-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Positives Outweigh Negatives, As USD Edges Lower

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* U.S. PLANS FIRST VACCINATIONS IN WEEKS, WARP SPEED HEAD SAYS (BBG)

* RTRS SOURCES POINT TO WIDENING OF U.S. LIST OF CHINESE FIRMS LINKED TO MILITARY

* FED CHAIR POWELL: WILL RETURN UNUSED MONEY TO TREASURY

* ECB'S LANE: EMERGENCY BOND PURCHASES TO LAST WHILE DISRUPTIONS PERSIST (RTRS)

* BREXIT MOOD MUSIC POSITIVE, EDGING TOWARDS DEAL, FAMILIAR ISSUES REMAIN

* UK & SOME OF EUROPE REPORTEDLY SET TO EASE COVID RESTRICTIONS AROUND CHRISTMAS

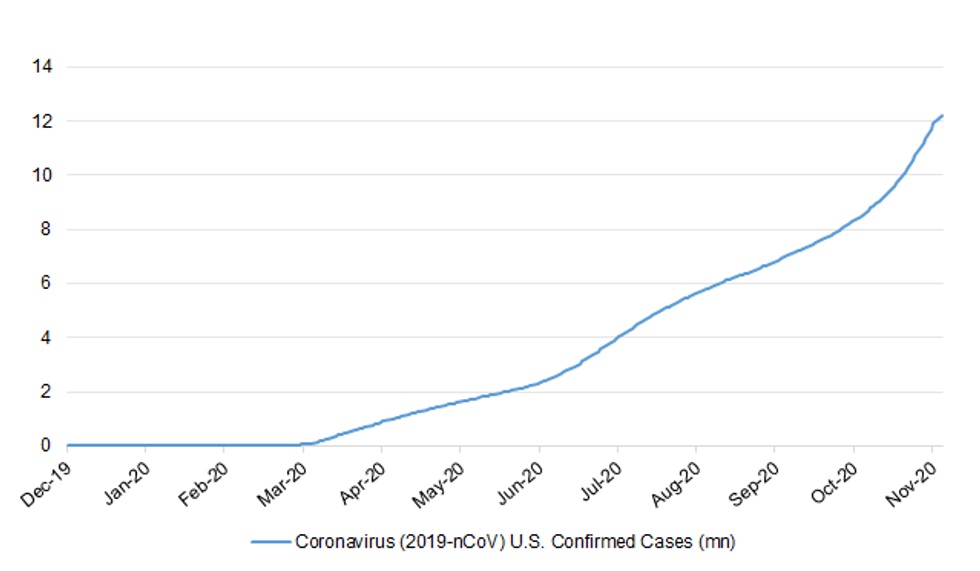

Fig. 1: Coronavirus (2019-nCoV) U.S. Confirmed Cases (mn)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Families will be allowed to meet for up to a week at Christmas – but tough restrictions could remain in place until then under Government plans to be announced early next week. Boris Johnson is preparing to announce a UK-wide relaxation of rules from December 22 to 28, allowing several families to join in one "bubble", The Telegraph can reveal. But the Prime Minister will say that the strength of the restrictions for the rest of next month will depend on how well the public complies with the current lockdown, which expires on December 2. (Telegraph)

CORONAVIRUS: Self-isolation will no longer be required for contacts of positive Covid cases under plans announced by the Government on Monday. (Telegraph)

CORONAVIRUS: The length of time people have to quarantine upon arrival to the UK will be cut from 14 days to just five, Boris Johnson is expected to announce. (Telegraph)

CORONAVIRUS: U.K. Prime Minister Boris Johnson will announce a massive increase in community coronavirus testing on Monday as part of a plan to reintroduce tiered restrictions in place of the England- wide lockdown that ends on Dec. 2. Areas under the highest level of curbs will have access to regular tests. People who come into contact with someone with the disease will be able to avoid quarantine by taking a test every day for seven days, Johnson's office said. (BBG)

CORONAVIRUS: Boris Johnson's plans for a new toughened three-tiered system to replace the national lockdown next week is under threat after 70 Conservative MPs threatened to veto the plans in Parliament. The Tory MPs on Saturday wrote to the Prime Minister saying they could not support further new restrictions if the Government does not publish an economic analysis of the impact of the restrictions. Mr Johnson will tell the House of Commons on Monday that he will end the lockdown in England next week and replace it with three new toughened-up tiers which will vary depending on the prevalence of the virus locally. (Telegraph)

CORONAVIRUS: Matt Hancock says he is "more and more confident" that life will return to normal in the spring as the NHS plans to give a coronavirus vaccine to every adult who wants one by Easter. The health secretary formally launched the process of approving the Pfizer vaccine for use in Britain, with a green light for the NHS to begin immunising expected in as little as two weeks. (The Times)

CORONAVIRUS: Retailers across England will open their doors to Christmas shoppers on December 2 under ministers' plans to end the nationwide lockdown and return to a localised system. In a big boost for the high street, non-essential shops are expected to reopen across England early next month. (The Times)

CORONAVIRUS: The Pfizer Covid vaccine could get the go-ahead in the UK even before the US authorises it, it has emerged, with hopes of a green light in as little as a week. (BBG)

BREXIT: Confidential notes seen by Sky News reveal European Union officials think a Brexit deal is 95% agreed - but show the extent of anxiety over the potential impact if negotiations break down. The notes come from a meeting of the most senior diplomats in Brussels on Friday morning, when they were briefed about the state of Brexit talks by the European Commission's Secretary General Ilze Juhansone. (Sky)

BREXIT: The U.K. and European Union are on course to strike a trade deal in coming days even though several big differences between them still need to be bridged, people close to the negotiations said. Despite the abrupt suspension of face-to-face talks this week after a member of the EU negotiating team tested positive for Covid-19, officials on both sides are optimistic. (BBG)

BREXIT: Civil servants have begun drawing up legislation for a Brexit deal that will need to pass through the Commons and Lords at "breakneck pace". The Cabinet Office has a team of officials working on the future relationship bill, which will enshrine any Brexit agreement in domestic law. (The Times)

BREXIT: Britain will resist a European Union demand for a review of a future trade, security and fishing deal in 2030 if countries such as France are unhappy with the loss of fish catch quotas. The expected demand, a further potential sticking point as talks go to the wire over the next two weeks, would give the EU the chance to call the whole agreement into question over fisheries, throwing trade between Britain and Europe into question in ten years. (The Times)

BREXIT: Boris Johnson is preparing to make a significant intervention in the Brexit trade talks this week as negotiators begin the "final push" before a deadline in eight days' time. The Prime Minister is expected to speak to European Commission President Ursula von der Leyen in an attempt to clear away the final barriers to a deal which both sides now believe is well within reach. (Telegraph)

BREXIT: U.K. Chancellor of the Exchequer Rishi Sunak signaled he is optimistic that a Brexit trade agreement with the European Union will be reached. Speaking to the BBC's Andrew Marr show on Sunday, he said "hopefully" negotiations will end in a "constructive" place. (BBG)

BREXIT: Britain quietly paid the billion-pound bill it was handed by Brussels on Brexit Day during EU trade negotiations, the Telegraph can reveal, as hopes that a deal can finally be done rise. The European Commission sent the Government a demand for an extra £1.09 billion on top of its Budget payments to Brussels on January 31, the very day the UK legally left the EU. (Telegraph)

BREXIT: Sir Keir Starmer is facing a shadow cabinet revolt over Brexit after the Labour leader said last week that his party should back a deal if Boris Johnson is able to secure one. Senior members of Starmer's top team said Labour should abstain rather than support what the party believes will be a "thin" trade deal with the EU. (Sunday Times)

BREXIT: The U.K. agreed with Canada to maintain the trading conditions it has through its European Union membership and to begin talks on a broader deal that would pave the way for even closer links with Britain's 12th-biggest trading partner. (BBG)

BOE: Remote working is leading to longer hours and could result in jobs being moved abroad, a member of Bank of England's rate-setting committee has said. Jonathan Haskel, an external member of the Bank's monetary policy committee, told The Times that the shift towards home working was unlikely to last as most companies had not found it to be productive. (The Times)

FISCAL: Rishi Sunak has told Sky News there will be no return to austerity in his upcoming spending review, but hinted at a future public sector pay freeze. (Sky)

FISCAL: Rishi Sunak will this week set out billions of pounds of public spending which he will say will "get the country through" the coronavirus pandemic, while warning that harder decisions are coming in the spring. A fund of up to £50 billion will be set aside to deal with Covid-19 in this week's Spending Review, and big decisions on social care and reforming higher education will be delayed by a year. (Telegraph)

FISCAL: Chancellor Rishi Sunak is to announce an extra £3bn for the NHS - but has warned that people will soon see an "economic shock laid bare" as the country deals with the Covid pandemic. (BBC)

FISCAL: Rishi Sunak is drawing up plans to cut pensions tax relief for higher earners to help to restore Britain's coronavirus-hit finances. The chancellor is said to be "very attracted" to the idea of moving to a flat rate relief on pensions of 25 per cent. "It's a matter of fairness for him," a government source said. He is expected to use his spending review on Wednesday to signal the need for future tax rises to help to restore the public finances. Any decisions on tax rises will come in the budget, expected in March, but could be put off until later in the year, Treasury sources suggested, if the economy went back in to recession. (The Times)

INFRASTRUCTURE: Chancellor Rishi Sunak will set out plans next week for a new National Infrastructure Bank to channel billions of pounds into capital projects as part of the UK government's "levelling-up agenda", according to government officials. The Treasury believes that the new institution, to be based in northern England, can play a key role in helping to kickstart Britain's economic recovery in the wake of the pandemic. The new lender, which will be operational by next spring, will have a remit to help deliver the UK's commitment to reach "net zero carbon" by 2050 and provide funding for projects across the UK. It will co-invest alongside private investors through a mix of loans and guarantees as well as taking equity stakes in projects. (FT)

ECONOMY: Almost half of the UK's manufacturers are unhappy with the government's efforts to "level-up" the country. "Levelling up" is the phrase used by Prime Minister Boris Johnson to describe the government's efforts to reverse regional inequalities. (Sky)

BANKS: British regulators have signaled to banks that they'll consider softening their resistance to dividends payouts on a case-by-case basis by early next year. The Bank of England's Prudential Regulation Authority is likely to take into account the wider economic backdrop and will take a final view only after lenders close their fourth-quarter books, according to people familiar with discussions between the regulator and banking executives in recent weeks. Any progress on a vaccine will also influence its thinking, one of the people said. (BBG)

EUROPE

ECB: The European Central Bank will continue its emergency bond purchases as long as the coronavirus pandemic continues to disrupt normal economic activity, ECB chief economist Philip Lane told French newspaper Les Echos in an interview. The ECB earlier said the emergency purchase would last until least June 30 but already signalled that it would "recalibrate" this programme at the December meeting, a message taken to mean that the purchases would be expanded and extended. "We won't terminate the programme until certain conditions have been met," Les Echos quoted Lane as saying on Sunday. "First of all, the pandemic must no longer interrupt normal economic activity." (RTRS)

CORONAVIRUS: Policymakers across Europe are preparing to relax Covid-19 lockdowns for the second time this year as they look to "save Christmas" and enable family reunions for 500m across the continent — except this time, they are avoiding calling it a reopening. (FT)

CORONAVIRUS: Europe, and Switzerland in particular, have failed to learn the lessons from the first wave of the virus, said David Nabarro, the World Health Organization's special envoy on Covid-19 preparedness and response. While Asian countries maintained restrictions after lowering infections, the response in Europe was incomplete and governments missed the opportunity to strengthen infrastructure during the summer when the first wave was brought under control, Nabarro told Swiss newspaper Schweiz am Wochenende. Without further action now, Europe will experience a third wave early next year, said Nabarro, adding that surveillance of individuals self-isolating needs to be done by the government. It's too serious to be left to individuals, he said. (BBG)

GERMANY: Germany's partial lockdown may be extended well into next month as Europe's biggest economy seeks to regain control over the spread of the coronavirus before people head home for the holidays. German officials are beginning to assume that the current curbs will have to be extended beyond this month and are aiming to see them lifted shortly before the holiday period, according to a person familiar with the matter. State leaders are considering reopening hotels and restaurants at least during the lucrative Christmas and New Year period so they can generate much-needed sales, the person said, declining to be identified because the talks are private. Officials would look at reinstating the controls in January if the infection rate is still considered to be too high, the person added. (BBG)

GERMANY: Vice-Chancellor Olaf Scholz told the Bild am Sonntag newspaper that the restrictions may have to continue "for some time" beyond the end of November. In that case, financial support for the sectors directly affected should also be extended, said Scholz, who's also finance minister, noting that this would be "financially challenging." (BBG)

GERMANY: Germany's Green party opened its bid to run Europe's biggest economy with a manifesto that seeks to broaden its appeal among mainstream voters, while risking opposition from fiscal hawks and business leaders. (BBG)

GERMANY: German Finance Minister Olaf Scholz plans to take on at least 160 billion euros ($190 billion) in new debt in 2021 to help stave off the economic impact of the coronavirus pandemic, three people familiar with the matter said on Sunday. This is at least 64 billion euros higher than the 96 billion euros initially eyed by Scholz for next year. (RTRS)

FRANCE: The French government plans to ease lockdown measures in three steps as infections recede, while keeping some restrictions to contain the epidemic. A first easing will take place "around" Dec. 1, followed by a second one before the end- of-the-year holidays and a third from January, government spokesman Gabriel Attal told Le Journal du Dimanche. Confinement measures and travel limitations will remain in place for some time, while restaurants and bars will still face restrictions, Attal told the newspaper. President Emmanuel Macron, who's due to speak Tuesday, will detail the government strategy for the weeks to come, he said. (BBG)

ITALY: Italy reported 28,337 new coronavirus cases Sunday, down from 34,767 a day earlier – in line with the normal weekend pattern as fewer tests are carried out. Daily deaths fell to 562 from 692 on Saturday. The government of Prime Minister Giuseppe Conte is considering temporarily easing a soft lockdown in the run-up to Christmas to allow shops to open for longer hours in worst-hit regions, Italian newspapers reported earlier Sunday.

ITALY: Italy and UniCredit SpA are intensifying talks about a takeover of state-controlled lender Banca Monte dei Paschi di Siena SpA as the country's Treasury steps up efforts to meet the bank's demands for acquiring the troubled lender, according to people with knowledge of the matter. The finance ministry is ready to inject as much as 2.5 billion euros ($3 billion) of fresh funds into Monte Paschi and is studying measures to shield the potential buyer from legal risks and integration costs, the people said, asking not to be identified because the process is private. (BBG)

ITALY/BTPS: Italy plans to sell up to 2 billion euros ($2.4 billion) of zero bonds due Sep 28, 2022 in an auction on Nov 25. The sale is a reopening of previously issued securities with 6.327 billion euros outstanding. (BBG)

PORTUGAL: Portugal will limit movement between municipalities on Nov. 28-Dec. 1 and Dec. 5-8, two periods that include weekends and national holidays on each following Tuesday. The number of daily new infections continues to be "worrying," even if the pace of growth has decelerated, Prime Minister Antonio Costa said at a press conference in Lisbon. (BBG)

GREECE: Greece reported 1,498 new coronavirus cases on Sunday — one of the highest daily totals on record — as the country's investment minister cautioned against reopening the economy too quickly. All but 22 were locally transmitted, the national health body known as EODY said. (FT)

BELGIUM: Belgian Health Minister Frank Vandenbroucke told VTM Nieuws on Friday that it's possible the country could get its first Covid vaccines at the start of the new year, according to De Tijd newspaper. "If that works out it will be very good news for us," Vandenbroucke said, adding that the quantities wouldn't be very large yet. (BBG)

SWEDEN: Sweden's Prime Minister Stefan Lofven used a rare Sunday night address to warn of the growing threat the coronavirus poses, amid fears the strategy used so far may not be enough to fight an increasingly deadly pandemic. (BBG)

RATINGS: Sovereign rating reviews of note from Friday included:

- Fitch affirmed Portugal at BBB; Outlook Stable

- DBRS Morningstar confirmed Lithuania at A, Stable Trend

- DBRS Morningstar confirmed Latvia at A (low), Stable Trend

BANKS: The uncertainty fuelled by a second COVID-19 wave calls for caution in the debate among European supervisors on whether to extend a recommendation that euro zone banks refrain from paying dividends, the Bank of Italy said on Friday. (RTRS)

U.S.

FED: MNI BRIEF: Fed Will Return Unused Money To Treasury - Powell

- Federal Reserve Chair Jerome Powell said Friday the Fed will return unused CARES Act money originally purposed for emergency lending facilities back to the government as Treasury Secretary Steven Mnuchin requested. "We will work out arrangements with you for returning the unused portions of the funds allocated to the CARES Act facilities in connection with their year-end termination," Powell wrote in a letter - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: The U.S. Treasury Department's request that the Federal Reserve wind down several emergency lending programs at the end of the year has given the central bank another reason to consider providing more support the economy in other forms. Without the facilities in place, Fed officials may take the view that downside risks to the economic outlook are higher, especially amid a stalemate in Congress over additional fiscal relief and worsening Covid-19 outbreaks. That would add to a debate about whether to make changes to the central bank's large-scale bond-buying program that Fed watchers were already expecting to be the focus of their Dec. 15-16 policy meeting. (BBG)

FED: MNI EXCLUSIVE: QE No Cure For Lost Fed Backstops- Ex-Officials

- The Federal Reserve won't rush to ramp up QE in compensation for Treasury Secretary Steven Mnuchin's decision to end emergency lending facilities, another burden on the world's largest economy amid rising Covid cases, former officials told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: President-elect Joe Biden's transition team sharply criticized Treasury Secretary Steven Mnuchin's decision to allow funding for several emergency Federal Reserve lending programs to expire, escalating a political fight. (WSJ)

FED: MNI BRIEF: Fed's George Wary Of Short-Term Outlook

- Kansas City Fed President Esther George said Friday she remains concerned about the near-term outlook, despite confidence for the economy in the years ahead - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED/FISCAL: U.S. Treasury Secretary Steven Mnuchin's decision to claw back funds from Federal Reserve coronavirus lending programs will not "hamstring" the next Treasury secretary because the move will leave nearly $600 billion in cash that could quickly aid workers and businesses, a senior Treasury official said on Friday. The official told Reuters in a phone interview that the Fed facilities will not be dissolved, and can be quickly recapitalized to a lending capacity of $750 billion to $800 billion with funds from Treasury's Depression-era Exchange Stabilization Fund. (RTRS)

FED/FISCAL: Funding for an expiring Federal Reserve lending program that Treasury Secretary Steven Mnuchin terminated should be "repurposed" for a new round of coronavirus aid that the U.S. Congress could craft, Senate Majority Leader Mitch McConnell said in a statement on Friday. (RTRS)

FISCAL: Sources tell FOX Business' Charlie Gasparino that the additional round of PPP could offer as much as $150 billion to struggling small businesses. (FOX Business)

FISCAL: The U.S. government stands to lose more than $400 billion from the federal student loan program, an internal analysis shows, approaching the size of losses incurred by banks during the subprime-mortgage crisis. The Education Department, with the help of two private consultants, looked at $1.37 trillion in student loans held by the government at the start of the year. Their conclusion: Borrowers will pay back $935 billion in principal and interest. That would leave taxpayers on the hook for $435 billion, according to documents. (WSJ)

FISCAL: While the next U.S. Treasury Secretary may make history as the first female to hold the role, she is a familiar face to the financial markets and welcome by progressives. FOX Business has learned former Fed Chair Janet Yellen is emerging as a frontrunner on Biden's short of list of potential picks which is among the most diversified in history with women and African Americans including; former Federal Reserve Vice Chair Roger Ferguson, Federal Reserve Bank of Atlanta President and CEO Raphael Bostic, Federal Reserve Gov. Lael Brainard, as well as Massachusetts Senator Elizabeth Warren. (FOX Business)

ECONOMY: Advisers to President-elect Joseph R. Biden Jr. are planning for the increasing likelihood that the United States economy is headed for a "double-dip" recession early next year. They are pushing for Democratic leaders in Congress to reach a quick stimulus deal with Senate Republicans, even if it falls short of the larger package Democrats have been seeking, according to people familiar with the discussions. (New York Times)

CORONAVIRUS: The first Americans to get a Covid-19 vaccine could receive their first doses in about a month, if an expected FDA approval timeline holds. Pfizer and BioNTech announced Friday they will file for emergency use authorization from the agency, a process expected to take a few weeks. The White House coronavirus task force has repeatedly said once the drug has approval, it can be mobilized for distribution within 24 hours. (CNBC)

CORONAVIRUS: Vaccinations against Covid-19 in the U.S. will "hopefully" start in less than three weeks, according to the head of the federal government's program to accelerate a vaccine. "On the 11th or on the 12th of December, hopefully the first people will be immunized across the United States, across all states, in all the areas where the state departments of health will have told us where to deliver the vaccines," Moncef Slaoui, head of the government's Operation Warp Speed, said on CNN's "State of the Union." (BBG)

CORONAVIRUS: The Food and Drug Administration on Saturday granted an emergency use authorization for Regeneron's Covid-19 antibody treatment, the experimental therapy given to President Donald Trump when he contracted the coronavirus in October. (CNBC)

CORONAVIRUS: Former FDA Commissioner Scott Gottlieb warned that staffing will be a bigger issue at hospitals than the number of available beds during the unfolding spike. "The hospitals can create new beds, they just won't have the people to staff them," he said. That's because unlike previous waves, there will be limited ability to surge staff from less-affected areas of the country to hot spots. (BBG)

CORONAVIRUS: New York City restaurants are expected to remain open through the Thanksgiving holiday, Governor Andrew Cuomo said. The city hasn't yet met the state's criteria that would require a shutdown of indoor dining, and isn't expected to do so until December at the soonest, Cuomo said on a call Friday with reporters. (BBG)

CORONAVIRUS: The Greater Los Angeles area added 2,718 new coronavirus cases Sunday, with the five-day average exceeding the 4,000 threshold that triggered additional measures where restaurants, breweries and bars will once again limit their businesses to just pick-up and delivery. The new curbs will start at 10 p.m. Wednesday. (BBG)

CORONAVIRUS: California Gov. Gavin Newsom's seven-month-old Task Force on Business and Jobs Recovery is disbanding as the coronavirus pandemic reaches a second peak, but his co-chairs predict the state will have a strong economic turnaround once the pandemic is past. (CNBC)

CORONAVIRUS: Wisconsin's governor on Friday extended a statewide mask mandate despite a legal challenge from conservatives, renewing an emergency health order requiring face coverings in public spaces to curb an alarming surge in COVID-19 infections. (RTRS)

CORONAVIRUS: Nevada will cut capacity at casinos and other public venues starting Tuesday to lower the spread of coronavirus infection, according to Governor Steve Sisolak. (BBG)

POLITICS: President Trump's campaign on Sunday filed a notice of appeal after a federal judge dismissed Trump's attempt to block the certification of votes in Pennsylvania. Attorneys for the president's campaign, including Rudy Giuliani, submitted an appeal to the U.S. Court of Appeals for the Third Circuit, following Judge Matthew Brann's scathing ruling Saturday rejecting Trump's case. (The Hill)

POLITICS: Republican leaders in Michigan said they "have not yet been aware of any information that would change the outcome of the election" in the state after meeting with President Trump at the White House Friday. (Axios)

POLITICS: Georgia Secretary of State Brad Raffensperger certified election results Friday that formally declared President-elect Joe Biden as the winner in the state. Biden won the state by more than 12,000 votes. President Donald Trump's campaign is still entitled to request a recount, because of the narrowness of the result. (POLITICO)

CORONAVIRUS: A staunch ally of Donald Trump said Sunday it was time for the President to end his futile gambit to overturn the results of the election. Former New Jersey Gov. Chris Christie said Trump has failed to provide any evidence of fraud, that his legal team was in shambles and that it's time to put the country first. (CNN)

POLITICS: Retiring Republican Senator Lamar Alexander on Friday said that the Trump administration should provide President-elect Joe Biden's team with all materials, resources and meetings necessary for a smooth transition. (RTRS)

POLITICS: Sen. Pat Toomey (R-Pa.) congratulated President-elect Joe Biden on his election win, saying in a statement, "President Trump has exhausted all plausible legal options to challenge the result of the presidential race in Pennsylvania." (Axios)

POLITICS: President-elect Joe Biden will announce cabinet appointments this upcoming Tuesday, incoming White House chief of staff Ron Klain confirmed on Sunday. (CNBC)

POLITICS: President-elect Joe Biden intends to name his longtime adviser Antony Blinken as secretary of state, according to three people familiar with the matter, setting out to assemble his cabinet even before Donald Trump concedes defeat. In addition, Jake Sullivan, formerly one of Hillary Clinton's closest aides, is likely to be named Biden's national security adviser, and Linda Thomas-Greenfield will be nominated to serve as Biden's ambassador to the United Nations. (BBG)

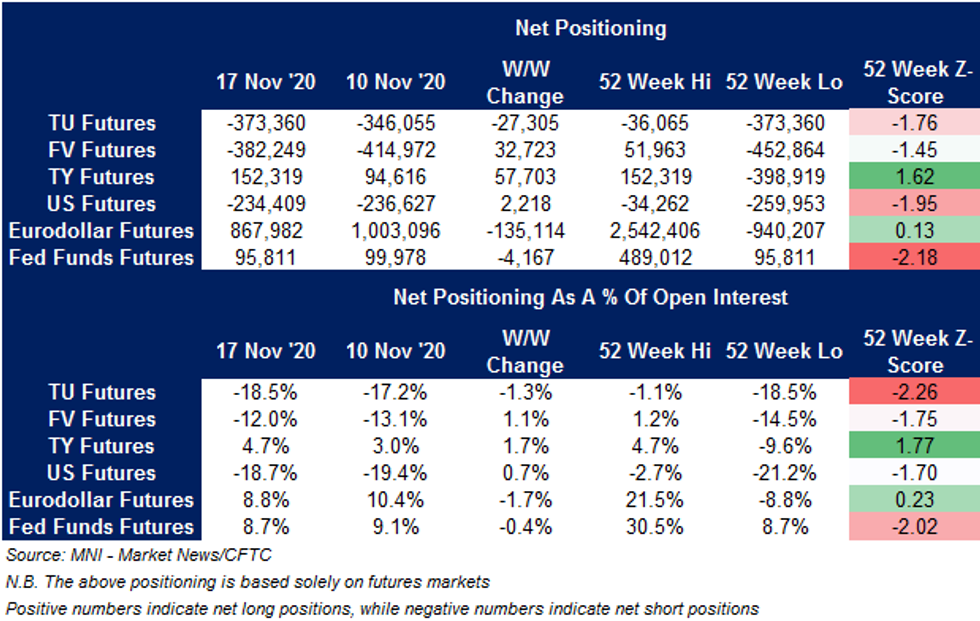

US TSYS: The latest CFTC Commitment of Traders report revealed that net short positioning in TU hit the widest levels (at least in outright terms) since early '19 in the week to November 17. Elsewhere, net length in TY grew, hitting the widest outright levels seen since late '17, while FV & US net shorts were pared backed, the latter by a marginal degree.

- In the STIR space, net overall exposure in Fed Funds futures was little changed, although marginal trimming resulted in the narrowest net length seen since September '19, when net positioning flipped long. Net length in Eurodollar futures was also trimmed.

EQUITIES: Europe is set to lift its flight ban on the Boeing 737 MAX passenger jetliner in January after U.S. regulators last week ended a 20-month grounding triggered by two fatal crashes. (RTRS)

BANKS: Big U.S. banks can't refuse to lend to entire categories of lawful businesses under a rule proposed Friday, following complaints that the oil-and-gas industry was unfairly denied financing by large lenders. (WSJ)

OTHER

GLOBAL TRADE: Germany would need to reach a consensus within government that a telecoms vendor poses a national security threat in order to exclude its equipment from national 5G networks, according to draft legislation reviewed by Reuters on Friday. (RTRS)

U.S./CHINA: The Trump administration is close to declaring that 89 Chinese aerospace and other companies have military ties, restricting them from buying a range of U.S. goods and technology, according to a draft copy of the list seen by Reuters. (RTRS)

U.S./CHINA: Washington is poised to designate four more Chinese companies as backed by the Chinese military, sources said, curbing their access to U.S. investors as the Trump administration seeks to cement its hawkish China legacy in its waning days. (RTRS)

U.S./CHINA: U.S. Democratic Senator Chris Coons, seen as a contender for secretary of state in the incoming Biden administration, told Reuters on Friday he hoped to see a bipartisan policy take shape for the United States to "out-compete" China. Coons also said that while the main U.S. focus would have to be on competing with Beijing, it was essential to cooperate on areas such as climate change, global health and nuclear nonproliferation. (RTRS)

U.S./CHINA: Beijing must drop its illusions that the China-US relationship will automatically get better under a Biden presidency and should be prepared for a tougher stance from Washington, a Chinese government adviser has warned. Zheng Yongnian, the dean of the Advanced Institute of Global and Contemporary China Studies, a Shenzhen-based think tank, said China should not miss any opportunity to mend relations with the United States but should not assume that relations with the US would return to how they were before Donald Trump's rise to power. (SCMP)

UK/CHINA: Britain will lose billions of pounds of investment and thousands of jobs unless it reverses its hostility to China, an influential lobby group for Chinese businesses has warned. (Sunday Times)

GEOPOLITICS: The U.K. will send an aircraft carrier to Asia in 2021 as diplomatic tensions with China mount over Hong Kong and other hot-button issues, part of new military plans that also include the creation of space and cyber defense forces. (Nikkei)

GEOPOLITICS: When it comes to protecting sensitive information from foreign hackers, President-elect Joe Biden's team is largely on its own. The federal government, which has some of the most sophisticated antihacking technologies in the world, is offering limited assistance to Mr. Biden's transition operation in securing its email and other communications, despite concerns that the team is likely a top espionage target for Russia, China, and other adversaries, according to people familiar with the transition. (WSJ)

CORONAVIRUS: Australian researchers have discovered that people who have been infected with Covid-19 have sustained protection against reinfection for at least eight months. (FT)

CORONAVIRUS: Leaders of the world's richest countries pushed for equality in the race to vaccinate people against the coronavirus, while President Donald Trump stayed quiet on sharing U.S.-made vaccines with other nations. The battle to counter the pandemic dominated the first day of a virtual summit of Group of 20 nations on Saturday, hosted by Saudi Arabia. (BBG)

CORONAVIRUS: Even the tens of millions of Covid tests Roche Holding AG is churning out won't be enough this winter as infections surge across the northern hemisphere, says Chief Executive Officer Severin Schwan. The Swiss giant is on pace to produce more than 80 million rapid antigen tests a month by the end of this year, along with the slower but highly accurate PCR tests that it's been delivering globally since January. But even that will fall short of demand amid continuing supply bottlenecks, so health officials will have to keep prioritizing resources. (BBG)

CORONAVIRUS: CanSino Biologics Inc. said surging infections around the world will allow it to quickly reach an interim milestone to analyze the efficacy of its single-shot vaccine. The Chinese company is testing its vaccine in Pakistan, Mexico, Argentina, Chile and Russia, Zhu Tao, the company's chief scientific officer, said at a forum in Zhuhai. CanSino needs 50 Covid-19 cases for an interim analysis and expects to quickly get them, he said. China's military has approved CanSino's shot for use among its personnel. (BBG)

HONG KONG: Hong Kong will give a one-time HK$5,000 ($645) payment to anyone in the city who tests positive for Covid-19 to encourage people to take tests for the virus, Health Secretary Sophia Chan said. The Labour and Welfare Bureau will announce details of the handout plan later, Radio Television Hong Kong cited Chan as saying in a radio interview. (BBG)

JAPAN: Japan said it will suspend a domestic travel campaign in areas where coronavirus infections are especially high as cases in the capital Tokyo hit a record high on Saturday. The partial suspension of the domestic travel campaign marks a change in direction for the government, which was holding back on curtailing a domestic travel subsidy programme. (RTRS)

AUSTRALIA: Treasurer Josh Frydenberg will move to expand the government's business expense tax break, allowing companies with more than $5 billion in turnover to instantly deduct the cost of new capital investments. (AFR)

AUSTRALIA: The Victorian government will deliver an unprecedented $23.3 billion budget deficit next financial year, with net debt expected to blow out to $155 billion within three years, after the state's tax revenue fell by 11.9 per cent. The coronavirus and the state's extended lockdown have smashed the economy causing employment to fall by 182,800 jobs between the March and September quarters, while economic output is forecast to fall by 4 per cent next financial year. (AFR)

AUSTRALIA: Victorians will be able to go outside without face masks for the first time since mid-July and office workers can head back onsite under the latest round of coronavirus restriction easing. Premier Daniel Andrews announced the widespread changes on Sunday as the state edges closer to eliminating the virus, with no new cases recorded for the 23rd day running and just one active case remaining. From midnight on Sunday, Victorians no longer have to wear masks outdoors, though they must carry them in case they cannot socially distance. They are required in all indoor settings. (AFR)

RBA: The JobKeeper Payment is a wage subsidy to help firms affected by COVID-19 retain their staff. We examine the extent to which JobKeeper cushioned employment losses in the first four months of the program. To do this, we use worker-level data from the Labour Force Survey and an identification strategy that exploits a threshold in eligibility to infer causality. We find that one in five employees who received JobKeeper (and, thus, remained employed) would not have remained employed during this period had it not been for the JobKeeper Payment. Given that 3½ million individuals were receiving the payment over the period from April to July 2020, this implies that JobKeeper reduced total employment losses by at least 700,000 over the same period. (RBA)

SOUTH KOREA: Starting Tuesday, indoor activities and after-dark businesses will be restricted around the Seoul capital region for two weeks amid fears of a third wave of coronavrius outbreaks. (Maeil)

TAIWAN: A two star Navy admiral overseeing U.S. military intelligence in the Asia-Pacific region has made an unannounced visit to Taiwan, two sources told Reuters on Sunday, in a high-level trip that could vex China. The sources, who include a Taiwanese official familiar with the situation, said the official was Rear Admiral Michael Studeman. They were speaking on condition of anonymity. According to the Navy's website, Studeman is director of the J2, which oversees intelligence, at the U.S. military's Indo-Pacific Command. (RTRS)

TAIWAN: The U.S. and Taiwan on Friday signed a memorandum of understanding to promote bilateral economic cooperation as both sides contemplate a bilateral trade agreement during President Donald Trump's final weeks in office. This opened the inaugural U.S.-Taiwan Economic Prosperity Partnership Dialogue, which is being held physically and virtually, where a Taiwanese delegation and American officials have discussed issues including clean 5G development, supply chain restructuring, energy and infrastructure. (Nikkei)

ASIA: Hong Kong and Singapore postponed the world's first quarantine-free travel bubble for two weeks after a surge of new coronavirus infections in Hong Kong, a setback for their flagship airlines and tourism businesses looking to kickstart a recovery. (BBG)

CANADA: Ontario officials announced new coronavirus lockdown measures for Toronto and Peel Region on Friday, as Canadian Prime Minister Justin Trudeau urged all residents to stay home, saying COVID-19 "cases across the country are spiking massively." Earlier on Friday, Trudeau warned that Canada's hospital system could be overwhelmed if COVID-19 cases spike as predicted."The cases across the country are spiking massively. We are facing a winter that's going to drive people inside more and more and we're really at risk of seeing caseloads go up and hospitals get overwhelmed and more loved ones dying," Trudeau said in televised remarks. "A normal Christmas is quite frankly right out of the question," he added. (Axios)

BOC: MNI BRIEF: BOC Balance Sheet +CAD8B to CAD537B

- The Bank of Canada's balance sheet assets grew CAD8 billion to CAD537 billion this week as holdings of government bonds expanded while T-bill holdings declined, according to figures posted Friday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

BRAZIL: Brazil's government plans to limit spending in January, Economy minister Paulo Guedes told the Valor Economico newspaper in an in interview. Private investment should be the growth engine, encouraged by new rules that have been approved, he says. Brazil has been adhering to a recommendation from the IMF to continue financial support while the nation faces a health crisis. "We have been practicing a gradual stimulus removal". (BBG)

RUSSIA: Russian President Vladimir Putin said he's ready to work with any U.S. leader, but still isn't ready to recognize the election victory of Joe Biden. (BBG)

RUSSIA: Russia imposed a travel ban on 25 U.K. officials in retaliation for sanctions on the same number of Russians adopted by the British government in July. The Russian Foreign Ministry said it would continue to respond to any further "unfriendly actions" by the U.K., according to a website statement on Saturday. (BBG)

SOUTH AFRICA/RATINGS: Sovereign rating reviews of note from Friday included:

- Fitch downgraded South Africa to BB-; Outlook Negative

- Moody's downgraded South Africa to Ba2, Outlook Negative

- S&P affirmed South Africa at BB-; Outlook Stable

MIDDLE EAST: Saudi Arabia says it should be a part of any potential negotiations between the incoming U.S. administration and Iran on a new nuclear deal, Foreign Minister Faisal bin Farhan Al-Saud told CNBC. Saudi Arabia seeks to partner with the U.S. administration on a potential new agreement, which would not only limit Iran's nuclear activities but also seek to address its "regional malign activity," Al-Saud told CNBC's Hadley Gamble on Saturday. (CNBC)

MIDDLE EAST: Saudi-Led coalition said it destroyed an explosive-laden drone launched by Yemen's Iran-aligned Houthi group towards the kingdom, Saudi state TV reported on Friday. (RTRS)

OIL: Leaders of the G20 member states have pledged to ensure "a stable and uninterrupted supply of energy" as the world recovers from the pandemic, according to a declaration published at the close of their summit in Riyadh Nov. 22. (Platts)

OIL: Abu Dhabi unveiled the discovery of 22bn barrels of unconventional oil reserves as the Gulf producer pledged $122bn in capital expenditure for its national oil company over the next five years. (FT)

OIL: A highly anticipated U.S. government report on the April 20 oil crash will stop short of blaming any specific traders or firms, and refrain from recommending structural changes for the crude market, said three people familiar with the matter. (BBG)

CHINA

CORONAVIRUS: While COVID-19 epidemic could rebound in some places in China, with at least three Chinese cities - Shanghai, Tianjin and Inner Mongolia's Manzhouli in North China - reporting COVID-19 infections in recent days, Chinese experts assured the public that the experience China has accumulated since earlier outbreaks this year would help the country cope with risk of a possible second wave of the epidemic mainly caused by imported goods. (Global Times)

CORONAVIRUS: Chinese consumers are more confident about domestic travel, but business travel is likely to trail leisure in a post-Covid-19 recovery, according to an HSBC survey released on Monday. Only 8 per cent of respondents said they were unlikely to undertake any domestic leisure travel, while half said they were unlikely to visit international destinations. (FT)

POLICY: China's local authorities must continue to tackle unemployment, create more jobs, help businesses and promote consumer spending, said Premier Li Keqiang in a video conference with local officials. Li's comments were cited in a statement on the government website on Sunday, and he went on to urge local governments to use public funding to encourage private investment and stabilize market expectations. (MNI)

PBOC: The PBOC is likely to keep liquidity ample to ensure a stable economic recovery and help banks control debt-servicing costs by renewing MLF and reverse repo purchases, the Shanghai Securities News said on Saturday citing Yan Se, an economist from Founder Securities. While the central bank kept the November LPR unchanged, loan-servicing rates for businesses are likely to further decline, the newspaper said citing analyst Wang Qing of Golden Credit Rating. Extraordinary policies introduced through the pandemic will only be withdrawn slowly over the next two years to avoid impacting on the real economy, Yan said. However, there may be some adjustments to rates and liquidity should the first quarter next year see a significant improvement in economic indicators, and if the demand for credit surges due to the risk of a capital market bubble, the newspaper reported citing Yan. (MNI)

YUAN: The Chinese currency is set to play a bigger role in global trade and investment in the wake of the pandemic, with the dominance of the US dollar in the international monetary system expected to decline, two Chinese central bank officials said on the weekend. Ding Zhijie, head of a research centre at the State Administration of Foreign Exchange, said the yuan had become a sought-after asset for global investors seeking stability and absolute returns as government bonds denominated in the US dollar, yen and euro offered little, or even negative, yields. "Whether you look at interest rates or exchange rates, yuan assets have clear advantages now [against assets denominated in other currencies]," Ding said on Saturday at the Understanding China Conference in the southern city of Guangzhou, an event hosted by China to promote the country's global influence. (SCMP)

BONDS: Chinese regulators must maintain order in debt markets with a "zero tolerance" approach and severely punish those who evade debt, issue debt with fraudulent information, misappropriate assets or misuse the capital raised, according to a statement following a meeting of the Financial Stability and Development Committee. A statement from the committee, chaired by Vice Premier Liu He, was posted on the government website and addressed the recent increase in bond defaults, attributing them to "cyclical, systemic and behavioral factors". Regulators must observe laws and implement accountability, said the committee. The meeting is the highest-level government response so far following bond market turbulence this month after high-profile defaults by companies including Yongcheng Coal and Electricity Group, a company owned by the central Henan government. (MNI)

OVERNIGHT DATA

AUSTRALIA NOV, P MARKIT M'FING PMI 56.1; OCT 54.2

AUSTRALIA NOV, P MARKIT SERVICES PMI 54.9; OCT 53.7

AUSTRALIA NOV, P MARKIT COMPOSITE PMI 54.7; OCT 53.5

Latest PMI data showed the recovery in the Australian private sector economy gained pace during November, setting the scene for a stronger GDP performance during the final quarter of 2020. A further easing of virus containment measures particularly benefited the services sector, which saw business activity growth accelerate in November. Manufacturing output also rose at a faster pace. A sustained increase in business activity saw firms boost their headcounts for the first time since January, with factory hiring particularly robust. Business confidence also improved to the strongest for over two years as firms were optimistic about market conditions returning to normal in a year's time. That said, the subdued rise in new business remains a concern. Renewed lockdown measures in parts of the world due to second waves of infections may keep border controls and travel restrictions in place for a longer period, thereby dampening external demand. If Australian sales growth continues to lag behind the rise in business activity in the months ahead, the current economic recovery could risk losing momentum. (IHS Markit)

NEW ZEALAND Q3 RETAIL SALES EX INFLATION +28.0% Q/Q; MEDIAN +19.0%; Q2 -14.8%

SOUTH KOREA NOV 1-20 EXPORTS +11.1% Y/Y; OCT -5.8%

SOUTH KOREA NOV 1-20 IMPORTS +1.3% Y/Y; OCT -2.8%

SOUTH KOREA OCT DEPARTMENT STORE SALES +4.2% Y/Y; SEP -6.2%

SOUTH KOREA OCT DISCOUNT STORE SALES +2.3% Y/Y; SEP +5.3%

CHINA MARKETS

PBOC NET DRAINS CNY10BN VIA OMOS MON

The People's Bank of China (PBOC) injected CNY40 billion via 7-day reverse repos with rates unchanged at 2.2% on Monday. This resulted in a net drain of CNY10 billion given the maturity of CNY50 billion of the Treasury's deposits at commercial banks today, according to Wind Information.

- The operations aim to maintain the liquidity in the banking system at a reasonable and ample level, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1853% at 09:31 am local time from the close of 2.2063% on Friday.

- The CFETS-NEX money-market sentiment index closed at 35 on Friday vs 38 on Thursday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5719 MON VS 6.5786

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.5719 on Monday, compared with the 6.5786 set on Friday.

MARKETS

SNAPSHOT: Positives Outweigh Negatives, As USD Edges Lower

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 is closed

- ASX 200 up 22.428 points at 6561.6

- Shanghai Comp. up 32.323 points at 3409.751

- JGBs are closed

- Aussie 10-Yr future up 1.5 ticks at 99.155, yield down 1.4bp at 0.848%

- U.S. 10-Yr future unch. at 138-16, cash Tsys are closed

- WTI crude up $0.11 at $42.53, Gold up $3.09 at $1874.09

- USD/JPY down 12 pips at Y103.74

- U.S. PLANS FIRST VACCINATIONS IN WEEKS, WARP SPEED HEAD SAYS (BBG)

- RTRS SOURCES POINT TO WIDENING OF U.S. LIST OF CHINESE FIRMS LINKED TO MILITARY

- FED CHAIR POWELL: WILL RETURN UNUSED MONEY TO TREASURY

- ECB'S LANE: EMERGENCY BOND PURCHASES TO LAST WHILE DISRUPTIONS PERSIST (RTRS)

- BREXIT MOOD MUSIC POSITIVE, EDGING TOWARDS DEAL, FAMILIAR ISSUES REMAIN

- UK & SOME OF EUROPE REPORTEDLY SET TO EASE COVID RESTRICTIONS AROUND CHRISTMAS

BOND SUMMARY: Japanese Holiday Limits Price Action

Core FI markets remain happy to operate in narrow ranges given the lack of meaningful macro headline flow evident since the re-open and the Japanese market holiday, looking through a more active Asia-Pac session for the FX space, in which the broader USD has ticked lower.

- T-Notes were happy to hold a narrow 0-02+ range early this week, last unchanged at 138-16, with cash Tsys closed owing to the Japanese holiday. Weekend developments seem to have all but ended any hope that Donald Trump held surrounding his legal campaign against the election process, as most expected, while Brexit, COVID & Sino-U.S. tensions continue to dominate headline flow elsewhere.

- In Australia, the local bond space was happy to look through a faster rate of expansion across the 3 major flash PMI readings, in addition to the latest round of fiscal developments. YM unchanged, XM +1.0.

EQUITIES: Generally Higher To Start The Week

Some pressure on the USD, generally upbeat Brexit mood music, solid South Korean trade data and focus on the more upbeat vaccine news (with the potential for another positive development on that front in the coming days, via the AstraZeneca trial) combined to support most of the regional equity markets during the first Asia-Pac session of the week, with liquidity thinned on the back of a holiday in Tokyo.

- Some also chose to look to the potential for the Fed to adjust its monetary policy in December, with a focus on the WAM of its Tsy purchases.

- Some local COVID worry seemingly resulted in pressure on the Hang Seng.

- E-minis ultimately moved higher after edging lower at the re-open.

- Nikkei 225 closed, Hang Seng -0.2%, CSI 300 +0.9%, ASX 200 +0.5%.

- S&P 500 futures +12, DJIA futures +105, NASDAQ 100 futures +46.

OIL: Little Changed In Asia

A downtick for the broader USD and a light bid in e-minis allowed WTI & Brent to add a handful of cents during Asia-Pac hours, building on the gains seen on Friday.

- In terms of weekend news flow, G20 leaders pledged to ensure "a stable and uninterrupted supply of energy," while the UAE pointed to US$122bn in oil and gas investments over the next 5 years, as the country looks to widen its production capabilities, even with the current OPEC+ limitations in play.

GOLD: No Challenge Of Lines In Sand

Spot last deals little changed, just shy of $1,875/oz, as it continues to coil within the confines of the recently established range, some distance away from the established key support and resistance levels. Real yields and the USD continue to be eyed, while a familiar mix of headline risk drivers remains apparent.

FOREX: GBP Rallies On Techs & Weekend Headlines, NZD Receives Boost From NZ Retail Sales Survey

Sterling showed some strength at the start to the week, racing to the top of the G10 pile on the back of technical and fundamental tailwinds. BBG sources cited positioning for buy-stops above Nov 11 & 18 highs of $1.3312 amid liquidity thinned by a Japanese public holiday. Cable accelerated gains upon the breach of that figure, printing best levels since early Sep. On the fundamental side, the UK and Canada agreed to keep their current trading conditions post-Brexit and enter talks on a broader deal, UK Cll'r was set to announce a boost to spending on public services Wednesday, while the Telegraph reported that UK regulators could give a green light for the Pfizer Covid-19 vaccine within a week. In a separate piece, the Telegraph reported that UK PM Johnson is set to reach out to European Commission Pres von der Leyen in a bid to "clear away the final barriers to a deal which both sides now believe is well within reach", albeit the article pointed to familiar sticking points.

- NZD was another top G10 performer, following the release of a strong quarterly retail sales survey out of New Zealand. Retail sales ex inflation surged 28.0% Q/Q in Q3, easily beating expectations of a 19.0% increase, boosted as the country lifted lockdown restrictions.

- Safe havens traded on the back foot, with USD leading losses amid some positive musings surrounding Covid-19 vaccine/treatment matters. News and data flow in Asia hours was thin, with Japan having a day off, leaving participants to reflect on weekend headlines and familiar risks.

- ZAR took a hit early on, in the wake of Friday's downgrade to South Africa's credit ratings from Fitch & Moody's, but the rand recovered thereafter.

- KRW inched higher after early South Korean trade data showed a continued recovery in shipments, even as local coronavirus worry continued to linger.

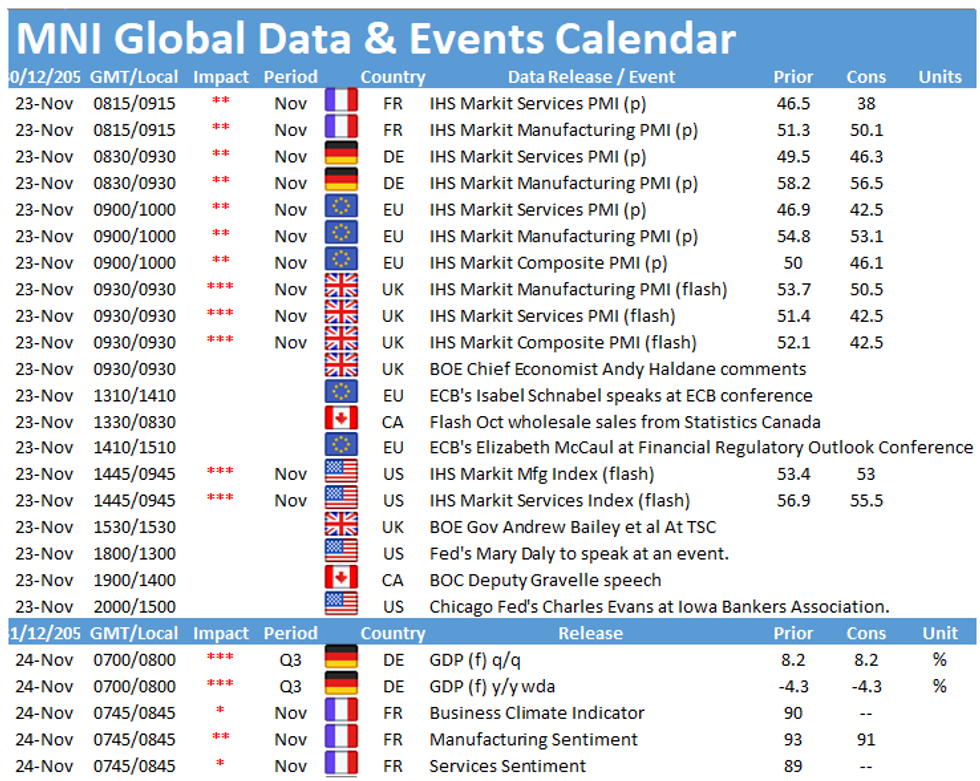

- Focus turns to a slew of preliminary PMI readings from across the globe, as well as comments from Fed's Barkin, Daly and Evans, BoE's Bailey, Haldane, Tenreyro & Saunders, ECB's Schnabel & BoC's Gravelle.

FOREX OPTIONS: Expiries for Nov23 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1700(E1.1bln), $1.1800-10(E563mln), $1.1850-60(E792mln)

- USD/JPY: Y105.15-25($540mln)

- GBP/USD: $1.3295-1.3305(Gbp647mln-GBP calls)

- EUR/GBP: Gbp0.8899-8900(E443mln-EUR puts)Gbp0.8990(E659mln)

- USD/CNY: Cny6.65($600mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.