-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Asia Cautious, Weighs Familiar Themes

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

- UK AND EU READY TO RESUME BREXIT TALKS ROILED BY CORONAVIRUS (BBG)

- GERMANY PLANS NEARLY EUR180BN IN NEW DEBT FOR 2021 (RTRS)

- ECB'S PANETTA OPEN TO CASE-BY-CASE RESUMPTION OF BANK DIVIDENDS (BBG)

- DOUBTS RAISED OVER ASTRAZENECA-OXFORD VACCINE DATA (FT)

- TRUMP TO GIVE AWAY POWER IF ELECTORAL COLLEGE PICKS BIDEN

Fig. 1: DXY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: MNI INTERVIEW: Covid Will Scar UK Economy, OBR's Bean Says

- The UK economy is likely to emerge deeply scarred from the Covid shock despite good news on vaccines, former Bank of England Deputy Governor Charles Bean told MNI, pointing to potential hits to productivity growth from corporate debt overhangs, skill shortages and a shrinking labour force - for more details please contact sales@marketnews.com.

CORONAVIRUS: Boris Johnson has said a new year lockdown would be needed without a tougher tier system under which indoor socialising will be banned across 99 per cent of England. The prime minister warned against "taking our foot off the throat of the beast" as he defended moving 28 million people previously subject to the lowest levels of restrictions up into Tiers 2 and 3 when the current lockdown ends next week. Chris Whitty, the chief medical officer for England, urged people not to hug elderly relatives at Christmas "if you want them to survive to be hugged again". (Times)

CORONAVIRUS/POLITICS: Boris Johnson faces a potentially perilous battle to get England's new coronavirus tiers plan through parliament after dozens of Conservative MPs protested at the curbs for their areas and demanded to see the evidence behind them. Some MPs predicted that, without significant change between now and Tuesday, when the vote on the system to replace the current England-wide lockdown takes place, as many as 70 Conservatives could vote against the plan or abstain. This could mean relying on Labour for the vote – which takes place on the day the lockdown lapses under law – to pass. Particular vehemence came from Tories who found their areas moved from tier 1 under the pre-lockdown system to tier 2 or, in the case of Kent, to the most rigorous restrictions of tier 3 starting at 00.01 on Wednesday 2 December. (Guardian)

CORONAVIRUS/POLITICS: Sir Graham Brady, Tobias Ellwood and Sir Robert Syms are among those planning to vote against the Government next week, with the 1922 Committee chairman blasting the "authoritarian" measures. But the Prime Minister defended his approach, saying: "The tiered approach was delivering, it was slowing the virus down and that's why a tiered, reasonable approach is the right way to go now." He signalled that mass community testing was the way out of Tier 3 restrictions, saying it involved "everybody working together to kick Covid out". Noting it was possible for people to escape the toughest restrictions, he added: "Your Tier is not your destiny." (Telegraph)

CORONAVIRUS: More than 34m people in England - over half of the population - are now facing tougher local Covid restrictions when the national lockdown lifts next month, Telegraph analysis has found. Around 29.5m are being moved into the next strictest local lockdown tier while 4.6m are moving up two levels, under root-and-branch changes to England's local lockdown map revealed on Thursday. Only 1.8m - 3 per cent - of the population will see local rules loosened, as the Liverpool city region fell from the highest tier. All in all, the Government's latest lockdown allocations means that all but 1.3 per cent of the country will be in the highest tiers of local restrictions by December 2. (Telegraph)

FISCAL: Boris Johnson is likely to have to break his manifesto pledge not to raise income tax, VAT or national insurance to help repair Britain's coronavirus-ravaged finances, economists have said. During the general election Mr Johnson promised to retain the triple lock on tax increases, severely limiting the government's room for manoeuvre as it seeks to stabilise national debt. The Institute for Fiscal Studies (IFS) said that the government would need to find £40 billion worth of savings or tax rises. (Times)

FISCAL: Chancellor Rishi Sunak came under fire on Thursday for leaving more than 6m of the UK's poorest households under threat of a £1,000 cut in their annual income just as unemployment is due to peak next year. Official forecasts published alongside Mr Sunak's spending review show the UK faces a long squeeze on living standards following the coronavirus crisis, with the economy set to be 3 per cent smaller and average earnings £1,200 a year lower even in 2025, relative to pre-pandemic expectations. (FT)

POLITICS: Boris Johnson has appointed a former investment banker who worked as George Osborne's principal private secretary as his new chief of staff. Dan Rosenfield, who left the Treasury in 2016, will become one of the most powerful figures in Downing Street after the departure of Dominic Cummings. (Times)

POLITICS: Jeremy Corbyn is to start a formal legal claim against the Labour party for suspending the whip, in a case which allies of the former Labour leader say is intended to prove there was a deal with Keir Starmer's office to readmit him to the party. The Guardian has seen evidence of exchanges between key members of Starmer's office and Corbyn's representatives, suggesting there were private meetings in the run-up to the party's decision to lift his suspension from the party. (Guardian)

BREXIT: U.K. and European Union negotiators are poised to resume face-to-face trade talks this weekend after key officials involved in the discussions were forced into quarantine. Michel Barnier, the EU's chief negotiator, will on Friday update diplomats from the bloc's 27 governments on the state of the negotiations, according to officials with knowledge of the discussions. He will also brief fishing ministers from coastal states as part of his round of regular updates -- but the meeting is significant because fishing rights have been a longstanding roadblock to a wider trade deal. Barring any last-minute changes to the plan, the EU negotiating team is preparing to travel to London to resume talks on Saturday, according to one EU official. Another said this was yet to be confirmed. (BBG)

BREXIT: The European Union's Chief Brexit Negotiator Michel Barnier has called a meeting of fisheries ministers from eight coastal states, including Ireland, for tomorrow, RTÉ News understands. The meeting comes at a critical stage in the EU-UK future relationship negotiations. The meeting will be held by video conference. Fisheries remains one of three most difficult issues in the negotiations, according to officials. It comes as talks on the final outstanding issues toward reaching a post-Brexit EU-UK trade deal were described by Minister for Foreign Affairs Simon Coveney as "very, very difficult". The issues which remain to be resolved are those around governance, level playing field, and fisheries.

BREXIT: European Union assessments of whether to grant market access for UK banks and other financial firms will not be completed in time for January, sources in the bloc said on Thursday as the estranged allies make a final push for a free trade deal. Britain's unfettered access to the EU market under post-Brexit transition arrangements ends on Dec. 31, leaving the City of London faced with being cut off from its biggest export customer, worth around 26 billion pounds a year. The many separate EU assessments are being made by the European Commission, which declined to comment on Thursday, under the bloc's system of direct financial market access known as equivalence. "The European Commission told member states on Thursday that the equivalence decisions won't be ready from January 1," said the EU diplomat, who took part in the closed-door briefing. (RTRS)

BREXIT: Britain and the European Union can clinch a Brexit trade deal and the shape of one is clear but London will not sign up to an accord at any cost, Prime Minister Boris Johnson's finance minister said on Thursday. (RTRS)

SCOTLAND: Scotland should hold a new independence referendum early in the next parliamentary session, First Minister Nicola Sturgeon said, as polls show consistent support for breaking away from the rest of the U.K.CScotland is scheduled to hold elections to its devolved Edinburgh parliament in May, with recent polls predictingthat Sturgeon's SNP could win decisively. Even though Scotland voted against leaving the U.K. in the previous independence vote in 2014, Brexit, which Scots voted against, has led to increased support for separation. (BBG)

EUROPE

ECB: "The consensual idea in the ECB Governing Council is that our instruments need to be recalibrated in December," ECB Executive Board member Fabio Panetta says about the ECB's next Governing Council meeting in an interview with Portuguese weekly newspaper Expresso. "There shouldn't be doubt about our commitment to make inflation return to our objective and to the continuity of our policies, even when the recovery is ongoing." "We want to see inflation converging in the direction of our objective in a sustained way and we can't hesitate to take decisive measures if we want to avoid the risk of a downward adjustment of the inflation outlook. We have firepower, we have instruments that we can recalibrate and we will do it." "Financing conditions are favorable. We were clear in expressing that we would ensure that they will remain favorable and our indications about forward guidance make our commitment explicit." (BBG)

ECB: European Central Bank Executive Board member Fabio Panetta said he's open to allowing some banks to resume paying dividends as the economy improves.Panetta said that while he would prefer that lenders be "prudent" and hold off from payouts, he understands that approach comes with costs. Banks have been frustrated by lagging share prices that could make it harder for them to attract investors. "If they don't distribute dividends this year, they can distribute more next year and in the meantime they will be in a better position to face a situation of serious crisis," Panetta said in an interview with Portuguese newspaper Expresso."If I had to choose between the two approaches, I would opt to be more prudent, but that could imply a cost for banks," he said. "I consider that a reasonable solution, as economic conditions improve, would be a case-by-case approach by banking supervision authorities." (bbg)

EU: The leaders of Poland and Hungary doubled down on their threat to veto the EU's €1.8 trillion budget and coronavirus recovery package on Thursday, rejecting efforts to tie the spending to the rule of law. Following a meeting in Budapest, Polish Prime Minister Mateusz Morawiecki and his Hungarian counterpart Viktor Orbán released a joint declaration that committed them to continue the fight: "We have decided to align our positions on these issues. Neither Poland, nor Hungary will accept any proposal that is deemed unacceptable by the other." Morawiecki warned that tying cash to democratic standards is "extremely dangerous for European unity. This is a bad solution which creates the danger of the breakup of the union." The hardening of the Polish-Hungarian position — which comes despite intensive attempts by German Chancellor Angela Merkel to settle the dispute — means EU leaders are now heading for a major clash on rule of law at their upcoming European Council summit on December 10-11. While Warsaw and Budapest are adamant that they won't accept what they call "arbitrary" rule of law provisions, the rest of the bloc and the European Parliament insist they won't give way on a principle they feel defines the EU's fundamental values. (Politico)

EU: The Italian and German governments are pushing for an EU-wide closure of ski resorts over the Christmas holidays in order to stave off another coronavirus surge in the new year. But Austria has other plans — as does non-EU member Switzerland. (Politico)

GERMANY: Germany plans to borrow almost 180 billion euros ($214.60 billion) next year, nearly double the amount initially foreseen, as Berlin extends aid measures to mitigate impact of the COVID-19 pandemic on Europe's biggest economy, lawmakers told Reuters on Friday. Germany's parliamentary budget committee of lawmakers agreed on the plans in the early hours of Friday after 17 hours of talks, saying it is the second largest amount of net new borrowing in the history of post-war Germany. "The new borrowing is the right thing to do. You cannot save your way through a crisis," said Greens lawmaker Sven-Christian Kindler. Planned new debt of 179.82 billion euros for next year compares to 96 billion euros initially envisaged by Finance Minister Olaf Scholz in September. (RTRS)

GERMANY: German Chancellor Angela Merkel defended the extension of Germany's partial lockdown in a speech to lawmakers Thursday. She said current lockdown measures had enjoyed some success, but more was needed to avoid the health system being overwhelmed. "Our goal is and remains to reduce the number of infections to such an extent that the health authorities are once again able to recognise and interrupt infection chains," Merkel stressed. She said this would be achieved if the number of new infections per 100,000 inhabitants fell below 50 within seven days. In most regions of Germany, the figure is currently significantly higher. Merkel said Germany is hoping to have ski resorts closed down across the European Union this year, but were being thwarted by Austria. (Deutsche Welle)

GERMANY: Germany's "lockdown lite" is likely to go on into the new year, as Angela Merkel, said the country would have to live with restrictions "for the foreseeable future", and her chief of staff said some restrictions would stay in place into March. In a TV interview on Thursday morning, the chancellor's chief of staff, Helge Braun, said life would not immediately return to normal with the start of the new year. "Difficult winter months lie ahead of us," Braun told the German broadcaster RTL. "That will continue until March." (Guardian)

FRANCE: France reported 13,563 new coronavirus infections on Thursday, compared with 16,282 on Wednesday and 21,150 a week ago, suggesting the spread of the virus continued to slow in the fourth week of a national lockdown. (Guardian)

FRANCE: Prime Minister Jean Castex made the comments at a press briefing in Paris on Thursday where he sought to reassure the French public that while progress had been made to reduce the Covid-19 infection rate there would be no "premature" lifting of the latest lockdown measures. Castex said the R rate, which measures the spread of a virus per each person infected, was now at 0.65 countrywide, the same level France reached at the end of an initial three-month lockdown in the spring. An R rate of 1.0 means that each infected person is spreading the virus to one other person, keeping community-wide infection rates steady. "Your efforts are paying dividends," Castex said. "Pressure from the pandemic is easing and it is easing more in France than in other European nations." (France24)

FRANCE: The head of press advocacy group Reporters Without Borders (RSF) said on Thursday France's prime minister promised to set up an independent commission to examine a proposed law that will curb journalists' ability to show images of police officers at work. RSF Secretary General Christophe Deloire said in a Twitter post he met Prime Minister Jean Castex to talk about the legislation, and that Castex told him at the meeting about his intention to set up the commission. The prime minister's office confirmed in a statement that the government intended to establish an independent commission tasked with proposing a new version of the draft bill. It said that judges and "qualified personalities" would be on the commission, which would publish recommendations at the end of December, ahead of a debate on the bill in the opposition-controlled Senate in January. (RTRS)

ITALY: Italy will open its borders to quarantine-free flights from the U.S. for the first time since the imposition of Covid-19 travel curbs. The waiver, backed by rigorous testing before departure and on arrival, is the first on a trans-Atlantic route, according to Delta Air Lines Inc., whose flights from Atlanta to Rome Fiumicino will trial the new rules. Alitalia will serve the Italian capital from New York John F. Kennedy airport on the same basis. The International Air Transport Association told Bloomberg that it knows of no other quarantine-exempt services from the U.S. to Europe. (BBG)

POLAND: The European Parliament accused Poland's nationalist government on Thursday of improperly influencing a court that imposed a near-total ban on abortion, and said that showed that the rule of law had collapsed in Poland. The head of the court hit back, accusing the European Parliament of "unprecedented" interference in Polish affairs - the latest in a series of clashes between institutions in Warsaw and Brussels. Hundreds of thousands of Poles have taken to the streets since an Oct. 22 Constitutional Tribunal ruling that sharply limited Poland's already restrictive abortion laws. The protests have seen a broader outpouring of anger at Poland's nationalist rulers, with many criticising government judiciary reforms they say have allowed ruling Law and Justice (PiS) party to hand pick judges. (RTRS)

U.S.

POLITICS: President Donald Trump said Thursday that he will leave the White House if the Electoral College formalizes President-Elect Joe Biden's victory — even as he insisted such a decision would be a "mistake" — as he spent his Thanksgiving renewing baseless claims that "massive fraud" and crooked officials in battleground states caused his election defeat. "Certainly I will. But you know that," Trump said Thursday when asked whether he would vacate the building, allowing a peaceful transition of power in January. But Trump — taking questions for the first time since Election Day — insisted that "a lot of things" would happen between now and then that might alter the results. As for whether or not he plans to formally declare his candidacy to run again in 2024 — as he has discussed with aides— Trump he didn't "want to talk about 2024 yet." (AP)

OTHER

GLOBAL TRADE: The European Union removed tariffs on U.S. lobster, making good on a pledge meant to improvetransatlantic trade ties strained by the "America First" agenda of outgoing President Donald Trump.The European Parliament voted on Thursday in Brussels to scrap the import duties, which range from 6% to 16%depending on the type of lobster. In return, the U.S. is cutting by 50% its levies on a handful of EU goods including crystal glassware (excluding drinking glasses), cigarette lighters, prepared meals and propellantpowders. The "mini" deal reached by both sides' trade chiefs in August marked a rare moment of consensus amid sharp disagreements. These include Trump's tariffs on European metals based on national-security grounds, his threats to hit EU cars and auto parts with duties on the same basis, and U.S. moves to impose levies on goods from the bloc as retaliation over digital taxes in Europe." Hopefully, this package of tariff reductions will pave the way toward further balanced, more ambitious and comprehensive negotiations with the U.S.," said Bernd Lange, German chair of the EU Parliament's tradecommittee. (BBG)

CORONAVIRUS: Disquiet is growing over the way that Oxford university and AstraZeneca have handled the early readout from trials of their coronavirus vaccine, which much of the developing world may rely on to emerge from the pandemic. The results were hailed a success for showing an average efficacy of 70 per cent — a figure reached by pooling the results from cohorts on two different dosing regimens. One set of participants received two identical doses a month apart, while the other group received a half-dose, and then a full dose. The efficacy for the first, larger group was 62 per cent. In the second subgroup, it was 90 per cent. It has emerged that administration of the half-dose started with a mistake. It was then given to a smaller number of participants than those who received two full doses, making the discovery of its greater effectiveness look like a lucky break. (FT)

CORONAVIRUS: Russia said its Sputnik V vaccine is 92% effective at protecting people from COVID-19, according to interim trial results, while AstraZeneca said its COVID-19 vaccine was 70% effective in pivotal trials and could be up to 90% effective. "If they go for a new clinical trial, we suggest trying a regimen of combining the AZ shot with the #SputnikV human adenoviral vector shot to boost efficacy," the developers of the Russian vaccine said on their Twitter account. "Combining vaccines may prove important for revaccinations." (RTRS)

JAPAN: A new adviser to Japanese Prime Minister Yoshihide Suga says a stimulus plan being drafted now should be more than double the size expected by investors if it is to prevent mass job losses and thousands of suicides. Yoichi Takahashi, one of Suga's six new economic advisers, says the government needs to spend 40 trillion yen ($384 billion) in its third extra budget to stop a surge in unemployment and prevent the suffering that would come with it. A more modest aid package of 10 to 15 trillion yen is what bond traders are forecasting now. "The number may surprise people but, theoretically speaking, it's needed," said Takahashi, a professor of economics at Tokyo's Kaetsu University, in an interview this week. "We need to put the fire out before it spreads to more rooms." That advice is likely to meet resistence from finance ministry officials who must manage the developed world's heaviest public debt burden, even as the government tries to prevent rising waves of the coronavirus from derailing the recovery. Japan has already budgeted about 58 trillion yen to fight the crisis, more than many other governments relative to the economy's size. (BBG)

JAPAN: An extra budget being drafted now must help Japan's economy transition into a post-pandemicera, rather than simply supporting the status quo, finance minister Taro Aso tells reporters Friday. (BBG)

AUSTRALIA/CHINA: China is set to impose anti-dumping duties of more than 100% on Australian wine from this weekend, adding to a series of sweeping trade reprisals this year and further escalating tensions with Canberra. The anti-dumping deposits will take effect Nov. 28 and range from 107.1% to 212.1%, the Chinese Ministry of Commerce said in a statement Friday. Australia responded by warning Beijing that its actions could create a perception among businesses and countries around the world that trade with China is risky. The duties come just three months after China started an anti-dumping and anti-subsidy investigation into Australian wine, and follows a raft of other measures barring imports from coal to copper to barley this year. China is the biggest buyer of Australian wine, importing A$1.2 billion ($880 million) in the year through September, according to government marketing body Wine Australia. That's 167% more than the value of exports to its next biggest market, the U.S. (BBG)

AUSTRALIA: Australia's underlying cash deficit was A$104.1 billion for the 2020-21 financial year through Oct. 31 compared with the budget forecast of a A$107.6 billion deficit in that period, the government says in a statement on its website. (BBG)

AUSTRALIA: Australia's second-largest state, Victoria, once the country's COVID-19 hotspot, said on Friday it has gone 28 days without detecting any new infections, a benchmark widely cited as eliminating the virus from the community. (RTRS)

SOUTH KOREA: Prime Minister Chung Sye-kyun said Friday that South Korea has confirmed more than 500 COVID-19 infections for the second consecutive day and warned that the virus appears to be spreading again in earnest nationwide. "As the number of newly confirmed COVID-19 patients reached above 500 for the second straight day (as of the start of Friday), it's a situation in which a resurgence is getting into full swing in our country as well," Prime Minister Chung Sye-kyun said during a meeting of the Central Disaster and Safety Countermeasure Headquarters at the government complex in Seoul. (Yonhap)

NORTH KOREA: North Korea has greeted the last two U.S. presidents with tests of missiles or nuclear bombs within weeks of taking office. And experts see the same happening with Joe Biden, whom the regime has called "a rabiddog." (BBG)

BOC: MNI POLICY: BOC Has Lots of Room to Boost QE if Needed

- Bank of Canada Governor Tiff Macklem said Thursday he has plenty of scope to expand QE if the economy requires, and other options such as yield curve control and perhaps a slight reduction of the 0.25% policy interest rate - for more details please contact sales@marketnews.com.

CANADA: MNI POLICY: Canada Defers Setting New Borrowing Limit

- Canadian Finance Minister Chrystia Freeland has deferred setting a precise higher government borrowing limit that was due this week, saying she will instead introduce other legal changes later to include emergency spending on the pandemic - for more details please contact sales@marketnews.com.

BRAZIL: Raising the minimum wage is not a possibility due to federal government spending on retirees and pensioners President Jair Bolsonaro said on his weekly live event in social networks. Bolsonaro celebrated the creation of 394 thousand new formal jobs in Brazil in October and said that the economy recovers in V, recalling the speech of Economy Minister Paulo Guedes Government plans to create the "My First Company" program to encourage entrepreneurship in the country, according to the president. (BBG)

MALAYSIA: Malaysia's Parliament approved the government's proposed 2021 budget on Thursday, throwing a political lifeline to embattled Prime Minister Muhyiddin Yassin amid strong resistance to his 9-month-old leadership. (CNBC)

TURKEY: Turkey on Friday ended a mechanism meant to encourage commercial banks to boost credit, reversing a key policy of former Treasury and Finance Minister Berat Albayrak. The central bank ended the rule, which allowed lenders to park smaller amounts with the monetary authority than otherwise required provided they met officially designated lending targets, according to a decree published in the Official Gazette. Friday's regulation raised so-called "required reserves" -- lira and foreign exchange that lenders must hold at the central bank -- for certain maturities. The decision cements efforts by Turkey's new economic managers to reverse the interventionist policies spearheaded by Albayrak, who resigned earlier this month. Policy makers, including new central bank Governor Naci Agbal, are mindful that their market-friendly U-turn could initially mean more volatility for the lira. Still, their pledge to return to market orthodoxy has generally been welcomed by investors. (BBG)

TURKEY: Qatar announced on Thursday a series of high-profile investments in Turkey, its biggest ally in a years-long rift with Gulf heavyweights Saudi Arabia and the United Arab Emirates, including the purchase of a stake in the country's main bourse. Doha-based sovereign wealth fund Qatar Investment Authority signed a memorandum of understanding with its Turkish counterpart known as TWF to purchase a 10% stake in Borsa Istanbul AS. The agreement for a minority stake in the company that runs the main Turkish stock exchange, for an undisclosed amount, was unveiled at a ceremony at the presidential palace in Turkey's capital Ankara. It was overseen by Turkish President Recep Tayyip Erdogan and Qatari Emir Sheikh Tamim bin Hamad Al Thani. (BBG)

TURKEY: A year of crisis for the lira has kept Turks buying gold at a record pace. Now the appetite for more bullion risks becoming a drag on the currency just as a rally struggles to regain momentum. In the two weeks after President Recep Tayyip Erdogan cleared out the leadership ranks blamed for failing to stabilize the lira and draining reserves, Turkish retail investors and firms added $2.2 billion to their gold holdings in the past two weeks, taking them to $36.4 billion, or almost triple the total last year, central bank data showed. (BBG)

IRAQ: The Iraqi military is training a former member of an Iran-backed militia, who is under U.S. sanctions for killing protesters, to become a high-ranking officer in the army, according to six government, security and militia officials. They said that Hussein Falih Aziz, known as Abu Zainab al-Lami, had been sent to Egypt with Iraqi officers for a year-long training normally reserved for the country's military personnel. A defence ministry document seen by Reuters showed his name, with the rank Major General, on a list of officers attending the training until next summer. (RTRS)

VENEZUELA: Venezuela has resumed direct shipments of oil to China after U.S. sanctions sent the trade underground for more than a year, according to Refinitiv Eikon vessel-tracking data and internal documents from state company Petroleos de Venezuela (PDVSA). Chinese state companies China National Petroleum Corp (CNPC) and PetroChina - long among PDVSA's top customers - stopped loading crude and fuel at Venezuelan ports in August 2019 after Washington extended its sanctions on PDVSA to include any companies trading with the Venezuelan state firm. (RTRS)

AFRICA: Mass vaccination against Covid-19 is unlikely to start in Africa until midway through next year and keeping vaccines cold could be a big challenge, the continent's disease control group said on Thursday. "We are very concerned as a continent that we will not have access to vaccines in a timely fashion," said John Nkengasong, director of the Africa Centres for Disease Control and Prevention, an African Union agency. (Guardian)

OIL: OPEC's president said the group must remain cautious, as its internal data pointed to the risk of a new oil surplus early next year if the cartel and its allies decide next week to go ahead with a supply hike. While crude prices have rallied to an eight-month high of $45 a barrel in New York this week, the surge may prove fragile, Algerian Energy Minister Abdelmadjid Attar -- who this year holds OPEC's rotating presidency -- said in a phone interview. The 23-nation OPEC+ coalition, led by Saudi Arabia and Russia, will gather on Monday and Tuesday to decide whether to proceed with a production increase of 1.9 million barrels a day scheduled for January. The coalition has signaled it's inclined to delay the hike. "OPEC+ will have to maintain its course and its uniqueness if we want to achieve a fair price in the interest of all," Attar said. (BBG)

OIL: Saudi Arabia has used its year in the G20 presidency to promote its circular carbon economy scheme, which it says will lower carbon emissions if adopted worldwide, while maintaining abundant energy supplies. The circular carbon economy concept has been endorsed by G20 member states but has yet to be put into practice, and the kingdom has not revealed any timelines or targets associated with the plan. The Saudi climate change mitigation scheme is based on "four R's" -- reduction, reuse, removal and recycling of carbon -- aimed at lowering the amount of carbon emissions being released into the atmosphere. Under this umbrella, initiatives such planting trees as natural carbon sinks, and increasing the capacity of carbon capture storage, sequestration and utilization projects, have been proposed by Saudi Arabia. Notably, presentations on the topic given recently by Saudi energy minister Prince Abdulaziz bin Salman did not mention any reduction in hydrocarbon production. (Platt's)

CHINA

PBOC: China's central bank is likely to continue marginal easing into next year, the Securities Times reported citing Ming Ming, Deputy Director of CITIC Securities Research Institute. Speaking after the release of the PBOC Q3 Monetary Policy Implementation Report, Ming said the central bank may focus on controlling the credit supply and keep the macro leverage ratios basically stable. The current inter-bank liquidity is relatively low, and continued tightening may cause a "policy cliff" and rapid deleveraging which would not be conducive to economic development, Ming said. (MNI)

PBOC: China is very likely to exit from some of its stimulus measures as the economy improves, but there won't be any interest rate hike soon, a leading state newspaper said on its front page Thursday."If previous rounds of withdrawing stimulus policies are a guide, 'tight money' and 'tight credit' are inevitable, and policy rate hikes are also normal," the China Securities Journal said. "However, we shouldn't see the monetary authority proactively raising the policy rate for some time to come." (BBG)

ECONOMY: China May Average 5% Growth Through 2025: Advisor

- China has the potential to set and achieve average annual growth of about 5% for the next five years after reaching 2-3% this year, although targets for 2021-2022 may be suspended to adjust for the skewing caused by the pandemic this year, Li Xuesong, a senior policy advisor told reporters Friday - for more details please contact sales@marketnews.com.

ECONOMY: More global investors are betting on China's stable economy, fast-improving trade structure and low asset valuations and are going long on their Chinese investments, said Securities Times in a commentary. The upward trend in both Chinese stock markets and the yuan exchange rate in the past few months has attracted faster capital inflows, while the continued appreciation of the yuan will increase the value of yuan assets and further attract capital, the newspaper said. Investors are now fearing they will lose out if they do not invest in China, the commentary said. (MNI)

CHINA/U.S.: The incoming Biden administration will be judged on how constructive it can be in managing its differences and in seeking coexistence with China, the Global Times said in an editorial. Major U.S. allies all have extensive cooperation with China and their strengthening alliances with the U.S. do not mean decreasing ties with China, the newspaper said. China's economic expansion gives it the right to partake in rule-making with other countries, even as the U.S. accuses China of trying to supplant its own dominance, the Times said. (MNI)

OVERNIGHT DATA

CHINA OCT INDUSTRIAL PROFITS +28.2% Y/Y; SEP +10.1%

JAPAN NOV TOKYO CPI -0.7% Y/Y; MEDIAN -0.7%; OCT -0.3%

JAPAN NOV TOKYO CORE CPI -0.7% Y/Y; MEDIAN -0.6%; OCT -0.5%

JAPAN NOV TOKYO CORE-CORE CPI -0.2% Y/Y; MEDIAN -0.2%; OCT -0.2%

NEW ZEALAND NOV ANZ CONSUMER CONFIDENCE 106.9; OCT 108.7

NEW ZEALAND NOV ANZ CONSUMER CONFIDENCE -1.7% M/M; OCT +8.7%

Consumer confidence was down 1.8pts to 106.9 in November, with the current and future conditions indexes falling by similar amounts. Consumer confidence remains under par – its historical average is around 120. Households are increasingly confident that the housing boom is going to continue, though this indicator does tend to lag the market rather than predict it. But they remain wary about whether it is a good time to buy a major household item. The latter has historically been the best retail spending indicator in the survey. It did not presage the sharp lift in retail sales seen in Q3. But there's no reason to think that the indicator will be wrong once the volatility subsides. Accordingly, we expect that as one-offs wane, retail spending growth will drop back to something more sustainable. (ANZ)

CHINA MARKETS

PBOC NET INJECTS CNY40BN VIA OMOS FRI

The People's Bank of China (PBOC) injected CNY120 billion via 7-day reverse repos with rates unchanged at 2.2% on Friday. This resulted in a net injection of CNY40 billion given the maturity of CNY80 billion repos today, according to Wind Information.

- The operation aims to maintain the liquidity in the banking system at a reasonable and ample level, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2239% at 09:25 am local time from the close of 2.3444% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 33 on Thursday vs 43 on Wednesday,. A lower index indicates decreased market expectations for tighter liquidity

PBOC SETS YUAN CENTRAL PARITY AT 6.5755 FRI VS 6.5780

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.5755 on Friday, compared with the 6.5780 set on Thursday.

MARKETS

SNAPSHOT: Asia Cautious, Weighs Familiar Themes

Below gives key levels of markets in the second half of the Asia-Pac session:

- UK AND EU READY TO RESUME BREXIT TALKS ROILED BY CORONAVIRUS (BBG)

- GERMANY PLANS NEARLY EUR180BN IN NEW DEBT FOR 2021 (RTRS)

- ECB'S PANETTA OPEN TO CASE-BY-CASE RESUMPTION OF BANK DIVIDENDS (BBG)

- DOUBTS RAISED OVER ASTRAZENECA-OXFORD VACCINE DATA (FT)

- TRUMP TO GIVE AWAY POWER IF ELECTORAL COLLEGE PICKS BIDEN

- Nikkei 225 up 121.08 points at 26659.01

- ASX 200 down 35.274 points at 6601.1

- Shanghai Comp. up 2.77 points at 3372.503

- JGB 10-Yr future down 6 ticks at 152.04, yield up 0.4bp at 0.030%

- Aussie 10-Yr future up 1 tick at 99.1, yield down 1.1bp at 0.901%

- U.S. 10-Yr future +0-05 at 138-13+, yield down 2.46bp at 0.857%

- WTI crude down $0.87 at $44.84, Gold down $9.56 at $1806.23

- USD/JPY down 32 pips at Y103.94

BOND SUMMARY: Core FI Pull Back After Early Uptick, Soft 2-Year JGB Auction Adds Pressure

T-Notes jumped in early Tokyo trade, moving above Thursday highs as a mild sense of broader caution emerged. The contract peaked at 138-17+ and reversed its course, eventually wiping out earlier gains. It last trades +0-05 at 138-13+. Cash Tsy curve bull flattened upon returning from holidays. Yields last sit 0.4-2.8bp richer, off lows & flats. Eurodollar futures trade unch. to +0.5 tick through the reds. U.S. President Trump held a press conference, noting that he will relinquish power once the Electoral College chooses Joe Biden, but refused to comment on his presence at his successor's inauguration and potential for his renewed presidential bid in future.

- JGB futures edged higher early on, peeking above overnight highs, before turning its tail. The sell-off resumed after lunch, with a soft auction of 2-Year JGBs (underwhelming bid/cover ratio of 3.21x, relatively long tail, low price lower than exp.) adding some fresh pressure. The contract trades at 152.06, 4 ticks shy of last settlement. Cash JGB yields trade mixed, little changed at typing. 20s & 40s lagged early on, after Japanese bond dealers said yesterday that the market could digest more issuance of these tenors. Tokyo CPI report showed continued, faster than exp. deflation. News flow revolved around local coronavirus matters/the third extra budged being drafted by the government, with PM Suga's adviser pointing to the need for a more sizeable stimulus than forecast by bond traders. Looking ahead, the BoJ will release its Dec bond-buying plan later today.

- In Australia, YM -1.0 & XM +1.0, after pulling back. Cash ACGB yields trade -1.3bp to +0.1bp across the flatter curve. Bills last seen unch. to -1 tick through the reds. The AOFM auctioned A$1.5bn worth of ACGB 0.50% 21 Sep '26 and released its weekly issuance slate. The space showed little interest in the latest escalation in Sino-Australian trade spat.

JGBS AUCTION: Japanese MOF sells Y2.5195tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.5195tn 2-Year JGBs:

- Average Yield -0.139% (prev. -0.130%) Average Price 100.481 (prev. 100.461)

- High Yield: -0.134% (prev. -0.127%) Low Price 100.470 (prev. 100.455)

- % Allotted At High Yield: 30.8217% (prev. 73.1880%)

- Bid/Cover: 3.212x (prev. 3.984x)

JGBS AUCTION: Japanese MOF sells Y6.1558tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y6.1558tn 3-Month Bills:- Average Yield -0.0897% (prev. -0.0989%)

- Average Price 100.0241 (prev. 100.0263)

- High Yield: -0.0856% (prev. -0.0940%)

- Low Price 100.0230 (prev. 100.0250)

- % Allotted At High Yield: 91.5868% (prev. 35.0742%)

- Bid/Cover: 2.941x (prev. 2.707x)

AUSSIE BONDS: The AOFM sells A$1.5bn of the 0.50% 21 Sep '26 Bond, issue #TB164:

The Australian Office of Financial Management (AOFM) sells A$1.5bn of the 0.50% 21 Sep 2026 Bond, issue #TB164:

- Average Yield: 0.3988% (prev. 0.3937%)

- High Yield: 0.4025% (prev. 0.3950%)

- Bid/Cover: 4.0300x (prev. 4.5220x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 40.5% (prev. 64.0%)

- bidders 42 (prev. 49), successful 17 (prev. 16), allocated in full 10 (prev. 7)

AUSSIE BONDS: AOFM Releases Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Wednesday 2 December it plans to sell A$2.0bn of the 1.00% 21 November 2031 Bond.

- On Thursday 3 December 2020 it plans to sell A$1.5bn of the 26 March 2021 Note & A$500mn of the 25 June 2021 Note.

- On Friday 4 December 2020 it plans to sell A$1.5bn of the 0.25% 21 November 2025 Bond.

- The AOFM noted that the next tender for the issue of Treasury Indexed Bonds is planned to be held on Tuesday, 8 December 2020.

- The AOFM also noted that the final tenders of Treasury Bonds, Treasury Notes and Treasury Indexed Bonds in 2020 are planned to be conducted in the week beginning 7 December 2020.

FOREX: Asia To End Week On Cautious Note

A sense of caution crept into G10 FX space in Asia after the U.S. Thanksgiving market closure translated into a slow start to the session. Questions surrounding AstraZeneca's Covid-19 vaccine research & the logistics of any future jab continued to temper initial enthusiasm about earlier reports from vaccine trials. Worrying global coronavirus situation & lockdown measures imposed across Europe helped keep risk appetite in check. JPY picked up a bid and outperformed all of its G10 peers, with USD/JPY sliding through the Y104.00 mark.

- The greenback brought up the rear in G10 basket. Outgoing U.S. President Trump said that he will give away power if the Electoral College chooses Joe Biden, bud deflected questions about his presence at Biden's inauguration & potential for running again in 2024.

- AUD held up well despite further escalation in Sino-Australian trade spat and a bearish 50-/100-DMA crossover in AUD/USD.

- USD/CNH recoiled after the release of Chinese industrial profits, even as their growth accelerated to a nine-year high of +28.2% Y/Y. Earlier in the day, the China Securities Journal suggested that the PBoC will not "proactively raise the policy rate for some time to come," although gradual exit from stimulus measures will continue.

- Eyes move to flash French CPI & final French GDP, Swedish GDP & retail sales, Norwegian unemployment & EZ sentiment gauges, as well as comments from ECB's Schnabel & Panetta.

Expiries for Nov27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1695-01(E838mln), $1.1850-60(E1.1bln), $1.1925(E550mln)

- USD/JPY: Y105.15-25($756mln), Y105.42($500mln)

- AUD/USD: $0.7250(A$1.8bln), $0.7325-30(A$1.3bln-A$1.27bln AUD calls), $0.7430(A$813mln)

- NZD/USD: $0.6950(N$676mln), $0.7050(N$865mln)

- USD/CAD: C$1.3000($600mln), C$1.3165-75($584mln)

- USD/CNY: Cny6.54($500mln)

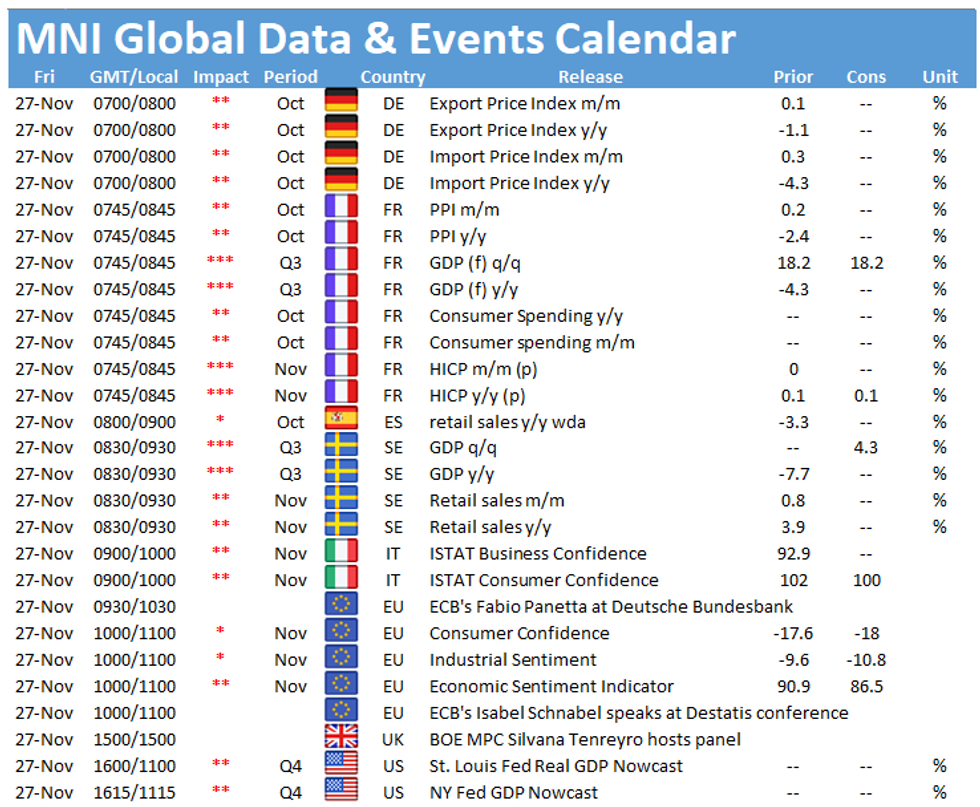

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.