIAN -0.4%; SEP 0.0%

JAPAN OCT CORE CPI -0.7% Y/Y; MEDIAN -0.7%; SEP -0.3%

JAPAN OCT CORE-CORE CPI -0.2% Y/Y; MEDIAN -0.3%; SEP 0.0%

JAPAN NOV, P JIBUN BANK M'FING PMI 48.3; OCT 48.7

JAPAN NOV, P JIBUN BANK SERVICES PMI 46.7; OCT 47.7

JAPAN NOV, P COMPOSITE PMI 47.0; OCT 48.0

The Japanese private sector economy continued its struggle to gain recovery momentum midway through the fourth quarter, with flash PMI survey data indicating a further decline in business activity during November. Demand conditions continued to weaken, with inflows of new business falling for a tenth month in a row, weighed down by a further drop in export orders. Other survey indicators also showed worrying signs. Operating capacity remained in excess amid weak sales, leading to a faster rate of decline in employment in November. Input and output prices fell while business expectations about output in the year-ahead slipped to the lowest for three months. Looking ahead, the path to recovery remains fraught with challenges as a renewed rise in the number of COVID-19 cases worldwide could dampen global economic activity and trade, thereby putting Japanese exporters in a tough situation. (IHS Markit)

JAPAN OCT CONVENIENCE STORE SALES -4.3% Y/Y; SEP -3.0%

NEW ZEALAND OCT CREDIT CARD SPENDING -6.3% Y/Y; SEP -9.8%

NEW ZEALAND OCT CREDIT CARD SPENDING +1.5% M/M; SEP +1.0%

SOUTH KOREA OCT PPI -0.6% Y/Y; SEP -0.4%

UK NOV GFK CONSUMER CONFIDENCE -33; MEDIAN -34; OCT -31

CHINA MARKETS

PBOC NET DRAINS CNY80BN VIA OMOS FRI

The People's Bank of China (PBOC) injected CNY80 billion via 7-day reverse repos with rates unchanged at 2.2% on Friday. This resulted in a net drain of CNY80 billion given the maturity of CNY160 billion of reverse repos today, according to Wind Information.

- The operations aim to maintain the liquidity in the banking system reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2019% at 09:31 am local time from the close of 2.2286% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 38 on Thursday vs 42 on Wednesday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5786 FRI VS 6.5484

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.5786 on Friday, compared with the 6.5484 set on Thursday.

MARKETS

SNAPSHOT: Tsy-Fed Tension Makes For Cautious End To Week In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 109.88 points at 25524.93

- ASX 200 up 0.474 points at 6547.7

- Shanghai Comp. up 3.447 points at 3366.535

- JGB 10-Yr future up 4 ticks at 152.22, yield down 0.3bp at 0.015%

- Aussie 10-Yr future up 2.0 ticks at 99.135, yield down 1.9bp at 0.868%

- U.S. 10-Yr future +0-05 at 138-16+, yield unch. at 0.829%

- WTI crude down unch. at $41.74, Gold up $0.68 at $1867.27

- USD/JPY up 8 pips at Y103.82

- U.S. TREASURY OPPOSES EXTENDING SOME FED FACILITIES (MNI)

- SCHUMER: MCCONNELL TO DISCUSS COVID RELIEF, AIDES NEGOTIATE GOV'T FUNDING (CNBC)

- UK, EU TRADE AGREEMENT COULD BE ANNOUNCED MONDAY (TELEGRAPH)

- EU LEADERS URGED TO STEP UP PREPARATIONS FOR NO-DEAL BREXIT (BBG)

- PBOC LOAN PRIME RATES UNCHANGED

BOND SUMMARY: Underpinned By Fed-U.S. Tsy Tensions

T-Notes last deal at 138-16+, +0-05 on the day, a little off of best levels, while the cash curve has witnessed modest twist flattening. The impact from the U.S. Tsy's request for the Fed to return unused funds that were provided for support schemes/a push to unwind some of the facilities at least partially moderated, although the contract never got back to unchanged levels vs. settlement. There has been little of any real note on the headline front during Asia-Pac hours, with market flow centring on the downside TY option plays that we flagged earlier.

- Friday provided another narrow session for JGB futures, ahead of a long weekend, with the contract last +5 ticks, alongside some light richening in the cash space. Little of note on the news flow front, with Japanese Chief Cabinet Secretary Kato playing down the need for a COVID-induced state of emergency, at least at present. Elsewhere, we have heard from Finance Minister Aso, who noted that policymakers must stimulate sentiment with fiscal policy.

- Aussie bonds were flatter on the Tsy dynamic, the futures curve is a little off of flattest levels ahead of the close. YM +0.5, XM +2.5. Local preliminary retail sales data was solid, while the AOFM's weekly issuance slate was vanilla after this week's long end syndicated tap.

JGBS AUCTION: Japanese MOF sells Y398.5bn of 1-5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y398.5bn of 1-5 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.010% (prev. -0.010%)

- High Spread: -0.008% (prev. -0.008%)

- % Allotted At High Spread: 14.5200% (prev. 56.0336%)

- Bid/Cover: 3.585x (prev. 3.557x)

JGBS AUCTION: Japanese MOF sells Y6.1334tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y6.1334tn 3-Month Bills:- Average Yield -0.0989% (prev. -0.0938%)

- Average Price 100.0263 (prev. 100.0252)

- High Yield: -0.0940% (prev. -0.0912%)

- Low Price 100.0250 (prev. 100.0245)

- % Allotted At High Yield: 35.0742% (prev. 80.2802%)

- Bid/Cover: 2.707x (prev. 3.464x)

AUSSIE BONDS: Vanilla Weekly AOFM Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Tuesday 24 November it plans to sell A$150mn of the 3.00% 20 September 2025 Indexed Bond.

- On Wednesday 25 November it plans to sell A$2.0bn of the 1.25% 21 May 2032 Bond.

- On Thursday 26 November it plans to sell A$1.0bn of the 26 March 2021 Note & A$1.0bn of the 23 July 2021 Note.

- On Friday 27 November it plans to sell A$1.5bn of the 0.50% 21 September 2026 Bond.

- The AOFM also noted that the final tenders of Treasury Bonds, Treasury Notes and Treasury Indexed Bonds in 2020 are planned to be conducted in the week beginning 7 December 2020.

EQUITIES: U.S. Tsy-Fed Tension Weighs On E-Minis

Risk was dented late in the NY day as U.S. Treasury Secretary Mnuchin requested that the Fed return the unused cash that was made available for its numerous support schemes, while Mnuchin pushed for an end to some of the facilities. The Fed noted that it "would prefer that the full suite of emergency facilities established during the coronavirus pandemic continue to serve their important role as a backstop for our still-strained and vulnerable economy." This clearly represents a potential source of tension between the two institutions, which weighed on e-minis after hours.

- The major Wall St. benchmarks recovered from worst levels on Thursday, closing in positive territory, aided by comments from DC which pointed to an impending resumption of talks surrounding fiscal support.

- Regional equities were mixed during Asia-Pac hours, with a strong showing for Chinese auto names given the well-documented positive focus surrounding the development of the sector on the part of policymakers.

- Nikkei 225 -0.6%, Hang Seng +0.4%, CSI 300 unch., ASX 200 unch.

- S&P 500 futures -22, DJIA futures -231, NASDAQ 100 futures unch.

OIL: Muted

WTI & Brent sit little changed at typing, holding narrow ranges in Asia-Pac hours after a limited Thursday session which saw the benchmarks finish little changed come settlement time.

- Oil-specific news flow has been limited at best over the last 24 hours, headlined by reports that Libyan crude production has recovered to 1.25mn bpd, although this remains a few hundred thousand barrels shy of levels that would trigger broader OPEC+ calls for the enforcement of limitations on Libyan crude production.

GOLD: Range Remains Intact

Spot is little changed, hovering around the $1,865/oz mark. The strength of the broader USD and direction of travel for U.S. real yields continue to come under scrutiny, with gold having a look lower on Thursday, before recovering from worst levels in NY hours. Bears have still not been able to force a challenge of support at $1,848.8/oz, which represents the Sep 28 low and bear trigger.

FOREX: JPY Grinds Lower On Gotobi Day, U.S. Tsy & Fed Clash Over Stimulus Funds

Conflicting opinions of U.S. Tsy & Fed on whether to unwind the central bank's emergency lending facilities inspired light risk aversion early on, which gradually faded away through the session. Outgoing Tsy Sec Mnuchin requested the return of unused cash from some lending programmes run by the Fed, which replied that it prefers to keep "the full suite of emergency facilities". Subsequent headline and data flow was lacklustre and provided little to move the needle, with the PBoC leaving its LPRs unchanged. JPY faltered, possibly on the back of Gotobi Day sales against USD, ahead of a long weekend in Japan.

- USD/CNH swung to a loss as the greenback shook off its initial strength, even as the PBoC set its central USD/CNY mid-point higher than expected.

- The Bank of Thailand unveiled measures to stem THB appreciation and reiterated its concern with the current level of the exchange rate.

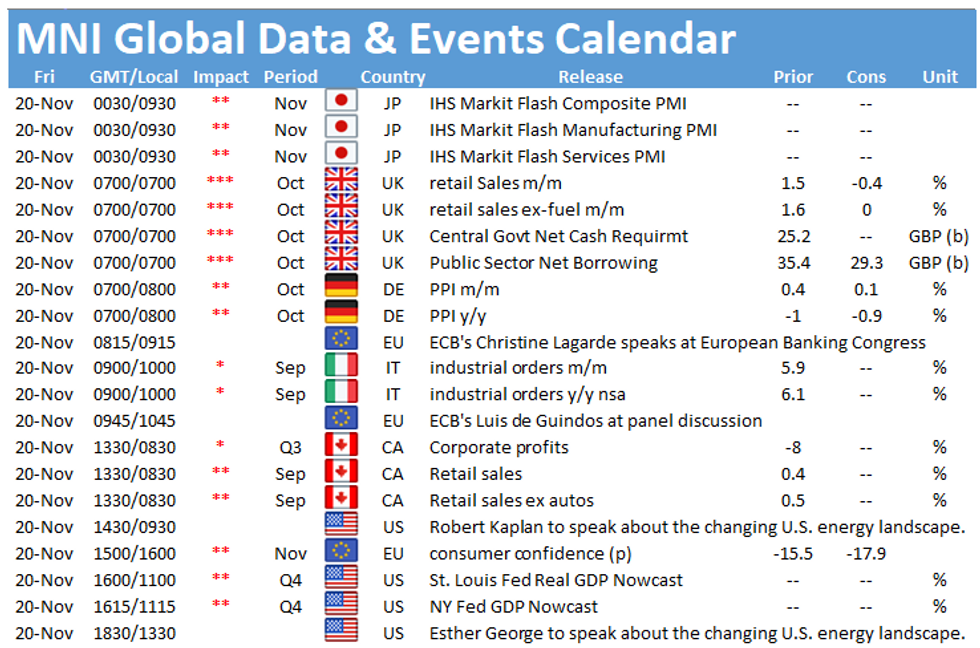

- Today's highlights include UK & Canadian retail sales, EZ consumer confidence, as well as comments from Fed's Kaplan, Barkin & George and ECB's Lagarde, de Guindos & Weidmann.

FOREX OPTIONS: Expiries for Nov20 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1850(E1.1bln), $1.1900(E1.4bln)

- USD/JPY: Y103.20-25($630mln-USD puts), Y103.75($682mln), Y104.00($970mln), Y105.46-50($1.3bln), Y106.50($1.1bln)

- GBP/USD: $1.3100(Gbp531mln)

- EUR/GBP: Gbp0.8840(E570mln-EUR puts)

- AUD/NZD: N$1.1000(A$1.6bln-AUD calls)

- USD/CAD: C$1.2900($760mln-USD puts), C$1.3000($888mln-USD puts), C$1.3100($1.1bln), C$1.3110-20($636mln)

- USD/CNY: Cny6.60($1.37bln-$1.32bln of USD puts), Cny6.90($2.0bln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.