-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: VdL-Johnson Dinner Fails To Yield Results, GBP Underperforms

EXECUTIVE SUMMARY

- 'LARGE GAPS' REMAIN AFTER CRUCIAL BREXIT TALKS IN BRUSSELS (BBC)

- U.S. HOUSE PASSES STOPGAP AS RELIEF TALKS DRAG ON (MNI)

- CYBER ATTACK EXPOSED DOCUMENTS RELATED TO PFIZER/BIONTECH COVID VACCINE (FT)

- U.S. SHOULD NOT WAIT TOO LONG ON ASTRAZENECA VACCINE, OXFORD'S HILL SAYS (RTRS)

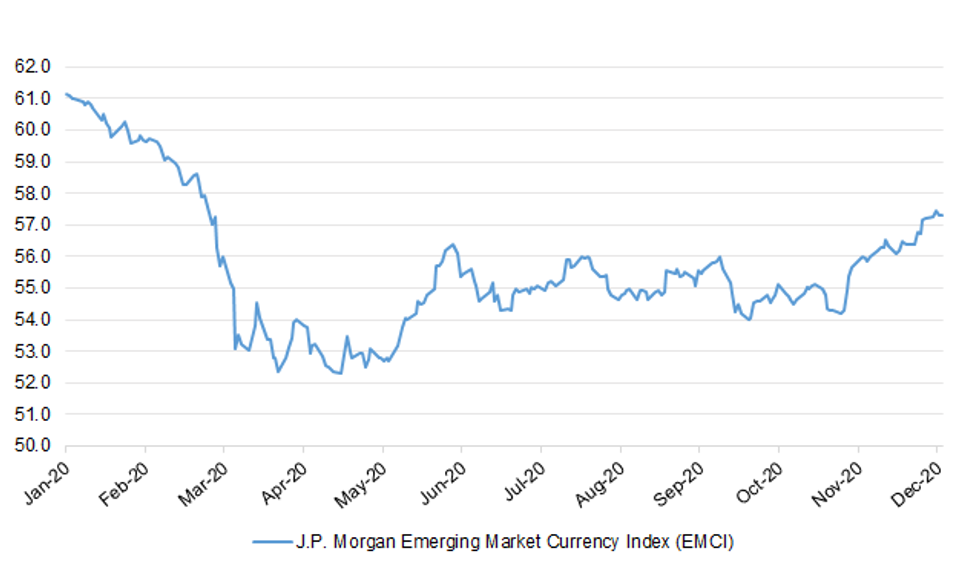

Fig. 1: J.P. Morgan Emerging Market Currency Index (EMCI)

Source: MNI - Market News/J.P. Morgan/Bloomberg

Source: MNI - Market News/J.P. Morgan/Bloomberg

UK

BREXIT: Boris Johnson's dinner with EU chief Ursula von der Leyen - aimed at breaking the Brexit trade talks deadlock - has ended without agreement. A No 10 spokesperson said "very large gaps remain" - but talks will continue with a "firm decision" on the prospects of a deal by Sunday. Mrs von der Leyen said that the two sides were still "far apart". Talks between the UK's chief negotiator Lord Frost and the EU's Michel Barnier will resume in Brussels later. The two negotiators also attended the three-hour dinner meeting between the two leaders. The BBC's Laura Kuenssberg said the evening had "plainly gone badly" and the chances of the UK leaving the post-Brexit transition period at the end of the year without a firm arrangement was a "big step closer". (BBC)

BREXIT: EU Commission President Von der Leyen tweeted the following on Wednesday "We had a lively & interesting discussion on the state of play on outstanding issues. We understand each other's positions. They remain far apart. The teams should immediately reconvene to try to resolve these issues. We will come to a decision by the end of the weekend." (MNI)

BREXIT: British Prime minister Boris Johnson said on Wednesday that Britain would prosper after Brexit regardless of whether it is able to agree a trade deal with the European Union or not. (RTRS)

BREXIT: The UK government on Wednesday announced temporary measures to smooth the disruption caused by a new trade border in the Irish Sea after January 1, but industry groups warned they still faced "considerable" long-term challenges as a result of the Brexit deal for Northern Ireland. (FT)

BREXIT: The government has suffered fresh defeats in the Lords over its blueprint for protecting trade between different UK nations after Brexit. Peers again pressed for the Internal Market Bill to give Scotland, Wales and Northern Ireland a greater say over cross-border trading rules. Opponents of the bill argue it will centralise power in London after the UK regains certain powers from the EU. UK ministers say the bill is needed to help firms trade across the country. (BBC)

BREXIT: The chairman of Tesco has admitted it has stockpiled long-life goods in preparation for possible supply disruption at the end of the Brexit transition period. (Sky)

ECONOMY: Britain's economy will bounce back next year from the Covid pandemic but a fifth year of weak business investment will delay a full recovery until the end of 2022, according to CBI forecasts. A combination of Brexit uncertainty, which is expected to continue into next year with or without a deal, and the blow to business confidence during the first and second lockdowns will delay a rebound in private sector investment. Business investment has remained flat since the 2016 Brexit vote as companies struggled to assess the impact of Brexit while negotiations continued. (Guardian)

FISCAL: The UK is eyeing a multibillion-pound tax raid on taxi rides with Uber, accommodation booked through Airbnb and odd jobs undertaken by TaskRabbit as it searches for new ways to plug the gaping hole in the public finances left by the coronavirus pandemic. In a consultation document published by the Treasury on Thursday, officials cast the spotlight on the "sharing economy", which has seen rapid growth but enables many people to consume services without paying the normal 20 per cent of value added tax due on the products. (FT)

CORONAVIRUS: Most Britons will be barred from visiting EU countries from January 1 when pandemic safety rules that allow free travel within the bloc stop applying to the UK. The end of the Brexit transition period means that the UK will be subject to a system that only allows non-essential travel from a handful of non-EU countries with low coronavirus infection rates, the European Commission said. EU member states have shied away from overriding a recommendation to stop the entry of travellers from countries such as the US, which are not on the list of "safe" third nations. Only eight of the countries with very low coronavirus infection rates are on the list.

EUROPE

ECB: ECB Preview - December 2020: Focus On Duration Over Size

- A December stimulus package is a foregone conclusion after the ECB signalled at the October meeting that it would recalibrate its instruments. Given the continued emphasis on the primacy of PEPP and the TLTROs during the Covid crisis, both will be expanded and adjusted at this week's meeting.

- GC members have recently argued the importance of maintaining favourable financing conditions and have stressed that the focus should be on the duration of policy support rather than the headline size of the stimulus programme.

- A EUR500bn expansion to the PEPP envelope and extension of net purchases by six-months to end-2021, additional TLTROs and an extension of the most preferential funding rate are the baseline scenario. Further deposit rate cuts are off the cards, but an adjustment to the tiering multiplier is possible - on email now - for more details please contact sales@marketnews.com.

EU/FISCAL: A Bloomberg reporter tweeted the following on Wednesday: "Final decision on EU stimulus and budget to be taken by leaders tomorrow.." (MNI)

EU/FISCAL: A new scheme linking EU funding to rule-of-law criteria may not be applied until the bloc's top court has ruled on its legality, according to a compromise plan to end a blockade by Hungary and Poland of the EU's budget and coronavirus recovery package. The text is contained in draft conclusions prepared by the German presidency of the Council of the EU for a summit of EU leaders taking place on Thursday and Friday. (POLITICO)

EU/FISCAL: A delay to the activation of the rule of law mechanism pending any court challenge could be particularly important to Mr Orban ahead of parliamentary elections due in 2022. Critics say the authoritarian premier is keen to fend off any potential impact from the new EU system until after those polls. Mr Ziobro reiterated his scepticism on Wednesday night. "If the regulation linking the budget with ideology comes into force, this will be a significant limitation of Poland's sovereignty, and a breach of the European treaties," he wrote on Twitter. "We do not agree to this!!!" (FT)

FRANCE: More than half of the French don't plan to get a shot against Covid-19, according to a survey by pollster Elabe for BFM TV published on Wednesday. Of those surveyed, 52% said they certainly or probably won't get vaccinated, up 4 points from two weeks earlier. That's even as 70% of respondents said they're worried about the coronavirus. Resistance to the vaccine is greatest in political groups opposed to the government of Emmanuel Macron, the survey found. (BBG)

ITALY: The Italian Senate on Wednesday gave the go-ahead for Prime Minister Giuseppe Conte to approve a contested reform of the euro zone's bailout fund, known as the European Stability Mechanism (ESM), at an EU summit this week. The 'yes' vote came hours after the lower house of parliament had also given its backing for the measure, defusing a potential political crisis that could have brought down the government. (RTRS)

SWITZERLAND: Switzerland's foreign-exchange interventions to weaken the franc will be enough for the U.S. to qualify the country as a currency manipulator, though it has the option to hold back on the designation, according to people familiar with the matter. Switzerland is likely to meet all three criteria when the U.S. Treasury updates its report on the currency practices of trading partners, said the people, who declined to be identified because the document hasn't yet been published. The franc gained following the news. It stood at 1.0750 per euro at 7:10 p.m. in Zurich.

U.S.

ECONOMY: Consumers are spending more via Bank of America accounts this year, in the midst of the coronavirus pandemic, than they did in 2019, according to CEO Brian Moynihan. "When you look at what they're spending year-to-date, they've spent more in 2020 than they did in 2019, and that is now across $2.7 trillion in money moved by our consumers," Moynihan told CNBC's Wilfred Frost in a Wednesday interview. (CNBC)

FISCAL: MNI BRIEF: U.S. House Passes Stopgap As Relief Talks Drag On

- The U.S. House of Representatives Wednesday passed a one-week stopgap spending bill providing more time for lawmakers to reach a deal on both Covid relief and an overarching spending bill to avoid a government shutdown. After the vote in the Democratic-run House, the Republican-led Senate is expected to follow Thursday, sending the measure to President Donald Trump to sign into law averting a government shutdown that would occur beginning Friday at midnight. The stopgap measure extends funding levels thru Dec. 18 - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: U.S. Treasury Secretary Steven Mnuchin said on Wednesday that President Donald Trump would rather send $600 checks to Americans as part of a new coronavirus aid package than supplemental unemployment benefits, arguing that it would put more people back to work more quickly. Mnuchin, speaking to reporters on a videoconference, said the $916 billion plan he proposed on Tuesday evening would use $40 billion to extend base unemployment benefits and spend $140 billion on direct payments. (RTRS)

FISCAL: A bipartisan Covid relief proposal would pay a $300 weekly supplement to unemployment benefits and extend benefits for millions of workers for 16 weeks, according to a summary of Senate legislation unveiled Wednesday. The $908 billion framework would issue the weekly benefit enhancement starting in late December, meaning it wouldn't be retroactive for earlier weeks of unemployment as many had hoped. (CNBC)

CORONAVIRUS: The US reported more than 3,000 coronavirus deaths in a single day on Wednesday for the first time, as fatalities have caught up with a record surge in cases and hospitalisations across the entire country since the start of the autumn. (FT)

CORONAVIRUS: U.S. officials said the federal government plans to start distributing 2.9 million Covid-19 vaccine doses by the end of this week once the Food and Drug Administration grants emergency clearance for Pfizer and BioNTech's vaccine, which could come as early as Thursday or Friday. (CNBC)

CORONAVIRUS: The Trump administration's top health official on Wednesday dismissed concerns over the potential for a "vaccine cliff" once initial supplies of the Pfizer and Moderna COVID-19 vaccines are exhausted. Health and Human Services Secretary Alex Azar said the administration is confident that it has enough contracts with other companies to make sure there are enough doses of a vaccine for all Americans. "We are very confident that during the second quarter of next year we'll have enough vaccines for every American who wants to be vaccinated," Azar said during the Milken Institute's health summit. "So, I don't see where this math is coming from." (The Hill)

CORONAVIRUS: The city of Chicago is aiming to offer all adult residents free Covid-19 vaccines in 2021, the mayor's office said on Wednesday. (FT)

CORONAVIRUS: California will allow playgrounds to remain open after outcry from parents and some lawmakers prompted the state to walk back plans to leave them closed as part of a broad effort to curb a record surge in coronavirus cases. (FT)

CORONAVIRUS: Two projections of New Jersey's second-wave hospitalizations paint a dire picture, with hundreds of more people needing in-patient care than during the April peak. In a worst-case scenario -- no masks and people not social distancing -- New Jersey hospitals would have 8,747 patients on Jan. 14, according to a model by the state health department. The state innovation office came up with 8,689 patients on Feb. 5. Last April 14, the pandemic's height, 8,270 people required hospitalization in New Jersey. In a moderate scenario, with people continuing to follow the precautions recommended by Governor Phil Murphy, the state would have 6,333 in-patients, according to the health department. The innovation office predicted 5,752. (BBG)

CORONAVIRUS: The White House Coronavirus Task Force has recommended to President Donald Trump that the United States begin allowing travelers into the country from Brazil, the United Kingdom and the 27 countries in the European Union, according to two officials involved in the discussions. If Trump signs off on the policy proposal, it would reverse bans on inbound travel for U.S. allies put into place at the beginning of the pandemic as the virus surged overseas. Travel from China and Iran, two of the earliest hotspots for the virus and from which travel was restricted in January and February, would not be relaxed, according to these officials. (CNBC)

POLITICS: President Donald Trump said Wednesday he will join Texas Attorney General Ken Paxton's long-shot effort at the Supreme Court to reverse Democrat Joe Biden's win in the election. Trump said that in addition to intervening in the Texas case, he or his campaign will ask to join lawsuits in a number of other states as part of his attempt to reverse the Nov. 3 election results. (CNBC)

POLITICS: Seventeen states whose elections were won by President Donald Trump told the Supreme Court on Wednesday that they support Texas Attorney General Ken Paxton's bid to file a lawsuit that could effectively reverse President-elect Joe Biden's projected Electoral College victory. The filing backing Paxton by those states came a day after he asked the Supreme Court for permission to sue Georgia, Michigan, Pennsylvania and Wisconsin, all of which Biden won, over their voting processes. (CNBC)

POLITICS: Some Senate Republicans are refusing to commit to confirmation hearings or votes for Joe Biden's Cabinet picks while election challenges from President Trump and others continue to play out. The foot-dragging could prevent the president-elect from having key team members in place on Day One — just six weeks from today. (Axios)

POLITICS: President-elect Joe Biden's son Hunter Biden revealed Wednesday that he is under investigation by the top federal prosecutor in Delaware in connection with his taxes. (CNBC)

EQUITIES: Facebook now faces two legal challenges alleging it engaged in anticompetitive practices. The lawsuits come from the Federal Trade Commission and a coalition of 48 attorneys general led by New York AG Letitia James. Both lawsuits target two of Facebook's major acquisitions: Instagram and WhatsApp. Both are seeking remedies for the alleged anticompetitive conduct that could result in requiring Facebook to divest from the two apps. (CNBC)

EQUITIES: The EU will require "very large" tech companies such as Facebook and Amazon to take greater responsibility for policing the internet or face fines of up to 6 per cent of their turnover, under a draft regulation to be published next week. Big tech companies will have to vet third-party suppliers like the vendors who sell products on Amazon, and share data with authorities and researchers on how they moderate illegal content, according to the confidential document, seen by the Financial Times. Large online platforms will have to ensure greater advertisement transparency by letting users know "in a clear and unambiguous manner and in real time" that they are viewing an ad. Consumers will also have to be told who is behind the ad and be given "meaningful information about the main parameters used to determine" why they were targeted. For the first time, regulators in Brussels define "very large platforms" as those with more than 45m users, or the equivalent of 10 per cent of the bloc's population. The plan targets such companies because of their "disproportionate influence" on internet users in the EU. (FT)

OTHER

GLOBAL TRADE: President-elect Joseph R. Biden Jr. is expected to select Katherine Tai, the chief trade lawyer for the House Ways and Means Committee, as the United States trade representative, a key post that will bear responsibility for enforcing America's trade rules and negotiating new trading terms with China and other countries, according to people familiar with the plans. Ms. Tai has garnered strong support from colleagues in Congress, who credit her with helping to wrangle an unruly collection of politicians and interest groups in negotiations to pass the revised North American Free Trade Agreement. From 2007 to 2014, Ms. Tai worked for the Office of the United States Trade Representative, where she successfully prosecuted several cases on Chinese trade practices at the World Trade Organization. (New York Times)

GLOBAL TRADE: Apple is reportedly working with supply chain partner TSMC on an autonomous vehicle chip for an "Apple Car" said to be similar to a Tesla. The Cupertino tech giant's Project Titan is thought to be focused on developing technology to facilitate self-driving cars, but other reports indicate that Apple could be developing its own vehicle as well. (AppleInsider)

GEOPOLITICS: The Trump administration has imposed sanctions at a record- shattering pace of about three times a day during the president's time in office: a slew of measures targeting companies, individuals and even oil tankers tied to Iran, North Korea, China, Venezuela and Russia. President-elect Joe Biden's team is promising a top-to-bottom review of sanctions operations, but don't expect a significant slowdown on his watch. About seven weeks before the inauguration, Biden's picks for top administration slots are making clear that economic restrictions on countries will remain an essential tool, even if they don't like everything about the way Trump used them.

JAPAN/CHINA/HONG KONG: The Japanese government has confirmed that domestic banks with operations in the United States are required to adhere to sanctions imposed by Washington, meaning they are not permitted to carry out transactions on behalf of Hong Kong Chief Executive Carrie Lam. (SCMP)

CORONAVIRUS: Coronavirus patients who develop "post-Covid syndrome" brain fog and fatigue — often referred to as "long haulers" — may feel the effects for more than a year, according to a Mayo Clinic doctor studying the phenomenon. (CNBC)

CORONAVIRUS: Warp Speed officials said they expect interim data from Johnson & Johnson's trial in early January, though company executives have said that because of how quickly the virus is spreading they could have data before the end of the year. Emergency authorization could come by early 2021. (The Hill)

CORONAVIRUS: Johnson & Johnson is cutting the size of its pivotal U.S. Covid-19 vaccine trial — the only major study testing a single dose of a Covid vaccine — from 60,000 volunteers to 40,000 volunteers. The change is being made possible by the fact that Covid-19 is so pervasive across the country, according to a person familiar with the matter. The more virus there is in the U.S., the more likely it is that participants will be exposed to it, meaning researchers will be able to reach conclusions based on a smaller trial. Changing the size of the study does not indicate that results will come on a different timetable, or anything about whether they will be positive or negative. (STAT News)

CORONAVIRUS: Jenner Institute Director Adrian Hill, who oversees the Oxford-AstraZeneca COVID-19 vaccine research and development, said a vaccine would not be available in the United States until "the middle of next year" if regulators wait for the end of their vaccine trial. "I would hope that the (Food and Drug Administration) would look at the data set on this vaccine, including all of the available data in January. To wait for the end of the trial would be the middle of next year," Hill said in remarks released by NBC. "That's too late to take the value of this vaccine, which is effective, available at large scale and easily deployed." (RTRS)

CORONAVIRUS: The U.S. Food and Drug Administration will likely consider the two allergic reactions reported by U.K. health-care workers vaccinated against Covid-19 as it decides whether to authorize Pfizer's vaccine in the U.S. — though the incident shouldn't be surprising, medical experts said. (CNBC)

CORONAVIRUS: A cyber attack on the European Medicines Agency has exposed documents related to the Pfizer/BioNTech Covid-19 vaccine. The EU regulator said it had launched a full investigation, working with law enforcement agencies. BioNTech said documents related to its regulatory submission had been "unlawfully accessed" on the EMA server. "It is important to note that no BioNTech or Pfizer systems have been breached in connection with this incident and we are unaware that any study participants have been identified through the data being accessed," the German vaccine maker said in a statement. (FT)

HONG KONG: Some residents in a block of Richland Gardens in Kowloon Bay will be sent for quarantine amid a coronavirus outbreak in the housing estate, government adviser and virologist Yuen Kwok-Yung says at a briefing. Advisers are concerned that the spread may come from drainpipes Hong Kong finds more than 100 coronavirus cases Thursday, local media including Cable TV report, citing unidentified people. (BBG)

BOJ: MNI POLICY: BOJ Sees Limited Risk Of Yen Rising After Fed

- Bank of Japan officials are sensitive to the risk of the yen's move following events but they see limited scope for the currency to strengthen after the U.S. Federal Reserve's policy decision next week in the absence of supporting factors, MNI understands - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

AUSTRALIA/CHINA: China's Commerce Ministry said Thursday that it would impose temporary antisubsidy tariffs on Australia-imported wines, adding more levies after hefty antidumping duties applied two weeks ago. The ministry said the temporary duties of 6.3% to 6.4% will take effect Friday. The action came after Beijing imposed antidumping duties of 107.1% to 212.1% on Australian wine in late November, as an investigation found exporters dumped cheap wine into the Chinese market. The latest measure is expected to add more tension to bilateral relations, which went sour after Canberra called for a probe into the origins of the coronavirus, angering Beijing. (Dow Jones)

AUSTRALIA/CHINA: Australia will pay a price if its unreasonable China policy fails to change, the Global Times, a tabloid owned by the People's Daily, said in an editorial late Wednesday. Australia has been a "lap dog" of the U.S. in attacking China, the newspaper said. Canberra should seek to improve ties with China in 2021 in line with Australian public opinion and the views of the Opposition party, the Times editorial said.

NEW ZEALAND: The latest BNZ/SEEK employment report noted that "with its 6.9% advance in November, job advertising indicated a genuine recovery is in train. This is after gains in September and October that likely had elements of rebound from a compromised August, when COVID-19 restrictions were tightened. The sense of underlying recovery was also evident in the fact November's ads were down just 5.1% on year-ago levels. This continues a clawback that has been underway ever since April's ads were down 73.7% on an annual basis… By work type, job advertising for part-time positions was arguably logging the best recovery, albeit still well shy of levels of mid-to-late last year. The full-time category was lagging part- time but it was arguably contract/temp positions with the most work to do to recover pre-COVID-19 heights." (MNI)

NEW ZEALAND: Banks could have avoided looming regulation of the fees they charge retailers to process credit and debit cards transactions if they had "done the right thing", Small Business Minister Stuart Nash says. The Government kicked off consultations on regulating merchant fees on card transactions on Thursday, forecasting that would reduce retailers' costs and in some cases flow on to cheaper goods for consumers – particularly when they are shopping with smaller businesses. (Stuff NZ)

SOUTH KOREA: South Korean authorities are rushing to install hospital beds in containers in Seoul as medical facilities have been stretched by the recent sharp spike in new coronavirus cases despite stronger social distancing measures. Health officials have expressed concerns about a shortage of hospital beds, especially in intensive-care units, as the country struggles to contain the third wave of the pandemic in the winter. (FT)

BOK: The Bank of Korea (BOK) warned Thursday that a winter wave of coronavirus outbreaks is likely to hurt the fragile recovery of private consumption. The BOK also took a cautious tone on progress in the global coronavirus vaccine campaign, saying it will take more time to speed up the distribution of vaccines worldwide. South Korea, which has largely brought outbreaks under control, has been facing a resurgence of virus cases in recent weeks, with the nation reporting more than 600 daily new cases on average. "There is a possibility that a resurgence of coronavirus infections could weaken a recovery of consumption," the BOK said in a monetary policy report. (Yonhap)

ASIA: The overall forecast for Developing Asia (46 ADB member economies across Asia and the Pacific) is a contraction of 0.4% in 2020, less than the 0.7% envisaged in September. Growth will rebound to 6.8% in 2021, but output will remain below what was envisioned before the pandemic. (Asian Development Bank)

BOC: MNI INTERVIEW: BOC May Bring More Vaccine Optimism in January

- The Bank of Canada may be saving some of its optimism about Covid vaccine breakthroughs for the next policy meeting in January, when it will also deliver a wider forecast paper, CIBC Senior Economist and former central bank researcher Royce Mendes told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

CANADA: Canada on Wednesday approved its first COVID-19 vaccine and said initial shots will be delivered and administered across the country starting next week, while every Canadian will be able to be inoculated as early as the end of September. (RTRS)

CANADA: The U.S. is challenging Canada's allocation of dairy tariff-rate quotas, saying they way it's done undermines the ability of American dairy farmers sell a wide range of products to Canadian consumers. U.S. Trade Representative Robert Lighthizer announced the enforcement action, which is being done in terms of the United States-Mexico-Canada Agreement, in an emailed statement Wednesday. By setting aside and reserving a percentage of each dairy TRQ exclusively for processors, Canada's "measures violate its commitments and harm U.S dairy farmers and producers," Lighthizer said. (BBG)

TURKEY: Turkey's planned judicial reforms are of "great importance" to improve the investment environment, Finance Minister Lutfi Elvan told parliament late on Wednesday, adding that the determination in the fight against inflation would continue. Elvan said Turkey would maintain fiscal discipline and would focus on sustainable and "high quality" economic growth policies in the coming period to increase employment. (RTRS)

TURKEY: "We plan to increase predictability and attract foreign investors interest in domestic bonds," state-run Anadolu Agency cites Treasury and Finance Minister Lutfi Elvan as saying in a speech during budget debates at parliament late Wednesday. "We aim to decrease FX debt share in local borrowing next year". "Turkey's pandemic related measures on banking sector are modest compared to measure in Europe". (BBG)

MEXICO: Mexico's Senate approved Wednesday a bill that will force the central bank to buy dollars from banks that can't place them elsewhere, ignoring concerns from policy makers that the bill could make the bank take illegal drug money. Lawmakers brought the bill to a vote, only hours after top members of the country's bank association had warned that the bill threatened the autonomy of the central bank and could expose it to sanctions for money laundering if it was approved. The bill goes on to the lower house for a debate and vote. (BBG)

MEXICO: Banxico board member Gerardo Esquivel tweeted the following on Wednesday: "It is regrettable that reforms to the Bank of Mexico Law have been approved in the Senate that put international reserves at risk and that undermine the autonomy of the Bank of Mexico. I hope that the Chamber of Deputies will correct this situation." (MNI)

MEXICO: Ricardo Monreal, the leader of President Andres Manuel Lopez Obrador's Morena party in the Senate presented a bill that seeks to have bank interest rates draw closer to central bank reference rates. (BBG)

MEXICO: Mexico's Senate approved President Andres Manuel Lopez Obrador's selection of Galia Borja Gomez to the board of the country's central bank. (BBG)

MEXICO: Mexico's government is weighing making further reductions to the tax burden on national oil company Petroleos Mexicanos (Pemex) to bring it closer to that of ordinary corporations, a top finance ministry official said on Wednesday. (RTRS)

BRAZIL: Brazil's central bank kept its benchmark interest rate at a record low but signaled that a pledge to keep it at that level for the foreseeable future may be coming to an end as inflation expectations accelerate toward the official target in coming years. The bank, led by its President Roberto Campos Neto, on Wednesday held the Selic at 2% for the third straight meeting, as expected by all 34 analysts surveyed by Bloomberg. Policy makers halted their monetary easing cycle in September after cutting 450 basis points from rates as part of measures to stem the damage of the coronavirus outbreak. "A scenario of inflation expectations converging to the target suggests that the conditions for maintaining the forward guidance may soon no longer apply," policy makers wrote in a statement accompanying their unanimous decision. (BBG)

BRAZIL: A key ally of President Jair Bolsonaro is stepping up an offensive to win the helm of Brazil's lower house of congress and steer the government's reform proposals over the next two years. Arthur Lira, a veteran centrist lawmaker, on Wednesday launched his candidacy for house speaker, a coveted position that gives its holder the power to effectively control the legislative agenda by deciding which bills go to a vote and when. Lira will face a candidate supported by incumbent Speaker Rodrigo Maia, who was barred from running himself and is leading a campaign to shield the lower house from Bolsonaro's influence. House representatives and senators are expected to elect the heads of their respective chambers in the beginning of February. (BBG)

MIDDLE EAST: The Saudi-led coalition fighting in Yemen said on Wednesday it intercepted and destroyed two explosive-laden boats south of the Red Sea, Saudi state TV reported. The coalition added the boats were launched by Iran-aligned Houthis from Yemen's port city of Hodeidah, state TV said. (RTRS)

OIL: Libyan crude and condensate exports are poised to jump to a 13-month high of 1.24 million b/d this month, according to S&P Global Platts estimates compiled using data from shipping and trading sources. This comes as Libya's oil production has undergone a rapid rebound of almost 1 million b/d in the past two months after the UN-backed Government of National Accord and the self-styled Libyan National Army agreed a truce. (Platts)

CHINA

PBOC: China should keep its current monetary policies, despite registering -0.5% CPI in November, as the weakening inflation was largely caused by falling food prices while core demand remains strong, the China Securities Journal said citing economists. The PPI may strengthen in December and return to positive by Q1 after recording -1.5% in November, supported by stronger domestic demand, the newspaper said. (MNI)

CREDIT: China may tighten its credit expansion as it normalizes its monetary policy and redirects capital to the real economy, reported Securities Times citing Wang Qing, an analyst from Golden Credit Rating. The scale of China's social financing and new loans was likely to drop in December to ensure new credit this year totals around CNY20 trillion, and that social financing is within CNY35 trillion, Wang said. Wang Yifeng, an analyst from Everbright Securities told the Times that new credit growth in Q1 was likely to rise given steady demand and increasing credit supply before the Lunar New Year, while the supply side faced marginal tightening. (MNI)

EQUITIES: S&P Dow Jones Indices published a list of Chinese securities that will be deemed ineligible for equity and fixed-income indexes following the Nov. 12 U.S. executive order regarding a prohibition on U.S. transactions in certain Chinese securities. The equity securities will be deemed ineligible for S&P DJI equity indexes effective prior to the open on Dec. 21. The fixed-income securities will be deemed ineligible for S&P DJI fixed-income indexes effective prior to the open on Jan. 1. (BBG)

OVERNIGHT DATA

JAPAN Q4 BSI LARGE M'FING 21.6; Q3 0.1

JAPAN Q4 BSI LARGE ALL INDUSTRY 11.6; Q3 2.0

JAPAN NOV PPI -2.2% Y/Y; MEDIAN -2.2%; OCT -2.1%

JAPAN NOV PPI 0.0% M/M; MEDIAN 0.0%; OCT -0.2%

JAPAN NOV TOKYO AVG OFFICE VACANCIES 4.33; OCT 3.93

AUSTRALIA DEC CONSUMER INFLATION EXPECTATION +3.5%; NOV +3.5%

NEW ZEALAND NOV CARD SPENDING RETAIL +0.1% M/M; OCT +9.0%

NEW ZEALAND NOV CARD SPENDING TOTAL +0.1% Y/Y; OCT +8.2%

NEW ZEALAND NOV ANZ TRUCKOMETER HEAVY -0.3% M/M; OCT -2.2%

Traffic volumes eased in seasonally adjusted terms in November. There is still a degree of catch-up activity evident in the Heavy Traffic Index, but it is gradually unwinding. The Heavy Traffic Index fell 0.3% in November, while the Light Traffic Index fell 3.1%. In broad terms, heavy traffic primarily reflects the movement of goods, while light traffic captures the movement of people. In normal times, light traffic provides a lead on momentum in the economy, whereas heavy traffic is a realtime indicator of goods production. The Heavy Traffic Index in October was 6.2% higher than a year ago, while the Light Traffic Index is 8.6% higher than a year ago (3-month average). However, the unsmoothed data does show the light traffic overshoot also dissipating – the latest three reads were a 12.1% bounce out of lockdown-lite in September, a pretty flat outturn in October, and a 3.1% fall in November. As well as catch-up activity easing, some of the November weakness likely reflects that November is typically the first big month of the summer season for inbound tourism. There are going to be a lot fewer people than normal in New Zealand over the summer, and that will show up in traffic. (ANZ)

UK NOV RICS HOUSE PRICE BALANCE 66%; MEDIAN 63%; OCT 67%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with rates unchanged at 2.2% on Thursday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to maintain the liquidity in the banking system at a reasonable and ample level, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2000% at 09:25 am local time from the close of 1.8685% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 39 on Wednesday vs 40 on Tuesday. A lower index indicates decreased market expectations for tighter liquidity.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.5476 on Thursday, compared with the 6.5311 set on Wednesday.

MARKETS

SNAPSHOT: VdL-Johnson Dinner Fails To Yield Results, GBP Underperforms

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 50.66 points at 26768.82

- ASX 200 down 45.372 points at 6683.1

- Shanghai Comp. up 9.89 points at 3381.656

- JGB 10-Yr future up 2 ticks at 152.12, yield down 0.6bp at 0.016%

- Aussie 10-Yr future up 3.8 ticks at 99.014, yield down 3.4bp at 0.991%

- U.S. 10-Yr future +0-03+ at 137-23+, yield down 1.16bp at 0.925%

- WTI crude up $0.22 at $45.73, Gold up $1.60 at $1841.21

- USD/JPY up 18 pips at Y104.40

- 'LARGE GAPS' REMAIN AFTER CRUCIAL BREXIT TALKS IN BRUSSELS (BBC)

- U.S. HOUSE PASSES STOPGAP AS RELIEF TALKS DRAG ON (MNI)

- CYBER ATTACK EXPOSED DOCUMENTS RELATED TO PFIZER/BIONTECH COVID VACCINE (FT)

- U.S. SHOULD NOT WAIT TOO LONG ON ASTRAZENECA VACCINE, OXFORD'S HILL SAYS (RTRS)

BOND SUMMARY: Core FI Better Bid Overnight, Ranges Tight

The lack of positive developments surrounding Brexit and the fiscal situation in DC provided some support for core FI markets during Asia-Pac trade. This promoted some light bull flattening in the U.S. Tsy space, although overnight trade has been relatively rangebound with the space moving back from richest levels, leaving yields across the curve within 1.0bp of their respective Wednesday closes. T-Notes last print +0-03 at 137-23, sticking to a 0-02+ range.

- Local news flow in Japan remains light, but the longer end of the cash curve continues to benefit from the recently outlined fiscal dynamic, although firm JGB issuance details surrounding the package are still lacking. There was little in the way of observable concession ahead of this afternoon's 20-Year JGB supply, perhaps aided by the U.S. fiscal and Brexit dynamics. This allowed futures to unwind their overnight losses and more, hitting the lunchbreak 4 ticks above yesterday's settlement levels. JGB futures then ticked lower after the lack of concession resulted in a sloppy 20-Year auction, which saw the low price come in below broader dealer expectations of 100.55 (as proxied by the BBG dealer poll), while the cover ratio slid to the lowest level seen at a 20-Year auction since '15 and the tail widened vs. prev. auction. Futures last unch. on the day.

- Aussie bonds traded better bid on the tweaked round of RBA 3-Year yield target enforcement flagged earlier, which saw the Bank offer to buy both ACGB Apr '23 & ACGB Apr '24, as opposed to the recent norm of just ACGB Apr' 24, with YM +1.2 and XM +3.4, sitting within touching distance of best levels of the day.

JGBS AUCTION: Japanese MOF sells Y975.1bn 20-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y975.1bn 20-Year JGBs:

- Average Yield 0.366% (prev. 0.388%)

- Average Price 100.62 (prev. 100.22)

- High Yield: 0.372% (prev. 0.391%)

- Low Price 100.50 (prev. 100.15)

- % Allotted At High Yield: 14.6471% (prev. 17.0997%)

- Bid/Cover: 3.011x (prev. 3.611x)

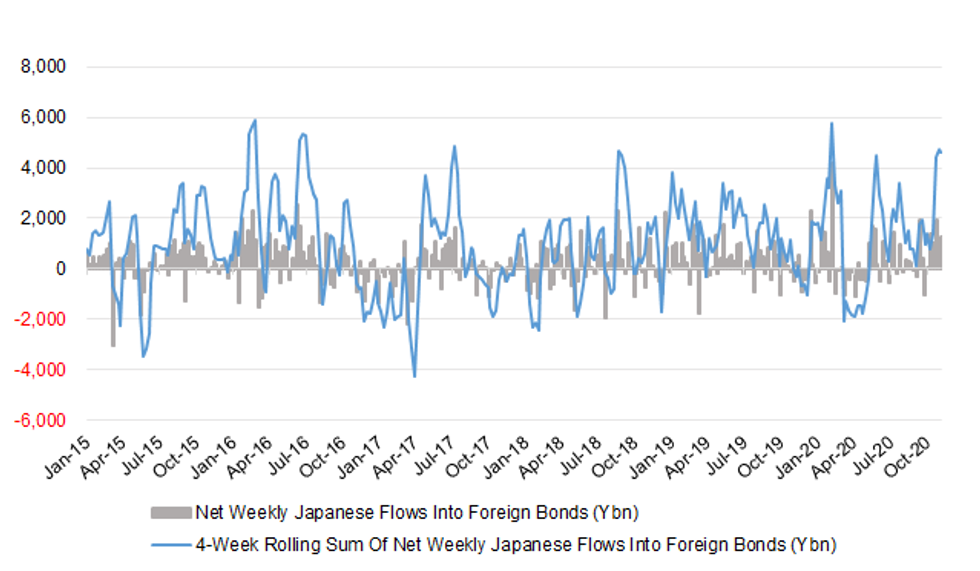

JAPAN: Japanese Buying Of Foreign Bonds Dominates Weekly Data, Again

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 1252.7 | 372.5 | 4599.4 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -691.2 | -835.8 | -3226.9 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -278.0 | -116.1 | 803.9 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 42.1 | 457.9 | -270.5 |

Source: MNI - Market News/Japanese Ministry Of Finance

Japanese investment into foreign bonds provided the most notable round of net flows observed in the latest round of weekly Japanese international security flow data, with net purchases of foreign bonds topping Y1.0tn for the 4th week in 5.

- The remaining net flows in the dataset were much more muted but maintained the same directions when compared to the previous week.

EQUITIES: Awaiting Developments

Equity trade lacked any real sense of clear direction during Thursday's Asia-Pac session, with the U.S. fiscal impasse and troubles surrounding Brexit continuing to dominate headline flow. That left the major regional benchmarks operating in a marginally mixed manner, with the same holding true for the e-mini contracts.

- Nikkei 225 -0.3%, Hang Seng -0.5%, CSI 300 +0.2%, ASX 200 -0.7%

- S&P 500 futures -2, DJIA futures +4, NASDAQ 100 futures -40.

OIL: Marginally Higher In Asia

WTI and Brent sit ~$0.30 above their respective settlement levels, even with the continued U.S. fiscal impasse and Brexit tension remaining evident.

- This comes after the metrics settled at essentially unchanged levels on Wednesday, with recent crude-specific news flow headlined by a multi-month high in terms of the latest headline DoE weekly crude inventory build, which was accompanied by larger than expected builds in both gasoline and distillate stocks. The ensuing price action was choppy, before the contracts settled at near enough unchanged levels, as mentioned above.

- Elsewhere, comments from Russian Energy Minister Novak, further comments out of Iran pointing to increased crude supply and an attack on an oilfield in Iraq's Kirkuk region did little in the grand scheme of things.

GOLD: Tight After Yesterday's Dip

A lack of fiscal movement in DC and Brexit worry has provided light support for the U.S. Tsy space during Asia-Pac hours, applying modest pressure to real yields in the process, with the latter metrics now unwinding the entirety of the gains that were lodged in early NY trade on Wednesday. Spot bullion has held to a tight range after yesterday's weakness, last dealing little changed around the $1,840/oz mark. Yesterday's weakness in the yellow metal was likely linked to an uptick in the broader DXY, although that index remains within touching distance of the recent cycle lows. The technical backdrop remains unchanged.

FOREX: Sterling Feels Brexit Angst

Sterling went offered across the board as the Johnson/von der Leyen dinner failed to bring a breakthrough. Odds of striking a Brexit deal on time have faltered as both sides suggested that they remain far apart on key outstanding issues, while picking Sunday as the new cliff-edge date for reaching accord. Cable recovered from early session lows, but GBP remained comfortably the worst performer in G10 FX space.

- EUR traded mixed ahead of some noteworthy events on the Old Continent. EU leaders will convene for the European Council summit today, but Brexit's not on the agenda. Leaders will focus on coordination on COVID-19, climate change, security and external relations. Meanwhile, the ECB will announce its monetary policy decision, with a presser from Pres Lagarde due in its wake.

- Other than that, the risk switch flicked to on, with commodity- tied FX catching a bid. AUD topped the G10 pile owing to a surge in iron ore futures in Singapore. AUD/NZD rose to a four-week high but failed to make much headway beyond former resistance zone at NZ$1.0628-31 and trimmed gains.

- Safe haven currencies declined, despite lingering concerns over deadlocked U.S. fiscal talks. USD/JPY printed a fresh weekly high, with Gotobi Day flows potentially adding a modicum of pressure to the yen.

- The PBOC set the USD/CNY central parity at 6.5476 this morning, 165 pips weaker for the redback than yesterday's fix and bringing parity off its lowest levels for 29 months. USD/CNH has reclaimed the 6.50 handle but ground lower during the session. USD/CNH last down 13 pips at 6.5271.

- Thailand starts its long weekend today and won't be back until Monday.

- Apart from what was already mentioned, U.S. initial jobless claims & CPI, UK economic activity indicators, Swedish & Norwegian CPIs and comments from BoC's Beaudry take focus today.

FOREX OPTIONS: Expiries for Dec10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-10(E1.4bln), $1.1900-05(E1.0bln), $1.2000(E572mln), $1.2045-60(E1.1bln)

- USD/JPY: Y103.50-60($1.3bln), Y104.00($836mln), Y104.25-35($898mln), Y104.90-105.00($1.2bln), Y105.35-40($661mln), Y105.50-55($838mln), Y105.75-85($1.4bln)

- EUR/GBP: Gbp0.8890-00(E532mln), Gbp0.8970(E847mln), Gbp0.9075(E579mln)

- AUD/USD: $0.7270-80(A$1.2bln), $0.7400-05(A$1.1bln), $0.7430(A$533mln), $0.7495-00(A$771mln)

- AUD/NZD: N$1.0660(A$590mln)

- USD/CNY: Cny6.50($904mln-USD puts), Cny6.60($1.4bln-USD puts), Cny6.70($726mln)

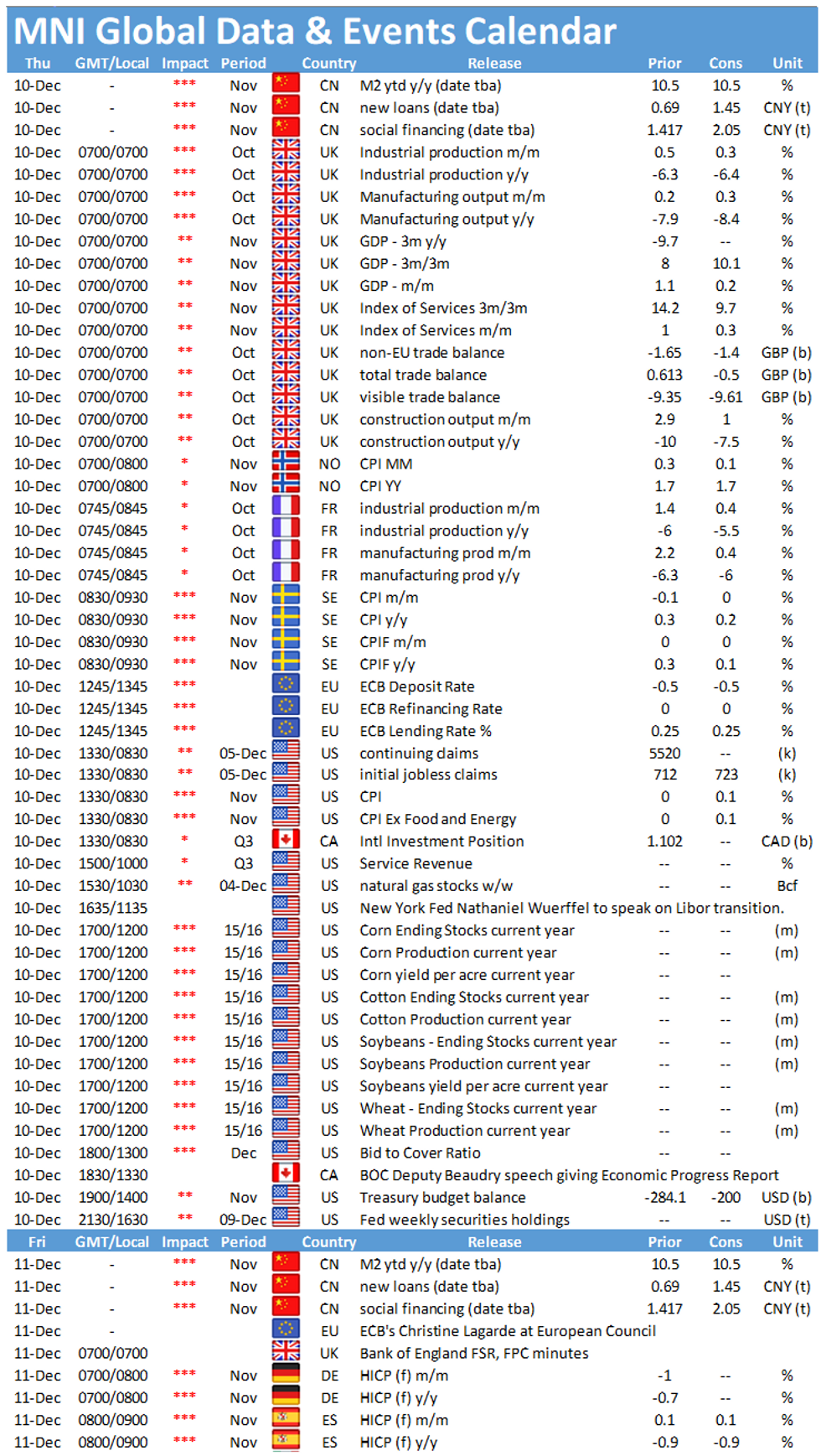

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.